Full Length Research Paper

ABSTRACT

This study's objective was to assess how lending appraisal affected SACCO performance in the District. The study's outcome variables were the performance of SACCOs, with SACCO governance serving as a predictor variable. The investigation was preceded by a cross-sectional survey. Data from 5 SACCOs with 109 respondents were collected, and both quantitative and qualitative analyses were merged. The analysis was conducted at three levels, namely: Descriptive, bivariate and multivariate analyses. Since descriptive analysis entailed description of a single variable and its attributes, frequency tables were used to present the data. At the bivariate level, a Pearson correlation matrix was conducted to ascertain the relationships between the predictor variables and the dependent variable. The dependent variable was regressed against using the updated predictor variables for loan approval at the multivariate level (performance of SACCOs). A linear regression model was used to fit the data. According to study findings from the regression model, loan appraisal (coef. = -0. 635, p-value=0.000) have a positive influence on the performance of SACCO in District. This study's main finding is that corporate governance has a big impact on SACCOS performance. The study consequently advises that more emphasis should be given to implementing corporate governance in order to ensure good performance of SACCOs in Rukiga District.

Key words: Lending appraisal, performance, SACCO.

INTRODUCTION

Appraisal refers to assessing the applicant's credit worthiness, which may also be a sign of their capacity to keep their promises (Odhiambo, 2019) and increase performance of SACCOs. A credit assessment is a thorough evaluation of a specific loan application or proposal to determine the borrower's capacity for repayment. A lender will perform a credit appraisal primarily to ensure that the bank will be reimbursed for the funds it lends to its clients (Aduda and Obondy, 2021). According to Alio (2021), three thousand years ago, in Ancient Greece and Rome, the lending system was invented. One of the first lending practices was adopted by the pawnbrokers. Pawnbrokers lend by requiring collateral from the borrower in order to reduce risk for the lender. The exchange of products initially used this strategy. Lending appraisal processes through measuring, cash flow analysis, collateral measure, character assessment, capital considerations, and conditions fulfillment globally have not been taken into consideration in an effort to improve performance, which has affected SACCO performance in terms of realizing profitability, portfolio size, growing SACCO membership, and asset base Orichom and Omeke (2021). The effectiveness of SACCOs is being questioned, which is why the majority of them are closing at a high rate and they are not growing, but governments throughout the world are interested in using them as a tool to fight poverty. In the past, lending appraisal in Africa began with microfinance and progressed through many stages. The sector was invented in the 1970s, notably in West and East Africa, by financial intermediaries such cooperatives, rural savings banks, and postal savings banks Bosco (2019). By the end of the 1990s, the sector had seen a number of donor-supported non-governmental organizations (NGOs) that only provided credit grow and occasionally change into new categories of non-bank financial institutions Agaba and Turyasingura (2022).Credit cooperatives are currently the majority in West Africa, regulated non-bank financial institutions are the majority in East Africa, and Southern Africa is served by a sizable number of NGOs, some downsizing banks, and newly established special-purpose MSME banks (Zipporah, 2019). The majority of MFIs that are reported are regulated, however the majority of uncontrolled MFIs are found in East Africa. The shifting regulatory environment that has existed since 2004 and allowed MFIs to become regulated deposit taking institutions continues to be advantageous for MFIs in Uganda. As a mortgage information and analytics supplier, Loan Performance provides risk management and financial analysis for the SACCO's operations (Cheror, 2020). A performing loan is any loan in which interest and principal payments are fewer than 90 days past due, less than 90 days' worth of interest has been refinanced, capitalized, or deferred by arrangement, and continuous payment is anticipated, according to the International Monetary Fund. Orichom and Omeke (2021) explain that loan performance is based on the notion that a loan contract's income results from an interest rate premium over a rate at which the funds could have instead been invested. As a result, it is a rough indicator of the surplus the bank could expect if there are no issues throughout the span of the credit contract. The effectiveness of a loan is also determined by the frequency of disruptions, such as borrower delays in making principal and/or interest payments, borrower technical defaults, or even insolvency. According to Gichuhi and Omagwa (2020), such disturbances imply either a categorical loss of payments for the bank, increased costs owing to renegotiations, active engagement in the borrower's company policy, usage of collateral, or possibly all of these elements. Therefore, loan performance declines as the frequency of such interruptions increases. From 2017 to 2018, Kihanga SACCO's loan portfolio had a performance of 75%; from 2018 to 2019, it had a performance of 45%; from 2019 to 2020, it had a performance of 30%; from 2020 to 2021, it had a performance of 25%; and in 2021–2022, it had a performance of 20%. Bukinda SACCO's loan portfolio has performed satisfactorily from 2017 to 2018 with a 69% success rate, 57% success rate from 2018 to 2019, 46% success rate from 2019 to 2020, 30% success rate from 2020 to 2021, and 25% success rate from 2021 to 2022. The performance of the loan portfolio at Kamwezi SACCO from 2017 to 2018 was 78%, the performance from 2018 to 2019 was 70%, the performance from 2019 to 2020 was 62%, the performance from 2020 to 2021 was 45%, and the performance from 2021 to 2022 was 20%. Lyamujungu SACCO's loan portfolio has performed 74% satisfactorily from 2017 to 2018, 50% satisfactorily from 2018 to 2019, 46% satisfactorily from 2019 to 2020, 35% satisfactorily from 2020 to 2021, and 18% satisfactorily from 2021 to 2022. Rukiga SACCO's loan portfolio has performed 81% satisfactorily from 2017 to 2018, 62% satisfactorily from 2018 to 2019, 30% satisfactorily from 2019 to 2020, 21% satisfactorily from 2020 to 2021, and 15% satisfactorily from 2021 to 2022.This was the driving force behind the researcher's inquiries into the reasons behind and approaches to identifying timely solutions.

