ABSTRACT

The growing business prosperity in African countries has brought new opportunities for enterprises to carry out transnational operation in Africa; however, it may also be accompanied by some transnational operation risks. Enterprises incorrectly identify and analyze these risks, which brings enterprises great uncertainty and huge losses. So enterprises should establish a transnational operation risk management system as soon as possible to ensure the healthy transnational operation in Africa. Based on the survey of 83 experts at African research and the relevant literatures, this paper puts forward a transitional risk early-warning evaluation index system composed of 8 primary indexes including strategic management risk, operation management risk, human resource risk, marketing risk, supply chain management risk, financial management risk, national political risk and macro environmental risk. This paper also determines the weights of the indexes by AHP method and sets the transitional operation risk early-warning evaluation standards based on advice from experts. Furthermore, this paper takes 259 Zhejiang Africa-related enterprises as samples and assesses the transitional operation risk of them by the system established, finds that human resource risks, financial management risks, national political risks and national macro environmental risks are relatively large. Finally, some suggestions are given.

Key words: Risk early-warning index system, transitional operation, Africa-related enterprises.

Since the 21st Century, with the rapid development of information technology and the high degree of globalization of industry, transitional operation has not only been widely adopted by large enterprises in developed economics such as EU, US and Japan; more and more SMEs (small and medium-sized enterprises) in emerging economies,with China as the representative, have been rapidly improving their transnational operation, and have obtained a remarkable transnational operation performance (Li et al., 2017). As one of the largest emerging markets in the world, Africa has abundant resources and great market potential; in addition, a series of remarkable changes have taken place in political and economic situation in recent years, which is characterized by increasingly stable overall political situation and sustained economic growth. At present, Africa markets are ripe with business opportunities for enterprises to exploit. Thus, it is important for Chinese enterprises to timely grasp these business opportunities in Arica as well as effectively manage the potential risks (Modou and Liu, 2017). The proposal of the belt and road has also brought a new historic opportunity for Chinese enterprises to expand their investment in Africa and deepen the cooperation with Africa. At the same time, African countries have seized the historical developing opportunity to speed up the industrialization and economic integration in Africa. With China-Africa economic and trade cooperation constantly upgrading, Africa becomes a new blue ocean and the favored destination for Chinese enterprises to expand international presence. However, in the face of great opportunities, there are also some challenges in the transnational operation in Africa for Chinese enterprises (Doku et al., 2017). Under this background, how to scientifically analyze and evaluate transnational operation risks has become an important issue in transnational operation of Africa-related enterprises. The Africa-related enterprises are the enterprises that carry out transitional operation in Africa countries.

Throughout the existing literatures, a lot of research on risk early-warning of transnational operation has been done by scholars (Tong and Reuer, 2007; Jensen and Young, 2008). However, due to different economic development status in different parts of the world, the research abroad cannot entirely satisfy the urgent need of transnational operation risk management practice of domestic enterprises (Wu et al., 2015). Besides, most of the existing research focuses on technological innovation, localization operation, industrial clusters effect and macro-countermeasures to further transnational operation with little focus on specific regions (Buckley et al., 2007; Poulis et al., 2012). As a result, there is a large deviation between the existing risk early-warning system and the need of these enterprises for risks management practice. Zhejiang Province is the pioneer of the development of China-Africa economic and trade cooperation, accounting for more than 20% of China’s trade with Africa. By the end of 2018, Zhejiang enterprises have brought its total investment fund for Africa to 3.1bn dollars, and their investment expand from traditional fields such as textile and wholesale to new fields like medicine, security, e-commerce and culture. Zhejiang enterprises actively invest, which promotes the economic development of Africa, increases local employment opportunities, brings theologies suitable for Africa and enhances independent construction capability. At the same time, Zhejiang enterprises’ transnational operation in Africa is an important support for the development of external trade of Zhejiang.

In order to respond to the actual needs of domestic Africa-related enterprises for transnational operation risk management and make up for the lack of pertinence of existing research, this paper aims to construct a risk early-warning index system of transnational operation and build a risk management model of transnational operation based on analytic hierarchy process (AHP) for Africa-related enterprises in Zhejiang. This paper also sets a transnational operation risk evaluation standard. Further, this paper evaluates the transnational operation risk of 259 Africa-related enterprises in Zhejiang in order to provide decision support for Zhejiang enterprises to carry out transnational operation in African countries.

