This quantitative study examines the reasons for changes in the leverage levels of the firms in GIPSI countries (Greece, Ireland, Portugal, Spain, and Italy), following the development of the sovereign debt crisis that began in 2009. This research belongs to the empirical literature studying the effects on firm leverage of reduced bank credit supply caused by that crisis. For all the sample firms and for each firm typology, that is, unlisted, listed, unlisted family, unlisted nonfamily, listed family and listed nonfamily, and for the entire period being analysed, the sample means of the debt-to-assets ratio in each year were calculated. The results show that owing to the lack of bank credit, unlisted firms reduced their leverage, whereas listed companies generally maintained their indebtedness, thanks to their access to financial markets. In spite of their orientation to socio-emotional wealth and its protection, unlisted family firms could not decrease their debt-to-assets ratio significantly less than unlisted nonfamily firms, due to the restriction of capital offered by banks. In contrast, the inclination toward the consolidation of socio-emotional wealth possibly enabled listed family firms to take advantage of the scarcity in bank capital to increase their leverage via bond issues, while listed nonfamily firms reduced the proportion of debt they employed, as the perpetuation of the business for future generations is not an issue for them.

GIPSI countries (Greece, Ireland, Portugal, Spain, and Italy) are generally characterized by bank-oriented financial systems (Bijlsma and Zwart, 2013). This implies that unexpected and sudden events weakening bank credit availability, such as the recent sovereign debt crisis in the euro zone of the European Union, have a sizeable impact on the capital structure of firms in GIPSI countries. Specifically, the sovereign debt crisis, which started in late 2009 in Greece and propagated throughout the euro zone among GIPSI countries, caused the interest rates of the bonds of the sovereign debt of these states to increase and thus provoked the deterioration of the equity value of the banks that invested in those bonds. Consequently, banks’ access to collateralized lending decreased, because the value of eligible collateral dropped, typically in sovereign bonds, and the available offer on interbank markets became weaker (Bofondi et al., 2013). Furthermore, raising capital from depositors became difficult for banks, as the perceived risk by investors considerably increased. Hence, this problem of cash affecting banks, which had already been hit by the consequences of the subprime crisis exploded in 2007 and 2008 (Cingano et al., 2016) passed on to trade and manufacturing firms within the GIPSI countries, in the context of the extended slow development of the euro zone generally and of the GIPSI states in particular (Shambaugh, 2012). The general deterioration of the financial situation of the considered firms generated a sizable amount of non-performing loans and a further weakening of banks’ ability to provide cash for businesses, in a complicated vicious circle involving GIPSI states and their financial and real economy.

Some researchers opine that the reduction in bank lending depended on the restriction in the offer and the increase in the cost of bank financing (Acharya et al., 2018; Corbisiero and Faccia, 2020; DemirgÈ•ç-Kunt et al., 2020), while others believe it was caused by a decline in the demand for credit by firms because of poor and scarce business opportunities (Jiménez et al., 2012; Bofondi et al., 2013). Both supply and demand reasons play a role in the reduction of bank lending and, regardless of the strength of these explanations, different kinds of firms are likely to react differently to the declining credit availability (supply), in terms of changes in their capital structure. This depends on their ability to substitute bank credit for lending from other sources, such as bond issues on financial markets, and their attitude toward debt as opposed to equity.

Hence, the focus of this study is the analysis and explanation of the possible capital structure variations of the firms in GIPSI countries, whereas the aim of this research is to empirically examine if, why, and how firms from GIPSI countries and of different characteristics changed their capital structure composition, owing to the reduction in bank supply as a consequence of the sovereign debt crisis. The objective of this analysis is to provide a contribution to the understanding of the consequences in terms of capital structure changes of the firms being investigated. This work uses a quantitative approach based on the interpretation of available data gathered from a large dataset of several thousand GIPSI businesses. The value of the research lies in the fact that it increases the knowledge and awareness of the real effects of the sovereign debt crisis in the euro zone, as expressed by the change in the leverage (measured by the debt-to-assets ratio) of the non-financial firms in GIPSI countries. The research problem being investigated concerns how companies with specific characteristics respond to credit availability, depending on whether they can issue bonds in financial markets (listed vs. unlisted firms) and their higher or lower orientation toward debt sources (family vs. nonfamily firms).

