ABSTRACT

This study investigates the audit quality of Big-x auditing companies within the context of the Italian non-listed firms by examining (i) auditing ability to restrict accrual-based earnings management and (ii) the level of auditing independence. The Italian non-listed firms provide a unique set of auditing environment with multiple layers of audit quality compared to other European auditing environments. Accounting related data are collected from the Bureau van Dijk AIDA Database, and the data sample includes 18,721 firms with 168,489 firm-year observations. The findings suggest that Big-x auditing companies, and in general also non-Big-x auditors, are more efficient than statutory auditors on restricting accrual-based earnings management initiatives. Still, Big-x auditors’ engagement on a financial audit increases the likelihood of a modified audit opinion to be issued.

Keywords: Audit quality, Board of statutory auditors,Italian non-listed firms, Big 4.

This study investigates the audit quality within the context of Italian non-listed firms. Focusing on the Big-x auditing companies, we examine their ability to restrict the level of discretionary actuals and their independence to report the detected accrual-based earnings management initiatives. The mainstream of auditing related research focuses on listed firms operating primarily in common law environments (DeAngelo, 1981; Jeong and Rho, 2004; Piot and Janin, 2007; Memis and Cetenac, 2012; Nawaiseh, 2016; Fleisher et al., 2017). However, a number of research initiatives within the context of non-listed firms (Van Tendeloo and Vanstraelen, 2008; Mariani et al., 2010; Bisogno, 2012; Hope et al., 2012;Alhadab and Clacher, 2018) provide limited empirical evidence that Big-x auditing companies constrain discretionary accruals than other types of auditors. Evidence of auditor independence in non-listed firms is rather scarce, even though various stakeholders experience greater information asymmetries in the case of non-listed firms than in the case of publicly traded firms (Lennox, 2005; Ball and Shivakumar, 2005). The lack of relevant empirical evidence and the idiosyncratic characteristics of non-listed firms stimulated our research interest to collect additional empirical evidence concerning the role of auditing services provided by Big-x auditing companies in mitigating information asymmetries by examining (i) their auditing ability to restrict accruals and (ii) their level of auditing independence.

The research site of this study is the institutional auditing setting of Italian non-listed firms. In Italy, the non-listed firms are about 99.9% of the Italian companies (EC, 2019). At the end of 2017, only 384 firms were listed out of about 5.5 million of Italian firms. According to the Italian corporate governance model adopted by most

Italian (listed and non-listed) firms (Mariani et al., 2010), there is a separation between administrative and financial audit. The administrative audit is assigned to the Board of Statutory Auditors (in Italian “CollegioSindacale”) that is an independent and professional committee with the purpose to control a firm’s management for protecting the interests of various internal and external stakeholders. Statutory auditors are anchored with high skills in financial accounting, management accounting, organizational processes, finance, commercial law, auditing and taxation. Also, Italian law imposes several penalties for a statutory auditor that fails. Thus, a statutory auditor is different from an internal auditor because of the high level of professional skills and the high degree of independence. The financial audit can be assigned either to an external auditor, such a Big-x auditing company or the Board of Statutory Auditors (BSA). In the latter case, the BSA is responsible for both the financial and administrative auditing.

Investigating the level of audit quality provided by the Big-x auditing companies in the case of Italian non-listed firms is, also, interesting for additional two reasons. First, contrary to prior empirical evidence that large auditors dominate the market of financial auditing services (Ballas and Fafaliou, 2008; Ishak et al., 2013), the market share of statutory auditors in the case of Italian non-listed firms seems to be high. For instance, the 71.05% of the firms of our data sample engage a statutory auditor in charge of the financial audit suggesting that statutory auditors are anchored with competencies that might be valued by the non-listed firms as indicators of high quality of audit services. Thus, the context of Italian non-listed firms provides an appropriate research site for examining the audit quality provided by the Big-x auditing companies under conditions on intense competition. Second, the Italian auditing institutional setting for non-listed firms may be of interest for extracting valuable experience for policy-making purposes within a wider international context. For instance, the EC (2011) Green Paper on Corporate Governance proposes the introduction of an Independent Professional Supervisory Board (IPSB), which skills are similar to those of a statutory auditor and for this reason an IPSB may also be engaged as financial auditor, limiting the monopoly of the large Big-x auditing companies in the audit market. Further, the Chartered Accountants of Spain and France were interested in introducing a controlling body similar to the Italian BSA inside the corporate governance of European non-listed firms (Zanardi, 2010).

Effective policy making requires additional empirical evidence that a statutory auditor provides a high audit quality similar to this provided by the large Big-x auditing companies.

Prior literature investigating the audit quality in the Italian context of the non-listed firms is quite scarce. Mariani et al. (2010) investigate a sample of Italian non-listed firms for the period 2004-2005 and find that Big-x auditing companies are more likely to constrain accrual-based earnings management initiatives. Bisogno (2012) investigates a sample of Italian non-listed manufacturing firms for the period 2008-2010 and finds no difference in the audit quality provided by the statutory auditors and by the Big-x auditing companies.

Our study expands prior empirical evidence for the audit quality within the context of the Italian non-listed firms by expanding prior research initiatives (Mariani et al., 2010; Bisogno, 2012) in two ways. First, this study investigates the audit quality of the statutory and external auditors for a longer updated time period that is from 2009 to 2017. Second, this study examines another aspect of audit quality that is the level of auditing independence.

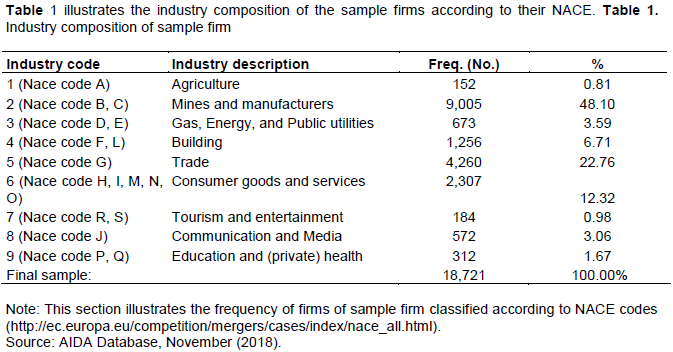

All financial and governance data were drawn from the AIDA Database. Our data sample includes Italian non-listed firms for the financial years 2009 to 2017. In November 2018, when we collected data, the population of firms on the database obliged to submit their financial statements in the mandatory full format (within which accounting and corporate governance information was available) provided by the articles 2424 and 2425 of the Italian Civil Code, was 264,223. Within this population available on AIDA Database, the companies presenting the full format of financial statements with all financial and governance data and incorporated before 2007 are 18,721 (for 168,489 firm-year observations).

Our empirical findings indicate that statutory auditors (BSA) are negatively associated and Big-x auditing companies positively associated with the level of discretionary accruals. Thus, in the case of Italian non-listed firms, a Big-x auditing company provides a similar or lower level of audit quality than a BSA. The latter seemed to be more efficient than the Big-x auditing companies on restricting accrual-based earnings management initiatives. A possible reason is that the Big-x auditing companies exhibit greater degree of opportunistic auditing behaviour in the case of non-listed firms than in the case of listed firms due to (i) the lower probability of discovering an audit failure (Ball and Shivakumar, 2005) and (ii) the reliance on the administrative auditing performed by statutory auditors ensures that the internal control system can restrict the earning management initiatives to a substantial degree.Besides opportunistic auditing behaviour, a BSA is expected to provide a high quality of financial auditing services. As responsible for the implementation of an efficient administrative auditing system, a BSA has a better understanding than a Big-x auditing company of a firm’s internal environment, organizational structures, management quality, etc. Thus, a BSA can evaluate efficiently the intention and the capability of a non-listed firm to implement earnings management. This improved knowledge makes a BSA capable of providing a similar or higher level of audit quality than other types of auditing companies.

In addition, our study provides evidence that, in the case of Italian non-listed firms, there is a positive relationship between a modified audit opinion and the engagement of a Big-x auditing company in charge of the financial auditing. The engagement of a Big-x auditing company increases the likelihood of a modified audit opinion to be issued more than the engagement of a BSA. We conjecture that the auditing environment of the Italian non-listed companies increases the intensity of reputational and litigation risk for the Big-x auditing companies more than in the case of smaller auditing companies and statutory auditors. Further, it is also plausible to assume that the primary revenue base of Big-x auditing companies consists mainly of public companies and for this reason, a Big-x auditing company rely less on individual non-listed firms.

Audit quality and measurement of audit quality

Auditing of financial statements is a control mechanism with the purpose to safeguard interests of different stakeholders, ensuring that the audited financial statements are free from misstatements (Ugwunta et al., 2018).

DeAngelo (1981) defines the audit quality as a two-dimensional concept that is the joint probability of two events: (i) the detection of a misstatement in a firm’s financial statements by the auditor and (ii) the disclosure of the misstatement to the external users via the audit opinion. Palmrose (1988) and Teoh and Wong (1993), supporting the DeAngelo, also agree that audit quality depends on the competence and the independence of the auditors in discovering and reporting misstatements in financial statements.

