ABSTRACT

Climate change dramatically impacts the structure of energy business by adding renewables. In traditional energy networks, the balance between the demand for- and the offer of- power is managed by increasing the amount of commodity or by shedding loads. Customer-centered grid brings new paradigm about changing the economic behavior of small- and medium- scaled energy users instead of varying the amounts of commodity that is called flexibility. Flexible cooperative behavior of many actors participating in liberalized intraday market reduces pollutants because it optimizes renewable energy. However, it has implications on power markets in terms of prices and has technology implications nation-wide. This article discusses a generational change that moves decision making from few control rooms to the democratic neighborhood of the web. The objective is to present a changed socio-economic context and attract the attention of researcher to new challenges. The main result is a dynamic equilibrium that exists between the reward offered by the utilities to their customers and the advantage obtained by the utilities from such a flexible behavior. The article main conclusion is on the role of new market product called demand-side flexibility in the transformation of power markets towards ecological sustainability.

Key words: Demand-side flexibility, energy market, intraday trading.

Climate change is a relatively new reality that impacts the structure of fossil and nuclear- based energy businesses. It has several adverse effects, including poverty (Houghton et al. 1995); but can also lead to prosperity in a sustainable way (World Bank 2016). More than 89% of observational studies have shown significant changes in physical and business systems consistently based on response to warming (Parry 2007); it is an activity that generates new jobs and values.

To reduce CO2 and particulate matter pollutants, energy business adopted environmental-friendly power plants from Renewable Energy Sources (RES). The RES production has several peculiarities requiring attention because it is poorly predictable, weather-dependent, and has low-inertia. Because of the laws of physics, electricity distribution networks impose strict balance between the electric power being offered and the electric power being demanded at each instant over time.

African countries form the electricity-poor region in the world where millions lack access to electricity and millions more are connected to an unreliable grid in terms of energy service needs. The International Energy Agency (IEA) forecasts the total demand for electricity in Africa to increase at an average rate of 4% a year through 2040. This includes self-generation from diesel generators being operated daily for some few hours. To meet the said demand, the region has to significantly expand its generation capacity, to upgrade the power grid, and consider the flexibility. Therefore, Africa is burdened with a complex and persistent electricity gap, of which the self-generation modality presents an interesting challenge because of the social aspects.

Big population of small-scale energy producers operates daily diffused self-generation from their own micro-plants, but they are not directly included in liberalized energy markets. In power market terms, the amount of commodity being offered and traded should be always equated in real time by the corresponding amount of demand in terms of both the energy and the rate of energy.

In traditional electricity distribution grid, the balance between the demand for- and the offer of- power was easily managed by increasing the amount of commodity or by shedding the amount of loads because of high inertia. In both inertia-less RES and self-generation scenario, there could be no sufficient time to take economic decisions in order to safeguard the stability of the supply in the case of unexpected production drop-outs.

An alternative solution is required to balance between the time-varying offer and the demand. A large population can decide to become more flexible when demanding resources. This can improve balancing of energy distribution networks. Because of the universality, this approach has an advantage to be transferable between different domains and geographic areas. For example, it can be used to optimize the limited resources of water, oil, or any other kind of energy-containing substance.

Demand side flexibility

Instead of varying the quantity of a commodity being offered on the market at a given time, an attempt to piloting the dynamics of the demand for power was recently proposed in the context of Transactive Energy Control (TEC) framework defined as a system of economic and control mechanisms that allow the dynamic balance of supply and demand across the entire electrical infrastructure using value as a key operational parameter. This new concept is currently known as the flexibility of demand for power associated with the key concept of value (CEER, 2016).

By definition, the Demand-Side Flexibility (DSF) is a capacity to change energy usage process by end-use customers (including different types of energy users, residential or non-residential ones) from their “normal” or current consumption patterns in response to market signals, such as time-variable electricity prices or other incentive payments, or in response to acceptance of the consumer's bid, alone or through aggregation, to sell demand reduction/increase at a price in electricity markets or for internal portfolio optimization (Allcott, 2011).

Legacy associates generically the demand with the value (Value=f(Demand)), without specifying the structure of Quantities Demanded (QD). New multi-scale interpretation associates the Change in Demand (CiD) with the Value being Modulated (VbM) through one or more economic signals Value=g(Signalj, ChangeInDemand). On an individual level (Eurelectric, 2014), flexibility is the modification of prosumption patterns in reaction to an external signal in order to provide an ancillary service within any multi-energy system.

