ABSTRACT

Insurance was widely recognized as a useful tool for risk management in regional economic growth. Lots of analysis focused on building a fixed functional relationship between insurance development and economic growth. However, the effects of this mechanism varied widely across countries. And there was a clear gap in the understanding of how this mechanism works in coastal areas, the forward position of one country. Could it be reflected by fixed function or a more complex one? The answer was crucial to realize the harmonious development, especially for China, the most important emerging economy. This study assessed China's 11 coastal cities, focusing on the dynamic linkages between insurance development and economic growth. Non-parametric local polynomial regression was used to obtain the change between insurance development and economic growth, and fit the curve relationship between insurance density per capita GDP, with the purpose of gaining the suitable function model. The result demonstrated that it was certain that insurance growth had a positive effect on the economic development of the coastal area, and the law of diminishing marginal returns held in most cases. We further classified research into three parts the Northern, Eastern and Southern coastal areas (China's administrative division), and found that, there were obvious differences in output efficiency and marginal revenue among the three regions. This relationship in the Northern and Southern area was stable, but the curve changed complicatedly in the Eastern area. So fixed function was not qualified to describe the linkage between insurance development and economic growth in China's coastal areas. Those conclusions offered several countermeasures for policy-makers and researchers.

Key words: Coastal regions, insurance density, economic growth, non-parameter local polynomial model.

The relationship between insurance development and economic growth has gained more attention during the past few decades because of the rapid expansion of the insurance industry. For the period 1985 to 2007, the world's total real insurance premiums had increased by approximately 5.5 times from US$0.63 trillion to US$4.13 trillion (Chiu and Lee, 2012),with an insurance premiums growth rate of 57% in developed countries compared to 27% in developing countries (Arena, 2008).

As one of the most important developing nations, China’s insurance premiums reached 242.8 billion Yuan in 2015, nearly 1.52 times higher than that of 2000; meanwhile, 180 insurance companies had set up branches across China, including 57 foreign institutions.

Studies examining the insurance-growth nexus have been primarily based on data from developed economies (Lee et al., 2011; Billio et al., 2012; Law et al., 2014). As the importance of the insurance industry’s significance in loss compensation, financial intermediation and risk management for emerging markets began to be realized, more researchers have become involved in the study of the influence of the development of insurance market on economic growth (Webb et al., 2002; Liedtke, 2007; Roe and Siegel, 2011), while little is known about this mechanism between insurance development and economy growth in China.

With the further implementation of China's strategy of building an ocean power, coastal regions played important role in regional economic development by virtue of the special geographical conditions. Accordingly, examining the role of insurance industry in economy and investigating the changes of the linkages between insurance development, and economy growth was vital to promote China's marine economy fast and healthy developing.

The main purpose of this study is to illustrate the dynamic relationship between insurance development and economic growth in China's coastal areas. Based on the non-parametric local polynomial regression, the paper fits the curve of insurance density and GDP per capita. The action mechanism will be analyzed from the view of monotonicity, convexity and dynamic change characteristics of the curve.a

The remarkable effects of insurance during the course of economic development were formally acknowledged in 1964 (UNCTAD conferences). In the long run, the insurance industry accelerates economic growth by appealing to the following channels:

1. Benefiting risk identification, reinforcement and repairing

2. Strengthening financial management of enterprises

3. Enhancing the risk management of individuals

4. Stabilizing personal and family life

5. Managing civil compensation liabilities

6. Improving credit for the entire society.

As life and nonlife insurance (property or liability) take on different functions, there are usually distinctive effects on economic growth. Related research can be divided into theoretical and empirical research.

Theoretical research has primarily been conducted from two perspectives: the supply-following angle and the demand-leading angle (Patrick, 1966). From the supply-following point of view, non-banking financial institutions usually have positive externalities and intermediates of accommodation, which could result in stimulating economic innovation and enhancing economic growth. In addition, the demand-leading angle means that the growth of the real economy will bring profound changes to the economy and to society. Namely, these changes include alterations in the relationship between risk spread and transmission in population structure and in income levels, etc. All of these undoubtedly generate new requirements for risk diversification and particularly relevant insurance services.

