ABSTRACT

The purpose of this study is to identify the key determinant of the bank selection decision by Sudanese banks’ customers. The motivation for this paper is the lack of research that empirically studied bank selection criteria that influence customers' selection decisions on banking services in Sudan. Data were collected using self-administered questionnaires to a sample of 253 of Banks customers in Khartoum State. Their responses on the importance of 22 different selection criteria were rated and analyzed. Mean analysis and exploratory factor analysis is applied to rank the most important determinants of bank selection. The main results concluded that Corporal Efficiency is the most important determinant that has influenced the customer's selection decision. Other factors perceived to be important include bank marketing efforts, convenience and service delivery. Research on determinant factors of consumers’ bank selection decision is scarce in Sudan. This study contributes in that direction.

Key words: Selection criteria, banking industry, consumer behavior, Sudan.

The rising competition in the banking sector and the similarity of services offered by banks in Sudan makes it critical for the banks to pinpoint the important determinants of bank customers' selection decision. It is important to understand bank selection criteria upon which customers choose between providers of financial services in order to shape their services delivery and to build a robust growth strategy that focuses on products and services valued the most by customers and motivate them to deal with their bank. Understanding customers’ bank's selection criteria have been argued to be helpful to banks in identifying the appropriate marketing strategies needed to attract new customers and retain existing ones (Kaynak and Kucukemiroglu, 1992).

Determinants of bank selection criteria and customer’s bank preferences of Islamic banks have been extensively discussed and various dimensions have been identified in various Islamic countries. However, a review of the literature also indicates that most studies related to bank selection criteria have been mainly conducted in countries with a dual banking system where both conventional and Islamic banking systems exist.

Sudan is among the few countries with its financial system built completely according to Islamic principles with 100% Islamic bank services (Chong and Liu, 2009). Since 1992, the financial sector in Sudan is built entirely on Islamic principles and any financial transaction that is not compatible with Shariah is not allowed. Therefore, since all banks in Sudan work under the Islamic principles “religious” variable is supposed to be constant and will not be considered in this study.

The objective of this paper is to add to the current body of literature by empirically identifying the determinants that customers consider when selecting their bank. In effect, the study will evaluate and rank the relative importance of various selection criteria that influence bank choice in Sudan.

