This paper examines the relationships between corporate governance variables and the extent of risk disclosures among listed companies in Kenya. The study aims to empirically examine the relationship between corporate governance variables and risk disclosures in 48 listed non-financial companies in Kenya. Content analysis of annual reports for the period 2010-2016 was used to measure the level of risk disclosures and compute the risk disclosure index for each company studied. The relationships between variables were analysed using panel data analysis. The findings show that the percentage of non-executive directors, ownership dispersion, percentage of foreign ownership, women in boards affected significantly the level of risk disclosures in the studied companies. Additionally, the control variables, firm’s size and firm’s profitability also significantly affected the level of risk disclosures. It can be concluded that the agency theory and the signalling theory can be used to explain the risk disclosure behaviours of listed firms in Kenya. It is recommended that companies should strengthen their corporate governance mechanisms in order to deal with risks facing them.

Corporate governance definition

Sharman and Copnell (2002, p. 23) define corporate governance as “the system and process by which entities are directed and controlled to enhance performance and sustainable shareholder value and it is concerned with the effectiveness of management structures, the sufficiency, and reliability of corporate reporting and the effectiveness of risk management systems”. Solomon and Solomon (2004, p. 14) state that “Corporate governance is the system of checks and balances, both internal and external to companies, which ensure that companies discharge their accountability to all stakeholders and act in a socially responsible way in all areas of their business activities”. The main elements of the corporate governance mechanism are the board of directors‟ structure, roles, responsibilities and remuneration, internal control, audit committee, internal audit, risk management, and shareholders‟ rights.

Corporate governance and disclosure theories

Even though there is a lot of literature on corporate governance, there is very little on the role of directors in the disclosure process (Haniffa and Cooke, 2002). Corporate governance mechanisms are put in an effort to solve the agency problem and make sure that managers act in the best interest of all stakeholders (Ho and Wong, 2001). Agency problems are usually caused by information asymmetry between owners and managers of a firm. The problem of information asymmetry can be solved by disclosing more information. This will lower uncertainty among investors because they can do more accurate forecasts of investments pay-offs (Deumes and Knechel, 2008).

According to Spira and Page (2003) the corporate governance framework through, among other things, accountability mechanisms of financial reporting, audit and internal control, was designed to manage risk. It is clear that companies need to be more transparent and accountable, and corporate governance mechanisms are put in place to assist in this. Ghazali (2008) says that among the factors that influence voluntary disclosure is accountability. Research has shown that where good corporate governance is practised, voluntary disclosures have been seen to increase. Disclosures of information, therefore, is very important in corporate governance because it reflects the degree of accountability to the stakeholders (Mallin, 2002).

Theoretical discussion on risk management

A number of theories can be used to explain risk disclosures. According to Carpenter and Feroz (1992), disclosure theories should not be seen as competing but should rather be seen as complementary and joint consideration could be of great help in understanding corporate disclosure practices. The main theories used to explain risk disclosures are the agency and signalling theories.

Agency theory postulates that in order to reduce agency costs, managers must prove that they are acting in the best interest of the shareholders by presenting relevant information (Healy and Palepu, 2001). By providing information to various stakeholders the information asymmetry problem is reduced (Jensen and Meckling, 1976). Risk management is seen as a monitoring mechanism to mitigate agency problems and it is therefore important for the manager to disclose risk-related information (Kajuter et al., 2008).

Non-executive directors (NED)

According to Haniffa and Cooke (2002), non-executive directors provide the check and balance mechanism that is important for board effectiveness. Non-executive directors are considered important for controlling and monitoring because they provide the necessary checks and balances for board effectiveness (Barako et al., 2006). The inclusion on the board may, therefore, reduce the conflicts between owners and managers (Fama and Jensen, 1983). Supporting this view, Abraham, and Cox (2007) boards with greater numbers of non-executive directors are more accountable and transparent. Boards with non-executive members are, therefore, expected to disclose more risk information (Eng and Mac, 2003).

