ABSTRACT

The purpose of this study was to examine the effect of procurement performance on the profitability of Foam Mattress Firms in Uganda. Cross-sectional research design was used to execute the study. Stratified and simple random sampling techniques were employed to draw a sample size of 40 Departments whose inventory, supply chain, production, marketing, internal audit and accounting department formed the unit of analysis while inventory managers, store keepers, supply chain managers, quality controllers, production managers, accountants, and internal auditors formed the unit of inquiry. Questionnaires were self-administered to 200 respondents. The units of analysis (Departments) were each represented by five (5) respondents. The responses were aggregated to the respective units of analysis (Departments). Correlation and regression statistical analysis were performed by SPSS. The findings revealed that procurement performance is positive and significantly associated to profitability (r=0.857; p<0.01). Overall, the results indicate that procurement performance greatly influences profitability in Foam Mattress Manufacturing Firms in Uganda. The study was cross-sectional with its intrinsic weaknesses. This study was limited to Foam Mattress Manufacturing Firms sector in Uganda. Future study should examine the same in line with other private sector industries. Moreover, the findings were drawn from the study within the setting of Uganda, thus future study should examine the same in different countries.

Key words: Procurement, performance, procurement performance, profitability.

Improving profitability demands that firms should be raised to a high level of performance (CPA Australia, 2011). This is because profitability is an essential driver of the future of all firms (CPA Australia, 2011). Conceptually, profitability is the ability of a given investment to earn a return from its use (Tulsian, 2014). Besides, firms that are managed efficiently command higher profits (Al-Jafari and Al Samman, 2015). From the aforementioned studies, it implies that profitability is mostly influenced by overall firm’s positive performance (Pandya, 2014). Moreover, profitability is key to the achievement of firm’s objectives, and most importantly aids the firm to focus on growth strategies to attain these objectives (Margaretha and Supartika, 2016; Khan, 2017). Accordingly, this can be ascertained through the assessment of return on assets (ROA), return on sales

(ROS), return on equity (ROE), return on capital employed (ROCE) and net present value (NPV) (Mwelu et al., 2014; Pandya, 2014; Al-Jafari and Samman, 2015; Richard et al., 2009). Besides, it is through being well-informed on the aforementioned assessment that firms more especially in the manufacturing sector (Foam Mattress) can develop better level of understanding on improving profitability.

In Uganda, this is articulated in numerous government frameworks and strategic plans. Particularly, Uganda Vision 2040 (Republic of Uganda, 2013) visualizes a transformed Uganda from a low-income nation to a modest upper-middle income nation. In this respect, manufacturing sector (Foam Mattress industries) development in Uganda subjugates a significant position in the government’s vision. However, in spite of the important role of profitability as described earlier, profits from manufacturing firms, particularly foam mattress firms have been evidently poor (Uganda Bureau of Statistics, 2014). This is due to limited access to affordable credit, costly, unreliable, and inadequate raw materials, unreliable supply of inputs, low level of technology, and lack of innovations mastery, which adversely impacts on profitability (AFDBG, 2014).

Furthermore, Uganda Bureau of Statistics (2014) supported this evidence through the firms’ performance index between 2009 and 2013 which was seen to be inconsistent. Consequently, there has been accumulated salary arrears leading to lack of motivation of staff, low re-investment rates, under production, accumulated deferred payments, poor deliveries, frequent stock outs, substandard products, failure to meet revenue targets, lack of asset utilization, customer disloyalty, poor customer service among others (Mwelu et al., 2014; AFDBG, 2014; UBOS, 2014).

In view of the aforementioned, procurement performance has been considered as an important facet to an improved profitability (Juma, 2010; Lysons and Farrington, 2006; Van Weele, 2010). Procurement performance is a measure of ascertaining the degree to which the procurement function is able to meet the objectives with least possible costs (Van Weele, 2002). Precisely, it entails how well organizational procurement objectives have been attained (value for money) (Schiele, 2007). Realising this demand firms to focus on supplier delivery accuracy, flexibility, quality conformance, cost saving, inventory flow and price effectiveness (Shalle et al., 2014; Accenture, 2002).

