The Savings and Credit Cooperative Societies (SACCOS) which are co-operative financial models are flourishing in most of the developing economies recently. However, loan repayment capacity remains a challenge that threatens their future. Using financial statements data for the year 2012, from 36 SACCOS in Kilimanjaro Region, Tanzania, and using descriptive statistics and regression models in the analysis, this study examines the relationship between financial performance and loan repayment capacity. It thus examines the extent by which SACCOS are capable of recovering the loan issued and also the financial ratios that explain loan repayment capacity in SACCOS. The study depicts that there is a severe financial risk management problem among Tanzanian SACCOS. Focusing on sustainability is significant for improvements of loan repayment, but focusing on profitability in SACCOS results to an adverse loan repayment. The study asserts that the primary focus of SACCOS should not be profit but member’s wealth maximization and sustainability of the institution. Moreover, we suggest that in addition the traditional means of dealing with financial risk, the uses of a modern risk management tool like credit scoring should be considered in evaluating borrowers.

Loan repayment performance is an important concept for all the lending institutions. It is a measure of whether loans are settled up in full according to the loan contract or not. The higher loan repayment performance leads to the higher probability of the collecting interest revenues and lower loan losses in a lending institution (Okurut and Kinyondo, 2009). On the other hand, the poor loan repayments have a harmful impact on institutions capital, earning as well as in realizing its objectives and may even lead to a financial institution collapse. For instance, failure to manage loan repayment performance results in losses and high delinquency management costs (Ledgerwood, 2000). The higher expenses are for closer monitoring, more frequent portfolio and legal fees for pursuing seriously delinquent loans. Such costs adversely affect the generated income, and, in general, the operations of the lending institution, thus, the institution becomes unsustainable (Njanike, 2009).

Recently, the issue of credit risk management in microfinance institutions has become hot. Microfinance institutions prove to be highly vulnerable to poor loan recovery (Oguntoyinbo, 2011; Ayayi and Sene, 2010; visits to borrowers, more extensive analysis of the loan Arvelo et al., 2008). The point is that Micro-financialinstitutions have information opaque about their borrowers, and this plays a greater role in their failure in Credit Risk Management (Hermes and Lensink, 2007). Due to their weak institutional and managerial capacity they are not easily able to quantify quality project which means they suffer from adverse selection problem. Also, they cannot ensure that the loan issued not channeled in an alternative project that was not the reason for receiving credit which indicating moral hazard problem (Berger and Udell, 2002).

Similarly, cooperative financial institutions cannot detach themselves from loan recovery problem. This study thus focused on the Savings and Credit Cooperative Societies (SACCOS), which are co-operative based microfinance institutions, to add understanding of Credit Risk Management (CRM). The issue is, as other microfinance institutions SACCOS provide credit that lacks collateral to the poor. In SACCOS, the CRM is complicated and requires keen understanding and more innovative strategies in dealing with it. The reasons are; firstly, SACCOS as other co-operative institutions has mixed objectives to fulfill (Royer, 2014; Lagat et al., 2013). One, as a business entity, they have a financial objective of delivering services in a way that ensures the generation of income. To cover the cost of funds, other operational costs, and surplus for recapitalization purposes. Two, as co-operative, they focus on social objectives, for instance, enable members to save their money and access credit easily and at a lower costs. Three, they have to mobilize savings and to repackage the savings received to issue loans at a favorable price that benefits the members of the institution. Indeed, the second and third objectives are contradicting with the first which is focusing on sound financial stability. The reason is that the second and third objectives are likely to increase the adverse selection and moral hazards problems that, therefore, results in poor credit management.

Secondly, many stakeholders take for granted that SACCOS have a worthy portfolio, given the fact that these institutions play as cooperatives and have their standards of operations. In this case, the assumption lies in the three traditional methods of credit risk management in SACCOS that bonded to the cooperative attributes. First, as other “savings and credit” institutions, SACCOS use members’ savings deposits as security to minimize financial risks (Absanto and Aikaruwa, 2013; Huppi and Feder, 1990). A member-borrower should borrow depending to his/her savings such that in case of default, the member’s savings could recover the loan. Second, principally SACCOS are formed and serve persons with a similar field of membership/common bond. That means members know each other, as well as members, have the same focus, which then increases trust and eventually maximizes loan security (McKillop and Wilson, 2011). Third in their management structures, they have credit committees that have the task of implementing credit policy, especially in evaluating and monitoring loans.

