ABSTRACT

Weather Index-based Crop Insurance (WII) scheme have been introduced as an innovative way of mitigating downside risk effects, especially for smallholder farmers in developing countries. The uptake and effectiveness of such a scheme, especially in Kenya is not well documented. A stratified random sampling procedure was employed to get a representative sample of 330 smallholder farm households. This paper uses a double hurdle model to establish factors influencing adoption and the eventual extent of uptake of a weather-based crop insurance, what in Kenya is referred to as Kilimo Salama meaning safe farming in English. The results show that, access to extension, perception and group membership had significant positive effects on adoption (at 1% level), household head education level (at 5% level) whilst, adoption was negatively influenced by distance to agrovet and distance to the extension agent office (at 1% level), farming experience, age of household head and size of cultivated land (at 10% level). Distance to agrovet negatively influenced extent of adoption at 1% level while distance to extension agent together with farm size positively influenced the extent of adoption at 5 and 10% level respectively. To enhance participation by farmers in Kilimo Salama insurance scheme and consequently reduce production risks in their farming business, interventions that would enable farmers access to agricultural information, membership to groups, reduction of transaction costs and training farmers on benefits of an insurance scheme should be encouraged.

Key words: Kilimo Salama, adoption, double hurdle model, crop insurance, Kenya.

A majority of smallholder farmers employ informal risk management strategies such as income diversification, borrowing from money lenders, selling assets, participating in off-farm work and in government as well as non-government relief programmes (Hardaker et al., 2004). However, these traditional risk management strategies have the limitation of co-variability problem (Gautam et al., 1994). Co-variability problem is a situation that traditional risk management strategies may involve more cost. For example, diversification pursued as a risk management reduces average income, credit borrowed in drought years must be repaid with interest while temporarily liquidating assets is costly due to capital losses. Therefore, there is a need for innovative risk management strategy such as Weather - Index Insurance (WII).

Weather-Index Insurance (WII) is an innovative form of index insurance that covers farmers against weather-related extreme events. The technology uses a proxy (or index) – such as the amount of rainfall, or temperature, or wind speed - to trigger indemnity payouts to farmers. This index helps to determine whether farmers have suffered losses from the insured peril and hence need to be compensated (World Bank, 2011; Tadesse et al., 2015). The Kilimo Salama insurance application of WII is against rainfall deficits, including drought, based on rainfall measurements at reference weather stations during a defined period. In this scheme, insurance payouts are made based on a pre-established indemnity scale set out in the insurance policy. Here, the sum insured is based on the production costs for the selected crop, and indemnity payments are made when actual rainfall in the current cropping season, as measured at a selected weather station, falls below pre-defined threshold levels or exceeds it (Sina, 2012).

The WII empowers the rural communities, especially the smallholder farmers to cope with increasing livelihood vulnerabilities through maintaining stability in farm income, promoting technology adoption, encouraging investment, and increasing credit flow to the agricultural sector (Hess and Syroka, 2005; Skees and Barnett, 2006). In both developed and developing countries WII technology has gained attention because its contracts are relatively simple in implementation, sales and marketing (Barnett and Mahul, 2007). Further, the technology reduces adverse selection and moral hazard. Therefore, neither sellers nor the buyers of the insurance scheme can influence its realization (Giné et al., 2005). Despite the advantages associated with the technology, WII’s are expensive to start and suffers from basis risk. Basis risk is a situation that what is predicted by the index differs from farmers’ experiences in some regions under insurance cover (Hess, 2003; Collier et al., 2009).

In the face of increasing uncertainty and risk faced by the farming community associated with climate change, a private insurance scheme in Kenya, the Kilimo Salama insurance evolved in the year 2008. Kilimo Salama a Kiswahili phrase meaning safe farming in English is a kind of weather index crop insurance scheme. The scheme aimed to protect farmers against drought and excess rainfall risks, in particular, protecting their investment in input (seeds, fertilizer, and crop chemicals). in which the premium was bundled in input bought. Farmers are therefore guaranteed some compensation in case of harsh conditions. The scheme uses solar-powered weather stations to monitor rainfall and mobile phone payment technology to collect premiums and make payments to farmers. An indemnity is paid whenever the realized value of the index report drought or excess rainfall in the farmers’ registered weather station (Sina, 2012). The scheme was launched by Syngenta Foundation for Sustainable Agriculture in partnership with the insurance company UAP and the telecommunication Safaricom. The pilot phase of Kilimo Salama insured 200 maize farmers in Nanyuki in Laikipia County (Stutley, 2012, quoted in WFP- IFAD 2010). Currently, it has spread to Nyanza, Eldoret, Busia, Embu, and Kitale. Despite the existence of Kilimo Salama insurance scheme in Kenya, there exists an empirical knowledge gap on factors affecting its adoption and extent of adoption.

Past empirical studies on WII have focused on the evaluation of factors influencing demand and participation in the insurance programmes. For example results of several studies reveal that the age and education level of the farmer, and trust positively influence the demand for crop insurance (Smith and Baquet, 1996; Goodwin and Mishra, 2006; Boyd et al., 2011; Velandia et al., 2009). To the contrary, there was negative relationship between farmers’ age and their family size with the adoption of crop insurance indicator (Sadati et al., 2010). While Velandia et al. (2009) reported off-farm income to influence demand for crop insurance positively, Sakurai and Reardon (1997) reported a negative influence. Credit constraint influence demand for crop insurance negatively (Giné et al., 2008; Giné and Yang, 2009; Cai et al., 2009).

From the reviewed literature, none of the studies attempted to determine both factors that influence adoption and extent of adoption of crop insurance together. In assessing the performance of any agricultural technology, it is important to understand the factors that influence adoption process and the extent to which technologies have spread throughout the target population. Also, understanding the factors that influence adoption of an insurance scheme is important in coming up with relevant evidence-based policies regarding formal agricultural crop management strategy as well as enhancing its uptake by farmers. Similarly, insurance providers, on the other hand, may be able to determine the economic gain associated with their investment against this backdrop.The objective of this study was to determine factors that influenced the decision to adopt as well as the extent of adoption of Kilimo Salama insurance scheme using the Cragg‟s double hurdle model. The postulated hypothesis of the study was that socio-economic, institutional and technological factors do not influence the participation and extent of the insurance scheme.