The major objective of this research is to examine the effect of procurement performance and profitability of foam mattress firms in Uganda’s setting.

The empirical study was completed using data drawn from 200 respondents in a sample size of 40 departments drawn from a population frame of 49 departments of foam industries in Uganda (Vita Foam Ltd., Tuf Foam Ltd., Megha Industries, Crest Foam Ltd., Arua Foam Industries, Com Foam Ltd., Euroflex Ltd. and Royikems Firms Ltd. in Uganda). This study contributes to literature through positioning procurement performance in a new context as a predictor to improved profitability. Despite the fact that procurement performance fosters profitability (Juma, 2010), this linkage has not been empirically tested in Foam Mattress firms in Uganda. The closest was by Mwelu et al. (2014), however, this focused on lean manufacturing and profitability of the manufacturing firms in Uganda. The absence of a similar study in the foam mattress firms necessitates this study. Besides, empirical evidence designates that such test in the jurisdiction of Uganda is vague.

Procurement performance

According to Van Weele (2002), procurement performance is a measure of ascertaining the degree to which the procurement function is able to meet the objectives with least possible costs. Precisely, it entails how well organizational procurement objectives have been attained (value for money) (Schiele, 2007). Realising these objectives demand firms to focus on supplier delivery accuracy, flexibility, quality conformance, cost effectiveness, inventory flow and price effectiveness (Shalle et al., 2014; Nasra, 2014; Accenture, 2002). Besides, the core objective of procurement performance is associated with quality conformance, risk management, cost effectiveness, supplier delivery accuracy and uninterrupted inventory flow (Walter et al., 2015). Therefore, it is imperative to comprehend that procurement performance is crucial to firms and its effective execution can uphold firm success (Juma, 2010).

Profitability

Profitability reinforces firm’s performance and is a necessary driver of all firms’ sustainability (CPA Australia, 2011). It is not just about generating money now but also safeguarding the ability to develop the firm in time to come (CPA Australia, 2011). Thus, enhancing profitability will increase the proficiency of the firm to improve performance and this is a necessity of firm proprietors and managers (Swagatika and Ajaya, 2018; CPA Australia, 2011). Besides, no enterprise can endure functioning when they are generating no profits (Smith et al., 2010). This is because profitability is an imperative facet in firm’s engagements (Margaretha and Supartika, 2016). Moreover, profitability is key to the achievement of firm’s objectives, and most importantly aids the firm to focus on growth strategies to attain these objectives (Khan, 2017; Margaretha and Supartika, 2016). Accordingly, this can be ascertained through the assessment of return on assets (ROA), return on sales (ROS), return on equity (ROE), return on capital employed (ROCE) and net present value (NPV) (Mwelu et al., 2014; Pandya, 2014; Al-Jafari and Samman, 2015; Richard et al., 2009). Besides, it is through being well-informed on the aforementioned assessment that firms more especially in the manufacturing sector (Foam Mattress) can develop better level of understanding on improving profitability.

Procurement performance and profitability in an organization

Literature has positioned procurement performance as unique attribute towards improving the company’s profitability (Juma, 2010; Lysons and Farrington, 2006). This means that the right practices of procurement function leads to competitive acquisition hence achieving quality supplies. Besides, the core objective of procurement is linked with quality conformance, risk management, cost effectiveness, supplier delivery accuracy, uninterrupted inventory flow and being a center for reference in the competitive industrial market (Walter et al., 2015; Shalle et al., 2014). Such practices further increase the level of profitability.