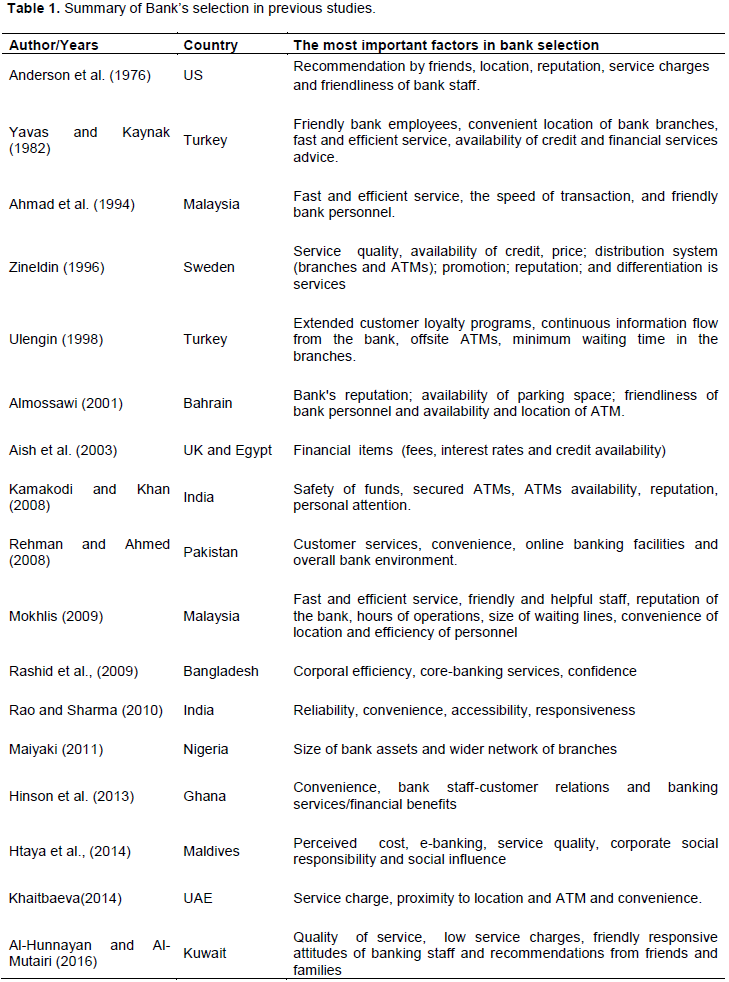

The study of the bank selection criteria was pioneered by Anderson et al. (1976) who used “determinant attribute analysis” in a survey in the USA and stratified their samples according to convenience and services. Based on 15 selection criteria convenience customers selected “recommendation by friends” as the most important factor, followed by “location”, “reputation”, “service charges” and “friendliness of bank staff”. Whereas, service customers ranked “availability of credit” as the most important factor, followed by “reputation”, “recommendation by friends”, “friendliness of the staff” and “interest charged on loans”. These accords with the findings of Yavas and Kaynak (1982) in Turkey, who found that frequent banking customers preferred friendly bank employees, convenient location of bank branches, fast and efficient service, availability of credit and financial services advice. Ahmad et al. (1994) found that the three most important criteria perceived by Muslims in Malaysia were the provision of a fast and efficient service, the speed of transaction, and friendly bank personnel. For Sweden, Zineldin (1996) surveyed 19 potential factors which customers consider as important in the selection of a bank. The results demonstrated that service quality, availability of credit, price, distribution system (branches and ATMs), promotion, reputation, and differentiation in services were the most sought factors among Swedish consumers. In another study, Ulengin (1998) indicated that customer in Turkey was more interested in the functional quality of financial services rather than the technical quality dimension. The study further concluded that on an average, respondents of the survey prefer the extended customer loyalty programs, the continuous information flow from the bank, the offsite ATMs, the minimum waiting time in the branches and a simplified applications form for all accounts a bank offers. In Bahrain, Almossawi (2001) examined the college students’ perception towards Islamic banks. The results revealed that bank’s reputation, bank convenience and the availability and location of Automated Teller Machines (ATM) are the main factors behind selecting Islamic banks. Later, Aish et al. (2003) compared the bank selection decisions of the small business market across the UK and Egypt. The results reported showed various similarities and provided evidence to suggest that brand plays a major role in the bank selection decisions of the small businesses at both UK and Egypt. The study reinforces the opinion that technical quality of service is more important than functional quality in bank selection decisions. More specifically, both Egyptian and UK small business customers consider financial items (fees, interest rates, and credit availability) as the most important factors in bank selection decisions.

For India, Kamakodi and Khan (2008) surveyed banks customers on the factors that influence the bank selection decisions and concluded that the top 10 parameters based on importance are found as Safety of Funds, secured ATMs, ATMs availability, reputation, personal attention, pleasing manners, confidentiality, closeness to work, timely service and friendly staff willing to work. The study by Rehman and Ahmed (2008), analyzed the major determinants of a bank selection by a customer in the banking industry of Pakistan. The findings of the study reveal that the most important variables influencing customer choice are customer services, convenience, online banking facilities and overall bank environment.

According to Mokhlis (2009), the fast and efficient service, friendly and helpful staff and reputation of the bank are important factors in the selection of a bank, as the friendliness of staff plays the major role in the bank decision process, followed by hours of operations, size of waiting for lines, convenience of location and efficiency of personnel. In another study, Mokhlis (2009) added that customers devote much emphasis on electronic services (ATM) which gives them quick and convenient access to the bank service. Rashid et al., (2009) investigated customers’ influential bank selection factors of Islamic banks in Bangladesh. The results revealed that Corporal efficiency, Core-Banking services, and Confidence were given higher weights by the majority of the respondents. Corporal efficiency and Confidence were the two most important factors found in this analysis.