The study area

This study was conducted in Daiga and Lamuria divisions of Laikipia East Sub-county in Laikipia County because they are the two divisions where Kilimo Salama insurance scheme was piloted in 2008. The divisions are situated within the transitional zone of wetter and drier rainfall regime. The rainfall ranges between 280 and 1100 mm per annum in Daiga and Lamuria receive an average rainfall of 1024 and 787 mm per annum, respectively. The rainfall pattern is bi-modal with the long rains occurring from March to May and short rains from October to November (Gichuki et al., 1998). The divisions also experience continental rains (rain caused by the Congo airstream) which occur between June and September (Jaetzold et al., 2005). Daiga and Lamuria are classified as semi-humid and semi-arid zones with an elevation of 2020 and 1840 m above mean sea level (msl), respectively.

The dominant livestock in the County are cattle, sheep and goats while the dominant crops grown are maize and beans planted by almost all farmers. Other crops are potatoes, peas, sweet potatoes, cabbages, kales, and peas. Maize is a staple food in both divisions, and its production is affected periodically by inadequate and poorly distributed rainfall. The weather index crop insurance known as Kilimo Salama was initiated in the divisions in 2008 to mitigate against production risks and improve food security status.

Sampling and data collection

A sample of 330 households was obtained through a stratified random sampling procedure from Laikipia County. The sample comprised of 130 adopters and 200 non-adopters of Kilimo Salama insurance scheme. The non- adopters considered were about a 5 km radius from adopters to take care of spillover effects. To get the adopters of the insurance scheme, a list of households who adopted the insurance at the pilot stage was developed. This was possible with the help of the chairpersons of the groups whose members had adopted the insurance scheme. For the non-adopters, a systematic random sampling was used. A random route, in this case, the roads were used along which every third household to the right and then to the left were selected and interviewed by the enumerators. A stratified sampling method was preferred to get control of the sample and to enable replacement of household from the same strata.

Primary data were collected using pre-tested questionnaires that were administered through face-to-face interviews between April and May 2012. Data collected were on household demographic, socio-economic and institutional characteristics postulated to have an influence on adoption of Kilimo Salama insurance scheme. Data on the amount of inputs bought from the insurance scheme and other sources were also collected. The extent of adoption was determined by computing a ratio of cost of inputs bought from insurance scheme relative to total cost of inputs used in the farm in two cropping seasons in the year 2011.

Theoretical framework and variable description

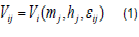

Assuming that smallholder agriculture is rain-fed and those smallholder farmers are rational but exhibit risk-averse behaviour, and then it follows that the smallholder farmers would be willing to participate in Kilimo Salama insurance scheme. Consequently, the indirect utility function for respondent j can be specified as (Equation 1):

where Vij is the utility function, mj is the production function of the jth household, hj represents a vector of household characteristics and choice attributes such as age, education, farming experience and input costs, and εij a random error unobserved component of utility.

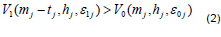

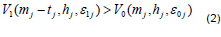

In this study, i = 0 indicated production occurring without drought insurance and i = 1 is a proxy indicator for production where farmers have adopted Kilimo Salama insurance. In a case where household j has adopted Kilimo Salama insurance scheme, indicating payment of a premium tj to insure, it follows that the utility received on insuring is higher than when there is no insurance (Equation 2).

where V1 is the utility function incorporating willingness to pay for crop insurance, mj-tj is production with insurance, hj represents a vector of household characteristics, and choice attributes and εij is a random error term while V0 is the utility derived by the farmer with no insurance, mj is production without insurance, and ε0j is a random error term without the insurance. If the utility V1 – V0> 0, a farmer will prefer to adopt Kilimo Salama insurance scheme. Thus, the difference between the expected utility production with the insurance and without the insurance is the potential factors determining farmers’ decision of Kilimo Salama insurance adoption.

To determine factors that influence adoption of improved agricultural technologies in Kenya numerous studies have utilized the Logit, Probit or Linear probability models (Mwabu et al., 2006; Amudavi et al., 2008; Nambiro and Okoth, 2013). The biggest shortcoming of Probit and Logit models is that they do not measure the extent of technology adoption (Feder et al., 1985). The decision whether to adopt a technology such as Kilimo Salama insurance scheme and extent of adoption can be made jointly or separately. In this case, the Heckman two- stage, the Tobit and the Double hurdle model can be used. Several studies have used the Heckman two-stage model to determine probability and extent of adoption of agricultural technologies (Wachira et al., 2012; Kinuthia et al., 2011; Ramaekers et al., 2013). The model, posses a characteristic of the first hurdle dominance; a condition in which the adoption decision receives greater importance than the extent decision yet both decisions are equally important.

In a situation where the decision to adopt and extent of adoption are made jointly and affected by same factors then the Tobit model would be appropriate for analysis (Greene, 1993; Ouma and De Groote, 2011; Murage et al., 2012). Thus, if a given factor leads to whether to adopt then this factor has a positive effect on how much to adopt. However, there may be a proportion of the population of farmers who would because they will be negatively affected by adopting insurance scheme, never adopt under any circumstances (Moffatt, 2005). In such a case, a model such as the Tobit might be too restrictive because it allows one type of zero observation, namely a corner solution since it is based on the implicit assumption that zeros arise only as a result of the respondent’s economic circumstances (Martínez-Espiñeira, 2006).

Berhanu and Swinton (2003) argued that adoption and extent decisions are not necessarily made jointly. The decision to adopt may precede the decision on the extent of use, and the factors affecting each decision may be different. With this reasoning, the appropriate model to analyse factors that affect probability and extent of adoption is the double hurdle model. The Double hurdle model was first suggested by Cragg (1971) to solve the restriction of too many zeros in Tobit model and has been used by several authors (Moffatt, 2005; Burke, 2009; Olwande et al., 2009; Mignouna et al., 2011). The underlying assumption in the double-hurdle approach is that individuals make two decisions about their willingness to adopt Kilimo Salama insurance scheme. The first decision is whether they will buy insured inputs while the second decision is about the amount of the insured inputs they will buy, conditional on the first decision. The importance of treating the two decisions independently lies in the fact that factors that affect one’s decision to adopt may be different from those affecting the decision on how much to adopt. Implying that households must cross two hurdles to adopting and therefore, the first hurdle needs to be met to be a potential adopter. Furthermore, this model approach allows us to understand characteristics of a class of households that would never adopt Kilimo Salama insurance scheme. Thus, the probability of a household to belong to a particular category depends on a set of household's characteristics.

