Full Length Research Paper

ABSTRACT

The study assessed measures in curbing casualisation of labour in financial institutions with a specific study of banks in Sokoto metropolis. The exploitative nature of most commercial banks in Sokoto reflects on the working condition of most casual staff in these banks as payment is not commensurable to the work done. While the casual staff is being deprived of certain social benefits, allowances and social security of jobs, such exploitation necessitated the need for stratifying measures in curbing casualization of labour for equal status of staff in the banking industry. The study was exploratory and employed a qualitative research design; 60 participants (casual staff and bank managers) were selected for the interview sessions. The study found that Business Solution Firms (BSFs) were the major agents in the exploitation of casual workers in commercial banks in Nigeria. In proffering solution for achieving the targeted objectives, the study recommended that there is a need for concerned individuals, labour ministry or lawmakers to legislate laws (where absent) or ensure strict compliance with existing labour laws (if available) regulating recruitment, salary payment, promotion or regularization as well as retrenchment of casual workers in the financial institutions, and erring banks should be properly sanctioned. Furthermore, unionization was strongly recommended as a move towards negotiating the rights of casual staff.

Key words: Bank, casualisation, contract staff, exploitation, labour laws.

INTRODUCTION

The Nigerian financial sector is as old as the country itself and is full of several activities of the ‘invisible chain’ called casualization of labour. The utilization of provisional work shapes a huge part of the workforce in the financial industry in Nigeria and businesses use organizations known as work/administration project workers through moving to utilize contractors (McLaughlin, 2011). In the capitalist societies, many workers are paid wages that do not satisfy their basic needs, but continue to work because they could not find other lucrative jobs. Hussmanns (2004) noted that Sokoto like many other cities in Nigeria is braced by unemployment levels following the effects of economic recessions. Most of the people employed are in the informal sector and one of the categories in the informal sector are employees who have informal jobs, whether employed in the formal sector enterprise, informal sector enterprises, or as paid house workers by households . Courtois and O'Keefe (2015) defined casualisation as temporary employment; it is defined as twining work less secure so that workers work on an occasional basis instead of being offered full time employment. Different terms have been deployed for this type of irregular employment contract such as contract work, temporary work, seasonal work, casual work etc. Casualization as a type of work practice is the interaction whereby business shifts from a prevalence of full time and stable situations to more elevated levels of easygoing situations, in a sporadic or discontinuous nature (Luswili, 2009; Fapohunda, 2012). It is important to distinguish between three types of casual labour: First, there are those employed directly by the firm; secondly, those supplied by a labour broker and thirdly, the independent contractors. In the first type of casual labour, the workers are directly employed by a firm on a casual or temporary basis. These contracts are used to supplement the work force during period of peak demand like holidays and so forth. The second type of casual labour is of the triangular employment relationship in which a labour broker supplies labour to a firm, if a firm contacts a labour broker to provide workers, does it assume the responsibility of employer or are these workers employed by the subcontractor or labour broker? Workers often identify with a firm in which they have been deployed even though they are employed by the labour broker, especially in cases where deployment is for an extended period of time. Independent contractors and home-based workers fall into the third category of casual laborers. Many social scientists that discuss and examined the recent crises in capitalism treat work as subordinate. They only see work in the context of employment and as field which has to cope with the consequences of crises (Nies and Sauer, 2018). They do not take the performance of the labour process into account. In studying work, attention is mostly focus on the growth of precarious forms of employment like agency work, mini jobs and wages below the subsistence level (Cranford et al., 2003). Worker's organization, lawful and strategy specialists from all throughout the planet have contributed important years of involvement and examination into the current report, giving some underlying thoughts for how to accomplish fair work for tricky specialists (Seidman, 2007). Directing problematic work will require mediations in monetary and social approach, counting a strong social floor, a living pay, diminishing monetary market unpredictability, reinforcing the assessment base, public administrations and public speculation for comprehensive, profitable and earth rea-sonable social orders, keeping wage development in line with efficiency development, and forestalling unmerited rivalry in the work market. Thorough government backed retirement frameworks specifically fortify the capacity of laborers to dismiss unstable positions (Barchiesi, 2011).

Lawful structures should likewise be refreshed to guarantee that problematic specialist’s advantage from at any rate similar security as any remaining laborers. Against this background, the study examined measures in curbing casualisation of labour in the banking sector.

