Full Length Research Paper

ABSTRACT

This paper aims to review systematically the existing studies of corporate governance that positively impact organisational performance in Africa and put forward theories, research methods, topics, and variables that emerge from the review. The systematic literature review is based on 32 peer-reviewed journal articles (and a further 12 thesis publications from Google Scholar Database focused on corporate governance, board characteristics, and ownership structure and Thesis publications produced by universities in Africa and in the diaspora). This study's conceptual framework is based on agency theory. The majority of results show a positive correlation between corporate governance and organisational performance with agency theory being the most utilised theory of choice. This paper undertakes a significant thorough systematic review of corporate governance with firm performance literature. It gives a 20-year review with a reference index from 2003 to 2022, useful for both academics and professionals. This study acts on recommendation to expand geographical spread across all continents to cover corporate governance area and to improve studies related to corporate governance and its impact on firm performance. Lastly, it is recommended that more studies that look at the impact of the corporate governance and firm performance should be performed especially in the public sector.

Key words: Corporate governance, business administration, firm performance; company performance, ownership structure; Africa.

INTRODUCTION

LITERATURE REVIEW

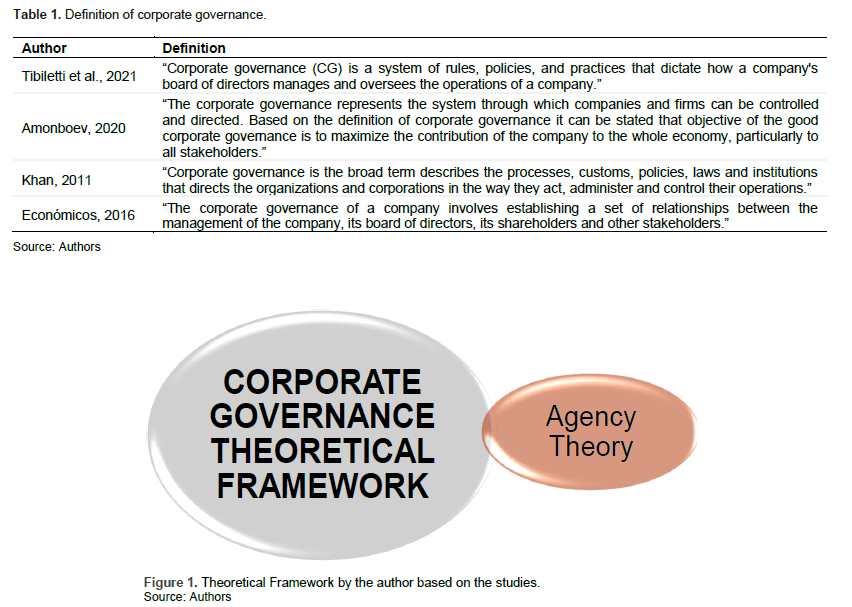

Over the last few decades, a corporate governance revolution has occurred, resulting in the creation of numerous anchoring theories. The agency hypothesis is by far the most popular theory in corporate governance. The most common theories in corporate governance are based on agency theory (Aguilera et al., 2019, Dinh and Calabro, 2019). Table 1 displays the definition of corporate governance.

The theoretical framework for the study is the agency theory (Figure 1). The concepts are discussed briefly here, along with an evaluation of how they have been employed in journalpapers. When it comes to the application of superiority in corporate governance, agency theory is unique (Madhani, 2017, Wiley and Monllor-Tormos, 2018). The corporate governance has been developing for over two decades now. It has been used in many fields of study including politics, economics, business, management, psychology and many others.

