ABSTRACT

The purpose of this paper is to investigate the factors that influence decision making in the selection of projects in renewable energy sector of Zambia. Project selection and development of a portfolio of projects in line with corporate strategy is an important task of decision makers in the renewable energy sector of both public and private organizations. The selected projects have to meet the appropriate time frame for completion and delivery, a suitable risk profile and other distinct factors in order to pursue corporate objectives successfully. A modified Delphi approach was applied in this study to investigate the factors that contribute to optimal selection of projects in the renewable energy sector of Zambia. The significance of the findings in this research established which critical factors decision makers must be considered when building up their project portfolio and considering the value of their investment.

Key words: Project selection, renewable energy, strategic decision making, Zambia.

The renewable energy sector in Zambia is one of the areas identified by government under the seventh national development plan (7NDP) as key for Zambia’s economic growth and development. It is a sector that offers immense opportunities for private investment participation.

A keen interest in this sector when it comes to the type of projects being selected and the factors that influence those tasked with making such decision makes this study appropriately especially considering what is at stake.

With the national electrification rate standing at 45% for urban area and 3% for rural area, a specific focus has been placed on enhancing national access to electricity to 90 and 51% access by 2030 in urban and rural areas, respectively (Ndhlukula et al., 2015). The huge goal of providing access to energy for development to the productive population is top priority not only for Zambia but for the SADC region. With an estimated population of 280 million and a combined gross domestic product (GDP) of USD 575.5 billion as reported in 2018, the southern Africa development countries (SADC) region is growing at 5.14% (SADC, 2018). In 2008, the SADC primary energy supply was estimated around 9,552 pet joules (PJ) (International Energy, 2011). Coal dominated the primary energy mix with a large share of 44%, followed by renewable energy (39%), oil (14%), gas (2%), and nuclear (1%). The 39% share for renewable energy is distributed among traditional biomass (36.66%), primarily used for cooking and heating, hydro (1.95%), and modern biomass (0.39%). Other renewable energy sources include solar, geothermal, wind and biofuels (Dastgeer et al., 2011; UNIDO, 2011). The SADC has drawn up many energy access goals. Access to adequate and reliable energy services for the entire SADC region is a key in achieving a regional growth and reducing poverty on a sustainable basis (REN21, 2018). The region has established an operational goal to reduce the number of SADC inhabitants who do not have access to energy services by 50% by 2020, and reduce the number of those remaining without access by 50% every five years until the strategic goal of full access is achieved. Efforts to increase access to energy focus on the expansion of distribution networks, often implemented by the national utilities, and the use of small-scale distributed generation, often implemented through rural electrification agencies. Furthermore, SADC put in place a regional renewable energy and energy efficiency agency. The preliminary goal was to create an enabling environment for the uptake of renewable energy and energy efficiency through energy planning and policies, business models and technical innovation (Ndhlukula et al., 2015).

SADC member countries have signed several inter-governmental memorandum of understanding (MoUs) like the southern African power pool (SAPP) established 1995 and the Regional Energy Protocol (REP) of 1996. These agreements ensure consumers in each member country optimize the use of available energy resources in the region, and support inter-country co-operation during emergencies and recognize the need for a coordinated approach to energy strategy formulation and planning for the SADC. As of June 2018, the installed capacity of the total energy shared among SAPP members was estimated at 60,719 megawatts (MW) with an available capacity of 67,190 MW, against a peak demand plus excess of 55,009 MW (SAPP, 2018); most of the energy coming from coal (74% of the total), followed by hydro (20%) with nuclear and diesel covering 4 and 2% respectively. To meet rising demand and support economic growth, it was estimated that about 7,000 megawatts (MW) of new generation capacity must be installed each year (African Development Bank , 2010). The report estimates the cost of such investment at USD 41 billion per year, which represents 6.4% of the region’s GDP. This cost is in exclusion of the cost for clean energy (African Development Bank , 2010).