The rest of this paper is organized as follows. Firstly, the main dimensions of the sovereign debt crisis and their linkage with other euro zone crisis are discussed. Secondly, an explanation of the distinctive features of family businesses, which may determine a greater orientation toward debt relative to their nonfamily counterparts, is offered. Thirdly, a few hypotheses of the impact of the sovereign debt crisis on the capital structure of the sampled firms are put forward. Then, the research method and results are given. Lastly, conclusions are presented.

The sovereign debt crisis and its linkage with other euro zone crises

The impact of the sovereign debt crisis on the capital structure of affected firms can be fully and correctly interpreted if the sovereign debt crisis in the specific financial and economic context in which it exploded is analyzed. Specifically, three major crises occurred in the euro zone after the subprime crisis of 2007 and 2008 (Cingano et al., 2016). First, a banking crisis occurred, as banks were undercapitalized and encountered liquidity problems. Then a crisis arose categorized precisely as a sovereign debt crisis because a few states, that is,the GIPSI countries, faced rising bond yields and found it difficult to acquire financing. Lastly, there was a growth crisis, with both a low overall level of growth in the euro zone and an unequal distribution across countries (Shambaugh, 2012).

The subprime crisis generated a banking crisis owing to the collapse in the value of house prices and mortgages in the US (Fender and Gyntleberg, 2008). Moreover, despite the several securitization procedures of these risky assets, banks had financed the special purpose vehicles involved or they were sponsors of the operations and thus needed to avoid the bankruptcy of the special purpose vehicles to safeguard their reputation by financially supporting them (Monti, 2009). The banking crisis provoked a reduction in the liquidity of the international interbank markets, leading to credit restrictions (Gaiotti, 2013) in several countries. That significantly prevented firms from obtaining cash for investments and repayment of their outstanding debts, successively causing banks to increase the perceived level of risk of their borrowers and enterprises to increase the estimated degree of risk within transactions. The related deterioration of the business expectations and value creation provoked a fall in tax revenues, whereas public spending grew to help the real economy cope with the negative effects of the general crisis.

The banking crisis in particular worsened the public finance indicators (specifically debt-to-GDP and deficit-to-GDP ratios) of some countries within the so-called euro zone of the European Union, that is, Greece and the other GIPSI countries, which already had a weak public finance situation. In fact, following the collapse of Lehman Brothers in September 2008, most governments in the euro zone adopted banking-sector rescue packages of extraordinary impact. Furthermore, banking crises implied further substantial losses of tax revenue (Gerlach et al., 2010). Additionally, as previously mentioned, there was a general crisis that generated a decrease in tax revenues and an increase in public spending in an attempt among governments to sustain enterprises and families. All of this entailed a further increase in the public deficit and debt relative to the GDP of the GIPSI countries and hence a significant growth of the spread of their bonds compared to that of the German bonds.

From an historical point of view, the sovereign debt crisis that originated in the euro zone in late 2009 became manifest from the first part of 2010, when it hit the GIPSI countries. In spring 2010, Greece was the first to exhibit difficulty with placing its public bonds on the market, owing to its very poor public finance situation. During the following months, other GIPSI countries, that is Ireland (November 2010), Portugal (April 2011), Spain, and Italy (July 2011), underwent the effects of a high increase in investors’ requests for returns on public bonds (Busetti and Cova, 2013).

Moreover, the considerable public debt and low-growth prospects of countries such as Italy were also responsible for the high increase in the spread during the last part of 2011 (Busetti and Cova, 2013). Specifically, the euro zone was characterized by two dimensions of growth crisis. On the one side, the area on the whole developed too little to reduce the unemployment rate and support the debt level, and on the other side, the GIPSI countries grew considerably more slowly (Shambaugh, 2012).