LITERATURE REVIEW

In a study by Jepkorir (2022) on the impact of lending appraisal on SACCO performance in Kenya, it was found that when a client is being considered for a loan facility, their records in the SACCO should be transparent and show cash flow analysis, collateral considerations, character evaluation, and conditions fulfillment. The study used a case study approach and came to the conclusion that lending appraisal should make a clear assessment of the clients' records in the institution for efficient loan disbursement. The choice should be based on how the SACCO's performance ought to be. Given the loan sizes and terms, the loan appraisal should include the clients' ability to repay the loan. Joshua et al. (2021) conducted a study of the Influence of Credit Risk on Financial Performance of Deposit Taking Microfinance Banks in Kenya. The findings revealed that, the study examined 9 banks over a 7-year period (2011 to 2017). The association between credit risk and performance of deposit-taking microfinance banks in Kenya was captured using secondary data. Descriptive statistics, correlation analysis, and panel regression analysis were used to analyze the data. Eview version 8 statistical software was used to calculate the association between the study variables. Using Durbin-Watson factors, the autocorrelation within the regression model was examined. The null hypothesis was tested for acceptance or rejection using the augmented Dickey Fuller (ADF) unit root test (non-stationarity) (stationality). According to the regression results, credit risk had a favorable and statistically significant impact on the financial performance of Kenya's deposit-taking microfinance institutions. In addition to analyzing the impact of credit risk on other financial institutions like SACCOs and commercial banks, the study suggests that additional research be done to determine the impact of credit on the financial performance of deposit-taking microfinance banks using more credit variables and longer time periods. Additionally, as they are not covered by the study, research on additional risks, such as market, interest-rate, liquidity, strategic, compliance, and legal risks, needs to be done. However, the study was silence of the 5cs which guide lending appraisal on performance of SACCOs.

According to (Karanja and Simiyu, 2022) loan assessment is the "heart" of a stellar portfolio (2022). A study on the credit management practices and loan performance of microfinance banks in Kenya was undertaken by Karanja and Simiyu. This study's objective was to determine the impact of credit management techniques on loan performance at Kenyan microfinance firms. This effort focuses on 13 microfinance institutions in Kenya. An approach to descriptive research was used in the study. Additionally, the study indicated that client evaluations were successful. According to the report, the company investigates a client's creditworthiness before approving a loan. The study discovered that the bank employs credit analysts, whose job it is to evaluate every possible loan applicant. There are many service providers that the bank has hired, such as credit tracking companies to help track vehicles used as collateral, insurance companies, law firms that help with security in cases where land has been used as collateral, CRB companies that help by providing information on clients' CRB performance, and company search firms, such as credit info, that help. According to the survey, the rate of loan defaults is under 20%. The study also discovered that calling clients regularly to remind them of their loan obligations, especially the persistent defaulters, can enhance loan performance. According to the analysis, microfinance banks in Kenya had significant advance displays of credit policy, client evaluation, collection policy, credit terms, and credit hazard control, all of which were rated at 5% importance and 95% certainty. The review's findings reveal that their organizations conduct customer evaluation. The study also revealed the value of client evaluations. According to the study, the company investigates a customer's credit quality before approving a loan.

