Full Length Research Paper

ABSTRACT

Commercial banks in developing economies play an important role in promoting the growth of SMEs through the loan provided since they create conducive environment for their growth and success. The study focuses on investigating the challenges SMEs face in acquiring loans from commercial banks. The study used 120 respondents who were purposively and randomly selected. Both primary and secondary data were used. Data were analyzed descriptively and presented in tables, percentages, pie charts and tabulation to show differences in frequencies. Statistical Package for Social Sciences (SPSS) version 20.0 was used in coding, entering and analyzing the data. The study found that high interest rates, lack of collateral, short repayment period, lack of loan information, lack of integrity of bank officers and lack of innovations were the major challenges/difficulties which SMEs face in accessing credit facilities from commercial banks in Morogoro municipality. The study findings generally revealed that SMEs are facing challenges in accessing credit facilities in Morogoro Municipality; hence the researchers, based on the study findings, conclude that SMEs in Tanzania are small because they prefer to get their start-up capital from personal savings, relatives and friends. Based on the study findings, researchers recommended that for banks to attract customers (SMEs) to borrow, they should reduce the interest rates charges. Also, commercial banks should adjust repayment period which would be flexible enough within the business operational cycle of different SMEs in the study area.

Key words: Small and medium enterprises, credit facilities, commercial bank.

INTRODUCTION

Commercial banks in developing economies play an important role in promoting the growth of SMEs through the loan provided since they create conducive environ-ment for their growth and success. Despite the fact that SMEs fail to acquire loans from commercial banks due to unfavorable lending conditions (Mwakababu, 2013), commercial banks are hindered by the absence of a well-functioning SMEs lending market that impedes the growth of SMEs in terms of economy. This led to the negative consequences for economic growth and macroeconomic resilience (Berry, 2002). Commercial banks are financial institutions that accept demand and time deposits, make loans to individuals and organizations, and provide services such as documentary collections, international banking, trade financing (Warsame et al., 2018). Therefore, in this study commercial banks were regarded to be important to all depository institution (Miller and VanHouse, 1993). In Tanzania, the history of commercial banks dates back to 1991 when the Government initiated financial sector reforms in order to create an effective and efficient financial system (URT, 2000). Despite the establishment of local and foreign private banks, such reforms led to the restructuring of two state-owned commercial banks, namely the National Bank of Commerce (NBC) and the Co-operative and Rural Development Bank (CRDB). The problem of acquiring loans from financial institutions is more pronounced for SMEs (Berger and Udell, 2007). This has led to increased interest from various researchers and academicians in Tanzania on the topic of loan provided towards SMEs. For instance, a study by Madole (2013) examined the impact of microfinance credit on the performance of SMEs, Laiser (2013) examined the determinant factors affecting small business holders in microcredit access, Lwidiko (2014) investigated the banks’ trade financing and its contribution to SMEs development while Oni and Daniya (2012) investigated the role of Governments and their financial institutions towards development of SMEs.

Financing SMEs is a topic of significant research interest in academics; it is an imperative issue to policy makers around the globe since majority of them are not considered credit worthy due to various reasons (Alhassan and Sakara, 2014). The study conducted by Sapienza (2004) revealed that SMEs financing is mostly affected by imperfections of financial markets in obtaining external funds compared to larger ones. In this context, it is worth noting that when an economic environment changes, it leads to commercial bank consolidation, mergers, and acquisitions, and most likely affect the credit allocation that hits the core problem of SMEs; that is, changes in the accessibility and availability of loans. In another case, Peek and Rosengren (1995) pointed that, the size of the commercial banks affects the acquisition of loans by SMEs whereby large sized commercial banks tend to lend to medium and large companies; while small or micro size commercial banks often specialize in lending to SMEs. This happens because small size cannot disburse large sized loans because of, (a) legal lending limit regulations, and (b) the diversification strategy of a loan portfolio; small banks have small portions of their loan portfolios with SMEs due to the problem of economy of scale in the screening and monitoring process. The study by Marwa (2014) noted that most SMEs operate as family-based enterprises with no clear demarcation between family and business assets; they operate outside the formal economy. This makes their ability to meet the collateral requirement by commercial banks extremely difficult. In addition to this, the study pointed that most SMEs suffer from a lack of, or poor record keeping systems, undocumented business processes and contracting which lead to an unexpected barrier to loan from formal commercial banks.