In sum, the sovereign debt crisis took place in a situation of banking and growth crisis in the GIPSI countries, and this contributed to the poor availability of financing from banks, as explained in a subsequent paragraph. Past researches concerning financial crises and credit reduction to firms (credit crunch) have investigated their relationships. For example, Soana et al. (2013) observe that three main interpretations can be put forward in the context of the subprime mortgage crisis. In fact, the reduction in credit can depend on the restriction of the supply of bank financing (Albertazzi and Marchetti, 2010; Puri et al., 2011; Jemenéz et al., 2012; Iyer et al., 2014); on the contrary, a contraction in the demand for credit by firms can occur (Kremp and Sevestre, 2012; Rottmann and Wollmershauser, 2013); finally, some claim that the credit crunch should be viewed as the product of a simultaneous reduction in both credit supply and credit demand (Popov and Udell, 2010; Presbitero et al., 2012). Similarly, and more recently other authors examined the impact of the credit crunch, during the European sovereign debt crisis, on the corporate policies of GIPSI firms and also find mixed results. However, these studies cover very specific sources of bank financing for considerable firm investments, that is syndicated loans (Acharya et al., 2018), focus on SMEs to analyse their ability of obtain bank credit (Corbisiero and Faccia, 2020), compare firms with different dimensions, without dealing with their family nature or not (DemirgÈ•ç-Kunt et al., 2020), concentrate on a specific GIPSI country (Jiménez et al., 2012; Bofondi et al., 2013).

Hence, to the best of the researcher’s knowledge, no prior study covers the specific topic investigated. The issue examined concerns the capital structure decisions of firms in all the GIPSI countries, as a consequence of the sovereign debt crisis and thus bank credit rationing. In doing so, the study considers the various sources of financial debt and distinguishes not only between listed and unlisted firms, but also between family and nonfamily firms. A large amount of data was used to infer the likely reasons for the changes in indebtedness of the enterprises considered. Thus, this study helps clarify the effects of the sovereign debt crisis on the capital structure decisions of firms in GIPSI countries.

Family firms, socio-emotional wealth, and indebtedness

Numerous explanations have been given to justify the level of indebtedness of a firm. In this respect, after the publication of the irrelevance theory by Modigliani and Miller (1958), researchers have identified taxation and distress costs (Kraus and Litzenberger, 1973), asymmetric information between insiders and outsiders (Myers, 1984; Myers and Majluf, 1984), and agency problems (Ross, 1973; Jensen and Meckling, 1976; Myers, 1977; Smith and Warner, 1979; Jensen, 1986; Mork et al., 1988) as significant determinants of the capital structure choices of businesses (Harris and Raviv, 1991; Rajan and Zingales, 1995; Frank and Goyal, 2009; La Porta et al., 1999; among others).

Several studies demonstrate that family firms would rather choose debt over equity when they finance their investments, whereas few show a negative effect of family ownership on the employment of debt financing (Michiels and Molly, 2017). However, this preference for debt financing is not likely to be associated with the specific role of the aforementioned main determinants of the capital structure in the context of family firms and, in particular, regarding substantial agency conflicts in family firms. The motivation is that family enterprises are characterized by a specific ownership and governance and they also need to create and maintain their socio-emotional wealth (SEW). It is worth emphasizing that SEW is defined as a group of several factors, including identity, the ability to exercise family influence, and the perpetuation of a family dynasty (Gomez-Mejia et al., 2007). SEW generation and safeguard require autonomy and control, family cohesiveness, supportiveness, harmony, loyalty, pride, family name recognition, respect, status, goodwill in the community (Zellweger et al., 2011), the need to transfer the family business to future generations, and the need to sustain the family’s image and reputation (Naldi et al., 2013).

As just stated, ownership and governance features and SEW recognition imply that all types of agency conflicts are negligible in family firms and thus debt employment is not connected to the effect of or control on agency costs in family businesses. This assertion can be clarified as follows.