H0: there is no significant relationship between the percentage of non-executive directors firm and risk disclosures.

H1: there is a significant relationship between the percentage of non-executive directors firm and risk disclosures.

Ownership structure

Having a significant influence on attitudes to financial reporting and corporate governance is the ownership structure (Beattie et al., 2004). According to Abraham and Cox (2007), ownership structure and governance play an important role in a firm’s risk disclosures. Institutional ownership, ownership concentration, family ownership, government ownership, managerial ownership, and foreign ownership are some of the different proxies that have been used for the ownership structure variable in disclosure studies (Wachira, 2018). In this study institutional ownership, concentrated ownership, government ownership, and foreign ownership were used as variables.

Institutional ownership causes firms to disclose more information because, in order to obtain social legitimacy, managers respond to institutional pressure by disclosing more information (Kiliç et al., 2015). By performing a monitoring role, institutional investors are expected to mitigate information asymmetry (Fama and Jensen, 1983). Institutional investors are also expected to reduce the likelihood that management would withdraw risk information (Healy and Palepu, 2001). In a study in the UK in 2000, it was found that institutional investors agreed that increased risk disclosure helped their investment decisions. However, in 2007 Abraham and Cox (2007) found a positive relationship between short-term institutional investors and risk disclosures and a negative association between risk disclosures and long-term institutional investors. Other researchers, such as Zhang and Taylor (2011) in a study in Australia found no relationship between long-term institutional investors and risk disclosures and also found a positive association between short-term institutional investors and risk disclosures.

H0: there is no significant relationship between institutional ownership and risk disclosures.

H2: there is a significant relationship between institutional ownership and risk disclosures.

The relationship between ownership structure and disclosure is explained by the agency theory because modern companies are characterized by a separation of control and ownership (Owusu-Ansah, 1998). Agency costs are brought by agency conflicts between owners and managers, and between bondholders and owners-managers (Cooke, 1998). As would be expected, agency costs are higher for firms with widespread ownership, because more pressure for information is applied by the owners. According to Owusu-Ansah (1998), where there is widely dispersed ownership, individual shareholders do not have the bargaining power to access internal information and therefore do not have a strong influence on disclosure policies and practice of the firm. Managers in firms with concentrated ownership are not put under a lot of pressure because the owners have more access to information. Another theory that has been used to understand the influence of ownership on disclosures is the signalling theory. In order to signal that they are acting in the best interest of the owners, managers may disclose more information (Hossain et al., 1994). According to Kiliç et al. (2015) separate ownership for management and ownership diffusion pattern promote higher disclosure for information. Conversely, firm’s with concentration ownership may not need to disclose a lot of information because a lot of information is communicated in the boardroom meetings (Mohobbot, 2005). However, Konishi and Ali (2007)) found no significant relationship between the two variables.

H0: there is no significant relationship between ownership dispersion and risk disclosures.

H3: there is a significant relationship between ownership dispersion and risk disclosures.

According to Owusu-Ansah (1998), companies with high government ownership may lack incentives to disclose more information because the government may have exceptional access to company information. This view is supported by Konishi and Ali (2007) who say that if firms with high government ownership are likely to disclose less risk information than firms with distributed ownership. This is because in distributed ownership managers are under pressure to disclose risk information. However, some studies have found no relationship between disclosures and government ownership (Cooke, 1998).

H0: there is no significant relationship between government ownership and risk disclosures.

H4: there is a significant relationship between government ownership and risk disclosures.

Mohobbot (2005) argues that firms with high foreign ownership disclose more risk information because of the pressure on the directors to disclose. This is supported by findings by Mangena and Tauringana (2007), that there is a positive relationship between risk disclosures and foreign ownership. However, some studies have found no relationship between risk disclosures and foreign ownership (Konishi and Ali, 2007).

H0: there is no significant relationship between foreign ownership and risk disclosures.

