Full Length Research Paper

ABSTRACT

For there to be sustainable revival of Kenya’s Cotton Industry, its cotton-value needs to be analyzed, there is need to identify its weak points and implement measures to ameliorate its key constraints. Various authors have developed and analyzed the value-chain of the Cotton Industry in Kenya. This paper reviews important components of the value-chain focusing on strengthening the supply of safe, adequate and quality seeds to smallholder farmers as first and immediate priority. The government of Kenya has portrayed a strong policy support to increase cotton production in cotton growing counties of Kenya. In December 2019, the government approved the first commercial release of improved biotech cotton. The government also enacted laws, regulations and policies to strengthen the cotton value-chain and instituted institutional reforms such establishment of Kenya National Biosafety Authority, the Fiber Directorate, the Cotton Development Authority and revitalization of Rivatex Textile Industry. These excellent efforts need to be synchronized and harmonized for effective and efficient performance of the cotton value-chain especially to enhance the supply of improved quality cotton seeds for smallholder farmers. Because of the introduction of county governments and devolution of agricultural functions from central to county governments, it is imperative that two arms of government synchronize activities in the Cotton Industry to ensure adequate support for smallholder farmers for key services such as extension services, supply of quality seeds and provision of credit.

Key words: Cotton industry, quality cotton seeds, policies, regulations, institutional reforms.

INTRODUCTION

The importance of Cotton Industry in Kenya is based on several premises. Kenya’s Vision 2030 identifies cotton as the key sub-sector with the potential to benefit 8 million people in the drier areas of the country that cover 87% of the country (Gok 2007; Gitonga et al, 2016). The government set up the Cotton Development Authority (CODA) to coordinate the revitalization of the Cotton Industry (Gitonga et al, 2016). Kenya has 52 textile mills of which 15 are operational and operate at less than 45% capacity. The mills use outdated technology and suffer from low skilled labour and productivity (Eleksie, 2017). Kenya has a strong regional position under AGOA with a share of total SSA textile; its apparel exports to the US increased from 16% in 2004 to 37% in 2014 (Eleksie, 2017). Apparel manufacturing in Kenya is the most attractive investment option for global investors of duty-free access to the USA and to the EU under EPA, has well-developed export channels, infrastructure and linkages with large USA buyers, which can prove beneficial for new investors (Eleksie, 2017). In 2015, Kenya’s total apparel exports reached USD 380 million and were expected to grow at 5% reaching $400 million in 2016 (Eleksie, 2017). AGOA gives most sub-Saharan Africa (SSA) firms duty free, quota free access to United States, offering a substantial competitive advantage over other textile-apparel exporting countries and trade agreement is pivotal in the growth of the continent’s textile-apparel sector (Eleksie, 2017). Kenya’s textile and apparel sector has potential to strengthen the country’s progress into middle income status and as a source of gainful employment for its fast growing, young population (Eleksie, 2017). Kenya’s annual demand for cotton lint was 111,000 tonnes of seed cotton, while the average annual production of seed cotton was 18,000 tonnes from 2005 to 2010 (FAOSTAT, 2012; CODA, 2008). The textile Industry meets the deficit through lint imports from Tanzania and Uganda (Monroy et al, 2012).

The purpose of this review paper is to project scenarios of sustainable delivery of adequate quality Bt cotton hybrid seeds to small holder farmers in Kenya.

METHODOLOGY

Information outlined in this work was obtained from reviews of literature and various reports on the establishment and development of the cotton, textiles and apparel industry in Kenya as well as experiences in supporting and building of the cotton industry.

Information on Kenyan cotton seed system was collected using zoom-based interviews of key stakeholders in biotechnology, biosafety and seeds systems. Information was also obtained from interviews done with experienced representatives of Africa Seed Trade Association, Bayer East Africa, Kenyan Fiber Directorate and Cotton Research. The information was augmented through visit and interviews of two major cotton growing counties in Kenya-Makuweni and Kirinyaga. Interviews were made with heads of Makuweni Cotton Ginnery and Biotechnology farmers’ Association (Sobitex) who grew Bt cotton hybrid. Two smallholder farmers were interviewed in Kirinyaga who grow cotton and are involved in growing first round of Bt cotton hybrid. Based on the reviews of reports, visits, interview results, and focused discussions, the various pathways used to deliver Bt cotton seeds to smallholder farmers in Kenya were identified and new alternative scenarios that can be used for the seeds delivery were proposed.

RESULTS AND DISCUSSION

Production of cotton

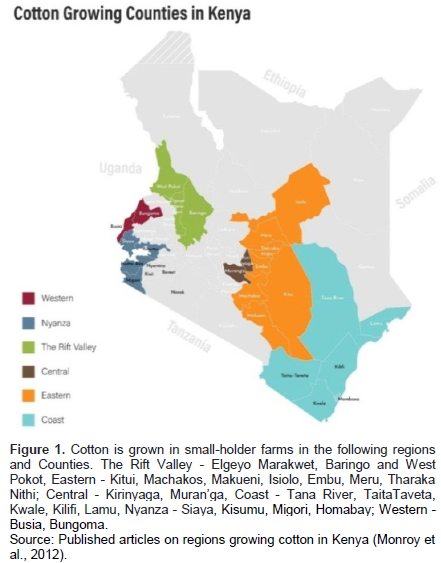

In Kenya, cotton is produced in five regions: Western, Nyanza, Central, Eastern and Coast which today represent 23 of the 47 County Governments (Figure 1). Western and Nyanza regions receive 1000 to 1500 mm annual rainfall. The cropping season of cotton is March to October and the regions have a potential to grow irrigated cotton. The Eastern and Central regions receive 600 to 1200 mm rainfall annually; the crop lasts from August to October. The Coast Region gets 800 to 1200 mm rainfall annually; the cropping season is from April to November (Monroy et al, 2012).

Most cotton in Kenya is grown by about 140,000 smallholder farmers; they have average yield of 0.53 tonnes of cotton seed per hectare. The output characterized by poor quality cotton fiber (World Bank, 2005; FAOSTAT, 2012). Kenya has about 384,500 ha potential for growing cotton of which 10% is currently under cotton production (World Bank, 2005; CODA, 2008). If this potential land is used for cotton production, the country can produce 200,000 tonnes of seed cotton. However, between 2005 and 2010 the country produced on average of 18,000 tonnes per year, equivalent to 9% of this potential.

Constraints to cotton production

Nine key constraints to cotton production in Kenya include inadequate availability of quality planting seed, availability of substandard agro-chemicals, lack of updated quality assurance protocol and testing equipment, low yields of cotton seed, low gross margin of cotton compared to other enterprises, risk aversion by the private sector and farmers, lack of adequate enabling policy support for the industry, inadequate irrigation facilities and high input costs (Gitonga et al, 2016; FAOSTAT, 2012). The Government of Kenya on realizing the need and urgency to revitalize the Cotton Industry in Kenya has embarked on programs to alleviate these constraints that include policy reforms, improved quality seeds supply to farmers, modernization of cotton textiles, revitalization of ginners among others. This paper reviews these reforms in Cotton Industry emphasizing the provision of adequate supply of quality seeds to farmers.

Cotton value chain in Kenya

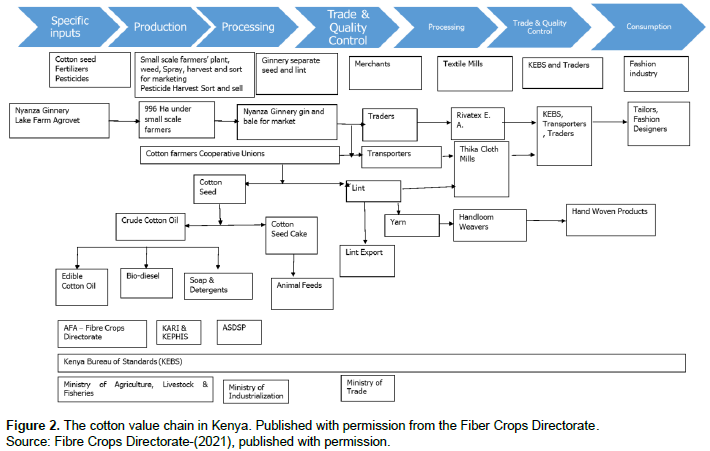

Various authors have developed and analyzed cotton value chain in Kenya (Ikiara and Ndirangu, 2003; World Bank, 2005; World Bank, 2004; Monroy et al, 2012; Fibre Crops Directorate, 2021; Malicha and Njoroge, 2020; Njoroge and Wario, 2021). Figure 2 shows the most explicit value chain developed by the Kenya Fibre Crops Directorate 2021. This later value chain is quite detailedand is categorized into six important components: specific inputs, production, processing, trade and quality control and consumption (Fibre Crops Directorate (2021). The preceding value chain is quite comparable to the World Bank (2005) value chain with five components: cotton farmers, gin operators, textile producers, garment manufacturing and exporters. This paper reviews the components of this value chain in respect to the current interventions supported by the Government of Kenya to revive the Cotton Industry categories; they are policy reforms, institutional reforms, global opportunities, seed system based on emerging technologies of hybrid insect resistant cotton and stacking of other traits such as herbicide and insect resistance.