Procurement is crucial to firms and its effective implementation can promote business success (profitability). Similarly, studies have demonstrated that poor procurement performance results to financial losses due to delivery of poor materials, questionable value for money among others. This is to mean that shrinkage in profitability of organizations is linked to poor procurement performance (Juma, 2010).

Poor procurement performance is an impediment to growth of many firms and studies have positioned it as the reason for delay in timely delivery, promotes defects, and supply of poor quality materials and sometimes failure to delivery (Migai, 2010). Consequently, these constraints might have been realized as a result of outdated procurement procedures, unskilled personnel, poor integration of procurement activities, failure to install e-system procurement, nonexistence of quality assurance frameworks and up-to-date procurement policies and regulations (Juma, 2010).

Van Weele (2010) further expresses that purchasing performance policies and regulations can contribute to business success in three ways: first, by improving sales margins through substantial cost savings; secondly, through better quality and logistics arrangements with suppliers which leads to a higher capital turnover ratio and thirdly, through establishing effective relationships with the suppliers, which improves the company’s return on net assets.

Similar, the aforementioned has also been demonstrated by Mwelu et al. (2014) in their study on Lean Manufacturing (procurement performance) and Profitability of Manufacturing Firms in Uganda. In the said study, cost reduction, reduction in production time, increase in sales volume as well as profit margins, improved service delivery, increase in return on capital among others resulted from effective procurement performance hence improved profitability. Moreover, procurement performance entails how well organizational procurement objectives have been attained (value for money) (Schiele, 2007).

The aforementioned reviewed literature demonstrates procurement performance as a significant facet of profitability (Juma, 2010; Van Weele, 2010; SAP, 2007; Lysons and Farrington, 2006). Therefore, it is hypothesized that:

H1: Procurement performance is positively linked to profitability in foam mattress manufacturing firms in Uganda.

Conceptual framework

The conceptual framework shown in Figure 1 was drawn from reviewed literature. The procurement performance and profitability is independent and dependent variable, respectively. Since demographic measurements have hitherto been utilized as control variables in research (Min and Khoon, 2014; Al-Khali and Mahmoud, 2012) as cited by Ong’unya and Kalenzi (2019), gender, education, age and tenure were employed as control variable in this study. The measurements utilize for each variable is drawn from previous studies. The perception depicted from Figure 1 assumes that procurement performance affect profitability in foam mattress manufacturing firms in Uganda.

Hypothesis development

Demonstrated from the reviewed literature and theoretical framework, the following research hypothesis was framed:

H1: There is a positive and significant link between procurement performance and profitability in foam mattress manufacturing firms in Uganda.

Study design and technique

This study adopted a cross-sectional research design. Data was obtained from a sample size of 40 departments out of 49 departments drawn from approved population frame of foam mattress industries, as advised by Krejcie and Morgan (1970) for determining sample size. The study covered Foam Mattress firms comprising Vita Foam Ltd., Tuf Foam Ltd., Megha Industries, Crest Foam Ltd., Arua Foam Industries, Com Foam Ltd., Euro flex Ltd. and Royikems Firms Ltd. in Uganda whose inventory, supply chain, production, marketing, internal audit and accounting department formed the unit of analysis while inventory managers, store keepers, supply chain managers, quality controllers, production managers, accountants, internal auditors formed the unit of inquiry.

Stratified sampling technique was applied in selecting 7 inventory departments, 7 supply chain departments, 8 production departments, 8 marketing departments, 6 internal audit departments and 4 accounting departments. Successively, employing simple sampling technique, 6 balls marked with layer’s name were provided. All designations of units of analysis (Departments) were registered on a paper and placed on those corresponding balls as per the layer’s name, from which the samples were drawn without replacement until the sample size of 40 was attained. This sample size is arbitrated adequate as demonstrated by Roscoe (1975), rule of the thumb, signifying that a sample size between 30 and 500 is adequate for any study. Questionnaires were self-administered to 200 respondents.

