ABSTRACT

Despite in recent years the impact of market sentiment on the performance of listing firms has gained increased attention from academics and professionals, a research question that remains uncovered deals with how the retail investor sentiment and attention might impact the IPO pricing in the primary market. This analysis proposes a stochastic frontier model approach on a sample of 412 US firms listed between 2010 and 2016. The main research questions aim at revealing the effects that the number and the sentiment of the Tweets in the 3 months prior to each IPO produce in terms of the distance between the maximum achievable price and the actual offer price of the stocks. Results show that the more favorable the sentiment, the closer the offer price is set to the maximum achievable to the benefit of the issuer; on the contrary, negative sentiments seem to play no effect on the pricing, supporting the idea that investors are net buyers of attention-grabbing news. The number of Tweets shows no effect as well. Few and good is then the desirable attention and sentiment that issuers should wish for their listing firms.

Key words: Initial public offering, sentiment, investors’ attention, underpricing, social media.

IPOs are naturally affected by information asymmetry problems that increase the difficulties with establishing an appropriate value for the new shares in an untried company (Antón et al., 2011; Xia et al., 2012). Previous literature attempting to draw factors which mitigate the information asymmetry - between the issuer and the underwriter on one side, and between the underwriter and investors on the other side - has surprisingly devoted little attention to the relationship between media information production and IPO valuation (Bajo and Raimondo, 2017). This lack of interest among the scientific community may in part be because such studies combine two, seemingly different, disciplines, that is, mass communication and finance (Kolbeins, 2010). The mass communication literature explains how the media have been able to draw people’s attention to the stock market and generate interest in stocks. By solely covering a topic, the media raise that subject’s importance in the eyes of investors, in that the more attention the media pays a particular subject, the more important the public believes that topic to be (McCombs and Reynolds, 2009). Furthermore, media can influence people’s attitudes towards subjects by portraying them in a positive or a negative light (Blankespoor et al., 2014; Irbo and Mohammed, 2020; Tewksbury and Scheufele, 2009). Yet some recent studies (Tetlock, 2007, 2011) seem to suggest that media coverage may be significantly related to asset prices even when it does not reveal hard, breaking news, contrasting with the traditional asset-pricing theory.

A restrained number of studies investigate the media information production and its effect on the IPO pricing in terms of the attention that media chase upon investors and of the sentiment they can generate regarding listing firms, which ultimately drives retail investors’ demand. Nevertheless, such studies mainly concentrate on the secondary market effect of investors’ attention and market sentiment.

A research question that remains uncovered in the IPO pricing context deals with how the retail investor sentiment and/or attention might impact the IPO pricing in the primary market. Truth be told, it is easily arguable that primary market players (institutional investors) are less influenced by the sentiment generated by the media or by social networks, as they have access to more detailed information and possess a greater ability in processing raw information than retail investors (Bajo and Raimondo, 2017). Nevertheless, the way the IPO offer price is set and adjusted in the primary market is driven by several factors, including the expectations that underwriters and investors have in terms of the IPO secondary market success. So far, attention and sentiment are likely to affect the way the offer is priced in the primary market: if institutional investors anticipate an aloof investor sentiment or feeble attention in the secondary market (moderate underpricing), they would demand a higher compensation for re-selling shares (that is, they expect the underwriter to keep the offer price below its maximum achievable value in order to leave a deliberate pre-market underpricing as a compensation).

This study empirically tests to what extent the social media Twitter - as sentiment and attention generator - works as a benefit or a detriment for issuing firms. Researchers hence propose a stochastic frontier model where the effects of market sentiment on the primary market pricing are revealed. Based on a sample of 412 US firms listed between 2010 and 2016, this analysis investigate the effects that market attention and sentiment - disclosed by the number and sentiment of the Tweets in the 3 months prior to each IPO - produce in terms of deliberate pre-market underpricing (that is the distance between the maximum achievable price and the actual offer price of the stocks). This study provides evidence that the more positive the sentiment, the closer the offer price is set to the maximum achievable to the benefit of the issuer; on the contrary, negative sentiments charge a discount with respect to the firm’s fair price in order to ease the completion of the offer: ‘few and good’ is then the desirable attention and sentiment that issuers should wish for their listing firms in order to mitigate the information asymmetry which naturally affects new listings. The contribution of this paper lies in enlarging the debate on the effect of market sentiment in the IPO pricing embedding the primary market dynamics rather that limiting the analysis to the secondary market pricing. Although several studies have documented a positive correlation between investors’ sentiment and the underpricing, employing different proxies to capture the investors’ attention/sentiment, none of these studies investigate the relationship between IPO primary market pricing and market sentiment. In particular, Da et al. (2011) used the Google Search Volume Index (SVI) as a proxy of investors’ attention and found that such attention positively relates to initial returns, as an expression of the secondary market demand. Bajo and Raimondo (2017) enlarge the perspective to the investors’ sentiment by relating measures of sentiment to the IPO pricing; they maintain that a positive sentiment produced by newspaper news is positively associated with the level of observed underpricing, suggesting that first-day returns increase in response to a more benevolent press, as an effect of the larger generated demand. Tsukioka et al. (2018) have investigated whether pre-IPO investor sentiment on the Yahoo finance message boards relates to the IPO initial returns. They found that investor attention and sentiment positively relate to the likelihood that IPO firms set their offer price at the filing range’s maximum point and they are also related to higher initial returns.