According to Hsu et al. (2015), Yang et al. (2014) and Hsu and Liao (2015), the development of insurance in certain areas will depend on psychological and social factors, such as willingness to pay, level of education and age. Beck and Webb (2003), Li et al. (2007), and Lee et al. (2010) determined economy growth had a positive relationship with insurance and explained this by demonstrating how life insurance and real incomes have grown.

Feyen et al. (2011) further confirmed that different income levels would have various insurance demands. Empirically, different subjects and methods result in various conclusions. Employing time-series or cross-sectional datasets to analyze insurance premiums and macroeconomics in a country or among certain areas has been the mainstream approach.

Several articles employed panel unit root, panel cointegration, and panel causality tests to explore the relationship between per capita real gross domestic product and per capita real insurance premiums, then determined insurance markets and economic growth exhibit long run and short run bidirectional causalities (Chen et al., 2013; Abdul and Vera, 2014; Samargandi et al.,2015). Haiss and Sümegi (2008) researched the relationship between insurance and economic growth based on a panel data model for all European countries, and concluded that there had been an insignificant effect between insurance (life insurance and non-life insurance) and economic growth.

Lee and Chiu (2012) applied a panel smooth transition regression (PSTR) model to obtain a non-linear insurance-income nexus. The calculations demonstrated that as economic bases were different in each sample, the relationships between insurance premiums (life and non-life) and economic growth were also much.

In addition, Han et al. (2010) brought a gaussian mixture model (GMM) approach to studying the relationship between insurance development and economic growth for 77 countries. The results illustrated insurance development had a positive effect on economic growth, which had significant different forms between developing countries and developed countries.

Specifically, Ward and Zurbruegg (2000) investigated the causal relationship between insurance industry growth (real insurance premiums) and economic growth (real GDP) for Australia, Canada, Italy, Japan, and France. The long-term conclusion stated that most samples had bidirectional causal relationships, but a few countries had a unidirectional causality relationship, such as France.

Considering the specific performance of the two variables, different areas were prone to display various effects. Choong (2012) found insurance development had a one-way causal relationship to economic growth. Alhassan and Fiador (2014) employed an autoregressive distributed lag (ARDL) bounds approach (Pesaran et al. ,2001) to examine the long run causal relationship between insurance and economic growth in Ghana from 1990 to 2010, and found there were a long run positive relationship and unidirectional causality from aggregate insurance penetration, life and non-life insurance penetration to economic growth.

Cristea et al. (2014) established a correlation between insurance and economic growth in Romania by considering insurance penetration and insurance density. Hansen et al. (2014) analyze the corresponding impacts and financing burden of a potential health insurance reform in the US. Shen et al. (2017) proposed a two-stage hybrid MCDM model to measure the plausible synergy effects between life insurance industry and economy attributes.

Most existing studies, however, investigate either the impact of economic growth on insurance or, conversely, the impact of insurance on economic growth of certain areas by one specific model, for example Cobb-Douglas function, but neglect the dynamic changes in the relationship of the economic growth and insurance market.

Because of this background, we attempted to indicate the potential hidden covariation between insurance activities and economic growth of China, particularly in the emerging and growth-leading coastal area. With the purpose of obtaining the concrete states of these relation, we classified our research into three parts the Northern, Eastern and Southern coastal areas (China's administrative division). Based on the non-parametric local polynomial regression, the paper aimed at the dynamic change relationship between insurance development and economic growth, and tried to obtain fitting curve for insurance density and GDP per capita, then analyzed the fitting effect by the monotonicity, convexity and dynamic change characteristics of the curve.