Policy reforms

The Government of Kenya has formulated several policies, laws and regulations and revised old legislation to spur the development and sustainability of the cotton 2030, The Big Four Agenda (GOK, 2017), The Co-operative Societies Act (Cap 490), The Kenya National industry. These include but not limited to Kenya’s Vision Biosafety Act 2009 and Implementing Regulations, The Cotton Act, Cap 335 in 1990 among others outlined subsequently (Gok, 2007; KNBA 2021a, KNBA 20021b).

Kenya Vision 2030 and the Big Four Agenda and Pillar 4-Manufacturing

Kenya Vision 2030 is the country’s new development blueprint covering the period 2008 to 2030. It aims to make Kenya a newly industrialized, “Middle income country providing high quality life for all its citizens by 2030” (Gok, 2007). “The Big Four Pillars” is an economic blueprint developed by the government to foster economic development and provide a solution to the various socio- economic problems facing Kenyans (Gok, 2017; Mutuku, 2019). The agenda entails four pillars: food security and nutrition, affordable universal health, affordable housing, and enhancing manufacturing (GoK, 2007). Under Pillar 4, “Manufacturing” the government plans to develop local manufacturing industries that include textiles, leather and eliminating impediments to manufacturing (Mutuku, 2019; Mwasiagi et al, 2015; GOK, 2017).

Kenyan biosafety act and implementing regulations

The National Biosafety Authority (KNBA) was established by the Biosafety Act No. 2 of 2009 to provide regulatory oversight, supervision and control over the transfer, handling and use of genetically modified organisms (GMOs) (KNBA, 2021a). The Biosafety Act, 2009 was passed into law by the Kenyan parliament in December 2008 and received Presidential accent on 12 February 2009 (KNBA; 2021b) and Implementing Regulations (KNBA; 2021b). The objectives of this Act are: (1) To facilitate responsible research and minimize risks that may be posed by genetically modified organisms; (2) To ensure adequate level of protection in the development. Commercialized biotech crops are usually approved after thorough review of environmental safety such as gene flow; examples are gene flow studies in sorghum in Kenya (Magomere et al., 2015), impact on non-targets among others (Environmental Protection Authority, 1998; EFSA; 2010) and food safety data covering aspects such as allergenicity and toxicity (FAO/WHO, 2001; EFSA, 2009; Codex, 2009; EFSA, 2010; EFSA, 2011; EFSA, 2017; Kenya BCH-CBD, 2016) and also socio-economic consideration in accordance with international standards. KNBA reviewed these categories of safety data before approving the Bt cotton in Kenya (KNBA, 2019; Monsanto, 2000; USDA, 2002; Kenya BCH-CBD, 2016). In addition, KNBA has developed and approved Genome Editing Guidelines making Kenya the second country in Africa after Nigeria to have regulatory policy over this rapidly emerging technology (Obukosia et al., 2020; KNBA, 2022; NBMA, 2019). Till date, KNBA has provided in the country a regulatory oversight over research, development and commercialization of several biotech crops including maize, cassava, cotton, sweet potatoes, sorghum among others to ensure the technology is safe to humans, animals and the environment (KNBA, 2009; AATF, 2021; CIMMYT, 2022; KALRO, 2020; AHBFI, 2007; Obukosia, 2014; KNBA 2019; KNBA, 2021c; KNBA, 2021b, Henley et al., 2010; Ping et al., 2016, Magomere et al, 2015). Recently, KNBA has approved contained research applying genome editing technology to enhance productivity of several crops including potatoes, cassava, bananas, sorghum among others in Africa (KNBA, 2022b).

This policy reform and experience with the KNBA gives the institution divers versatility, regulatory capacity and oversight over GMOs research, biosafety approvals, including emerging technologies and credit to strong policy support from the Kenya government.

Although Kenya NBA approves the GMO crops based on thorough safety considerations, the crops must further be assessed under the National Performance Trials (NPT), the auspices of Kenya Plant Health Inspectorate Services (KEPHIS) and later approved for variety registration and commercialization by the National Variety Release Committee.

Role Kenya plant health inspectorate service

In our recent published paper on “Interface between Event Approval and Commercial release of biotech crops” (Olalekan et al., 2021), we noted that in countries with Seeds Acts such as Kenya (Gok, 2012b), for biotech crops to be commercialized for smallholder cultivation, they go through two key stages of regulatory approval. First, is the biosafety approval and second is approval for varieties registration release/commercialization by conducting National Performance Trials (NPT) (KEPHIS, 2021a) under the auspices of KEPHIS and variety release, registration/commercialization by the National Variety Release Committee (NVRC) (KEPHIS, 2021a; Waturu et al., 2019).

With regard to the recently approved insect resistant cotton “Event Mon 15985”, KEPHIS provided oversight over the NPTs of “essentially derived” varieties before they were released in Kenya (KEPHIS, 2021a). In addition, KEPHIS routinely provides Seed Certification services for conventional seeds and is now getting into biotech crops to ensure sustainable supply of quality certified seeds to farmers (KEPHIS; 2021b; KEPHIS, 2921c). Today KEPHIS is providing oversight over NPTs of another biotech crop, Virus Resistant Cassava for Africa (VIRCA) in Kenya. KEPHIS has developed a Guideline for the NPT of Biotech crops and it has adequate institutional and human capacity for regulatory oversight of quality seeds of biotech crops down the value chain (KEPHIS (2021a; KEPHIS, 2021b; Waturu et al, 2019).

Policies and laws and institutions regulating the cotton industry in Kenya

The Cotton Lint and Seed Marketing Act of 1955 was the first legal instrument to regulate the Cotton Industry in Kenya. The Act stipulated the formation of the Cotton Lint and Seed Marketing Board whose main function was to purchase both lint and seed from the ginners and advise the Minister of Agriculture on the prices to be paid by ginners to growers. The Act was repealed by the Cotton Act, Cap 335 in 1990 and established the Cotton Board of Kenya as a State Corporation under the Ministry of Agriculture. The Cotton Act was amended in 2006 to create Cotton Development Authority (CODA) under section 3 (Fibre Crops Directorate, 2021; CODA, 2021; Ruotsi (1989). The Cotton Development Authority is a regulatory state corporation under the Ministry of Agriculture established under section 4 of the Cotton (Amendment) Act 2006. The role of the Authority is to promote, coordinate, monitor, regulate and direct the cotton industry in Kenya (CODA, 2021).

The Cooperatives Policy Framework-Acts, Regulations and By-Laws

Kenya has strong Cooperative Society movement whose role is to ensure the welfare of their members. Three co-operative laws applicable to the co-operatives in Kenya are: The Co-operative Societies Act (Cap 490 of the laws of Kenya) Gok, 2012a), The Co-operative Societies Rules 2008, The Sacco Society Act 2008; The Registered By-laws of the Cooperative Society (GoK, 2013). To operationalize these laws Kenya has “The Sacco Societies Regulations and provision for the Registered By-Laws of the Cooperative Society. The Co-operative Societies Act (Cap 490 of the laws of Kenya) is an approved Act of Parliament governing the constitution, registration, and regulation of co-operative societies. It is the supreme law relating to the operations of the co-operative societies. The current and future Cotton Farmers Cooperative Societies need to be governed by these laws and regulations for proper governance to strengthen the bargaining power of both small scale and forthcoming large scale farmers. Their adherence to this governance and accountability structure will help the cotton farmers’ cooperative to eschew previous challenges that may have cost loss of farmers’ confidence in their management and cotton industry.

Institutional reforms

The Government of Kenya conducted several institutional reforms aimed to revitalize the Cotton industry in the country: establishment of the Cotton Development Authority (CODA), reconstitution of the Fibre Development Authority, revitalization of Cotton Ginneries and Cotton Cooperative Societies, modernization of cotton textiles notably the Rift Valley Textiles (Rivatex) outlined subsequently (Fibre Crops Directorate, 2021; Abuyeka, 2021; CODA, 2010). In addition, in 2010, Kenya adopted a “New Constitution” that created county governments with delineated functions from the Central National Government abolishing the provincial administrative system (Githinji, 2021).

Role of county and central government in cotton industry in Kenya

In 2010, Kenya adopted a new constitution designated “The Constitution of Kenya 2010 (Githinji, 2021) under which the country adopted a devolved government systems consisting of the National and 47 County Governments (Gok, 2010a) (Figure 1). The Constitution Article 6(1) divides the territory of Kenya into the forty-seven counties specified in the First Schedule. The governments at the national and county levels are distinct and inter-dependent but conduct their mutual relations based on consultation and cooperation (Article 6:2). The functions of County Governments in Kenya are provided for in Article 186 and assigned in The Fourth Schedule of The Constitution (Githinji, 2021). The function of the county government includes agriculture consisting of (a) crop and animal husbandry, (b) livestock sale yards, (c) county abattoirs, (d) plant and animal disease control, and (e) fisheries (Githinji, 2021). Trade development and regulation, including (a) markets, (b) trade licences (excluding regulation of professions), (c) fair trading practices, (d) local tourism, and (e) cooperative societies. The function of the National Government on the other hand comprises monetary policy, currency, banking (including central banking), the incorporation and regulation of banking, insurance and financial corporations, universities, tertiary educational institutions and other institutions of research and higher learning, agricultural policy, and veterinary policy (Gok, 2010b; KLRC, 2022).