Despite these noble practices and theoretical expectations, the current experiences do not concur with the premise that SACCOS are risk-free institutions. The current situation signals the possible severe and unrestrained financial risk problem in SACCOS. In Tanzania, for instance, the Ministry of Agriculture, Food Security and Cooperatives reports for the year 2012 show that, out of 5,424 SACCOS, 1,346 (25%) were inactive. Given the fact that the main products traded by these institutions are financial services, the number of inactive organizations, among other factors, it is associated with poor quality of loan portfolio (reduced loan repayment). More importantly, recent literature including Magali and Qiong (2014), Lagat et al. (2013) and Absanto and Aikaruwa (2013) shows doubt in the CRM practices in SACCOS. As such, there are some questions that do not have enough answers, thus need to be explored in SACCOS for the purpose of improving the management of these important institutions. Firstly, to what extent SACCOS are capable of recovering the loan issued. Secondly, what factors determine loan repayment capacity of SACCOS?

This study contributes knowledge on these issues by employing portfolio at risk for 30, 90, 365 and total, as proxy measures for the loan repayment performance in SACCOS. It used portfolio at risk in determining the nature of credit risk in SACCOS. Moreover, the study accesses the effects of financial performances by examining the effects of various financial ratios that represent growth, liquidity, profitability, and sustainability, on loan performance capacity of SACCOS. The knowledge established in this study is useful in improving SACCOS practices and more importantly in improving policies within the SACCOS industry.

OVERVIEW OF SACCOS IN TANZANIA

SACCOS are the co-cooperative, non-profit association. They are member based microfinance institutions. SACCOS are the societies whose principal objective is to encourage saving among its members and to create a credit source for its members at a fair and reasonable rate of interest. On the same line, they are voluntary associations whereby members regularly pool their savings and subsequently obtain loans that they may use for a different purpose. To the members, SACCOS is a valuable safeguard for the unexpected illness, housing, employment and provides room for investment by enhancing microenterprises. Principally, SACCOS is important in financing small investments in farm and non-farm micro-enterprises that contribute the income and poverty reduction (Wangwe and Lwakatare, 2004; Sizya, 2001).

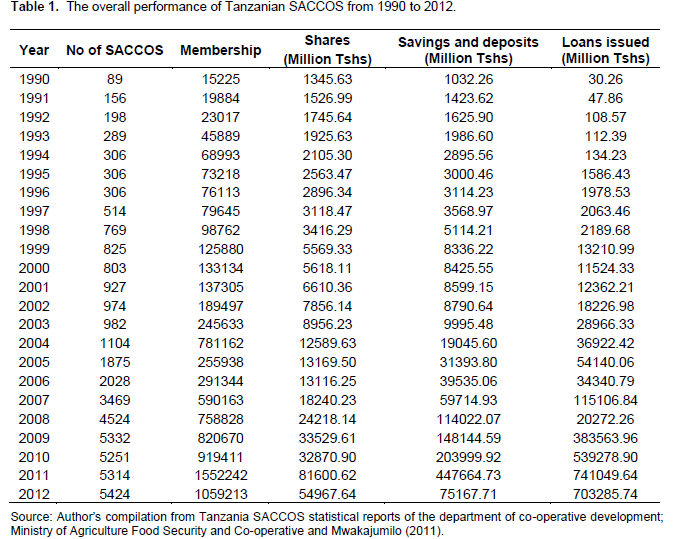

SACCOS are attractive to many people, especially in rural areas. SACCOS are now active cooperatives as well as micro-financial institutions (Kivuvo and Olweny, 2014; Sumelius et al. 2014; Kaleshu and Temu, 2012). The implication is that SACCOS has shown rapid growth and acceptance by all. In Tanzania, for instance, SACCO’s industry has shown a tremendous expansion since early 1990's. Both dimensions including the number of SACCOS and membership explain the escalation of SACCO’s industry. Also, the growth is observed in terms of savings, loans, and shares (Table 1).