With the barrage of projects to achieve all this, no single sector requires huge financial investments. Potential investors in the field of renewable energy have vested interest which they must protect by all means and will only put their stakes on investment for which they are sure to reap benefits. Whereas the government may be politically motivated (driven) by the need to improve the social economic status of its citizens, private investors may be interested in having a return on their investment. The question is: how do they decide on what project to invest in? What are some of the factors to consider in arriving at their choices? Organizations use the concept of project portfolio management to answer these questions. Project portfolio management focuses on making sure organizations are selecting the right project to execute. The foundation of project portfolio selection starts with a solid strategic plan. Objectives are evaluated and prioritized because objectives are not all equally important – some have greater strategic importance than others. All project proposals or business cases are measured against how well they support strategic objectives. Those projects that best align with corporate strategy are chosen for further evaluation in the selection process. The purpose of the project portfolio management process is to find the best mix of projects that makes the most efficient use of constrained resources while driving strategic objectives forward. In order to help decision makers with this important task, models are usually employed, either in their most simplified form of complex form (Henriksen and Trynor, 1999. Linstone, 1999, Murray et al, 2009).

LITERATURE ON PROJECT SELECTION

Experts in the subject of decision making recognize six important issues that managers ought to consider when evaluating project screening models (Souder, 1984). These critical factors are: realism; capability; flexibility; ease of use; cost and comparability.

i. Realism: An effective model must reflect organizational objectives, strategic goals, and mission. It must take into account the constraints on resources such as money and availability of personnel. The model must also consider the existing commercial and technical risks, including performance, cost, and time.

ii. Capability: A model should be flexible enough to respond to changes in the conditions under which projects are carried out. It should be robust enough to accommodate new criteria and constraints and should be able to simulate different scenarios and optimize the decision to cover the greatest possible range of project types.

iii. Flexibility: The model should be easily modified if trial applications require changes. It must have ability to provide valid results within a range of conditions.

iv. Ease of Use: A model must be simple enough to be used by people in all areas of the organization, both those in specific project roles and those in related functional positions. The choices made for project selection, and the reasons for those choices should be clear and easily understood by organizational members. The model should allow users to generate the screening information rapidly and assimilate that information without any special training or skills.

v. Cost: The screening model should be cost effective, the cost of obtaining selection information and generating optimal results should be low enough to encourage use of the models rather than diminish their applicability.

vi. Comparability: It must be broad enough to be applied to multiple projects. If a model is too narrowly focused, it may be useless in comparing potential projects or foster biases toward some over others. A useful model must support general comparisons of project alternative.

Selection models identified in literature can broadly be classified as non-numerical and numerical. Non-numerical models consider broader aspects such as market share, political issues and client perception. Their focus is on social benefit. This means projects are undertaken for the good of society. Due to their subjective and unscientific in nature, these models are less relied upon in decision making.

Numerical models are objective and scientific in nature and are broadly classified as profit and profitability models and scoring models (Meredith and Mantel, 2009). They are the most used in decision making as they are non-subjective. These models can be broken down as illustrated in Figure 1.

The standard for project portfolio management (Project Management Institute, 2013) identifies seven strategic consideration for project authorization which can be taken individually or in combination. These seven strategic considerations are:

i. Market demand: this well describes consumer driven projects. These projects are executed to satisfy the market that is willing to pay for them.

ii. Strategic opportunity/business need: exploring new frontiers through product research and development which will set the company apart from its competitors.

iii. Social need- looking at the benefits of the project to the people for who it is done. Generally such projects are done by the government or non-governmental organizations such as churches

iv. Environmental consideration: eco-friendly projects such as clean energy production

v. Customer request- similar to the market demand driven projects, these projects are carried out at the behest of the customer.

vi. Technological advance: technology is used to mass produce components and optimize the use of resources.

vii. Legal requirement: new legislation may necessitate the authorisation of projects to effect the changes for compliance.