The detection of a misstatement in the financial statements depends on the auditors’ technical capability. Auditors’ technical capability refers to the professional skills that elevate the auditing capability of detecting earnings management initiatives. Prior studies from various national settings provide evidence that, in the case of listed firms, a Big-xauditor constrains the magnitude of abnormal accruals and, thus, the intensity of earnings management (Francis et al., 1999; Gul et al., 2009; Chen et al., 2005; Rusmin, 2010; Chen et al., 2011).

The second dimension of the audit quality is the probability that an auditor will comment on any discovered misstatements in the audit opinion. This probability depends on the level of auditor’s independence from the audited firm (DeAngelo 1981). Existing research within the field of audit opinions documents a positive association between audit opinions and the level of discretionary accruals (e.g., Francis and Krishnan, 1999; Chen et al., 2001; Herbohn and Ragunathan, 2008).

As a latent variable, the measurement of audit quality remains a central argument in empirical studies. Discretionary accruals, a proxy of earnings management, are generally used to measure audit quality (Maijoor and Vanstraelen, 2006). Alternative measures of audit quality are (i) the incidence of issuing going-concern auditor reports (Reichelt and Wang, 2010), (ii) the audited client’s propensity to report earnings that meet a benchmark (Carey and Simnett, 2006), (iii) the results of independent parties’ inspections of audit firms (Hilary and Lennox, 2005), (iv) the restatement of previous years financial statements (Kinney et al., 2004), (v) the audit size (DeAngelo, 1981; Becker et al., 1998; Sawan and Alsaqqua, 2015)and audit fee (Copley, 1991; Kinney et al., 2004); (vi) auditor industry specialization (Chen et al., 2011; Khajavi and Zare, 2016), and (vii) audit tenure (Knapp, 1991; Okolie, 2014).

The auditing environment of the Italian non-listed companies

Νon-listed Italian firms operate under two basic legal schemas: (i) “Società per Azioni” (S.p.A.) – Joint-Share Company (Incorporation) and (ii) “Società a responsabilitàlimitata” (S.r.l.) – Limited Liability Company. In the case of Italian non-listed firms, administrative auditing is separated from financial auditing. All S.p.A. must have a Board of Statutory Auditor (hereafter BSA), which is a mandatory body in charge of administrative auditing in all stock corporations as well as in all limited liability companies with equity exceeding € 50,000 (until June 2014 the threshold was € 120,000).

The BSA is a multi-faceted, qualified and independent statutory body, which represents a distinctive feature of the Italian traditional corporate governance model which is based on a clear distinction between the administrative function and the internal control function and aims on ensuring continuous supervision of the management by an independent body with significant powers of intervention in order to protect the interests of both firm insiders and outsiders.It is appointed for a three years term and consists of independent, professional members whose skills and responsibilities are clarified in law (art. 2400 et seq. Civil Code). They conduct the duties assigned to them in compliance with the law and the Governance Code,and they are responsible for ensuring compliance with the law, the principles of correct administration, and the suitability of the organizational, administrative and accounting system as well as its correct functioning.

Financial auditing can be performed either by a statutory auditor or by an external auditor. In case that an external auditor is engaged to be in charge of the financial auditing, the statutory auditors work closely with the external auditor in the preparation of the financial statements. Statutory auditors have to report their opinion to the annual shareholders’ meeting.

Theoretical framework and research motivation

The mainstream of auditing related research focuses on listed firms operating primarily in common law environments. Prior empirical evidence for the quality of auditing services within the context of non-listed firms is limited on some studies examining the relation between accrual earnings management and the quality of auditing services (Tendeloo and Vanstraelen, 2008; Mariani et al., 2010; Bisogno, 2012). Evidence of auditor independence in non-listed firms is rather scarce, even thoughvarious stakeholders experience greater information asymmetries in the case of non-listed firms than in the case of publicly traded firms (Lennox, 2005; Ball and Shivakumar, 2005).The lack of relevant empirical evidence and the idiosyncratic characteristics of non-listed firms stimulated research interest to explore the role of auditing services in mitigating information asymmetries.

We focus on non-listed firms operating within the Italian economy for some reasons. First, in common with the EUstandards, the majority of Italian firms are non-listed, underlining the importance of studying such firms in an established EU country setting. Second, the 99.9% of Italian firms are Small-Medium Enterprises (EC, 2015), and about 94.4% of them are micro-sized firms (EC, 2015), suggesting weaker agency problems in these firms. Third, the Italian business environment of non-listed firms is attributed with corporate governance features that could encourage external auditors to rely on the work of the statutory auditors (Hashem et al., 2010),neglecting any control over discovering any breach in preparing financial statements.

The research hypotheses were developed on the grounds of the primary economic factors that drive audit quality: (i) insurance rationale and (ii) reputation rationale. The insurance rationale implies that auditors have incentives to perform high-quality audits to protect themselves from litigation losses (Dye, 1995). The reputation rationale is based on the assumption that audit firms perform high-quality audits to preserve future business opportunities (DeAngelo, 1981). Prior evidence indicates that the insurance rationale as the primary factor underlying the provision of high-quality auditing services in the U.S. market (Weber et al., 2008) whereas for non-U.S. markets, reputation serves as a potential force available to discipline auditors (Hope and Langli, 2010). Previous research providing empirical evidence of the high quality of the Big-x auditors mainly investigated environment (as the U.S. and other countries) where auditors face a high litigation risk from stakeholders in the case they provide a lower quality auditing. In these contexts, the auditing acts as a monitoring mechanism to mitigate agency problems (Alzoubi, 2016; Abid et al., 2018).

Τhe auditing environment of the Italian non-listed firms might be a departure for hypothesizing alternative perspectives that Big-x auditing companies might adopt to theorise the trade-off between audit quality and the risk of litigation and reputation damage. The limited empirical evidence is not conclusive for the level of audit quality of Big-x auditing firms. Mariani et al. (2010), analysing a sample of Italian non-listed companies, find that an external auditor provides higher-quality auditing than a BSA, while Bisogno (2012) finds no difference on a sample of industrial firms. Azzali and Mazza (2018), analysing a sample of Italian non-listed firms, find that while auditor size is effective in improving earnings and audit quality in listed firms, this relationship is not clear in non-listed firms.

Even though only statutory auditors provide administrative auditing services to all Italian non-listed companies, the latter can obtain financial auditing services by (i) Big-x auditing companies, (ii) non-Big-x auditing companies and (iii) statutory auditors. The structure of financial auditing services market for the Italian non-listed companies has two implications for the quality of financial auditing services provided by a Big-x auditing company. First, Big-x auditing companies experience intense competition, and a rational strategic decision is to rely on their reputation of superior technical capabilities in order to provide a high level of financial audit quality as a mean of differencing their product portfolio and achieving competitive advantage over other types of auditing companies. This course of action indicates that Big-x auditing firms adopt a conservative and adverse behaviour towards risk of litigation and reputation damage. Second, the presence of BSA as a charge of administrative auditing might stimulate a Big-x auditing company to improve the quality of its financial auditing services. The reason is that the management of a non-listed firm may decide to delegate the financial audit to the BSA than a (non) Big-x auditing company in an attempt to improve the cost-benefit ratio of the overall (both administrative and financial) auditing function. This is an additional reason that a Big-x company that is responsible for the financial auditing will attempt to provide a high quality of services and satisfy the market expectation gap of the audit.

Hypothesis development

Combining the two implications described above, within the setting of the Italian non-listed firms, the Big-x auditing companies have theincentive to provide financial auditing services of higher quality than other types of auditors as a mean to differentiate from competition of the external environment and as a way to gain auditing contracts from statutory auditors already performing the internal audit of the non-listed firm.On the other side, according to Azzali and Mazza (2018), Big-x auditors develop specific industry competences and specialisations than domestic auditors because of their competitive advantage to operate across multiple business environments. In addition, expertise of these audit companies to use robust and efficient auditing methodologies, their ability to service several clients in different locations attract clients seeking for high quality audit. Scholars, analysing a sample of Italian non-listed firms, provide empirical evidence that Big-x auditors also reduce risks related to earnings management initiatives. Bisogno and De Luca (2016), analyzing a sample of Italian non-listed firms, hypothesize that voluntary joint audit increases earnings quality. Scholars use the term joint audit to indicate a situation in which the financial auditing is assigned to an external auditor, while the administrative audit is carried out by a BSA. Scholars find that the presence of the two auditors increases audit quality, by preventing earnings management practices. Based on the above analysis we introduce the following hypothesis:

H1: In the case of Italian non-listed firms, a Big-x auditing company provides a higher level of audit quality than other types of auditing companies.