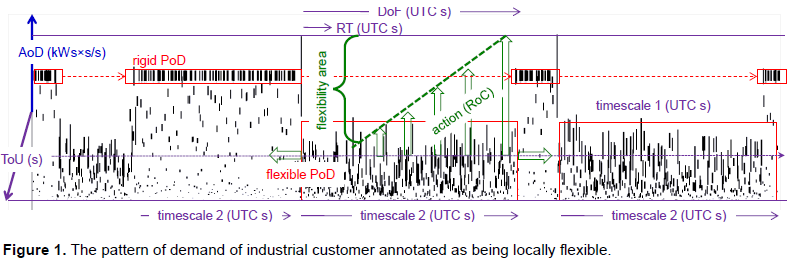

In this interpretation, the flexibility becomes measurable through the parameters such as the Amount of Demand (AoD) being modulated, the Duration of Flexibility (DoF), the Pattern of Demand (PoD) being modulated, the Rates of Change (RoC) in the pattern, the Response Time (RT) or the latency of the action, and the geo-location of the node. New realized demand pattern comes from the input PoD after the action RoC is expected to last (DoF-RT) in time.

On an aggregated level, the DSF can be materialized by collective cooperative behavour of a group of people that decide to change their demand-response behaviour in order to achieve the shared prosperity in terms of sustainable use of energy-containing commodities. The aforementioned transformation represents a societal challenge. The exemplified pattern of demand (Figure 1) partly annotated as being flexible and/or non-flexible indicates a flexibility potential.

DSF value

The DSF appears to be a good that is very similar to the additional generation capacity, but it is CO2 and particulate matter emission-less. The DSF is an energy-equivalent being collectively produced by certain group of people that are immediately expended by the totality of consumers, so it is an extremely short-living good. However, the DSF is supposed to be known in advance, so it appears predictable.

Therefore, the DSF should have a market price similar to- or higher than- the price of energy offered by power plants that use peak generators only. For example, ten percent DSF being effectively realized on a real intraday market during an over-crowded time slot between 9:00 and 11:00 AM has a specific size (10% of the traded volume) and a specific price (averaged spot price during the today’s time slot 9.00 to 10.00 AM). However, the DSF is not a tangible asset that belongs to certain well-known energy producer, but a virtual product that depends on the collective behavior of many actors.

In this example, the incentive-driven collective behavior of energy-efficiency oriented users materializes the desired amount of DSF. Thus, the DSF belongs to the community of energy users and it can be traded by someone on behalf of them. Most likely, the price of the DSF is cleared by utility. Moreover, the incentive (reward) that can be offered to end users cannot exceed the variable cost of energy production by peak generators. For this reason, the determination of the market price of DSF is not a trivial task.

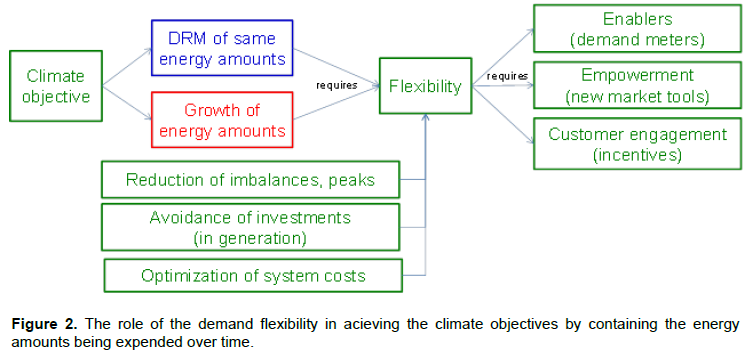

The research investigates the enabling role of the DSF in the TEC and how to spread its use at a scale (Figure 2).

This issue appears important because it indicates sustainable way to contain steadily growing demand for newly generated energy amounts by shaping intelligently the patterns of demand – instead of or in addition to the amounts of demand - based on the mutual knowledge about the time-varying changes in the capacity/availability of the energy resource.

The outcome appears highly impacting because only in Sub-Saharan Africa populated by 1 billion of people ca, more than 600 million people lack stable access to networked electricity. Given the estimate of the demand growing rate of 4% a year through 2040 and given the limited investments in infrastructure, the DSF behavior can ameliorate the current electricity access rates of about 20% destined to deteriorate without (policy) interventions (Avila et al., 2017).