With the advent of social media, the range of action of the literature has been extended by covering social media as a source of information production in IPO pricing: Liew and Wang (2016) published the first paper correlating Twitter and IPOs, in which they conclude that there is a positive correlation between investors’ sentiment in the days before the IPO and the IPO return on the first day of trading. Based on this evidence, this study empirically demonstrates that when a positive sentiment is disclosed by social media on the listing firms the offer price is set closer to the maximum achievable to the benefit of the issuer, thus supporting the role of social networks in mitigating the information asymmetry which naturally affects new listings.

1. Hanley (1993) first documented that the adjustment of the offer price to the midpoint of the filing range is positively correlated with the underpricing, meaning that the relation of the final offer price to the offer range disclosed in the preliminary prospectus is a good predictor of the level of initial returns.

HYPOTHESIS AND RELATED RESEARCH

In recent years, the impact of attention and sentiment on the performance of listing firms has gained more and more attention from both academics and professionals. One stream of literature focuses on how investors’ sentiment might explain the IPOs pricing anomalies. As an example, according to Ljungqvist et al. (2006) issuers know that the presence of a class of irrationally exuberant investors, sentiment investors will bid up prices in the after-market, leading to higher offer prices. In addition to this, Derrien (2005) maintains that regular investors purchase the over-valued IPO shares with the expectation of re-sell them to sentiment investors at even higher prices, the demand for shares increases, leading to underpricing and negative performance in the long term. Fluctuations in investor sentiment, could also provide an explanation of why so many companies go public during some periods (hot markets) and the dramatic fall in the number of IPOs since 2000 (Lowry, 2003). At last, Cornelli et al. (2006) found that over-optimism by small investors can cause IPOs to trade at prices on the first day at 40.5% higher, on average, than they would have in the absence of sentiment demand.

Another steam of IPO literature has documented that media-provided information might facilitate or inhibit the process of investors’ impression formation (Bhattacharya et al., 2009; Bushee et al., 2010; Pollock and Rindova, 2003). Numerous researchers have also suggested that the media plays an important role in legitimation processes (Kosicki, 1993; McCombs et al., 1997; Rogers et al., 1993) especially during the waiting period when retail investors’ purchases are attention-driven rather than information based (Bushee et al., 2010; Bhardwaj and Imam, 2019). However, these studies share one common gap in that they only consider the role of attention and sentiment on the secondary market by focusing on the IPO performance as measured by underpricing (Da et al., 2011; Liu et al., 2014). Despite social media are more likely to reflect retail rather than institutional attention and sentiment, previous studies have documented that the way the offer price is set and adjusted in the primary market - where underwriters and institutional investors build the book - is largely influenced by the expectations that they both have regarding the secondary market demand (Ibbotson et al., 1988; Hanley, 1993; Thornton et al., 2009). Jiang and Li (2013), focusing on the Hong Kong market, provide evidence that individual investor sentiment could influence both the pre-market and aftermarket IPO pricing. Moreover, the study of Chung et al. (2017) shows a spillover effect from pre-market to aftermarket sentiment given that initial returns are significantly and positively related to the individual investors’ sentiment. Researchers therefore argue that a positive sentiment, as revealed by the tone of the Tweets, communicates an expected investors’ interest towards the offer and in turn the demand for shares. If it is so, the offer price will be set as close as possible to the maximum achievable and no ‘discounts’ must be imposed to complete the offer, thus providing a favorable pricing for the issuer in the primary market.

Based on this assumption this study tests the following hypothesis:

H1: a positive sentiment on the listing firm reduces the distance between the offer price and the maximum achievable value.

Previous literature has demonstrated that while a positive sentiment is likely to increase the investors’ interest towards the IPO and in turn the demand for shares, negative sentiment appears not to be associated with the price behavior on the first day of trading (Barber et al., 2008; Bajo and Raimondo, 2017). In particular, the study of Ahmad et al. (2016) finds that media-expressed negative tone impacts on firm-level returns occasionally, because only sometimes media comment contains value-relevant information or news while other times can be sentiment (or noise). Moreover, investors are net buyers of attention-grabbing news: they purchase stocks that have caught their attention, but they are less sensitive to negative information because they tend to only sell stocks they already own. Following these evidences, this study then tests the following hypotheses:

H2: a negative sentiment on the listing firm has no effect on the distance between the offer price and the maximum achievable value.

Consistent with previous literature on the attention-grabbing news researchers also check for the effect of the number of Tweets on the primary market pricing; the study here hypothesizes that a larger number of Tweets is likely to catch investors’ attention thus possibly anticipating a large demand on the market, as follows:

H3: the higher the number of Tweets (investors’ attention) on the listing firm, the lower the distance between the offer price and the maximum achievable value.

