Full Length Research Paper

ABSTRACT

Local content development is a strategic management issue for multinational extractive companies in Africa with significant business implications. As local content statutory regulators aim to increase the average local content value in the Nigeria oil and gas industry from 26% in 2017 to 70% in 2027, supply chain managers need strategies to increase local content. The purpose of this qualitative multiple case study was to explore strategies supply chain managers in the multinational oil and gas companies in Nigeria use to increase local content. The participants comprised eight supply chain managers and leaders in multinational oil and gas companies and the Nigerian Content Development and Monitoring Board involved in local content development activities. Data were collected from semi structured interviews and secondary documents. Thematic analysis generated two themes: Business value drivers for local content development and overarching local content development strategies. A key recommendation is for supply chain managers to document business value drivers for implementing local content development strategies. Future research recommendations include review and ranking of strategies by using a quantitative methodology, and an assessment of the relationship between local content development expenditure and tangible business value created.

Key words: Nigeria, Oil and Gas, local content, supply chain.

INTRODUCTION

Local content policies, which are generally protectionist and discriminatory, have had mixed results in various economies around the world: being effective in growing fledging industries in developing economies, but in some cases serving the interest of few or creating a distortion in an economy where wrong sectors or outputs are protected (Acheampong et al., 2016). In his pioneering work on local content development, Grossman (1981) found that resource allocation, in terms of market structure and local intermediate goods industry, was influenced by need for local content preference and protection and was viewed as germane and helpful to developing countries. Most of the developed countries once used various protectionist approaches to shield and nurture their young industries and stimulate growth (Nwapi, 2016; Ovadia, 2014).

Local content policies and laws have become key priorities of host governments and industrial players in oil and gas producing countries (Acheampong et al., 2016). According to Hansen (2020) and Ovadia (2016), there has been proliferation of local content policies in Africa as natural resource rich countries craft legal frameworks to regulate resource extraction. In this vein, the president of the Federal Republic of Nigeria on April 2, 2010, signed into law the Nigerian Oil and Gas Industry Content Development Bill (NOGICDA) wherein the local content development rules, regulations, and minimum targets for various inputs into oil and gas businesses in Nigeria, and penalties for violations are defined. The literature suggests that Nigerian government and fiscal response to develop a viable alternative to the oil and gas revenues has been ineffective, intermittent, and not properly prioritized (Akanbi, 2015; Babajide, 2017; Innocent, 2017; Adeleye, et al., 2020; Olomu, et al., 2020; Opeoluwa et al., 2021); thereby, creating an opportunity for local content policies to diversify the Nigerian oil and gas sector.

Local content development relates to supplier development, which is a strategic supply chain management activity that organizations have exploited for sustainable competitive advantage. Local content development may also be viewed from the perspective of strategic corporate social responsibility (CSR) investments, which not only accrues social capital to the buying organization but can in the long run contribute to comparatively lower input costs and enhanced security of supply for materials and services supplied by local companies whose capabilities were developed. We examined local content development from the buying firms’ strategic perspective and explored how supply chain managers are addressing the NOGICDA requirements both in terms of compliance and as strategic business imperative.

Local content development is rapidly becoming a strategic management issue for multinational extractive companies in Africa with significant implications for efficiency and profitability (Hansen, 2020). Nigeria’s economy is over-reliant on the oil-revenue stream and minimal tax revenue is generated from the non-oil segment of the economy, indicating that oil endowments have not trickled down where diverse economic activity could be carried out (Akanbi, 2015). In Nigeria, local content statutory regulators have a target to raise average local content value in the oil and gas industry from 26% as of 2017 to 70% by 2027 and this requires innovative, competitive, and sustainable strategies (Wabote, 2017). The specific business problem is that some supply chain managers lack strategies to increase local content of their companies’ processes and products. The purpose of this qualitative multiple case study was to explore strategies that supply chain managers in the Nigerian oil and gas industry use to increase local content of their processes and products and equip managers and business leaders with actionable strategies to help them achieve sustainable competitive advantage through local content development.