Furthermore, the study conducted by Abdesamed and Wahab (2014) revealed that, in most of the developing economies Tanzania being included, commercial banks are often unable or reluctant to grant loans to SMEs; instead they prefer lending to well large and micro enterprises that have well maintained financial statements and credit histories. These findings were supported by Hall and Fang (2004) who argued that, lending to SMEs is perceived to be riskier than to large established enterprises. In this context, lending to SMEs is mostly obstructed by SMEs size and age, lack of business stra-tegy, collateral, financial information, bank requirements as well as the owners or manager’s educational background and business experience. Despite having various studies, little is known on the benefits and non-financial services offered by commercial banks regarding loans towards the growth of SMEs. Thus, this necessitates the need of conducting this study by investigating the effects of loans offered by commercial banks on the performance of SMEs in Tanzania, the case of NMB Bank in Morogoro Municipality.

THEORETICAL AND ANALYTICAL FRAMEWORK

Pecking order theory

The Pecking Order Theory (POT), also known as the Pecking Order Model, relates to a company’s capital structure. The theory was developed by Myers and Majluf (1984). The theory states that managers follow a hierarchy when considering sources of financing (Myers and Majluf, 1984). Therefore, the pecking order theory states that managers display the following preference of sources to fund investment opportunities: first, through the company’s retained earnings, followed by debt, and choosing equity financing as a last resort. The POT arises from the concept of asymmetric information; asymmetric information, also known as information failure, occurs when one party possesses more information than another party, which causes an imbalance in transaction power. These information asymmetries result in varying costs of additional external finance, as potential investors perceive equity to be riskier than debt. Company managers typically possess more information regarding the company’s performance, prospects, risks, and future outlook than external users such as creditors (debt holders) and investors (shareholders). Therefore, to compensate for information asymmetry, external users demand a higher return to counter the risk that they are taking. In essence, due to information asymmetry, external sources of finances demand a higher rate of return to compensate for higher risk. In the context of the POT, retained earnings financing that is, internal financing comes directly from the company and minimizes information asymmetry. As opposed to external financing, such as debt or equity financing where the company must incur fees to obtain external financing, internal financing is affordable and the most convenient source of financing.

When a company finances an investment opportunity through external financing (debt or equity), a higher return is demanded because creditors and investors possess less information regarding the company, as opposed to managers. In terms of external financing, managers prefer to use debt over equity; the cost of debt is lower compared to the cost of equity. The issuance of debt often signals an undervalued stock and confidence that the board believes the investment is profitable. On the other hand, the issuance of equity sends a negative signal that the stock is overvalued and that the management is looking to generate financing by diluting shares in the company. Therefore, when considering sources of financing, the cheapest is through retained earnings, second through debt, and third through equity. Despite the fact that various literatures emphasize that SMEs rely on internal source of finance and external borrowing in order to finance SMEs operations and growth. However, some firms operate under a constrained pecking order and thus do not consider external equity (Howorth, 2001). Indeed, SMEs demand additional capital to finance their operations. Therefore, the study used the POT to explain the need of credit to SMEs in Tanzania.

RESEARCH METHODS AND METHODOLOGY

Description of the study area

The study was conducted in Morogoro municipality, located about 195 km to the West of Dar es Salaam. It is situated on the lower slopes of Uluguru Mountains whose peak is about 1,600 feet above sea level. It is one of the six districts in Morogoro region, with co-ordinates of 6°49’20” S, 37°40’0” E, covering 260 km2 with a population of 315,866 people (URT, 2013). Morogoro Municipality is bordered by Kilombero District to the south, Kilosa District to the south and Mvomero District to the north (URT, 2013). The study area was chosen because of the availability of Small and Medium Enterprises (SMEs) together with financial accessibility, that is, credit provider institutions like NMB Bank and other commercial banks.

Research design

The study employed a case study research design based on mixed research approach. The case study design was used because it is a more cost-efficient method compared to other research designs since it focuses on a single unit, namely the NMB Bank in Morogoro Municipality (Kothari, 2004). Therefore, quantitative approach was used to collect data on predetermined instruments that yield statistics data, while qualitative approach was used to gain deep understanding of respondents’ attitudes and opinions on the challenges small and medium enterprises (SMEs) face in acquiring loans from commercial banks (Mwonge and Naho, 2021).

Sample size and sampling techniques

Sample size

The sample size of this study was 120 SMEs. This size was obtained from the table proposed by Bartlett et al. (2001) that is used in determining the minimum returned sample size for a given population size.