Different from the general estimation model, non-parametric estimation usually does not require constraints. We can obtain better fitting precision with fewer limits on the functional distribution of explanatory variables, and explained variables under this model. Nonparametric estimatorchanged with the variety of variables x. Thus, the local polynomial estimation of the regression equation was estimated as:

We can obtain the local linear regression estimates according to the former

Target selection and data process

This study classified subjects into three parts the Northern, Eastern and Southern coastal areas based on China's administrative division for the period 1990 to 2015. Considering that there is a large discrepancy in the size of population and the economic foundations of each city, we utilized insurance penetration and insurance density in analyzing the data property, while only deployed insurance density to verify the dynamic relationship between insurance market development and economic growth. Following the principle of simplicity in econometrics, we set insurance development as the explanatory variable and per capita GDP as the independent variable. Annual data for real GDP per capita was obtained from the Chinese Statistical Yearbook. The data for insurance premiums were taken from the statistical year books of various provinces (1990-2015). All variables involved were converted by the GDP deflator based on 1990.

Characteristics of the data

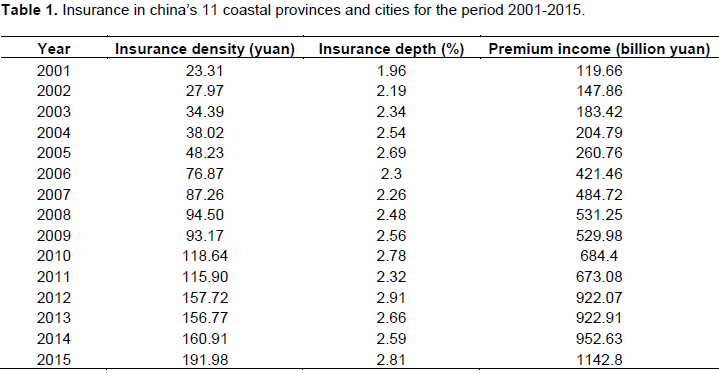

According to the CIRC yearbook 2016, the nominal premium income of China's 11 coastal provinces and cities reached 1142.80 billion Yuan, accounting for approximately 47.07% of the total premium income. Table 1 presented the premium income in coastal areas, with an actual average annual growth rate of 18.59%, and an obvious growth trend between 2001 and 2015. Insurance depth was relatively stable and insurance density had an apparent growth trend of approximately 17.32%. Generally speaking, the development of the insurance industry in coastal areas has been consistent with marine economy growth since 2001. Being affected by financial crises in 2007, the insurance investment had two mutation points in 2009 and 2011.

Table 2 displayed the insurance development in China's coastal provinces. Although the insurance development in China's coastal area had been increasing as a whole, the contrast between different regions on scales of insurance market and trends of insurance development were sharp. From 2001 to 2015, Hebei had an obviously rising premium income ratio in contrast to the more slowly increasing trend of Shandong, Jiangsu,

Fujian, Guangdong and Hainan; Tianjin, Zhejiang, Guangxi kept a relatively narrow growing band, and Liaoning, Shanghai exhibited a mildly declining trend.

Fitting results

The dynamic relationship between gross domestic product (GDP) per capita and insurance density

Figure 1 displayed the fitting results between GDP per capita and insurance density. According to China's administrative division, we classified the research into three parts the Northern, Eastern and Southern coastal areas. The entire coastal area was set as the reference unit, and the Northern, Southern, Eastern coastal districts were set as contrast units.

The local polynomial estimation shown in Figure 1 demonstrated that the data points almost near the fitting curve reflected the relationship of regional GDP per capita and insurance density well. Overall, bandwidth was set to 0.396 for reference unit, and the value of insurance density was 24 to 113 Yuan. The distribution of these data points was relatively uniform, which was more intensive in 2002 to 2008.