LITERATURE REVIEW

In the extant literature on local content development, far more attention is given to forms of binding contractual or regulatory constructs that require multinational organizations to use certain volume of locally sourced inputs (Kolstad and Kinyondo, 2017) than a consideration of strategies and tactics that the multinational companies pursue in order to increase local contents of their products and services. This dominant narrative of the local content development may have been influenced by a view that without external impetus, companies involved in the extraction of natural resources will not give due consideration to local content requirement (Ovadia, 2014; White, 2017). Ovadia observed that although local content development benefits multinational companies and the private sector in the long term through lower procurement costs, government intervention using local content policy is necessary because multinational companies generally lack self-motivation to take action due to initial higher costs associated with training and skills development for nationals and local suppliers. There is however a need to also look at local content requirement from the business and macroeconomics perspectives.

Kolstad and Kinyondo argued that the mandatory local content requirements have cost implications, which in some cases outweigh the intended benefits. Similarly, Hansen (2020) argued that local content requirements may negatively impact the financial viability of multinational companies’ operations, disrupt their supply chains, and threaten their brands reputation. The increased cost for the extractive multinational companies could translate to increased price of outputs and reduced tax for the government (Hansen, 2020). Investment in local content development can also be rewarding where a multinational company pursues it as part of supply chain management strategy leading to lower sourcing costs, access to valuable local knowledge, and opportunities to leverage local industrial clusters and share investment risks for human capital and supply chain development (Hansen, 2020). When a multinational company embarks local content development, it can generate opportunities to stimulate and cultivate a sustainable culture of capabilities and service quality that align with international standards and can exceed buyers’ expectations (Calignano and Vaaland, 2017). The objectives of increasing domestic employment and local sourcing of inputs could therefore be better achieved through non-mandatory policies where multinational companies are incentivized to voluntarily pursue local sourcing (Kolstad and Kinyondo, 2017).

Ngoasong (2014) found that some multinational oil and gas companies view local content as a business strategy and opportunity to achieve operational efficiency and maximize shareholders’ value. As noted by Ramdoo (2016), companies are beginning to change their attitude to local content from the mind-set of risk management and minimum compliance with regulatory requirements and now seek mutually beneficial business opportunities with the local communities and suppliers in response to local content requirement policies. Such companies consider that a good local content strategy, which involves the use of local labor and local sourcing of some inputs, can significantly reduce direct operating cost and mitigate against non-technical risks and concomitant costs (Ngoasong, 2014). The companies that excel in local content development integrate local supply chain support in their procurement policies as cost effectiveness measures, focus on core inputs where local suppliers have capability, and provide support to assist them meet the standards and requirements (Ramdoo, 2016). Key success factors are building of strong relationships with the local businesses, aligning common interests, and working together with other companies in the industry to maximize economy of scale from the local market (Ramdoo, 2016). Furthermore, the companies that excel in local content development invest in community development activities to earn freedom to operate and require their contractors to continuously improve the local content value of their services through local sourcing of inputs (Ngoasong, 2014). Ngoasong (2014) further described multinational oil and gas companies’ implementation of local content development initiatives as an insurance against non-technical risks such as regulatory backlash, protests, work stoppages, and boycotts, considering that non-technical risks account for most of cost overruns in oil and gas development projects.

The review of literature indicated that local content development is a public policy that has been established in Nigeria, just as it is in other resource rich developing countries in Africa and other parts of the world. Nigerian markets have become increasingly globalized and vulnerable to international sectors with evidence suggesting that systemic gaps, sustainability, and short comings in the services sector being the main driver (Akanbi, 2015; Boamah, 2017; Olomu et al., 2020). It is established that local content policy is important business strategy consideration for business leaders in the Nigerian oil and gas industry. Akanbi (2015) indicates that the over-reliance on oil-revenue stream has resulted in a neglect of the non-oil segment of the economy. The author indicates that one of the actions the government must undertake to improve fiscal response to the oil and gas sector is to disaggregate the economy into oil and non-oil segments. As opposed to focusing primarily on structural changes, supplier development is a sustainable supply chain management strategy that can improve local supplier capabilities, reduce supply chain costs, improve security of supply, and increase profitability. The successes recorded with supplier diversity program in the United States of America supports the thesis that there is business value in pursuing local supplier development as a strategic business imperative that will create competitive advantage in the long term.