First, agency conflicts between managers and owners (Berle and Means, 1932; Jensen and Meckling, 1976; Jensen, 1986) are irrelevant in first-generation family businesses, as ownership and management are usually concentrated on the founder and his/her nuclear family (Blanco-Mazagatos et al., 2007). Besides, family owners usually have large ownership structures (Cheng, 2014), hence they have a strong incentive to effectively monitor managers (Demsetz and Lehn, 1985; Shleifer and Vishny, 1986; Villalonga et al., 2015), when they are not (rarely) managers themselves. In addition, owing to the SEW orientation; a family dominant group is more likely to engage in proactive stakeholder engagement activities, even when they offer no obvious financial returns. From this point of view, family managers are closely identified with the firm’s actions and tend to live in the community (Gómez-Mejia et al., 2011). The virtual absence of the previously mentioned type of agency costs in first-generation family firms protects them from their use of debt being influenced by agency conflicts between owners and managers in these firms, neither by possible opportunistic managers nor as a means of control over managers by careful owners. Moreover, agency conflicts between managers and owners are also insignificant in later-generation family businesses, despite the fact that ownership and management become more dispersed and differentiated, and hence owner-managers can be focused on the interests of their family branch and make decisions for the benefit of their own nuclear family, rather than for that of the family (firm) as a whole (Blanco-Mazagatos et al., 2016). This is connected to the presence of appropriate governance mechanisms, such as direct control by non-manager owners, existence of board of directors and family governance mechanisms (for example, the family council mentioned by Villalonga et al., 2015), efficaciously disciplining managers, with no need for debt employment.

Secondly, agency conflicts between family controlling and non-controlling owners are also trivial. The very often considerable ownership by the family in family businesses and their related long investment horizon and great reputation concerns (Gedajlovic and Carney, 2010; Steijvers and Niskanen, 2014) lessen the agency conflicts between dominant family owners and minority owners in family firms. Hence, debt employment does not have a correlation with this kind of agency problem.

Thirdly, the agency conflicts between owners and lenders are looked at, they appear to be of minor importance, as is the scarce use of debt in reducing them, thanks to the SEW dimension, in terms of business perpetuation and family’s image and reputation, for which family owners tend to behave very fairly toward lenders. At the same time, though, because of their SEW orientation, family firms strive to maintain control over their business in the long run, which actually represents an important dimension of family socio-emotional wealth (Gottardo and Moisello, 2014) and dominate risk considerations (Gottardo and Moisello, 2014; Burgstaller and Wagner, 2015). In turn, this need for control over the business among present and future generations can lead family firms to pursue different capital structure decisions in the context of the sovereign debt crisis, as opposed to their nonfamily counterparts, that is to prefer a higher level of indebtedness. This issue constitutes a core topic of this work and thus will be further discussed in the next section, in which specific hypotheses are offered.

The sovereign debt crisis and its impact on the capital structure of the firms of GIPSI countries

Following the eruption of the sovereign debt crisis, bank lending to non-financial corporations located in the GIPSI countries strongly decreased (Corbisiero and Faccia, 2020). Finance literature has investigated the underlying causes of the reduction in bank credit, producing two main interpretations.

According to some, the decline in bank lending essentially depended on the restriction in the conditions and supply of bank financing. First, banks’ exposure to sovereign debt and the related value decrease of their equity, as well as the change in the banks’ portfolios from corporate lending toward risky sovereign debt (through the moral suasion channel and risk-shifting channel) (Acharya et al., 2018), reduced the availability of bank financing for firms. In fact, on the one hand, less sound banks became riskier and found it difficult to raise new capital from depositors, corporate bond issues, or other banks (at least at affordable rates of interest) to provide to businesses. On the other hand, the increasing proportion of banks’ liquidity employed in sovereign debt deteriorated the availability of bank credit for firms. Secondly, the further weakness in the bank balance sheet, caused by considerable non-performing loans, implied a lower ability to grant lending even to healthy firms (Corbisiero and Faccia, 2020). Lastly, during a financial crisis, the general weakening of the creditworthiness of firms means greater risk for lenders, so the term premium at which they are willing to lend increases significantly (DemirgÈ•ç-Kunt et al., 2020), and that generates a decrease in the actual access to bank loans for businesses.