DATA

Sample selection

The sample of US IPOs was collected from the Thomson One Deals database (TOD). Researchers searched for all the IPOs occurring from January 2010 to December 2016, on the NASDAQ and NYSE. IPOs with the following characteristics are excluded: offer price below $5, non-common shares, closed-end funds, filings by foreign-domiciled firms, Master Limited Partnerships (MLPs), American Depository Receipts (ADRs) and Real Estate Investment Trusts (REITs). Information regarding financial statements of issuing firms from Compustat are also included. Jay Ritter's website was also used to obtain information regarding the market conditions and the rankings on US underwriters’ reputations.

Stock Tweets collection

Stock Tweets represents a restricted category of Tweets; for this reason, they have peculiarities that deserve to be discussed, especially in terms of how they can be collected for research purposes. According to Bar-Haim et al. (2011) stock Tweets differ from common Tweets by having one or more references to stock symbols - as for example the tickers preceded by the dollar sign - but also hashtags, the labels represented by the symbol “#” that users apply to certain content. Stock Tweets, as well as the common ones, are typically characterized by an informal language, slang expressions or abbreviated and ungrammatical utterances (Bar-Haim et al., 2011). Due to this low level of lexicon standardization, the automatic sentiment analysis could produce a relative low level of accuracy (Borromeo and Toyama, 2015).

Based on this premise, in this paper the Twitter data collection and sentiment evaluation were both conducted manually by the authors. In particular, data were collected by adopting the advanced search features provided by the Twitter platform. To detect stock Tweets, researchers set a search criterion that has been applied to each company. By setting the advanced search feature, this research was able to identify all the stock Tweets related to each company that have been published in the three months prior to the firm’s IPO. Researchers then selected the content of those stock Tweets specifically related to the company, that is, only those Tweets that included one ticker (Bar-Haim et al., 2011). A total number of 9,560 stock Tweets were then selected and analysed.

2Stocks with a price below $5.00 per share are subject to the provisions of the Securities enforcement Remedies and Penny Stock Reform Act of 1990, aimed at reducing fraud and abuse in the penny stock market (Ritter, 1991).

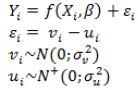

This study employed a stochastic frontier approach to test all the cross-sectional relationships stated in the hypotheses. The Stochastic Frontier Analysis (SFA) combines an ordinary linear regression model with a composite error term (Aigner et al., 1977). The error term can be broken down into a symmetric error term, which represents the usual stochastic error terms, and an asymmetric error component. This non-idiosyncratic disturbance represents a systematically negative bias due to some inefficient pars. Widely used in estimation of production efficiency, this methodology has been adopted also in pricing IPOs (Hunt-McCool et al., 1996). Under the IPO pricing scenario, the SFA allows an estimation of the maximum or “efficient” offer price that would prevail in a situation of full information, given the firm's characteristics.

Typically, in the IPO pricing context, Y is the observed offer price of the issuer i; X is a vector of the observed firm's characteristics; β is a vector of parameters to be estimated; vi is the symmetric error component with a normal distribution and ui is the asymmetric error term with a half-normal distribution, truncated at zero. In other terms, for a given IPO, a point on the frontier represents the unobserved “fair” offer price, that is, the maximum price that investors are willing to pay given a set of “pricing factors” included in the vector of input X. The stochastic frontier assumes that a maximum price exists, and that actual prices fall below the maximum for some systematic reasons such as “economic inefficiency” (or “deliberate premarket factors”). This deviation from the maximum price can be measured by a one-sided error term. As pointed out in Hunt-McCool et al. (1996), the advantage of using this method in IPO pricing is to avoid using aftermarket information to compute IPO prices in the primary market.

Reber and Vencappa (2016) provided an additional contribution by modelling the exogenous factors that influence the gap from the frontier. In other terms, when fitting the IPO offer price frontier, they also explicitly model the heteroscedasticity of the one-sided error term (Kumbhakar and Lovel, 2003). Empirically, the one-sided error variance is modelled together with the frontier as:

where

gives the dimension of the deliberate premarket underpricing and Z is a vector that includes a set of variables capturing the information asymmetry such as: the market conditions at the time of the IPO, the deal characteristics, the presence of third-party certification and, more generally, the uncertainty surrounding the IPO. The model presented in this study, that takes a leaf from Reber and Vencappa (2016), is built around a sentiment variable which account for the number and nature of the Tweets that have interested each IPO in the sample on the 3 months prior to the listing as predictors of the distance of the price set from the frontier. In details, researchers expect to observe deviations between the actual and optimal price correlated to the nature and intensity of the market sentiment as revealed by the social media.