Sampling techniques

Both purposive and simple random sampling techniques were used in our study. Purposive sampling technique was used in the selection of NMB Bank staffs while 120 SMEs were randomly selected in this study.

Data type and collection

Data collection is a process of gathering specific information aimed at providing or rejecting some facts (Kothari, 2004). Both primary and secondary data were used in order to obtain valid and reliable results; primary data were collected from 120 SMEs through interviews and questionnaires; while secondary data were collected through documentary reviews, that is, business annual report, internet and journals.

Data analysis

Data analysis refers to the computation of certain indices or measures along with searching for patterns of relationship that exist among the data group (Kothari, 2004). The collected data were coded and processed using the statistical tool SPSS (Statistical Package for Social Science) version 20 to compute descriptive statistics such as percentages, frequencies and standard deviation. The study results were presented in the form of pie charts and tables.

RESULTS AND DISCUSSION

Challenges SMEs face in acquiring loans from commercial banks

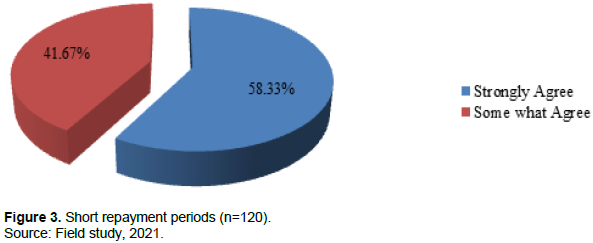

Despite the benefits small business derived from MFIs there are some difficulties they usually face when accessing credit facilities. Our study sought to know the challenges SMEs face in accessing credit facilities from MFIs in Morogoro municipality. Respondents were required to indicate the degree of improvements they know and/or perceive whether they are Strongly Agree (SA), Somewhat Agree (SoA), Neutral (N), somewhat Disagree (SoD) and Strongly Disagree (SD). The study found out that the challenges hindering SMEs from accessing credit facilities were high cost of repayment, that is, high interest rate, integrity of bank officers, short repayment period, unavailability of loan information, lack of collateral, and lack of innovations. Table 1 presents the study results. Table 1 shows the respondents’ perception about the difficulties SMEs face in accessing bank loan. The study found that high interest rates, lack of collateral, short repayment period, lack of loan information, lack of integrity of bank officers and lack of innovations were the major challenges/ difficulties which SMEs face in accessing credit facilities from commercial banks in Morogoro municipality.

High interest rates

The study findings revealed that majority of the respondents, about 80, comprised 66.67%, indicating that high interest rate charged by MFIs is a very big challenge SMEs face in accessing credit facilities; followed by 30 respondents (25%), who agreed to some extent that high interest rate is a challenge, while 10 respondents (8.33%) disagreed with the statement. Figure 1 presents the study results. The study results found out that access to credit facilities from MFIs by SMEs is highly limited by high interest rate of credit given. Indeed, high costs of loan in terms of high interest rates make it extremely difficult for SMEs to access credit facilities from MFIs. The study result is in line with the findings of many related studies (Vuvor and Ackah, 2011; Ndungu, 2014; Mira and Ogollah, 2013) who found that high cost of loan in terms of high interest rates makes it extremely difficult for SMEs to access bank loans. Therefore, based on the study findings, researchers recommended that the management of commercial banks should consider lowering their interest rates to encourage SMEs to borrow and access bank credit.

However, study findings indicate that, 10 (8.33%) of the respondents indicated that the level of interest rate charged by lending institutions is not a challenge SMEs encounter in accessing loans from commercial banks. This implies that SMEs are charged lower interest at NMB Bank as compared to other commercial banks.

These findings were supported by an interviewee who revealed the following:

In our bank, interest rates are not one of the problems

encountered by SMEs in acquiring loans. For instance, SMEs customers are charged lower as compared to other banks, whereby 21% of interest rates are charged for surveyed collaterals and 24% for un-surveyed collaterals.

Another interviewee pointed the following arguments that supported these findings:

Apart from charging low interest rates, our banks charged also low fees towards loans whereby 1.5% of the requested amount are charged as the processing fees, and 0.075% of the requested amount is charged as the insurance fees.