METHODOLOGY

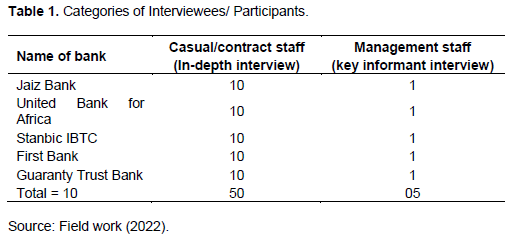

The study is an exploratory research. It is described as a study used to analyze a trouble which is not always certainly described (Stebbins, 2001). It is meant to gather descriptive information and provide a better understanding of the ways to curb casualisation of labour. It is carried out to have a better know-how of the present trouble; however it does not offer conclusive results. For the sort of studies, a researcher begins off with a popular concept and makes use of this study to become aware of issues that may be the focal point for future studies. The study utilized both primary and secondary data. The primary data involved information obtained from the informants (casual workers and the bank managers), while the secondary data information was from the literature reviewed. Qualitative method of data collection was used. Data were collected through the use of in-depth interviews and key informant interviews. The interview questions were derived from the research objectives. Purposive sampling procedure was used in selecting the respondents from the study population. This is because it allows the researcher to gather qualitative responses, which leads to better insights and more precise research results. The information gathered was coded, transcribed, analyzed and presented in descriptive manner based on each objective of the research and discussed on the bases of themes. The general population of the study includes all the banks in Sokoto metropolis. The reason for selecting this site is because of the familiarity with the community and also most of the banks in the community employ more casual workers than permanent ones. Another reason for selection of Sokoto town is because of the access to the respondents. Presently there are eighteen (18) banks operating within Sokoto metropolis (First bank, Access bank, Guaranty Trust, Diamond bank, Jaiz bank, Echo bank, United Bank for Africa, Zenith bank, and Union bank, FCMB, Fidelity, Heritage, Wema bank, Unity bank, Stanbic IBTC, TAJ bank, Polaris bank and Bank PHB).The target population includes all the casual staff of the sampled banks. As at 31st December, 2020, all the banks have one hundred and seventy one (171) casual staff, as such complete enumeration of inclusion will be appropriate to generate the desired data. A total of 5 banks were used as sample for the purpose of the study: these constitute seventy percent 70% of the banks in Sokoto metropolis. Out of the one hundred and seventy one casual staff of the selected banks through random sampling, fifty (50) respondents (casual/contract workers) were purposively selected to constitute the sample of the population (Table 1). Also five (5) management staff, one (1) from each of the selected banks was interviewed through the use of key informant interview guide. This was done in order to have more information from the managers of the banks, who were believed to have relevant knowledge regarding the measures to be put in place to curb casualisation in the banking sector.

Qualitative method was employed in conducting the study. This was done through the use of in-depth interview and key informant interview. The in-depth interview was carried out with 50 casual staff under the guidance of the researcher; the venue was quiet, spacious enough and comfortably accommodated all participants. This is because it will facilitate face-to-face contact between the researcher and the respondents and minimize any perceived differences between them and us. Interview guide was designed in line with the objectives of the study. The researcher used an audio recorder to record all the conversations; also one research assistant was employed and trained as a note taker who assisted the researcher in taking notes of the conversations. The study also used key informant interview (KII) to gather data; the researcher chose respondents from the management staff who have relevant information regarding the topic of the study and engaged them in face to face interactions with a range of issues on allowances, loans/advances, benefits, salary/wages, hours of work, freedom of association, opportunity for personal growth, job security, etc. This enabled better understanding and ability of the respondents to express more on answering the research questions. Thematic analysis was employed in analyzing the data collected. The data were transcribed through converting recorded conversations into written form; the data were studied and linked with analytic notes. The researcher familiarized himself by reading the transcripts of the data to be collected again and again to be familiar with the data collected from the field. The data were categorized into sub-themes; a number of categories were categorized under each theme according to research objectives. Therefore, the data collected were arranged according to each theme and presented in a thematic form (attached with verbatim quotations/matrix of voices 1-4 in a matrix tables (Appendix)) based on the research objective, sub-merged and interpreted on the basis of sub-themes.

RESULTS

This section presents and analyzes the data obtained from the field. The data were presented in a thematic manner based on the objective of the study. The transcribed interviews (in-depth interview and key informant) were discussed and analyzed on the basis of themes and sub-themes.

