ABSTRACT

The study examines the impact of financial loans on growth of small-scale enterprises (SSEs) in Uganda. The contribution of SSEs in promoting economic growth and development is widely documented. Access to credit finance guarantees financial liquidity and sustainability of SSEs hence enhancing their profitability and growth. A cross-sectional research design was adopted using a quantitative approach, targeting managers of SSEs. Primary data were collected using closed ended questionnaires and analyzed to generate descriptive, correlation and regression statistics. The findings suggest that categories of financial loans, that is; secured loans and working capital loans have a positive and significant effect on growth of SSEs. The effect of group loans is not statistically significant. The implication of the study is that secured loans encourage small-scale enterprise managers to work hard to spur growth and also protect collateral securities from being mortgaged by lenders. Furthermore, working capital loans help SSEs to efficiently manage their day-today operations which ultimately enhance their profitability, survival and growth.

Key words: Small-scale enterprises, secured loans, working capital loans, group loans and growth.

Small and Medium Enterprises (SMEs) are the backbone of all economies and are also globally considered as the stepping stone for industrialization. Developed and robust economies like the United States of America (USA) and United Kingdom (UK) trace their development from the growth of small and micro enterprises (Kamunge et al., 2014). Micro and small enterprises are considered to be the lifeblood of most economies and are viewed as key drivers of economic and social development in Africa (Gichuki et al., 2014). They play a critical role in triggering and sustaining economic growth and development in both developed and developing economies. According to Eton et al. (2017), there is no universally agreed definition of SMEs and the term covers a wide range of definitions and measures varying from country to country. Those who attempt to define SMEs use their characteristics such as the size of capital investment, number of employees and sales turnover. For developing countries, small scale enterprises generally mean enterprises with less than 50 employees while medium sized enterprises are those with 50-99 employees (Arinaitwe and Mwesigwa, 2015). In Uganda, SMEs are described using both the number of employees and annual revenue turnover (Turyahebwa et al., 2013). For entities to be

described as SSEs, they should be employing 5 to 49 people and have total assets value of Uganda shillings 10 to 100 million (Kyambadde, 2015). Because of the contributions made by SSEs in Uganda such as creation of employment opportunities and government revenue, they need prioritized financial resources to boost the economy and enhance economic growth and development. A report by Uganda Investment Authority (2012) discloses that there are 1,069,848 registered SSEs in urban and rural areas which account for 90% of the private sector and contribute about 75% of Gross Domestic Product (GDP).

For SMEs to grow and contribute to economic development, access to adequate credit finance is critical (Hasnah et al., 2013). This is because SMEs cannot raise adequate equity finance through informal savings and retained earnings to sustain their operations and growth. Several studies have established that credit finance obtained at affordable interest rates and well utilized have a positive significant effect on growth of SMEs. For instance, findings of previous studies by Sitharam and Hoque (2016), Chowdhury and Alam (2017) and Lukuma et al. (2019) reveal that access to credit financing provides funds required to enhance growth of micro, small and medium enterprises. However, empirical studies by Moscalu et al. (2019) and Kamunge et al. (2014) show that high costs of credit, bank charges and fees hamper growth of SMEs. Furthermore, Mweheire (2014) state that majority of SSEs lack access to formal financial services provided by commercial banks and only access financial loans from informal money lenders and microfinance institutions. This is because, commercial bank loans are hard to pay back and have laborious requirements to fulfil before the loan application is approved.

According to Gichuki et al. (2014), the main sources of capital needed to finance growth of SMEs; retained earnings and informal personal savings are normally unpredictable, insecure and have little scope for risk sharing. Because of this inadequacy, SSEs normally seek for bank and microfinance loans to fund their growth plans and increase sales revenue. These loans include secured, group and working capital loans. Growth of SSEs is determined by increase in stock, capital and revenue. It is also assessed in terms of consistent increase in profits, market share and customers. Secured loans are offered to SSEs after providing collateral to the lending institution. Group loans are offered to borrowers after forming groups usually ranging from 25 to 30 people and members in the group act as security to each other since they normally interact closely (Byabashaija et al., 2015). Working capital loans are a newly introduced form

of loans offered to entrepreneurs of SSEs for a short period agreed upon by the lending institutions.