The double hurdle model is, therefore, superior in comparison to other models that are used in adoption decisions especially Tobit, which assumes that the two decisions are affected by the same factors. With this respect, to achieve the objective of the study, a double hurdle model was preferred. The model consists of two hurdles representing two sequential decision-making process. The two decisions are whether to participate in Kilimo Salama insurance scheme and to what extent. The extent of adoption was considered as the ratio of insured inputs to the total inputs bought by each household. The households must cross two hurdles to be considered as adopters. Each hurdle is conditioned by household socio-economic and demographic characteristics (e.g., age, education and farm size) and Kilimo Salama attributes (access to information about the scheme, premium for inputs and distance to registered agrovet). Non–economic factors can condition the attainment of the first hurdle while economic factors are important to determine a positive outcome of the second hurdle.

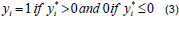

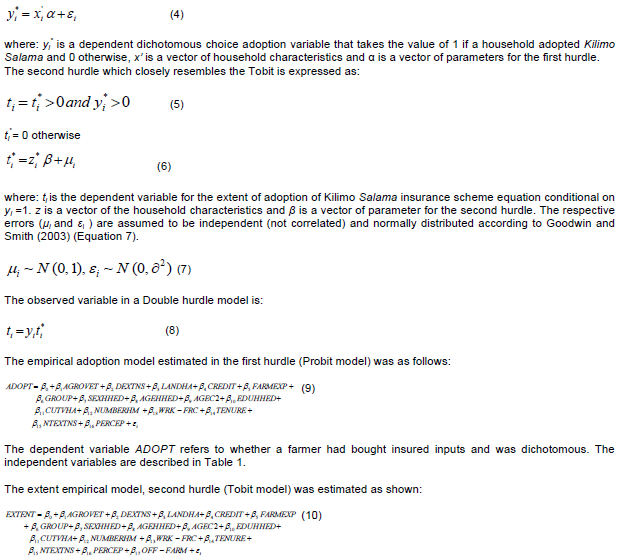

In the first hurdle, the Probit model was used to determine the probability that a household could adopt Kilimo Salama insurance scheme and a Tobit model to determine the extent of adoption. In double hurdle model, whether a household has adopted Kilimo Salama (a dichotomous choice) and the extent of adoption that is, the cost of input bought (a continuous variable); Double hurdle is a parametric generalization (Equation 3 and 4).

The first equation relates to the decision to adopt (y) can be expressed as (Mignouna et al., 2011):

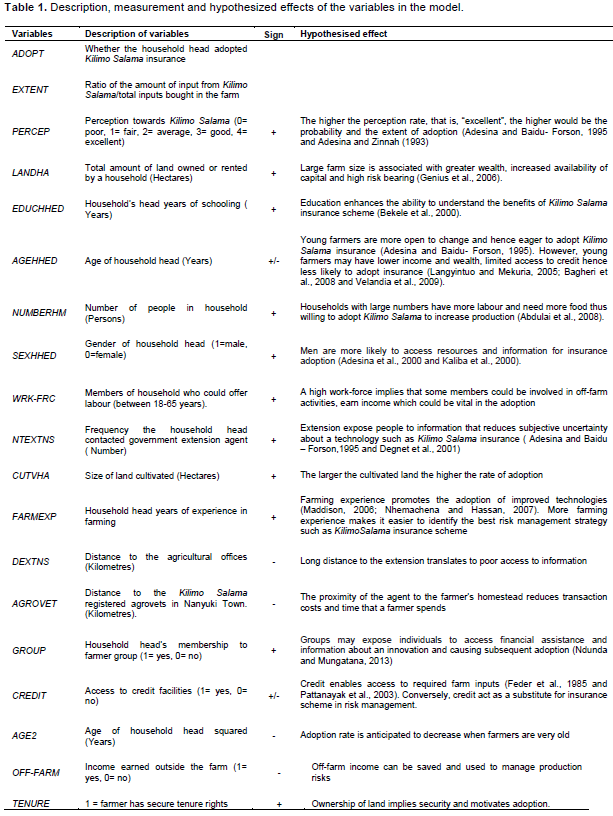

The dependent variable in the second equation (EXTENT) refers to the ratio of the insured inputs to the total inputs bought by the household. Description of independent variables used are shown in Table 1.The study estimated the unconditional average partial effects (APE), and run bootstrapping replications on each observation. Determination of APE helps in estimating the observed coefficient, standard errors and the P-values showing the significance levels described by Burke (2009).

Descriptive results

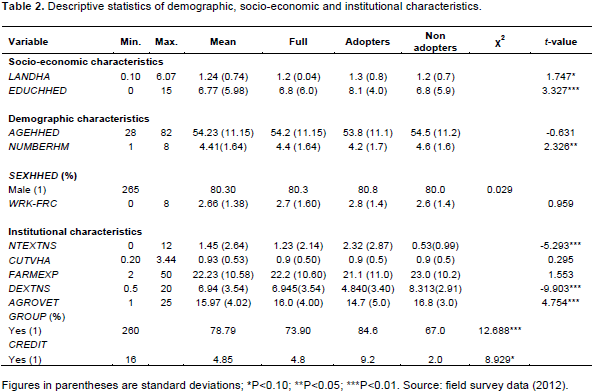

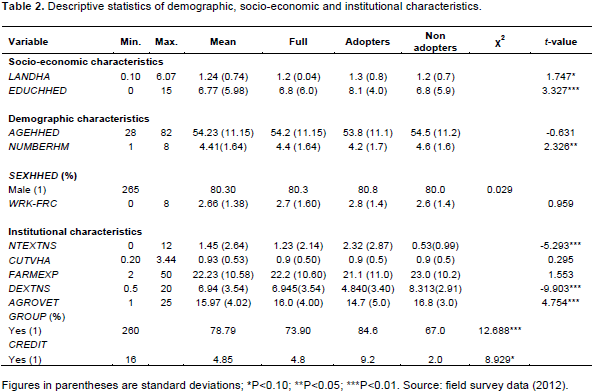

Table 2 presents the descriptive statistics of demographic, socio economic and institutional characteristics of sampled farmers.