Curbing casualisation of labour in financial institutions in Sokoto Metropolis

Regularization of contracts is expected after six months or one year, except when expertise is contracted after retirement for regularized staff to take advantage of retired employees' skills and knowledge. Contractual em-ployment is viewed by some as exploitative, while others believe that it paints a poor picture of most contract workers, whose employment can be terminated at any time. As a result of casualization of labour in Nigeria, dominance, subjugation, and exploitation are common characteristics. In Nigeria, a casual employee is deprived of his time; a casual worker must report to work as early as 7:00am and must finish working by 8:00pm. A casual worker is deprived of his leisure time during the weekends to spend with family and friends, since some of these employees are obliged to work on Saturdays to maintain ATMs. In the subsequent paragraph, a discussion will follow suit on the ways to curb or mitigate the casualization of labour in Sokoto Metropolis. In doing so, an attempt will be made to look at how enacting laws will help curb or mitigate casualization of labour, whether an increase in wages will mitigate casualization of labour or eradication of casualization system will be the best, the choice of allowing freedom of association and implementation of existing labour laws.

Implementation of the international labour laws and enacting of laws to curb casualization of labour in financial institutions in Sokoto Metropolis

Stakeholders lamented that the labour law opined that “if somebody is a contract staff between 5 years to 10 years, it is either he becomes a full-time professional staff or he exits the system". Despite having knowledge of the labour laws by commercial banks, participants allude that the commercial banks strategize ways of manipulating the labour laws by retrenching staff that had completed at least 10 years in the banking system once a replacement is found for that position. This is to minimize the cost of validating the appointment of such a person being a full-time professional staff with all benefits attached. Commercial banks have a policy of employing full-time professional staff with a minimum of B.Sc or Higher National Diploma; this means casual staff has the grace of 5 years to acquire any of the qualifications since findings from the study discovered the most casual staff to be diploma holders. Such casual staff has the grace of 5 years to improve themselves and acquire higher qualifications to justify their validation of appointment. To mitigate the phenomenon of casualization of labour, laws were enacted both at the international and local levels by concerned labour unions. The international labour law specifies that anybody who has worked for 6 months should be given regularized employment. It is expected that anybody that had worked in an organization for 6 months has acquainted and familiarized himself with all modalities in the job; this is to evade exploitation of such workers at a minimal cost. Similar to the international labour law, the labour act of 1994 also enacted laws to protect the right of casual workers. Even though the labour act of 1994 seems vague, the findings underway suggested possible ways to either curb or improve the conditions of casual workers in Nigerian financial institutions. Stakeholders expressed divergent views on ways to mitigate the casualization of labour in Nigerian financial institutions. Most stakeholders allege that there is a need for lawmakers to enact laws guiding the recruitment, regularization and irregular retrenchment of casual bank staff in Nigerian financial institutions. This will guide the practices of financial institutions on reliance on contract staffing by individuals for over a decade without regularization, so as to minimize cost and profit-oriented motive. Most commercial banks in Nigeria only employ a few full-time professional staff to manage the activities of the vast employed casual staff to minimize cost. This is why participants call for regulation in the recruitment process by enacting laws at the federal level, and monitoring units at the state and local level. The Nigeria Deposit Insurance Corporation (NDIC) and the Central Bank of Nigeria (CBN) were recommended to serve as overseer to ensure full compliance. To ensure the sustainability of the labour laws, participants recommended that Nigerian labour laws should be reviewed every 10 years taking into consideration emerging development, global labour market and emerging scenario and events in the global market. Stakeholders further expressed that policies and laws by the international labour laws should be strengthened where casual staff should be granted automatic employment after 6 months into the banking job. It was in the course of the study that most internet fraudsters were former casual bank staff (retrenched casual bank staff) due to their knowledge of the banking system. Enacting the international labour laws will further minimize the ceaseless prevalence of internet and banking fraud perpetrated in the Nigerian society.