According to others, however, this represents a contraction in the demand for credit by firms, owing to a lack of new business opportunities that caused the amount of bank loans to diminish (Jiménez et al., 2012; Bofondi et al., 2013). In other words, the worsening of the business forecasts in the context of a general crisis and slow growth mostly in GIPSI countries (Shambaugh, 2012) pushed enterprises to postpone or give up new loan applications. The study neither disentangles demand and supply factors nor discuss their role and importance in terms of credit contraction among GIPSI countries, even if, both explanations may account for the decrease in bank lending. On the contrary, the study will provide a feasible explanation of the differences in capital structure decisions among firms of different types in GIPSI countries over the sovereign debt crisis. In fact, the possible change in the leverage of the firms belonging to these countries likely depends on their characteristics, since the latter are important determinants of a firm’s capital structure choices (Jensen and Meckling, 1976; Jensen, 1986; Myers, 1977; Myers, 1984; Myers and Majluf, 1984; Harris and Raviv, 1991; Rajan and Zinagales, 1995; Frank and Goyal, 2009).

Specifically, listed firms have access to financial markets and thus can compensate for a decrease in bank lending. In other words, capital markets provide a “spare tire” in time of financial crisis for listed companies (DemirgÈ•ç-Kunt et al., 2020). On the contrary, unlisted firms strongly depend on bank credit, especially in bank-oriented financial systems such as those in the GIPSI area (Bijlsma and Zwart, 2013) and thus are more likely to be affected by the worsening in the availability of bank loans (Shambaugh, 2012). Therefore, unlisted firms may have needed to reduce their leverage owing to more difficult access to bank lending, whereas generally listed firms may have not significantly changed their capital structure mix. Following this reasoning, the hypothesis is as follows:

H1: Unlisted firms reduced their leverage, whereas listed firms did not significantly decrease their leverage.

As far as family firms are concerned, several studies show that family firms prefer debt over equity when they finance their investments, whereas few show a negative effect of family ownership on the employment of debt financing (Michiels and Molly, 2017). This is due to SEW considerations, as argued in the previous section and, in particular, to the need to maintain control over the business in the long run (Burgstaller and Wagner, 2015) by avoiding the use of (external) equity. However, because of limitations in bank credit over the sovereign debt crisis, unlisted family firms could have been unable to reduce their leverage significantly less than unlisted nonfamily firms. Therefore, the further hypothesis is as follows:

H2: Unlisted family firms did not reduce their leverage significantly less than unlisted nonfamily firms.

The study finally contend that the attention to SEW, in terms of family business preservation and its consolidation, probably caused listed family companies to take the opportunity during a lack in bank capital to increase their leverage by issuing bonds. On the contrary, listed nonfamily firms reduced their leverage because they have no particular reason to prefer bonds over shares in times of bank credit restriction. This happens especially when ownership is characterized by block holdings and because listed nonfamily companies are just not concerned about the perpetuation of the business. Thus, this study’s last hypothesis:

H3: Listed family firms increased their leverage, whereas listed nonfamily firms reduced their leverage.

Table 1 shows that the majority of the firms in the sample are Italian businesses (74%), Spanish firms are the second group (18%), followed by the Greek (5%), Portuguese (2%), and Irish (1%) companies. Listed firms are very few; they prevail in Greece (40) and, on the whole, represent less than 1% of the firms being studied, demonstrating the low development of capital markets, which is a specific feature of the bank-oriented financial systems of the GIPSI countries.

Generally speaking, family firms are a common type in these states (76%). Nonetheless, the situation changes depending on the country being considered. Family firms constitute the largest kind of business in Italy (77%) and Spain (76%); while only in Portugal, family firms cover less than half of the firms (46%). The presence or absence of “familiness” (Habbershon and Williams, 1999) for the sampled firms do not seem to characterize the ability of a firm to go or not to go public, since the distribution of the listed family firms differs across the countries under analysis. In fact, whereas 88% of the listed firms in Greece are family firms, in Italy only 48% of the listed companies are family firms, and in Spain they are 36%. Moreover, in Portugal, the only listed firm is a nonfamily one, and in Ireland, there are no listed firms at all. That also leads me to conclude that probably the need to maintain control of the family business can be ensured even when these companies obtain the listing on financial markets, thanks to the use of pyramidal structures, cross-holdings, and dual-class shares (Faccio and Lang, 2002).