Further, a study conducted by Rao and Sharma (2010) on bank selection criteria employed by MBA students in India concludes that convenience is an important determinant. Factors such as a parking facility, free delivery of demand, phone banking, and free home cash delivery suggest that clients want convenience in banking and they want to save time. A study of banking customers conducted in Nigeria by Maiyaki (2011) revealed that the size of bank assets and a wider network of branches were vital determinants of bank selection decision. The former factor indicates the need for safety and avoidance of uncertainty, and the latter emphasizes the convenience. Ahmad et al. (2011) investigated the factors that determine a customer’s bank selection in Malaysia and found that convenience, ATMs and their locations, parking space, the attractive location of the banks, and its opening hours were all important factors. In Pakistan, Subhani et al. (2012) investigated ten factors to investigate the consumers’ criteria for selecting Islamic banking. High profit and low service charges were found to be the most important factors, followed by religious motives and quality of service. In Ghana, Hinson et al. (2013) investigated bank selection criteria among undergraduate students using a qualitative survey. The findings confirmed that convenience, bank staff-customer relations and banking services/financial benefits are the first three most important determining factors. Htaya et al., (2014) identified five patronage factors of banking selection criteria in the Maldives. These factors were perceived cost, e-banking, service quality, corporate social responsibility and social influence as the new factors leading banking selection. According to Khaitbaeva (2014), the most important criteria influencing student-customers’ bank preferences in the UAE are: service charge, proximity to location and ATM, and convenience. In Kuwait, Al-Hunnayan and Al-Mutairi (2016) examine the main items behind selecting Islamic bank by customers and concluded that it showed that quality of service, low service charges, friendly responsive attitudes of banking staff and recommendations from friends and families are the main important factor for bank selection respectively. A summary of published and cited bank selection empirical studies including a brief summary of relevant findings are illustrated in Table 1.

Data was collected on a random basis, from a convenient sample of banks’ visiting customers during working hour using questionnaire survey instrument. Undergraduate business students were trained to fill in the questionnaires via face-to-face meetings with the respondents at bank locations in Khartoum State capital.

The questionnaire was divided into two parts. Part one includes questions regarding demographics, consumers’ accounts information. In part two, participants were requested to rate the relative importance of 22 criteria of bank’s selection decision on a five-point Likert scale ranging from extremely important to not at all important. The instrument for the study was adopted from previous literature e.g. (Al-Ajmi et al., 2009; Ahmad et al., 2011; Awan and Bukhari, 2011). To collect the data, a number of 260 questionnaires were distributed, of which 253 were returned (a response rate of 97%). SPSS V.25 was used to run the descriptive and factor analysis of the data. To assess the reliability of the collected data, a reliability test was performed.

RESEARCH FINDINGS AND DISCUSSION

Respondents’ profile

The summary of demographical characteristics for bank customers is depicted in Table 2. The data shows that respondents are quite young (60% between 20 and 40 and 81% between 20 and 50). The sample is almost evenly divided between males and females. Bachelor and master holders dominate the sample (70%), while secondary school graduates represent 26%. Most of the respondents are employed in the public (32.2%) and private sectors (29.2%) of the economy, while a sizable portion (31.2%) is a retired segment. However, the respondents are not quite experienced in dealing with banks. Only 14% have more than 10 years of experience in dealing with the bank.

Mean-ranking analysis

The findings presented in Table 3 focused on the individual criteria for bank’s selection in order to determine the important criteria as ranked by the respondents. The mean scores and ranks of all the factors, shown in Table 2, revealed that customers highly regard Quality of Service (mean=4.67) as the most important factor in their bank selection decision and then comes Trust and Commitments (mean=4.63), together with Privacy and Confidentiality (mean=4.61) as the second and third important factors followed by Faster transaction (mean=4.67) and Friendly and Responsive attitude of banking staff (mean=4.67) to be the fourth and fifth important factors, respectively for selecting a bank. These findings are in accordance with the studies of Ahmad et al. (1994), Almossawi (2001), Ahmad et al. (2011), Subhani et al. (2012), and Al-Hunnayan and Al-Mutairi (2016).

Factor analysis

Exploratory factor loadings are created by PCA extraction through varimax rotation with Kaiser Normalization on the selection criteria to delineate patterns of patronage factors more clearly. The Kaiser-Meyer-Olkin (KMO) measure of sample adequacy showed a value of (0.823) and Bartlett’s Test of sphericity also reaches statistical significance (0.000), supporting the factorability of the correlation matrix. The rotated solution (presented in Table 4) revealed the presence of seven factors with a number of strong loadings that emerged from the analysis for the bank customers with all 22 items of the bank selection criteria exhibiting large factor loadings (above 0.5 significant levels) and explaining a total of 67% of the variance.