A key gap found from the literature is absence of research on strategies that supply chain managers in the Nigeria oil and gas industry are using to increase local content development and how such strategies are linked to overarching supply chain management strategies. Ngoasong (2014) identified technical capacity development and human capacity development as broad business framework and 4 thematic pillars that define multinational oil and gas companies’ response to local content requirement. While the findings provide useful insights on broad strategies that the multinational oil and gas companies use, these are high level and do not offer specific tactical actions that a supply chain manager can replicate. While the conceptual model developed by Owusu and Vaaland (2016) provides useful additional insights on antecedents of local content development by highlighting key actors and necessary interrelationships, it does not provide specific actionable strategies that the supply chain manager can use. Hansen (2020) proposed a typology of local content strategies for multinational extractive companies but omitted a recommendation of specific actionable initiatives that supply chain managers may adopt. The objective of this study was to close this scholarship gap by building on the extant literature and exploring from the lived experiences of the supply chain managers in the leading multinational oil and gas companies in Nigeria oil and gas industry, actionable strategies for increasing local content in processes and products.

METHODOLOGY

Data collection

The study employed a qualitative multiple case study design that enabled the collection of contextual data from supply chain managers in the multinational oil and gas companies to obtain broad insights on the strategies that they are using to increase local content in their organizational processes. The data was primarily collected via semi structured interview. Relevant secondary data from the participants was collected such as company reports and journals containing information on strategies and performances in respect of local content development, supplier development, and CSR. The participants in this study were seven contracting and procurement managers in multinational oil and gas companies and one manager in the NCDMB, who were directly responsible for formulating, modifying, and implementing supply chain management strategies. The participants were purposively selected.

Interview questions

1. What overarching strategies are in place for increasing local content in your company’s processes and products?

2. How does your organization measure and monitor the effectiveness of local content development strategies?

3. What local content development strategies have been most effective? Explain why, based upon your experience, they have been effective.

4. How is the local supplier development linked to local content development strategies in your company?

5. What strategies has your company used to influence original equipment manufacturers to establish facilities in Nigeria?

6. How are corporate social responsibility programs in your company linked to strategies for increasing local content?

7. How does the implementation of local content development strategies contribute to competitive advantage for your organization?

8. What other information might be relevant in explaining the strategies that supply chain managers in the Nigerian oil and gas industry use to increase local content in their companies’ processes and products?

Data analysis

We adopted the 5-steps data analysis process comprising: compiling of data, disassembling the data, reassembling the data, interpreting the data, and drawing conclusions based on the analyzed data presented by Castleberry and Nolen (2018). We used a form of key words in context (KWIC) data analysis technique, which entailed the clustering of the relevant key words along emerging themes and developed synthesis of the strategies that leaders in the oil and gas industry use to increase local content.

RESULTS AND DISCUSSION

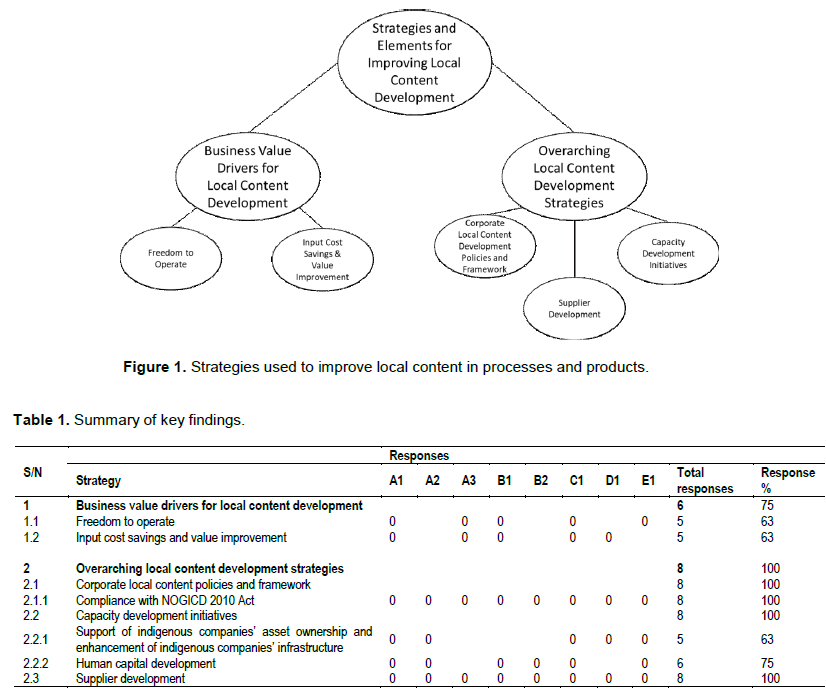

The main strategies for increasing local content development, which were identified from the study, were the business value drivers for local content development and the overarching local content development strategies deployed. Figure 1 depicts strategies and elements for improving local content development in the Nigeria oil and gas industry. The key findings are summarized in Table 1.