In Italy, recent bankruptcy, auditing system and financial crisis monitoring reforms of 2019 have arisen and reinforced the role of the BSA as administrative auditor in both listed and non-listed firms. On the other side, the same reforms indicate that, to increase the reliability of financial information, the financial auditing should be assigned to an external independent auditor also in non-listed firms. However, in 2019 Italian non-listed firms may still engage the BSA also in charge of the financial auditing. BSA competes on the audit market with Big-x and non-Big-x auditors. Bisogno (2012), analyzing a sample of Italian non-listed firms, compares the audit quality in firms audited by a BSA and by external auditors. The Scholar finds no significant differences in term of discretionary accruals. Corno et al (2007) provides evidence that members of statutory committee (BSA) face with lower auditing fees than external auditors and tend to act also as tax advisor in non-listed firms in which they also carry out the administrative audit. This may reduce the quality of financial audit because the independence of the BSA members could be threatened especially in an environment, as Italy, characterized by a lower litigation risk in the case of an audit failure (Tendeloo and Vanstraelen, 2008). Based on the analysis above, we can introduce the following hypothesis:

H2: In the case of Italian non-listed firms, a BSA provides a lower level of audit quality than external auditors (both Big-x and non-Big-x auditors).

The second relevant dimension of the audit quality is auditing independence namely the probability that an auditor will comment on any discovered misstatements and weaknesses in the audit report. Big auditing companies seem to be more independent than smaller auditing companies because they are exposed to greater reputational and litigation risk. In addition, Big auditing companies rely less on an individual client’s revenues and hence are less likely to be influenced by an individual client (Palmrose, 1988; Stice, 1991; Bonner et al., 1998; DeFond and Zhang, 2014; Ugwunta et al., 2018).

We conjecture that the auditing environment of the Italian non-listed companies increases the intensity of the reasons above indicating that big auditing companies are expected to be more independent than smaller auditing companies and statutory auditors. A plausible assumption is that Big-x auditing companies experience greater reputational risk than other auditors operating in the auditing market of the Italian non-listed firm. Further, it is also plausible to assume that the primary revenue base of Big-x auditing companies consists mainly of public companies and for this reason, a Big-x auditing company rely less on individual non-listed firms. Seeking for empirical evidence to verify that the Big-x auditing companies are anchored with higher levels of auditing independence, we introduce the following research hypothesis:

H3: In the case of Italian non-listed firms, there is a positive relationship between a modified audit opinion and the engagement of a Big-x auditing company in charge of the financial auditing.

METHODOLOGY AND SAMPLE SELECTION

Sample selection

Accounting and corporate governance data are collected from the Bureau van Dijk AIDA Database which includes the statutory financial statements of all limited-liability Italian companies with a turnover higher than € 1 million, gathered from the Italian Chamber of Commerce depository. Our data sample includes Italian non-listed firms for the financial years 2009 to 2017. In November 2018, when we collected data, the population of firms on the database obliged to submit their financial statements in the mandatory full format (i.e. within which accounting and corporate governance information were available) provided by the articles 2424 and 2425 of the Italian Civil Code, was 264,223. Within this population available on AIDA Database, the companies presenting the full format of financial statements with all needed financial data, incorporated before 2007, and not obliged to prepare consolidated financial statements(entities of no public interest) are 18,721 (for 168,489 firm-year observations). Italian auditors and BSA use domestic auditing standards, similar to International Standards of Audit (ISA).

Estimation of discretionary accruals

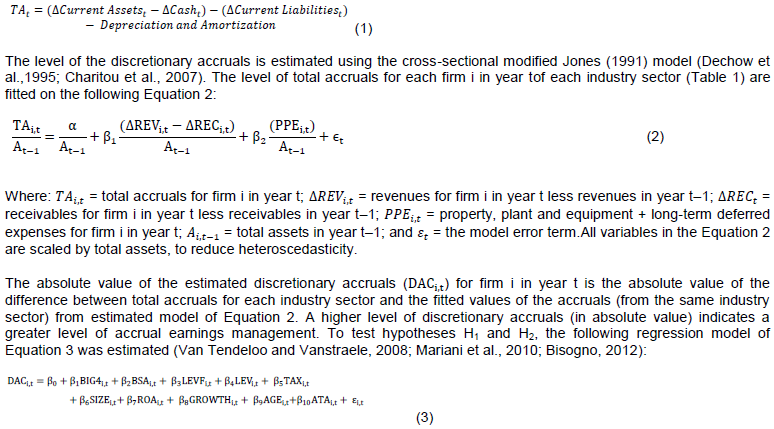

We calculate the level of total accruals (TAi,t) for firm i in year t using Eq. (1) Whichis based on the balance sheet and income statement line items. Cash flow statements are not mandatory for Italian non-listed firms (until to 2015)and the information is not systematically included in the AIDA database. Thus, the level of total accruals (TAi,t) for firm i in year t is defined as follows:

Where is the signed value of estimated discretionary accruals from model of Equation 2 for firm i in year t; is the auditor type dummy variable, taking the value 1 if the auditor of firm i in year t is a Big-4, and the value 0 otherwise; is a binary variable for the auditing system adopted by the non-listed firm, taking the value 1if the firmi in year t engage the BSA and the value 0 if the firm assigns the auditing to an external auditor (both Big-x or a non-Big-x auditing company), is the financial leverage ratio of firm i in year t; is the leverage ratio of firm iin year t; is the amount of the tax payables scaled by the income before taxes of firm i in year t; is the natural logarithm of the total assets; is the return on assets of firm i in year t; is a proxy for a firm’s growth defined as the ratio of change in current year sales and previous year sales; the natural logarithm of the years from the incorporation of the firm i up to the date of the analysis; is the absolute value of the total accruals of firm i in year t and is the model error term.

The testing variables in the regression model of Equation 3 for hypotheses H1 and H2 are and . Following prior literature (Tendeloo and Vanstraelen, 2008; Mariani et al., 2010; Bisogno, 2012; Wang 2006; Hassan and Farouk, 2014; Poli, 2015; Poli, 2017), the estimated regression model includes several control variables for capturing the effects of various factors affecting the level of accrual management activities.

We introduce the variables and capture the effects of leverage on the intensity of accrual earnings management activities. The impact of financial leverage on earnings management is an empirical controversy. Two different streams are found describing the relationship between financial leverage and earnings management. The debt contracting hypothesis (Watts and Zimmerman, 1986) suggests a positive impact of the financial leverage on the accrual-based earnings management initiatives in order to avoid debt covenants violations (DeFond and Jimbalvo, 1994; Opler and Titman, 1994; Dechow et al., 2010). On the other hand, the control hypothesis, debt creation reduces managerial opportunistic behaviour (Jensen 1986). Empirical results for the effects of the (total) leverage ratio are, also, controversial in the case of non-listed firms (DeAngelo et al., 1994; Ardison et al., 2012; Llukani, 2013; Hassan and Farouk, 2014). As bank-loans are the main source of finance for non-listed firms (Ball and Shivakumar, 2005; Poli, 2015; Vanstraelen and Schelleman, 2017), it is arguable that leveraged firms are more likely to manage earnings to avoid debt covenant violations (Azzali and Mazza, 2018). Therefore, according to the debt-contract hypothesis, we expect a positive relation between the (signed) discretionary accruals and the financial and total leverage.

The variable is introduced to capture the impact of taxation on earnings management. Taxation might triggers earnings management activities as the burden of the tax paid by the company reduces the level of dividends (Scott, 2003; Amiram et al., 2013). Prior studies show that strong versus weak tax alignment makes a difference in the earnings management of non-listed firms (Coppens and Peek, 2005; Burgstahler et al., 2006; Van Tendeloo and Vanstraelen, 2008; Poli, 2013). As Italy is a high tax alignment country and based on prior empirical evidence (Burgstahler et al., 2006; Tendeloo and Vanstraelen, 2008) we expect a positive sign for .

We also control for the effect of a firm’s operating performance on accrual-based earnings management by introducing in the Equation 3 growth in revenue ( ) and firm profitability measured as return on assets ( ). Prior empirical evidence indicates that a firm’s revenue growth has either an insignificant negative (Van Tendeloo or Vanstraelen, 2008) or a significant positive relation (Sarkar et al., 2008; Collins et al., 2017) with accrual-based earnings management. Assuming that firms experiencing a high sales growth have more incentives in earnings management that expose the firm to the scrutiny of the stakeholder, we expect to observe a positive relationship between signed accrual-based earnings management and revenues growth. On the other hand, prior empirical evidence concerning the relation of a firm’s profitability with the level of earnings management within the context of listed firms indicates that when the performance of firms increases, also increase the earnings management initiatives (e.g. Davidson, Stewart and Kent, 2005; Hashem et al., 2012). Van Tendeloo and Vanstraelen (2008), analysing a sample of non-listed firms, find a negative association between return on assets ratio (ROA) and earnings management, suggesting that profitable firms are less likely to manage earnings. Bisogno (2012) finds a mixed result, as ROA has a negative sign only in 2008; in 2009 the coefficient is not significant, while in 2010 the coefficient shows a positive sign. A possible explanation is that in fiscal years 2009 and 2010, non-listed firms have realised the effects of the financial crisis and they were motivated to employ earnings management to avoid reporting negative earnings. Given the mixed results and considering that the financial statements of non-listed firms are less scrutinized by markets (Ball and Shivakumar, 2005; Van Tendeloo and Vanstraelen, 2008), we expect a positive sign between a firm’s profitability and the level of signed accrual-based earnings management.