It is evident that this delineation of functions between the national and county governments will affect the ability to create a sustainable cotton industry in Kenya. For example, farmer cooperative, agricultural extension serves which are vital for enhancement of small holder cotton production should be provided by counties. While, improved cotton seed support by National Agricultural Research Stations (NARS) or universities should be provided by the national government. Ginners also vital in sustainability of cotton industry are under the jurisdiction of county governments. It cannot therefore be overemphasized that harmony and synchrony of functions between the two governments will be prerequisite to the sustainability of the cotton industry in Kenya. This disparity in functions was evident when we visited the Mwea County in Kenya and farmers informed us that support from the county may not be forthcoming because its cotton was not factored in the 2021 budget.

Cotton development authority

In 2006, the Government of Kenya established Cotton Development Authority (CODA) to promote cotton industry with the principal objectives to promote, co-ordinate, regulate and direct the cotton industry in Kenya. The core functions of CODA include to enforce regulations and standards as spelt out in the Cotton (General) Regulations, 2007; to promote cotton production through extension and advisory services; to strengthen research and technology development in the industry; to promote cotton value addition; and to facilitate marketing of cotton and its products (CODA, 2010). Two outstanding roles of CODA that need immediate attention are to enhance quality of cotton and promote cotton production through extension and advisory support.

Fibre crops development authority

In 2014, the Agriculture and Food Authority (AFA) was established under Section 3 of the Agriculture and Food Authority following the operationalization of the Crops Act 2013 that repealed the Acts Cotton Act, Cap 335 in 1990 and Sisal Industry Act, 1946 (No. 77 of 1946) of the parliament (CODA, 2021). Subsequently, the Fibre Crops Directorate was established and assumed the functions of the Sisal Board of Kenya and Cotton Development Authority. To date, the regulatory, development and promotion mandate of the fibre value chains is under the AFA-Fibre Crops Directorate (CODA, 2021; AFA 2022).

The functions of Fiber Crops Directorate are: provision of technical and advisory services; market research and dissemination of market information; promotion of product diversification and value addition; provision of technical support towards development of infrastructure in fibre crops; development of fibre standards and regulations along the chains in liaison with KEBs and the industry players; proposal of research in sisal and cotton in collaboration with institutions involved; and compliance with standards and regulatory framework for fibre crops and establishment of a reliable database of the fibre crops value chain (Fibre Crop Directorate, 2021).

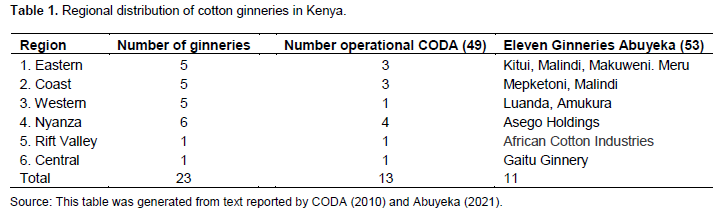

Role of cotton ginneries in cotton industry

Data on number of cotton ginneries and functionality conflict a little bit. In 2010, CODA reported that there were 22 ginneries of which only 13 were operating (CODA, 2010). The 23 ginneries are located in six of the cotton growing regions of Kenya. The Eastern, Coast and Western regions each has five ginneries; Nyanza has six while Rift Valley and Central each has one (CODA, 2010).). In total, farmer cooperatives own 4 ginneries but only one is operational (CODA, 2010).

The 13 operational ginneries are also located in the six of the cotton growing regions of Kenya-Central (1), Eastern (3), Coast (3), Rift Valley (1), Western (1), and Nyanza (4) regions of Kenya (CODA, 2010). In 2017, Eleksie (3) reported that Kenya has 23 ginneries and only 8 were operational. Abuyeka (2021) listed eleven cotton ginneries currently in existence in Kenya, namely Gaitu ginnery (which is the largest), Luanda, Mpekoteni, Kitui, Malindi Ginneries Limited, Amukura Ginners Limited, Kitui Ginnery, Asego Holdings Limited, African Cotton Industries, Makueni Ginners Ltd., Meru Ginnery Limited, and Mpeketoni Ginnery (Table 1). It is notable that each of the cotton production regions in Kenya has at least one ginnery which is fair distribution given that the industry is just being revived. However, effective and efficiency ginning of cotton is key to sustainable globally competitiveness of the textile industry in Kenya. CODA 2010, outlined several challenges and opportunities pertinent to cotton ginneries in Kenya. Key impediments to efficient functionality of ginneries included high operational costs due to use of old technology and frequent breakages, infrequent ginnery maintenance, low ginning outturn, high cost of power, below capacity operation and farmer owned ginneries have inadequate working capital for operations and weak management (CODA, 2010).

The Government of Kenya proposed several measures to improve efficiency of ginneries that include enhancing cotton production to enable ginners to work at full capacity, improving the management of farmer owned cooperative ginneries and concomitant resource mobilization; enhancing local and international partnerships in the sector; enhancing the ability of the sector to access bilateral soft loan and ginners to update ginning technology to international standards (CODA, 2010). Unlike the cotton textiles where some textiles have modernized there are no reports on adoption of modern technology in cotton ginning in Kenya. The constraint of inefficiency within the ginning section of the value chain still needs urgent attention.

Role of farmer cooperatives in the agriculture and potential of cotton farmer cooperatives

Agricultural cooperatives are agricultural-producer-owned with primary purpose to increase members’ agricultural production and productivity achieved through facilitating access to finance, agricultural inputs, know-how, access to output markets and increased incomes (ATA, 2012). The role of agricultural cooperatives falls into four categories: to facilitate farmers’ access to natural resources (land and water); to provide information, knowledge and extension services; to provide access to markets and productive assets such as seeds and tools and policy and decision making (SIFA, 2014). There are successful cooperative movements in Africa (the dairy sector in Kenya, coffee in Ethiopia, cotton in Mali and in Asia like Taiwan) that resulted in increased farmers’ profits (Wang et al., 2019; Byjus; 2022; Vietnam (MoA&RD), 2018; Conroy, 2018) that are instrumental sector transformation. However, some cooperative movements have performed below expectation (Ruotsi, 1989).

Farmer cotton cooperatives in Kenya

Ruotsi 1989, reviewed the genesis of Cotton Cooperatives Societies in Kenya from mid-1970s, and understanding the genesis of their past challenges is key to strategizing the potential role in the Cotton Industry in Kenya. Cotton Cooperative Unions in Western Kenya took over from cotton ginneries in Western Kenya from their previous Kenyan-Asian owners in the 1970s. The main economic activity of the unions during the period, 1976-1984 was the ginning of seed cotton in their own ginnery and the related seed cotton buying activity. Additional activities undertaken by these unions are similar in all of them: they operated seasonal credit schemes with funds loaned from the Cooperative Bank of Kenya; operated farm input stores and owned lorries which transported seed cotton and the farm inputs.Their existence as economic units depended entirely on their performance as parts of the cotton industry (Ruotsi, 1989). Only one cooperative the Malaba/Malakisi Farmers Cooperative Union Ltd diversified and managed ginnery; the union also bought a soap plant and an oil mill.

Ruotsi 1989, gave three reasons for the decline in cotton production in Kenya in 1980 namely- perpetual delayed payment to farmers by the Cotton Lint and Marketing Board, low producer price for the seed cotton and poor performance of the Cooperative Societies and Unions, that served as agents of Cotton Board to buy and gin cotton, provide input credit to farmers. It is imperative that previous challenges of Cotton Cooperative Societies are identified and elucidated and measures put in place to eschew the previous impediments to cotton production in Kenya. The Government of Kenya has made reforms in the Cotton Cooperatives to address these past deficiencies through Cotton Development Authority (CODA).

Current status of cotton cooperative societies in Kenya

The Cotton Development Authority (CODA, 2010) reported that the Government has written off all non-performing loans owed to the Cooperative bank of Kenya by the societies in the tune of US $ 2 million US $ in 2007/2008 (49). However, the Cooperatives Societies still lacked capital, management skills and good governance. The Authority has embarked on a programme to train groups in collaboration (CODA, 2010). The revival of Cooperative Societies is imperative to strength farmers’ bargaining power. It is a welcome venture but it cannot be overemphasized that the preceding challenges if not addressed will erode the confidence of Banks in providing loan to farmers’ cooperative and also the farmers’ confidence in cooperative societies. The Government of Kenya has also embarked on restructuring Kenya Textiles Industry.

The structure of the cotton, apparel and textiles industry in Kenya

The Cotton, Textiles, and Apparel (CTA) industry is Kenya’s second-largest manufacturing industry second to food processing. It is core industry to Kenya economic development (Anon 2021; KIA, 2016; Onyango et al; 2009) and has potential to play a key role in anchoring spurring into middle income status (Gok, 2015). Kenya’s Textile Industry consists of three main segments- Textile mills, Textile product mills and Apparel manufacturing (Matheka, 2021). Textile mills provide the raw material to make apparel/clothing and textile products, Textile product mills convert raw textiles into finished products, other than apparel such as carpets, rugs, towels, curtains, and sheets while Apparel manufacturing transforms fabrics produced by textile manufacturers into clothing and accessories (Matheka, 2021). Alternatively, the textile industry could broadly be broken into yarn spinning, fabric manufacturing and garment manufacturing. Kenya has 52 textile mills with only 15 currently operational and operate at less than 45% of total capacity (Ikiara and Ndirangu, 2003). Many of the existing mills use outdated technology and the sector suffers from low levels of labor skills and low productivity. The top 10 best textiles industries in Kenya are Spin Knit Limited, Rivatex East Africa Limited, Thika Cloth Mills, Sunflag Textile and Knitwear Mills: Spinners and Spinners Ltd, Fine Spinners Ltd, Alliance Garment Industries Ltd, KEMA East Africa Ltd, Supra Textiles Ltd and Specialized Towel Manufacturers Ltd (Abeyuka, 2020; Rivatex, 2021; Anon, 2021; Malicha and Njoroge, 2020). The Government of Kenya made commendable progress in supporting revitalization of the Rift Valley Textile Industry (Rivatex), which has transformed from outdated technology, low levels of labor skills and low productivity (Ikiara and Ndirangu, 2003; CODA, 2010) to the current state-of-art in textile technology.