Lack of collateral

The study findings show that 65(54.17%) of the respondents indicated that collateral requirement is very big challenge for SMEs to acquire bank loans followed by 46 (38.33%) of respondents who agreed to some extent while 9 (7.5%) disagreed with the statement. The study result implies that indeed, this is the SMEs costs incurred for securing the loan before (mortgaging) the credit being issued. The results give an indication that SMEs struggle in accessing credit facilities (bank loans) with the high requirement of collaterals SMEs can access banks loan smoothly. The results are presented in pie chart as shown in Figure 2. The study findings from Figure 2 reveal that access to credit facilities is highly limited by strict collateral requirements such as group guarantees, individual guarantors, having a bank account, having equity capital and assets as title deeds and log books. However, the analysis shows that these MFIs operate within the lending principles and the challenge here is that most of the respondents, that is, SMEs in this case do not have these collaterals the MFIs request. The study finding is consistent with the findings of various related studies (Marwa, 2014; Mashenene, 2015; Kwaning et al., 2015; Gangata and Matavire, 2013) who found that lack of collateral is a major challenge for SMEs to access loans from commercial banks. They further argued that though most SMEs have limited contractual arrangement with their suppliers and customers, they have no formalized lease ownership for the land or premises they are operating from. This makes them unable to meet the collateral requirement by banks.

Short repayment periods

The study findings found that 70 (58.33%) of the respondents indicated that short repayment period is a major challenge for SMEs to access credit facilities; followed by 50(41.67%) of the respondents who agreed with the statement to some extent. Indeed, repayment period influences SMEs to access credit to a great extent (M= 1.60, SD= 0.991). The results are presented in pie chart as shown in Figure 3. The study findings from Figure 3 indicate that, all respondents agreed that repayment period was the challenge SMEs encountered in accessing loans from commercial banks. The banks have set the short repayment period that requires SMEs to make payments (that is, principal and interest) in a short period of time. The study result is in line with the findings of various related studies (Rweyemamu et al., 2003; Kamanga, 2020) that financial institutions, that is, MFIs have failed to serve the SMEs by providing loans in both urban and rural communities because of short loan repayment challenges.

Also, these findings were supported by an interviewee who revealed the following:

The repayment period does affect most SMEs in accessing loans from our banks, since they fear that they won’t be able to repay the loan. This arises because of the nature of their business that does generate fluctuating cash flows which might bring difficulties on repaying loans in a given period of time.

Another interviewee pointed out the following that supported these findings:

The repayment period is observed by SMEs as a challenge because the minimum repayment period of six months and maximum period which is extended to 24 months seems to be a short-term period for most of them.

It was further revealed that most of the entrepreneurs interviewed said that the repayment period for the first loan, usually six months was relatively short. They added that they could only manage to access a small amount since the shorter the period, the higher the repayment amount. The suggestion put forward was that the NMB Bank should push the loan repayment period from the current to one year at least to enable the entrepreneurs repay from their business proceeds generated from the borrowed funds.

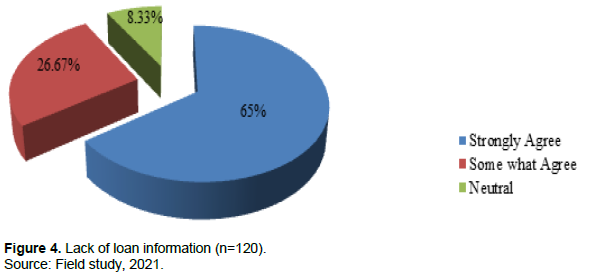

Lack of loan information

The results show that 78(65%) of the respondents strongly agreed that unavailability of loan information was the challenge SMEs face in acquiring loans from commercial banks followed by 32 (26.67%) who agreed to some extent, while 10 (8.33%) were neutral. The results are presented in pie chart as shown in Figure 4. The study findings from Figure 4 indicate that, despite the fact that 8.33% of respondents were neutral the remaining 91.67% agreed that lack of loan information provided by banks was the challenge encountered in accessing loans from commercial banks. Examples of such information are, how to calculate interest amount, different types of loan products that are available for SMEs and how to apply them and their requirements, as well as various alternatives on repayment periods.