Data and measurement of variables

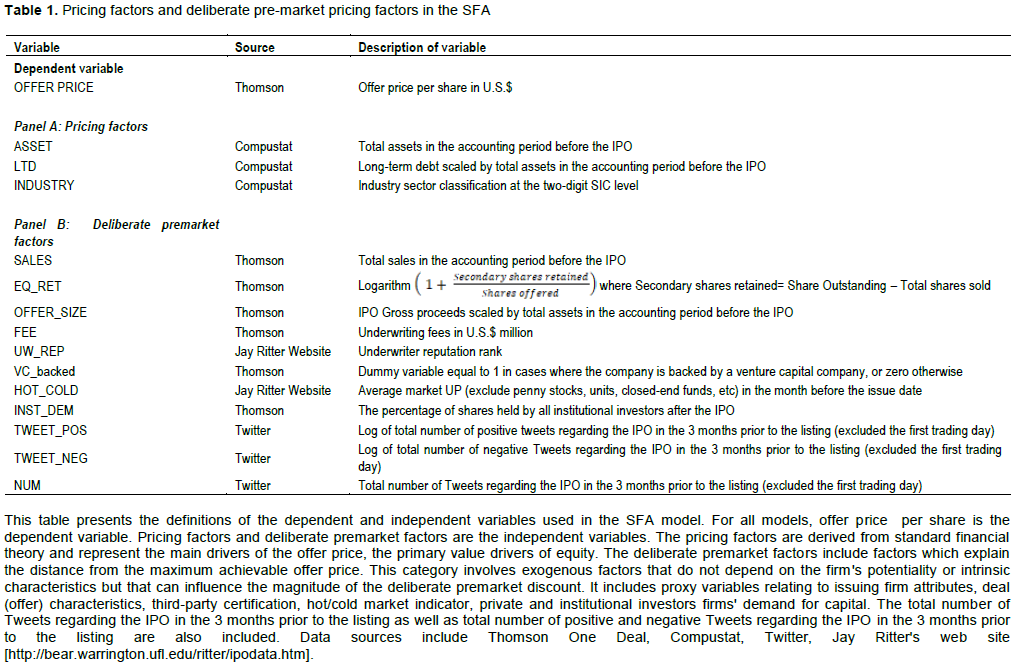

The model uses the offer price per share as the dependent variable. Explanatory variables are classified into two categories: “pricing factors” and “deliberate premarket factors”. As for the first category, following Hunt-McCool et al. (1996) and Chen et al. (2002), researchers controlled for firm size, using the logarithm of the book value of the asset in the accounting period before the offer (ASSET). To account for the riskiness of the firm the logarithm of long-term debt (LTB) in the accounting period before the IPO was computed (Habib and Ljungqvist, 2001). As in Peng and Wang (2007), researchers expected a negative correlation between debt level and the IPO market price. To consider the potential role of asymmetric information, researchers added an INDUSTRY dummy to account for the fact that firm's value is unlikely to be uniformly distributed across the industry (Ritter, 1991). In line with previous studies, researchers allocated IPO firms into 12 two-digit SIC industry sectors. The presence of different sectors allowed us to take into consideration not only differences in riskiness but also in growth opportunities. Table 1 provides a detailed review of all the variables (pricing factors and deliberate pre-market pricing factors) that were used in this the study along with the data sources.

As for the second category, that is, “deliberate premarket factors”, these variables include factors that explain the distance of the actual price from the maximum achievable offer price. This category involves exogenous factors that do not depend on the firm's potential performance or its intrinsic characteristics, but that can influence the magnitude of the deliberate premarket underpricing (Reber and Vencappa, 2016).

The size of the firm was controlled by means of the SALES effect because it is reasonable to expect that larger firm size implies less uncertainty, better operation conditions, and higher efficiency (Peng and Wang, 2007). Researchers used the proportion of stocks owned by insiders (EQ_RET) as a measure of the risk characteristics of the IPO that are negatively related to the offer price (Beatty and Ritter, 1986). They also argued that the larger the equity retained, the smaller the distance from the fair offer price for an IPO (Bradley and Jordan, 2002; Loughran and Ritter, 2004; Lowry and Murphy, 2007). The logarithm of the amount of gross proceeds was used and scaled by total assets in the accounting period before the IPO to account for the offer size (OFFER_SIZE) and as a signalling variable (Reber and Vencappa, 2016). The logarithm of fee (FEE) as a proxy for information risk was added because underwriters ask for a higher commission when facing more severe asymmetric information problems (Meng et al., 2016). In line with Carter and Manaster (1990), researchers included the variable underwriter reputation (UW_REP). Generally, low risk firms attempt to reveal their low risk characteristic to the market by selecting a highly prestigious underwriter: the more highly ranked the underwriter is, the higher the efficiency achieved in price setting. This means that if the firm is followed by underwriters with a good reputation, the offer price is expected to be set closer to the true value of the firm. Researchers also introduced a dummy variable (VC_backed) that is equal to 1 in cases where the company is backed by a venture capital company, or zero otherwise. The market condition was taken into account by including a hot and cold market indicator (HOT_COLD). This variable represents the average market underpricing in the month before the issue date (excluding penny stocks, units, closed-end funds, etc).

To better understand the role of institutional investors in the bookbuilding process, this study also controlled for the institutional IPO demand (INST_DEM) by using the percentage of shares held by all institutional investors after the IPO. Following the argument proposed by Benveniste and Spindt (1989) and later empirically tested by Hanley (1993), researchers expected high (low) demand to reveal positive (negative) information that causes the offer price to be adjusted upward (downward). The intuition behind this hypothesis is that IPOs are not fully priced by underwriters because of the uncertainty they face as to demand for new shares. Therefore, to increase the probability of success and to clear the aftermarket, the investment banker sets the offer price deliberately low. Researchers would expect to find that market sentiment allows investment banks to control the demand in the primary market, resulting in less uncertainty and a better price accuracy process.