Access to formal banking support by SSEs in Uganda was a dream to most entrepreneurs as majority of them were unable to access loans, especially from formal financial institutions like commercial and development banks. However, the funds provided by government in selected commercial banks, savings and credit cooperatives and establishment of micro-finance institutions played a key role in availing loans and promoting growth of SSEs (Uganda Microfinance Sector Review, 2014). The increase in number of SSEs encouraged financial institutions to provide specific loans for the enterprises to borrow at relatively low interest rates hence facilitating their growth (Ocinneidel, 2009). Utilization of financial loans enhances operations of small-scale businesses which significantly influence their growth and competitiveness. However, because of lack of collateral and information to track use of funds by micro and small enterprises, financial institutions become risk-averse in funding small-scale businesses. Furthermore, despite all the interventions in place to ensure access to credit finance by SSEs in Uganda, the failure rate of majority of SMEs remains high as about 90% of the enterprises do not celebrate their first year in operation (Arinaitwe and Mesigwa, 2015). In addition, Nangoli et al. (2013) assert that sustainability of small businesses in Uganda is limited because most of them do not survive for long in operations. Therefore, the objective of the study is to investigate the extent to which financial loans contribute to growth of SSE. Specifically, the study aims to; establish the growth of SSEs in Uganda and to examine the relationship between use of loans and growth of SSEs in Uganda. The study contributes to literature by establishing the extent to which different categories of loans impact on growth of SSEs.

Financial loans and growth of small scale enterprises

Globally, credit finance has been identified as one of the major factors that facilitate the growth of SMEs (Ramcharran, 2017). Adequate access to finance is vital to enable SMEs improve their operations and contribute to economic growth and development of a nation (Hasnah et al., 2013). Growth of micro and small enterprises is vital because of the role they play in triggering and sustaining economic growth in both developed and developing economies. SSEs provide prolific sources of employment and also grow into medium and large enterprises, which are critical for industrialization (Kamunge et al., 2014). The growth of small-scale enterprises is attained by accessing new customers and increased sales. The high volume of products stocked by an enterprise attracts new customers and agents to open up other business outlets.

Increase in stock volume builds confidence in the customers and confirm an enterprise as a going concern which indicates growth of small-scale enterprises. To facilitate growth, SSEs in Uganda have opportunities to access secured, group and working capital loans from financial institutions, but the nature and form of the loan determines the activity to be funded depending on the agreed duration of the loan, interest rate and loan size. However, despite these available options of credit financing, most micro and SSEs fail within the first year of operation. Eton et al. (2017) argue that access to credit and especially working capital, remains a constraint hindering growth and performance of SSEs. Also, most of the SMEs have limited access to capital markets because of the perception of high risk, information asymmetry and high costs of intermediation (Kofi et al., 2013).

A secured loan is one that relies on assets such as a home title, television set, car, and land title among others as collateral securities (Ezera, 2010). And because of this, secured loans attract low interest rates compared to other types of loans hence borrowers find them convenient for business growth. However, according to Chiou et al. (2011), financial institutions find it hard to give secured credit to small-scale businesses due to of lack collateral security. It is important to note that in Uganda, demand for secured loans from banks and non-bank institutions has increased over time through the amendment of the fiscal policy by Government which encourages financial institutions to provide financial loans to SSEs (World Bank, 2009). However, this has not been useful because most SSEs continue to fail in their first year of startup even when secured loans are expected to provide a longer repayment period to facilitate them to grow (Kagugube, 2010). Contrary to this, Oyelaran-Oyeyinka and Lal (2006) states that secured loans offered by the microfinance institutions mount tension on the small businesses, limiting the benefits from market opportunities and innovation possibilities because of fear to lose their securities which adversely affect the growth of SSEs. This view is supported by Okpukpara (2009) who asserts that secured loans cannot facilitate growth of SSEs because of their negative impact through high and rough debt policy.

To understand the effect of secured loans, Bowale and Akinlo (2012) examined their influence on the growth of SSEs and discovered that, entrepreneurial traits may influence the impact of the secured loans on the performance of the firm. However, enterprises which offer valuable securities are inclined to work towards the realization of more sales to finance the loan obligation. This view is supported by Ramcharran (2017) who argues that secured loans enable small-scale enterprises to increase their sales and generate enough revenue business expansion. However, much of the returns are used to service the debt, leaving the business with little resources for re-investment in the growth of the firm. This forces entrepreneurs in developing countries to maintain a low profile for many years.