But the distribution exist great differences among the contrast units. First, for the Northern unit, the bandwidth was set to 0.337, and the insurance density’ values were 16.4 to 110.7 Yuan, with a cluster zone of 82 Yuan. As the corresponding period was 2002 to 2008, it was assumed the change process of the relationship between insurance development and economy growth was the same as that of the reference unit. For the Eastern unit, the bandwidth was set to 0.681, and the insurance density’ values were 27.3 to 147.2 Yuan, with a cluster zone of 113 Yuan. The corresponding period for this cluster was 2002 to 2006 slightly before the reference unit. So superior resources and geographical advantages indeed brought in more mature insurance market. For the Southern unit, the bandwidth was set to 1.64 and the insurance density’ values were 34.7 to 80.2 Yuan, with a cluster of 57 Yuan and the proper period being 2003 to 2005.

Therefore, the speed and quality of insurance development in the Southern area were both behind other coastal areas. It was obvious that the development of insurance had high consistency with the growth of economy. Social progress created increasing demand for insurance products, but economic crisis might also bog down insurance institutes.

Dynamic features of the relationship between insurance development and economic growth

Based on the fundamental analyses of the relationship between insurance development and economic growth in the three coastal areas, monotonicity, concavity and convexity tests were adopted to identify the dynamic characteristics of the interaction between the two variables.

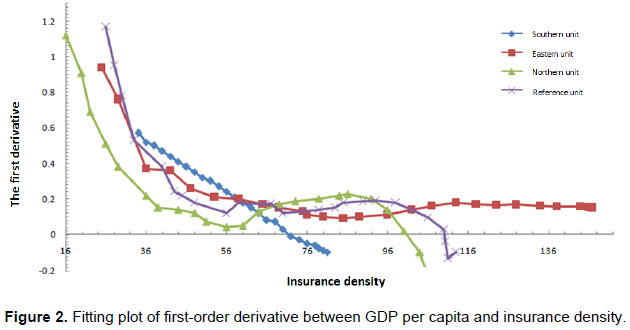

The first derivative was used to represent the ratio of per capita output growth and insurance density growth, and to explain the changes of the marginal product value of insurance density. The larger of the first derivative, the higher regional output efficiency would be. Figure 2 illustrated the fitting plots of the first-order derivative, which experienced decline - steady - decline changing process for the Northern unit, the Eastern unit and the reference unit, but exhibited steady declining for the Southern one.

In accordance with the point mutation of insurance density at 56 Yuan / person and 88 Yuan / person, we divided the curves into three intervals. Before the first interval, all of the output efficiency were declining, and the law of diminishing marginal returns did work. In the middle section, most of the units' output efficiency was relatively stable, and all of those turned into decreasing after the second interval. The Eastern unit had stronger economic strength and risk control ability, so its insurance output efficiency was farther right, and had

been changing more slowly.

The fitting plots of the first-order derivative of the Northern unit and the reference unit were similar. The Northern unit's output efficiency was found at the far left and changed faster than others'. Because of long-time historical, economical and cultural factors, the process of the Southern unit's financial market was lagging behind and undermining the speed and the return of its insurance development, the output efficiency of which only had a single declining trend. Besides, the law of diminishing marginal returns held in most cases, but it would be unfeasible due to external shocks, such as the financial crisis during 2008 to 2010.

Figure 3 showed the second derivative trend of per capita GDP, and insurance density. We introduced the second derivative to reflect the function between insurance development and economy growth, then the sign and the value of the derivative displayed the function types and the rates of relative growth of the two variables respectively. Exponential type was the most common function chosen by analysis focused on relationship between insurance development and economic growth, for which the second derivative was always negative.

But Figure 3 illustrated that only the second derivative of the Southern unit was negative and parts of those were positive of the Eastern and Northern units. So the fixed function, such as the exponential function, could not reflect the correct linkage between insurance development and economy growth in China's coastal areas.

