ABSTRACT

In the current study, we have analyzed the impact of formal credit on agricultural output : Evidence from Pakistan. by using secondary data from 1996 to 2015. Augmented Dickey Fuller (ADF) test was applied to check the stationarity of the data. Contrarily, the Johansen Co-integration test (Trace Statistic) was used to find out whether there exists a long run relationship between formal credit and agricultural output. The method of (OLS) was used to estimate the impact of formal credit on agricultural output. The empirical regression results indicate that the explanatory variable (formal credit) was statistically with coefficient of 0.860350. This means 1% increase in credit will increase the agricultural output by 0.86%. It is clear that impact of formal credit on agricultural output has positive and significant. Therefore, our study suggests that the procedure of credit should be made simple and flexible and financial institutions should launch crop insurance scheme in case of crop failure by flood, draught, pest attack, and heavy rains. Also Government of Pakistan should support small farmers through credit schemes on affordable interest rate. It will helpful in raising farm productivity and the standard of living of the small farmers.

Key words: Formal credit, agricultural output (value added), Pakistan.

Agriculture sector is the backbone of Pakistan's economy. It accounts for 20.9% of the GDP and absorb 43.7% of labour force (GOP, 2014-15). This sector provides raw materials to agro-based industries and it is also source of country’s export earnings. In Pakistan, the agriculture sector growth rate was 2.7% in 2013-2014 which was slightly increased to 2.9% in the year of 2014-15 as given in Table 1 (at constant factor cost), (Statistical Supplement, and 2014-15). The growth of agriculture sector in Pakistan always was poor in all aspects such as productivity, production, consumption and exports compared to developed countries. However, the agricultural growth of Pakistan is facing several problems like severe water shortage, along with soil erosion, lack of mechanization, natural calamities and rising price of inputs such as seeds fertilizers, pesticides etc. Therefore, this growth has required the use of fertilizers, improved seed varieties, better irrigation, and modern equipment, which in turn has required the credit availability to the farmers. 68% population living in rural areas and mostly rural population is engaged in agricultural activities.Agricultural farming requires capital like other business for its farm operations. Timely availability of credit leads to adoption of improved seeds, fertilizers and modern technologies which increase the agricultural productivity and the growth rate. Therefore, agriculture credit is an essential element for modernization in agriculture. In the past few decades, the need of credit in agriculture sector rapidly increased because of rise in use of fertilizer, pesticides, high yield variety seeds and mechanization and rise in their prices. In Pakistan, there are two sources of credit: informal and formal. Informal sources of credit include friends, relatives, commission agent, input supplier, shopkeeper, landlords, employer, traders and private money lenders and the formal credit sources consists of financial institutions like Zarai Taraqiati Bank limited, (ZTBL) previously known as Agricultural Development Bank of Pakistan (ADBP), However, ZTBL was established in 1961 through merger of Development Finance Corporation and Agricultural Development Bank of Pakistan. ZTBL is an important source for supply of credit to agriculture sector in Pakistan. ZTBL provides short - term, medium- term and long-term credits for farm and non-farm activities. The bank provides five types of loan such as Development loan, Production Loan, Agri-business loans, and off farm income to farmers generating activities loans (Chandio et al., 2015). On the other hand, Commercial banks such as National Bank Limited (NBP), United Bank Limited (UBL), Allied Bank Limited (ABL), Muslim Commercial Bank (MCB), Habib Bank Limited (HBL), and co-operative societies. However, all financial institutions have been playing vital role in the provision of agriculture credit for the last two decades. These sources provide loans for the production and development purposes for increasing the production and productivity of this sector. The share of these institutions is increasing day-by-day as described in Table 2. Therefore, the share of commercial banks has increased over time and they are the largest contribution in this sector followed by ZTBL (GOP, 2013-14). In Pakistan, Small farmers, landlord farmers and non-farm population in agriculture sector they are facing rigorous problem of lacking in capital. After green revolution, and technological changes in agriculture sector, the requirement of credit has rapidly increased to purchase inputs. However, small farmers and share croppers usually face complicate procedure and collateral problems in availing credit. These impediments had hardly hit the tenants and share croppers who did not own land. Despite these problems, financial institutions have been playing positive and significant role to enhance technological change in agriculture sector. After considering the importance of agricultural credit the study focused on the impact of formal credit on agricultural output (value added) of Pakistan: an econometric analysis. Furthermore, the layout of the study is as follows: First is the literature review followed by the methodology. Thereafter, the results and discussion are presented followed by the conclusion and recommendations.