We, also, control for firm size ) and firm age ( ). Prior literature (Burgstahler and Dichev, 1997; Rangan, 1998; Nelson et al., 2002) within the context of listed firms have documented that firm size is positively correlated with accrual-based earnings management. On the other hand, in the case of Italian non-listed firmsa negative relation between a firm’s size and the intensity of accrual-based earnings management (Mariani et al., 2010;Bisogno, 2012). Francis et al. (1999) argue that larger non-listed firms are less likely to manage their earnings due to better internal control systems. Campa (2019) also finds a negative relationship between income-increasing discretionary accruals and firm size in French listed and non-listed firms. Therefore, we expect a negative relationship between firm’s size and the level of signed accrual-based earnings management. Prior empirical evidence documents, also, a negative relation between firm age and accrual-based earnings management (Ahmed et al., 2014; Alsaeed, 2006) because old firms have a reputation to save in order to increase the relationship with markets and customers (Nasse et al., 2019). We expect similar findings in the case of Italian non-listed firms.

Finally, according to Mariani et al. (2010) and Bisogno (2012), we control for the absolute value of the total accruals (ATA). Francis et al. (1999) argue that firms with greater total accruals have greater uncertainty about reported earnings.Mariani et al. (2010) and Bisogno (2012), investigating a sample of Italian non-listed firms, have documented a positive and significant relation between absolute value of discretionary and total accruals.

Auditors’ independence

The second dimension of audit quality refers to the auditor’s independence in reporting any misstatements. For this reason, we use the unsigned value of accrual-based discretionary accruals ( ) in order to intercept any misstatement in the financial statements. Within the context of this study, the auditor’s independence is tested by estimating a binary logistic panel regression model of Equation 4a)and b:

The variable is a dichotomous one. We collected the audit opinion manually through the notes by using a research option available by the AIDA Database. The audit opinions were divided into the following two categories (Ianniello and Galloppo, 2015):

(i) Modified audit opinions for any reason (the variable equals to 1). We signal as “modified audit opinion” also in the case that the audit opinion signals to the users of the financial statements some events that may influence or threats the future of the firm;

(ii) Non-modified audit opinions (the variable equals to 0).

The binary logistic panel regression model of Equation 4a includes the following variables: is the absolute value of estimated discretionary accruals from the model of Equation 2 for firm i in year t; is the auditor type dummy variable, taking the value 1 if the auditor of firm i in year t is a Big-x, and the value 0 otherwise; is a binary variable for the auditing system adopted by the non-listed firm,

taking the value 1if the firmi in year t engage the BSA and the value 0 if the firm assigns the auditing to an external auditor (both Big-4 or a non-Big-4 audit company); is the return on assets of firm i in year t; is the natural logarithm of the total assets; is the level of total liabilities scaled by total equity of the firm i in the year t; is the sum of inventory and accounts receivable divided by total assets; is a dummy variable taking the value 1 if the firm i reported a loss in previous year t-1, the value 0 otherwise; and is the model error term.In order to take into account the different levels of discretionary accruals in the sample firms; we estimated the regression model of the Equation 4b. The regression model of the Equation 4b includes interaction terms of the variables and with the variable .

The binary panel regression model of the Equation 4 includes some control variables that they have been identified in prior literature as they are likely to affect the audit opinion decision in listed firms and they concern either firm idiosyncratic factors (i.e. profitability, liquidity, solvency and operating risk) or auditors’ specific characteristics (Ozcan, 2016). We control for the impact of firm’s profitability on the probability of receiving a qualified audit opinion by introducing the control variable . Based on prior empirical evidence (Laitinen and Laitinen, 1998; Tsipouridou and Spathis, 2014; Omid, 2015), we expect a positive relationship between the dependent moreover, the control variable .

Consistent with prior literature (Boone et al., 2010; Tsipouridou and Spathis, 2014; Omid, 2015), we introduce the inventory and accounts receivables scaled by total assets ( ), and the total liabilities scaled by total equity ( ). However, in the case of Greek (Tsipouridou and Spathis, 2014) and Iranian (Omid, 2015) there isn’t a significant association between the dependent variable and the independent variables and . For this reason, we expect that even in the case of Italian non-listed firm there is no significant relationship between the dependent variable and the independent variables and .

We control for the impact of firm size on the probability of receiving a qualified audit opinion. The literature (Tsipouridou and Spathis, 2014; Omid, 2015) predicts that firm size has a negative impact for going-concern qualified opinions, but it can have a positive impact on the likelihood of a firm receiving a MAO, as larger firms are more complex, thereby increasing the likelihood of misstatements in the accounts (Ireland, 2003). This literature finds a negative and significant relationship, highlighting that the higher the firm size the lower the probability of receiving a qualified audit opinion. According to the literature, we expect a negative relationship between the dependent variable and the control variable also in non-listed firms.

Finally, we control for the effect of loss in the previous year t-1 on the probability of receiving a qualified audit opinion in year t. Tsipouridou and Spathis (2014) and Omid (2015) find that firms reporting a negative income in the previous year are also more likely to fail, thereby increasing the probability of receiving going-concern qualified opinions. According to that stated above, we expect a positive sign between and the control variable . Variables description and measurement are illustrated in Table 2.

Descriptive statistics and correlations

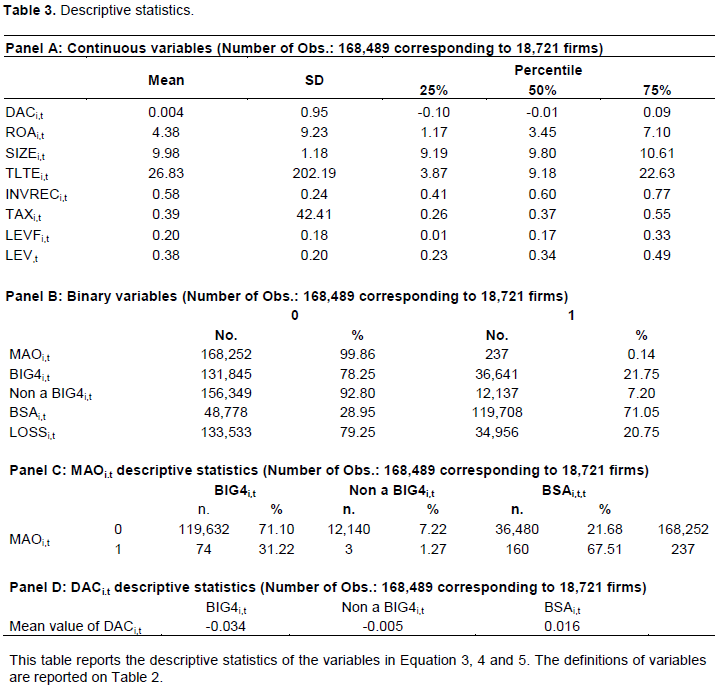

Table 3 illustrates the descriptive statistics for respectively continuous and binary variables in Equation 3and 4. The mean of the variable (that is, the signed value of the discretionary accruals) of the full sample firm is 0.004, while the median is -0.012. The firms in first quartile of distribution exhibit, inaverage, a mean of of -0.103, these in the third quartile a mean of 0.093.

The 71.05% of the sample firms (119,708 obs.) engage a BSA, the 21.75% (36,641 obs.) engage a Big-xauditing company in charge of the financial audit (Panel B – Table 3), while 7.20% of the observations (12,137 obs.) engage a non a Big-xauditing company as auditor. The descriptive statistics (Table 3, Panel D) indicate that firms engaging a Big-x auditor exhibit, in average, engage less in accrual-based earnings management than BSA audited firms. The sample firms have a mean value of 0.20. The profitability ( ) of the sample firms is, in average, 4.38, and the values are around the average in all percentile subsamples of (not tabulated). Only the 4.6% of firms (447 obs.) of the sample received a modified audit opinion in the previous year, while 4.7% received a modified audit opinion in the year of the analysis.

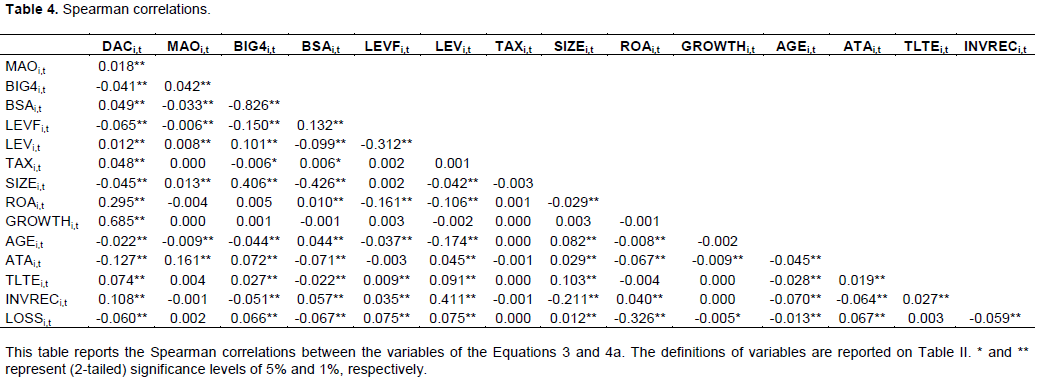

Table 4 exhibits the Spearman correlations between the variables of the Equation 3and 4a. We find a negative and significant (at 1% level) correlation between the dependent variable and the independent variable . On the contrary, instead, the positive and significant correlation between and (0.049) indicates that the BIG4restrict the intensity of the accrual-based earnings management initiatives.