Transnational operation is more complex and difficult to control because it involves the operation between different countries and regions, and the risks of transnational operation are diversified. Therefore, risk management is particularly important in transnational operation of enterprises (Oetzel and Miklian, 2017). Risk management is defined as a kind of management method that economic units control and deal with risks by using known theoretical knowledge and effective economic and technical measures after identifying risks, analyzing risks and measuring risks, and finally reduce the loss of risks to an acceptable range by the most acceptable cost or loss (Miller, 1996). It includes three stages: risk identification, risk assessment and risk response.

To improve the reliability and accuracy of risk early-warning, based on subjective assignment method, principal component analysis method and factor analysis method, a series of risk early-warning models have been proposed, including the single variables predicting model (Beaver, 1966), the Z-Score model (Altman et al., 2017), the hybrid intelligent early-warning model (Wang, 2010), the back propagation artificial neural networks (Pradhan and Lee, 2009; Cao et al., 2009). Furthermore, some scholars have constructed different risk early-warning model for transnational operation. Xie et al. (2010) proposed a dynamic transitional operation risk warning model by using the methods of logistic regression and multiple linear regression. Ge and Shi (2014) analyzed and quantified various overseas investment, and quantified the overseas investment risks as risk indexes to provide risk early-warning countermeasures for enterprises' overseas investment. Liu (2008) built a three-level prevention mechanism of transnational risk management and a transitional operation risk early-warning index system for SMEs. The dynamic transitional operation environment determines that enterprises must make timely strategic adjustments (Ahn et al., 2003). Further, Persaud (2005) put forward the corresponding risk management strategies according to the new characteristics of the risk management of multinational corporations. Wu et al. (2010) also put forward a risk prevention mechanism under the internal and external linkage between the government and the enterprise.

With the vigorous development of Chinese enterprises’ transitional operation activities in Africa, the risk early- warning issues have attracted the attention of a large number of scholars. The corporate investment in Africa offers high returns, but at the same time, enterprises face the complicated risks of law, policy, finance, culture and so on (Swanepoel et al., 2010). Besides, the investment environment of African countries is significantly different, so there are still quite a lot of difficulties in transitional operation of Africa-related enterprises in Arica, the most important of which is insufficient awareness of the risks when entering into a new country (Fosu et al., 2001). To overcome these difficulties, Africa-related enterprises should have a comprehensive analysis and investigation of the social, cultural, legal and institutional environment of Africa to fully understand the existing and potential risks of transnational operation in Africa (Zhang et al., 2013). Further, Zhang et al. (2013) classified the operating environment of various African countries in light of economic growth, international trade, human resources and other indexes, and put forward the corresponding risk management strategies. Cheung and Haan (2012) analyzed the location decision, entry path and strategy of Chinese enterprises’ transitional operation in Africa, and selected several Africa countries with better investment environment. The SMEs align with other enterprises in the same industry to enter the African market, which can make up for the shortage of the SMEs and reduce the possible risks (Buhlungu, 2011). Due to the great importance of Africa, the SMEs are encouraged to enter into Africa in a cluster way and innovate the development mode of overseas parks, and effectively manage the existing and potential transitional operation risks, promoting healthy and sustainable development of enterprises (Zhang and Li, 2010).

The risk early-warning system of transitional operation is composed of the transitional operation risk early-warning evaluation index system and evaluation standards (Wu et al., 2010). This paper follows the principles of scientific, systematic, independent and measurable in order to improve the effectiveness of the transitional operation early-warning evaluation index system (Wang et al., 2018). 100 experts in the fields of politics, manufacturing, education, law, management consulting, and human resources management were questioned, 83 effective questionnaires collected; the effective questionnaire recovery rate is 83%.

Firstly, this paper establishes a transitional operation early-warning evaluation index system based on literature research and questionnaire survey (Modou and Liu, 2017; Mhaka and Jeke, 2018). The secondary indexes were obtained through filtering and merging of 145 transitional operation early-warning evaluation indexes selected from the relevant literatures; the primary indexes were extracted from the secondary indexes by exploratory factor analysis following the rule of Kaiser with the survey data of 83 experts.

Further, based on the transitional operation risk early-warning evaluation index system and the questionnaire data from 83 experts, the weights of the transitional operation early-warning evaluation indexes were determined by analytic hierarchy process (AHP) and Delphi. The hierarchical structure model was built using the software of Matlab 2016. The importance comparison data among each index collected from 83 experts was input into Matlab.