In Pakistan not a lot of work has been done in past to see the impact of credit on agricultural output. Few studies in this regard are documented by Malik et al. (1989), Zuberi (1989), Sarfraz and Akhtar (1992), Iqbal et al. (2003) and Afzal (2005). The role of institutional credit in agriculture sector is significant. However, modern agriculture is essential for economic development of the country. Employing modern agricultural technologies is possible when farmers are provided credit for purchasing modern inputs (Schultz, 1964; Zuberi, 1989). Many developed countries had recognized the benefits of using modern farm technology. But application of farm technology to increase agricultural output had increased financing needs of farmers (Mellor, 1966). The impact of institutional credit, fertilizers, seeds, and irrigation on agricultural production was found positive and significant (Zuberi, 1983, 1990; Malik et al., 1991; Iqbal et al., 2001; Waqar et al., 2008).

Abedullah (2009) states that easy and cheap credit the quickest way for boosting agricultural production use of modern agricultural technology increased demand for credit and resulted in increase in agricultural yield of small farmers.

Zuberi (1989) examined the production function in the agriculture sector in Pakistan. The study used the time series data from 1956 to 1986 and developed the strategy for the agricultural development in Pakistan. It is concluded that agricultural development depends on the maximum utilization of better and low cost technology. It is suggested that government should provide the institutional credit in a simple and easy procedure to make possible for farmers to purchase modern imple-ments and use the modern methods of production. It is also concluded that the use of modern agricultural technology and additional inputs are necessary for rising productivity.

Siebel (2000) reported that agriculture farming is seasonal activity. The agricultural credit institutions should increase the credit supply during the sowing season. Researcher suggested that agricultural credit should provide for only agricultural purpose, especially for crop production.

Ansari (2001) reported that agricultural productivity could be increased through the introduction and promotion of innovative agricultural technology. Farmers are looking towards financial sources for taking loans on easy terms and conditions so as to increase their agricultural productivity.

Iqbal et al. (2003) suggested that the formal financial institution should be encouraged to expand the agriculture loans for farming sector especially small poor farmers. The study also indicated that the institution should expend the loan for consumption farmers in case of emergencies (flood and drought etc). In addition to a crop insurance, other schemes should also be launched to provide protection to the farmer against the pest attack, drought, heavy rains and flood) on payment of minimum premium.

Chachar (2007) found that credit is the need of both subsistence and economic land holders for production and development. 95% farmers have less than 25 acres land. Mostly in rural areas, where the institutional finance is neglected except ZTBL. The small farmers are hesitating to avail credit facilities from formal institutions due to complicated and lengthy procedure. They prefer to purchase the input on double prices payable after the marketing of their produce.

Data source

This study was designed to cover a period of 20 years (1996-2015). A time series data was used for this study. Data used in this study were collected from Economic survey of Pakistan (2014-15). The main objective of this study is to investigate the impact of formal credit on agricultural output (value added.) through econometric analysis.

Model specification

Conventionally, agricultural output function depends upon the inputs such as land, labour, capital and other inputs like as water, fertilizer, pesticides etc. However, in this study agricultural output (value added) was used as dependent variable and output was assumed to be a function of availability of credit and all those inputs which were purchased with the help of credit such as seeds, fertilizers, tractors and tube wells. But, instead of taking seeds, fertilizers, tractors and tube wells, only credit was taken as this was used to purchase all these inputs.