Rift valley textile industry

In 2007, Rift Valley Textile Industry (Rivatex) was acquired by Moi University, but prior to this, the company had old and outdated technology machines which could not compete internationally to realize high returns (Rivatex, 2022). Through intervention of Government and facilitation of credit the textile has undergone extreme transformation of the vertically integrated textile mill; today it has highly trained staff and is ranked the best facility for woven fabric in East Africa. The presence of highly efficient equipment has opened doors to students from institutions of higher learning and those from Technical Vocational and Training (TVET) colleges who now have an opportunity to interact and gain practical skills from the new textile technology (Rivatex, 2022). The textile has the current state-of- the-art machines at the facility. Spinning, weaving and processing sections are fully equipped with ultra-modern machines thanks to the Government’s unwavering support to ensure textile industry is fully revived and contributes to the country’s Gross Domestic Product (GDP) as well as create employment. Currently, the facility produces 40,000 meters of finished fabric daily with a capacity of producing more than 100,000 meters per day, depending on the demand along with an increase in the number of spindles from the initial 500 to 16,800. Initially, the facility used to consume less than 10,000 bales of cotton annually but the provision of state-of-the-art machines has seen a tremendous increase that will require more than 40,000 bales annually sourced from farmers through ginneries. With the commissioning of the new machines, the company has been able to take up huge orders from the Government such as supplying superior fabrics for the National Police Service, County hospitals, Kenya Power (KP), Geothermal Development Company (GDC), among many others (Rivatex, 2022).

\Modernization of the factory has significantly increased the production capacity and diversification of product range and outfits in the cloth line that are very attractive, targeting both local and global markets. The faculty has invested in quality assurance and control, which ensures all the products are fully tested and checked to meet international standards. The modernization of the factory process has encouraged counties to start cottage industry and Small Medium Sized Enterprises (SMEs) who complete the value chain by adding value to our products (garmenting and tailoring) while creating employment in the forward integration (Rivatex, 2022).

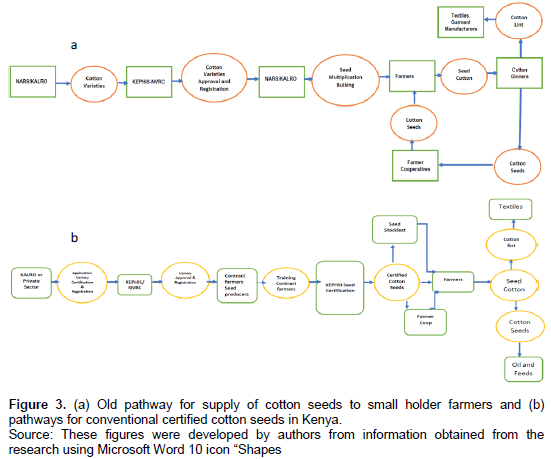

Towards production of certified quality cotton seeds supply in Kenya

For long time cotton farmers in Kenya have been growing uncertified cotton seeds left after ginners separate seed cotton into lint and cotton seed (CODA, 2010). The cotton seeds are retained by ginners and distributed to farmer directly or through farmer Cooperatives Societies (Figure 3). As a result of continued recycling of cotton seeds from the ginners, the varieties slowly degenerate in purity and quality. Degeneration of cotton varieties is expected because although cotton is predominantly self-fertilizing, in the presence of pollinators outcrossing 10-48% have been reported, causing gradual decline in seed purity. When farmers grow uncertified cotton seeds they cannot be globally competitive and will not realize optimal production even with the use of best agronomy practices including fertilizers and pest control. Many experts agree that timely, availability quality certified seeds at affordable prices are critical to enhance agricultural production in Africa and cotton is no exception (CODA, 2010). Diverse national, regional and international organizations are working in Africa to address the issue of providing quality seeds to farmers including USAID, AGRA, AFSTA, Kenya Seed improving food security, resilience, income of livelihoods for smallholder farmers in Trade Association, Wageningen University, Africa Seed Trade Association, Kenya Seed Trade Association among others (Europeanseed, 2019, AFSTA, 2021; AGRA, 2021; USAID, 2020; USAID, 2017; Kenya Seed Trade Association, 2021; Access to Seed Index, 2019). It cannot be overemphasized that farmers’ access to quality seeds is the first and important starting point toward meeting Africa’s continental and individual country for realizing agricultural goals such as food security, nutritional security, improved household incomes, improved livelihoods among others.

In 2008, the Government of Kenya recognized that to revitalize the cotton industry calls for timely availability of quality and high yielding cotton varieties for farmers (CODA, 2010). Key tenets of realizing this goal call for maintenance of genetic purity of introduced, promising and existing commercial varieties. Towards this end, the government embarked on evaluation of newly introduced varieties from Monsanto and anticipated to get drought tolerant and insect resistant Bt varieties from India and China. In addition, in 2009, the production of basic and foundation seed of the two conventional commercial varieties HART 89M and KSA 81M Kenya Agricultural Research Institute (KARI) centers in Kibos and Mwea was enhanced to maintain genetic purity (CODA, 2010) (Figure 3b). In 2009, a total of 150 metric tonnes of certified seed was produced by farmers who had been contracted by KARI from the Coastal Region. This pathway to supply certified quality seeds, though good, still has constraints such as inadequacy capacity in seed bulking, needs more trained manpower and financial support to purchase equipment for the commercial production of seed by the private sector (Gitonga et al, 2016). Given the high demand of quality certified cotton seeds in Kenya and given that the Government encouraged the farmers to source for different improved cotton sees, it is imperative that these limitations are alleviated and to enhance supply of certified quality cotton seeds from the public and private sector.

However, in 2019, Kenya approved commercial release of improved insect resistant and hybrid cotton seeds. This calls for the need for alternative options but complementary system that allow timely supply of quality certified cotton seeds to farmers. Private seeds producers have to recoup input costs and some profit margin is needed.

Toward improved quality cotton seeds and opportunities for sustainability

One solution to alleviate the supply of quality seeds is for farmers to adopt the improved insect resistant hybrid cotton seeds approved for commercialization in Kenya in 2019 under several jurisdictions-the Biosafety Act 2009 (KNBA, 2021a), Regulations for Environmental Release (15), Kenya Seed Act of and National Performance Regulation of The Kenya Seeds and Plant Varieties (Amendment) Act, 2012 (2013) and Seeds and Plant Varieties (National Performance Trials) Regulations, 2009 (Gok, 2009; 2012b).

Based on field trials, environmental and food safety research, in December 2019, Kenya approved BollGuard II Bt. cotton from the Mahyco Seeds Company in India for commercial release in Kenya. Three “Essentially Derived Varieties“ of insect resistant hybrid cotton varieties have been registered by KEPHIS designated as- MAHYCO C 570 BGII, MAHYCO C 569 BGII, MAHYCO C 571 BGII and four conventional hybrids cotton varieties designated

as- MAHYCO C 567, MAHYCO C 569, MAHYCO C 570, MAHYCO C 571 (KEPHIS, 2021a, 2022). Mahyco commercialized this technology in collaboration with various government agencies. Given that the Bt cotton hybrid technology is technology to Kenyan farmers and seed prices are higher, farmers may recycle seeds unless they are supported technically and financially. Therefore, the government initially purchased Bt cotton hybrids seeds and supplied them free to farmers for planting on-farm demonstration plots in various cotton growing regions.

As a launching phase, in 2020, the Kenya Government through Agriculture and Food Authority (AFA) purchased 700 kilos of Bt cotton seeds of three hybrids (C569, C570 and C571) from Mahyco. About 500 farmers in Western and Coastal regions of Kenya received free seeds to plant in demonstration plots (Figure 1). For the next growing season from October 2020 to January 2021 (short rain season), the government purchased additional 16 metric tons (16,000 kilos) of Bt cotton hybrid seeds from Mahyco and expanded the demonstration plots with 10,000 acres in 9 counties in Eastern and Central Kenya.

The demonstration plots showcased the value of the Bt cotton and hybrid technology as well as training of farmers on agronomic and crop management practices associated with Bt cotton hybrid technology. Observing the Bt cotton demonstration and subsequent results, a farmer in Central Kenya area expressed “…the remarkable progress indicated so far has convinced me to invest in Bt cotton seed. I will not wait to receive the seeds from the government. I hope the seeds can be available in my local farm input suppliers (agrovet) so that I can purchase, just like we get hybrid maize seeds” (Alliance for Science, 2021). With the success of demonstration trials, farmers’ demand for Bt cotton hybrids are expanding.

But due to the financial crunch faced by the government because of the COVID-19 Pandemic, the purchase of Bt cotton seeds from Mahyco Company in India has been hampered. Therefore, a transition from subsidy to farmers independently purchasing Bt cotton seeds in a few years’ time is the preferred approach. In the 2021 growing season (March/April 2021) when seed was no longer subsidized, only 10% of farmers in a cotton growing areas of 37,000 acres purchased improved Mahyco’s Bt cotton seeds.