From the table, a large number of newly SACCOS have been established, and perhaps some large SACCOS have developed rapidly in size. Most of these SACCOS are in rural locales and become significant institutions in rural finance. For example, the Tanzania SACCOS statistical reports of the Ministry of Agriculture Food Security and Cooperative (MAFC) for the year 2012 show that, out of 5424 SACCOS, 3039 (56%) were rural SACCOS, and 2385 (44%) were urban SACCOS. Also, the participation of men and women in SACCOS is more or less even. For the same year (2012), male members were 57% while female members were 43%.

Furthermore, recent reports show that SACCOS have gained popularity as the most useful financial tool especially in rural settings in Tanzania. According to the Bank of Tanzania (BOT, 2014) SACCOS is an essential element in the national financial inclusion framework. The BOT showed that in the year 2012, SACCOS contributed 5% out of 22% of the proportion of the population formally included in the financial arrangement. In general, there is profound acceptance and promotion by the users, governments, researchers and other stakeholders that, SACCOS are the crucial economic developmental model. Recent empirical literature like Mwangi and Wanjau (2012) indicated an active role in SACCO’s development in economic development. Consequently, the central issue, which requires continuous investigation, be their long-term viability, so as to ensure that SACCOS model remains the long run development model, which is also the subject of this study.

LITERATURE REVIEW

There is a wide literature on Credit Risk Management (CRM) in financial institutions. The general conclusion in recent literature like Ab Manan et al. (2014) is that credit risk continues to be a threat to Microfinance sustainability. Due to this there has been deliberate effort to seek more reliable and precise methods for assessing the risks in microfinance (Arvelo et al., 2008). In examining the management of credit risk in microfinance, there has been some suggestion. For instance, Oguntoyinbo (2011) studied Accion Microfinance Bank Limited (AMFB) in Nigeria and found that fine regulatory corporate governance and management practices, sound quantitative credit risk assessment and management, and quality and maturity of management lead to low credit risk accompanied by high profitability and sustainability for MFBs. Also Ayayi (2012), in a study that used data from Vietnam, found that low credit risk is a direct consequence of sound implementation of good governance practices and sustainable financial performance through sound qualitative and quantitative risk management tools.

Recent studies in SACCOS primarily have been focusing on the sustainability. Some of the recent works include Marwa and Aziakpono (2014), Olando et al. (2013) and Temu and Ishengoma (2010). Many of these determine whether SACCOS model is sustainable and efficient and in many cases, develop the determinants. However, one of the important areas of the viability of SACCOS that have given less weight in the literature is Credit Risk Management (CRM). Since SACCOS are meant to facilitate members’ savings and provide loans to members, the knowledge of loan repayment is useful as a way to ensure financial stability and increase member’s savings’ security. However despite the growing number of works in microfinance as a whole, there is tiny works specifically for SACCOS.

Among the few previous works that are available include, Absanto and Aikaruwa (2013) which investigated the role of credit rationing among member-borrowers on Loan Repayment performance in Tanzania. The study asserted that the SACCOS understudy were experiencing poor loans recovery because of the poor practice of credit rationing. The researchers referred credit rationing as the situation where the borrower receives a smaller loan amount than desired. The implication was that; the credit rationing mechanism failed to distinguish unworthy credit borrowers from creditworthy borrowers.

Magali (2013a) investigated the influence of rural savings and credit co-operative societies’ variables on the loans defaults risk of Tanzania rural SACCOS. From his investigation, the results indicated that, on total assets, the more the loans issued, the more the risk and therefore positively influenced loans defaults risk. While failing to apply their high levels of education in managing defaults and their failure to repay the loan debts, managers’ high level of education encouraged loan default risk. Nonetheless as a result of inadequate credit risk management that ensured no follow up on borrowers, the more the number of borrowers increased, the more the co-operative based MFIs were at the risk of loan defaults. The researcher was also able to establish that savings and deposits were key variables to reducing loan default risk. Therefore, the study recommended the continued use of savings and deposits as means of managing credit risk in the co-operative based MFIs. Lagat et al. (2013) examined the effect of employing credit risk management practices among Savings and Credit Co-operatives in Kenya. Credit risk management practices were risk identification, analysis, monitoring, evaluation and mitigation of the number of the loan facility and performance of the lending portfolio. They revealed that the majority of the SACCOS were primarily employing risk management practices as means of managing their lending portfolio. Also, the majority of SACCOS had the definite methods and mechanisms for identifying lending default risks. The mechanisms for identifying lending default risks described as the overall risk identification policy of the institution. Results demonstrated that risk identification, analysis, monitoring, and mitigation had significantly affected the performance of the lending portfolio. Risk evaluation found to having no significant effect on the performance of the lending portfolio. In contrast, a risk analysis was the only factor found to have no significant impact on the number of loan facilities in the lending portfolio. Others including risk identification, monitoring, evaluation, and mitigation were revealed to have a significant impact in adopting the number of loan facilities in the lending portfolio.