The first and most factor which can be named as ''Corporal Efficiency'' contributes about 13.95% of the reasons for bank selection decision with highest eigenvalue and variance and represents the most important factor that has influenced consumers' decision to select a bank. This factor can be used as an indicator of customers’ concern about bank 'Trust and Commitments', 'Privacy and Confidentiality', 'efficiency in carrying out transactions', 'efficiency of counter services' and 'Friendly and Responsive attitude of banking staff'.

The second important factor which explains 11.86% of the total variance concerns with the ''Bank Marketing Efforts''. The Marketing Efforts indicators include 'media and PR', 'advertising and promotion', 'Recommendations from friends/family' and 'past experience with the bank'.

The third factor deals with ''Convenience'' involving the 'Interior comfort of Branches', ' availability of parking space ' and 'Wide range of services' and contributes about 10.46% of the reasons for bank selection decision.

The fourth factor concerns with the ''Bank Service Delivery'' and includes 'Quality of Service', 'Faster transaction' and 'online banking' and contributes about 9.12% of the reasons for bank selection decision.

The fifth factor named as ''Social Factor'' can be used as an indicator of customers’ concern about bank social aspects and comprises both availabilities of separate ladies section in the bank and bank social responsibility and contributes about 7.85% of the reasons for bank selection decision.

The sixth factor which contributes about 6.967% of the reasons for bank selection decision, relate to the salient ''Bank Location'' which comprises two items 'No. of Branches' and eye-catching location of the branch.

The seventh factor can be named as ''Cost and Benefits'' in term of money and time and includes 'High profit and Low service charges' and ' lower waiting queues'. This factor contributes about 6.943% of the reasons for bank selection decision.

After the factors were identified, Cronbach’s alpha was employed to measure internal reliability by unit weighting items with salient loadings in a factor. As depicted in Table 3, all factors produced alpha coefficient greater than 0.5 indicating high internal consistencies and reliability where Cronbach’s alpha coefficient at 0.5 or higher was considered acceptable (Hair et al., 1998).

This study aimed to determine the pertinent factors which Sudanese bank customers perceive as important in their bank selection decision. In line with previous similar studies, e.g. Rashid et al., (2009), the most important point revealed by the study is that customer's bank selection decision depends mainly on the bank corporal efficiency in term of 'Trust and Commitments', 'Privacy and Confidentiality', 'efficiency in carrying out transactions', 'efficiency of counter services' and 'Friendly and Responsive attitude of banking staff'. Those factors should be considered seriously by bankers in designing their market strategies and corporal issues according to the consumers' needs to attract and retain bank consumers. Accordingly, banks in Sudan must work on enhancing their corporal efficiency which considered a vital factor that meets the needs of their consumers and affects the bank’s competitiveness.

The importance of study findings increases with the current lift of American economic sanction on Sudan which will result in the entrance of international banks in the Sudanese banking industry. Thus, domestic banks have to work side by side with foreign banks. Less efficient banks are likely to suffer from domestic and international competition.

The findings of this study can help bank practitioners identify the major factors that may influence bank selection decisions among their customers. Providing insights on this phenomenon will help banks identify the suitable marketing strategies needed to attract and retain customers. It is therefore recommended that for competitive advantage, banks managers ought to consider these factors as guidance in their future planning. This study is limited to a certain segment which is banks’ visiting customer in Khartoum State; other segments such as students or banks’ customer in other Sudanese states, who may have different selection behavior, can be considered for future study. Also, additional studies comparing bank patronage behavior based on gender or age as well as from different states of Sudan might generate interesting findings.

The author has not declared any conflict of interests.

REFERENCES

|

Ahmad K, Dent MM, Rustam GA (2011). Brand preference in Islamic banking. Journal of Islamic Marketing 2(1):74-82.

Crossref

|

|

|

|

Ahmad N, Haron S, Planisek SL (1994). Bank patronage factors of Muslim and non-Muslim customers. International Journal of Bank Marketing 12(1):32-40.

Crossref

|

|

|

|

|

Aish EMA, Ennew CT, McKechnie SA (2003). A cross-cultural perspective on the role of branding in financial services: The Small Business Market. Journal of Marketing Management 19:1021-1042.

Crossref

|

|

|

|

|

Al-Ajmi J, Abo HH, Al-Saleh N (2009). Clients of conventional and Islamic banks in Bahrain: How they choose which bank to patronize. International Journal of Social Economics 36(11):1086-1112.