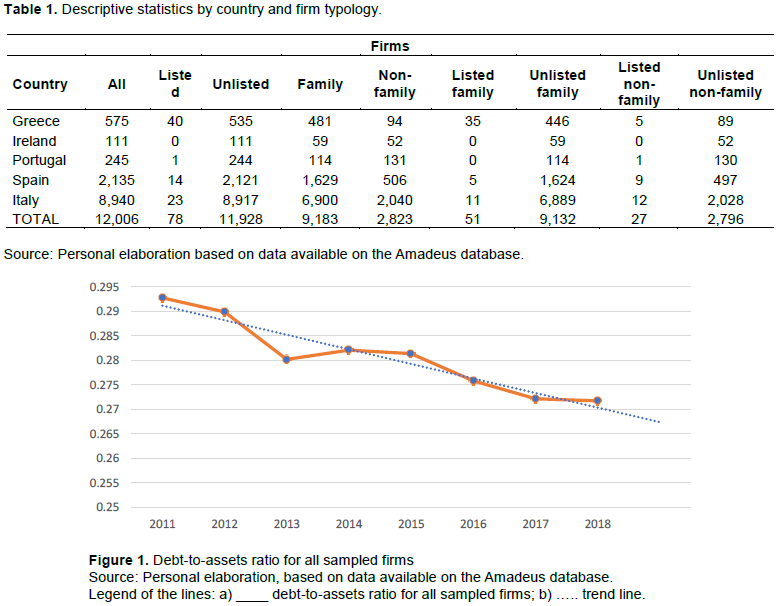

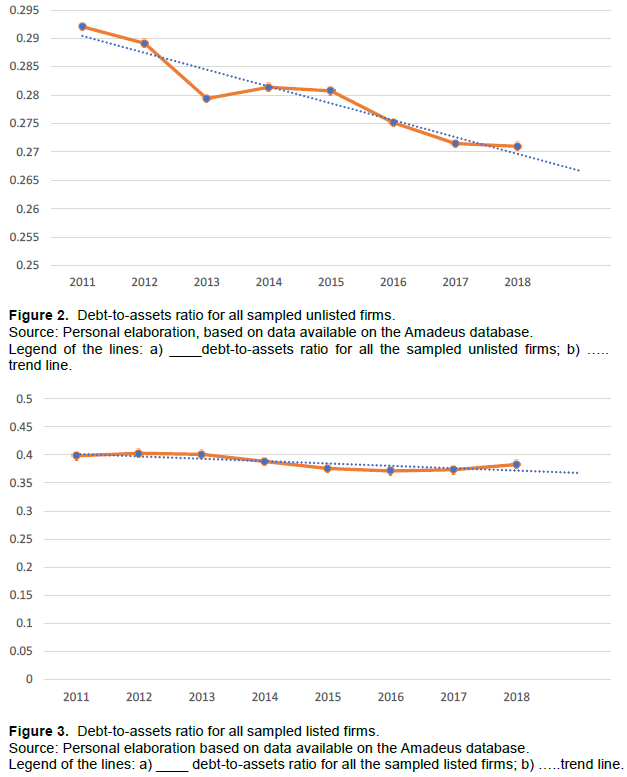

If the leverage of the enterprises in the sample is looked at, Figure 1 indicates a declining trend from 2011 to 2018. However, this movement hides two different phenomena. In fact, while the debt-to-assets ratio for the unlisted firms decreased (Figure 2), the debt-to-assets ratio for the listed companies is fairly constant throughout the period considered (Figure 3), despite the deterioration of credit offered from banks. This suggests that the listed firms, by gaining access to financial markets, were generally able to substitute the lack or scarce availability of bank capital by issuing new corporate bonds. Thus, hypothesis H1 (unlisted firms reduced their leverage, whereas listed firms did not significantly decrease their leverage) is confirmed.