Increase in the wages of contract staff in Sokoto Metropolis

The reason behind the general outcry of casual staffing revolves around the income of casual staff in comparison to the full-time professional staff that does almost the same job (sometimes not up to the casual staff) as the casual staff. The wide variability in the income of full-time professional staff which exceeds over 50% that of the contract staff exert extreme inequality and double exploitation of the contract staff by the chief executives of various commercial banks in Sokoto metropolis. Based on the findings from the study, a contract staff receives 50,000 naira, and 115,000 naira at most for contract staff that have spent over a decade in the system; while a full-time professional staff receives at least 200,000 naira for a start-up, where both the contract staff and the full-time professional staff execute the same job. In the banking hall, it is difficult for someone to differentiate a contract staff from a full-time staff except if one carefully looks at the identity card of the staff; the identity card of contract staff usually captures CS signifying Contract Staff. What further accentuates the wide variability in the income are the middlemen/company employment brokers known as the “business solution firms” (BSFs) owned by the chief executives of the commercial banks. It is based on the findings that stakeholders recommended that the income of the casual workers be increased (not necessarily equal to that of the full-time professional staff) for them to be motivated to diligently execute tasks assigned to them, instead of allowing the BSFs to recruit the contract staff and post them to different banks as Place of Primary Assignment (PPA). This can only be achieved if the system of middlemen/company employment brokers (BSFs) is completely eradicated, by accruing all proceeds paid to the BSFs and transferring such to the wages of casual staff. Stakeholders recommended a system where commercial banks will recruit the contract staff directly and offer appointment letters.

Eradication of the system of casual staffing in banks in Sokoto Metropolis

Stakeholders allege that eradicating the system of casual staffing will further entrench unemployment and redundancy among the semi-skilled graduates possessing Ordinary National Diploma (OND) since most of the casual staff recruited by commercial banks in Sokoto only have OND qualifications. Since every commercial bank has a standard for recruitment and the minimum qualification is B.Sc and HND, it is best all casual staff in the banking sector acquire higher qualifications for them not to be retrenched. In contrast, some participants recommended that banks can adjust their standards by conferring appointments to OND holders who have considerable wealth of experience in the banking sector.

In a divergent view from the above discussion, most participants alleged that amendment in the system of casual staffing can only be offered in a partially beneficial system. Since the phenomenon of casual staffing is enfeebled, the best practice would be to eradicate the system due to the double exploitation attached as well as the profit-oriented motive of commercial banks. Findings from the study recommended that eradication of casual system in the banking sector can only be achieved through policy back-up attached with stringent laws by the federal government or legislatures as participants believed the top executives of commercial banks are key officials and allies in government.

Allowing freedom of association by contract staff in Sokoto Metropolis

Stakeholders lamented that section (3) of the Nigerian constitution guarantees freedom of association as long as that association does not involve the commission of a crime or breaking of any law, thus encouraging unionization to boost solidarity and collegiate relationship through a collective bargain with the bank management. Even though all commercial banks in Sokoto metropolis ensure a strict ban on anything that deals with forming a union for a collective bargain or to fight for their rights by all bank staff (regardless of contract or full-time professional staff), or anything similar to such, stakeholders contend that in making laws, there is need for the government to make provisions where contract staff in Nigerian financial institutions can collectively bargain their right with their employers. This will go a long way to minimize the domination, double exploitation and subjugation suffered by contract staff in most commercial banks in Sokoto metropolis. In furtherance to that, such unionism should only be formed when the system of contract staffing has been eradicated, otherwise, commercial banks may still suppress the casual staff by intimidation as they are yet to be conferred with letters of appointment. Attempts had been made by some casual staff in some commercial banks for a collective bargain with their employers; but due to the fear of the unknown (being sacked), most of the agitators withdrew from such agitation and accepted modern slavery.

DISCUSSION

To curb the casualization of labour in Nigerian financial institutions, findings from the study discovered various recommendations to curtail the exploitative and contemporary form of slavery. Most of the stakeholders allege casual staffing is only another form of exploitation and add little or no meaningful value to financial industries since the chief executives of commercial banks and the BSFs are sui generis but dissimilar in salary payment of casual workers where all proceeds accrued transverse to a single treasury. This finding was also corroborated by Bodibe (2007) who notes that some casual workers work seven days and get an hour break in a day. Stakeholders call for the total elimination of the BSFs. Based on the above, the study discovered that there is a need for an increase in wages and social security benefits as well as the elimination of the BSFs. This is in line with Tukamuhabwa (2012) who revealed that organizational incentives in form of reward improved workers compliance and performance. This means that where there is poor or no appropriate motivation, workers are likely not to give in their best. In a separate development, major findings from the study call for the implementation of both international and national labour acts law (where available); enactment of new laws are absent, and regulatory bodies should be put in place to monitor the activities of financial institutions as it relates to recruitment, salary and benefits payments, as well as retrenchment. This authenticates the findings of Tinuke (2012) who revealed that informal employment of people is not regulated via the Nigerian Labour Laws; their fame is not described and no provisions are made for the law of the phrases and situations in their employment. Tinuke further asserted that the Nigerian Labour Act does not outline casualisation and offer a criminal framework for the law of the phrases and situations in their paintings arrangement. However, Section 7(1) of the Act affords that no employee should be hired for more than 3 months without the regularization of such employment. After 3 months each employee ought to be regularized via the corporation to encapsulate total freedom from bondage and create room for a collective bargain; stakeholders recommended freedom of association in Nigerian financial institutions to ensure workers' rights are protected.