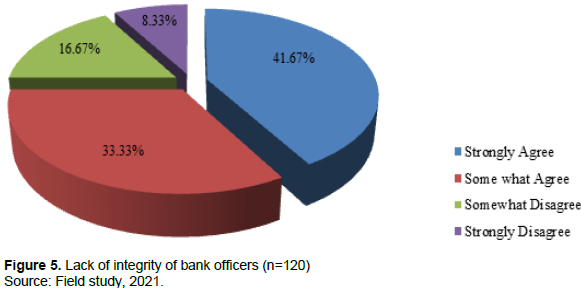

Lack of integrity of bank officers

The study results in Table 1 show that 50 (41.67%) of the respondents strongly agreed that integrity of bank officers was one of the challenges faced by SMEs in acquiring loans from commercial banks followed by 40 (33.33%) who agreed to some extent; 20 (16.7%) of the respondents disagreed, while 10 (8.33%) strongly disagreed with the statement. The results are presented in pie chart as shown in Figure 5. The study findings indicate that 50 (41.6%) of the respondents strongly agreed that integrity of bank officers was the challenge encountered in accessing loans from commercial banks. The study result implies that bank officers were effecting their obligations by abiding to procedures in disbursing loans. Hence, there are no bureaucracy and corruptions among bank officers. The study finding is in line with the findings of Cowton (2002) who argued that banks should generate the trust necessary for any banking system to flourish and contemporary banks need to take into account the consequences of their lending policies.

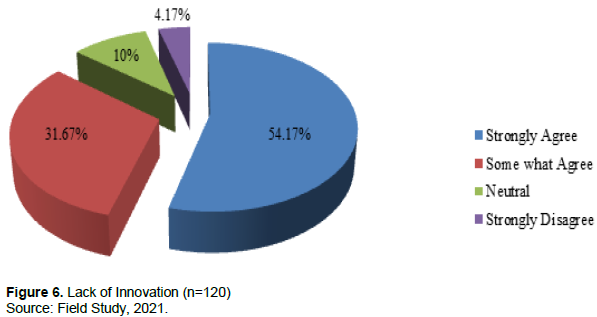

Lack of innovations

The study results in Table 1 show that 65 (54.17%5) of the respondents strongly agreed that lack of innovations was one of the challenges SMEs face in acquiring loans from commercial banks in the study area, followed by 38 (31.67%) who agreed to some extent, while 12 (10%) were neutral, and 5 (4.17%) strongly disagreed with the statement. The results are presented in pie chart as shown in Figure 6. The study result in Figure 6 implies that the banks have failed to be innovative in attracting new customers (SMEs in this case); for instance, introduction of an application that will enable SMEs in tracing the total amount of loans they can access based on the value of their collateral, the interest and principal amount they have to pay, and the time period of a loan.

CONCLUSION AND RECOMMENDATIONS

The study findings generally revealed that SMEs are facing challenges in accessing credit facilities in the Morogoro Municipality; hence the researchers, based on the study findings, conclude that SMEs in Tanzania are small because they prefer to get their start-up capital from personal savings, relatives and friends. Based on the study findings, the researchers recommended that for banks to attract customers (SMEs) to borrow, they should reduce the interest rates charges. Also, it was recommended that financial institutions should set more flexible, affordable, and attractive requirements in financing SMEs in Tanzania.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Abdesamed HK, Wahab AK (2014). Financing of Small and Medium Enterprises (SMEs): Determinants of Bank Loan Application. African Journal of Business Management 8(17):717-727. |

|

|

Alhassan F, Sakara A (2014). Socio-Economic Determinants of Small and Medium Enterprises (SMEs) Access to Credit from the Barclays Bank in Tamale-Ghana. International Journal of Humanities and Social Science Studies 1(26):26-36. |

|

|

Berger N, Udell G (2007). The Economics of Small Business Finance: The Roles of Private Equity and Debt Markets in Financial Growth Cycles. Banking Finance Journal 22(8):613-673. |

|

|

Berry A (2002). The Economics of SMMEs in South Africa. Trade and Industrial Policy Strategies 1(2):1-19. |

|

|

Cowton CJ (2002). Integrity, responsibility and affinity: Three aspects of ethics in banking. Business Ethics a European Review 11(4):393-400. |

|

|

Gangata K, Matavire EHM (2013). Challenges Facing SMEs in Accessing Finance from Financial Institutions, Bulawayo, Zimbabwe. International Journal of Applied Research and Studies 2(7):1-10. |

|

|

Hall C, Fang Y (2004). The APEC Entrepreneur Consortium: Active Risk Management of SMEs Lending through Online Platforms. Paper to the APEC Conference on Promoting APEC Entrepreneurs. The Financiers Perspective HuaHin Thailand pp. 29-30. |