Model estimation

The study was conducted in the year 2015 by using an econometric analysis to assess the impact of formal credit on agricultural value added in Pakistan .Secondary data ranging from 1996 to 2015 on the above variables has been taken from Economic Survey of Pakistan (Statistical Supplement, 2014-15) .In modern approach Augmented Dickey Fuller test (Dickey and Fuller, 1979, 1981) and Phillips-Perron (PP,1988) test was applied to check the stationarity of the data and the Akaike Information Criterion (AIC) was used to select the optimum ADF lag. Variables, which were non-stationary at level, were again checked to assure the stationary after taking first difference and second difference. Furthermore, to empirically estimate the long run relationship we employed the multivariate co integration technique (Johansen-Juselius). To investigate the impact of credit on agricultural output (value added), the method of Ordinary Least Square (OLS) was used and the following model was estimated inducting agricultural credit as explanatory variable while agricultural output as dependent variable.

Lnagriop = β0 + β1Lncr +µ (1)

Where, Lnagriop = Natural logarithm agricultural output (value added) measured in terms of million rupees;

Lncr = Natural logarithm of credit disbursement from all institutions in million rupees;

µ= error term

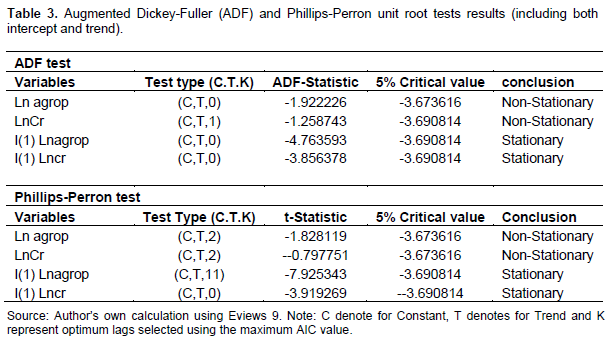

The problem of autocorrelation has been solved by using Durbin two-step methods. At first step, the following model was estimated to find out the value of ρ^ (that is, coefficient of Lnagriop-1, which is β1 here).

Lnagri = β0 + β1Lnagriop-1 + β2Lncr + β3Lncr-1 (2)

At second step, Lnagriop* has been regressed on Lncr*

Where

Lnagri* = Lnagriop - ρ^ Lnagriop-1

Lncr* = Lncr - ρ^ Lncr-1

A statistical package Eview has been used for deriving the results.

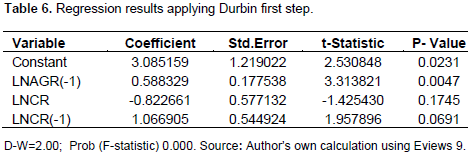

Table 3 presents the results of the ADF and PP unit-root test for dependent variable (Agricultural output (value added) and independent variable (Formal credit) in the levels and first difference including both intercept and trend. The results showed that the series were stationary at first difference, I (1) and non-stationary at their levels.

Since all the series were at the same order, the dataset was appropriate for further analysis. The dependent and independent variables are stationary at the first difference. The results from the Johansen Co-integration analysis were present in Table 4 where the Eigen value and trace statistics examine the null hypothesis of no co-integration against the alternative of co-integration. Therefore, analysis of annual data from 1996 to 2015 appears to support the proposition that there exists a stable long run relationship among the dependent variable agricultural output (value added) and independent variable formal Credit. The values of the trace statistic were greater than relevant critical values which showed that the existence of 2 co-integration equation (s) at 5% statistically significant level.

Regression analysis

Table 5 presents the result of the regression analysis using Ordinary Least Square (OLS) method. The empirical regression results indicate that formal credit is statistically significant at both 1 and 5% probability level. However, the coefficient value of formal credit showed that 1% increase in credit, agricultural output (value added) will increase at 0.86%. These results are in line with the earlier studies by Feder et al. (1991), Khander and Faruqee (1999), Nazli (2001), Olagunj (2007), Bashir et al.(2008,2009) and Chandio et al.(2015).The high value of R2 was 0.77 which indicated that about 77% of total change in agricultural output (value added) by independent variable formal credit.