In general, these previous empirical studies show that despite the fact that SACCOS have risk management practices yet they are highly vulnerable to poor loan recovery. This situation is dangerous for the success and survival of SACCOS model in Tanzania and many other developing countries that are increasingly using SACCOS model. This study focuses on identifying financial ratios that are relevant in credit risk managements. As such the paper aim at increasing understanding the role of financial performance in credit management and ensuring the long-term viability of SACCOS.

The analysis of this study grounded on the importance of the CRM in financial institutions. CRM theory based on risk identification, analysis, monitoring, evaluation, and mitigation. Under this theory, therefore, the study examined how various financial ratios affect credit risk management in SACCOS. The study used secondary data gathered from SACCOS network known as Umoja wa SACCOS za Wakulima (USAWA). USAWA is an organization, created in 2006 that gather Savings and credit co-operatives into a network to mutualise technical and financial support and contribute to improving access to the management of financial services. Data collected from 2012 financial statement of all SACCOS members of USAWA (up to November 2014 there were 36).

The loan repayment performance is the dependent variable. It is measured by the percentage of the Portfolio at Risk (PAR). PAR formula is an unpaid balance divided by Current Loan Amount (outstanding portfolio) (Khan and Jain, 2009; Ledgerwood, 2000). For the sake of making a broad discussion, the study used both PARs in 30, 90, 365 days, as well as total PAR. In general, the PAR ratio shows the exact situation about the institution’s portfolio at risk and is used to evaluate potential losses, as well as any future credit risks. Increasing the percentage (ratio) means reduced loan repayment performance.

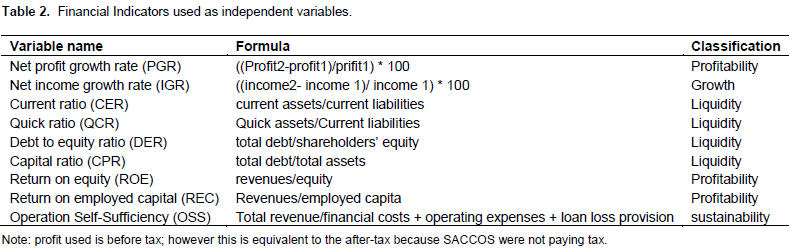

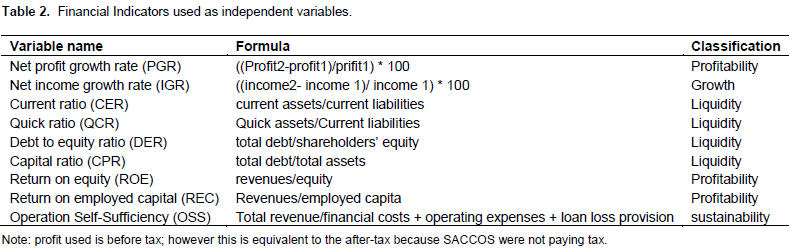

The independent variables were financial ratios, with the attentions on the profitability, liquidity, sustainability and growth ratios. Usually, for the firm’s credit risk evaluation, the financial indicators are the primary tools. The reason is that they have the nature of comparable and measurable, and so they make the comparison between the firm and historical data possible (Wei et al. 2010). The assumption in this study is that SACCOS are non-profit institutions thus the increase in profit increase adverse loan repayments. Also, SACCOS should focus on investing in loans than physical assets because they were made to provide finance to the members. Thus, liquidity is expected to lower financial risk. In term of sustainability, the assumption is that sustainable SACCOS are that which can collect the loans issued. Hence, sustainability lowers financial risks. Similarly, reasonable growth is necessary and a sign of sound performing loans. Table 2 provides the summary of independent variables (financial ratios) that is used in the model. Most of the ratios used were adapted from previous works that focused on other forms of enterprises, like Wei et al. (2010). However, the researchers were careful in calculations because SACCOS are not perfectly the same as other forms of financial institutions.