The research outcome allows the preserving of the average energy consumption in any - the sub-Saharan, Asian, and others – geographic area by differently apportioning the available richness over time instead of insisting on the amounts and/or different re-distribution over population. To real numbers, the International Energy Agency report (IEA) indicated 16.8% of self-generation in Sub-Saharian Africa (71 TWh of self-generation out of 423 TWh in total in 2010s. It is the estimate of the population that can get direct benefit from the DSF in the exemplified geographic area because this population already owns small-scale generation plants and uses them for self-consumption.The DSF can convert the standalone capacity in the networked demand-response action optimally distributed over time.

This article started from the specialized literature review in order to establish the availability of components dealing with the DSF. The most difficult and less researched issues appear to be the analytic measurement of the population that originates the DSF and the real-time measurement of the change in demand figures they originate.

In order to acquire information about the shapes of demand-response, the observational study was considered. In the known state of the art, demand-oriented energy meters are not deployed to small-scale actors. Researchers explored the Event-Driven Meters being deployed by the PowerIntellimeter project to several users in Northern Italy because it allowed the QD.

In the examples, authors used anonymized time series of real life data from some industrial and residential users. Newly acquired individual and aggregated groups data emerged as a possibility to define new metrics and to build useful indicators. Given the experimental data, business analytics were derived by using state of the art statistical, descriptive, and sensitivity analysis tools.

Measuring the DSF

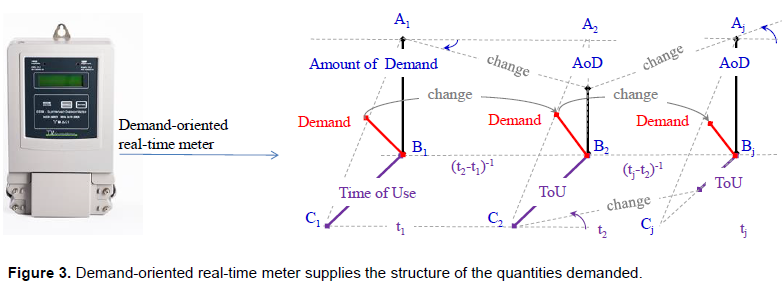

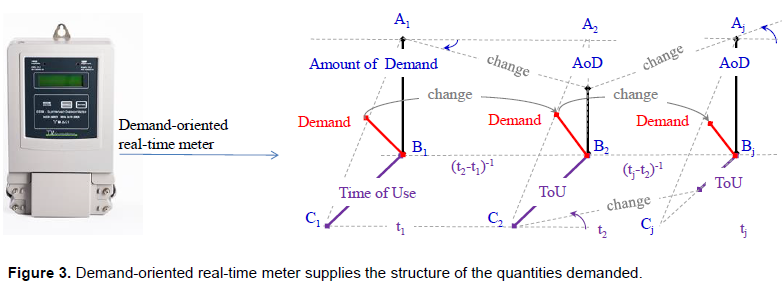

Since the amount of demand (expressed in kWh) alone is not sufficient to know the rates of work, the pre-requisite for DSF estimation is the analytical acquisition of the structure of the PoD (expressed in triplets (kWh), (kWh/s), and (s-1)] from real life by measurements (Figure 3).

The Customer Baseline (CBL) is a sequence of QD (expressed in kWh/s) effectively expended during well-defined ToU (expressed in suse) at certain well-specified RoW (expressed in (kWh)/s) by certain customer or a group of customers. The structured PoD is exemplified on the ad-hoc developed visual form (Figure 1) by plotting the diagonals AjCj from the Figure 3 appearing in the form of vertical strobes [expressed in digital units ((kWh)2+(s)2)0.5) . They are sequenced in non-uniform frequency domain after time wrapping factors ||tj-tj-1||-1 : 1-1 in order to make ad-hoc timers appear virtually as unitary ones. After this definition, the realized DSF is a difference between two time series namely the CBLj in the baseline scenario hypothesis and the CBLk after the signal being issued and considered by customer(s).

The valuation of DSF can be done either explicitly or implicitly. Since DSF appears explicitly on the market, it can be sold as a product/service on a power market. Therefore, it requires a specific control that traces the CBLs and other parameters used in the Demand-Response Management (DRM) actions.