.png)

Durbin-Watson value (0.96) suggests positive serial autocorrelation. To take away the autocorrelation, Durbin-two step method is estimated. The results of Durbin-two step method are given in Tables 6 and 7. In the first step, the estimated value of ρ^ is 0.588329. In the second step, putting this value in the transformed model, gave the Durbin-Watson value equal to 1.92, which is closer to 2 showing no problem of autocorrelation.

The main purpose of this study was to investigate the impact of formal credit on agriculture output (value added) in Pakistan for the period of 1996 to 2015. Data was collected from Economic Survey of Pakistan. Augmented Dickey Fuller (ADF) and Phillips-Perron test was applied for check the stationary of data. In order to analyze the data Ordinary Least Square (OLS) method was performed to show the impact of formal credit on agriculture output (value added). From the facts and figures it was clear that impact of formal credit on agricultural output was positively and significantly. The coefficient of credit was 0.860350; this means 1% increase in credit will increase the agricultural output by 0.86%. The explanatory variable (formal credit) was statistically significant at both 1 and 5% probability level of significance. However, credit is an important component which is used indirectly in agricultural production systems.

On the basis of above study it can be concluded that credit itself cannot play any direct role in increasing the agricultural output rather indirectly supports in the growth and development of agriculture sector through purchasing modern inputs. Therefore, the following recommendations are suggested:

1. The procedure of credit should be make simple and

easy it could be a good opportunity for small farmers and

credit should be provided in kinds as compare to cash.

2. Small farmers and small tenant usually facing the financial problems and they are not able to purchase high yield variety seed, sufficient fertilizer, pesticide and modern equipment, therefore specially ZTBL and Commercial banks should supply credit on flexible terms and conditions to small framers and small tenant.

3. Financial institution should provide information through electronic media and print media about agricultural credit in farming communities so they have an easy way to access to the financial services.

4. The government of Pakistan through the ministry of Agriculture should collaborate with financial institutions and other stakeholders, should lunch crop insurance scheme for farmers as compensation in case of crop failure by flood, draught, pest attack, and heavy rains because during 2010-11 and 2015 small farmers and tenant faced this kind of problems, thereby will help the farmers to sustain their livelihood.

5. Government of Pakistan should support small farmers through credit schemes on affordable interest rate and subsidize on agricultural inputs such as fertilizers, seeds and pesticide. It will help in raising farm productivity and the standard of living of the small farmers.

The author is thankful to Mr. Jiang Yuansheng, Deputy

Dean, Faculty of Economics and Management, Sichuan Agricultural University and Mr. Feng Wei, Assistant Professor Faculty of Economics and Management, Sichuan Agricultural University, Wenjiang Chengdu Sichuan 611130, China, for his support, suggestions, and co-operation during the research work.

The authors have not declared any conflict of interest.

REFERENCES

|

Abedullah N, Mahmood M, Khalid I, Kouser S (2009). The role of agriculture credit in the growth of livestock sector: A case study of Faisalabad, Pakistan. Vet. J. 29(2):81-84.

|

|

|

|

Afzal M (2004). Impact of Institutional credit on Agricultural output, unpublished MPhil's thesis G.C. University, Lahore, Pakistan

|

|

|

|

|

Ansari FB (2001). Agricultural Development Bank of Pakistan to promote innovative technology. House J. Agro. Bankers ADBP, Islamabad, Pakistan.

|

|

|

|

|

Bashir MK, Gill ZA, Hassan S (2009). Impact of credit disbursed by commercial banks on the productivity of wheat in Faisalabad district, Pakistan. China Agric. Econ. Rev. 1(3):275-282

Crossref

|

|

|

|

|

Bashir MKG, ZA Hassan, S Adil SA, Baksh K (2008). Impact of credit disbursed by commercial banks on the productivity of sugarcane in Faisalabad district, Pakistan. J. Agric. Sci. 44(2):61-63.