The average land size was 1.2 ha, and only 0.93 ha was under cultivation. The latter accounted for about 75% of the total land size under cultivation. Adopters owned a mean land size of 1.3 while non-adopters owned 1.2 ha. There was a significant difference in mean land size owned between adopters and non-adopters at 10% significance level. However, there was no significant difference in cultivated land size between adopters and non-adopters.

Years of education of household heads ranged from 0 years (no formal) to 15 years of education with a mean of 6.8. Education level varied among household heads with a standard deviation of 5.98. Education level was statistically different between adopters and non-adopters of Kilimo Salama at 1% level of significance. The percentage of literate adults in the population was about 84.5% and was relatively higher than the national average of 79.5% (GoK, 2007). The age of household heads’ ranged from 28 to 82 years with an average age of 54.23 years having a standard deviation of 11.15.

There was no statistical difference in age between adopters (53.8) and non-adopters (54.5).

The results showed that on average, the household size (NUMBERHM) of the sample in the study areas was four persons while individually ranging from 1 to 8 persons per household. The mean family size in the study areas (4 persons per household) is relatively lower than the

The pattern of the gender distribution of household heads was similar among adopters and non-adopters. The Kenya’s sex ratio stands at 97 males per 100 females (GoK, 2007). The study areas, therefore, have relatively lower proportion in respect of sex ratio compared to the national average.

The variable WRK- FRC (Workforce of a household) captured the effect of availability of family labour and the dependency ratio in the household. There was no significant difference between mean workforce of adopters (1.4) and non-adopters (1.4) of Kilimo Salama insurance scheme. Contact with government extension officer (NTEXTNS) informed on the effect of availability of extension services on adoption of innovative technology by farmers in crop production. On average, a smallholder farmer had about 1.45 days of extension contacts per year. There was a significant difference in contact with extension officers between adopters and non-adopters of Kilimo Salama insurance scheme at 1% level. It was also found that household head had an average of 22.2 years in farming with a minimum of 2 years and a maximum of 50 years.

Distance to the main market matters in the adoption of technology as well. The variable AGROVETwas used as a proxy of distance to the main market. The Kilimo Salama agrovets are situated in Nanyuki town which is the main market for the two divisions under consideration. The amount of inputs purchase, input and output price availability and other institutional services that the smallholder farmer can get might be determined by the distance of a smallholder farmer from the main towns and service centres. On average, to reach the nearest primary market household members had to travel 15.97 km with the minimum of 1 and a maximum of 25 km. There was a positive significant difference between adopters and non-adopters of Kilimo Salama insurance scheme at 1% level.

Farmers’ membership to group plays a role in spreading information about an existing or emerging technology. Most of the farmers in the sample were found to be in groups (73.9%) with more adopters of the Kilimo Salama insurance scheme in groups (84.6%) compared to non-adopters (67.0%), and this difference was significant. Worthy noting is the fact that the effect of credit on adoption of the insurance scheme was not determined a priori. However, there was a positive significant difference in access to credit between adopters and non-adopters of Kilimo Salama insurance

scheme at 10% level.

The double hurdle model results

The double hurdle model was estimated using STATA 10 econometric software (Burke, 2009). Diagnostic tests for the existence of multicollinearity and heteroskedasticity were conducted using Variance Inflation Factor (VIF) (Gujarati, 2004) and the White Test (White, 1980), respectively. The VIF results ranged between 1.09 and 1.67. Hence, multicollinearity was not a problem among the continuous variables. Similarly, for dummy variables the contingency coefficients test was employed. For the dummy variables, if the value of contingency coefficients is greater than 0.75, the variable is said to be collinear. The coefficients varied between 0.001 and 0.217, which indicated that there was no evidence of a strong correlation between the dummy variables. The White test for heteroskedasticity showed there was no problem of heteroskedasticity among the variables and the error term (p = 0.1980).

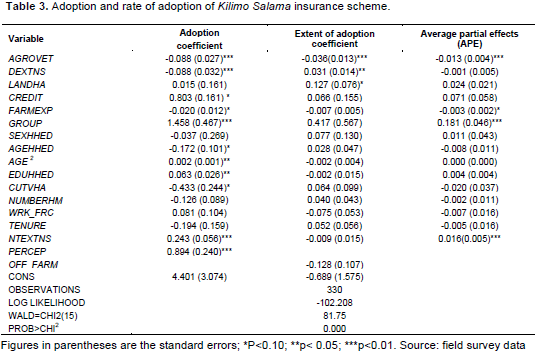

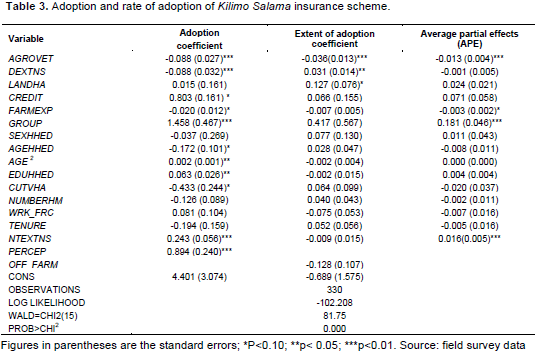

The maximum likelihood parameter estimates for the double hurdle model and the marginal effects of the variables were obtained using the Craggit command in Stata (Burke, 2009). In Table 3, the results of the determinants of adoption and extent of Kilimo Salama adoption are presented. Sixteen coefficients were estimated in the adoption hurdle where eleven of them were statistically significant. In the second hurdle only three coefficients were statistically significant.