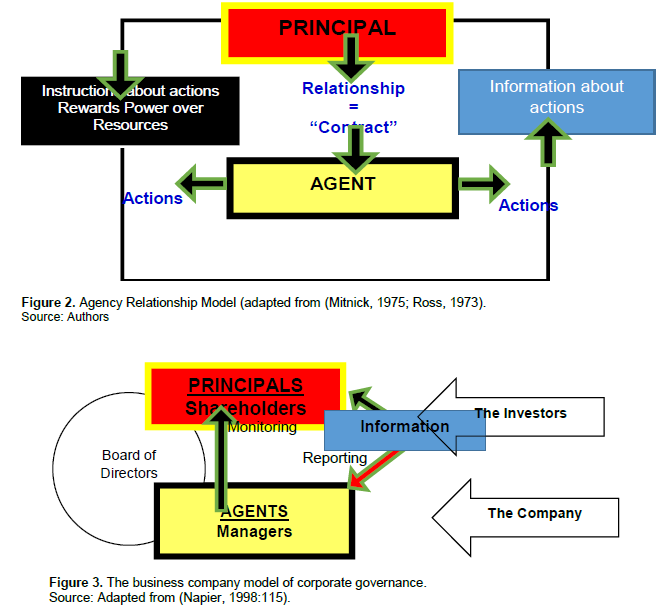

The agency problem is termed as the conflict that arises as agents tend to think for themselves and how they can maximise self-enrichment as opposed to advancing shareholder value. The agency problem and how to address it are best explained using agency theory. The agency idea is supported by the stewardship and stakeholder theories (Booth-Bell and Jackson, 2021; Wang, 2021).

Agency theory

As shown in Figure 3, the governance structure that emerged as a result of the convergence of directors and managers was dubbed in the business firm model (Napier, 1998). At a theoretical level, the connections between shareholders, directors, management, and auditors have been widely studied using various methodologies.

Shareholders nominate and elect directors to safeguard their interests, while directors accept a fiduciary obligation to be stewards of those interests, according to stewardship theory (Shah and Napier, 2019; Barzuza et al., 2019). On the other hand, agency theory sees the owners of the business employing managers, who may act in ways detrimental to the owners’ interests (Dong et al., 2021, Karim et al., 2020). The auditor's job, according to the agency theory, is to keep an eye on management's actions. Auditors should also be strictly regulated and monitored. Do directors, in contrast to management, represent the interests of shareholders, or are they essentially the same? However, there is no conclusive answer to this question.

Models of corporate governance

The agency theory has given birth to how shareholders might effectively use agents to ensure that shareholders' interests are tightly guarded against agents'. There are several suggestions on how this can be accomplished. There are two categories, namely stakeholder and shareholder model. The contrasting and contending views are that one emphasises the shareholder over the stakeholder.

RESEARCH METHODOLOGY

Systematic literature review into corporate governance and its applicability

In order to find the theories, methodologies, and themes employed in corporate governance research published in the Google Scholar family of journals, this study used the systematic literature review approach.

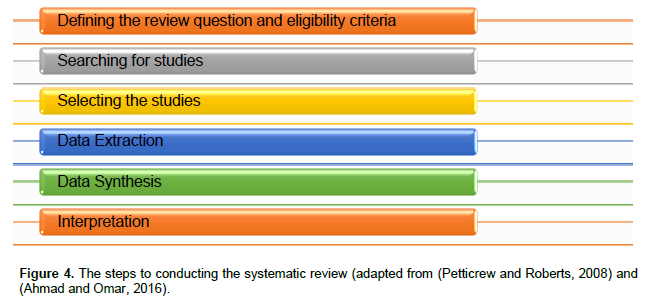

The research follows fundamental guidelines stated by (Petticrew and Roberts, 2008) for conducting a systematic review in the social sciences. Also, this research followed an amended five-step process (Ahmad and Omar, 2016) as shown in Figure 4.

Defining research questions

The study analyses corporate governance research and company performance in Africa using the Google Scholar Database. These studies focus on corporate governance and business performance. As a result, the research will review and assess research methods as well as corporate governance concepts. The purpose of this study is to examine the concepts, methodologies, topics, and variables that are frequently covered in corporate governance literature.

Systematic literature review

The systematic literature review approach considers keyword identification, database selection, and search period selection, all of which will be detailed further down.