Measurements of variables

To tap into the realm procurement performance and profitability, this study reviewed the Accenture (2002) model and Richard et al. (2009) model. According to Accenture (2002), dimensions of procurement performance include purchase price index, quality conformance, material inventory turnover, and supplier delivery accuracy. Conversely, Richard et al. (2009) identified the following accounting based dimensions of profitability: return on assets (ROA), return on sales (ROS), return on equity (ROE), return on capital employed (ROCE) and net present value (NPV). The items in both models were adjusted to fit this study. For validation purposes, the items in the tool were distributed to 10 experts comprising both manufacturing managers and academicians. The content validity index was established to be above 0.80. This was beyond the suggested minimum of 0.70 (Nunnally, 1978). Items were anchored on a five-point Likert-like scale (1-5) ranging from Strongly Disagree to Strongly Agree. The adjusted questionnaire had 30 and 18 items, respectively.

Validity and reliability

The items in the tool were distributed to 10 experts comprising both manufacturing managers and academicians. All study variables recorded a content validity index of 0.80. This was above the suggested minimum of 0.70 (Nunnally, 1978).

Similarly, the reliability scale of the two scales of procurement performance and profitability were also established using Cronbach Alpha Coefficient as generated by Statistical Package for Social Scientists (SPSS). Cronbach alpha coefficient for all the study variables was 0.89 and 0.80, respectively. This was well beyond suggested threshold of 0.70 (Nunnally, 1978). Therefore, the scale for measuring procurement performance and profitability were reliable as shown in Table 1.

Correlation and regression analysis

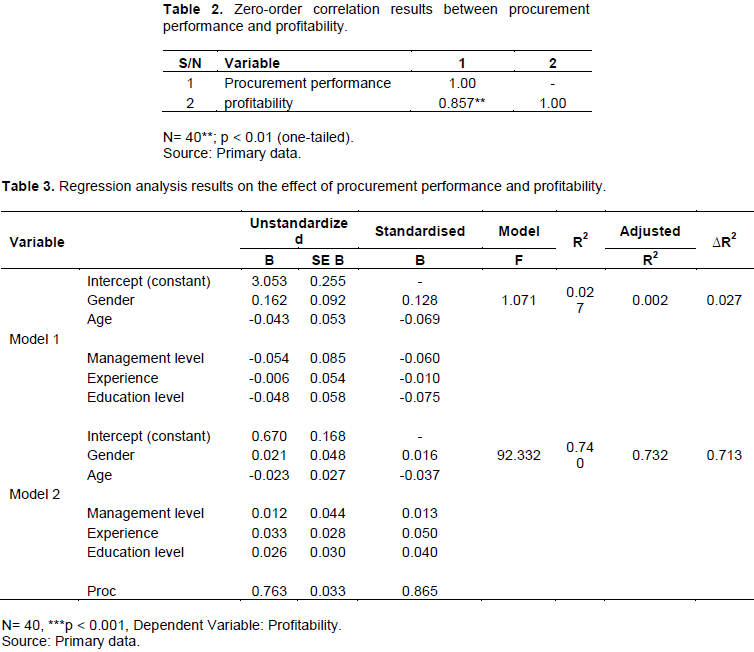

Pearson’s product moment correlation coefficient and regression analysis was utilized to evaluate the relationship between the study variables. The statistical results are shown in Table 2.

The correlation analysis results demonstrated in Table 2 exhibit a positive and significant (r = 0.857; p<0.01) link between procurement performance and profitability of foam mattress firms in Uganda. The model assessment results unveiled in Table 3, indicate that Model 1 is statistically insignificant (R2 = 0.027; p > 0.05). Given that demographic dimensions have earlier been utilized as control variables in studies by Min and Khoon (2014) and Al-Khali and Mahmoud (2012) as cited by Ong’unya and Kalenzi (2019) in Model 1; the control variables were controlled (gender, age, management level, experience and educational level). The findings demonstrate that control variables explained 2.7% of the overall variation in profitability. This implies that the livelihood of demographic measurements to profitability in Foam Mattress Firms in Uganda is statistically insignificant (R2 = 0.027; p > 0.05). On the other hand, regression analysis is shown in Table 3: Model 2 established that 74% of the overall variation in profitability is illustrated by procurement performance (R2 = 0.740; p < 0.001). Based on the correlation results (r = 0.857; p < 0.01), supported by regression analysis results (R2 = 0.740; p < 0.001) hypothesis (H1) is supported.