The DSF is produced by a well-defined group of actors that makes certain percentage x of the total population of energy users y. For each member of the DSF-making group xj, the CBL is analytically measured by using the real-time demand-oriented EDM metering device (Simonov et al., 2017) that produces the quantities demanded. More precisely, the input data include the amounts of energy, the time of use of energy, the demand factors, and similar values. Given the CBL ordered in natural time, the Load Duration Curve (LDC) is being produced by computations of true levels of load and re-ordering of newly established data. As an effect, the DSF=CBLk-CBLj becomes measurable at multi-levels, for an individual customer x and/or for any individual group Gy of y customers being scaled from y<N up to the entire portfolio GN that counts N customers, but also for any arbitrary composition {Gi Å … Å Gj Å …} that combines said groups of DSF-makers.

Additionally, since the DSF is also associated with the duration of action, the multi-scale timing should be adopted (viola time arrows on Figure 1) for measuring the DSF resulting from single incentive or from a series of incentive. Therefore, the ensemble of flexibility-making actors populates the sample space modeled after the N-T-cube with the effective dimensions drawing from the size of portfolio N (expressed in scalars) and the upper bound of the duration [expressed in seconds of natural time] of flexibility action T gauged to timers (expressed as a partition of time-arrow).

The information contained in the CBLs is consumed by Business Analytics (BA) in order to realize the decision variables that will be used to support automated decisions to trade the DSF or not to trade. A kind of composite indicator is required to realize the decision-making values associated with the DSF as a market good. Here, the DSF-index receives time series of numeric estimates of the structure of QD expressed in kWs/s and the estimate of risk/uncertainty associated with the crowd behavior.

To complete the model, new index of responsiveness is being computed as a percentage change in one variable (the Change In Value, CIV) with respect to the percentage change in another variable (the Change in Risk, CIR). The DSF operation appears useful until this index eciv|cir=(DCIV/CIV)/(DCIR/CIR) remains greater than 1, for example, in all cases when the added values appears higher compared to the increase in risks.

On the other hand, the DSF is implicit because it does not need such a process. In effect, the DSF is produced by x, but it is never sold by an individual to anyone. The DSF remains for the benefit of the universality of final consumers y and for the corresponding retailer or for the Balance Responsible Party (BRP) as an optimization of its sourcing costs or imbalances (CEER, 2016).

In this assumption, the DSF value is already embedded - as part of - in any Intraday amount AoE(tk) and it can be expressed as a percentage and as a set of percentage changes. The DSF tool extracts and makes explicit the flexibility. By assuming that the value for the day j is DSF(tj), the DSF can be recursively evolved after the formula DSF(tj)=DSF(tj-1)+/-DDSF(tj), where the delta term is driven by the ratio between the AoE(tk) and the AoE(tk-1). More accurate description of the process requires deeper discussion in a separate work.

Using the DSF

In power systems, the capacity to generate new energy is used at different rates of time by throttling between the levels of power. By fixing the total daily amount of energy expressed either in kWh or in monetary units, its distribution over time in storage-less system varies because of time-varying demand and physical laws imposed to consume the total of energy produced exactly in the same timescale.

As such, the daily amount of capacity can be decomposed in the daily amount of demand plus the corresponding amount of reserves/inertia. Currently, the ratio between the capacity and the reserves is computed empirically based on the past statistical estimates. When the power system is running at the highest capacity, or it is inertia-less, the DSF becomes a tool that can govern the security of supply. For this reason it is important to estimate the extent of flexibility/elasticity in the network.

Being flexible with how and when end-users consume and how small-scale plants produce energy means increasing the certainty that the power generated and delivered matches the amount being used at exactly the same time. The DSF as a service provider to power system appears on the power market after when modifying generation and/or consumption patterns in reaction to an external signal, for example a change in price, becomes measurable (Ilic et al., 2013). Once the DSF is quantified, it can be expended. In the Customer-Centered Smart Grid (CCSG) new paradigm called flexibility appears. It is about changing economic behavior of small- and medium- scaled energy users instead of varying the amounts of commodity. This behavioral aspect cannot be ignored because the cooperative behavior of many such actors participating in liberalized intraday market can mitigate poorly predictable energy production from renewable sources. It has several implications on power markets in terms prices. At the same time, new scenario has multiple implications on the technology side of country-wide critical infrastructure such as Smart Grid (Karnouskos, 2011).