Apart from secured loans, SSEs in Uganda can access working capital loans whose security is the business inventories and sales. This form of finance is paid in installments over a period of 6-12 months though it can sometimes be extended. The repayment frequency can be scheduled in weekly, monthly or quarterly intervals (Micro Credit Uganda report, 13th November 2014). Kyambadde (2015) discloses that, the availability of working capital loans has solved the problem of short-term financing for the small-scale businesses. However, the interest charged on these loans is high with a short payback period which adversely affects the growth of the SSEs. Mead (2009) states that the short payback period provided on working capital loans may not facilitate the growth of SSEs since there is no room to re-invest profits back in the business. However, access to these loans does not require assets as collateral security but only needs a going concern business and an active operating bank account. According to Wellen and Mulder (2008) lending institutions always offer working capital loans with expected short repayment periods to encourage entrepreneurs of small enterprises to increase sales volumes so as to generate funds to finance the loan. Most SSEs need working capital loans to boost operations and also meet customer demands. Lending institutions offer such loans because of the pressure they exert on the borrowers to pay back. Apart from secured and working capital loans, SSEs also access group loans to facilitate the growth of their operations.

In Uganda, group loans are extended to people where group members have to first register with the lending institution. This involves forming groups of about 5-15 experienced business people where members act as guarantors to one another. The group normally receives training from a loans officer of the financial institutions before loans are disbursed. According to Flamholtz and Randle (2012), group loans significantly influence the growth of SSEs. In addition, Turnbull (2009) established that for the growth of SSEs, group members are expected to adhere to virtues such as trust and integrity. Majority of SSEs in developing countries like Uganda access financial services through group lending due to lack of collateral security. Byabashaija et al. (2015) assert that the use of group lending is often used as a major innovation amongst SSEs since it enables borrowing without collateral. Group loans cultivate joint liability. In case one member fails to repay, others have to pay on his/her behalf, or otherwise the group will be denied financing. Therefore, voluntary group formation reduces the risks of adverse selection and joint liability which checks moral hazards through peer monitoring, as group members ensure that their colleagues pay on time.

Although group lending promotes unity among members and increase chances of accessing credit financing, it also has limitations. For instance, Dowla (2006) asserts that group loans are associated with a number of challenges which include transportation costs to attend meetings and regular visits of members in the group to confirm their existence and progress of loan repayment. Other costs include group formation, training members on group lending procedures, increased supervision and a higher frequency of installment payments. These group lending costs increase interest rates, leading to enhanced repayment risk (Kodongo and Kendi, 2013). This reduces time for the business which adversely affects growth of SSEs. However, according to (Sanusi, 2013) group loans are not stressful compared to other forms of loans though they are relatively small in size with regular short repayment periods. The nature of the loan encourages the borrower to work hard and increase sales to finance the loan. This has led to a strong relationship between group loans and increase in sales volumes of an enterprise. Furthermore, a study by Okello (2006) in Uganda, established that there is a significant positive relationship between group loans and enterprise growth. This is achieved through proper use of the loans, elaborate system of networks, fear of financial distress and community shame. The argument for this is that the role of group members in monitoring payment schedules of fellow members encourages the borrower to work hard and increase sales volumes, leading to eventual growth of SSEs.

Effect of demographic factors on growth of SSEs

The study considered the effect of demographic factors such as form of the enterprise, years of operation and loan size on the growth of SSEs as control variables. The common legal type of small enterprise ownership in developing countries is sole proprietorship. Unlike other business enterprises, sole proprietorship requires small equity capital with minimum legal documents to start business operations. For instance; partnerships require a partnership deed, while companies and joint venture entities require a memorandum of association amongst other legal documents before they can be allowed to start operations. The growth of a sole proprietorship enterprise through credit finance is hampered by lack of access to adequate credit finance because of lack of collateral security (Gichuki et al., 2014). With regard to years of operation, small-scale businesses are normally relatively young and due to their small size and inherent vulnerability to market fluctuations, mortality rates are relatively high with low opportunities of growth. For loan size, Becker and Neihaves (2010) assert that large loans facilitate adequate funding which leads to the growth of the business and therefore, there is a positive significant relationship between loan size and growth of the SSEs. However, entrepreneurial skills and the business operating environment play a vital role in enhancing growth of the small-scale business. The competitive advantage of an enterprise stems from its entrepreneurial capacity, management abilities, technical know-how and adaptability to the internal and external business environment. Sensitization on the use of financial loans and sustained investment in on-the-job training in entrepreneurial skills is very crucial for the survival and growth of SSEs (Perks and Smith, 2006). Furthermore, government policy on the bank rate as set by the central bank affects the interest rate charged by the financial institutions and, ultimately, influences business growth. For instance, government policy could be concerned with providing direct funding of small-scale enterprises to boost their growth rate Turyahikayo (2015). In the Ugandan context, government has provided special financial loans for the youth, market vendors, women, and special needs groups so as to boost income.