The correlation (-0.065) between and isnegative and significant at 1% level, indicating that an increase in leverage predicts a decrease in the intensity of the accrual-based earnings management initiatives. In addition, the correlation between and ispositive and significant at 1% level. The correlation shows between and , predicting a positive relation between firms’ profitability andaccrual-based earnings management initiatives. There is, also, a negative and significant correlation (at 1% level) among , and indicatinga negative impact of firm’s age, total accrual-based earnings management and firm’s size on the accrual-based discretionary accruals.

Focusing our analysis on the relation between the discretionary accruals and the modified audit opinion received in the year of the analysis; we find a positive and significant (at 1% level) Spearman correlation (0.042) between the variables and . There is an association between an audit carried out by a Big-xauditing company and the probability to report any misstatements on the audit report. On the contrary, there is a negative correlation between and (-0.033), indicating that firms engaging a BSA in charge of the financial auditing decrease the probability to receive a modified audit opinion. Table 4, also, shows a not significant association between the variables and .

Accrual-based earnings management initiatives and audit quality

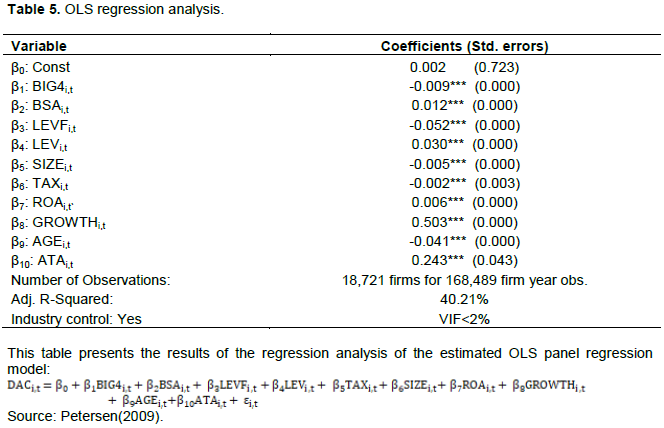

Table 5 illustrates the results of the regression analysis of

the estimated OLS panel regression model of Equation 3. The dependent variable is , the signed discretionary accruals. We ensured that the empirical results were not driven by the properties of the data. We winsorized the variables at 1% level in order to remove the effect of outliers. The Hausman test (p<0.005) suggests that a fixed-effect model is more appropriate specification than the random model in our model specification. The Breusch–Pagan test suggests that a random model is more appropriate than the pooled OLS. Finally, we applied Petersen (2009)’s methodology for selecting the estimation procedure for the regression model of Equation 3. Due to the presence of firm effect and to control for autocorrelation and heteroscedasticity, the regression model of Equation 3 was estimated by employing firm-clustered standard errors. The empirical model in Table 5 shows an Adj. R-squared of 40.21%.

The coefficient (β1) of the variable BIG4i,t, testing H1,has an estimated negative value, as expected, of -0.009(significant at 1% level).This result shows that non-listed clients of Big-x auditors are associated with lower accrual-based earnings management, suggesting that these auditors are more conservatives than non-Big-x auditors and BSA. Probably, according to the DeAngelo (1981)’s reputational rational, Big-x auditors are more likely to make any effort to provide high-quality audit to reduce the probability of an audit failure that could damage the auditor’s reputation also in the context of non-listed (Van Tendeloo and Vanstraelen, 2008). In addition, the negative sign of the variable BIG4indicates that Big-x auditors show an approach oriented to earnings underestimation. This finding may be also explained by the circumstance thatthe Italian auditing environment for non-listed firms provides strong incentives to Big-x auditing companies to deliver high-quality audit and constrain earnings management initiatives for the following reason. The Big-x auditing companies collaborate with and can rely on the auditing efforts of statutory auditors in order to reduce their efforts and to achieve cost savings (Bisogno and De Luca, 2016). Therefore, Big-x auditors may rely on a good internal control system that reduces audit risks. This finding is consistent with prior empirical reported evidence concerning listed firms which indicates that Big-x auditing companies restrict accrual-based earnings management initiatives (DeAngelo, 1981; Becker et al., 1998; Chen et al., 2005; Gul et al., 2009; Chen et al., 2011; Alzoubi, 2016; Ugwunta et al., 2018) or, rarely, have no effect on the level of discretionary accruals (Abid et al., 2018). This finding is also consistent with the literature concerning non-listed firms (Mariani et al., 2010; Azzali and Mazza, 2018), while it is not consistent with Bisogno (2012). Therefore, hypothesis H1 is accepted.

This table reports the Spearman correlations between the variables of the Equations 3 and 4a. The definitions of variables are reported on Table ΙΙ. * and ** represent (2-tailed) significance levels of 5% and 1%, respectively.

The coefficient (β2) of the variable BSAi,t, testing the H2, has an estimated positive value, as expected, of 0.012 (significant at 1% level). This finding indicates that the financial statement audited by a BSA is less reliable that those audited by external auditors (Big-x and non-Bi-x auditors) because the statutory committee tend to earnings over estimation initiatives. This finding may be explained by the circumstance that BSA members face with lower audit fees, and at the same time, they tend to act as tax advisors of the firms they audit (Mariani et al., 2010; Corno et al., 2007). In addition, because of their involvement in the day-by-day operations as administrative auditors, BSA members have less competitive advantages compared to external auditors. For example, they have less knowledge of diverse business practices; have a lower ability to benefit from robust and efficient audit methodology and processes. This is a surprising result as the 71.05% of our sample firm assigns the financial audit to the BSA. This finding is consistent with Mariani et al. (2010), while it is not consistent with Bisogno (2012). Therefore, hypothesis H2 is accepted. The following paragraphs analyse the estimated coefficients of the control variables of the Equation 3 concerning the intensity and the direction of the impact of various factors on the level of the discretionary accruals.

The estimated coefficient (β3) of the control variable LEVFi,t for the magnitude of the financial leverage (debt-to-banks) has a negative value of -0.052, contrary to expectation. According to DeAngelo et al. (1994), firms experiencing financial problems are more likely to be conservative in order to avoid issues with lenders. This finding is consistent with the control hypothesis (Jensen, 1986), indicating that more highly leveraged firms tend to manage their earnings downwards. Our finding is consistent with prior literature (Mariani et al., 2010; Bisogno, 2012). In addition, the estimated coefficient (β4) of the control variable LEVi,tfor the total leverage has a positive value of 0.030, contrary to expectation. Consistent with the debt contracting hypothesis (Sweeney, 1994; Dechow and Skinner, 2000; Rosner, 2003; Ardison et al., 2012), firms experiencing temporary financial difficulties (proxied by the total debts/total assets ratio) manage their earnings upwards in order to avoid debt covenant violations. However, this finding is not consistent with the empirical results concerning Italian non-listed firms, which are reported by Bisogno (2012) and Mariani et al. (2010) and they are in favour of the control hypothesis.

The estimated coefficient (β5) of the control variable TAXi,t concerning the level of the tax burden (tax payable) has a negative value of -0.002 contrary to expectation and prior empirical evidence (Coppens and Peek, 2005; Burgstahler et al., 2006; Van Tendeloo and Vanstraelen, 2008; Poli, 2013). A possible explanation is that Italiannon-listed firms are more likely to engage in earnings management initiatives in order to decrease the probability of an investigation by the tax authorities. In fact, the Italian tax system issues an investigation or estimate the tax income according the tax law (therefore, the tax office considers unreliable the financial statements),if a firm does not fully comply with specific tax indexes (in Italian these indexes are named the “Studi di Settore” or (from 2019) the “Index of tax reliability”).

In the case of Italian non-listed firms,larger firms are less likely to manage earnings than other firms. The estimated coefficient (β6) of the control variable SIZEi,thas a negative value of -0.017.This finding is consistent with prior empirical evidence within the Italian context reported by Mariani et al. (2010) and Bisogno (2012).

The results indicate that firms experiencing revenue growth, as expected, are more likely to manage earnings than other firms since the estimated coefficient (β7) of the control variable GROWTHi,t is 0.503. Further, the estimated coefficient (β8) of the control variable ROA is positive, as expected, significant at 1% level, suggesting that high profitable firms are, also, more likely to manage earnings than other firms. This finding is partially consistent with Bisogno (2012), analysing a sample of Italian manufacturer firms, and not consistent with Van Tendeloo and Vanstraelen (2008). Our finding indicates that the earnings quality of high profitable firms is poor.