In the past, investments were concentrated on large scale generators and their running. In new scenario, the investments come to smaller decentralized PV-, Wind-, and Bio- plants. New data-driven cooperative modality requires different ICT equipment and complex software (Lamparter et al., 2010). It moves to the software markets and markets of internet-enabled services. It enables a generational change that moves decision making from few control rooms to the democratic neighborhood of the web. In the African context with limited availability of resources and limited interconnectivity, this concept could offer additional benefits at different scales, for example at the microgrid level.

In the example from the Sub-Saharian Africa past, an individual is running its own nano-generator in order to compensate chronic unavailability of the commodity from the distribution grid. Alternatively, several individuals – a group of x – decide running higher-scaled generators in shifts lasting up to 24/x h each. Since the individual demand levels are not constant in time but the production rate of generators is constant, the cost of the expended fuel between members of the group was compensated mutually (choice 1). However, the changes in amount of expended energy can be measured and the demand-oriented billing (choice 2) can be introduced. The cost repartitioning after metering figures can bring benefit because of the possibility to run shorter or longer shifts (choice 3) or because of the opportunity to sell extra energy to the external network (choice 4). At this point the market-based choice 4 can be exploited through the DSF.

Market competition and security of supply

Market competition is a balance in the supply of wholesale electricity, including generation and demand response, where there is an ideal harmony between provider profits and consumer savings. The current generation of market management systems has made significant technological strides to facilitate various market rules and designs towards competition. The aggregation of this functionality has helped ensure sufficient amount of transmission capacity in the market, as well as the elasticity of demand with respect to price. For energy trading to be realized, the necessary tools as well as timely information exchange between all stakeholders need to be provided. Part of it is also the actual smart metering that is, the high granularity of metering data acquisition. Through better resolution of the production and consumption (prosumption) data and effective analysis, any market participant is able to monitor and even predict his energy behavior. Data-driven real time smart meter technology, as well as the necessary energy services, prosumers will be able to offer and purchase electricity. Going back to the example, self-generation is a tool to mitigate a-posteriori chronic unavailability of the commodity from distribution network. The DSF can mitigate exactly the same issue based on the information about programmable unavailability (by shifting in time the demand) and/or about programmed availability (by deciding flexible and better elastic shares in the prosperity) of the commodity (Suvak, 2010). It becomes clear why the DSF can be used to adapt urban environments to climate change (Carter et al., 2015).

It was found that the DSF is a new product enabled by Digital Energy Technology (DET) because it exploits the convergence of technologies, policies, and financial drivers in an active liberalized market as analyzed in Lim et al. (2014). The DSF operations are based on the anticipatory information about the amount/percentage of the limited resource/commodity that is-, can be-, or will be- unavailable to meet the demand. Researchers adhere to more specific definition of the Transactive Energy (TE) as a software-based grid management of grid reliability and resilience driven through a kind of incentives. In this conceptualization, artificial intelligence software applications use economic signals and timely operational information to value the DSF as an indicator used to manage production and consumption of energy.

Researchers defined the measurable indicators of DSF by using real time demand-oriented energy measurement tools (Simonov et al., 2017). Researchers found that the known state of the art lacks tools including small-scale energy producers in the intraday markets (Liu et al., 2017), which is a major obstacle in any geographic context.

Researchers projects that the DSF will cause a societal change because it materializes a kind of collectively-owned (social) energy. In the past, energy was seen as a commodity being distributed over distribution network. The DSF-based approach uses the information and knowledge being shared in order to sensitize people about the change in amount of prosperity that needs to be apportioned in optimal, fair, or other required fashion.

From the small-scale plant owner’s viewpoint, the DSF is a knowledge-based enabling tool that includes them in the market. From the ecology-friendly consumer’s viewpoint, the DSF is a driver of the behavioral change that keeps sustainable the exploitation of natural energy-containing resources by humans. From the societal viewpoint, the DSF is a democracy and policy tool that elastically re-shapes the energy markets in a hybrid way.

Researchers found that in the context of very different developing countries (World Bank, 2011), the DSF framework could be particularly beneficial to manage fair access to energy because of raising awareness and informing about energy needs, variations in demand figures, and ways to share the resource in knowledge-grounded fashion.

Finally, the authors found applicable the Global Sensitivity Analysis (GSA) with respective sensitivity indices to behavioral tracking of certain group of flexibility-makers with respect to the action realized by other group(s). However, this investigation has to continue in future work in order to express compositions of flexibility actions in nested- or differently organized models.