As far as the core sentiment variables are concerned (deliberate pre-market pricing factors), researchers collected, for each IPO in the sample, the stock Tweets released in the 3 months before the IPO, excluding the first trading day. This study chose such a time frame in order to consider the signals coming from the secondary market while the book is built in the weeks prior to the listing. Both data collection and data coding were carried out by the authors. Coding instructions as well as a standardized coding worksheet were jointly created and agreed by the authors in order to ensure the consistency in the coding procedure. Despite the evident advantage in term of time-saving and sample size, researchers intentionally avoided any automated content analysis tool; possible shades in the content of the Tweets (sarcasm, emoticons and double meanings) would in fact have probably been misunderstood by any automated tool. Once the Tweets were extracted, their sentiment was assessed into ‘positive’ and ‘negative’’ categories (Liu, 2015). The first category identifies the Tweets which denote a veil of optimism or, sometimes, of pure enthusiasm on the part of users towards the company itself. Some of the words most used by "positive Tweeters" are love, great, jump, interesting.

The second category includes Tweets which sometimes consist of attempts, are volunteers and not, to influence the market through the disclosure of negative or pessimistic news about one society. Sometimes sarcasm is the way ‘negative Tweeters’ use to express their negative view on a firm. Examples of words recurring in negative Tweets are: fail, terrible, waste of, down.

Descriptive statistics

Table 2 presents summary statistics for the 412 IPOs in the sample. The average offering price is US$14.51 per share. The average value of total assets of the listing firms prior to the offer, as a measure of the level of operations, is US$1.66 billion. The offer size variable indicates that, on average, firms have US$335 million. On average, underwriting fees are $1 million. The average rank of an underwriter is 7.8, out of a maximum attainable of 9; so, researchers can conclude that, on average, only highly ranked underwriters followed the issues. The shares owned by insiders’ amount to approximatively 60%, which could be a positive signal of how confident the insiders are regarding the firm’s prospects. The institutional demand represents around the 70% of the shares held after the IPO. IPOs that are VC backed represent the 60% of the sample. As far as the sentiment variables are concerned, the average number of Tweets in the 3 months before the IPO is 35 (out of a maximum of 337). On average, positive Tweets tend to exceed negative ones.

3. To account for technical inefficiency, ui can be assumed to follow either half normal, truncated normal, exponential, or two-parameter gamma and represents the independently distributed non-negative random variable.

4. Researchers initially put a set of firm’s characteristics variables into the model (such as EBIT, Capital Expenditure, Research and Development expenses and so on). Due to the high correlation between those variables they were dropped from the model to avoid multicollinearity issues.

5. The impact of the variable Equity Retained on underpricing is mixed when used in stochastic frontier models. On the one hand, Hunt-McCool et al. (1996) report a positive relationship between equity retained and estimated offer price. On the other hand, Chen et al. (2002) and Reber and Vencappa (2016) do not find a statistically significant relationship.

6. The information regarding the participation of the institutional investors to the offer are not publicly available. Therefore, as many of previous authors did, researchers made use of the first reported holding by investors at the end of the offering quarter as a proxy for the participation to the IPO (Reuter, 2006; Ritter and Zhang, 2007; Field and Lowry, 2009).

7. There is an asymmetry in the bankers' expected profits as the result of the SEC institutional constraint which prohibits adjusting the offer price ex post to clear the primary market and the uncertainty about the exact realization of demand for the issue.

8. It is important to remember that the quarterly period considered did not include the first day of trading, so the sentiment was essentially analyzed until the eve of the IPO: this reflects once again the purpose of our work, which is to evaluate what happened before the listing. Considering also the actual day of listing, a "procedural bias" would have been committed, as it is certainly more likely that a company would be Tweeted in the D-Day of its life than in the previous days (or months).

EMPIRICAL RESULTS AND DISCUSSION

Table 3 presents the estimates of the Stochastic Frontier model. The output used in the stochastic frontier model is the natural logarithm of the offer price. The inputs or pricing factors X and the deliberate premarket factors Z used to model the variance of the non-idiosyncratic error component are those already discussed earlier.

Model 1 in Table 3 reports the results of the model used to estimate the maximum offer price achievable, according to the Reber and Vencappa (2016) framework. It only provides the basic baseline regression without the relationship variables related to deals.

As for the control variables, in contrast with Chen et al. (2002), but in line with Hunt-McCool et al. (1996) and Peng and Wang (2007) researchers found a positive impact of the asset book value on the IPO offer price. Contrary to Koop and Li (2001), however, the study found that firms belonging to industries with great growth potential, such as electronics and communications, are undervalued.