Various authors have also tried to re-categorize these factors in literature (Klein, 1998; McClung, 2002; Adams, 2006; Meredith and Mantel, 2009; Khadija and Laila, 2015). Their work is captured and summarized in Table 1. The list, though not exhaustive, highlights generic factors that can influence decision making in this critical industry.

Adams (2006) recognizes as important the knowledge acquired through experience and the level of risk associated with the projects during selection of projects.

When it comes to carrying out projects whose unknowns are not in the text books or documented anywhere, the value of tacit knowledge is superior. Seasoned project managers who have acquired this skill often make better choice for projects. McClung (2002) further adds to this the leadership factor and experience in the field as crucial in choosing projects. Businesses are more comfortable choosing projects over which they have knowledge as opposed to new ones which might present new challenges that could be difficult to go around. Availability of personnel with project knowledge, experience and business knowledge might sway the decision makers to favor particular types of projects. Many private businesses are profit oriented; their goal is to make profits within specified periods of time. They have to weigh the risks associated with undertaking such projects against the benefits. These risks could be in the form of time, finance, political even environmental risk (Klein, 1998; Adams, 2006). Whereas Meredith and Mantel (2009) mainly focus on the financial returns, Swanson (2011) reveals that management now not only considers return on investment (ROI) but also strategic contribution, resource limitations, and non-numeric factors, such as regulatory mandates and operating necessities when selecting and evaluating projects for portfolio management.

A combination of these criteria when it comes to evaluating projects is more desirable as it gives a good balance to meet the multiple objectives of organizations. Other perspectives included in the evaluation of projects to meet or align with different organizational objectives, project types, and social contexts have been identified by various experts. These perspectives include strategic importance, competitive advantage, innovation, business fit, reasonableness, relevance, financial benefit, risk, environment, and social and political impacts (Brenner, 1994; Buchanan et al., 1998; Mikkola, 2001; Reisinger et al., 2003; Hsu, 2005).

A Modified Delphi technique applied using 9 experts subject matter in renewable energy was employed to investigate the factors involved in the selection of projects and the results were collected and analyzed using the Microsoft excel software.

Modified Delphi technique

Round 1 Survey

The first round primarily involved interviewing nine energy experts to examine their experiences in project portfolio selection and decision making, getting their views on what may represent best practice in the sector; and what they consider to be the major contributors to effective project selection and decision making. To address the research questions, guiding questions were developed. The nine participants were selected based upon their experience, availability and recognition in their fields. The number of experts to be used in a Delphi technique is not definitive. Skulmoski et al. (2007) suggests that the number depends on the group selected whether it is homogeneous or heterogeneous. For a homogeneous group, nine experts would suffice especially where there are few experts on the subject matter. For a heterogeneous group, the numbers would be higher.

An analysis on the comments from the interview with the experts was made to determine the factors influencing decision making in the selection of projects.

Round 1 research design

Interview questions designed to address the research questions were developed. These were guiding questions, suitable for the participants from very different backgrounds and multiple sector involvement. The discussion had to be flexible and adaptable, at the same time addressing the research questions, and getting their views on the important factors that contribute to or have a negative impact on effective investment decision making.

One interview was taken at the participants’ work place in a quiet conducive environment to minimize interruption; the rest of the interviews was done via phone. Throughout all this process notes were taken for valuable information extraction.

Round 2: Questionnaire

A questionnaire was administered to the participants from the first round to rate the proposed factors and identify some of the tools used in decision making. The responses were then collated for analysis.

Round 2 research design

A questionnaire was designed to obtain participants’ profile information as well as their ratings on the importance of each of the contributing factors identified in the first round.

The Likert scale was used to rate the participants’ scores where 5 = ‘very important’, 4 = ‘quite important’, 3 = ‘neutral’, 2 = ‘not very important’ and 1 = ‘not important at all’. The scores were entered as shown in Table 2. Participants are initialed by the letter P from participant number 1, P1 to participant number 9, P9.