The estimated coefficient AGROVET (distance to agrovet) variable was found to be negative (-0.088) and statistically significant at 1% level in adoption hurdle suggesting that farmers who are closer to the agrovet have a higher probability to adopt the insurance scheme than those that are far away. The probability marginal effects of the distance to agrovet variable were noted to be statistically significant at 1% level. This indicated that expected adoption of Kilimo Salama insurance scheme decreased by 1.3% as the distance to registered agrovet increased by one kilometre. The finding was in line with what was observed by Abdulai and Huffman (2005), who indicated that farmers living away from market incurred increased transaction costs and, therefore, they are unlikely to adopt a technology. Also, farmers, faced with high farm-to-market access costs or poor market access, commit less land, fertilizer and machinery resources to production (Obare et al., 2003). In the second hurdle, the rate of adoption, the coefficient for agrovet was negative and significant at 1% level suggesting that as distance to registered agrovet increased the amount of input bought decreased.

The coefficient for distance to extension agent (DEXTNS) was negative and significant at 1% level indicating that the greater distance to extension agent means lower the probability of adoption. In the second hurdle, the coefficient of distance to the extension was positive and significant at 5% level. The government subsidized fertilizer is distributed through the government extension agents and since Kilimo Salama insures chemicals, seeds and fertilizers, farmers who are far away from extension agent office may not access information when the subsidized fertilizer is available and, therefore decide to insure. The results were in contrast with the results reported by Adesina et al. (2000) who reported a significant positive relationship between access to extension services and the adoption decision of alley cropping in Cameroon.

The coefficient for LANDHA (farm size owned) by the household was not significant in adoption hurdle. This can be explained by the fact that adoption involves the use of inputs which are bundled in small amounts and; therefore adoption is not conditioned by the size of land. In the extent hurdle, the land size coefficient was positive and significant at 10% level. The implication is that household heads with large pieces of land bought a large amount of the inputs. This was in line with results of several studies (Goodwin, 1993; Goodwin and Mishra, 2006; Velandia et al., 2009) who found farm size positively related with the adoption of crop insurance. However, to the contrary, various authors did not find any significant relationship between farm size and demand of crop insurance (Smith and Baquet, 1996; Goodwin and Smith, 2003).

The coefficient for CREDIT (access to credit) by farmers positively and significantly influenced adoption at 10% level. This indicated that credit access was significant on farmer’s adoption of Kilimo Salama insurance scheme. This could be because access to credit improves the financial situation of the farmer.

Consequently, it enables access to required resources if accessed at the beginning of the season. The results were congruent with the findings of Cai et al. (2009), Cole et al. (2009), Giné and Yang (2009) and Giné et al. (2008) who reported that credit received by farmers had a positive effect on the propensity of farmers to purchase insurance. The results were in contrast with results of Kakumanu et al. (2012) who stated that credit access does not have any significant effect on farmer’s WTP for Weather-Based Crop Insurance Scheme.

The coefficient for FARMEXP (farming experience) was negative and significant at 10% level. Results suggest that as years in farming business by the household head increases the probability of adopting the Kilimo Salama insurance scheme decreased. Household who have been in farming business for a long time could have encountered weather-related risks and have ways of coping with them, hence not likely to adopt Kilimo Salama insurance scheme. However, one other possible explanation for the negative coefficient could be associated with imperfect knowledge of the technology. Some studies reported a decrease in adoption rate as farming experience increases (Foster and Rosenzweig, 1995; Ghadim and Pannell, 1999).

Group membership had a positive and significant influence on adoption (1% level). An explanation is that as household heads join groups they can get information about the existence of Kilimo Salama insurance scheme. The unconditional marginal effect of this coefficient was positive and significant at 1% level. This showed that adoption increased by 18.1% when farmer belonged to a group. These results were consistent with results reported by Nkamleu (2007) and Giné et al. (2008) who highlighted membership to a group as a key determinant on adoption of fertilizers in Cameroon and rainfall insurance in India respectively.

The estimates of the sex of household head, household size, workforce, and land tenure were not significant at all conventional levels contrary to the hypothesized positive influence on adoption of the insurance scheme. This could be because the insurance scheme insured maize which acts as a cash crop and food crop for the study area. Therefore, male and female headed households preferred its farming equally and there was no significant difference across households by gender of the household head. Also, the scheme insures inputs used in own or rented land therefore the land rights that could result to women not adopting new technology due to land inheritance could not apply.

The age of household head (AGEHHED) variable was negative and significant in the adoption decision at 10% level. This suggests that younger farmers had a high probability of adopting Kilimo Salama than older farmers. It could be that older farmers due to their high experience in farming and consequent awareness of risk and uncertainties, they have put in place risk management strategies and, therefore, do not consider Kilimo Salama as an effective risk management strategy. The results were consistent with findings of Kakumanu et al. (2012) who found out that, age had a negative and significant effect on farmer’s willingness to pay (WTP) for Weather-Based Crop Insurance Scheme (WBCIS). Similarly, Sadati et al. (2010) and Velandia et al. (2009) reported that farmers’ age influenced adoption of crop insurance negatively. However, a positive relationship between age and adoption of crop insurance was reported by Sherrick et al. (2004).

To capture the possibility of a non-linear relationship between age and adoption of Kilimo Salama insurance scheme the variable for AGE 2 (age of household head squared) was included in the model. Its coefficient was positive and significant at 5% level. This indicated that as the age of household head increased the probability of adoption increased at an increasing rate up to a certain age when adoption rate decreased. An explanation could be that as the household head gets aged, he/she had experience with production risks and accumulated some wealth which they can use when faced with production risks.

The coefficient for EDUHHED (education of household head) was positive and significant at 5% level. This showed that as years in education increased, adoption of Kilimo Salama also increased. Educated farmers are more aware of benefits of crop insurance scheme as compared to those who have less and, therefore, adopt the insurance scheme. The results are consistent with findings of the study by Sadati et al. (2010) which established a positive relationship between education of a household head and the decision to adopt crop insurance.

The coefficient for CUTVHA (cultivated land) was negative and significant at 10% in the adoption hurdle. An explanation is that because adoption of insurance scheme involves extra cost, the larger the size of land cultivated the lower the adoption rate due to the high cost of inputs. Furthermore, farmers wish to distribute risk by buying uninsured products which are cheaper as well as grow various enterprises which are not under insurance cover. Another explanation could be that farmers who cultivate larger areas have larger farms and are wealthy and can use other risk management strategies influencing insurance negatively.