The study examined the effect of procurement performance and profitability in Foam Mattress Firms in Uganda. The study showed that the relationship between procurement performance and profitability was positive and significant. This finding is in line with Van Weele (2010), Lysons and Farrington (2006), Juma (2010), Shalle et al. (2014) and Walter et al. (2015) suggesting that as right practices in procurement function are put in place, there is a likelihood that quality conformance, risk management, cost effectiveness, supplier delivery accuracy and uninterrupted inventory flow will be achieved; as Foam Mattress Manufacturing firms in Uganda aim to ensure that they attains success (profitability), they become effective in implementing best procurement performance practices and therefore, success is realized. Subsequently, there is a probability that salary constraints, low re-investment rates, under production, accumulated deferred payments, poor deliveries and frequent stock outs, substandard products, failure to meet revenue targets, lack of asset utilization, customer disloyalty, poor customer service among others will be settled.

The study assessed the effect of procurement performance on profitability of Foam Mattress Manufacturing Firms in Uganda. The finding shows that the relationship between procurement performance and profitability was positive and significant. Hence, it is necessary to note that procurement performance is significant towards improved profitability. Therefore, this study appendage to the literature through positioning procurement performance as a facet that enhance profitability in Foam Mattress Manufacturing Firms within Uganda’s setting.

Although this study has unearthed significant and valuable information to pertinent stakeholders, it is also limited in the following ways:

(1) The findings were drawn from the study within the setting of Uganda. This made it difficult to generalize the findings in relation to other countries. Therefore, future study should examine the same in line with another country.

(2) The study was carried out in Foam Mattress Manufacturing industry in Uganda. The future study should look at the same in line with other private sector firms in Uganda or the same but in global perspective.

The authors have not declared any conflict of interests.

REFERENCES

|

Accenture (2002). The Buying Organization of the Future - 2002 European Procurement Survey. Accenture.

|

|

|

|

African Development Bank Group (AFDBG) (2014). Eastern Africa's Manufacturing Sector-Uganda Country Report: Promoting Technology, Innovation, Productivity and Linkages. Available at:

View

|

|

|

|

|

Al-Jafari MK, Al Samman H (2015). Determinants of Profitability: Evidence from Industrial Companies Listed on Muscat Securities Market. Review of European Studies 7(11):303-311.

Crossref

|

|

|

|

|

Al-Khali A, Mahmoud AB (2012). The role of demographics in patients' perception towards the quality of health care services provided at public hospital in Damascus. European Journal of Economics, Finance and Administrative Sciences 48:113-121.

|

|

|

|

|

CPA Australia (2011). Improving Business Performance. Available at:

View

|

|

|

|

|

Juma MJ (2010). Lead from where you are: Quarterly PPO Bulletin (4)1. Nairobi: A publication of Non-Governmental Organizations Procurement Oversight Authority.

|

|

|

|

|

Khan ZA (2017). Profitability Maximization as an Objective of a Firm-A Robust Perspective. International Journal of Research in Finance and Marketing 7(6):217-219.

|

|

|

|

|

Krejcie RV, Morgan DW (1970). Determining Sample Size for Research Activities. Educational and Psychological Measurement 30(6):607-610.