The sign of the control variable AGEi,t, proxying the age of the company from the date of the incorporation, is negative, as expected, significant at 1% level. The result indicates that old firms have their reputation to maintain. Therefore, these old firms are less likely to manage their earnings (Alsaeed, 2006; Ahmed et al., 2014). Finally, the sign of the control variable ATAi,t, proxying the unsigned value of the total accruals, is negative, contrary to expectation, significant at 1% level. Our finding, not consistent with prior literature investigating a sample of Italian non-listed firms (Mariani et al., 2010; Bisogno, 2012) indicates that firms with greater total accruals have lower uncertainty about reported earnings.

Accrual-based earnings management initiatives and audit quality

The second dimension of the audit quality is the probability that an auditor will comment on any discovered misstatements in the audit opinion. According to the H3, it is expected that, in the case of Italian non-listed firms, there is a positive relationship between a modified audit opinion and the engagement of a Big-x auditing company in charge of the financial auditing.

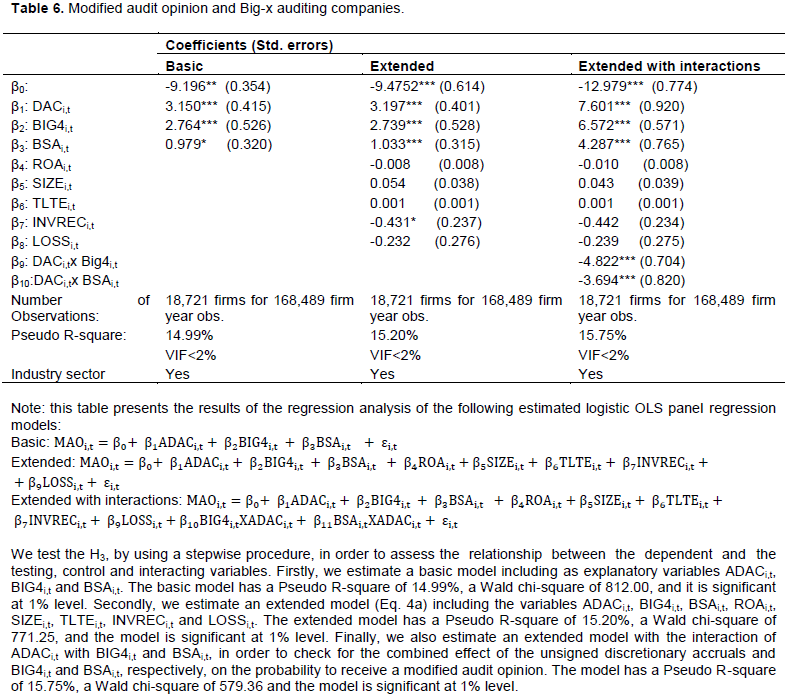

Table 6 illustrates the results of the regression analysis if the estimated logistic OLS panel regression models of Equation 4aandb). We ensured that the empirical results were not driven by the properties of the data. We winsorized the variables at 1% level in order to remove the effect of outliers. We applied Petersen’s (2009) methodology for selecting the estimation procedure for the regression model of Equation 4aand 4b. Due to the presence of firm and time effects and in an attempt to control for autocorrelation and heteroscedasticity, the regression model of Equation 3 was estimated by employing firm and time-clustered standard errors.

We test the H3, by using a stepwise procedure, in order to assess the relationship between the dependent and the testing, control and interacting variables. Firstly, we estimate a basic model including as explanatory variables ADACi,t, BIG4i,t and BSAi,t. The basic model has a Pseudo R-square of 14.99%, a Wald chi-square of 812.00, and it is significant at 1% level. Secondly, we estimate an extended model (Eq. 4a) including the variables ADACi,t, BIG4i,t, BSAi,t, ROAi,t, SIZEi,t, TLTEi,t, INVRECi,t and LOSSi,t. The extended model has a Pseudo R-square of 15.20%, a Wald chi-square of 771.25, and the model is significant at 1% level. Finally, we also estimate an extended model with the interaction of ADACi,t with BIG4i,t and BSAi,t, in order to check for the combined effect of the unsigned discretionary accruals and BIG4i,t and BSAi,t, respectively, on the probability to receive a modified audit opinion. The model has a Pseudo R-square of 15.75%, a Wald chi-square of 579.36 and the model is significant at 1% level.

The dependent variable of all estimated regression models is MAOi,t, a dummy variable taking the value 1 if the firm in the sample has received a modified audit opinion, and the value zero otherwise. The descriptive statistics for the variable MAOi,t indicate that only 237 firms out 168,489 (the 0.14%) in the sample period received a modified audit opinion. More specifically, the not-tabulated descriptive statistics for the variable MAO indicate that 19 firms out of 18,721 (= 0.001%) received a modified audit opinion (MAO) in the year 2009; 38 firms out of 18,721 (0.002%) in the year 2010; 26 firms out of 18,721 (= 0.001%) in the year 2011; 34 firms out of 18,721 (= 0.002%) in the year 2012; 29 firms out of 18,721 (= 0.001%) in the year 2013; 31 firms out of 18,721 (= 0.002%) in the year 2014; 23 firms out of 18,721 (0.001%) in the year 2015; 20 firms out of 18,721 (= 0.001%) in the year 2016; and 17 firms out of 18,721 (< 0.000%) in the year 2017.

The estimated coefficient (β2) of the independent variable BIG4 has a positive value in each one of the estimated models (the basic, the extended and the extended with interaction models). In addition, the finding suggests that Big-x auditing companies are more likely to report an anomaly than other types of auditors. The not-tabulated descriptive statistics indicate that 160 Big-x audited firms received a modified audit opinion in the sample period, while non-Big-x auditors issued 77 modified audit opinion in the sample period. The aforementioned empirical result is in favour of H3.

The positive value of the estimated coefficient (β3) in each one of the estimated models suggests that also the firms audited by the statutory committee are likely to receive a modified audit opinion. A possible explanation is that also the BSAhas some incentive to report irregularities on the audit report. However, the not-tabulated descriptive statistics indicate that only 74 firms audited by a BSA received a modified audit opinion in the sample period, while 163 firms audited by other auditors (a Big-x and a non-Big-x auditor) received a modified audit opinion in the sample period. A BSA is engaged in financial auditing by 78.3% of the sample firm and, yet, it is less likely to report anomalies in the audit opinion than other auditors. In the case of the estimated basic regression model, the coefficient for BSAi,t (0.979) is lower than that for BIG4i,t (2.764).

We, also, control for the association between the issuance of a modified audit opinion and the magnitude of the discretionary accruals. The not-tabulated results indicate that the firms receiving a MAO have, in average, a magnitude of unsigned discretionary accruals of 0.51, while the firms with no modified audit opinion have a corresponding value of 0.16. The control variable ADACi,t (the unsigned discretionary accruals) has an estimated coefficient of a positive value, significant at 1% level in all three models. Thesefindings suggest that a modified audit opinion is issued in association with a higher level of unsigned discretionary accruals (a proxy of earnings management).

To control for the combined effect of the auditor type with the level of unsigned discretionary accruals on the probability the issuance of a modified audit opinion is issued, we introduce two interacting variables in our model (extended model with interactions). We employed the interacting variables because the corresponding estimated coefficient will show the incremental effect of each variable (BIG4i,tand BSAi,t) on the relationship between the level of unsigned discretionary accruals (ADACi,t) and the issuance of a modified audit opinion.

The estimated coefficients of both interacting terms (ADACi,txBIG4i,t and ADACi,txBSAi,t) exhibit a negative sign, significant at 1% level. There are a number of possible explanations. The first one is that the two types of auditors (the Big-x auditing company and the BSA) are concurrent in providing high-quality audit services and in signalling any anomaly. The second reason is that both types of auditors (and especially the statutory committee) suggest changing the anomalies in the financial statements before to submit it to the shareholders meeting. Finally, in our data sample, there are only 237 firms receiving a modified audit opinion (the 0.1% of the observations). The estimated coefficient of the control variable ROAi,t is negative, as expected, indicating that the negative firm performance does not impact on the issuance of a modified audit opinion. Our finding is consistent with prior literature (Tsipouridou and Spathis, 2014; Omid, 2015) concerning listed firms.

The firms’ profitability (ROAi,t), the firm size (SIZEi,t), the ratio of total liabilities scaled the equity (TLTEi,t) and the dummy variable indicating if the firm experienced loss in a previous year (LOSSi,t) are not significant. These findings suggest that these variables do not explain the issuance of a modified audit opinion. These findings are partially consistent with previous literature (Tsipouridou and Spathis, 2014; Omid, 2015). In more specific terms, also previous literature concerning listed firms has found that the ratio of total liabilities to equity was not significant. Finally, the estimated coefficient of the control variable INVRECi,t is negative, significant at 10% level only on the extended model, indicating that the ratio of inventories and receivables on the total assets, do not drive the probability of receiving a modified audit opinion. Our finding is partially consistent with Tsipouridou and Spathis (2014) and consistent with Omid (2015).

Our study expands prior empirical evidence for the audit quality within the context of the Italian non-listed firms by expanding prior research initiatives (Mariani et al., 2010; Bisogno, 2012) in two ways. First, this study investigates the audit quality of the statutory and external auditors for a longer updated time period that is from 2009 to 2017. Second, this study examines another aspect of audit quality that is the level of auditing independence.