From the interviews, the researcher was able to gain insight into the current practice in the renewable energy sector on how projects are selected. The interviews revealed that project selection criteria, tools and techniques in the sector are not uniform. In fact there is no standard way in which projects are selected across the sectors. In the private sector, the participants choose the approach of conducting feasibility studies to determine the type of project, involve stake holders (Government/Private partners) alike, examine the technical/finance environment and social impact, look at project sustainability as well as use basic financial decision-making tools such as payback period (PBP), internal rate of return and check lists. The participants in the public and government owned institutions were largely guided by the energy master plan. Basically, the government employed consultants to do all the preliminary works and recommend to government which projects would be profitable or worth carrying out, and then they would implement such. Most of these experts would not be part of the decision-making team but the implementation team. These revelations are consistent with literature were Astebro (2004) stated that no single optimal method exists for selecting projects even in the same sector. The participants seem not to agree that organization culture influenced the methods used for selecting projects. They were also cognizant of the fact that there are other tools and techniques which they may not have been so conversant with that existed and could be used in the selection of projects. Depending on the experience of each participants and what organizations they worked under, the adopted tools were largely dependent on what was comfortable for the organization to use. There where similarities as well as variations on the adopted tools and techniques.

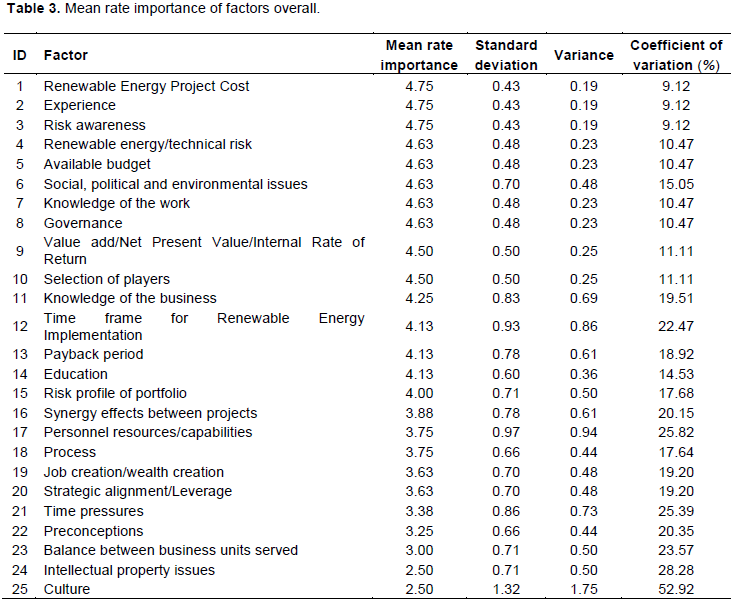

Table 3 indicates the mean, standard deviation and variance of the factors at a global level and shows their behavior when plotted against each other. As expected the variance and standard deviation trends are showing the similarities of dependence on each other. While culture may be an extremely important factor in the selection of projects in other fields, the study shows that it is overall not considered important in the energy sector in Zambia.

When rated and ranked in importance on the Likert scale, overall, fifteen factors come out as being more important than the rest; their mean-rated importance as computed in Table 2 is above 4.0. These factors are: risk profile of portfolio; renewable energy/technical risk; value add/net present value/internal rate of return; available budget; renewable energy project cost; time frame for renewable energy implementation; payback period; social/political and environmental issues; knowledge of the business; knowledge of the work; education; experience; risk awareness; governance and selection of players.

The top 3 factors across the sector are those involving project cost, personnel experience in the field and the risk associated with the projects. This is not surprising because projects in the renewable sector bear high financial risk usually involving extensive financing and care must be taken to ensure success by getting experts with technical know-how to execute these projects.