Options for sustainable seed supply to farmers in Kenya

The free supply of Bt cotton seeds is not a sustainable and viable option in a long run. Due to the issues related to foreign exchange and financial constraints faced by the government due to the COVID-19 Pandemic, the Kenyan government is not able to purchase seeds for 2021 growing seasons. The government, therefore in collaboration with the technology provider (Mahyco Company), is under discussion to develop a strategy and options for providing access to Bt cotton hybrid seeds.

Based on the discussion with various stakeholders, the following four options were suggested as potential pathways to provide access to Bt cotton hybrid seeds to farmers. Given that the farmers have limited access to credit to purchase Bt cotton seeds, the government and the technology provider will need to work together to develop viable and affordable schemes to support the cotton sector. Stakeholders are of the opinion that diversifying options of improved cotton technologies to include Bt cotton hybrids, non-Bt cotton hybrids and even open pollinated ones would improve access to seed and satisfy the diverse needs of farmers. Such diverse interest can also have challenges in the current setting of the cotton seed system that is not well established. Therefore, possible options for consideration and further discussions are as follows.

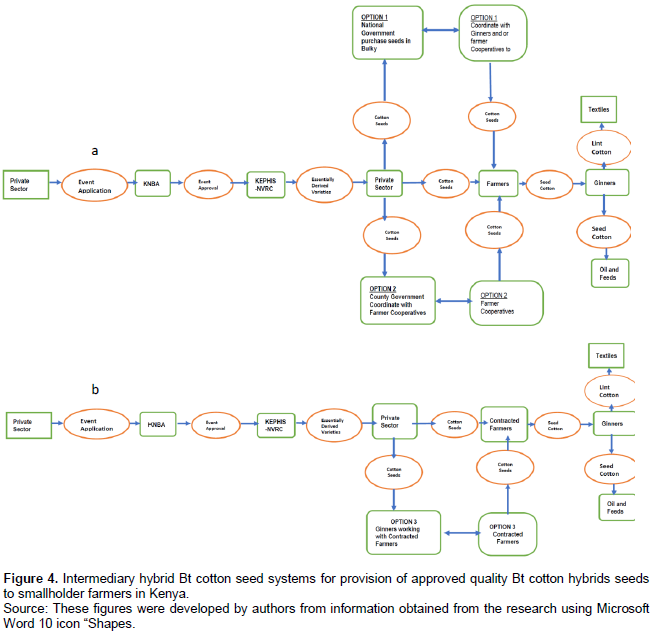

Option 1: Federal/National government seed purchase subsidies

This option would enable farmers to purchase seeds at discounted prices for several years to enhance wider adoption of the technology and empower farmers with their own financial resources. The government would need to make capital/financing arrangements through national and international instruments (Figure 4a).

This strategy would include government purchase of Mahyco seeds. Farmers would purchase the seeds at a discount for three years, gradually transitioning to paying full costs in the fourth year. The discount could follow this schedule to purchase seeds from cooperatives, ginners or agro-dealers: Year 1 (2021) – 75% discount on the Bt cotton seed costs; Year 2 (2022) – 50% discount on the Bt cotton seed costs; Year 3 (2023) – 25% discount on the Bt cotton seed costs.

As a part of this strategy, the government could collaborate with cooperatives and ginneries to recover the seed costs through a levy-based system where farmers are charged certain portions of the selling price when they bring their harvested cotton for sale. This would require agreement with government, ginneries, and farmers on the levy rates and payback period.

Option 2: Use of farmers’ cooperatives and county government in cotton seed supply

Farmers’ cooperatives and county governments could play a significant intermediary role in the supply of improved certified cotton seeds to cotton farmers either individually or synergistically (Figure 4a). Today, Kenya has about 20 cotton operational Farmer Cooperatives societies each with about 200 members. In addition, the government has taken measures to revitalize and improve governance standards of the cooperatives, established annual general meetings and financial accountability measures such as annual account audit. It is also notable that in 2010, Kenya adopted a new constitution that established two arms of government- the National and County Governments with devolved functions. The provision of agricultural services to small holder farmers is under the mandate of county governments.

In option 2, the County Governments could directly purchase cotton seeds in bulk from the private sector such as Mahyco thus ensuring steady and regular supply of improved seeds. The advantage of bulky purchase is to give the private sector the impetus to supply seeds regularly and on annual basis, seed could be sold at discounted rates. These seeds could be channeled to individual county farmers directly or more efficiently through farmer cooperatives. For example, in 2020, Lamu County government purchase improved certified seeds directly from the Mahyco Seeds Company in India and provided them to local Lamu County farmers. In 2021, Lamu County government ordered 4.5 metric tons (4,500 kilos) of hybrid Bt cotton seeds from Mahyco for its farmers. It is anticipated that the order of improved seeds by Lamu County and other counties in Kenya will grow yearly.

Cotton growing counties need to put the cotton sector high in their annual development agenda and include the sector in development plans and budgetary allocation. Although County governments receive their annual development budgetary allocation from the National Government and it is incumbent upon them to provide budgetary allocation to the cotton sector. Unlike Lamu County which purchased cotton seeds for its farmers, one of the counties we visited could not support in purchasing improved hybrid Bt Cotton seed because in 2021 they had not included cotton sector in their development agenda and budgetary allocation.

The advantage of County Government working in collaboration with farmer cooperatives is that the later have registered farmers, have mechanisms for providing seeds to farmers and ways of recovering debt in case seeds are given on credit (Figure 4a). The Government through Cooperatives could work on debt recovery procedures for farmers but seeds on credit. This option could also enable increased farmers’ access to credit and allow cooperatives to purchase seeds from Mahyco and supply farmers at a discount rate. One limitation with this option is that the number of farmers covered by the cooperatives scheme could be less than with other options.

If counties work directly with farmers then they must find way of registering farmers and clustering them in groups. It is also possible for several countries in Kenya to cluster together and purchase seeds in bulk. This will give the private sector the needed economies of scale to produce adequate seeds in a timely manner. The discounts, the levy rates and payback period can best be established between farmers and the cooperatives and with the involvement and support of the government. In major cotton producing counties in Kenya, county governments can also form “county - clusters” of cotton farmers and develop a mechanism of purchase of seeds through tripartite partnerships between county government clusters, farmer cooperative, and ginners.

Option 3: Contract farming and ginneries support in supply of cotton seeds

In option 3, ginners could play an additional major role in cotton seed supply during the transition intermediary period. This will be modification of the old model where ginners used to supply recycled cotton seeds to farmers as shown in Figure 3a; they should supply quality certified cotton seeds (Figure 4b). Through government support such as extension servicers, the farmers can be organized to work in partnership with ginners under contract. The ginners could purchase Bt cotton hybrid seeds directly from Mahyco and supply seeds to farmers through a post-harvest payback agreement scheme. The details of the payback arrangement can be worked out in the contracts with farmers (Figure 4b). The practicability of this option is exemplified in 2021 growing season, where some ginners purchased 1.2 metric tons of Bt cotton hybrid seeds from Mahyco and requested for an additional 700 to 800 kilos of seeds to meet their demand. This method can also be reinforced in future to include the ginners supplying other enhancing production inputs such as pesticides, fertilizers and credit finance to farmers. The purchase of Bt hybrid cotton seeds by farmer cooperatives, ginners, and county governments directly from Mahyco is expected to grow in 2022.

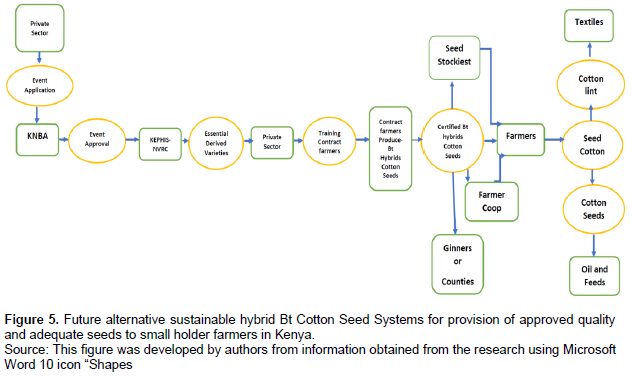

Option 4: Selling seeds to farmers through open market scheme

For future sustainability supply of improved cotton seeds to farmers will be needed for farmers to be full established in cotton production and purchase seeds from the open market without government subsidies. Farmers will directly purchase seeds or buy though Cooperatives or Agro-dealers (Figure 5). In addition, the seed companies will need to establish seed production centre in Africa that may serve several countries that have commercialized Bt cotton such as Ethiopia, Malawi, Nigeria and many that may come on board in future to take advantage of economies of scale (Alliance for Seed, 2020; 2021). Today, Kenya has agro-dealers actively selling maize and other crops seeds, pesticides, fertilizers and other inputs. In Nigeria and Malawi, Bt cotton hybrid seeds are supplied through agro-dealers. The open market option can be viable and competitive but will require a strong cotton seed quality regulatory oversight by the government to address the issues related to fake seeds. This can be addressed through enforcement of policies related to strict seed quality.