Business value drivers for local content development

Business value drivers here refer to tangible and measurable contributions to the business objectives that justify a company’s pursuance of local content development. The business drivers answer the “what is in it for us?” question. Seventy-five percent of the respondents discussed aspects of this strategy. The main elements discussed here are freedom to operate, local content performance recognition or goodwill, and input cost savings. According to Respondent A1, local content is viewed by senior leadership of Company A as a business imperative for business sustenance.

Freedom to operate

Sixty-three percent of the respondents (Respondents A1, A3, B1, C1, and E1) indicated that pursuit of local content development contributes to business stability by assuring “freedom to operate” or “social license to operate” for the business. The term freedom to operate or social license to operate is a subsisting acceptance and approval from local communities and stakeholders whose environment is impacted by the activities of the company (Melé and Armengou, 2016; Smits et al., 2017). In the Nigerian oil and gas industry, freedom to operate have become popular phrase for describing peaceful and cooperative relationship between an oil and gas company and the host communities or government authorities, which enables the oil and gas company to conduct its business without hinderances. Youth restiveness in the Niger Delta region is a violent response to perceived neglect and injustice felt by the oil and gas resource host communities (Elum et al., 2016). Studies have shown that such disruptions are largely reduced or completely abated when the oil and gas company is perceived to sincerely solicit and encourage fair participation of members of host communities in the oil and gas business through employment and the supply of input materials and services. Securing freedom to operate from the host communities in order to minimize youth restiveness is therefore a key motivation for oil and gas companies embarking on social investments and local content development. Respondents B1 and B2 particularly underscored this business imperative by highlighting that owing to the involvement of communities in its operations, the Company B’s facilities are never impacted whenever host community youths vandalize the facilities of other multinational oil and gas companies in the same vicinity.

The term freedom to operate also refers to being in good working relationship with the NCDMB (the statutory regulatory body for local content), and other stakeholders such as the joint venture partners, industry interest groups such as Petroleum Technology Association of Nigeria (PETAN), Oil and Gas Trainers Association of Nigeria (OGTAN), Manufacturers Association of Nigeria (MAN), who have vested interests in local content development and who could disrupt or influence disruption of the operations of multinational oil and gas companies that do not comply with the Nigerian content law. The NCDMB has statutory powers to impose a fine of 5% of project value or to cancel a project that fail to comply with Nigerian content law. According to Respondent A1, the compliance with local content regulatory requirements elicits prompt approvals by regulators and joint venture partners and thus contributes towards contracting cycle time optimization, which in turn could contribute to early project onstream and earnings from the oil and gas assets. The companies that emphasize the assurance of freedom to operate may be approaching local content from the perspective of risk management and minimum compliance with regulatory requirements (Ngoasong, 2014). The additional direct and indirect costs that result from disruptions by dissatisfied stakeholders such as host communities or NCDMB imposed fine or project cancellation represent significant business risks for the organization and therefore a strong justification to pursue local content development.

Input cost savings and value improvement

Sixty-three percent of the respondents (Respondents A1, A3, B1, C1, and D1) mentioned input cost savings for the oil and gas business as a benefit of pursuing local content development. According to Respondents A1 and A3, Company A achieved 55% cost savings through support and patronage of an indigenous company that produces nuts and bolts that are certified to international standards; 12% cost savings plus improvement of lead-time from 4 months to 4 weeks through the support and patronage of a local manufacturer for split clamps used for repair of hydrocarbon pipelines; and logistics cost savings and improved service level for helicopter services and marine vessels that fly Nigerian flag. Respondent B1 believes that localizing the supply of inputs ultimately leads to lower input costs and reduction in unit operating cost of oil and gas production. According to Respondent C1, the impact of local content development on the business bottom-line is not yet visible in Company C due to extenuating macro-economic factors such as absence of critical support infrastructure and difficulty of doing business in Nigeria, but nonetheless this respondent opined that investment in local content development will lead to lower cost in the long run. Also, Respondent D1 underscored the fact that local content development may have initial cost premium but in the long run will pay off and contribute to competitive advantage for the multinational oil and gas companies. The views of Respondents C1 and D1 about short-term cost premium are supported by the findings of Probst et al. (2020), which state that local content requirement policies resulted in a marginal increase in the cost of solar photovoltaic power in India over a 4-year period.