CONCLUSION

Sociology is the scientific study of human social behavior. In the course of such study, sociology studies the social behaviour and normative codes in every organizational structure for comparison with the ethical standard of jobs assigned to individuals as it commensurate to the income received. Even though casualization of labour is expected to be a short term appointment with automatic regularization after a few months or at most 2 years in service, commercial banks in Sokoto hold casual bank staff to ransom for 12 to 15 years of casual labour with little or no benefit attached and retrenchment may set-in without prior notice, especially when a replacement for such position is available with little pay. This is an entrenching factor worsening the system of casual labour in financial institutions in Nigeria. This is why the study concludes on unionization in the banking sector as well as enacting policies targeted towards eradicating the system of casual staffing. Based on the above findings, the Effort-Reward imbalance model was ascertained as there is an imbalance in the effort put by casual workers in Nigerian banks and the reward paid as take home coupled with other benefits. This is a clear indication that the findings of the study are in line with the postulated model. There is a need for government and lawmakers to analyze the exploitation leveled against casual workers by most commercials banks as well as the BSFs. A thorough investigation should be conducted on the working hours spent by casual and their commensurability to the salaries and other allowances accrued. This will help to shape future action on whether the BSFs scheme should be completely eradicated or whether certain amendments should be made to the scheme, especially the management of such organization. Payments of the benefit accrued by a casual staff should be delinked from the BSFs and linked between the contract staff and the bank directly. This will minimize the double exploitation suffered by casual staff in the hands of the bank and the BSFs as well. Unionization should be highly promoted in Nigerian financial industry where all workers can collectively bargain their rights and air their grievances, to minimize exploitation and occupational threat, especially among the contract staff. This can be achieved when government and lawmakers capture the freedom of association and unionization as a constitutional backing of which all financial institutions must abide. Casual workers employed with OND should hastily enroll into higher institutions of learning for self-development and enhancement in terms of regularization since the minimum qualification most financial institutions employ is B.Sc or HND for full-time professional staff. This will give most casual staff the opportunity for quick regularization that was previously recommended after 2 years of employment.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Bodibe O (2007). The Extent and Effects of Casualization in Southern Africa: Analysis of Lesotho, Mozambique, South Africa, Swaziland, Zambia and Zimbabwe. Research Report for the Danish Federation of Workers. |

|

|

Barchiesi F (2011). Precarious liberation: Workers, the State, and contested social citizenship in postapartheid South Africa. Suny Press. |

|

|

Courtois ADM, O'Keefe T (2015). Precarity in the ivory cage: Neoliberalism and casualisation of work in the Irish higher education sector. Journal for Critical Education Policy Studies 13:1. |

|

|

Cranford C, Vosko L, Zukewich N (2003). The gender of precarious employment in Canada. Relations industrielles/Industrial relations 58(3):454-482. |

|

|

Fapohunda TM (2012). The global economic recession: Impact and strategies for human resources management in Nigeria. International Journal of Economics and Management Sciences 1(6):7-12. |

|

|

Hussmanns R (2004). Measuring the informal economy: From employment in the informal sector to informal employment. Policy Integration Department, Bureau of Statistics, International Labour Office. |

|

|

Luswili C (2009). The effects of investment on employee rights in Zambia: Casualization of Labour. Bachelor of Law thesis, University of Zambia. |

|

|

McLaughlin H (2011). Understanding social work research. Sage. |

|

|

Nies S, Sauer D (2018). Work-more than employment? critique of capitalism and the sociology of work. Capitalism and labor: towards critical perspectives, pp. 44-70. |

|

|

Seidman GW (2007). Beyond the boycott: Labor rights, human rights, and transnational activism. Russell Sage Foundation. |

|

|

Stebbins RA (2001). Exploratory research in the social sciences. Sage. Volume 48. |

|

|

Tinuke M (2012). Employment Casualisation and Degradation of Work in Nigeria. International Journal of Business and Social Science 3:9. |

|

|

Tukamuhabwa BR (2012). Antecedents and Consequences of Public Procurement Non- compliance Behavior. Journal of Economics and Behavioral Studies 4(1):34-46. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0