|

|

Howorth CA (2001). Small firms demand for finance: A research note. International Small Business Journal 19(4):78-86. |

|

|

Kamanga PJ (2020). Challenges Facing Small and Medium Enterprises in Accessing Credit Facilities from Micro financial Institutions in Tanzania: MA Dissertation, Jordan University College. |

|

|

Kothari CR (2004). Research Methodology: Methods and Techniques, 2nd edition, New Delhi: New Age International Publishers Limited. |

|

|

Kwaning CO, Nyantakyi K, Kyereh B (2015). The Challenges behind SMEs' Access to Debts Financing in the Ghanaian Financial Market. International Journal of Small Business and Entrepreneurship Research 3(2):16-30. |

|

|

Laiser LG (2013). Determinant Factors Affecting Small Business Holders in Microcredit Access in Tanzania: A Case of National Microfinance Bank in Morogoro Municipal. Master Dissertation. Mzumbe University. |

|

|

Lwidiko B (2014). Banks' Trade Financing and its Contribution to SMEs Development in Tanzania: The Case of Selected SMEs in Dar es Salaam City, Tanzania. European Journal of Business and Management 6(29):14-27. |

|

|

Madole H (2013). The Impact of Microfinance Credit on the Performance of SMEs in Tanzania: A Case Study of National Microfinance Bank - Morogoro. Master Dissertation. Mzumbe University. |

|

|

Marwa N (2014). Micro, Small and Medium Enterprises' External Financing Challenges: The Role of Formal Financial Institutions and Development Finance Intervention in Tanzania. International Journal of Trade, Economics and Finance 5(3):230-234. |

|

|

Mashenene RG (2015). Constraints of Accessing Debt Financing from Commercial Banks among Small and Medium Enterprises in Tanzania: A Literature Review. EAR15 Swiss Conference, Paper ID: Z545. |

|

|

Miller RL, VanHouse DD (1993). Modern Money and Banking. (3rd edition). New York: McGraw Hill. |

|

|

Mira GK, Ogollah K (2013). Challenges facing accessibility of credit facilities among young women owned enterprises in Nairobi Central Business District, Kenya. International Journal of Social Sciences and Entrepreneurship 1(7):377-396. |

|

|

Mwakababu JA (2013). Assessment of the Contribution of Commercial Banks to the Success of SMEs in Tanzania: A Study of NMB Bank PLC; Morogoro Municipality, Master Dissertation Mzumbe University. |

|

|

Mwonge LA, Naho A (2021). Determinants of credit demand by smallholder farmers in Morogoro, Tanzania. African Journal of Agricultural Research 17(8):1068-1080. |

|

|

Myers SC, Majluf NS (1984). Corporate Financing and Investment Decisions When Firms Have Information that Investors do not have. Journal of Financial Economics 13(2):187-221. |

|

|

Ndungu CW (2014). Factors affecting credit access among small and medium enterprises in Murang'a County, Master Dissertation, University of Nairobi, Kenya. |

|

|

Oni EO, Daniya AA (2012) Development of Small and Medium Scale Entrepreneurs: The Role of Government and their Financial Institutions. Arabian Journal of Business and Management Review 1(7):16-29. |

|

|

Peek J, Rosengren ES (1995). Small Business Credit Availability: How Important is Size of Lender? Working Paper P 95. |

|

|

Rweyemamu DC, Kimaro MP, Urassa OM (2003) Assessing Microfinance Services in Agricultural Sector Development, Tanzania: IFPRI Eastern Africa Food Policy Network Brief. P 4. |

|

|

Sapienza P (2004). The Effects of Government Ownership on Bank Lending. Journal of Financial Economics 72(2):257-384. |

|

|

United Republic of Tanzania (URT) (2000). National Micro-Finance Policy. Dar es Salaam: The Government Printer. |

|

|

United Republic of Tanzania (URT) (2013). 2012 Population and Housing Census: Population Distribution by Administrative areas. Dar es Salaam: National Bureau of Statistics. |

|

|

Vuvor S, Ackah J (2011). The Challenges Faced by Small and Medium Enterprises (SMEs) in Obtaining Credit in Ghana. Available at: |

|

|

Warsame MA, Mohamed AA, Gedi ADF (2018). Factors influencing customer satisfaction in commercial banks: Some selected banks in Mogadishu. Degree Roject. Simad University. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0