The conceptual framework in Figure 1 is developed from literature review where loans and growth of SSEs are independent and dependent variables respectively. Research studies by Eton et al. (2017), Hasnah et al. (2013) and Arinaitwe and Mwesigwa (2015) show that credit finance enhances growth and performance of SSEs. Since demographic factors have previously been used in research as control variables (Kalenzi and Ongúnya, 2019), loan size, form and age of the enterprise were used in this study as control variables.

The research design was cross-sectional using a quantitative survey approach to examine the relationship between the effects of loans on growth of SSEs in Uganda. The study population included managers of SSEs from various sectors operating in Kampala Central Business area in Uganda. The sectors include those engaged in business services (information technology firms, saloons and restaurants), trade and wholesaling including supermarkets, social services (pharmacies, medical clinics and private educational institutions). SSEs considered were those employing between 5-49 people (Uganda Micro, Small and Medium Enterprise Policy Report, 2015). A total sample of 132 managers of licensed SSEs in Kampala Central business area in Uganda was used for this study. This is consistent with the sample size used by Eton et al. (2017) and Hasnah et al. (2013) and is supported by Roscoe’s rule of thumb for sample size determination that sample sizes larger than 30 and less than 500 are appropriate for most research (Sekaran, 2006). The respondents were selected using stratified and simple random sampling. Data were collected using a self-administered closed ended questionnaire which was developed based on the research objectives (Appendix 1). Questions were structured using a 5 Point-Likert scale range which include; strongly disagree (1), disagree (2), not sure (3), agree (4) and strongly agree (5). The dependent variable (growth of SSEs) was measured in terms of increase in stock, customers, asset base, revenue and profits while analysis of the independent variable (financial loans) focused on effective use of secured loans, group loans and working capital loans. The demographic factors included in the study as control variables and analyzed were form and age of the business and loan size.

The questionnaire was first pre-tested to establish the degree of reliability and validity of constructs and items used in data collection. Consistent with Taber (2017), Alpha Cronbach values were obtained to measure the degree of reliability of the constructs. The results were growth of small-scale enterprise (α = 0.707), secured loans (α = 0.752), group loans (α = 0.685) and working capital loans (α = 0.724). All alpha coefficients were above 0.5 implying that the data collection instrument was reliable. This is supported by Daud et al. (2018) who state that Alpha Cronbach values ranging 0.6-0.8 are considered moderate but acceptable. Validity was measured by obtaining item content validity index (I-CVI) for all the 19 items used in the questionnaire for all the variables of the study. The instrument was given to three experts to give opinions on the relevance of the questions using a four-point scale ranging from not relevant (1), somewhat relevant (2), quite relevant (3) and highly relevant (4). The I-CVI’s were computed by obtaining the ratio of the number of those who scored 3 and 4 to the total number of the items of the data collection instrument and the results were 0.789, 0.895 and 0.842 for experts one, two and three respectively. These results validated the data collection instrument and are supported by Rodrigues et al. (2017) who state that an I-CVI of 0.78 or higher is considered excellent. Data analysis is generated using the Statistical Package for Social Sciences (SPSS) version 20 quantitative report for descriptive statistics, Pearson’s correlations and multiple regressions tests. The regression equation model for the study was,

GE =β0+β1SL +β2GL +β3WCL+β4FE+ β5AE+ β6SMB+ ε)

β0 = Constant parameter

β1, to β6 = Coefficient of the independent variables/regression parameters

GE = Growth of the enterprise

SL = Secured loans

GL = Group loans

WCL = Working capital loans

FE= Form of enterprise

AE = Age of the enterprise

SMB= Loan size

ε= Probabilistic error term.

Data collected were analyzed to obtain descriptive statistics of growth of SSEs, Pearson’s correlation coefficients and multiple regression tests. 132 Questionnaires were distributed to managers of small scale enterprises and 131 filled in questionnaires were collected. This gave a response rate of 99.2% which was sufficient to provide reliable findings.