H5: there is a significant relationship between foreign ownership and risk disclosures.

Role duality

Duality means that the roles of the CEO and the board's chair are combined and performed by one person. This combination signals the absence of control in decision management and control (Fama and Jensen, 1983). Separation of the two roles enhances monitoring control and improves the quality of reporting because the advantages that could be gained by withholding information is reduced (Haniffa and Cooke, 2002). According to Forker (1992), duality may affect the quality of disclosures due to the dominance by one person of the governance processes. This is because the persons who occupy both positions may withhold information that which they consider detrimental to their position (Apostolou and Nanopoulos, 2009).

Findings on the relationship between duality and risk disclosures are mixed. For example, Forker (1992) found a significant negative relationship between duality and the quality of disclosure, Haniffa and Cooke (2002) found a positive association between voluntary duality and disclosure.

H0: there is no significant relationship between role duality and risk disclosures.

H6: there is a significant relationship between role duality and risk disclosures.

Audit committee

It is a good corporate governance practice to have an audit committee of the board of directors, as part of the control mechanism. This is because audit committee members are expected to act for the shareholders’ benefit of and on behalf of the board. Ho and Wong (2001) posit that most audit committee consists mainly of no-executive directors and, therefore, leads to the reduction of the information withheld and therefore more disclosures. According to Barako et al. (2006), an audit committee improves the quality of information flow between the managers and the firm owners and managers because it acts as a monitoring mechanism. It is an effective monitoring tool that would reduce agency cost and improve the quality of disclosures (Forker, 1992). This would explain why the agency theory and information asymmetry theory are the dominant theories in explaining the influence of an audit committee on levels of disclosure.

Bierstaker et al. (2012) say that independent audit committees reduce information asymmetry because they are more likely to advocate for the interests of the shareholders. This positive association between the audit committee and the quality of disclosures have been found by researchers such as Forker (1992) and Oliveira et al. (2011).

H0: there is no significant relationship between the presence of an audit committee and risk disclosures.

H7: there is a significant relationship between the presence of an audit committee and risk disclosures.

Presence of risk management department

One of the important elements of corporate governance is risk management. Corporate failures have led to the growth of interest in risk management and as a result, risk management is now one of the factors that influence financial reporting and disclosures. Incorporating risk management in the governance of firms has also been as a result of regulatory initiatives (Kajuter et al., 2008). Apart from the regulatory requirements, many studies have demonstrated that risk management has many benefits which include wealth maximization of the shareholders (Solomon et al., 2000).

H0: there is no significant relationship between the presence of a risk department and risk disclosures.

H8: there is a significant relationship between the presence of a risk department and risk disclosures.

Board size

According to Cheng and Courtenay (2006), the relationship between board size and the level of voluntary disclosure remain an empirical issue because there is no preponderance of theory suggesting a relation between the two variables. It can be expected that a larger number of directors on the board may encourage more disclosures (Chen and Jaggi, 2000). The number of directors may also influence the control and monitoring activities of the board and this could lead to increased disclosures (Healy and Palepu, 2001). It would, therefore, be expected that risk disclosures would be positively related to the number of directors on the board.

H0: there is no significant relationship between firm size and risk disclosures.

H9: there is a significant relationship between firm size and risk disclosures.

Women in the board

The presence of women on the boards has recently received increased attention (Ellwood and Garcia-Lacalle, 2015). This is because women are now expected to play a key role in the management of an organization that has been the case before. The agency theory does not explain how gender diversity can affect the effectiveness of the Board, but it is expected that, due to their different perspective on issues, their contribution can add value in the performance of the Board. Studies on gender diversity in the performance of the Board and in the overall performance of an organization have risen in the recent past and there are mixed results. Nielsen and Huse (2010) found that the higher the number of women on the board the higher its effectiveness. On the gender diversity influence on business performance, Ntim, Lindop and Thomas (2013) found a positive association, Bianco et al. (2011) found no relationship, while Allini et al. (2014) found a negative association.