RESULTS AND DISCUSSION

The search strategy and identification of keywords

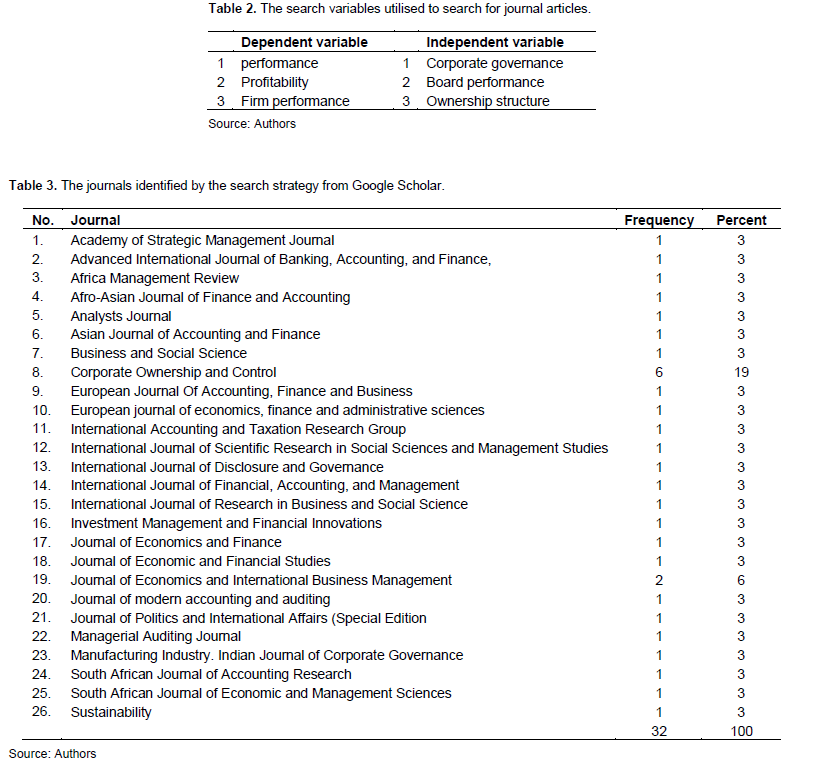

The search strategy was related to keywords as shown in Table 2. As independent variables, there are three keywords: independent variable, company performance, corporate governance, and ownership structure. The authors looked for publications that had these terms in at least one of the fields: title, abstract, and keywords. The following keywords were identified:

1) Corporate governance

2) Organisational or firm performance

3) Ownership structure

4) Africa

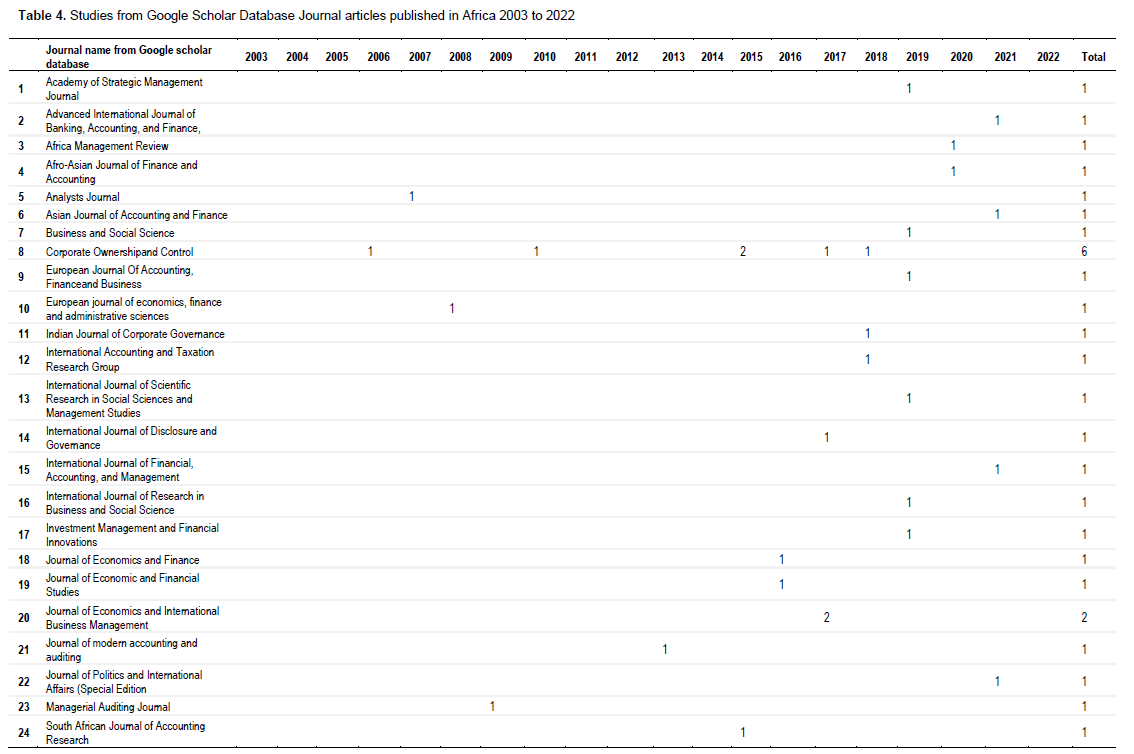

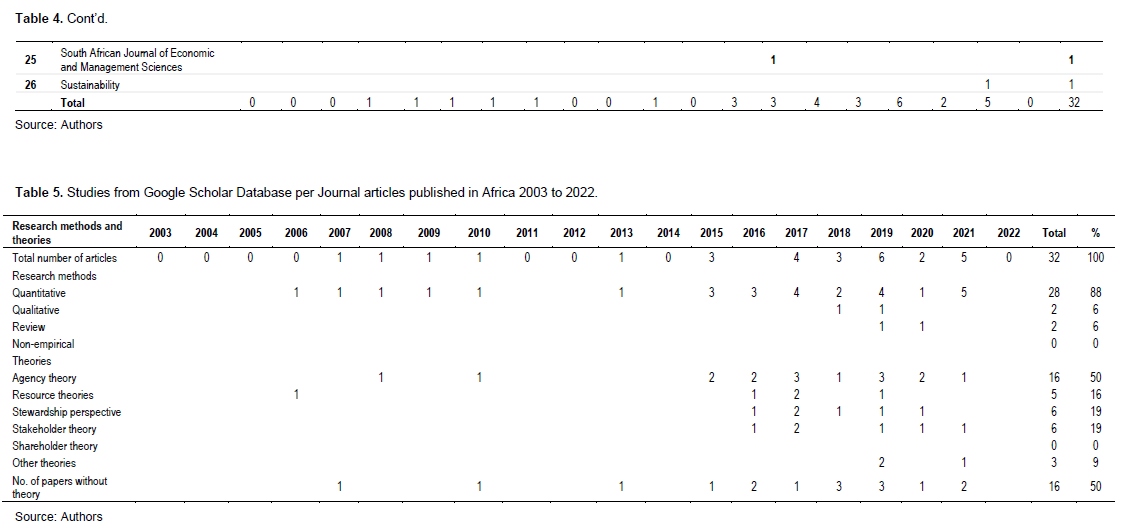

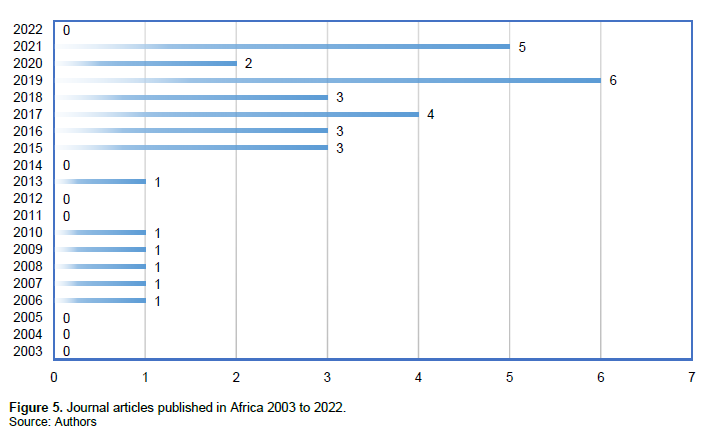

Because the Google Scholar Database is well regarded and contains a large number of peer-reviewed articles, it has emerged as the ideal choice for searching for corporate governance and business performance. The number of journals that returned research based on the aforementioned keywords utilized and to analysis is shown in Tables 3 and 4 (Journals) and Table 5 (Figure 5) (Research Methods and Theories), respectively. The 20-year period from 2003 to 2022 was used as the limiting condition. 202 journal articles were discovered after applying rejection criteria based on geographical location, and we narrowed them down to 32 peer-reviewed studies that would be the focus of the systematic literature review.