Overarching strategies for improving local content development

The overarching strategies for increasing local content in the multinational oil and gas companies’ processes and products include developing and implementing corporate local content policies and frameworks, compliance with the NOGICDA, the use of category strategy development to identify local content development opportunities, embarking on capacity development initiatives, supplier development, deliberate creation of business opportunities for local companies, financial support to indigenous companies, monitoring contractors’ and suppliers’ local content capacity development, and influencing OEMs to set up facilities in Nigeria. All the participants contributed to aspects of this strategy.

Corporate local content policies and framework

Local content development in the oil and gas industry is largely influenced by the extent of corporate level commitment as typified by an existence of overarching corporate level local content policies and frameworks that are endorsed by senior executives of the organizations. All the participants discussed aspects of this element. Notably, Participants A1 and A2 underscored the fact that the overarching local content strategies for Company A are aligned with the parent group policy which requires the promotion, support, and utilization of available local resources. Similarly, Participant E1 stated that local content development in Company E is driven by corporate local content development strategy framework. The corporate local content frameworks here refer to the organizational functions, local content policies, processes, and organizational culture that are antecedents for local content development.

Compliance with the NOGICDA: Commitment to ensuring compliance with the provisions of the NOGICDA (the overarching local content policy statute) by the multinational oil and gas companies themselves as well as their contractors and suppliers is key to driving increase of local content in the multinational oil and gas companies’ processes and products. All the participants indicated that local content development in their organizations is driven by statutory duty and the policy of complying with extant government policies on local content development. This aligns with Kazzazi and Nouri (2012) local content development conceptual framework as well as views of Ahmad et al. (2016), Arbatli (2018), Nwapi (2016), and White (2017) that local policies drive local content development. Compliance with the NOGICDA includes giving preference to indigenous companies in tendering and contract award for supply of goods and services, carrying out research and development for purpose of finding local substitutes to imported goods and services, integration of community content into local development as variously mentioned by the participants, and monitoring the buying company as well as contractors and suppliers to ensure compliance with local content targets specified in the NOGICDA and the NCDMB’s guidelines. An organization can achieve the basic minimum statutory local content development targets by simply taking steps to comply with the letters of the NOGICDA.

Capacity development initiatives

All the respondents mentioned aspects of this strategy. Capacity development initiatives are specific projects embarked upon by the buying company to build local supply capacity and capability. Capacity development initiatives are wide ranging and include support for indigenous asset ownership, support for enhancement of indigenous companies’ infrastructure, support for in-country manufacturing, human capacity development, and facilitating partnerships between local companies and foreign companies to transfer technical skills. There are mandatory capacity development initiatives that are directed by the NCDMB as a precondition for approving certain sourcing strategies where the local content targets cannot be achieved due to gaps in local supply capacity. Examples are NCDMB’s requirement for oil and gas companies to execute project scopes of industrial parks, provide jetties, and support indigenous companies to acquire assets or improve infrastructure. There are also non-mandatory capacity development initiatives that buying companies voluntarily carry out in furtherance of local content development objectives. Respondent D1 considers the execution of mandatory capacity development initiative to be among the most effective strategies for increasing local contents in the oil and gas industry given that the oil and gas companies commit to executing such initiatives within a stated time frame, whereas the execution of the non-mandatory capacity development initiatives could fall through the cracks especially when there is budget constraint.