Moving to the variables explaining the distance from the maximum achievable offer price, when the characteristics of the deal are considered, researchers find that the higher the equity retained by the insiders, the smaller the closer to price to its maximum achievable. This result suggests that underwriters might take into account equity retention when pricing the IPO because the greater the retention, the lower the probability of required aftermarket price support and, consequently, the lower the variance of the inefficient error component. Also, researchers find evidence that size of the firm, as measured by sales, is negatively related to the distance thus supporting the idea that larger firms are perceived as less speculative (Hunt-McCool et al., 1996; Tinic, 1988); the underwriter reputation is not a critical variable in explaining the offer pricing. This last result is in line with Reber and Vencappa (2016) who conclude that underwriters’ reputation does not affect the level of deliberate premarket underpricing and suggest that it is the amount of money spent on underwriting, rather than the choice of a particular underwriter, which is important in the primary market pricing (Koop and Li, 2001). Finally, the study found a significant influence of the market conditions on pricing: specifically, researchers found that the higher the average underpricing recorded in the month before the issue, the lower the distance from the frontier. In other terms, if the market is ‘hot’ there is no need for the investment bank to apply an intentional discount to guarantee the complete subscription of the offer. This study finally found empirical evidence that the percentage of shares held by all institutional investors after the IPO (as a proxy of the institutional investors demand) makes the offer price closer to its potential.

As far as the sentiment variables are concerned, model 1 shows a positive effect of the number of Tweets on the pricing of the offer, as in hypothesis 1: the higher the number of positive Tweet in the 3 months prior the IPO, the smaller the distance of the offer price to its maximum achievable. No significant relationship is found on the negative Tweets (models 2) in line with the second hypotheses and also with previous literature which demonstrated that investors are net buyers of attention-grabbing news: they purchase stocks that have caught their attention, but they are less sensitive to negative information (Barber et al., 2008; Bajo and Raimondo, 2017).

Contrary to the expectations (hypothesis 3), the attention variable ‘number of Tweets’ shows no significant effect on the pricing.

In recent years, the impact of attention and sentiment on capital markets has developed as a mainstream of finance (Ritter, 2003). By solely covering a topic, media can raise people’s attention towards that topic (McCombs and Reynolds, 2009). Furthermore, media can influence people’s attitudes towards subjects by portraying them in a positive or a negative light (Tewksbury and Scheufele, 2009). According to Liu (2015) sentiment analysis, is the field of study that analyzes people’s opinions, sentiments, appraisals, attitudes, and emotions toward entities and their attributes expressed in written text. In IPO studies, the application of sentiment from social media platforms - Twitter as an example - is a new territory worthy of a substantial amount of research efforts (Liew and Wang, 2016). Previous studies maintain that a positive retail investor sentiment produced by mass or social media is positively associated with initial returns (Da et al., 2011; Liew and Wang, 2016; Bajo and Raimondo, 2017; Tsukioka et al., 2018). However, such literature only considers the role of attention and sentiment on the secondary market by focusing on the IPO performance as measured by underpricing. A research question that is yet uncovered deals with how the retail investor sentiment and/or attention might impact the IPO pricing in the primary market. In this paper researchers therefore test a stochastic frontier approach where the effects of market sentiment on the primary market pricing are revealed. Based on a sample of 412 US firms listed between 2010 and 2016, researchers investigate the effects that market attention and sentiment - disclosed by the number and sentiment of the Tweets in the 3 months prior to each IPO - produce in terms of deliberate pre-market underpricing (that is the distance between the maximum achievable price and the actual offer price of the stocks).

Results suggest that a positive sentiment on the listing firms helps to set the offer price closer to the maximum achievable value, thus yielding a benefit to the issuer; on the contrary, negative sentiments impose a discount on the firm’s fair price in order to ease the completion of the offer.

Current results provide an analysis sentiment on IPOs, as this study supports the role of social networks in mitigating the information asymmetry which naturally affects new listings. Nevertheless, according to the perspective presented in this paper, firms should do their best in order to avoid any inflation in the number of Tweets also favoring the positive sentiment over the number. Few and good is indeed the desirable attention and sentiment that issuers should wish for their listing firms in order to maximize the benefits coming from Twitter.

The author has not declared any conflict of interests.

REFERENCES

|

Ahmad K, Han J, Hutson E, Kearney C, Liu S (2016). Media-expressed negative tone and firm-level stock returns. Journal of Corporate Finance 37:152-172.

Crossref

|

|

|

|

Aigner D, Lovell CK, Schmidt P (1977). Formulation and estimation of stochastic frontier production function models. Journal of Econometrics 6(1):21-37.

Crossref

|

|

|

|

|

Antón AJM, Alonso JJM, Rodriguez GS (2011). Are IPOs (Initial Public Offering) still outperforming the market? Evidence from Spain in the period 2000 to 2010. African Journal of Business Management 5(14):5775-5783.

|

|

|

|

|

Bajo E, Raimondo C (2017). Media sentiment and IPO underpricing. Journal of Corporate Finance 46:139-153.

Crossref

|

|

|

|

|

Barber BM, Odean T, Zhu N (2008). Do retail trades move markets? The Review of Financial Studies 22(1):151-186.

Crossref

|

|

|

|

|

Bar-Haim R, Dinur E, Feldman R, Fresko M, Goldstein G (2011). Identifying and following expert investors in stock microblogs. In Proceedings of the conference on empirical methods in natural language processing. pp. 1310-1319.

|

|

|

|

|

Beatty RP, Ritter JR (1986). Investment banking, reputation, and the underpricing of initial public offerings. Journal of Financial Economics 15(1-2):213-232.

Crossref

|

|

|

|

|

Benveniste LM, Spindt PA (1989). How investment bankers determine the offer price and allocation of new issues. Journal of Financial Economics 24(2):343-361.