This paper establishes the judgment matrix among indexes and tests the rationality and effectiveness of the matrix. Then the weight of each index was automatically calculated by Matlab. According to the relevant literatures (Altman et al., 2017; Fosu et al., 2001), the standard transitional operation early-warning evaluation standard was set combined with the experts' suggestion.

By exploratory factor analysis, 8 common factors with characteristic values greater than 1 were extracted from 30 secondary indexes. These 8 factors explain 62.253% of the variance of all indexes of the original scale, which are higher than the standard value of 60%. After the maximum orthogonal rotation of the factors, the load of each index on each dimension factor is obtained. The results show that the factor load of the 30 indexes is above 0.5. Executive quality, resource ability, strategic foresight, dynamic adaptability and credit level have a large load on factor 1, and the characteristic value is 7.235, which explains 24.117% of the total variance. These 5 indexes are classified into dimension 1 named strategic management risk. In the same way, the rest indexes are classified into 7 dimensions respectively named operation management risk, human resource management risk, marketing risk, supply chain management risk, financial management risk, national political risk and macro environmental risk. The transitional operation risk early-warning evaluation index system includes 30 secondary indexes and 8 primary indexes, as shown in Table 1.

The weights of 8 primary and 30 secondary transitional operation risk early-warning evaluation indexes are also shown in Table 1. The weights of financial management risk (0.2037), national political risk (0.1514) and macro environmental risk (0.1584) are greater than others so that they need more attention. The weights of strategic management risk (0.0835), operation management risk (0.1002), human resource risk (0.1042), marketing risk (0.0954) and supply chain management risk (0.1032) are also not low so that they should not be ignored. The transitional operation risk early-warning condition was divided into five levels: Level I indicates a security condition and level V indicates a crisis condition, as shown in Table 2.

Evaluation of risk early-warning of sample enterprises

Africa-related enterprises in Zhejiang were sampled for this paper, because Africa has been an important region for Zhejiang’s enterprises to carry out transitional business (Modou and Liu, 2017; Hua et al., 2016). It took nearly two and half months and nearly 300 questionnaires were distributed; 276 questionnaires were collected and 259 questionnaires were valid accounting for 86.3% of the total amount of questionnaires. Samples include 259 Africa-related enterprises across manufacturing, agriculture, mining, construction, information technology, wholesale and retail and service consulting. These enterprises include limited liability companies (41%), joint ventures (19%) and so on. As for the annual sales in Africa, enterprises with sales of less than 500 thousand RMB account for 36%, with sales of 500-2000 thousand RMB accounting for 38%; sales of more than 2 million RMB account for 16%.

According to the transitional operation risk early-warning evaluation model established above, the values of the primary indexes are represented by Bi, and the values of the secondary indexes are represented by Cij. Meanwhile, Wi indicates the weights of the primary indexes, and Wij indicates the weights of the secondary indexes. Through the following formula, the value of the primary risk early-warning indexes was obtained and then was matched to the corresponding risk early-warning interval to obtain the risk early-warning level and warning status of the sample enterprises. Using the comprehensive evaluation method, the 8 integrated risk values and the 30 single risk values of 259 samples were calculated.

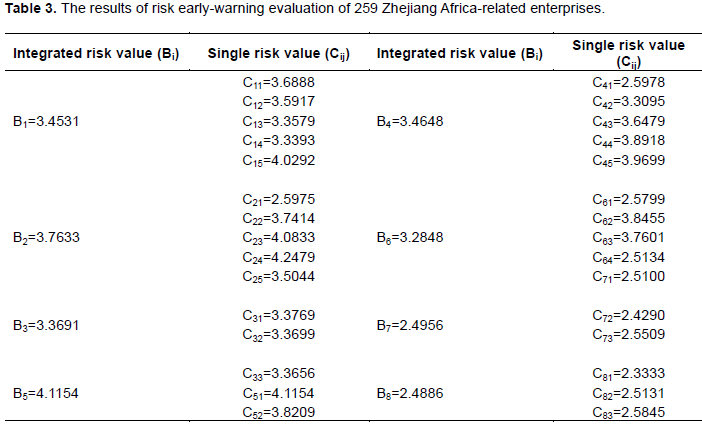

Based on relevant research, the risk early-warning evaluation standard for transitional operation of Africa-related enterprises uses a 5-point scale. The lower the score, the greater the risk is, accordingly, the higher the warning level. The results of the risk early-warning evaluation of 259 Zhejiang Africa-related enterprises are shown in Table 3.