Support for indigenous asset ownership and enhancement of indigenous company’s assets: Sixty-three percent of the respondents (Respondents A1, A2, C1, D1, and E1) mentioned support for indigenous companies’ asset ownership and enhancement as strategy for increasing local content development. According to the respondents, providing support to indigenous companies in acquiring and enhancing operational assets has proved effective in achieving significant increase in local capacity and capability for Nigerian indigenous companies. This involves the buying company providing technical and financial support to the indigenous company to acquire requisite equipment, facilities, or technical skills in order to meet the buying company’s technical specification. This strategy has elements of supplier assessment, incentives, and direct supplier involvement per the mediated impact model of supplier development (Krause et al., 2000). The contractor is selected through a tendering process that includes technical and commercial evaluations leading up to contract award. A likelihood of repeat contracts and buying company’s willingness to be deeply involved through provision of financial support or similar assistance give the supplier good incentive to improve. Moreover, the buyer’s direct involvement in handholding the contractor to ensure successful outcome protects the buyer’s investment while deepening relationship between the buyer and supplier. A notable success story is the development of Caverton Helicopters Limited from a little-known startup helicopter service operator in Nigeria to a major player in the sub-Saharan Africa region. This was made possible through a contractual arrangement between the local company and the Shell Petroleum Development Company of Nigeria Limited (SPDC) that included an advance payment to enable Caverton acquire additional 11 helicopters to upgrade and expand its service capability; something that would have been difficult if this local company was to borrow the money from the financial market. The arrangement allowed SPDC to amortize the advance payments through services rendered by the contractor over the contract period. Another example of this local content development strategy is upgrading of LADOL’s technical capability with support of Total Engineering and Production Company Limited, which facility was then utilized for the Egina FPSO project integration in Nigeria; a project scope that would otherwise have been carried out overseas and significant value retained abroad. Similarly, oil and gas companies have supported local community start-up enterprises to acquire marine vessels with which they provide marine transportation services to the oil and gas companies and the public, resulting in the growth of the local enterprises, value adding service delivery to the buying companies, and freedom to operate. Similarly, Company A supported an indigenous steel pipe manufacturer, SCC, to expand its capability for the manufacture of 20-inch diameter oil and gas line pipes to international standard. According to Respondent A1, the buying company’s support to local contractors and suppliers to acquire production assets and equipment is the most effective strategy for increasing local content development. This is because the strategy elicits contractor’s commitment to improve being motivated by the financial involvement of the buying company and subsisting contract for uptake of the goods or services provided through the improved capacity. Also, the buying company stands to reap from the investment in developing the local contractor through improved contractor performance and earning of preferred customer status, which may accrue competitive advantage.

Human capacity development: Pursuant to the NCDMB’s guidelines, the oil and gas companies carry out human capacity development through training programs by themselves or through contractors, funding of tertiary institutions’ academic programs, and award of scholarships to Nigerians for skills relevant to the oil and gas business. Seventy-five percent of the respondents (Respondents A1, A2, B1, B2, C1, and E1) mentioned this strategy. Company A sponsors master’s degree programs for Niger Delta indigenes in areas of geology and engineering on condition that they will return to Nigeria after their studies to contribute their skills. The company also sponsors vocational training programs in the areas of masonry, electrical wiring, scaffolding, fitting, welding, and lifting. Every year Company B trains two batches of geosciences graduates and run mentoring lecture sessions for final year students of the University of Port Harcourt using its technical team resources. According to Respondent B2, Company B sets aside three percent of project contract value for human capital development. Similarly, Company C supports technical education targeted at growing local skills in its areas of operation, while Company E’s human capital development initiatives focus on helping local services suppliers to become self-sustainable. As was further opined by Respondent A1, human capacity development, which is mandated in the NOGICDA, has been moderately effective as it has contributed to raising skills levels of Nigerians who are able to take up roles that were previously performed by expatriates at premium costs, but the downside of this strategy is limited employment opportunities to retain candidates whose capacities are developed. Nonetheless, this strategy has high spillover effect as the candidates who are developed become more employable within the oil and gas industry and in other industrial sectors, and can indirectly add value to the buying company through contractors and sub-contractors that employ them, thus increasing local contents of the buying companies’ products.

Supplier development

All the respondents mentioned supplier development as part of strategies for increasing local content in their companies. Variants of supplier development approaches used by the companies include actively canvassing for Nigerians in the diaspora who have critical expertise in the oil and gas business to return to the country and provide such services that were previously sourced from foreign suppliers (Company A); a requirement for multinational contractors to train identified local contractors who will take over supply of the provision of such services in the future (Company B); and deliberate award of contracts to local contractors and in some cases availing them of funding (Company A and Company B).

Company A set up an internet-based Nigeria global network that brings together Nigerians in the diaspora to participate in proffering solutions to problems that would otherwise be contracted to foreigners. A typical outcome of this strategy is the domestication of equipment repairs that were previously carried out in Aberdeen, United Kingdom. As underscored by Respondent A3, category strategy development is a precursor to supplier development as the exercise is used in identifying business opportunities where development of local suppliers is most beneficial.

Company B influenced the development of local companies that took over seabed survey service, which was previously carried out by multinational companies. Similarly, Company B contributed to the development of a Nigerian company to provide integrated manpower supply services, which were previously performed by a foreign company. As part of contracts scope of work, the multinational companies were required to allow the Nigerian companies to understudy them and provide to necessary support to enable succession after a given period. In some cases, Company B paid additional fees to make this happen.