Crossref

|

|

|

|

|

Bhardwaj A, Imam S (2019). The tone and readability of the media during the financial crisis: Evidence from pre-IPO media coverage. International Review of Financial Analysis 63:40-48.

Crossref

|

|

|

|

|

Bhattacharya U, Galpin N, Ray R, Yu X (2009). The role of the media in the internet IPO bubble. Journal of Financial and Quantitative Analysis 44(3):657-682.

Crossref

|

|

|

|

|

Blankespoor E, Miller GS, White HD (2014). The role of dissemination in market liquidity: Evidence from firms' use of Twitter™. The Accounting Review 89(1):79-112.

Crossref

|

|

|

|

|

Borromeo RM, Toyama M (2015). Automatic vs. Crowdsourced Sentiment Analysis. Proceedings of the 19th International Database Engineering and Applications Symposium. pp. 90-95.

Crossref

|

|

|

|

|

Bradley DJ, Jordan BD (2002). Partial adjustment to public information and IPO underpricing. Journal of Financial and Quantitative Analysis 37(4):595-616.

Crossref

|

|

|

|

|

Bushee B, Core J, Guay W, Hamm S (2010). The role of the business press as an information intermediary. Journal of Accounting Research 48(1):1-19.

|

|

|

|

|

Carter R, Manaster S (1990). Initial public offerings and underwriter reputation. The Journal of Finance 45(4):1045-1067.

Crossref

|

|

|

|

|

Chen A, Hung CC, Wu CS (2002). The underpricing and excess returns of initial public offerings in Taiwan based on noisy trading: a stochastic frontier model. Review of Quantitative Finance and Accounting 18(2):139-159.

|

|

|

|

|

Chung CY, Kim J, Park J (2017). Individual Investor Sentiment and IPO Stock Returns: Evidence from the Korean Stock Market. Asiaâ€Pacific Journal of Financial Studies 46(6):876-902.

Crossref

|

|

|

|

|

Cornelli F, Goldreich D, Ljungqvist A (2006). Investor sentiment and preâ€IPO markets. The Journal of Finance 61(3):1187-1216.

Crossref

|

|

|

|

|

Da Z, Engelberg J, Gao P (2011). In search of attention. The Journal of Finance 66(5):1461-1499.

Crossref

|

|

|

|

|

Derrien F (2005). IPO pricing in "hot" market conditions: Who leaves money on the table? The Journal of Finance 60(1):487-521.

Crossref

|

|

|

|

|

Field LC, Lowry M (2009). Institutional versus individual investment in IPOs: The importance of firm fundamentals. Journal of Financial and Quantitative Analysis 44(3):489-516.

Crossref

|

|

|

|

|

Habib MA, Ljungqvist AP (2001). Underpricing and entrepreneurial wealth losses in IPOs: Theory and evidence. The Review of Financial Studies 14(2):433-458.

Crossref

|

|

|

|

|

Hanley KW (1993). The underpricing of initial public offerings and the partial adjustment phenomenon. Journal of Financial Economics 34(2):231-250.

Crossref

|

|

|

|

|

Hunt-McCool J, Koh SC, Francis BB (1996). Testing for deliberate underpricing in the IPO premarket: A stochastic frontier approach. The Review of Financial Studies 9(4):1251-1269.

Crossref

|

|

|

|

|

Ibbotson RG, Sindelar JL, Ritter JR (1988). Initial public offerings. Journal of Applied Corporate Finance 1(2):37-45.

Crossref

|

|

|

|

|

Irbo MM, Mohammed AA (2020). Social media, business capabilities and performance: A review of literature. African Journal of Business Management 14(9):271-277.

Crossref

|

|

|

|

|

Jiang L, Li G (2013). Investor Sentiment and IPO Pricing during Pre-Market and Aftermarket Periods: Evidence from Hong Kong. Pacific-Basin Finance Journal 23:65-82.

Crossref

|

|

|

|

|

Kolbeins G (2010). The effect of media coverage on IPOs. Research in Social Sciences 11:89-96.

|

|

|

|

|

Koop G, Li K (2001) The valuation of IPOs and SEO firms. Journal of Empirical Finance 8(4):375-401.

Crossref

|

|

|

|

|

Kosicki GM (1993). Problems and opportunities in agenda-setting research. Journal of Communication 43:100-127.

Crossref

|

|

|

|

|

Kumbhakar SC, Lovell CK (2003). Stochastic frontier analysis. Cambridge university press.

Crossref

|

|

|

|

|

Liew JKS, Wang GZ (2016). Twitter sentiment and IPO performance: a cross-sectional examination. The Journal of Portfolio Management 42(4):129-135.

Crossref

|

|

|

|

|

Liu B (2015). Sentiment analysis: Mining opinions, sentiments and emotions (1st ed.). New York: Cambridge University Press. Available at:

Crossref

|

|

|

|

|

Liu LX, Sherman AE, Zhang Y (2014). The long-run role of the media: Evidence from initial public offerings. Management Science 60(8):1945-1964.