The authors discussed a new environmental-friendly energy product/service called DSF. In the past, investments were concentrated on large scale generators and their running in order to obtain scalable amounts (of energy).

In newer scenarios, the investments come to smaller decentralized PV-, Wind-, and Bio- plants in order to emerge locally flowing QDs. However, no investments at all in generators (Figure 2) are needed to differently concentrate the flows in after the flexibility. Instead, the investment goes to the cyber (information, software) assets. By introducing the DSF in power networks, new demand measurement and verification tools are required in order to determine the previous CBL, the new CBL, the effective amount of the DSF that can be used, and the correct price associated with the DSF. For this reason, the use of the DSF implies new data-driven cooperation between many users that should be supported by new ICT equipment and sophisticated software products. Therefore, it evolves software markets and enriches markets of internet-enabled services by introducing new high-tech products and services.

The advent of the flexible behavior on energy markets depends on the investment made in the knowledge sharing infrastructure (DSF Framework) that allows knowledge-based decisions, in the tools for inclusion as market participants (Participatory Framework) that allows operations, and in mentality changing practice (Framework of Operations) that scales up the size of the group of DSF-makers.

The authors have not declared any conflicts of interest

REFERENCES

|

Allcott H (2011). Rethinking real-time electricity pricing. Resour. Energ. Econ. 33(4):820-842.

Crossref

|

|

|

|

Avila N, Carvallo JP, Shaw B, Kammen DM (2017). The energy challenge in sub-Saharan Africa: A guide for advocates and policy makers: Part 1: Generating energy for sustainable and equitable development. Oxfam Research Backgrounder series 2017

View

|

|

|

|

|

Carter JG, Cavan G, Connelly A, Guy S, Handley J, Kazmierczak A (2015). Climate change and city: Building capacity for urban adaptation. Prog. Plan. 95:1-66.

Crossref

|

|

|

|

|

CEER (2016). Scoping of flexible response, CEER discussion paper. Ref: C16-FTF-08-04, 3 May. Retrieved from

View

|

|

|

|

|

Eurelectric (2014). Flexibility and Aggregation (report), available online at

View

|

|

|

|

|

Houghton JT, Meira Filho LG, Callander BA, Harris N, Kattenberg A and Maskell K Eds (1995). Climate Change 1995: The Science of Climate Change, Cambridge University Press, Cambridge, UK, online at

View

|

|

|

|

|

Ilic D, Goncalves Da Silva P, Karnouskos S, Griesemer M (2013). An energy market for trading electricity in smart grid neighbourhoods. Proceeding of 6th IEEE International Conference on Digital Ecosystem Technologies-Complex Environment Engineering (IEEE DEST-CEE), Italy, 2012.

|

|

|

|

|

Karnouskos S (2011). Demand side management via prosumer interactions in a smart city energy marketplace, Proc. of IEEE International Conference on Innovative Smart Grid Technologies (ISGT 2011), Manchester, UK, December 5-7.

Crossref

|

|

|

|

|

Lamparter S, Becher S, Fischer JG (2010). An agent-based market platform for smart grids, In Proc. of the 9th International Conference on Autonomous Agents and Multiagent Systems: Industry track, ser. AAMAS '10. Richland, SC: International Foundation for Autonomous Agents and Multiagent Systems, 1689-1696.

|

|

|

|

|

Lim B, Spanger-Siegfried E, Burton I, Malone E, Huq S (2014). Adaptation policy frameworks for climate change: developing strategies, policies and measures. Cambridge University Press, Cambridge, UK.

|

|

|

|

|

Liu Z, Wu Q, Huang S, Zhao H (2017). Transactive Energy: A Review of State of The Art and Implementation. 2017 IEEE Manchester PowerTech, Manchester. pp. 1-6.

Crossref

|

|

|

|

|

Simonov M, Chicco G, Zanetto G (2017). Event-Driven Energy Metering- Principles and applications. IEEE Trans. Ind. Appl. 53(4):3217-3227.

Crossref

|

|

|

|

|

Suvak A (2010). Integrated urban development strategies- comparing European and Hungarian approaches. Rev. Landscape Stud. 3:139-146.

|

|

|

|

|

World Bank (2011). Guide to Adapting to Climate Change in Cities.

|

|

|

|

|

World Bank (2016). Climate Action Plan.

View

|

|