As discussed by Respondent A3, the award of contracts to community-based contractors under the community content strategy, a strategy of local content development, offers opportunity to develop the low-level suppliers. As further discussed by Respondent B2, supplier development is carried out as part of contract management process during which the contractors’ performances are reviewed using 360-degree review template based on a set of key performance indicators and the contractor is given feedback on areas for improvement.

Generally, the data we obtained from the field do not indicate a consistent use of supplier development by the oil and gas companies as a strategic investment approach to developing local content and improving security of the supply. Whereas some respondents indicated that their companies carry out supplier development, none provided evidence of in-depth programs and well-structured approaches in developing local suppliers such as a deliberate combination of supplier assessment, supplier incentivization, and direct involvement in the development of suppliers as conceptualized by Krause et al. (2000). Contrary to expert opinions from literature about potential supply chain value improvement that results from supplier development (Routroy and Pradhan, 2014; Rotich et al., 2014; Chen et al., 2015), Respondent A1 considers supplier development to be the least effective strategy for growing local content in Nigeria. In the opinion of Respondent A1, supplier development has not been effective because local contractors tend to expect too much from the buying companies, consider buying companies’ local content development investment as their entitlements, and are generally unwilling to make financial commitment to the supplier development initiatives initiated by the buying company. Also, Respondent B1 underscored challenges with supplier development as dearth of funds to effectively support this initiative and many Nigerian business owners not being consistent in nurturing their companies to become major reliable players.

CONCLUSIONS AND FUTURE RESEARCH

The research problem examined was that some supply chain managers lack strategies to increase local content of their companies’ processes and products. The purpose of this qualitative multiple case study was to explore strategies that supply chain managers in the Nigerian oil and gas industry use to increase local content of their processes and products and equip managers and business leaders with actionable strategies to help them achieve sustainable competitive advantage through local content development. Through the study, we have identified strategies for increasing local content development, which were the business value drivers for local content development and the overarching local content development strategies deployed. Limitations of this study include the limited number of participants, the focused geographical area, and the understanding that some respondents may have not fully disclosed their strategic local content development plans due to concerns about confidentiality of such information.

The strategies identified have varying degrees of effectiveness as reported by the respondents. It is necessary to further review and rank the strategies in order of effectiveness, using a quantitative methodology. The outcome of the further study will be a recommendation of shortlist of most effective local content development strategies for supply chain managers to pursue. Another area of further research is an assessment of the relationship between local content development expenditure and tangible business value created for the buying companies in Nigeria.

Further research is also needed on effective strategic responses to the non-oil markets including increased entrepreneurship, more direct investment, better market segmentation, industrial upgrades, and restrictive monetary policy (Babajide, 2017; Innocent, 2017; Olomu, et al., 2020; Opeoluwa et al., 2021). Policymakers have implemented fiscal policies that are inconsistent with monetary policy resulting in asymmetries in the financial sector, which is a big component of long-run industrialization and a key driver of developing local content policies (Akanbi, 2015; Adeleye et.al, 2020). The outcome of this study will provide stronger impetus for the oil and gas companies to sufficiently invest resources into local content development as lever for business performance improvement and competitive advantage.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interest.

REFERENCES

|

Acheampong T, Ashong M, Svanikier VC (2016). An assessment of local-content policies in oil and gas producing countries. Journal of World Energy Law and Business 9(4):282-302. |

|

|

Adeleye N, Osabuohien E, Asongu S (2020). Agro-industrialisation and financial intermediation in Nigeria. African Journal of Economic and Management Studies 11(3):443-456. |

|

|

Ahmad WNKW, Rezaei J, Tavasszy LA, de Brito MP (2016). Commitment to and preparedness for sustainable supply chain management in the oil and gas industry. Journal of Environmental Management 180:202-213. |

|

|

Akanbi OA (2015). Sustainability of fiscal policy in an oil-rich economy: The case of Nigeria. African Journal of Economic and Management Studies 4:380-401. |

|

|

Arbatli E (2018). Resource nationalism revisited: A new conceptualization in light of changing actors and strategies in the oil industry. Energy Research and Social Science 40:101-108. |

|

|

Babajide F (2017). Return and volatility spillovers between oil and stock markets in South Africa and Nigeria. African Journal of Economic and Management Studies 8(4):484-497. |

|

|

Boamah NA (2017). The relevance of global sector influence in African sector portfolios. African Journal of Economic and Management Studies 8(2):205-220. |