H0: there is no significant relationship between firm size and risk disclosures.

H10: there is a significant relationship between firm size and risk disclosures.

Control variables

The purpose of incorporating the control variables in this study is to reduce the influence of the corporate governance variables. In line with prior studies, two variables were included: Firm’s size and the firm’s profitability (Ntim et al., 2013; Allini et al., 2014). Both the firm’s size and the firm’s profitability have been shown to affect positively the level of risk disclosures (Wachira, 2018).

For this study, the deductive approach was used, which according to Saunders et al. (2016), is most common in the positivist researches. Hypotheses were developed using the relevant theories and tested empirically to examine the relationship between corporate governance characteristics and risk disclosures.

Data were collected from listed companies' annual reports. The sample consists of 48 non-financial listed companies in the Nairobi Securities Exchange (NSE). The study examined risk disclosures practices for the period 2010-2016. The focus was on non-financial sectors. Financial firms were omitted from the study firstly because they are regulated by other and different rules which may influence disclosure practice such as the Banking Act. This is in line with most of the risk disclosures studies (Khlif and Hussainey, 2014; Al-Maghzom et al., 2016).

Risk disclosure index development

To analyze data, content analysis was done from which a risk disclosure index was constructed in order to measure the level of risk disclosure. A content analysis of the annual reports was performed based on detailed decision rules. The decision rules were mainly adopted from ICAEW (1999), Linsley and Shrives (2006), Konishi and Ali (2007) and Abraham and Cox (2007) with some modifications. The items to include in the risk disclosure were identified through a pilot study. The procedures applied were adopted from Beattie et al. (2004) and Rajab and Schachler (2009).

A total of 48 items were identified for inclusion in the risk disclosure construction. A discourse index can be weighted or unweighted. In this study, the risk discourse index unweighted because the study did not focus on a particular user group (Naser et al., 2006). An item was given a score of one if disclosed and a score of zero if not disclosed.

To calculate the risk-disclosure index, the following formula was used:

Where, RDIj is the risk disclosure index for firm j, rd the disclosure score for firm i and if the item was not disclosed and 1 is the item was disclosed, nj the maximum number of items that could be disclosed.

Reliability of the data

To test the reliability of the data, an independent coder was used to code independently of the initial coder. Scott’s pi test was used in order to test the reliability of the data (Linsley and Shrives, 2006; Abraham and Cox 2007). The reliability test scored 83.4, 81.2, 84.2, 86.5 and 84.6. A score of 75 in the reliability test is considered enough (Milne and Alder, 1999; Beattie et al., 2004; Abraham and Cox, 2007).

To ensure the validity of the data, the risk disclosure items were reviewed against the IFRS disclosure checklist produced by the ICAEW and against two detailed IFRS compliance checklists which were obtained from professional auditors (Deloitte and KPMG). The purpose of using these checklists was to verify the completeness of the self-constructed checklist related to risk disclosure IFRSs.

Statistical tests and methods

Descriptive statistics

A one-way analysis of variance (ANOVA) was used to determine the significance of differences between the means of the variables. In addition, the nonparametric Wilcoxon Signed-Rank Test was performed, to compare two sets of scores in order to investigate any change in scores from one-time point to another. This test is assumed when the assumption of normality is violated because it does not assume normality (Altman, 1991).

Regression analysis methods

The sample of companies in this study comprised 48 non-financial firms listed at the Nairobi Securities Market over the seven-year period, 2010 to 2016. The model consisted of corporate governance characteristics and firm-specific characteristics. Both univariate and multivariate analyses were used.