A study on the credit management practices and financial performance of savings and credit cooperatives (SACCOS) in Mid-Western Uganda was also carried out by Kule et al. (2020). The study's goal was to determine the connection between SACCOs in Mid-Western Uganda's credit management systems and their financial performance. A closed-ended questionnaire was employed in the investigation. The typical linear regression analysis was run. Findings: A modest, significant, and favourable association between credit management systems and the financial performance of SACCOs in Mid-Western Uganda is revealed by the study's findings. One-of-a-kind contribution to practice and policy: This report advises management that in order for SACCOs to improve their financial performance by ensuring that attractive terms and conditions and an adequate client appraisal procedure are in place, effective credit management systems must be put in place. Government could also assist SACCOs by training personnel in the creation of credit terms and conditions and enhancing their client evaluation skills. To back up what has been said A study on the impact of client evaluation and loan monitoring strategies on the repayment of revolving funds in Kenya was carried out by Kinyua et al., 2022. The study's goal was to determine how client evaluation and loan monitoring procedures affected Kenya's revolving fund repayment. The study, which was completed in the 18-month period from January 2020 to June 2021, focused on Kenyan government revolving funds that were disbursed from 2010 to 2019. The WEF officers in the 47 counties and the Youth officers in the constituency were the target demographics. Purposive sampling and a correlational research strategy were used in the study. Data was gathered by questionnaires, and SPSS version 23 was used for analysis. The results of the study showed that business assessment visits (coefficient 5.473, P-000), training frequency before disbursement (coefficient 2.715, P-0.002), and the type of training provided before disbursement (coefficient 5.473, P-000) all had positive and significant effects on the repayment performance of revolving funds (coefficient 7.548, P000). On the other hand, it was shown that the frequency of monitoring visits had a favorable and significant impact on Kenya's revolving fund repayment performance (coefficient 2.327, P-0.023). Additionally, the amount of arrears report had a favorable and significant impact on Kenya's revolving fund payback performance (coefficient 2.842, P-0.02). The study found that loan monitoring tactics significantly improved the repayment performance of revolving funds in Kenya, while there was a strong positive correlation between customer appraisal strategies and repayment performance of revolving funds in Kenya. The five c's, however, which are crucial for improving SACCO performance, were not covered.

In general, the loan should be secured by collateral, and the board of directors should document and approve the route of approval. The success of SACCOs is indeed impacted by loan lending policies. The majority of SACCOs have efficient and effective loan lending practices. According to a study by Oji and Odi (2021), management can assess how well it will be able to generate profits from the SACCO's entire pool of assets through loan appraisal. If this assessment is not done well, it could have negative effects on asset returns and the financial performance of SACCOs in the USA. There was no need for SACCOs to improve their client loan evaluation policy in order to have a favorable impact on financial performance, according to the study's recommendations, which were based on a complete loan appraisal of the loan application before loan advancing. Salaton et al. (2020) further noted that credit evaluation provides SACCOs with knowledge about the rate of interest to charge the clients that may not push them too far into a corner by taking into account the clients' financial strength, credit score history, and payment patterns (Wambua et al., 2021) The processes and techniques used in credit evaluation have an impact on the efficiency of the credit appraisal system. In SACCOs, credit appraisal procedures range from straightforward objective methods to unofficial ways to highly intricate strategies including the use of simulation. Before increasing the loan facility, Wanyonyi et al. (2019) examined the efficiency of loan appraisal in determining the borrower's behavior and character. She also looked at how it affected the financial performance of SACCOs in Nigeria. According to Wilberforce et al. (2021), the degree to which financial transactions are conducted with trust, confidence, and the least amount of risk determines how effective SACCOs are in fostering growth and financial performance.