|

|

|

|

|

Chachar A (2007). Agricultural credit: the way forward. Dawn group of newspapers. www.dawn.com/2007/12/03/ebr5.htm

|

|

|

|

|

Chandio AA, Jiang Y, Joyo,MA, Noonari s,Sahito,JH(2015) The Role of Microfinance in Fisheries Sector: A Case Study of Ibrahim Hyderi District Karachi (EAST) Sindh Pakistan. Austral. J. Bus. Manage. Res. 05(03):38-47.

|

|

|

|

|

Chandio AA, Jiang Y, Koondher MA (2015). Raising Maize Productivity through Agricultural Credit A: Case Study of Commercial Banks in Pakistan. Eur. J. Bus. Manage. 7(32):159-165.

|

|

|

|

|

Dickey DA, Fuller WA (1979). Distribution of the estimators for autoregressive time series with a unit root. J. Am. Stat. Assoc. 74(336):427-431.

|

|

|

|

|

Dickey DA, Fuller WA (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica 49(4):1057-1072.

Crossref

|

|

|

|

|

Feder GJ, Lau LY, Luo X (1991). Credits effects on productivity in Chinese agriculture.Working Paper Agriculture and Rural Department the World Bank Washington DC. USA.

|

|

|

|

|

Government of Pakistan (2014-15). Statistical supplement, Economic Survey. Ministry of Finance Division, Economic Advisor's Wing, Islamabad, Pakistan.

|

|

|

|

|

Government of Pakistan (2010-11).Economic Survey of Pakistan. Ministry of Finance Division, Economic Advisor's Wing, Islamabad, Pakistan.

|

|

|

|

|

Government of Pakistan (2007-08).Economic Survey of Pakistan. Ministry of Finance Division, Economic Advisor's Wing, Islamabad, Pakistan.

|

|

|

|

|

Iqbal M, Ahmad M, Abass K (2003). The Impact of Institutional Credit on Agricultural production in Pakistan. Pak. Dev. Rev. 42(4):469-485.

|

|

|

|

|

Johansen S, Juselius K (1990). Maximum Likelihood Estimation and Inference on Cointegration with Application for the Demand for Money", Oxford Bull. Econ. Stat. 52:169-219.

Crossref

|

|

|

|

|

Khandker SR, Faruqee RR (1999). The impact of farm credit in Pakistan. World Bank Policy Research Working Paper No.2653.

|

|

|

|

|

Malik SJ (1989). Different access and the rural credit market in Pakistan: Some recent evidences. Pak. Dev. Rev. 28:4.

|

|

|

|

|

Mellor JW (1966). The economics of agricultural development.‖ Cornell University of credit Press, Ithaca.

|

|

|

|

|

Nazli H (2001). Role of micro credit in economic revival and poverty alleviation. J. Inst. Bankers Pak. 67:47-65.

|

|

|

|

|

Olagunj FI (2007). Impact of credit use on resource productivity of sweet potato's farmers in Osun-State, Nigeria. J. Soc. Sci. 14(2):175-178.

|

|

|

|

|

Phillips PCB, Perron P (1988). Testing for a Unit Root in Time Series Regression. Biometrica 75:335-446

Crossref

|

|

|

|

|

Schultz TW (1980). Noble Lecture: The Economics of Being Poor. J. Polit. Econ. 88(4):639-651.

Crossref

|

|

|

|

|

Siebel DH (2000). Agricultural Development bank. Close them and Reform Them? IMF (Finance and Development), P 37.

|

|

|

|

|

Sarfraz AQ, Akhter HS (1992). A critical review of rural credit policy in Pakistan. Pak. Dev. Rev. 31(4):781-801.

|

|

|

|

|

Zuberi HA (1983). Institutional credit and balanced growth: A case study of Pakistan. J. Econ. Dev. 8(2):167-184.

|

|

|

|

|

Zuberi HA (1989). Production Function, Institutional credit and Agricultural Development in Pakistan. Pak. Dev. Rev. 28(1):43-56.

|

|

APPENDIX

.png)

.png)