It is notable that there will be co-evolution of supply of certified cotton in Kenya to small holder farmers. At the commencement the key players will be county governments, ginners, farmers cooperatives working synergistically or independently with private sector to supply quality seeds to farmers. With the government playing a key regulatory role these options will eventually crystallize into the private sector consisting of seed companies and agro-dealers, that provide quality supply certified cotton seeds to farmers. Farmers’ cooperatives persist to enhance farmers’ productivity if they maintain good accountability and management. The later also depends on the government support and regulatory oversight.

As Kenya embarks on revitalizing the cotton Industry, it is notable that there are great opportunities for the country to tap into the global market of textiles which the country has not fully utilized including but not limited to African Growth and Opportunity Act (AGOA) ACP-EU Trade Agreement Common Market of Eastern and Southern Africa (COMESA) and the East African Community (EAC) (AGOA, 2021).

Lessons learnt from Indian’s experience in the deployment of Bt cotton

India adopted Bt cotton technology in 2002 when the area under cotton production was only 50,000 hectares. In 2015, the area increased to 12.2 million ha (of which 95% or 11.6 million ha was bt cotton) and an output of 39 miilion bales, overtaking China and becoming the largest producer of cotton globally (Arora and Bansal, 2012; James, 2015). In 2020/2021, the area under cotton production was projected to be 12.9 million ha (GAIN, 2021). Other countries that commercialized the Bt technology include Nigeria, Kenya, Malawi, Ethiopia, USA, South Africa, Mexico, and China, after thorough risk assessment of food safety and environmental safety and socio-economic considerations (Mexico-BCH-CBD, 2017, a, b, d; Nkechi, 2020; South Africa BCH-CDB, 2015). Today about 95% of cotton grown in India is Bt and is grown by small holder farmers. There are important lessons to be learnt from India’s experience: need to have a functional biosafety regulatory system, diversify released Bt hybrids, expand the Bt hybrid seed technology providers, inclusion of refuge cotton and addressing challenges of seed pricing (Arora and Bansal, 2012).

Mahyco commercialized three Bt cotton hybrids in India in 2002 and later sub-licensed the Bt technology to India companies resulting in increase in the commercialization of 20 Bt hybrids in 2005, 131 in 2007 and 207 in 2008. This helped the farmers to get the suitable varieties for different ecological zones. It one factor that facilitated changing India’s biosafety approval systems based on food safety and environmental from case-by-case approval to “Event based” (Arora and Bansal, 2012) and separation of “Event Approval from National Variety Release and Registration processes (Olalekan et al., 2021). Bt cotton seed pricing is a concern and has been reviewed several times by the state and central government for resource poor farmers to better access technology. Arora and Malik 2019, argue that price control should be balanced so as not to disincentive private sector investment in innovation. They propose the use of complementary approaches such as government reduction in regulatory approval costs, simplification of regulatory approval process subsidy for R and D among others (Arora and Malik, 2019).

There are reports of GM crops genetically engineered to produce insecticidal proteins Bt showing re-emergence of resistant (Bruce and Carrière, 2019; Arora and Malik, 2019), re-emergence of Pink Bollworm globally, in USA, India, Mexico (Storer et al, 2010; Dhurua and Gujar, 2010; Jurat-Fuentes et a, 2003; Rocha-Munive et al, 2018). In United States, farmers delayed resistance by planting non-Bt cotton refuges from 1996 to 2005; they cooperated in a program that used Bt cotton, mass releases of sterile moths, and other tactics to eradicate this pest from the region. In China, farmers reversed low levels of pink bollworm resistance to Bt cotton by planting second-generation hybrid seeds from crosses between Bt and non-Bt cotton. 25% non-Bt cotton plants were randomly interspersed within fields of Bt cotton. In India where non-Bt cotton refuges are scarce and pink bollworm resistance to pyramided Bt cotton producing Cry1Ac and Cry2Ab toxins is widespread and integrated pest management emphasizing shortening of the cotton season, destruction of crop residues, and other tactics is now essential.

Global opportunities for sustainability of cotton industry

There are global and regional opportunities that could spur the cotton industry in Kenya through creating ready market for the manufactured textiles. They are African Growth and Opportunity Act (AGOA), ACP-EU Trade Agreement, African Continental Free Trade Area, Common Market of Eastern and Southern Africa (COMESA), ACP-EU Trade Agreement and East African Community (EAC).

African growth and opportunity act

The African Growth and Opportunity Act (AGOA) is a United States Trade Act, enacted on 18 May 2000 as Public Law 106 of the 200th Congress. AGOA has since been renewed to 2025. (AGOA, 2021). The legislation significantly enhances market access to the US for qualifying Sub-Saharan African (SSA) countries. The preferential trade agreement with the U.S. Government temporarily eliminated all duties and quotas on Kenyan textile exports to the U.S. market until the year 2015. As a result of this agreement, which took effect in 2001, Kenya’s textile exports to the U.S. have increased significantly over the past decade. However, most of Kenya’s textile industry inputs continue to be imported (AFDB, 2013, World Bank 2004). Due to the minimal benefits captured by cotton producers. The World Bank, 2005 identified that a necessary condition for “gearing up the industry” is to improve the coordination and linkages throughout the cotton sector’s value chain.

African, Caribbean and Pacific-EU trade agreement

Economic Partnership Agreements (EPAs) are trade and development agreements negotiated between the EU and African, Caribbean and Pacific (ACP) countries and regions (European Commission, 2021). EU’s trade relationship with ACP countries is stipulated by the Cotonou Partnership Agreement signed in 2000 (European Commission, 2021, EU, 2022). This comprehensive political, economic and development partnership was due to expire in 2020 and Parties have negotiated a successor agreement (the so-called ‘Post-Cotonou Agreement’), which was initialed by the chief negotiators on 15 April 2021 (European Commission, 2021). In Sub-Saharan Africa, there are currently 14 countries implementing an EPA with Kenya (Embassy of Kenya Brussels, 2022). EPAs with Sub-Saharan African countries and other EU free trade agreements with Northern African countries contribute to AfCFTA and to the long-term perspective of a continent-to-continent free trade agreement (European Commission, 2021).

Common market of Eastern and Southern Africa (COMESA)

Kenya is a member of COMESA, a regional economic co-operation organization, which has been working to reduce trade barriers applied to goods produced within and traded among its 19 member countries. COMESA’s current strategy can thus be summed up in the phrase ‘economic prosperity through regional integration’. With its 21 Member States, population of over 583 million a Gross Domestic Product of $805 billion, a global export/import trade in goods worth US$ 324 billion, COMESA forms a major marketplace for both internal and external trading. Geographically, COMESA is almost two thirds of the African Continent with an area of 12 million (sq km) (COMESA, 2021a). COMESA strategy has three priority areas-Free Trade Area has been in effect since 2000. COMESA has three priorities- a Free Trade Area (PTA), Customs Union, Trade Promotion (COMESA, 2021b). The FTA was achieved on 31st October 2000 when nine of the member States namely eliminated their tariffs on COMESA originating products, in accordance with the tariff reduction schedule adopted in 1992. Today eleven COMESA countries Djibouti, Kenya, Madagascar, Malawi, Mauritius, Sudan, Zambia, Zimbabwe, Rwanda and Burundi have eliminated customs tariffs and are on the eventual elimination of quantitative restrictions and other non-tariff barriers (COMESA, 2022).

East African Community (EAC)

The East Africa Community has four integration Pillars viz, Customs Union, Common Market, Monetary Union, and Political Federation (EAC, 2022). Customs Union was the first Regional Integration milestone and critical foundation of the East African Community (EAC) and came into force since 2005 (EAC, 2021b). Under this pillar Partner States agreed to establish free trade (or zero duty imposed) on goods and services amongst themselves and agreed on a common external tariff (CET), whereby imports from countries outside the EAC zone are subjected to the same tariff when sold to any EAC Partner State (COMESA, 2022). The Common Market was the second Regional Integration milestone of the East African Community (EAC) and came into force in 2010. Under this pillar EAC Partner States maintain a liberal stance towards the four Freedoms of movement for all the factors of production including Free Movement of Goods (EAC, 2021c). The EAC comprises Kenya, Tanzania, Uganda, Rwanda, Burundi, South Sudan. Kenya being a member makes the country access market population of approximately 177 million across Seven (International Trade Administration, 2021) and Democratic Republic of Congo will soon join EAC.

African continental free trade area

African Continental Free Trade Area (AfCFTA) is a flagship project of Agenda 2063 of the African Union (AfCFTA, 2021a), approved by the 18th ordinary Session of Assembly of Heads of State and Government, held in Addis Ababa, Ethiopia in January 2012 which adopted the decision to establish a Continental Free Trade Area (AfCFTA, 2021a). The AfCFTA aims to accelerating intra-African trade and boosting Africa’s trading position in the global market by strengthening Africa’s common voice and policy space in global trade negotiations. To date, the Agreement has been signed by 54 out of 55-member States and by February 5, 2022, 36 countries ratified the AfCFTA agreement. It creates a single market for goods, services, facilitated by movement of persons in order to deepen the economic integration of the African continent and in accordance with the Pan African Vision of “An integrated, prosperous and peaceful Africa” enshrined in Agenda 2063. The cooperation is expected to benefit over 1.2 billion people, protect the national interests of the 55 AfCFTA nations and the safety and wellbeing of their citizens. The first went into effect in January 1, 2021 (AfCFTA, 2021b). Kenya was among nearly 55 African nations that signed a deal to create the AfCFTA in Kigali, Rwanda, on March 21, 2018. AfCFTA covers a population of 1.3 billion from 55 countries with GDP valued at US$3.4 trillion (Silk Road Briefing, 2021).