The number of household members (NUMBERHM) was not significant in influencing adoption of the insurance as postulated. An explanation could be that large households size were categorised of young children who were dependants and could not provide labour on the farm. Further, the smaller households comprised older household’s members who could provide little or no labour in their farm. The aged members depended on assistance from their off springs. Therefore, the size of the household did not have an effect on adoption and extent of adoption as anticipated.

Access to extension services by farmers positively influenced adoption of Kilimo Salama scheme at 1% level. The unconditional marginal effect on a number of contact with extension agent indicated that contact with extension agent increased adoption of Kilimo Salama insurance scheme by 0.5%. Contact with extension agents is one way of disseminating new technologies to farmers as a way of increasing agricultural productivity. Also, contact with extension services encourages adoption because exposure to information reduces subjective uncertainty about the insurance scheme. The finding of the study is consistent with the results obtained by Sadati et al. (2010) who reported a positive correlation between extension participation and adoption of crop insurance. Similarly, Kaliba et al. (2000) on maize adoption in Tanzania found that high intensity of extension services was among the major factors that positively influenced adoption of improved maize seeds. Further, Adesina and Baidu-Forson (1995) found a significant positive relationship between access to extension services and the adoption decision of new agricultural technology in Sierra Leone.

The estimated coefficient PERCEP (perception of Kilimo Salama insurance scheme) had a positive effect on adoption of Kilimo Salama insurance scheme at 1% level. Technology adoption is determined by many factors such as perceived characteristics of the technologies, farmer characteristics as well as institutional factors. The extent to which smallholder farmers perceives a technology such as Kilimo Salama insurance scheme as a risk mitigating strategy can determine adoption of the scheme. The adopter perception model reveals that the perceived aspects of innovations influence adoption behaviour (Adesina and Zinnah, 1993; Adesina and Baidu- Forson, 1995). Thus, adoption depends on users’ judgement of the value to their technology.

CONCLUSION AND POLICY IMPLICATIONS

Based on the findings of the study, policies that promote access to agricultural technology information should be encouraged. The insurance scheme providers should add more effort in training farmers on benefits of an insurance scheme to compliment the information offered by the government extension services to enhance adoption. Also, membership in a group should be encouraged because group membership enhances information, knowledge sharing and access to credit at affordable interest rates to buy insured inputs.

The authors have not declared any conflict of interest

The authors acknowledge the support of African Economic Research Consortium (AERC) for the financial support. They also highly appreciate enumerators and the respondents for their cooperation.

REFERENCES

|

Abdulai A, Huffman WE (2005). The diffusion of new agricultural technologies: the case of crossbred-cow technology in Tanzania. Am. J. Agric. Econ. 87(3):645-659.

Crossref

|

|

|

|

Abdulai A, Monnin P, Gorber J (2008). Joint Estimation of Information Acquisition and Adoption of New Technologies under Uncertainty. J. Int. Dev. 20(4):437-451.

Crossref

|

|

|

|

|

Adesina AA, Baidu-Forson J (1995). Farmers Perceptions and Adoption of New Agricultural Technology: Evidence from Analysis in Burkina Faso and Guinea West Africa. Agric. Econ. 13(1):1-9.

Crossref

|

|

|

|

|

Adesina AA, Mbila D, Nkamleu GB, Endaman D (2000). Econometric Analysis of the Determinants of Adoption of Alley Farming by Farmers in the Forest zone of Southwest Cameroon. Agric. Ecosyst. Environ. 80(3):255-265.

Crossref

|

|

|

|

|

Adesina AA, Zinnah MM (1993). Technology Characteristics, Farmers Perceptions and Adoption Decisions: A Tobit Model Application in Sierra Leone. Agric. Econ. 9(4):297-311.

Crossref

|

|

|

|

|

Amudavi DM, Khan ZR, Midega CAO, Pickett JA, Lynam J, Pittchar J (2008). Push-Pull Technology and Determinants Influencing Expansion among Smallholder Producers in Western Kenya. Paper Presented at the 24th Annual Conference of Association for International Agricultural and Extension Education, on Global Entrepreneurship in International Agricultural and Extension Education 9–15 March 2008, E.A.R.T.H. University, Costa Rica.

|

|

|

|

|

Bagheri A, Fami HS, Rezvanfar A, Asadi A, Yazdani S (2008). Perceptions of Paddy Farmers Towards Sustainable Agricultural Technologies: Case of Haraz Catchments Area in Mazandaran province of Iran. Am. J. Appl. Sci. 5(10):1384-1391.

Crossref

|

|

|

|

|

Barnett BJ, Mahul O (2007). Weather Index Insurance for Agriculture and Rural Areas in Lower-Income Countries. Am. J. Agric. Econ. 89(5):1241-1247.

Crossref

|

|

|

|

|

Bekele HK, Verkuijl H, Mwangi W, Tanner D (2000). Adoption of Improved Wheat Technologies in Adada and Dodola Woredas of the Bale Highlands, Ethiopia. Mexico, D.F: International Maize and Wheat Improvement Centre (CIMMYT) and Ethiopian Agricultural Research Organization (EARO).

|

|

|

|

|

Berhanu G, Swinton SM (2003). Investment in soil Conservation in Northern Ethiopia: The Role of Land Tenure Security and Public Programme. Agric. Econ. 29(1):69-84.

Crossref

|

|

|

|

|

Boyd M, Pai J, Zhang Q, Holly WH, Wang K (2011). Factors Affecting Crop Insurance Purchases in China: the Inner Mongolia Region, China. Agric. Econ. Rev. 3(4):441-450.

Crossref

|

|

|

|

|

Burke WJ (2009). Fitting and Interpreting Cragg'sTobit Alternative Using Stata. Stata J. 9(4):584-592.

|

|

|

|

|

Cai H, Chen Y, Fang H, Zhou LA (2009). Micro insurance, Trust and Economic Development: Evidence from a Randomized Natural Field Experiment, Working paper 15398, National Bureau of Economic Research.

|

|

|

|

|

Cole S, Giné X, Topalavo P, Townsend R, Vickery J (2009). Barriers to Household Risks Management: Evidence from India. Finance working paper No. 09-116. Harvard Business School, Boston.

|

|

|

|

|

Collier B, Jerry S, Barry B (2009). Weather Index Insurance and Climate Change: Opportunities and Challenges in Lower Income Countries. Geneva Papers 34:401-424.