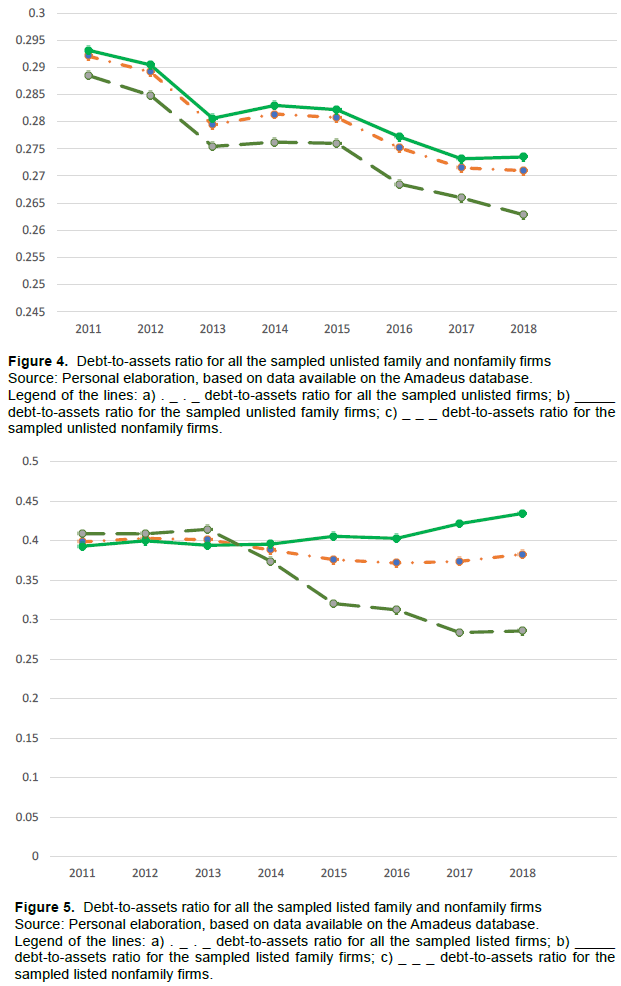

As indicated by Figure 4, unlisted family and nonfamily firms essentially exhibited a reduction in their leverage from 2011 to 2018, even if there was a temporary recovery in the debt level between 2013 and 2014 for both types of businesses. The debt-to-asset ratio for the unlisted family firms was also always appreciably greater than that of unlisted nonfamily enterprises, and that demonstrates a preference for debt use on the part of family firms, owing to SEW considerations. Nevertheless, unlisted family firms were unable to counter the bank credit restriction significantly better than nonfamily firms. In fact, debt-to-assets ratio decreased by about 2 percentage points for unlisted family firms and by about 3 percentage points for unlisted nonfamily firms during the period of the analysis. Thus, unlisted family firms were unable to decrease their proportion of debt significantly less than their nonfamily counterparts. As a result, hypothesis H2 (unlisted family firms did not reduce their leverage significantly less than unlisted nonfamily firms) is also confirmed. Interestingly, though, the leverage of unlisted nonfamily firms kept on decreasing after 2015, while that of unlisted family enterprises stabilized over 2018 at about 27.5%.

On the whole, comparison between Figures 5 and 4 first shows that listed firms rely on a larger use of debt (between about 40 and 39%) as opposed to unlisted firms (between around 29 and 27%) over 2011-2018, as listed firms can issue bonds on financial markets and finance investments through the use of debt more easily than unlisted firms. Secondly, when comparing listed family firms with listed nonfamily firms (Figure 5), the former essentially increased their leverage, while the latter reduced their proportion of debt capital, thus hypothesis H3 is confirmed too. One possible explanation is that listed family firms, mainly through bond issues, more than offset the scarce credit availability from banks to consolidate the family control over the business in the long run and hence strengthen their SEW preservation. In contrast, the dilution of ownership is less important in listed nonfamily firms, for which the perpetuation of the business for future generations is not an issue, especially when the control share is strongly in the hands of the dominant shareholder(s). Therefore, listed nonfamily firms compensated difficult access to bank credit by either issuing shares or bonds, and a decrease in leverage for these businesses can be justified. Nonetheless, this intuition could be investigated further.