Compared with the risk early-warning standard in Table 2 and the calculated results in Table 3, it indicates that the values of strategic management risk (3.4531), operation management risk (3.7633), marketing risk (3.4648) and supply chain management risk (4.1154) are smaller, which means that they are in a quasi-security state; the enterprises should pay attention to the trend of these specific relevant risks’ changes, and timely adjust the strategies of transitional operation in Africa to reduce the loss caused by these risks. It also indicates that the values of human resource risk (3.3691) and financial management risk (3.2848) are in a neutral level and state. In such a condition, there is no obvious problem that affects the development of transnational operation and no absolute advantage in the process of carrying out transitional operation in Africa; so these relevant risks need attention and reasonable prevention. It indicates, moreover, that the values of national political risk (2.4956) and macro environment risk (2.4886) are relatively higher, which illustrates that the 2 types of risks are in a quasi-crisis state; the normal transnational operation of enterprises has been affected. In this situation, Africa-related enterprises would suffer losses if the corresponding measures are not taken in time.

Based on the weight values of risk early-warning indexes summarized above and the risk values of 259 Zhejiang Africa-related enterprises, the following three countermeasures are proposed for transitional operation of Africa-related enterprises:

Firstly, target a transitional operation risk early-warning index system. With the increasingly rapid economic globalization and good economic development of Africa, the Africa-related enterprises should take this risk early-warning system as the reference to carry out various forms of transitional operation in Africa, such as international strategic alliances. The enterprises should not only reinforce the exchange and interaction with African partners in order to overcome the entry barriers to African markets (Poulis et al., 2012), but also effectively manage the existing and potential transitional operation risks, so as to reduce the losses caused by the risks to an acceptable range and ensure the transitional operation in Africa normally.

Secondly, implement classified and graded measures for different types and levels of risks (Liu, 2008). Africa-related should pay more attention to these riskier indexes with lower scores and not ignore these potential risks with meddle scores. Zhejiang Africa-related enterprises should focus on national political risk, macro environmental risk, financial management risk and human resource risk and pay reasonable attention to potential risks in policy environment, finance and cross-cultural by empirical research. In conclusion, Africa-related enterprises should rationalize the distribution of resources, identify and deal with risks of different importance in time as well, so as to avoid risks reasonably and keep the healthy development of the transitional operation. The specific measures are as follows:

(i) In terms of national political risk management, domestic government should build an information platform for overseas investment assessment and early-warning, actively integrate various aspects of data, and establish an authoritative and comprehensive risk assessment database (Wu et al., 2015). In the face of political risks, Africa- related enterprises should also know how to use African laws to protect their own interests and establish an independent political risk management system, especially the identification mechanism of political risks and the stop loss shock mechanism when political risks occur.

(ii) In terms of financial management risk management, in the face of foreign exchange risk and market risk brought by economic fluctuation, Africa-related enterprises should fully understand the financial policies and monetary market situation in host countries, use stable currencies as settlement currencies and buy derivative financial instruments such as futures to reduce the impact of fluctuations in the international monetary market (Tian and Yu, 2011).

(iii) In the aspect of human resource risk management, Africa-related enterprises should recruit local staff as much as possible, select and appoint local specialists, and respect the value of African employees to overcome the conflict of heterogeneous cultures. They should build a local human resource risk early-warning mechanism; maximize the potential of international human resources.

Thirdly, optimize the operation process and organizational mechanism of transitional operation risk early-warning.

The risk early-warning system is the key to developing sustainable competitive advantages. Accordingly, Africa-related enterprises should construct and optimize the operation process and organizational mechanism of transitional operation risk early-warning which consists of organization mechanism, information collection and transmission mechanism, analysis and early-warning mechanism and handling mechanism, so as to effectively support objectives of transnational operation.

This paper constructs a transitional operation risk early-warning evaluation system based on the relevant literatures and survey data of 83 experts. It includes 8 primary risk early-warning indexes, strategic management risk, operation management risk, human resource risk, marketing risk, supply chain management risk, financial management risk, national political risk and macro environment risk as well as 30 secondary risk early-warning indexes. The establishment of a reasonable and effective risk early-warning evaluation system can effectively avoid various transnational operation risks and make it more convenient for Africa-related enterprises to manage transnational operation risks, and further improve the transnational operation ability of Africa-related enterprises.