Crossref

|

|

|

|

|

Al-Hunnayan S, Al-Mutairi A (2016). Attitudes of Customers towards Islamic Banks in Kuwait. International Journal of Business and Management 11(11):59.

Crossref

|

|

|

|

|

Almossawi M (2001). Bank selection criteria employed by college students in Bahrain: an empirical analysis. International Journal of Bank Marketing 19(3):115-125.

Crossref

|

|

|

|

|

Anderson Jr. T, Cox III E, Fulchor D (1976). Bank Selection Decisions and Market Segmentation. Journal of Marketing 40(1):40-45.

Crossref

|

|

|

|

|

Awan HM, Shahzad BK (2011). Customer's criteria for selecting an Islamic bank: evidence from Pakistan. Journal of Islamic Marketing 2(1):14-27.

Crossref

|

|

|

|

|

Chong B, Liu M-H (2009). Islamic Banking: Interest-Free or Interest-Based. Pacific-Basin Finance Journal pp. 1-39.

Crossref

|

|

|

|

|

Hairs JF, Anderson RE, Tatham RL, Black WC (1998). Multivariate data analysis. Englewood Cliffs, NJ: Printice Hall.

|

|

|

|

|

Hinson R, Osarenkhoe A, Okoe A (2013). Determinants of Bank Selection: A Study of Undergraduate Students in the University of Ghana. Journal of Service Science and Management 6:197-205.

Crossref

|

|

|

|

|

Htaya NN, Ibrahim SS, Amin H (2014). An Empirical Investigation of Bank Selection Criteria in Maldives. Journal of Islamic Banking and Finance 31(1):90-104.

|

|

|

|

|

Kamakodi N, Khan BA (2008). An insight into factors influencing bank selection decisions of Indian Customers. Asia Pacific Business Review 4(1), 17-26.

Crossref

|

|

|

|

|

Kaynak E, Kucukemiroglu O (1992). Bank and Product Selection: Hong Kong, International Journal of Bank Marketing 10(1):3-17.

Crossref

|

|

|

|

|

Khaitbaeva S, Al-Subaiey A, Enyinda C (2014). An Empirical Analysis of Attributes Influencing Bank Selection Choices by Customers in the UAE: The Dubai Context. Proceedings of the Middle East Conference on Global Business, Economics, Finance and Banking. Dubai, 10-12 October.

|

|

|

|

|

Maiyaki AA (2011). Factors determining bank's selection and preference in Nigerian retail banking. International Journal of Business and Management 6(1):253-257.

Crossref

|

|

|

|

|

Mokhlis S (2009). Determinants of Choice Criteria in Malaysia Retail Banking: An Analysis of Gender Based Choice Decisions. European Journal of Economics, Finance, and Administrative Sciences, p. 16.

|

|

|

|

|

Rao S, Sharma RK (2010). Bank selection criteria employed by MBA students in Delhi: an empirical analysis. Journal of Business Studies Quarterly 1(2):56-69.

Crossref

|

|

|

|

|

Rashid M, Hassan MK, Ahmad AUF (2009). Quality perception of the customers towards domestic Islamic banks in Bangladesh. Journal of Islamic Economics, Banking and Finance 5(1):109-32.

|

|

|

|

|

Rehman HU, Ahmed S (2008). An empirical analysis of the determinants of bank selection in Pakistan: a customer view. Pakistan Economic and Social Review 46(2):147-160.

|

|

|

|

|

Subhani MI, Hasan SA, Ms Osman (2012). Consumer Criteria for the Selection of an Islamic Bank: Evidence fromPakistan; International Research Journal of Finance and Economics (IRJFE), P. 94.

|

|

|

|

|

Ulengin B (1998). Using hierarchical information integration to examine customer preferences in banking. International Journal of Bank Marketing 16:202-210.

Crossref

|

|

|

|

|

Yavas U, Kaynak E (1982). Bank Marketing: Key Dimensions of the Bank Patronage Decision. Management Research News 5(2):22-24.

Crossref

|

|

|

|

|

Zineldin M (1996). Bank strategic positioning and some determinants of bank selection. International Journal of Bank Marketing 14(6):12-22.

Crossref

|

|