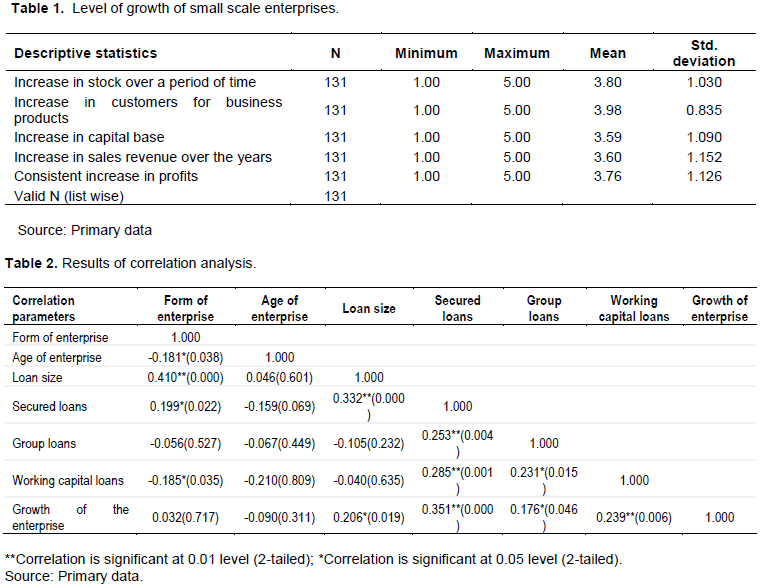

Descriptive statistics of growth of small-scale enterprise

The findings from Table 1 indicate that the mean value of increase in the stock of the enterprise was 3.80 with a standard deviation of 1.030. The average mean indicates that SSEs manage to increase their stock over a period of time. This increases their sales volume which is an indicator of growth of the enterprises. Increase in customers for business products had the highest mean of 3.98 and standard deviation of 0.835 which is a sign of growth. There is also increased asset base (mean=3.59 and standard deviation of 1.090) and most SSEs registered increase in sales volume (mean= 3.60 and standard deviation of 1.152). The results also show consistent improvement in profits (mean of 3.76 and standard deviation of 1.126). The descriptive statistics report a growth of SSEs shown by the mean values and are consistent with findings by Chowdhury and Alam (2017). The results are also supported by Sarwoko and Frisdiantara (2016) who argue that capital, profits and sales are good indicators of growth.

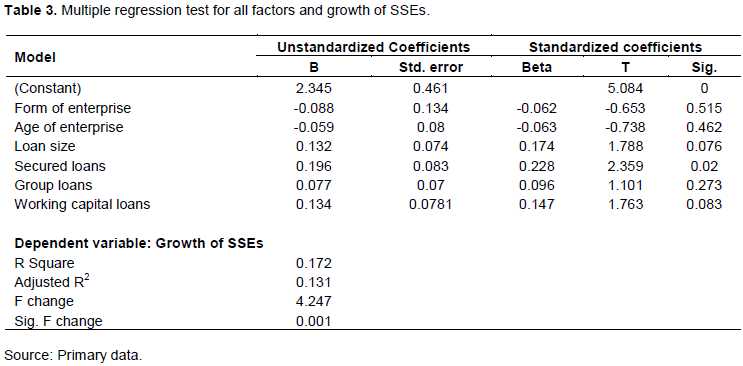

Pearson’s correlation analysis

This was carried out to establish the strength of the relationship between the variables. Results are presented in Table 2.

Results of the correlation analysis show that secured loans and growth of SSEs have a strong positive relationship which is significant at 1% level (r = 0.351 p value 0.000). This implies that funds which are secured encourage managers of SSEs to work hard to generate enough revenues and profits to pay back the loan and also expand the enterprise. In addition, secured loans attract low interest charges because of low perceived risk by the lenders. The findings are supported by Arinaitwe and Mwesigwa (2015), who argue that the security attached to secured loans encourages majority of SSEs to increase sales volume in order to finance the individual secured loan. Similarly, working capital loans and growth of SSEs have a positive and significant relationship at 1% level of significance (r = 0.239, p-value = 0.006). This implies that access to working capital loans help enterprises to finance day-to-day operations such as prompt payment of utilities, suppliers and wages. This helps to improve the liquidity position and further enhance business growth. The correlation analysis also shows that group loans and growth of SSEs are positively related and significant at 5% level (r = 0.176 p value 0.046). The findings also show that the relationship between loan size and growth of small-scale is positive and significant at 5% (r = 0.206, p-value = 0.019). The implication of the results is that if the loan size, secured loans and working capital loans increase, SSEs also grow. The findings are consistent with Oleka et al. (2014) that loan size influences growth of small-scale businesses. This is also supported by Sunday (2011) who states that working capital loans have a short repayment period that stimulates managers of enterprises to be innovative and work hard to manage operations of the business.