Prior empirical evidence for the audit quality within the context of non-listed firms is limited on a number of studies examining the impact of audit quality on the level of the accrual-based earnings management initiatives. We provided additional empirical evidence for the relation between accrual-based earnings management and the auditquality provided by Big-x auditing companies within the Italian setting of the non-listed firm. In addition, we expanded existing empirical research in the case of non-listed firms concerning another important but rather unexplored aspect of audit quality that is the auditor independence.

The Italian auditing environment provides multiple levels of audit quality for non-listed firms comparing with other European auditing environments. Our empirical findings indicate that statutory auditors (BSA) are positively associated and Big-x auditing companies are negatively associated with the level of signed discretionary accruals. These findings suggest that due to their wider experience, robust and efficient audit methodology and processes, knowledgeable and expert professional staff, external auditors (Big-x and non-Big-x auditors) should provide higher quality auditing than the statutory committee. In addition, external auditors must compete in a domestic and international auditing market; therefore any misstatement in the auditor may damage their reputation worldwide. Therefore, these competitive advantages, reducing the expectation auditing gap, attract clients seeking higher quality audit. Thus, according to previous literature,the findings suggest that, in the case of Italian non-listed firms, a Big-x auditing company (and, in general, also non-Big-x auditors) provides a high-quality audit than a BSA. Even though Italian non-listed firms assign the financial audit to a BSA, this is not a surprisingly result because BSA members have several commitments as administrative auditors (they have also to attend and monitor the shareholder meetings); therefore they may make any effort to strengthen the internal control system but, probably, BSA may have severe problems in carrying out a high-quality financial auditing. In addition, our study provides evidence that, in the case of Italian non-listed firms, there is a positive relationship between a modified audit opinion and the engagement of a Big-x company in charge of the financial auditing. Findings also indicate that the engagement of a Big-x auditing company increases the likelihood of a modified audit opinion to be issued more than the engagement of a BSA. Probably, this greater independence of Big-x companies may be explained by the circumstance that these auditors have their reputation to save (also when they audit non-listed firms) and their wider experience and robust and efficient audit methodology reduce any relationship with their clients. In this way these auditors increase their reputation on the auditing market.

The aforementioned empirical evidence contributes to widerpolicy-making issues concerning auditing regulation. The Italian auditing institutional setting for non-listed firms may be of interest for extracting valuable experience for policy-making purposes within a wider international context. For instance, the EC (2011) Green Paper on Corporate Governance proposes the introduction of an Independent Professional Supervisory Board (IPSB), which skills are similar to those of a statutory auditor and for this reason an IPSB may also be engaged as financial auditor, limiting the monopoly of the large Big-x auditing companies in the audit market. Further, the Chartered Accountants of Spain and France were interested in introducing a controlling body similar to the Italian BSA inside the corporate governance of European non-listed firms (Zanardi, 2010). Yet, effective policy making requires additional empirical evidence that a statutory auditor provides a high audit quality similar to this provided by the large Big-x auditing companies. Our empirical evidence provides evidence in this direction.

Finally, our empirical study has limitations which elevate the fact that additional comparative analysis is required. For instance, a comparative analysis of the audit quality between different auditing regimes across different national settings will empower policy makers with improved understanding of the quality difference between Big-x auditing companies and other types of auditors. Another type of valuable comparative analysis is between listed and non-listed firms operating within the same national setting.

The authors have not declared any conflict of interests.

REFERENCES

|

Abid A, Shaique M, Anwar ulHaq M (2018). Do big four auditors always provide higher audit quality? Evidence from Pakistan. International Journal of Financial Studies 6(2):58.

Crossref

|

|

|

|

Alhadab M, Clacher I, Keasey K (2016). A comparative analysis of real and accrual earnings management around initial public offerings under different regulatory environments. Journal of Business Finance and Accounting 43(7-8):849-871.

Crossref

|

|

|

|

|

Alsaeed K (2006). The association between firm-specific characteristics and disclosure: The case of Saudi Arabia. Journal of American Academy of Business 7(1):310-321.

|

|

|

|

|

Alzoubi E (2016).Audit quality and earnings management: evidence from Jordan. Journal of Applied Accounting Research 17(2):170-189.

Crossref

|

|

|

|

|

Amiram D, Bauer, AM, Frank MM (2013). Corporate tax avoidance and managerial incentives generated by shareholder dividend tax policy, working paper. Columbia University, University of Illinois and University of Virginia.

|

|

|

|

|

Ardison KMM, Martinez AL,Galdi FC (2012).The effect of leverage on earnings management in Brazil. Advances in Scientific and Applied Accounting 5(3):305-324.

Crossref

|

|

|

|

|

Azzali S, Mazza T (2018). The Internal Audit Effectiveness Evaluated with an Organizational, Process and Relationship Perspective. International Journal of Business and Management 13(6):238-254.

Crossref

|

|

|

|

|

BallR, Shivakumar L (2005). Earnings quality in UK private firms: comparative loss recognition timeliness. Journal of Accounting and Economics 39(1):83-128.

Crossref

|

|

|

|

|

Ballas AA, Fafaliou I (2008). Market shares and concentration in the EU auditing industry: The effects of Andersen's demise. International Advances in Economic Research 14(4):485-497.

Crossref

|

|

|

|

|

Bartov E, Gul F, Tsui J (2000).Discretionary accruals models and audit qualifications. Journal of Accounting and Economics 30:421-452.

Crossref

|

|

|

|

|

Becker CL, Defond ML, Jiambalvo J, Subramanyam KR (1998).The effect of audit quality on earnings management. Contemporary Accounting Research 15(1):1-24.

Crossref

|

|

|

|

|

Bisogno M (2012). Audit quality of Italian industrial non-listed firms: an empirical analysis. International Journal of Business Research and Development 1(1):32−47.

Crossref

|

|

|

|

|

Bisogno M, De Luca R (2016). Voluntary joint audit and earnings quality: evidence from Italian SMEs. International Journal of Business Research and Development 5(1):1-22.

Crossref

|

|

|

|

|

Bonner S, Palmrose Z, Young S(1998). Fraud type and auditor litigation: an analysis of SEC accounting and auditing enforcement releases. The Accounting Review 73(4):503-532.

|

|

|

|

|

Boone JP, Khurana IK, Raman KK (2010). Do the Big 4 and the second-tier firms provide audits of similar quality? Journal of Accounting and Public Policy 29(4):330-352.

Crossref

|

|

|

|

|

Burgstahler DC, Hail L, Leuz C (2006). The Importance of Reporting Incentives: Earnings Management in European Private and Public Firms. The Accounting Review 81(5):983-1016.

Crossref

|

|

|

|

|

Burgstahler D, Dichev I (1997).Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics 24:99-126.

Crossref

|

|

|

|

|

Butler M, Leone AJ, Willenborg M (2004).An empirical analysis of auditor reporting and its association with abnormal accruals. Journal of Accounting and Economics 37(2):139-165.

Crossref

|

|

|

|

|

Campa D(2019). Earnings management strategies during financial difficulties: A comparison between listed and unlisted French companies. Research in International Business and Finance 50(C):457-471.

Crossref

|

|

|

|

|

Carey P, Simnett R (2006). Audit partner tenure and audit quality. The Accounting Review 81(13):653-676.

Crossref

|

|

|

|

|

Charitou A, Lambertides N, Trigeorgis L (2007). Earnings behaviour of financially distressed firms: The role of institutional ownership. Abacus 43(3):271-296.

Crossref

|

|

|

|

|

Chen CJP, Chen S, Su X (2001). Profitability regulation, earnings management, and modified audit opinions: Evidence from China. Auditing: A Journal of Practice and Theory 20(2):9-30.

Crossref

|

|

|

|

|

Chen H, Chen J, Lobo G, Wang Y(2011). Effects of audit quality on earnings management and cost of equity capital: Evidence from China. Contemporary Accounting Research 28(3):892-920.

Crossref

|

|

|

|

|

Chen KY, Lin K, Zhou J (2005).Audit quality and earnings management for Taiwan IPO firms. Managerial Auditing Journal 20(1):86-104.

Crossref

|

|

|

|

|

Collins DW, Pungaliya RS, Vijh AM (2017).The Effects of Firm Growth and Model Specification Choices on Tests of Earnings Management in Quarterly Settings. The Accounting Review 92(2):69-100.

Crossref

|

|

|

|

|

Copley PA (1991). The association between municipal disclosure practices and audit quality. Journal of Accounting and Public Policy 10(4):245-266.

Crossref

|

|

|

|

|

Coppens L, Peek E (2005). An analysis of earnings management by European private firms. Journal of International Accounting, Auditing and Taxation 14(1):1-17.

Crossref

|

|

|

|

|

Corno F, Fossati S, Gini G, Luoni L, Mariani L, Tettamanzi P (2007). Crisis factors in control systems of Italian listed companies.In:ReboraG (ed.), La crisideicontrolli: imprese e istituzioni a confronto. Milan: Pearson Education.

|

|

|

|

|

Davidson R, Goodwin-Stewart J, Kent P (2005). Internal Governance structures and Earnings Management. Accounting and Finance 45(2):241-267.