CONCLUSIONS AND RECOMMENDATIONS

Institutional reform

The Government of Kenya has made diverse reforms in institutional framework with great potential to enhance the functionality of cotton value chain including establishment of Fibre Crops Development Authority, Cotton Development Authority, Kenya National Biosafety Authority, Textile Industries. These reforms are quite appropriate and if they institutions perform their functions adequately this will go a long way in enhancing them.

Reforms in the policies and regulatory framework

The Government has done an excellent work in policy reforms covering such as the Presidential Four Pillars, Kenya Vision 2030, The Co-operative Societies Act (Cap 490 of the laws of Kenya, Cotton Act, Cap 335 in 1990, Biosafety Act 2009 and Implementing Regulations. The polices if operationalized and laws enforced would spur growth and sustainability of the Cotton Industry in Kenya. KEPHIS has exemplified adequate institutional and human capacity to provide oversight over Biotech products after NBA Biosafety approval until the farmer gets quality, certified seeds.

Reforms in the seed system

Supply of timely, adequate and affordable cotton seeds, a very important segment of the cotton value is a weak link that needs immediate attention. Given both the Bt technology and hybrid cotton technology are new to farmers in Kenya, the continued engagement of government and technology providers to empower farmers and institutions that support farmers is critical in four ways. First, the County Governments should play additional role in engaging cotton producing counties in the different provinces in Kenya to form cotton producing ‘county-clusters’ to support access to Bt cotton hybrid seed and related inputs and access to cotton/product market to encourage cotton producing smallholders. Second, the four options to access Bt cotton hybrid seeds-Government Supported Scheme, Contract Farming Scheme and Open Market Scheme need to be further discussed with the government, key stakeholders and technology providers. Third, the hybrid cotton technology is new to Kenyan farmers and requires special agronomic treatment, crop management practices including fertilizers and irrigation use. Extension services and training of farmers and other relevant stakeholders in agronomy, crop management and product stewardship should be an integral component of commercialization and scaling-up strategy for Bt cotton. Fourth, the long-term strategy should be to develop innovative partnerships to produce Bt cotton hybrid seeds locally or regionally in Kenya or in East Africa.

Important role of county governments

Because of the developed agricultural functions, it is important that 23 of the cotton growing counties embark on intensified production of cotton in their respective areas. The participation of the country to enhance cotton production is one weak link in the cotton value chain. Key ways of providing support are through extension service, supporting farmer cooperative societies in enhancing the financial and administrative function of cooperative, ensuring stockiest supply of genuine farm inputs including seeds, chemical input among others.

Farmer cooperative societies

Cooperative societies have a very vital role in strengthening farmers’ cooperatives but need a lot of strengthening in the following ways: Establishing of cotton farmers’ cooperatives in countries that have none, and ensuring good administrative and financial accountability of these cooperatives.

Opportunities in the global and regional market

There are opportunities in the global and regional markets for textiles including the - African Growth and Opportunity Act (AGOA), ACP-EU Trade Agreement, Common Market of Eastern and Southern Africa (COMESA), ACP-EU Trade Agreement and East African Community (EAC) that should be exploited.

ACKNOWLEDGEMENTS

The authors thank Mrs. Andriette Ferreira of AUDA-NEPAD Directorate of Knowledge Management and Program Evaluation for the design of Kenya map of cotton growing counties. They thank the Manager of Makuweni Ginnery, Chairman of Kenya Biotechnology Association, Sobitex, Mr. Daniel Aghan from African Seed Trade Association (AFSA), Mr. Fanuel Lubanga of Kenya Fiber Directorate, Dr Charles Waturu former Center Director and breeder of Bt cotton, Mahyco Seeds Company, Bayer Crop Science Kenya, Dr. Olalekan Akinbo from AUDA-NEPAD ABNE and Cotton farmers from Kirinyaga County for providing information used in compiling this paper.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Abuyeka Z (2021). List of cotton ginneries in Kenya. Available online: |

|

|

Access to Seeds Index (ASI) (2019). Western and Central Africa. Available online: |

|

|

Agricultural and Food Authority (AFA) (2022). |

|

|

AFDB (2013). The State of Kenya's Private Sector. Africa Development Bank. |

|

|

Africa Growth and Opportunity Act (AGOA) (2021). About AGOA. AGOA. Available online: Info. |

|

|

Africa Harvest Biotechnology Foundation International (AHBFI) (2007). A global vision with an African focus to fight poor nutrition with nutrient-rich crops. The Africa Biofortified Sorghum M Mid-term Report. 2007. Available online: |

|

|

African Agricultural Technology Foundation (AATF) (2021). TELA Maize Project. TELA Maize Technology. |

|

|

African Continental Free Trade Area (AfCFTA) (2021a). About the African Continental Free Trade Area (AfCFTA). Available online: |

|

|

African Continental Free Trade Area (AfCFTA) (2021b). Press Release-The AfCFTA Secretary-General tours Egypt to support the AfCFTA national level implementation. |

|

|

African Seed Trade Association (AFSTA) (2021). Mission, Vision, Objectives. |

|

|

AGRA (2020). AGRA-Seeds-Systems-Development-Approach. |

|

|

Agricultural Transformation Agency (ATA) (2012). Agricultural Cooperatives Sector Development Strategy 2012-2016. |

|

|

Alliance for Science (2021). Kenyan farmers reap bountiful first harvest of GM cotton" Cornell University, USA. |

|

|

Anon (2021). The Textile Industry in Kenya. Kohan Textile Journal. |

|

|

Arora A, Bansal S (2012). Diffusion of Bt cotton in India: Impact of Seed Prices and Varietal Approval. Applied Economic Perspectives and Policy 34(1):102-118. |

|

|

Arora A, Malik DP (2019). An overview of cotton industry in India: policy implications and perspectives. Journal of Cotton Research and Development 33(2):303-313. |

|

|

Bruce ET, Yves Carrière Y (2019). Global Patterns of Resistance to Bt Crops Highlighting Pink Bollworm in the United States, China, and India. Journal of Economic Entomology 112(6):2513-2523. |

|

|

Byjus (2022). Names of 10 best cooperative societies in India. |

|

|

CIMMYT (2022). TELA Maize Project. |

|

|

Codex (2009). Foods derived from modern biotechnology. Second Edition. World Health Organization/ Food and Agriculture Organization of the United Nations Rome, 2009. |

|

|

COMESA (2022). What is COMESA. COMESA Objectives and Priorities. |

|

|

Conroy J (2018). Ethiopia progress in GMO crops. |

|

|

Cotton Development Authority (CODA) (2008). Strategic Plan 2008-2013. |

|

|

Cotton Development Authority (CODA) (2010). The Status Report on the Cotton Industry in Kenya for ICAC Plenary Meeting in Lubbock, Texas. |

|

|

Dhurua S, Gujar GT (2011). Field-evolved resistance to Bt toxin Cry1Ac in the pink bollworm, Pectinophora gossypiella (Saunders) (Lepidoptera: Gelechiidae), from India. Pest Management Science 67(8):898-903. |

|

|

East African Community (EAC) (2021b). East Africa Community- One People. Common Union- What is the Common Union. |

|

|

East African Community (EAC) (2021c). East Africa Community- One People, One Destiny. Common Market. What is the Common Market? |

|

|

East African Community (EAC) (2021a). East Africa Community-One People, One Destiny. Integration Pillars. |

|

|

European Food Safety Authority (EFSA) (2006). Guidance document of the Scientific Panel on Genetically Modified Organisms for the Risk Assessment of Genetically Modified Plants and Derived Food and Feed. EFSA Journal 99:1-100. |

|

|

European Food Safety Authority (EFSA) (2009). Scientific report of EFSA prepared by the GMO Unit on Public Consultation on the Updated Guidance Document of the Scientific Panel on Genetically Modified Organisms (GMO) for the risk assessment of genetically modified plants and derived food and feed. The EFSA Scientific Report 293:1-18. |

|

|

European Food Safety Authority (EFSA) (2010). EFSA Panel on Genetically Modified Organisms (GMO). Guidance on the environmental risk assessment of genetically modified plants. EFSA Journal 8(11):1879. |

|

|

European Food Safety Authority (EFSA) (2011). Scientific Opinion on Guidance for risk assessment of food and feed from genetically modified plants. EFSA panel on genetically modified organisms (GMO). EFSA Journal 9(5):2150. |

|

|

European Food Safety Authority (EFSA) (2017). Guidance on allergenicity assessment of genetically modified plants. 15(6):e04862. |

|

|

Eleksie (2017). Cotton, Textile and Apparel Sector - Kenyan Overview. |

|

|

Embassy of Kenya, Brussels (2022). Kenya ACP-EU Relations. Origin of partnership. |

|

|

Environmental Protection Authority (1998). Guidelines for Ecological Risk Assessment. In EPA (ed.). Environmental Protection Agency. Available online: |

|

|

European Commission (2021). Economic Agreements-Contonou. |

|

|

Europeanseed (2019). Seeds for Africa Access. |

|

|

FAO/WHO (2001). Evaluation of the allergenicity of genetically modified food of plant origin. Food and Agriculture Organization of the United Nations, Rome. |