Measurement of variables (dependent and independent variables)

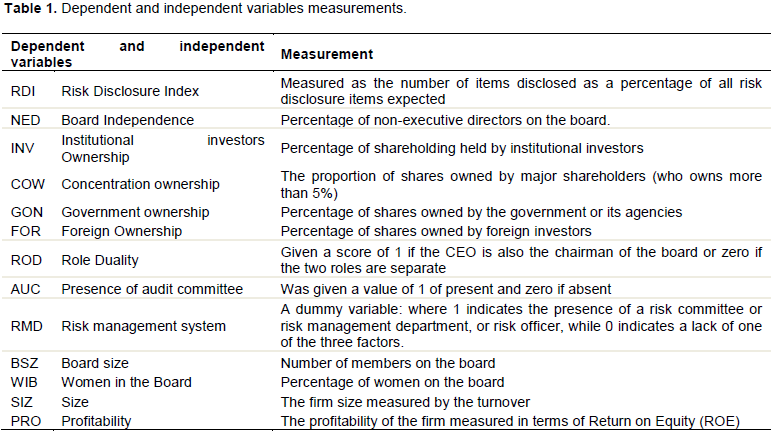

The main regression model examined total risk disclosures and factors of corporate governance firm-specific characteristics. Corporate governance variables included board composition, ownership structure, and duality of leadership, internal control, internal auditing, and risk management. Firm-specific characteristics were company size, industry type, profitability, liquidity, auditor type, and company risk level (Table 1).

Multivariate analysis

In this study panel data was used where the same cross-sectional unit was measured over time and analysed using the multiple regression method. According to Wright and London, 2009 multiple regression is an appropriate method of analysis where the objective is to determine the combined effects of the independent variables on predicting a dependent variable is desired.

Assumption of normality

In order to test for normality, the graphical method was used whereby the Normal Probability Plot was done. From the analysis, it was found that total asset, market capitalization, and revenue variable, were not approximately normally distributed. The values of these variables were, therefore, transformed into natural logarithms. The logarithmic transformation has been widely applied to address the non-normality of variables (Lopes and Rodrigues, 2007).

Regression model

Ownership concentration was negative and significant. This means that as ownership becomes more concentrated on a few people, less risk information is disclosed. Companies owned by a few members may not want to disclose all the information because they have a lot of information about the company. These findings are consistent with findings of other researchers such as Mohobbot (2005), and Al-Maghzom et al. (2016) and consistent with signalling and agency theories which posit that directors of companies with highly dispersed ownership are likely to disclose more information to mitigate against information asymmetries.

The relationship between risk disclosures and the presence of an audit committee was found to be positive and significant. This is an indication that the number of meetings of the audit committee does influence the level of risk disclosures. These findings are inconsistent with the findings of Allegrini and Greco (2013), and Al-Maghzom et al. (2016). This finding is also consistent with the agency theory which proposes that in order to reduce agency conflicts and information asymmetry, internal and external monitoring practices should complement each other.

Board size has a negative and significant relationship with the level of risk disclosures. This implies that the larger the board the lower the level of risk disclosures. This result is consistent with findings in Al-Maghzom et al. (2016). It is also consistent with agency theory which suggests that larger boards are not effective. The ineffectiveness of larger boards has also been shown in other studies such as Coles et al. (2008) and Guest (2009).

On the control variables, both firm size and profitability were found to be significantly positively correlated with risk disclosures. That firm size affects positively the disclosure of information has been found in a number of studies such as Elzahar and Hussainey (2012) and Wachira (2018). This means that larger firms are likely to disclose more information. This is consistent with signalling and agency theory which argue that larger firms are motivated to disclose more information in order to differentiate themselves from smaller ones. Therefore, larger firms are likely to use risk disclosures to differentiate themselves from smaller firms (Khlif and Hussainey, 2014).

That profitability of a firm affects its disclosure of risk information has also been supported by several studies (Khlif and Hussainey, 2014; Al-Maghzom et al., 2016). This means that highly profitable firms are likely to disclose more risk information. Directors firms for high profitable disclose risk information to signal stakeholders of their performance. This is consistent with signalling theory.