This article analyses the effect of the sovereign debt crisis that began in 2009 on the capital structure choices of listed and unlisted family and nonfamily firms in the GIPSI countries using a sample of 12,006 enterprises. The reduced bank credit availability (supply) that followed the sovereign debt crisis had a different impact on the leverage of the firms in GIPSI countries due to their characteristics. The results of the research are as expected, because all the three hypotheses (H1, H2 and H3) stated are confirmed.

Unlisted firms reduced their leverage, whereas listed firms did not significantly decrease their indebtedness (H1). Unlisted firms were forced to decrease their leverage because of their reliance on bank credit, whereas listed companies were generally able to essentially maintain their indebtedness thanks to financial market access.

Unlisted family firms did not reduce their leverage significantly less than unlisted family firms (H2). Despite their orientation to SEW and its safeguard, unlisted family firms could not decrease their debt-to-assets ratio significantly less than unlisted nonfamily firms, because of their dependence on the financial sources provided by banks.

Listed family firms increased their leverage, whereas listed nonfamily firms reduced their leverage (H3). The inclination to SEW probably allowed the listed family firms to take advantage of the lack in bank financing to increase their leverage through bond issues, thus reaching a higher level of SEW protection. In contrast, listed nonfamily firms reduced the relative amount of debt employed, because they are not concerned about the continuation of the business for future generations, and hence, they do not discriminate between bond and share issues, especially in the case of concentrated ownership.

This work joins in the debate concerning the effects on capital structure decisions of firms in GIPSI countries, generated by the reduction in bank lending, following the sovereign debt crisis. In this framework, no matter the underlying reasons of this reduction and their effective role, businesses from GIPSI countries reacted differently to reduced supply of bank credit, on the basis of their possibility of accessing financial markets and orientation toward debt sources. Compared to previous studies - covering this issue and analyzing specific sources of bank credit (Acharya et al., 2018), focussing on SMEs to understand their ability of obtain bank credit (Corbisiero and Faccia, 2020), assessing firms with different dimension, without dealing with their family nature or not (DemirgÈ•ç-Kunt et al., 2020), concentrating on a specific GIPSI country (Jiménez et al., 2012; Bofondi et al., 2013) - the work adopts a broader perspective. In fact, it allows for an understanding of the financial behaviour of the listed vs. unlisted firms on the one side, and family vs. nonfamily ones on the other, shedding new light on the impact of credit rationing on firms of different characteristics.

One lesson learned is that issuing securities in financial markets is important to cope with sudden and unexpected events which may undermine the possibility of accessing bank lending. Therefore, GIPSI countries should favour or develop financial markets dedicated to smaller firms, for which capital requirements for listing should be adequate to them. Moreover, on this line of reasoning, the study also asserts that the growth of alternative sources of financing, as opposed to bank credit, is needed for businesses to prepare for macroeconomic shocks, especially for unlisted firms belonging to bank-oriented financial systems, such as those within the GIPSI countries. The issue of alternative sources of financing appears to be of major importance, and policy makers should tackle it very carefully, especially in the recent context of the COVID-19 health crisis. In fact, in such a situation, bank interventions and provisions, even when adequately supported and facilitated by governments, may not be sufficient. Hence, further development of other channels of financing, for example, development of venture capital, direct lending or FINTECH activities, is required to effectively sustain the real economy

Owing to lack of information and data, the study did not distinguish between the firms of different generations and thus the role of the different intensity of SEW and its related impact in explaining capital structure choices in the situation being analysed. Moreover, for the same reason, the study could not appraise the effective influence of block holding ownerships in determining the choice of equity relative to debt in listed nonfamily firms in GIPSI countries and therefore also the different trend of the leverage of listed family firms versus listed nonfamily ones over the sovereign debt crisis. Therefore, future research could address these issues in depth thus enhancing the knowledge of how firm financing changes as a consequence of the scarce credit availability, following the sovereign debt crisis involving firms in GIPSI countries.