MATERIALS AND METHODS

Research design

This study used across sectional survey research design adopting quantitative and qualitative approaches. Quantitative approach helps to describe the current conditions and to investigate cause and effect relationships between the study variables, Mulinge (2019) while qualitative approach helps to gain insight, explore the depth, richness and complexity inherent in the phenomenon under investigation. The quantitative approach is sought to quantify and establish the relationships while the qualitative approach helped the researcher gain in-depth explanations on loan appraisal on performance of SACCOs in District.

Area scope

July 2017, Rukiga District was wrapped into District from Kabale District. It only has one county, four sub counties, two town councils, thirty parishes, and two hundred and ninety-three villages. Southern Uganda is where the district is situated. The Ntungamo District to the east, Kabale District to the southwest, Rubanda District to the northwest, and Rukungiri District to the north is the districts that border the District. The district offices are situated 11 km from the Mbarara-Kabale Highway. According to the Local Government Quarterly Performance Report (2018/2019), district has 56 registered SACCOs that are overseen and managed. This study took into account 5 SACCOs namely Rikiga SACCO, Kihanga-Mparo SACCO, Bukinda SACCO, Lyamujungu SACCO and Kamwezi United SACCO.

Data sources

Employees and members of the Rikiga SACCO, Kihanga-Mparo SACCO, and Kamwezi United SACCO provided the data for this study. Interviews and questionnaires were the main data sources for this project.

Study population

150 people from 4 SACCOs in Rukiga District make up the study's total population. Due to their high-performance levels in the District, four (4) SACCOs were chosen. But despite being the hub of Rukiga District, the rate at which the SACCO is deteriorating is worrying. The target population for the study consisted of the 15 employees of the SACCOs, with a fraction of 5 given to each SACCO. A list (sample frame) of these staff members and members from each SACCO was compiled. There were 135 members altogether among the 5 SACCOs, with 45 members apiece. There were three managers in all for the three SACCOs, one for each of the SACCOs. 150 people made up the study's population.

Sample size determination

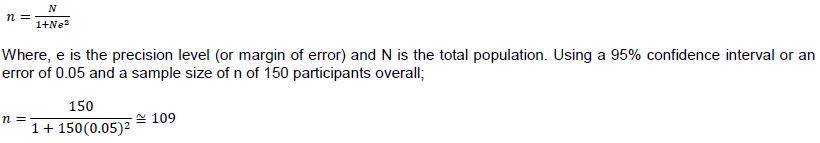

The researcher chose a total of 150 participants for the study and calculated the sample size using the formula provided in Tora Yamane (1970:886–87), as shown bellow.

Therefore, out of the total population of 150, 109 respondents were sampled.

Sampling techniques

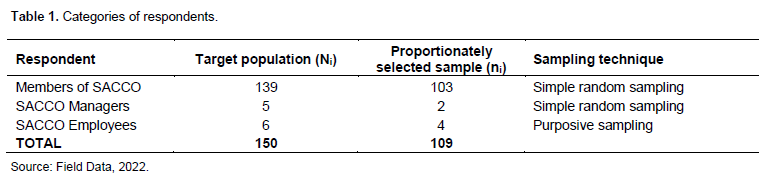

The population of the study was divided into subgroups using stratified random sampling, as indicated in Table 1 column 2. "Stakeholders' obligations" functioned as the subpopulation (N i) for the stratifying variable. Following that, sub samples (n i) were chosen using the probability proportional to size method;

Where N=150, n=109 and Ni=141;3 and 6.

Data collection methods and techniques

A systematic questionnaire was administered by the researcher in order to gather data from primary sources. This allowed the enumerators to clarify any issues that the respondents had questions about or that they felt were unclear. SACCO managers, SACCO staff, and SACCO members all received the questionnaire. The questionnaire was administered by the researcher, two research assistants, and enumerators. The enumerators had a full day of training in performing fundamental research, notably in practice surveys, and were then prepared to handle the data gathering work.

Quality control (validity and reliability)

Validity

To ensure validity, the research instrument covered all the dimensions of the phenomenon under study as clarified in the conceptual framework. (Orichom and Omeke, 2021) Prior to the study, the researcher visited District administration to seek for permission to conduct a study from the district and to ascertain that the study was necessary. This helped the researcher to make arrangements to ensure that all the necessary data was collected freely and timely.