Selection of database and journals

Search period

The study's search period runs from 2003 to 2022, spanning 20 years of corporate governance and company performance research on the African continent. This is in line with the global evolution of corporate governance, albeit African studies dealing with real instances have been sluggish to catch on.

Evolution of journal papers on corporate governance and firm performance

In the case of African nations, creating distinctive nation codes was the first goal. The guidelines were then implemented inconsistently, with many of them being modelled on the British company Cadbury's strategy. Many businesses have decided to adopt international corporate governance rules first, despite the well-established local regulations (Harnay, 2018; Maroun and Cerbone, 2020; Ferrarini et al., 2021). The application started to flow as a negotiating tool between governments and the private sector. This started at a very slow pace but its understanding and adoption in Africa has improved significantly (Corvino et al., 2020; Wachira et al., 2019; Singh et al., 2019).

Previous studies (Bhatia and Gulati, 2021; Brenes et al., 2011) established a positive relationship between good corporate governance practices and firm performance. However, few studies (Bathala and Rao, 1995; Bhagat and Bolton, 2008; Kajola, 2008; Sanda et al., 2010) have established a negative relationship between corporate governance and organisational performance. Nevertheless, some other researchers could not establish any relationship. The constrained nature of the data may be to blame for the discrepancies in the research conclusions. Despite these contradictory findings, the research consistently demonstrates that excellent corporate governance is critical to improving business success. The fact that governments, regional authorities, and private institutions are paying close attention to corporate governance challenges attests to this reality. The failures and weaknesses in corporate governance arrangements that could not serve their purpose of safeguarding against excessive risk-taking by financial institutions in the aftermath of the financial crisis in 2007 were largely due to failures and weaknesses in corporate governance arrangements that could not serve their purpose of safeguarding against excessive risk-taking by financial institutions.