This paper determines the weights of risk early-warning indexes by analytic hierarchy process (AHP) and Delphi method. The results show that macro environmental risk, national political risk, financial management risk and human resource risk had larger weights than others. Otherwise, the risk early-warning warning evaluation standard has been set which was divided into five levels and five corresponding states: crisis state, quasi crisis state, neutral state, quasi security state and security state.

Taking 259 Zhejiang African-related enterprises as samples, this paper conducts a risk early-warning evaluation on the transnational operation risks of Zhejiang Africa-related enterprises. The integrated risk values of 8 primary indexes and the individual risk values of 30 secondary indexes were obtained, as well as the early-warning level and state of the sample enterprises. The evaluation results indicate that the national politic risk, macro environment risk, financial management risk and human resource risk are larger while the strategic management risk, operation management risk, marketing risk and supply chain management risk are smaller.

This paper enriches the existing research on transitional operation risk. The existing research on transitional operation mainly focuses on its origin, motivation and mode but seldom focuses on its risk. Although scholars have divided the risk of transnational operation into political risk, foreign exchange risk, management risk, operational risk and technical risk, the research on risk early-warning of transitional operation of Africa-related enterprises is relatively insufficient. On the basis of the research on the transnational operation risk early-warning, this paper constructs transnational operation risk early-warning evaluation system for Africa-related enterprises by using both qualitative and quantitative research methods, and assesses the transitional operation risk of 259 Zhejiang Africa-related enterprises, and further propose several targeted suggestions for Africa-related enterprises to carry out transitional operation in African countries.

Due to the limitation of time and ability, there are still some shortcomings in this paper. There are only 83 groups of valid data, but the index system includes 8 primary indexes and 30 secondary indexes, so the training of the model cannot reach the optimal level. Due to the variety of risks in transnational operation, the risk segmentation is inadequate. This paper only uses the AHP method to determine the weights of the indexes that do not use a variety of evaluation methods and adopt the best for the weights not to be accurate enough. In further study, the improvement of questionnaire and more data collected can make the system more accurate; the indexes need more research and improvement. An optimal evaluation method based on the adoption of different evaluation methods to determine the weights of the indexes is needed.

The authors thank the Humanity and Social Science Foundation of Ministry of Education of China (Grant NO. 20YJA1237) for their support.

The authors have not declared any conflict of interests.

REFERENCES

|

Ahn DH, Conrad J, Dittmar RF (2003). Risk adjustment and trading strategies. Review of Financial Studies 16(2):459-485.

Crossref

|

|

|

|

Altman EI, Drozdowska IM, Laitinen EK (2017). Financial distress prediction in an international context: a review and empirical analysis of Altman's Z-Score model. Journal of International Financial Management and Accounting 28(2):131-171.

Crossref

|

|

|

|

|

Beaver W (1966). Financial ratios as predictors of failure. Journal of Accounting Research 4:71-111.

Crossref

|

|

|

|

|

Buckley PJ, Clegg J, Wang C (2007). The impact of foreign ownership, local ownership and industry characteristics on spillover benefits from foreign direct investment in China. International Business Review 16(2):142-158.

Crossref

|

|

|

|

|

Buhlungu S (2011). Union-party alliances in the era of market regulation: the case of South Africa. Journal of Southern African Studies 31(4):701-717.

Crossref

|

|

|

|

|

Cao L, Liang L, Li Z (2009). The Research on the early-warning system model of operational risk for commercial banks based on bp neural network analysis. The 8th International Conference on Machine Learning and Cybernetic Proceedings pp. 2739-2744.

|

|

|

|

|

Cheung YW, Haan JD, Qian X, Yu S (2012). China's outward direct investment in Africa. Social Science Electronic Publishing 20(2):201-220.

Crossref

|

|

|

|

|

Doku I, Akuma J, Afriyie OJ (2017). Effect of Chinese foreign direct investment on economic growth in Africa. Journal of Chinese Economic and Foreign Trade Studies 2(10):162-171.

Crossref

|

|

|

|

|

Fosu AK, Mlambo K, Oshikoya TW (2001). Business environment and investment in Africa. Journal of African Economies 10(2):1-11.