The least significant factors identified are Intellectual property issues and culture with mean of 2.50. It can be observed from the results that the participants were not in agreement on whether culture has a significant a role in the selection of renewable energy project, a variance above 1.0 is indicative of the different views the participants had on this factor; this is also seen in the coefficient of variation value being over 50%.

Contributing factors to project selection

Fifteen contributing factors were identified to be very important and influential in the selection of projects in the renewable energy division of Zambia. These were placed in four categories namely: (1) Players, leadership, and tacit knowledge; (2) risk factors; (3) governance; (4) timing and cost. The categories of factors where then

analyzed across the three sectors: private, public and Government owned institutions. The rest of the factors were rated higher in the same sector but not across all the three sectors.

Players and Tacit knowledge

Under this category are the following factors: (1) knowledge of the business; (2) knowledge of the work; (3) education; (4) experience; (5) selection of players.

Knowledge of the business usually goes hand in hand with skills. Garman (2006) defines this factor as the ability to apply business principles, including systems thinking to the work environment. Business knowledge competencies would include: project management, organizational business and personal ethics, facilities planning, purchasing procurement, evidence-based practice, inventory control systems, proposal analysis and contract negotiation, critical thinking, and analysis, needs analysis for and/or desirability of outsourcing, and outcomes management implementation. Possessing business knowledge gives one a competitive edge over his peers and is desirable to decision making. The Business Dictionary (2017) defines knowledge of work as job, process, or task that is distinguished by its specific information content or requirements. It is specific and technical knowledge usually associated with explicit knowledge, and provides crucial input into the decision-making process.

Project selecting committee consisting of key players is

fundamental to ensuring a quality process of project selection is established. Every organization must choose decision makers, executives and other key players who have the desired qualification, experience, expertise and intuition and personal qualities for leadership and collaboration. Whilst recognizing the importance of education, the participants rated it lower than work experience. Work experience reveals certain aspects of an individual’s character such as how one behaves when working in a team, how one deals with real life situation, resolving problems, which could be crucial when it comes to making decision. These qualities are rarely revealed by education but revealed in reality through experience which makes it more desirable (Schindler and Eppler, 2003).

Arikan and EnginoÄŸlu (2016) when discussing strategic leadership pointed out that it involved top management’s characteristics, their way of doing things and the way they affect their organization’s performance. “The boards, executives, and top management teams naturally play significant roles in determining the strategic direction and how the strategy gets translated into everyday execution”. This suggests that players in the project selection and strategic decision-making positions need to be carefully selected and they need to apply their tacit knowledge in their decision making.

Risk factors

Under this category are the following factors (1) risk profile of portfolio; (2) renewable energy/technical risk; (3) risk awareness; (4)social/political and environmental issues. The accumulation of a variety of significant investment risks makes the financing of renewable energy investments difficult in a developing country context. The general risk associated with the unfamiliarity of renewable energy technologies is particularly pronounced in developing countries that have never used these technologies before, overall business infrastructure and expert ability in these advancements. This risk is amplified by such investment risks that are typical for developing countries such as: political risk, currency, impact on the environment and commercial risk induced by the poor creditworthiness of state owned utilities that carry the payment obligations to buy generated power under power purchase agreements. The accumulation of these factors worsens the risk profile of investment, and the return expectations of potential developers and their financial backers reach alarming levels. For potential investors, risk profile and risk awareness is crucial in decision making. While the consideration of risk for each candidate project is crucial, at the strategic level the risk awareness of the organization when it comes to aligning strategic objective is desired. The awareness and application of enterprise wide approaches to risk management is certainly crucial to the identification and realization of business opportunities and benefits (Klein, 1998; Adams, 2006)

From the interviews and questionnaire, the participants rated financial and weather-related risk to be the highest in terms of ranking. They related that most of the renewable energy projects require high capital expenditures but there is a challenge in access to capital for them to be viable. Additionally, capital markets in Zambia are not as mature as in developed countries, making it difficult to get private financing. Another challenge related to this risk was the high interest rates of borrowing capital for such investments, which can explain the poorly developed bond markets. Additionally, concern raised was the fact that the average cost of electricity generation in general is exceptionally high, due to the small size of electricity markets and the resulting lack of economies of scale. This means that the return rates will be very slow and as such does not encourage private sector participation which is driven by profits.