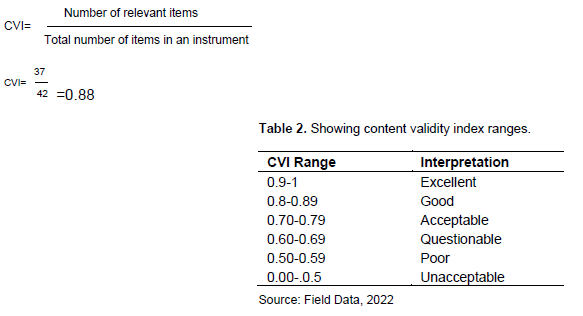

The questionnaire's format, contents, clarity, consistency, and relevance in relation to the research objectives were discussed with coworkers and the supervisor. The content validity index (CVI), a measure of an instrument's level of accuracy, was computed to determine the instruments' level of accuracy (Table 2). It was calculated using Amin's CVI formula from 2005: CVI = Number of items declared valid / total Number of items. The researcher calculated the CVI to assess the instrument's level of accuracy, and then used George and Mallery's (2003 rule of thumb to interpret the CVI:

A questionnaire had a good content validity index of 0.88, indicating that the instrument was reliable for gathering data

Reliability

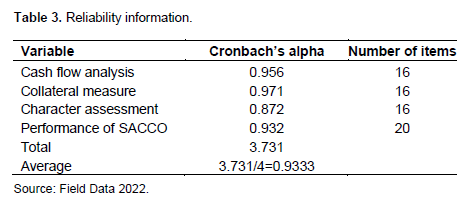

Reliability evaluations look at how consistently the measuring tools give results when the same populations of people are repeatedly measured under the same circumstances (Wilberforce et al., 2021; Turyasingura et al. (2022). A pilot study with respondents who were purposefully and simply chosen at random from the target area is also used to test the validity of the research tools. Five SACCOS in the District served as the pilot recipients of questionnaires. They were asked to review the questionnaire for the following qualities: question design, language, clarity, and thoroughness. Cronbach's Alpha coefficient was used to further prove the instruments' dependability. The results are 0.76 on a Statistic Package for Social Scientists (SPSS) scale, which shows that the tools are more accurate and useful. Therefore, it is inferred that there is a high level of trust in the dependability of the entire scale if individual items are significantly connected with one another. In terms of the Cronbach's alpha, George and Mallery (2003) offer the following guidelines: " > 0.9 - Excellent, > 0.8 - Good, > 0.7 - Acceptable, > 0.6 - Questionable, > 0.5 - Poor, and < 0.5 - Unacceptable" (Table 3).

Data management and analysis

Data management and processing

Three stages of data analysis, descriptive, bivariate, and multivariate were carried out. Frequencies, tables, and other output were produced as part of the descriptive analysis. In a bivariate study, the Pearson rank correlation was used to determine the linkages between categorical variables and, in addition, to compute the connections between the dependent variable and the independent variables. Again, cross tabulations were utilized to show relationships between the variables.

Multivariate analysis

Only independent variables that at the bivariate stage showed a significant connection with the dependent variable were incorporated into the linear regression model at this point in the fitting process. In other words, at the multivariate level, only variables that were significant in the bivariate stage were regressed. The equation below represents the multivariate model;

.png)

The success of SACCOs was predicted to be positively impacted by proper cash flow analyses, collateral measures, and character assessments.

Ethical considerations

The study was conducted solely for academic purposes; thus, the researcher asked the district SACCO administration for approval. Before distributing the questionnaire, she also asked the respondents for their consent

RESULTS AND DISCUSSION

Descriptive statistics for lending appraisal on performance of SACCOs in Rukiga District

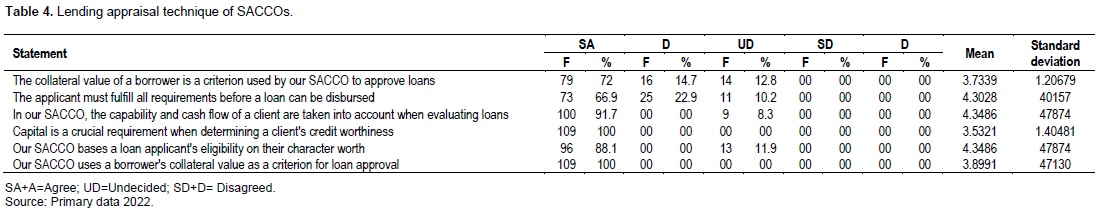

This section presents the descriptive statistics based on the views of respondents regarding lending techniques of SACCOs in district (Table 4).