The value of the second derivative showed the rates of relative growth of per capita GDP compared to insurance density. The value of the second derivative of the Northern unit had an obvious inverted U-shaped trajectory ahead of similar trend of the reference unit , and the downturn of those value was 70Yuan/ person of insurance density, being consistent with the fitting curve changing into stable in Figures 1 to 2. The value of the second derivative of the Eastern unit was like a J- shaped trajectory, the higher value at the left and the increasing upward trend of which was corresponding to the steep-beginning and rising-ending curve in Figures 1 to 3. But there still was a decreasing trend of the value in the end of the second derivative of the Eastern unit. The value of the second derivative of the Southern unit was steady, and had a slight increasing sign.

The development of the insurance market played an important role in economy growth of coastal areas, but the effects of this mechanism varied widely across regions. To promote the sustainable development of coastal areas, it was essential to enact targeted policy measures according to the dynamic characteristics of this mechanism.

This study adopted a nonparametric local polynomial to fit the relationship between the insurance development and economy growth of China's coastal areas, and used the monotonic and convex analysis to obtain the changing process of marginal products of regional insurance market and the dynamic function for insurance density and per capita GDP. The nonparametric estimation model avoided the deviation of function form in the parameter estimation, and effectively solved the issues of choosing a random distribution of interference.

The empirical findings of this study were summarized as follows. First, it was certain that insurance market had positive influence on economy growth in China's coastal areas. Stepping into the 20th century, China's marine economy entered a fast development period and improved the external operating environment for insurance industry, so the linkage between insurance development and economy growth turned from complex to stable after 2005. Second, the law of diminishing marginal returns held in general. But there still were some singular points, for example the Northern unit had a marginal product increasing period, which was just in the recovery of financial crisis. Third, the various values of the second derivative verified that fixed function did not apply to quantify the relationship between insurance development and economic growth in China's coastal areas. The convex fitting curve of insurance density and per capita GDP concluded a vague definition of the dynamic relationship between the two variables.

This study indicates that the development of the insurance industry in coastal areas plays an important role in regional economic growth, and it is essential to enact targeted policy measures according to the external environment’s characteristics.

For the Southern coastal area, the most important task is to improve penetration and acceptance of insurance products. For the Eastern coastal area, the exploration of insurance product should be more flexible and diversified. For the Northern coastal area, it was vital to focus on risk management to realize the sustainable development of insurance industry.

Although this study presents an approach for acquiring the dynamic linkage between insurance development and economy growth, it has several limitations. First, only insurance density and per capita GDP were considered in the modeling. Future research could incorporate other dimensions (for example, population structure) to enrich the findings.

Second, the necessary indicators were annual figures, so only yearly dynamic characteristics and changing trend were analyzed, and detailed statement could be gain with more plentiful data. Despite these limitations, future research has two potential directions. First, on the modeling side, the concept of dynamic relations could be integrated with concrete function for improving the explanatory ability. Second, on the application side, collaboration mechanism by using the proposed approach to reduce the region economy development gaps could be undertaken with insurance institutions.

The authors have not declared any conflict of interests.

REFERENCES

|

Arena M (2008). Does insurance market activity promote economic growth? A cross-country study for industrialized and developing countries. J. Risk Insuranc. 75(4):921–946.

Crossref

|

|

|

|

Abdul LA, Vera F (2014) .Insurance-growth nexus in China: An auto regressive distributed lag bounds cointegration approach. Rev. Dev. Finan.13:83-96.

|

|

|

|

Beck T, Webb I (2003) .Determinants of Insurance Consumption Across Countries, World Bank Economic Review.17:51-88.

Crossref

|

|

|

|

Billio M, Getmansky M, Lo AW, Pelizzon L (2012). Econometric measures of connectedness and systemic risk in the finance and insurance sectors. J. Financ. Econ. 104(3):535–559.

Crossref

|

|

|

|

Chiu YB, Lee CC (2012). The impact of real income on insurance premiums: Evidence from panel data. Int. Rev. Econ. Financ. 21(1):246-260.

Crossref

|

|

|

|

Chang CH, Lee CC (2012).Non-linear between life insurance and economic development: a revisited approach. The Geneva Risk and Insurance Rev. 37:227-275.