Governance

Good governance is concerned with the processes of making and implementing decisions that are consistent with relevant legislation. Governance drives accountability and process, and supports a collective approach to achieving best outcomes. The business dictionary defines governance as the “Establishment of policies, and continuous monitoring of their proper implementation, by the members of the governing body of an organization,” (Business Dictionary, 2017: 124). It further explains that included within it are the mechanisms required to balance the powers of the members (with the associated accountability) and their primary duty of enhancing the prosperity and viability of the organization. From this definition, a clear relationship between the selection of places and governance can be seen as the members who preside at governance are the carefully selected decision makers who have applied both explicit and tacit knowledge and their experience. This resonated well with the participants hence they ranked governance high on the Likert scale. They further characterized good governance as being accountable, transparent, following the rule of law, responsive, equitable and inclusive, effective and efficient and participatory.

Timing and cost

Under this category are the following factors: (1) available budget; (2) renewable energy project cost; (3) time frame for renewable energy implementation and; (4) payback period.

These factors are rated high across the sectors because of the financial and timing aspect associated with them. Available budgets and cost of renewable energy projects will normally dictate what type of project to engage in. These factors will have a strong bearing on the type of project selected. These two factors form part of what is commonly referred to as the triple constraint or the iron triangle in project management. Change in timing factor naturally impacts on the cost and quality. Recognizing the two as factors that matter on selection of projects reveals that the participants recognize project management principles in the decision making.

The influencing factors in project selection in the renewable sector cover: Players, leadership, and tacit knowledge; risk factors; governance; and timing and cost. Investment managers of these firms or organizations have a challenging job of deciding the type investment to pursue for their firms using the available resources. This process of selecting which opportunity to pursue is never a straight forward one because strategic goals and objectives of organizations and institutions are the drivers of project selection. Managers have to select viable projects and develop guidelines for balancing the opportunities and costs associated with each alternative. They must strive to maintain a balance between the competing demands of time and opportunity. Decision makers must exercise caution and make the best choice among their options. Organizations can develop selection models that permit them to optimize time and money, minimize losses while maximizing the likelihood of success. In order to come up with any framework structure for project selection, the next study should use these identified factors and put them to test empirically. A triangulation of methodologies including a literature analysis, focus group, Delphi study and case study can be used to achieve this. Having a framework in place will certainly help in meeting the economic challenge facing the country and help to electrify most of the rural areas; at the same time create employment investor in this sector must pay attention to these factors in order to optimize their decision making in selecting projects that align with their strategic objectives and maximize their return on investment. This must work hand in hand with strong frameworks for decision making to be in place.

The authors have not declared any conflict of interests.

REFERENCES

|

Adams L (2006). Avalanche experts' judgement and decision-making. The Crystal Ball 14(1):1-20.

|

|

|

|

African Development Bank (2010). The Committee of Ten Policy Briefs: Financing of Sustainable Energy Solutions. Tunis: African Development Bank press.

|

|

|

|

|

Arikan C, EnginoÄŸlu D (2016). A Contemporary Approach to Strategic Leadership. Available at:

View

|

|

|

|

|

Astebro T (2004). Key success factors for technological entrepreneurs' R&D projects. IEEE Transactions on Engineering Management 51(3):314-321.

Crossref

|

|

|

|

|

Brenner MS (1994). Practical R&D project prioritization. Research-Technology Management 37(5):38-42.

Crossref

|

|

|

|

|

Buchanan JT, Henig EJ, Henig MI (1998). Objectivity and subjectivity in thedecision making process. Annals of Operations Research 80:333-345.