|

|

FAOSTAT (2012). Analysis of incentives and disincentives for cotton in Kenya. |

|

|

Fibre Crops Directorate (2021). |

|

|

GAIN (2021). Cotton and Products Update April, Global Information Network, USDA. |

|

|

Githinji (2021). The Role and Functions of Kenya Government in Kenya. |

|

|

Gitonga WJ, Macharia MK, Mungai A, Njue H, Karanja DK, Olweny H (2007). Cotton Production, Constraints, and Research Interventions in Kenya. Agricultural Research Centre, Cotton Development Authority, CABI Africa. |

|

|

Government of Kenya (GoK) (2013). SACCO Societies Act No. 14 of 2008 Revised 2012. |

|

|

Government of Kenya (GoK) (2015). Kenya Apparel and Textile Industry- Diagnosis, Strategy and Action Plan. Ministry of Industrialization and Enterprise development. Prepared by World Bank Group and Global Development Solutions for the Ministry of Industrialization and Enterprise Development. |

|

|

Government of Kenya (GoK) (2012a). Co-operative Societies Act Chapter 490. |

|

|

Government of Kenya (GoK) (2007). Kenya Vision 2030. |

|

|

Government of Kenya (Gok) (2012b). Law of Kenya-Seeds and Plant varieties Act-Chapter 326 Revised Edition. |

|

|

Government of Kenya (GoK) (2017). The Big Four" - Immediate priorities and actions Specific Priorities for the new term. |

|

|

Government of Kenya Gok (2010a). The Constitution of Kenya, 2010. |

|

|

GoK (2010b). Kenya National Climate Change Response Strategy. Government of Kenya. |

|

|

Henley EC, Taylor JRN, Obukosia SD (2010). The importance of dietary protein in Human Health: Combating Protein Deficiency in Sub-Saharan Africa through Transgenic Biofortifed Sorghum. Advances in Food and Nutrition research 60:21-52. |

|

|

Ikiara MM, Ndirangu LK (2003). Developing a Revival Strategy for Kenya's Cotton-Textile Industry: A Value Chain Approach. Kenya Institute for Public Policy Research and Analysis (KIPPRA) Working Paper No. 8. Nairobi, Kenya. |

|

|

ISAAA (2021). Malawi moves to make Bt cotton seed accessible. |

|

|

James C (2015). Brief 51 20th Anniversary (1996 to 2015) of the Global Commercialization of Biotech Crops and Biotech Crop Highlights in 2015. Available online. |

|

|

Jurat-Fuentes JL, Gould FL, Adang MJ (2003). Dual resistance to Bacillus thuringiensis Cry1Ac and Cry2Aa toxins in Heliothis virescens suggests multiple mechanisms of resistance. Applied and Environmental Microbiology 69(10):5898-5906. |

|

|

KALRO (2020). Kenya National Biosafety Authority Approves Genetically Modified Cassava. |

|

|

Kenya BCH-CBD (2016). Risk Assessment for the Application Involving Environmental Release of Insect Protected Mon 15985 cotton and its varietal derivatives in Kenya. |

|

|

Kenya Investment Authority (KIA) (2016). Investment motion Investment (KIP). Cotton, Textile and Apparel Sector Investment Profile. A report of Kenya Investment Authority. |

|

|

Kenya Law Reform Commission (KLRC) (2022). Part 3. The Functions and powers of the Counties. View |

|

|

Kenya Plant Health Inspectorate Service (KEPHIS) (2021a). Seed Certification and Plant Variety Protection Services- Plant Variety Testing and Release, National Performance Trials, |

|

|

Kenya Plant Health Inspectorate Service (KEPHIS) (2021b). Plant Variety Testing and Release. View |

|

|

Kenya Plant Health Inspectorate Service (KEPHIS) (2021c). Phytosanitary-Seed Certification and Plant variety protection services. |

|

|

Kenya Plant Health Inspectorate Service (KEPHIS) (2022). Variety Release Catelogue. National Crop Variety List 2022. |

|

|

Kenya National Biosafety Authority (KNBA) (2022a). Genome Editing Guideline. |

|

|

Kenya National Biosafety Authority (KNBA) (2021b). Biosafety Regulations. |

|

|

Kenya National Biosafety Authority (KNBA) (2011). Biosafety regulations-Environmental Release Regulations. |

|

|

KNBA (Kenya National Biosafety Authority) (2019). Approved Genetically Modified Organisms Projects- Decision on Bt Cotton Approval. |

|

|

KNBA (Kenya National Biosafety Authority) (2021c). Approved Genetically Modified Organisms Projects- Contained Use (Trials at Laboratory, Growth Chambers, Green House and Animal Facilities), Confined Field Trials, Import and Transit, Decision on Bt Maize, Decision on Bt Cotton Approval. |

|

|

KNBA, Kenya National Biosafety Authority (Kenya) (2021a). Biosafety Act 2009. |

|

|

Magomere, Titus O, Ngugi K, Obukosia SD, Mutitu E, Shibairo S (2015). Real Time PCR Mediated Determination of the spontaneous occurrence of Sorghum Bicolor Alleles in Wild Sorghum Populations. African Journal of Biotechnology 14(7):551-568. |

|

|

Malicha W, Njoroge L (2020). Assessing the Cotton, Textile and Apparel Sector Employment Potential in Kenya. KIPPRA Discussion Paper No. 229. |

|

|

Matheka G (2021). A look at the potentials of Kenya's textile industry. HAPAKENYA. |

|

|

Mexico BCH-CBD (2017a). Solicitud 031/2016_Etapa Comercial, Gossypium hirsutum L. evento MON-15985-7 x MON-88913-8. |

|

|

Mexico BCH-CBD (2017b). Solicitud 029/2016_Programa Piloto,Gossypium hirsutum L. evento SYN-IR1Ø2-7 x MON-15985-7 x MON-88913-8 x MON-887Ø1-3. |

|

|

Mexico BCH-CBD (2017c). Solicitud 031/2016_Etapa Comercial, Gossypium hirsutum L. evento MON-15985-7 x MON-88913-8. |

|

|

Monroy L, Malinga W, Witwer M (2012). Analysis of Incentives and disincentives of Cotton in Kenya. View |

|

|

Monsanto (2000). Safety, Compositional, and Nutritional Aspects of Bollgard II Cotton Event 15985 Conclusion Based on Studies and Information Evaluated According to FDA's Policy on Foods from New Plant Varieties. |

|

|

Mutuku R (2019). The Big Four Agenda of the government explained. TUKO best news platform. View |

|

|

Mwasiagi JI, Kitiyu L, Ndaro MS, Sitati S, Ambrose Kiprop A (2015). A study of the quality of Kenyan cotton rotor spun yarn. African Journal of Textile and Apparel Research 1(1):13-17. |

|

|

National Biosafety Management Agency of Nigeria (NBMA) (2019). National Biosafety Management Agency (Amended Act 2019). |

|

|

Njoroge LK, Wario MW (2021). Constraints along the Cotton Textile and Apparel Value Chain in Kenya. |

|

|

Nkechi I (2020). Nigeria and Farmers will control Bt cotton seeds production. |

|

|

Obukosia S, Olalekan A, Woldeyesus S, Savadogo M, Timpo S, Modupe AM, Sunday A, Kebere J, Ouedraogo J, Aggrey A, Makinde D (2020). Regulatory Options of New Breeding Techniques and Biosafety Regulatory Options among Selected Countries: A Review. Asian Journal of Biotechnology and Bioresources Technology 6(3)-18-35. |

|

|

Obukosia S (2014). Biotechnology of nutritionally enhanced food crops targeting malnutrition in rural agricultural populations: the case study of Africa Biofortified Sorghum." Biotechnology in Africa. Springer, Cham, 2014. 157-177. |

|

|

Olalekan A, Obukosia S, Woldeyesus S, Savadogo M, Timpo S, Ouedraogo J, Mbabazi R, Karim Maredia K, Makinde D, Ambali A (2021). Commercial Release of Genetically Modified Crops in Africa: Interface between Biosafety Regulatory Systems and Varietal Release Systems. Frontiers in Plant Science 12:605937. |

|

|

Onyango C, Miencha F, Waiyaki N, Omiti J, Kiringai J (2009). Enhancing Competitiveness of Kenya"s Cotton and Textile. KIPPRA . Discussion Paper No. 982009. |

|

|

Ping C, Zuo-Yu Z, Glassman K, Dolde D, Hu TX, Jones TJ, Obukosia SD, Wambugu F, Albertsen (2016). Elevated vitamin E content improves all-trans B-carotene accumulation and stability in biofortified sorghum. Proceedings of the National Academy of Sciences 113(39):11040-11045. |

|

|

RIVATEX (2022). Modernization, how it enhanced production. Available Online. |

|

|

Rocha-Munive MG, Soberón M, Castañeda S, Niaves E, Scheinvar E, Eguiarte LE, Mota-Sánchez D, Rosales-Robles E, Nava-Camberos U, Martínez-Carrillo JL, Blanco CA, Bravo A, Souza V (2018). Evaluation of the Impact of Genetically Modified Cotton After 20 Years of Cultivation in Mexico. Frontiers in Bioengineering and Biotechnology 6:82. |

|

|

Ruotsi J (1989). Cotton Ginning Industry in Kenya: The Case of the Cooperative ownership and management mode. |

|

|

SIFA CB (2014). The role of cooperatives in agricultural development and food security in Africa. Available online: |

|

|