Regression analysis

Regression analysis was carried out to establish the extent to which the predictor variables influence growth of SSEs. Results of the multiple regression analysis for both the demographic factors (control variables) and predictor variables are given in Table 3. The dependent variable is the growth of SSEs.

Results from Table 3 show that secured loans have a positive and significant effect on the growth of SSEs (β= 0.196, P value = 0.020). This is consistent with Sakwa et al. (2019) who assert that collateral securities used to access credit finance encourage enterprises to work hard to generate revenue for business growth. The findings are also supported by Eton at al. (2017) who argue that collateral security has a positive influence in accessing credit finance for business growth and expansion. Furthermore, secured loans are normally accessed at a relatively low cost than unsecured loans because of low perceived default risk. This encourages enterprises to finance their operations which ultimately lead to business growth. Similarly, findings show that the effect of working capital loans is positive and significant (β= 0.134, p value 0.083). Working capital is needed to facilitate day-to-day operations which enhance business expansion. This implies that effective acquisition and management of working capital such as cash, inventories and receivables help the enterprise to manage its liquidity position and to finance short term obligations. This helps to smoothen the operations of the organization hence leading to its growth. This is consistent with Chowdhury and Alam (2017) who state that working capital facilitates growth and expansion by financing day-to-day operations. The results are also supported by Sadiq (2017) who argue that working capital is considered a life-giving force and is the most important factor for maintaining liquidity, survival, solvency and growth of an enterprise. About the effect of group loans, the findings are not significant.

CONCLUSION, IMPLICATIONS AND THE CONTRIBUTION OF THE STUDY

Using descriptive statistics, a general growth of SSEs is established and this is attributed to the use of secured and working capital loans. About demographic factors, loan size had a positive significant influence on growth of SSEs while form and age of the enterprise are not statistically related with the growth of SSEs. The study concluded that loan size, secured loans, and working capital are statistically significant and have a positive relationship with the growth of SSEs. The implication of the findings is that SSEs should endeavor to borrow secured and working capital loans in order to spur growth in their businesses. This is because availability of collateral for secured loans enables enterprises to access credit finance at low costs. These loans also encourage borrowers to work hard to generate enough earning to safeguard assets used as collateral security. For working capital loans, they are short term in nature and enable an enterprise to maintain liquidity needed to efficiently manage working capital operations. The contribution of the study is that it helps to establish the best model of funding the growth of SSEs in developing economies. It gives useful literature about different debt financing strategies that SSEs should select to spur growth. It is one of its kind and vital to policy makers and managers of SSEs, providing guidance on how to acquire and efficiently manage financial loans needed for smooth operations of enterprises.

In empirical research, it is always important to consider limitations when arriving at conclusions. The study is purely quantitative and a mixed methodology combining both quantitative and qualitative approaches in data collection could have facilitated an extensive understanding of the phenomenon studied. Another limitation is that the study only examined the effect of loans on growth of SSEs. The effects of other factors like enterprise innovation, technology and managerial competencies were not considered and therefore, future studies should focus on examining how these factors also affect the growth of SSEs.

Although few limitations have been identified, the study has contributed to the body of research in small and medium enterprises by providing useful insights about how financial loans could significantly influence growth of SSEs.

The authors have not declared any conflict of interests.

REFERENCES

|

Arinaitwe A, Mwesigwa R (2015). Improving credit accessibility among SMEs in Uganda. Global Journal of Commerce and Management Perspective 4(6):22-30.

|

|

|

|

Becker J, Niehaves B (2010). Influence of Loan on the growth of an enterprise. Journal of Business Finance and Information Systems 17:197-214.

Crossref

|

|

|

|

|

Bowale I, Akinlo H (2012). Determinants of Small and Medium Scale Enterprises (SMEs) performance and poverty alleviation in Developing Countries: Evidence from South West Nigeria. European Journal of Humanities and Social Sciences 17(1):848-863.

|

|

|

|

|

Byabashaija D, Aluonzi B, Karoro EA, Manyage NM, Nyambane OD, Besigye O (2015). Group formation criteria of Money lending Association in Rubirizi District, Western Uganda. Scholars Journal of Arts, Humanities and Social Sciences 3(7A):1174-1180.

|

|

|

|

|

Chiou J, Wu P, Huang B (2011). How Derivatives Trading among banks impacts on SMEs Lending. Interdisciplinary Journal of Research in Business 1(4):1-11.