Crossref

|

|

|

|

|

Business Dictionary (2017). Governance. Available at:

View

|

|

|

|

|

Dastgeer A, Karhammar R, Mwenechanya J, Kanduli B, Muleya J (2011). Mid-term Review and Evaluation of the Swedish and Dutch Support to the Rural Electrification Programme in Zambia.

|

|

|

|

|

Henriksen AD, Traynor AJ (1999). A practical R&D project-selection scoring tool. IEEE Transactions on Engineering Management 46(2):158-170.

Crossref

|

|

|

|

|

Hsu KH (2005). Using balanced scorecard and fuzzy data envelopment analysis for multinational R&D project performance assessment. Journal of American Academy of Business 7(1):189-196.

|

|

|

|

|

International Energy (2011). World Energy Outlook. Paris Cedex: IEA PUBLICATIONS.

|

|

|

|

|

Khadija B, Laila K (2015). Hybrid Approach for Project Portfolio Selection taking account of resources Management and Interactions between Projects. Journal of Digital Information Management 13(6):451-460.

|

|

|

|

|

Klein G (1998). Sources of power: How people make decisions. Cambridge, USA: The Massachusetts Institute of Technology Press.

|

|

|

|

|

Linstone HA (1999). Decision making for technology executives: Using multiple perspectives to improved performance. Boston, MA: Artech House.

|

|

|

|

|

McClung D M (2002). The elements of applied avalanche forecasting: The human issues. Natural Hazards 25:111-129.

Crossref

|

|

|

|

|

Meredith JR, Mantel Jr. SJ (2009). Project Management, a managerial approach, Strategic Management and Project Selection. Hoboken, New Jersey: John Wiley & Sons, Inc.

|

|

|

|

|

Mikkola JH (2001). Portfolio management of R&D projects: implications for innovation management. Technovation 21(7):423-435.

Crossref

|

|

|

|

|

Murray S, Burgher K, Alpaugh A (2009). Public Private Partnerships Project Selection Criteria. Proceedings of the 2009 Industrial Engineering Research Conference. Norcross: Institute of Industrial Engineers. pp. 10-21.

|

|

|

|

|

Ndhlukula K, RadojiÄić T, Mangwengwende S (2015). Africa Clean Energy Corridor: Analysis of Infrastructure for Renewable Power in Eastern and Southern Africa. Abu Dhabi: IRENA.

|

|

|

|

|

Project Management Institute (2013). A Guide to the Project Management Body of Knowledge- Fith edition. 14 Campus Boulevard Newtown Square, Pennsylvania: Project Management Institute, Inc.

|

|

|

|

|

Reisinger H, Cravens KS, Tell N (2003). Prioritizing performance measures within the balanced scorecard framework. MIR: Management International Review 43(4):429-437.

|

|

|

|

|

REN21 (2018). RENEWABLES 2018: GLOBAL STATUS REPORT. Paris: REN21 Secretariat.

|

|

|

|

|

SADC (2018). SADC Facts & Figures. Retrieved from sadc.int: Available at:

View

|

|

|

|

|

SAPP (2018). Retrieved from SAPP. Available at:

View

|

|

|

|

|

Schindler M, Eppler MJ (2003). Harvesting project knowledge: a review of project learning methods and success factors. International Journal of Project Management 21(3):219-228.

Crossref

|

|

|

|

|

Skulmoski G, Hartman F, Krahn J (2007). The Delphi method for graduate research. Journal of Information Technology Education: Research 6:1-21.

Crossref

|

|

|

|

|

Souder W (1984). Project Selection and Economic Appraisal. New York: Van Nostrand Reinhold Company.

|

|

|

|

|

Swanson SA (2011). All things considered It's time for executives to break out of the ROI stranglehold and look beyond the bottom line when picking projects. PM Network 25(2):36.

|

|

|

|

|

UNIDO (2011). Energy for Sustainable Development:Policy Options for Africa. UN-ENERGY/Africa, 78-89. Available at:

View

|

|