SACCOs use a borrower's collateral value as a criterion for loan approval

When asked if our SACCO uses a borrower's collateral value as a criterion for approving loans, 72% of respondents said yes, compared to 14% who were undecided at the time of data collection with the mean response of 3.7339, and the standard deviation of 1.20679. This implies that on average 3.73 of the respondents said yes. This suggests that the loans SACCOs provide to customers are determined by the loan officers' recommendations (Moma, 2019). Agaba and Turyasingura (2022) concurred, stating that loan performance serves as a provider of mortgage information and analytics, providing risk management and financial analysis for the SACCO's activities. And this is supported by Muriithi (2019).

Before a loan may be disbursed, the applicant must satisfy all requirements to obtain it

The results showed that before a loan can be disbursed, the applicant must satisfy all requirements for accessing

one. 10.1% of respondents were undecided, compared to 66.9% of respondents who strongly agreed with the statement with mean of 4.3028 with standard deviation of 40157.This implies that, 4.303 of the respondents said yes. This shows that the majority of the respondents who have been dealing with these SACCOs in District have found the lending methods to be effective. People who weren't sure may have firmly joined the SACCOs. Mongare and Nyakwara (2019) concur that a loan application must be supported by collateral before it can be approved. This suggests that the credit appraisal or loan appraisal process should be a comprehensive activity that begins when a potential borrower enters the bank and ends with credit delivery and monitoring.

In their SACCO, the client's capacity and cash flow are taken into account while evaluating loans

The results showed that in their SACCO, the client's capacity and cash flow are taken into account while evaluating loans. This demonstrated that 100% of respondents strongly agreed with the statement, which was supported by all respondents with mean of 4.3486 with standard deviation of 47874. This implies 4.48 of the respondents said yes. This suggests that the loans department pays close attention to the guidelines and practices that governed borrowing. The success of SACCOs can be attributed to this. According to Zipporah (2019), the client's loan application should be in place with the client cash flow within the company as the basis for an effective credit risk management procedure and this is supported by Muiruri et al, (2021)

When evaluating a client's credit worthiness, capital is a critical prerequisite

The results showed that capital is a crucial requirement when evaluating a client's credit worthiness with 100% with mean of 3.5321 with standard deviation of 1.40481. This implies that, 3.5.3 of the respondents said yes. The assertion was firmly agreed with by each and every respondent. This shows that the SACCOs in the district are doing well overall. Customers whoborrow money from SACCOs can afford to pay it back. This is in keeping with Salaton et al. (2020) assertion that credit provision needs careful consideration because credit risk management is one of the key components and a pressing issue among the problems that banks face. The two posts assert that risk management is essential for both sustainability and the expansion of the banking industry. It also helps stabilize the local currency and the economy as a whole.

SACCO bases a loan applicant's eligibility on their character value

The results demonstrate that SACCO bases a loan applicant's eligibility on their character value. This was demonstrated by the fact that 88.1% of respondents strongly agreed with the statement, compared to 11.9% who were unsure with mean of 4.3486 and standard deviation of 47874. This is an indication that, 4.348 of the respondents said yes. This suggests that the client must have been saving well and have a good character in order to acquire a loan facility.

The worth of the collateral determines a loan applicant's eligibility according to SACCO

The results demonstrate that SACCO bases a loan applicant's eligibility on the value of their collateral. This is shown by the fact that, during data collecting, 100% of respondents strongly agreed with the statement with the mean of 3.8991 and standard deviation of 47103. It means that, 3.899 of the respondents said yes. This suggests that, as far as SACCO performance is concerned, leadership tactics strategies in the SACCOs functioning in the Kabarole district have been successful for the institutions. This concurs with Agaba and Turyasingura (2022), who believe that poorly managed credit risk can result in liquidity risk, which leads to the insolvency of financial institutions. They also believe that the presence of risk in the financial sector is linked to the products they offer. Therefore, if loan quality slightly declines, the business is likely to fail, and credit risk management presents a workable alternative.