Crossref

|

|

|

|

|

Cragg JG (1971). Some Statistical Models for Limited Dependent Variables with Application to the Demand for Durable Goods. Econometrica 39(5):829-844.

Crossref

|

|

|

|

|

Degnet A, Belay K, Aregay W (2001). Adoption of High –Yielding Maize Varieties in Jimma Zone: Evidence from Farm-level Data. Ethiop. J. Agric. Econ. 5(1-2):41-62.

|

|

|

|

|

Feder G, Just RE, Zilberman D (1985). Adoption of Agricultural Innovations in Developing Countries. A Survey. Econ. Dev. Cult. Change 33(2):255-298.

Crossref

|

|

|

|

|

Foster AD, Rosenzweig MR (1995). Learning by Doing and Learning from others: Human Capital and Technical Change in Agriculture. J. Polit. Econ. 103(6):1176-1209.

Crossref

|

|

|

|

|

Gautam M, Hazell P, Alderman H (1994). Rural Demand for Drought Insurance, Policy Research Working Paper no. 1383, November.

|

|

|

|

|

Genius M, Pantzios CJ, Tzouvelekas V (2006). Information Acquisition and Adoption of Organic Farming Practices. J. Agric. Resour. Econ. 31(1):93-113.

|

|

|

|

|

Ghadim AK, Pannell DJ (1999). A Conceptual Framework of Adoption of an Agricultural Innovation. Agric. Econ. 21(2):145-154.

Crossref

|

|

|

|

|

Gichuki FN, Liniger HP, MacMillan LC, Schwilch G, Gikonyo JK (1998). Scarce water: Exploring resource availability, use and improved management. East. South. Afr. Geogr. J. 8:15-27.

|

|

|

|

|

Giné X, Lilleor HB, Townsend R, Vickery J (2005). Weather insurance in semi-arid India. Commodity Risk Management Group, Agricultural and Rural Development Department, The World Bank, Washington, DC.

|

|

|

|

|

Giné X, Townsend R, Vickery J (2008). Patterns of Rainfall Insurance Participation in Rural India. World Bank Econ. Rev. 22(3):539-566.

Crossref

|

|

|

|

|

Ginè X, Yang D (2009). Insurance, Credit, and Technology Adoption: Field Experimental Evidence from Malawi. J. Dev. Econ. 89(1):1-11.

Crossref

|

|

|

|

|

GoK (2007). Government of Kenya. Ministry of Planning and National Development; Kenya Integrated Household Budget Survey (KIHBS) 2005/06 (Revised Edition). Government Printers, Nairobi.

|

|

|

|

|

Goodwin BK (1993). An Empirical Analysis of the Demand for Multiple Peril Crop Insurance. Am. J. Agric. Econ. 75(2):425-434.

Crossref

|

|

|

|

|

Goodwin BK, Mishra AK (2006). Revenue Insurance Purchase Decisions of Farmers. Appl. Econ. 38(2):149-159.

Crossref

|

|

|

|

|

Goodwin BK, Smith H (2003). An Ex-post Evaluation of the Conservation Reserve, Federal Crop Insurance and other Government Program Participation and Soil Erosion. J. Agric. Resour. Econ. 28(2):201-216.

|

|

|

|

|

Greene WH (1993). Econometric Analysis. London: Macmillan.

|

|

|

|

|

Gujarati DN (2004). Basic Econometrics. 4th ed. New York: McGraw-Hill, Inc.

|

|

|

|

|

Hardaker JB, Huirne RBM, Anderson JR, Lien G (2004). Coping with Risk in Agriculture. 2nd Edition. CAB International Publishing. Wallingford. UK.

Crossref

|

|

|

|

|

Hess U (2003). Innovative Financial Services for Rural India: Monsoon-Indexed lending and Insurance for Smallholders, Agricultural & Rural Development Working Paper 9,World bank.

|

|

|

|

|

Hess U, Syroka J (2005). Weather-based Insurance in Southern Africa: The Case of Malawi, World Bank, Discussion paper No. 13.

|

|

|

|

|

Jaetzold R, Schimdt H, Hornetz B, Shisanya C (2005). Farm Management Hand book of Kenya, revised edition, II. Ministry of Agriculture, Nairobi.

|

|

|

|

|

Kakumanu KR, Palanisami K, Reddy GK, Nagothu US, TIrupataiah K, Xenario S, Ashok B (2012). An Insight of Farmers' Willingness to Pay for Insurance Premium in South India: Hindrances and Challenges. In: René G, François K (Eds.). The Challenges of Index-based Insurance for Food Security in Developing Countries (pp.137-145). Publisher:European Commission, Joint Research Centre, Institute for Environment and Sustainability.

|

|

|

|

|

Kaliba RMA, Verkuijl H, Mwangi W (2000). Factors Affecting Adoption of Improved Maize seeds and use of Inorganic Fertiliser for maize Production in the Intermediate and Lowland zones of Tanzania. J. Agric. Appl. Econ. 32(1):35-47.

|

|

|

|

|

Kinuthia EK, Owuor G, Nguyo W, Kalio AM, Kinambuga D (2011). Factors Influencing Participation and Acreage Allocation in Tree Planting Program: A Case of Nyeri District, Kenya. Agric. Sci. Res. J. 1(6):129-133.

|

|

|

|

|

Langyintuo A, Mekuria M (2005). Modelling Agricultural Technology Adoption Using the Software STATA. CIMMYT-ALP Training Manual No. 1/2005 (Part Two). International Maize and Wheat Improvement Centre, Harare, Zimbabwe.

|

|

|

|

|

Maddison D (2006). The Perception of and Adaptation to Climate Change in Africa. CEEPA. Discussion paper No. 10. Centre for environmental economics and policy in Africa. Pretoria: University of Pretoria.

|

|

|

|

|

Martínez-Espi-eira R (2006). A Box-Cox Double-Hurdle model of wildlife valuation: The citizen's perspective. Ecol. Econ. 58(1):192-208.