Crossref

|

|

|

|

Choong CK (2012).Does domestic financial development enhance the linkages between foreign direct investment and economic growth?. Empirical Econ. 42(3):819-834.

Crossref

|

|

|

|

Cristea M, Marcu N, Carstina S (2014).The relationship between insurance and economic growth in Romania compared to the main results in Europe-a theoretical and empirical analysis. Procedia Econ. Financ. 8:226-235.

Crossref

|

|

|

|

Feyen E, Lester R, Rocha R (2011) .What drives the development of the insurance sector? An empirical analysis based on a panel of developed and developing Countries. World Bank Working Paper, 5572.

Crossref

|

|

|

|

Han L, Li DM, Tian Y (2010). Insurance development and economic growth Geneva Papers.The Geneva Papers on Risk and Insurance-Issues and Practice.35(3):183-199.

Crossref

|

|

|

|

Han CL, Wang XJ (2012). The empirical research of the relationships between the development of insurance industry and economic growth in China. 5th International Institute of Statistics and Management Engineering Symposium.26,327-332.

|

|

|

|

Hansen GD, Hsu M, Lee J (2014). Health insurance reform: the impact of a medicare buy-in. J. Econ. Dyn. Control. 45:315-329.

Crossref

|

|

|

|

Hsu M, Huang XG, Yupho S (2015).The development of universal health insurance coverage in Thailand: Challenges of population aging and informal economy, Social Science &Medicine,145:227-236.

Crossref

|

|

|

|

Hsu M, Liao PJ (2015). Financing national health insurance: challenge of fast population aging. Taiwan Econ. Rev. 43 (2):145-182.

|

|

|

|

Wang JJ, Meng LL, Chun L (2010).The economic judgment of the agricultural insurance in modern agriculture development phase. 2nd International Conference on Information Science and Engineering, ICISE2010 - Proceedings 8, 708-711.

|

|

|

|

Li D, Moshirian F, Nguyen P, Wee T (2007). The demand for life insurance in OECD countries.J.Risk and Insurance. 74(3):637-652.

Crossref

|

|

|

|

Liedtke PK (2007). What's insurance to a modern economy? Geneva Papers Risk Insurance-Issues Pract. 32:211-221.

Crossref

|

|

|

|

Lee CC, Chiu YB, Chang CH (2013). Insurance demand and country risks: A nonlinear panel data analysis. J. Int. Money Financ. 36:68-85.

Crossref

|

|

|

|

Law SH, Singh N (2014). Does too much finance harm economic growth?, J. Bank. Financ. 41:36-44.

Crossref

|

|

|

|

Patrick H (1966) .Financial development and economic growth in underdeveloped countries, Economic Development and Cultural Change. 14(1):174-189.

Crossref

|

|

|

|

Roe MJ, Siegel JI (2011). Political instability: Effects on financial development, roots in the severity of economic inequality, J. Compar. Econ. 39(3): 279–309.

Crossref

|

|

|

|

Yang SY, Li HA, Fang HC (2014).The Non-linear relationship between economic and life insurance development in Asia: A panel threshold regression analysis. Computer Science and Its Applications - Ubiquitous Information Technologies. 330(20):1281-1290.

|

|

|

|

Samargandi N, Fidrmuc J, Ghosh S (2015) .Is the relationship between financial development and economic growth monotonic? Evidence from a sample of middle-income. World Development, 68:66-81.

Crossref

|

|

|

|

Shen KY, Hu SK, Tzeng GH (2017) .Financial modeling and improvement planning for the life insurance industry by using a rough knowledge based hybrid MCDM model, Information Sciences.375:296-313.

Crossref

|

|

|

|

United Nations Conference on Trade and Development, 1991. Handbook of International Trade and Development Statistics, United Nation :New York.

|

|

|

|

Ye A (2003). Non-parametric econometrics. Nankai University press, Tianjin. pp.82-92.

|