Bivariate analysis

Correlation analysis

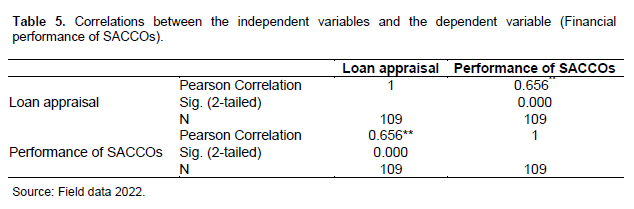

The correlations between the performance of SACCOs and the predictor variables (cash flow analysis, collateral measure, and character assessment) are shown in this section. The correlation matrix shows how the predictor variables and the dependent variable are related (Table 5).

Relationship between loan and performance of SACCO

Table 4 findings demonstrate that loan appraisal showed a substantial positive relationship (r=0.656**; p-value 0.01) with the performance of SMEs. These results suggest that loan evaluation enhances SACCO performance. According to Agaba and Turyasingura (2022), as a mortgage information and analytics supplier, Loan Performance provides risk management and financial analysis for the SACCO's operations. A performing loan is any loan that contains interest and principal payments that are fewer than 90 days past due, that has had less than 90 days' worth of interest refinanced, capitalized, or agreed-upon interest deferred, and that is expected to continue to be paid.

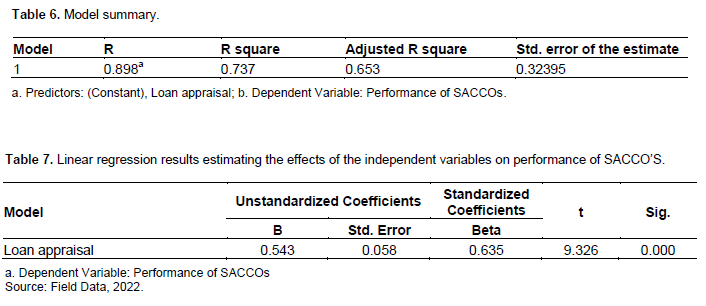

Multiple regression analysis

This section uses a linear regression model to describe the multivariate results for loan appraisal on SACCO performance. The performance of the SACCO was the dependent variable, and this model was chosen since it converted it into a continuous variable. According to Table 6 the independent variable loan appraisal (adjusted R-squared = 0.653) explains 73.7 percent of the variation in the performance of SACCOs. This suggests that even if SACCOs adhere to internal controls, SACCO governance, and loan evaluation procedures, they will only see a 62.7% improvement in performance. This indicates that in addition to loan evaluation, other financial management techniques also have an impact on SACCO success. Results indicate a substantial positive correlation between loan appraisal and SACCO performance (coef = -0.653, p-value = 0.000). Keeping other predictor factors fixed, an increase in loan appraisal is correlated with a 0.635 increase in SACCO performance (Table 7). The alternative hypothesis is preferred above the null hypothesis, which states that loan appraisal has no discernible impact on the performance of SACCOs.

CONCLUSION

The findings and discussion lead to the supposition that loan appraisal and SACCO performance in the district are significantly positively correlated. There was sufficient evidence to disprove the null hypothesis that loan appraisal had no impact on SACCO performance. These results demonstrate unequivocally that most SACCOs carry out cash flow analysis, collateral measure, character assessment, capital considerations, and condition fulfillment.

RECOMMENDATIONS

In order to make sure that the people requesting for loan facilities in the area can repay the money they have borrowed, the study advises management to first carefully assess the applicants' or customers' character, capacity, condition, and collateral. The profit will increase as a result, payments to employees will always be made on time, and performance information will be available.

CONFLICT OF INTERESTS

The authors declare they have no competing interests with study design or final report, no financial or personal relationships with other people or organizations that could inappropriately influence this research.