Crossref

|

|

|

|

|

Lysons K, Farrington B (2006). Purchasing and supply chain management. Pearson Education.

|

|

|

|

|

Margaretha F, Supartika N (2016). Factors Affecting Profitability of Small Medium Enterprises (SMEs) Firm Listed in Indonesia Stock Exchange. Journal of Economics, Business and Management 4(2):132-137.

Crossref

|

|

|

|

|

Miga J (2010). Development Partners and Governing Non-Governmental Organizations Procurement in Kenya. 1st Ed. Kenya: Macmillan Publishers.

|

|

|

|

|

Min S, Khoon CC (2014). Demographic Factors in the Evaluation of Service Quality in Higher Education: A Structural Equation Model (SEM) Approach. International Journal of Marketing Studies 6(1):90-102.

Crossref

|

|

|

|

|

Mwelu N, Rulangaranga DM, Watundu S, Tindiwensi K (2014). Lean Manufacturing and Profitability of Manufacturing Firms in Uganda. European Journal of Business and Management 6(18):187-190.

|

|

|

|

|

Nasra BH (2014). Procurement performance and operational efficiency in telecommunication industry in Kenya. (Unpublished thesis) University of Nairobi.

|

|

|

|

|

Nunnally JC (1978). Psychometric theory (2nd edition). New York, McGraw-Hill.

|

|

|

|

|

Ong'unya GO, Kalenzi A (2019). Internal control and quality service delivery in a public health sector: A case study of a Local Government in Uganda. African Journal of Business Management 13(16):557-563.

|

|

|

|

|

Pandya H (2014). Identifying Major Determinants of Profitability for Selected Nationalized Banks in India. International Journal of Business and Administration Research Review 2(4):105-125.

|

|

|

|

|

Republic of Uganda (2013). Uganda Vision 2040, National Planning Authority.

|

|

|

|

|

Richard PJ, Devinney TM, Yip GS, Johnson G (2009). Measuring Organizational Performance: Towards Methodological Best Practice. Journal of Management 35(3):718-804.

Crossref

|

|

|

|

|

Roscoe JT (1975). Fundamental Research Statistics for Behavioral Sciences. New York: Holt.

|

|

|

|

|

SAP (2007). Enabling Profitable Growth through Procurement: Transforming The Sourcing and Procurement Organization. Available at: View

|

|

|

|

|

Schiele H (2007). Supply-management maturity, cost savings and purchasing absorptive capacity: testing the procurement - performance link. Journal of Purchasing and Supply Management 13(4):274-293.

Crossref

|

|

|

|

|

Shalle NI, Guyo W, Amuhaya IM (2014). Role of inventory optimization. Journal of supply chain Management. 32 (7):139-144.

|

|

|

|

|

Smith MK, Ball PD, Bititci US, Van de Meer RR (2010). Transforming mass production contact centres using approaches from manufacturing. Journal of Manufacturing Technology Management 21(4):433-448.

Crossref

|

|

|

|

|

Swagatika N, Ajaya KP (2018). The determinants of corporate profitability: an investigation of Indian manufacturing firms. International Journal of Emerging Markets 13(1):66-86.

Crossref

|

|

|

|

|

Tulsian M (2014). Profitability Analysis: A Comparative Study of SAIL and TATA Steel. Journal of Economics and Finance 3(2):19-22.

Crossref

|

|

|

|

|

Uganda Bureau of Statistics (UBOS) (2014). Statistical Abstract. Available at:

View.

|

|

|

|

|

Van Weele AJ (2010). Purchasing and Supply Management: Analysis, Strategy, Planning and Practice. 5th Edition. London: Thomson Learning.

|

|

|

|

|

Van Weele AJ (2002). Purchasing and Supply Chain Management. Analysis, Planning and Practice. 3rd edition. London: Thomson Learning.

|

|

|

|

|

Walter NM, Christopher M, Kepha O (2015). Effects of Procurement Practices on the Performance of Commercial State owned Enterprises in Nairobi. International Journal of Scientific and Research Publications 5(6):1-11.

|

|