|

|

|

|

|

Chowdhury M, Alam Z (2017). Factors affecting access to finance of Small and Medium Enterprises (SMEs) of Bangladesh. USV Annals of Economics and Public Administration 2(26):55-68.

|

|

|

|

|

Chowdhury M, Alam Z (2017). Factors affecting access to finance of Small and Medium Enterprises (SMEs) of Bangladesh. USV Annals of Economics and Public Administration 2(26):55-68.

|

|

|

|

|

Daud KA, Khidzir NZ, Ismail AR, Abdullah FA (2018). Validity and reliability of the instrument to measure social media skills among small and medium entrepreneurs at Pengkalan Datu River. International Journal of Development and sustainability 7(3):1026-1037.

|

|

|

|

|

Dowla S (2006). Macroeconomic Challenges of Microfinance. EPRC Policy Brief: A hand book. Kampala Uganda.

|

|

|

|

|

Eton E, Mwosi F, Mutesigensi D, Ebong CD (2017). Credit Financing and Performance of SMEs in Lira Municipality. Research Journal of Finance and Accounting 8(8):121-127.

|

|

|

|

|

Ezera S (2010). Impact of financial loans on the performance of business operations. Journal on Financing 3(2):34-46.

|

|

|

|

|

Flamholtz EG, Randle Y (2012). Growing Pains of group loans: How to make the transition from entrepreneurship to a professionally managed firm. San Francisco: Jossey-Bass. ISBN-13:978-0787986162.

|

|

|

|

|

Gichuki JA, Njeru A, Tirimba OI (2014). Challenges facing Micro and Small Enterprises in accessing credit facilities in Kangemi Harambee market in Nairobi City Country Kenya. International Journal of Scientific and Research Publications 4(12):1-25.

|

|

|

|

|

Hasnah H, Said SB, Jayaraman K, Ismail I (2013). Factors influencing small medium enterprises (SMES) in obtaining loan. International Journal of Business and Social Science 4(15):182-195.

|

|

|

|

|

Kalenzi A, Ongúnya GO (2019). Procurement performance and profitability in foam mattress firms in Uganda. African Journal of Business Management 13(18):630-635.

Crossref

|

|

|

|

|

Kamunge SK. NJeru A, Tirimba OI (2014). Factors affecting the performance of Small and Micro enterprises in Limuru Town Market of Kiambu County Kenya. International Journal of Scientific and Research Publication 4(12):1-20.

|

|

|

|

|

Kodongo O, Kendi LG (2013). Individual lending versus group lending: An evaluation with Kenya's microfinance data. Review of Development Finance 3(2):99-108.

Crossref

|

|

|

|

|

Kofi NJ, Tanyeh P, Gaeten K (2013). Financing Small and Medium Enterprises (SMEs) in Ghana: Challenges and determinants in accessing bank credit. Journal of Research in Social Sciences 2(3):12-25.

|

|

|

|

|

Kyambadde A (2015). Report from Ministry of Trade, Commerce and industry on emerging trend of Small Medium sized enterprise in Uganda: Fountain Publishers.

|

|

|

|

|

Lukuma CP, Marty R, Muhumuza F (2019). Financial inclusion and micro, small and medium enterprises (MSMEs) growth in Uganda. Journal of Innovation and Entrepreneurship 8(15):2-20.

Crossref

|

|

|

|

|

Mead G (2009). The effect of industry growth and strategic breadth on new venture performance and strategy content. Strategic Management Journal 15(7):537-554.

Crossref

|

|

|

|

|

Moscalu M, Girardone C, Calabrese R (2019). SMEs growth under financing constraints and banking markets integration in the euro area. Journal of Small Business Management pp. 1-40.

|

|

|

|

|

Mweheire P (2014). Chief Executive Stanbic Bank Annual Report: Access on loan by SMEs". Available at:

View

|

|

|

|

|

Nangoli S, Turinawe D, Kituyi GM, Kusemererwa C, Jaaza M (2013). Towards Enhancing Business survival and growth rates in LDC: An exploratory study of the Drivers of Business Failure among SMEs in Kampala- Uganda. International Journal of Humanities and Social Sciences 3(8):284-291.

|

|

|

|

|

Ocinneidel P (2009). Economic recession, high unemployment rates and expansion of Small and Medium enterprises, 3rd Edition. Sage Publisher.

|

|

|

|

|

Okello J (2006). Impact of financial loans on the performance of the business. Journal of Business Management 4(7):51-59.

|

|

|

|

|

Okpukpara B (2009). Strategies for effective loan delivery to small-scale enterprises in rural Nigeria. Journal of Development and Agricultural Economics 1(2):041-048.

|

|

|

|

|

Oleka CO, Maduagwu EN, Igwenagu CM (2014). Analysis of the impact of Microfinance banks on the performance of small and medium scale enterprises in Nigeria. International Journal of Management and Social Science 1(2):45-60.

|

|

|

|

|

Oyelaran-Oyeyinka B, Lal K (2006). Learning new technologies by small and medium enterprises in developing countries. Technovation 26(2):220-231.