REFERENCES

|

Aduda J, Obondy S (2021). Credit risk management and efficiency of savings and credit cooperative societies: A review of literature. Journal of Applied Finance and Banking 11(1):99-120. |

|

|

Agaba M, Turyasingura JB (2022). An assessment of the accounting techniques on business performance in selected commercial banks in Kabale Municipality, Uganda. International Journal of Academic Accounting, Finance and Management Research 6(9):28-37. |

|

|

Alio D (2021). Determinants of credit utilization among Savings and Credit Cooperatives (SACCOS) members in Soroti district, Uganda (Doctoral dissertation, Makerere University). |

|

|

Bosco NJ (2019). Loan Management And Performance Of Microfinance Institutions In Rwanda: A Case Musanze District (2015-2017). |

|

|

Cheror WN (2020). Impacts of credit management practices on financial stability of savings and credit cooperative societies. |

|

|

Gichuhi AW, Omagwa J (2020). Credit management and loan portfolio performance of savings and credit cooperative societies in Nyandarua County, Kenya. International Academic Journal of Economics and Finance 3(5):121-139. |

|

|

George D, Mallery P (2003). SPSS for Windows step by step: A simple guide and reference. 11.0 update (4th edition). Boston, MA: Allyn & Bacon. |

|

|

Jepkorir S (2022). Determinants of Financial Distress in Deposit-Taking Savings and Credit Cooperative Organizations in Kenya. Doctoral dissertation, JKUAT-COHRED. |

|

|

Joshua A, Olweny T, Oloko M (2021). Influence of credit risk on financial performance of deposit taking Microfinance Banks in Kenya. |

|

|

Karanja SG, Simiyu EM (2022). Credit Management Practices and Loan Performance of Microfinance Banks in Kenya. Journal of Finance and Accounting 6 (1):108-139. |

|

|

Kinyua JW, Kiiru G, Njoroge D (2022). Effect of Client Appraisal and Loan Monitoring Strategies on the Repayment of Revolving Funds in Kenya. |

|

|

Kule BJMK, Kamukama N, Kijjambu NF (2020). Credit management systems and financial performance of savings and credit cooperatives (SACCOS) in mid-western Uganda. |

|

|

Moma J (2019). Effects of credit policy on financial performance of savings and credit cooperative societies at premier credit organization in Kampala Uganda (Doctoral dissertation, Kampala International University, College of Economics and Management). |

|

|

Mongare OJ, Nyakwara S (2019). Analysis of Performance Appraisal Implementation on Organization Performance in Saccos: Case of Kisii County, Kenya. Available at: |

|

|

Muiruri ZW, Ndegwa J, Gweyi M (2021). Moral Hazard Related Determinants of Bad Debts in Deposit Taking Saccos in Nairobi County. Journal of Finance and Accounting 5(1):1-15. |

|

|

Mulinge EK (2019). Effect of Credit Risk Management Framework On Financial Performance of Deposit Taking Savings And Credit Cooperatives In Kenya. |

|

|

Muriithi MN (2019). Factors Contributing To Loan Defaulting Among Savings And Credit Societies In Kirinyaga County, Kenya (Doctoral dissertation). |

|

|

Odhiambo SPO (2019). Determinants of financial performance of savings and credit cooperative societies in Nakuru town, Kenya. Reviewed Journal International of Business Management 1(1):42-53. |

|

|

Oji GU, Odi ER (2021). Risk management and return on equity: An estimated model of micro-credit institutions from Nigeria. |

|

|

Orichom G, Omeke M (2021). Capital structure, credit risk management and financial performance of microfinance institutions in Uganda. Journal of Economics and International Finance 13(1):24-31. |

|

|

Salaton KE, Gudda P, Rukaria G (2020). Effect of Loan Default Rate on Financial Performance of Savings and Credit Cooperative Societies Innarok, County Kenya. |

|

|

Turyasingura JB, Moses A, Meza O, Zombeire J, Kyabarongo B (2022). Resourcing and the sustainability of Donor funded Potatoes Projects in Kabale District, Southwestern Uganda. Available at: |

|

|

Wambua VM, Waweru KM, Kihoro JM (2021). Influence of Capital Adequacy on the Loan Performance of Deposit Taking SACCOs in Kenya. African Journal of Co-operative Development and Technology 6(1):1-10. |

|

|

Wanyonyi DJ, Kamau CG, Sasaka PS (2019). Effect of loanable funds and director's skills on financial performance of non deposit taking SACCOs in Mombasa County. Available at: |

|

|

Wilberforce B, Robert M, Atwiine DW (2021). The Effects of Credit Terms on Loan Performance of SACCOS in Mbarara City. |

|

|

Zipporah WM (2019). Determinants of The Level of Bad Debts in Deposit Taking Savings and Credit Cooperative Societies; Nairobi County. Doctoral Dissertation. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0