This study employed descriptive statistics and multiple linear regression models in the analysis. For multiple linear regressions the general regression model is:

PAR (30, 90, 365, Total) = β0 + β1ROE + β2REC + β3OSS + β4CER + β5CPR + β6QCR + β7DER + β8IGR + β9 PGR + µ (1)

Where:

PAR (30, 90, 365, Total) = repayment performance of loan

βis = coefficients of explanatory variables, and

β0 = is intercept

µ = error term

Then tested the hypotheses that;

H0 = β1 = β2= β3 =…β9 = 0

H1 = β1 ≠ β2≠ β3 ≠…β9 ≠ 0

Then the null hypothesis (H0) is: H0 = β1 = β2= β3 =β4 = β5 = 0, (H0 and H1 are not opposite, i.e. the opposite of H0 is H1 : βi ≠ 0 for any i ∈{1, 2,…9}(not all i ∈{1, 2,…9})).

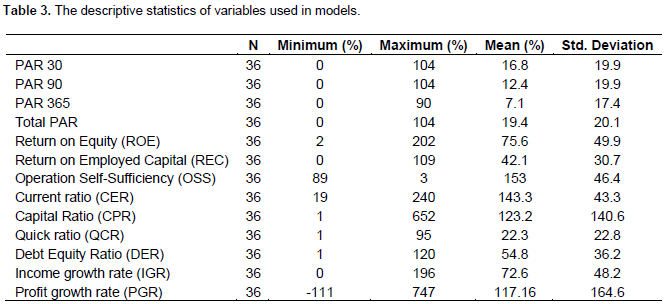

We started by analyzing the capacity of SACCOS in managing loans. In this case, the performance is presented in terms of loan repayment performance in PAR (30, 90, 365, Total). Table 3 shows that some SACCOS had PAR equal to zero. The indication is that there are SACCOS, which manage well their loans. However, most of these institutions are having a serious problem. For instance, basing on the criterion that, PAR30 days should not be above 5% of less than 2% for loans PAR 90. However, the mean values are far above the standards.

Table 4 is a summary of the default for two years, 2011 and 2012, for 36 SACCOS’ members of USAWA. First of all, the table reveals that there were no significant differences in loan performance between the two years. Secondly, the nonperforming loan is SACCOS more than 60 of all issued loans. The implication is that, at large, the industry has reduced loan recovery. These findings are in agreement with those of Magali (2013a and 2013b), and Lagat et al. (2013) that SACCOS have higher credit risk.

In Figure 1, the correlation between loan repayment performances in different periods is presented. The results indicate that there is a close relationship between PAR 30, 90, 365. The findings suggest that when SACCOS is failing to recover the loan in early days it is not capable even in the long time. The inverse is also true.

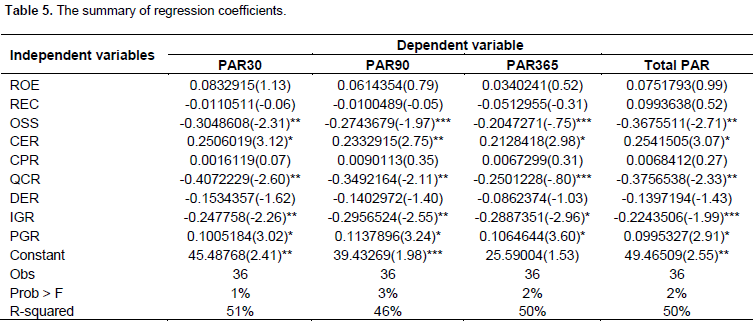

Table 5 is the empirical results. The table shows the estimated coefficients of all variables included in Equation 1, using four dependent variables (PARs) and multiple independent variables. In the table, the t-values are in parenthesis. Also *, **, and *** indicate significant level at 1%, 5% and 10% respectively. The STATA software determined the coefficients.