Crossref

|

|

|

|

|

Perks S, Smith EE (2006). Investigating training interventions required for upgrading black micro-entrepreneurial skills: An empirical study. In Eighteenth Annual Conference of the Southern Africa Institute for Management Scientists, Stellenbosch University, Stellenbosch. pp. 13-15.

|

|

|

|

|

Ramcharran H (2017). Financing small and medium-sized enterprises in Thailand: The importance of bank loans and financing diversification. Journal of Entrepreneurship and Finance 19(2):1-40.

|

|

|

|

|

Report on Uganda Micro, Small and Medium Enterprise (MSME) Policy (2015). Sustainable MSMEs for wealth creation and Social- Economic Transformation. Ministry of Trade, Industry and Cooperatives, the Republic of Uganda.

|

|

|

|

|

Rodrigues IB, Adachi JD, Beattie KA, MacDermid JC (2017). Developing and validation of a new tool to measure facilitators, barriers and preferences to exercise in people with Osteoporosis. BMC Musculoskeletal Disorders 18(540):1-9.

Crossref

|

|

|

|

|

Sadiq R (2017). Impact of Working Capital Management on Small and Medium Enterprises' Performance in Nigeria. Arabian Journal of Business Management Review 7(1):285.

|

|

|

|

|

Sakwa MA, Rambo CM, Osogo J (2019). Influence of collateral security on performance of SMEs in Turbo Sub County Kenya. European Journal of Business Management 11(18):21-30.

|

|

|

|

|

Sanusi LS (2013). Keynote Address at the Annual Micro, Small and Medium Enterprises (MSMEs) Finance Conference & D-8 Workshop on Microfinance for Small and Medium Enterprises (SMEs). Central Bank of Nigeria, Abuja, 15th-February. Available at:

View

|

|

|

|

|

Sarwoko E, Frisdiantara C (2016). Growth determinants of small medium enterprises (SMEs). Universal Journal of Management 4(1):36-41.

Crossref

|

|

|

|

|

Sekaran U (2006). Research Methods for Business: A skill building approach. John Wiley and Sons.

|

|

|

|

|

Sitharam S, Hoque M (2016). Factors affecting the performance of small and medium enterprises in KwaZul Natal, South Africa. Problems and Perspectives in Management 14(2):277-288.

Crossref

|

|

|

|

|

Sunday KJ (2011). Effective working capital management in small and medium scale enterprises (SMEs). International Journal of Business and Management 6(9):271.

Crossref

|

|

|

|

|

Taber KS (2017). Use of Cronbach's Alpha when developing and reporting research instruments in science education. Research in Science Education 48:1273-1296.

Crossref

|

|

|

|

|

Turnbull H (2009). Trait of the borrowers, Marketing and Investment Banking II: Relationships and Competitive Advantage. International Journal of Bank Marketing 14(2):38-49.

Crossref

|

|

|

|

|

Turyahebwa A, Sunday A, Ssekajugo D (2013). Financial management practices and business performance of small and medium enterprises in Western Uganda. African Journal of Business Management 7(3):3875-3885.

|

|

|

|

|

Turyahikayo E (2015). Challenges faced by Small and Medium Enterprises in raising finance in Uganda. International Journal of Public Administration and Management Research 3(2):21-33.

|

|

|

|

|

Uganda Investment Authority (2012). Report on management of Small Scale Enterprise in Uganda. Available at:

View

|

|

|

|

|

Uganda Microfinance Sector Review (2014). Uganda Microfinance Sector Effectiveness Review 2014. Available at:

View

|

|

|

|

|

Wellen H, Mulder A (2008). Micro credits in SMEs, Journal of finance and microfinance 7:122-134.

|

|

|

|

|

World Bank (2009). The Financial and Private Sector Development Africa Region: Making Finance work for Uganda.

|

|