Crossref

|

|

|

|

|

DeAngelo LE (1981).Auditor size and audit quality. Journal of Accounting and Economics 3(2):183-199.

Crossref

|

|

|

|

|

DeAngelo H, DeAngeloL,SkinnerDJ (1994). Accounting choice in troubled companies. Journal of Accounting and Economics 17(1-2):113-143.

Crossref

|

|

|

|

|

Dechow P, Sloan RG, Sweeney AP (1995).Detecting earnings management. The Accounting Review 70(2):193-225.

|

|

|

|

|

Dechow P, Skinner D (2000). Earnings management: Reconciling the views of accounting academics, practitioners, and regulators. Accounting Horizons 14(2):235-250.

Crossref

|

|

|

|

|

Dechow P, Ge W, Schrand C (2010). Understanding earnings quality: A review of the proxies, their determinants and their consequences. Journal of Accounting and Economics 50(2-3):344-401.

Crossref

|

|

|

|

|

DeFond ML, Jiambalvo J (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics 17(1-2):145-176.

Crossref

|

|

|

|

|

DeFond ML, Zhang J (2014).A review of archival auditing research. Journal of Accounting and Economics 58(2):275-326.

Crossref

|

|

|

|

|

Dye R (1995).Incorporation and the audit market. Journal of Accounting and Economics 19 No 1):75-114.

Crossref

|

|

|

|

|

European Commission (EC) (2019). 2019 SBA Fact Sheet, Italy.

|

|

|

|

|

European Commission (EC) (2011). Green paper: the EU corporate governance framework.

|

|

|

|

|

Fleisher R,Goettsche M,Schauer M (2017). The Big 4 premium: Does it survive an auditor change? Evidence from Europe. Journal of International Accounting, Auditing and Taxation 29:103-117.

Crossref

|

|

|

|

|

Francis JR, Maydew EL, Sparks HC (1999). The role of Big 6 auditors in the credible reporting of accruals. Auditing: A Journal of Practice and Theory 18(2):17-34.

Crossref

|

|

|

|

|

Francis JR, Krishnan J (1999).Accruals and auditors reporting conservatism. Contemporary Accounting Research 16(1):135-165.

Crossref

|

|

|

|

|

Gul FA, Yu Kit Fung S,Jaggi B (2009). Earnings quality: Some evidence on the role of auditor tenure and auditors industry expertise. Journal of Accounting and Economics 47(3):265-287.

Crossref

|

|

|

|

|

Hashem N,Bahman B,Azam S (2012). An Empirical Analysis of Earnings Management Motives in Firms Listed on Tehran Stock Exchange. Journal of Basic and Applied Scientific Research 2(10):9990-9993.

|

|

|

|

|

Hassan SU, Farouk MA (2014).Firm attributes and earnings quality of listed oil and gas companies in Nigeria. Review of Contemporary Business Research 3(1):99-114.

|

|

|

|

|

Herbohn K, Ragunathan V (2008). Auditor reporting and earnings management: some additional evidence. Accounting and Finance 48(4)575-601.

Crossref

|

|

|

|

|

Hilary G, Lennox C (2005). The credibility of self-regulation: evidence from the accounting profession's peer review program. Journal of Accounting and Economics 40(1-3):221-229.

Crossref

|

|

|

|

|

Hope OK, Langli JC (2010).Auditor independence in a private firm and low litigation risk setting. The Accounting Review 85(2):573-605.

Crossref

|

|

|

|

|

Hope OK, Langli JC, Thomas WB (2012).Agency conflicts and auditing in private firms. Accounting, Organizations, and Society 37:500-517.

Crossref

|

|

|

|

|

Ianniello G, Galloppo G (2015). Stock market reaction to auditor opinions - Italian evidence. Managerial Auditing Journal 30(6-7:610-632.

Crossref

|

|

|

|

|

Ireland JC (2003). An empirical investigation of determinants of audit reports in the UK. Journal of Business Finance and Accounting 30(7-8:975-1016.

Crossref

|

|

|

|

|

Ishak AM, Mansor N, Maruhun ENS (2013).Audit market concentration and auditor's industry specialization. Procedia-Social and Behavioral Sciences 9(1):48-56.

Crossref

|

|

|

|

|

Jensen, MC (1986). Agency costs of free cash flow, corporate finance and takeovers. American Economics Review 76(2):323-329.

|

|

|

|

|

Jeong SW, Rho J (2004). Big six auditors and audit quality: The Korean evidence. The International Journal of Accounting 39(2):175-196.

Crossref

|

|

|

|

|

Jones JJ (1991). Earnings management during import relief investigations.Journal of Accounting Research29(2):193-228.

Crossref

|

|

|

|

|

Khajavi S, Zare A (2016). The effect of audit quality on stock crash risk in Tehran Stock Exchange. International Journal of Economics and Financial Issues 6(1):20-25.

|

|

|

|

|

Kinney WR, Palmrose ZV, Scholz S (2004). Auditor independence, non-audit services, and restatements: was the U.S. government right? Journal of Accounting Research 42(3):561-588.

Crossref

|

|

|

|

|

Knapp MC (1991). Factors that audit committee members use as surrogates for audit quality. Auditing-A Journal of Practice and Theory 10(1):35-52.

|

|

|

|

|

Laitinen EK, Laitinen T (1998).Cash Management Behavior and Failure Prediction. Journal of Business Finance and Accounting 25(7-8:893-919.

Crossref

|

|

|

|

|

Lennox CS (2005). Management ownership and audit firm size. Contemporary Accounting Research 22(1):205-227.

Crossref

|

|

|

|

|

Llukani T (2013). Earnings management and firm size: an empirical analyze in Albanian market. European Scientific Journal 9(16):135-143.

|

|

|

|

|

Maijoor SJ, Vanstraelen A (2006). Earnings management within Europe: the effect of member state audit environment. Audit Firm Quality and International Capital Markets. Accounting and Business Research 36(1):33-52.

Crossref

|

|

|

|

|

Mariani L, Tettamanzi P, Corno F (2010).External auditing vs statutory committee auditing: the Italian evidence. International Journal of Accounting 14(1):25-40.

Crossref

|

|

|

|

|

Memis MU, Cetenak EH (2012). Earnings management, audit quality and legal environment: An international comparison. International Journal of Economics and Financial Issues 2(4):460-469.

|

|

|

|

|

Nasse T, Ouedraogo A, Sall F (2019). African Journal of Business Management Religiosity and consumer behavior in developing countries: An exploratory study on Muslims in the context of Burkina Faso. African Journal of Business Management 13(4):116-127

Crossref

|

|

|

|

|

Nawaiseh ME (2016). Can Earnings Management be Influenced by Audit Quality? International Journal of Finance and Accounting 5(4):209-219.

|

|

|

|

|

Nelson M, Elliott J,Tarpley R (2002).Evidence from Auditors about Managers' and Auditors' Earnings Management Decisions. The Accounting Review 77:175-202.

Crossref

|

|

|

|

|

Okolie AO (2014). Audit quality and earnings response coefficients of quoted companies in Nigeria. Journal of Applied Finance and Banking 4(2):139.

Crossref

|

|

|

|

|

Omid AM (2015). Qualified audit opinion, accounting earnings management and real earnings management: Evidence from Iran. Asian Economic and Financial Review 5(1):46-57.

Crossref

|

|

|

|

|

Opler TC, Titman S (1994). Financial distress and corporate performance. The Journal of Finance 49(3):1015-1040.

Crossref

|

|

|

|

|

Ozcan A (2016).Determining factors affecting audit opinion: evidence from Turkey. International Journal of Accounting and Financial Reporting 6(2):45-61.

Crossref

|

|

|

|

|

Palmrose Z (1988).An analysis of auditor litigation and audit service quality. The Accounting Review 63(1):55-73.

|

|

|

|

|

Petersen MA (2009). Estimating standard errors in finance panel data sets: comparing approaches. Review of Financial Studies 22(1):435-480.

Crossref

|

|

|

|

|

Piot C,Janin R (2007).External Auditors, Audit Committees and Earnings Management in France. European Accounting Review 16(2):429-454.

Crossref

|

|

|

|

|

Poli S (2013). The Italian unlisted companies' earnings management

|

|

|

|

|

practices: The impacts of fiscal and financial incentives. Research Journal of Finance and Accounting 4(11):48-60.

|

|

|

|

|

Poli S (2015). Do ownership structure characteristics affect Italian private companies' propensity to engage in the practices of earnings minimization and earnings change minimization?.International Journal of Economics and Finance 7(6:193-207.

Crossref

|

|

|

|

|

Poli S (2017). Is gender diversity in ownership structure related to private Italian companies propensity to engage in earnings management practices? African Journal of Business Management 11(1):1-11.

Crossref

|

|

|

|

|

Rangan S (1998). Earnings management and the performance of seasoned equity offerings. Journal of Financial Economics 50:101-122.

|

|

|

|

|