|

|

Calignano G, Vaaland TI (2017). Supplier development in Tanzania: Experiences, expectations and motivation. The Extractive Industries and Society 4(2):385-397. |

|

|

Castleberry A, Nolen A (2018). Thematic analysis of qualitative research data: Is it as easy as it sounds? Currents in Pharmacy Teaching and Learning 10(6):807-815. |

|

|

Chen L, Ellis S, Holsapple C (2015). Supplier development: a knowledge management perspective. Knowledge and Process Management 22(4):250-269. |

|

|

Elum ZA, Mopipi K, Henri-Ukoha A (2016). Oil exploitation and its socioeconomic effects on the Niger Delta region of Nigeria. Environmental Science and Pollution Research 23(13):12880-12889. |

|

|

Grossman GM (1981). The theory of domestic content protection and content preference. The Quarterly Journal of Economics 96(4):583-603. |

|

|

Hansen MW (2020). Toward a strategic management perspective on local content in African extractives: MNC procurement strategies between local responsiveness and global integration. Africa Journal of Management 6(1):24-42. |

|

|

Innocent O (2017). Agripreneurship development: A strategy for revamping Nigeria's economy from recession. African Journal of Economic and Management Studies 8(4):474-483. |

|

|

Kazzazi A, Nouri B (2012). A conceptual model for local content development in petroleum industry. Management Science Letters 2(6):2165-2174 |

|

|

Kolstad I, Kinyondo A (2017). Alternatives to local content requirements in resource-rich countries. Oxford Development Studies 45(4):409-423. |

|

|

Krause DR, Scannell TV, Calantone RJ (2000). A structural analysis of the effectiveness of buying firms' strategies to improve supplier performance. Decision Sciences 31(1):33-55. |

|

|

Melé D, Armengou J (2016). Moral legitimacy in controversial projects and its relationship with social license to operate: A case study. Journal of Business Ethics 136(4):729-742. |

|

|

Ngoasong MZ (2014). How international oil and gas companies respond to local content policies in petroleum-producing developing countries: A narrative enquiry. Energy Policy 73:471-479. |

|

|

Nwapi C (2016). A survey of the literature on local content policies in the oil and gas industry in East Africa. The School of Public Policy Publications. |

|

|

Olomu MO, Moses CE, Akinlo T (2020). Agricultural sector value chain and government policy in Nigeria: Issues, challenges and prospects. African Journal of Economic and Management Studies 11(3):525-538. |

|

|

Opeoluwa AA, Olumide SA, Olajide CJ (2021). Policy asymmetries and fiscal sustainability: Evidence from Nigeria. African Journal of Economic and Management Studies 12(2):302-320. |

|

|

Ovadia JS (2014). Local content and natural resource governance: The cases of Angola and Nigeria. The Extractive Industries and Society 1(2):137-146. |

|

|

Ovadia JS (2016). Local content policies and petro-development in Sub-Saharan Africa: A comparative analysis. Resources Policy 49:20-30. |

|

|

Owusu RA, Vaaland TI (2016). A business network perspective on local content in emerging African petroleum nations. International Journal of Energy Sector Management 10(4):594-616. |

|

|

Probst B, Anatolitis V, Kontoleon A, Anadón LD (2020). The short-term costs of local content requirements in the Indian solar auctions. Nature Energy 5(11):1-9. |

|

|

Ramdoo I (2016). Local content policies in mineral-rich countries. An Overview. (Discussion Paper No 193). European Centre for Development Policy Management. |

|

|

Rotich GC, Aburi EO, Kihara ASN (2014). The influence of specific supplier development practices on a firm's competitive advantage: A case study of Safaricom Limited. International Journal of Social Sciences and Entrepreneurship 1(11):70-75. |

|

|

Routroy S, Pradhan S (2014). Analyzing the performance of supplier development: a case study. International Journal of Productivity and Performance Management 63(2):209-233. |

|

|

Smits CC, van Leeuwen J, van Tatenhove JP (2017). Oil and gas development in Greenland: A social license to operate, trust and legitimacy in environmental governance. Resources Policy 53:109-116. |

|

|

Wabote SK (2017). Summit: Moving Nigerian content to the next level. Local Content Digest Q2 2017. |

|

|

White S (2017). Regulating for local content: Limitations of legal and regulatory instruments in promoting small scale suppliers in extractive industries in developing economies. The Extractive Industries and Society 4(2):260-266. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0