Crossref

|

|

|

|

|

Mignouna DB, Manyong VM, Mutabazi KDS, Senkondo EM (2011). Determinants of Adopting imazapyr-resistant maize for Striga control in Western Kenya: A double-hurdle Approach. J. Dev. Agric. Econ. 3(11):572-580.

|

|

|

|

|

Moffatt PG (2005). Hurdle models of loan default. J. Oper. Res. Soc. pp. 1063-1071.

Crossref

|

|

|

|

|

Murage AW, Obare G, Chianu J, Amudavi DM, Midega CAO, Pickett JA, Khan ZR (2012). The Effectiveness of Dissemination Pathways on Adoption of "Push-Pull" Technology in Western Kenya. Q. J. Int. Agric. 51(1):51-71.

|

|

|

|

|

Mwabu G, Mwangi W, Nyangito H (2006). Does adoption of improved maize varieties reduce poverty? Evidence from Kenya. In: International Association of Agricultural Economists Conference, Gold Coast, Australia. pp. 12-18.

|

|

|

|

|

Nambiro E, Okoth P (2013). What factors influence the adoption of inorganic fertilizer by maize farmers? A case of Kakamega District, Western Kenya, Sci. Res. Essays 8(5):205-210.

|

|

|

|

|

Ndunda EN, Mungatana ED (2013). Determinants of Farmers' Choice of Innovative Risk-Reduction Interventions to Waste water-irrigated Agriculture. Afr. J. Agric. Res. 8(1):119-128.

|

|

|

|

|

Nhemachena C, Hassan R (2007). Micro-level analysis of farmers' adaptation to climate change in South Africa. IFPRI Discussion paper No.00714. Washington, D.C.: International Food Policy Research Institute.

|

|

|

|

|

Nkamleu GB (2007). Modelling Farmers' Decisions on Integrated Soil Nutrient Management in Sub-Saharan Africa: A Multinomial Logit Analysis in Cameroon. In: Bationo A (Ed.). Advances in Integrated Soil Fertility Management in Sub-Saharan Africa: Challenges and Opportunities. Springer Publishers, Netherlands. pp. 891-903.

Crossref

|

|

|

|

|

Obare GA, Omamo SW, Williams JC (2003). Smallholder Production Structure and Rural Roads in Africa: The case of Nakuru District, Kenya. Agric. Econ. 28(3):245-254.

Crossref

|

|

|

|

|

Olwande J, Sikei G, Mathenge M (2009). Agricultural technology adoption: A panel analysis of smallholder farmers' fertilizer use in Kenya.Center of Evaluation for Global Action.

|

|

|

|

|

Ouma JO, De Groote H (2011). Determinants of Improved Maize Seed and Fertilizer Adoption in Kenya. J. Dev. Agric. Econ. 3(11):529-536.

|

|

|

|

|

Pattanayak SK, Mercer DE, Sills E, Jui-Chen Y (2003). Taking stock of agroforestry adoption studies. Agroforestry Syst. 57(3):173-186.

Crossref

|

|

|

|

|

Ramaekers L, Micheni A, Mbogo P, Vanderleyden J, Maertens M (2013). Adoption of Climbing beans in the Central Highlands of Kenya: An Empirical Analysis of Farmers' Adoption Decisions. Afr. J. Agric. Res. 8(1):1-19.

|

|

|

|

|

Sadati SA, Ghobadi FR, Sadati SA, Mohamadi Y, Sharifi O, Asakereh A (2010). Survey of Effective Factors on Adoption of Crop Insurance among Farmers. Afr. J. Agric. Res. 5(16):2237-2242.

|

|

|

|

|

Sakurai T, Reardon T (1997). Potential Demand for Drought Insurance in Burkina Faso and its Determinants. Am. J. Agric. Econ. 79(4):1193-1207.

Crossref

|

|

|

|

|

Sherrick BJ, Barry PJ, Ellinger PN, Schnitkey G (2004). Factors Influencing Farmers' Crop Insurance Decisions. Am. J. Agric. Econ. 86(1):103-114.

Crossref

|

|

|

|

|

Sina J (2012). Index- Based Weather Insurance - International and Kenyan Experiences, GIZ/ MoA (ACCI), Nairobi, 2012.

|

|

|

|

|

Skees JR, Barnett BJ (2006). Enhancing Microfinance Using Index-Based Risk Transfer Products. Agric. Finance Rev. 66(2):235-250.

Crossref

|

|

|

|

|

Smith H, Baquet A (1996). The Demand for Multiple Peril Crop Insurance: Evidence from Montana Wheat Farms. Am. J. Agric. Econ. 78(1):189-201.

Crossref

|

|

|

|

|

Stutley C (2012). Promoting Food Security in a Volatile Climate: The Role of Agricultural Insurance. Preliminary Paper prepared for: Financial Sector Symposium, Berlin, January 19/20, 2012.

|

|

|

|

|

Tadesse M, Bekele S, Olaf E (2015). Weather index insurance for managing drought risk in smallholder agriculture: lessons and policy implications for sub-Saharan Africa. Agric. Food Econ. 3(1):1-21.

Crossref

|

|

|

|

|

Velandia M, Roderick M, Rejesus T, Knight O, Sherrick BJ (2009). Factors Affecting Farmers' Utilization of Agricultural Risk Management Tools: The Case of Crop Insurance, Forward Contracting, and Spreading Sales. J. Agric. Appl. Econ. 41(1):107-123.

|

|

|

|

|

Wachira K, Gerald O, Wale E, Darroch M, Low J (2012). Factors Influencing Adoption and Intensity of Adoption of Orange Flesh Sweet Potato Varieties: Evidence from an Extension Intervention in Nyanza and Western provinces, Kenya. Afr. J. Agric. Res. 7(3):493-503.

|

|

|

|

|

White H (1980). A Heteroskedasticity-Consistent Covariance Matrix Estimator and a Direct Test for Heteroskedasticity. Econometrica 48(4):817-838.

Crossref

|

|

|

|

|

World Bank (2011). Weather index insurance for agriculture: Guidance for development practitioners. Agriculture and Rural Development Discussion paper 50. The World Bank, Washington, DC

|

|