Crossref

|

|

|

|

|

Ljungqvist A, Nanda V, Singh R (2006). Hot markets, investor sentiment, and IPO pricing. The Journal of Business 79(4):1667-1702.

Crossref

|

|

|

|

|

Loughran T, Ritter J (2004). Why has IPO underpricing changed over time? Financial Management 33(3):5-37.

|

|

|

|

|

Lowry M (2003). Why does IPO volume fluctuate so much? Journal of Financial Economics 67(1):3-40.

Crossref

|

|

|

|

|

Lowry M, Murphy KJ (2007). Executive stock options and IPO underpricing. Journal of Financial Economics 85(1):39-65.

Crossref

|

|

|

|

|

McCombs M, Llamas JP, Lopez-Escobar E, Rey F (1997). Candidate images in Spanish elections: Second-level agenda-setting effects. Journalism and Mass Communication Quarterly 74(4):703-717.

Crossref

|

|

|

|

|

McCombs M, Reynolds A (2009). How the news shapes our civic agenda. In Media effects. Routledge pp. 17-32.

|

|

|

|

|

Meng JG, Zhang W, Zou G (2016). Deliberate IPO underpricing or market misvaluation? new evidence from China. China Accounting and Finance Review 18(4):1-22.

Crossref

|

|

|

|

|

Peng Y, Wang K (2007). IPO underpricing and flotation methods in Taiwan-a stochastic frontier approach. Applied Economics 39(21):2785-2796.

Crossref

|

|

|

|

|

Pollock TG, Rindova VP (2003). Media legitimation effects in the market for initial public offerings. Academy of Management Journal 46(5):631-642.

Crossref

|

|

|

|

|

Reber B, Vencappa D (2016). Deliberate premarket underpricing and aftermarket mispricing: New insights on IPO pricing. International Review of Financial Analysis 44:18-33.

Crossref

|

|

|

|

|

Reuter J (2006). Are IPO allocations for sale? Evidence from mutual funds. The Journal of Finance 61(5):2289-2324.

Crossref

|

|

|

|

|

Ritter JR (1991). The long-run performance of initial public offerings. The Journal of Finance 46(1):3-27.

Crossref

|

|

|

|

|

Ritter JR (2003). Investment banking and securities issuance. In Constantinides G, Harris M, Stulz R (eds.), Handbook of the Economics of Finance North-Holland, New York, NY.

Crossref

|

|

|

|

|

Ritter JR, Zhang D (2007). Affiliated mutual funds and the allocation of initial public offerings. Journal of Financial Economics 86(2):337-368.

Crossref

|

|

|

|

|

Rogers EM, Dearing JW, Bregman D (1993). The anatomy of agenda setting research. Journal of Communication 43(2):68-84.

Crossref

|

|

|

|

|

Tetlock P (2007). Giving content to investor sentiment: the role of media in the stock market. Journal of Finance 62(3):1139-1168.

Crossref

|

|

|

|

|

Tetlock PC (2011). All the news that's fit to reprint: Do investors react to stale information?. The Review of Financial Studies 24(5):1481-1512.

Crossref

|

|

|

|

|

Tewksbury D, Scheufele DA (2009). News framing theory and research. In Media effects. pp. 33-49. Routledge.

Crossref

|

|

|

|

|

Thornton B, Adams M, Hall G (2009). Do underwriters create value in the determination of the IPO final offering price? Journal of Applied Business Research 25(6):1-12.

Crossref

|

|

|

|

|

Tinic SM (1988). Anatomy of initial public offerings of common stock. The Journal of Finance 43(4):789-822.

Crossref

|

|

|

|

|

Tsukioka Y, Yanagi J, Takada T (2018). Investor sentiment extracted from internet stock message boards and IPO puzzles. International Review of Economics and Finance 56:205-217.

Crossref

|

|

|

|

|

Xia N, Junyan S, Pei G (2013). Empirical study on initial public offering (IPO) underpricing and long-run performance: Evidence from Chinas A-share market. African Journal of Business Management 7(11):852-861.

|

|

gives the dimension of the deliberate premarket underpricing and Z is a vector that includes a set of variables capturing the information asymmetry such as: the market conditions at the time of the IPO, the deal characteristics, the presence of third-party certification and, more generally, the uncertainty surrounding the IPO. The model presented in this study, that takes a leaf from Reber and Vencappa (2016), is built around a sentiment variable which account for the number and nature of the Tweets that have interested each IPO in the sample on the 3 months prior to the listing as predictors of the distance of the price set from the frontier. In details, researchers expect to observe deviations between the actual and optimal price correlated to the nature and intensity of the market sentiment as revealed by the social media.

gives the dimension of the deliberate premarket underpricing and Z is a vector that includes a set of variables capturing the information asymmetry such as: the market conditions at the time of the IPO, the deal characteristics, the presence of third-party certification and, more generally, the uncertainty surrounding the IPO. The model presented in this study, that takes a leaf from Reber and Vencappa (2016), is built around a sentiment variable which account for the number and nature of the Tweets that have interested each IPO in the sample on the 3 months prior to the listing as predictors of the distance of the price set from the frontier. In details, researchers expect to observe deviations between the actual and optimal price correlated to the nature and intensity of the market sentiment as revealed by the social media.