Crossref

|

|

|

|

|

Ge S, Shi AN (2014). Construction of the factors affecting China's hydropower projects and overseas investment risk assessment index system. In Applied Mechanics and Materials. Trans Tech Publications pp. 2077-2084.

Crossref

|

|

|

|

|

Hua X, Wang Y, Miao W (2016). 'The innovation and performance impacts of venture capital investment on China's small and medium-sized enterprises. China Economic Journal 9(2):167-185.

Crossref

|

|

|

|

|

Jensen NM, Young DJ (2008). A violent future? Political risk insurance markets and violence forecasts. Journal of Conflict Resolution 52(4):527-547.

Crossref

|

|

|

|

|

Li JY, Cao JX, Liu YQ (2017). A Study on the effects of dual network embeddedness on organizational learning and internationalization performance. Eurasia Journal of Mathematics, Science and Technology Education 13:5219-5229.

Crossref

|

|

|

|

|

Liu XR (2008). Early warning and management of transnational operation risks of small and medium-sized enterprises. Enterprise Economy 5:73-75.

|

|

|

|

|

Mhaka S, Jeke L (2018). An evaluation of the trade relationships between South Africa and China: An empirical review 1995-2014. South African Journal of Economic and Management Sciences 21(1):a2706.

Crossref

|

|

|

|

|

Miller KD (1996). A framework for integrated risk management in international business. Journal of International Business Studies 23:311-331.

Crossref

|

|

|

|

|

Modou D, Liu H (2017). The impact of Asian foreign direct investment, trade on Africa's economic growth. International Journal of Innovation and Economic Development 3(1):72-85.

Crossref

|

|

|

|

|

Oetzel J, Miklian J (2017). Multinational enterprises, risk management, and the business and economics of peace. Multinational Business Review 25(4):270-286.

Crossref

|

|

|

|

|

Persaud A (2005). Enhancing synergistic innovative capability in multinational corporations: an empirical investigation. Journal of Product Innovation Management 22(5):412-429.

Crossref

|

|

|

|

|

Poulis K, Yamin M, Poulis E (2012). Domestic firms competing with multinational enterprises: the relevance of resource-accessing alliance formations. International Business Review 21(4):588-601.

Crossref

|

|

|

|

|

Pradhan B, Lee S (2009). Landslide risk analysis using artificial neural network model focusing on different training sites. International Journal of Physical Sciences 4(2):1-15.

|

|

|

|

|

Swanepoel E, Strydom JW, Nieuwenhuizen C (2010). An empirical analysis of a private company's corporate social investment in SMME development in South Africa. Southern African Business Review 14:58-78.

|

|

|

|

|

Tian F, Yu Z (2011). A research on medium-sized and small enterprises financial risk early warning information system design. IEEE 2nd International Conference on Software Engineering and Service Science Proceedings pp. 745-748.

|

|

|

|

|

Tong TW, Reuer JJ (2007). Real options in multinational corporations: organizational challenges and risk implications. Journal of International Business Studies 38(2):215-230.

Crossref

|

|

|

|

|

Xie G, Yue W, Wang S, Lai KK (2010). Dynamic risk management in petroleum project investment based on a variable precision rough set model. Technological Forecasting and Social Change 77(6):891-901.

Crossref

|

|

|

|

|

Wang Q, Tang H; Yuan X, Wang M (2018). An early warning system for oil security in China. Sustainability 10(2):283.

Crossref

|

|

|

|

|

Wang W (2010). Hybrid intelligent model of project risk prediction and its application. Computer Engineering and Applications 46:189-192.

|

|

|

|

|

Wu J, Wang C, Hong J, Piperopoulos P, Zhuo H (2015). Internationalization and innovation performance of emerging market enterprises: the role of host-country institutional development. Journal of World Business 51(2):251-263.

Crossref

|

|

|

|

|

Wu SJ, Lien HC, Chang CH (2010). Modeling risk analysis for forecasting peak discharge during flooding prevention and warning operation. Stochastic Environmental Research and Risk Assessment 24(8):1175-1191.

Crossref

|

|

|

|

|

Zhang Y, Li H (2010). Innovation search of new ventures in a technology cluster: the role of ties with service intermediaries. Strategic Management Journal 31(1):88-109.

Crossref

|

|

|

|

|

Zhang J, Wei WX, Liu Z (2013). Strategic entry and determinants of Chinese private enterprises into Africa, Journal of African Business 14(2):96-105.

Crossref

|

|