From the Table 5, OSS, CER, QCR, IGR, and PGR are the significant factors that influence the loan repayment performance in SACCOS. OSS is a show the negative relation to the loan repayment. The meaning is that increase in OSS increase SACCOS loan repayment capacity (note that higher percentage of the portfolio at risk indicate poor loan recovery). SACCOS, which have a higher level of OSS, are those which can maximize the collection of income from their investments. The effects of OSS are similar to the IGR that represent the growth of SACCOS, which also shown an opposite relationship with loan repayment performance. It shows that those SACCOS that have higher income growth also have good repayment capacity. This observation is similar to that of Ayayi (2012) that little credit risk has a close relationship with the sound financial sustainability.

However in the case of liquidity there are mixed results. QCR is having an inverse relationship with poor loan repayment. The meaning here is that SACCOS, which were liquid, are those which had little credit risk. However, on the other hand, more CER means reduced loan repayment performance in SACCOS. A lot of current assets in SACCOS indicate a higher level of issuing loans. This finding is congruence to the Magali (2013a) whose findings are that the larger the size of the loan granted the higher the credit risk.

Lastly the PGR (profitability growth) lower the repayment capacity. The indication is that, when an SACCOS is aiming at a profit, firstly it is needed to expand loans that are their primary business. As the results of focusing on profit, the first thing is that SACCOS increases the average loan. The problem is that most of the people collect much money without proper business plans, in which most do not manage the investment and have difficulty in repaying. Also, some SACCOS give loans to the ineligible applicants, for example, those who have no enough deposits by using compensating balance idea. For example, a candidate, who asks for Tshs 10,000,000, is approved for a loan and receiving Tshs 7,000,000 whereas Tshs 3,000,000 remains in SACCOS as compensating balance. Of course, it is the easiest way to expand business and may lead to higher profit but in turn, the institution is increasing the risk because there is less security for their money. When SACCOS are focusing on profit, they mostly depend on external funds and possibly try to stretch their managerial and institutional abilities. As commented by Huppi and Feder (1990), this should never be done in credit cooperatives. Also, the results indicate that an increase in CER and CPR increases the credit risk in SACCOS. These are the measures of liquidity and solvency. These findings might be slightly different from other creditors like commercial banks when they are rating borrowers (say institution borrowers), the higher ratio is good. For instance, it is indicated in Khan and Jain (2009) that the ratio of more than 1.5 is good as compared to that of less than 1.5.

This paper adds knowledge on credit risk management in SACCOS by analyzing the relationship between financial performance (measured by financial ratios) and loan repayment performance in SACCOS. The findings suggest that despite the available traditional tools used in SACCOS to manage financial risks, there is a higher level of credit risk problem in SACCOS. Also, findings suggest that focusing on sustainability and growth of SACCOS is a valuable tool to fight reduced loan repayments by member-borrowers. However, the results show that focusing on profitability lower loan repayment in SACCOS. The reason is that when SACCOS are focusing on the maximizing profit they tend to stretch their activities beyond their managerial and institutional abilities. As such most of the people collect much money without proper business plans, in which most do not manage the loan and have difficulty in repaying. Also, sometimes SACCOS give loans to the ineligible applicants, for example, those who have no enough deposits or have been members for a short time that their behaviors are not well known. In the case of the level of liquidity, the study found mixed results for different liquidity ratios.

From these findings, the implication is that the financial performance is important in showing the loan repayment performance. These findings congruence to the previous works like Wei et al. (2010) and Sharma and Zeller (1997) which acknowledge the role of financial indicators on firm’s credit evaluation. Thus, as cooperatives based microcredit institutions, SACCOS should focus on relevant performance, which focuses on maximizing the member’s welfare and not maximizing profit. It is also a time for SACCOS to reconsider appropriate means to improve their loan recovery. In this paper, we suggest that SACCOS can use, and it is important to use credit scoring model following the fast growth experienced in recent years. As also shown by Berger et al. (2007) and Frame et al. (2001), credit scoring on small financial enterprises tends to increase portfolio quality by reducing information opaque. That is to say, an essential tool in CRM is appropriate information through a highly efficient loan administration and management information system. This study has deployed secondary data from 36 SACCOS for one year, which then can affect the conclusion. As such, an area for future research, the study can be conducted by surveying large sample and including more financial factors and nonfinancial factor. Also, primary data will add value in understanding CRM management practices is SACCOS as well as in informal financial institutions.