Research methodology used

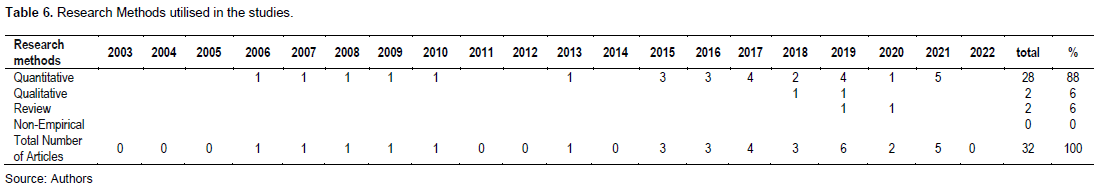

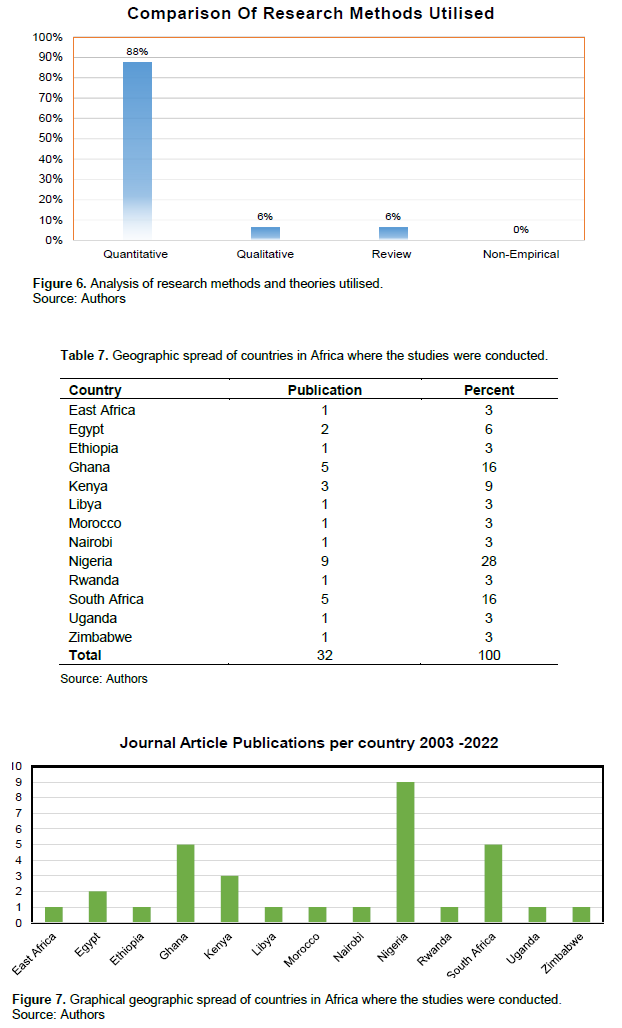

There were 32 qualifying studies that satisfied the criteria, with 88% of them using quantitative research technique, 6% using qualitative research methodology, 6% using review, and none using non-empirical research methodology. It was also noticed that none of the studies employed a mixed-methods approach. The study of the research methodologies employed by the journal articles is shown in Table 6 and Figure 6. The majority of the research, according to this study, employed quantitative analysis, followed by qualitative and review approaches. There is a startling revelation: no journal publications on the subject were published between 2003 and 2006, or between 2011 and 2012.

Geographical spread of research in Africa

Nigeria is by far one country at 28% of the studies where corporate governance research is leading. Nigeria is a leading economy in Africa with a very high population. It is further one country which is highly educated and where research is done in Nigeria and throughout the world by students studying in those countries. South Africa and Ghana follow suit next at 16% each, followed by Kenya and Egypt at 9% and 6% respectively. All others fair at 3% each. Of the 51 countries, the 12 countries show a high activity of work done and published in academic journals (Table 7 and Figure 7).

Theories used

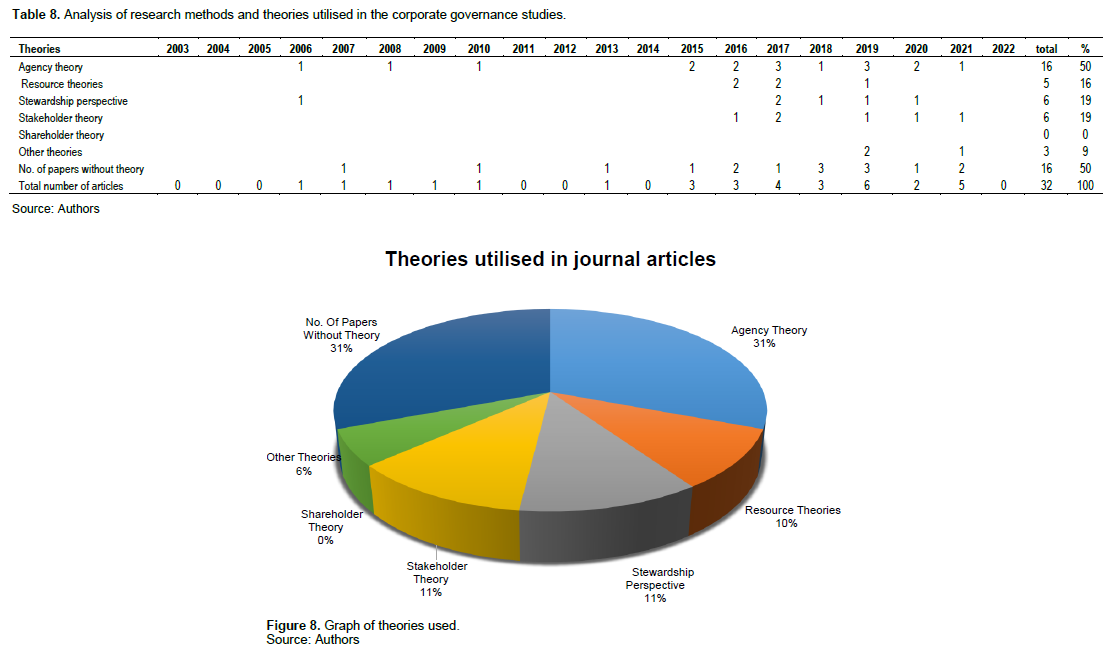

Agency theory is by far the most used theory of corporate governance with 16 studies of the 32. This is 50% of the studies, showing that by far agency theory as posited by (Tang et al., 2020; Adegboye et al., 2019; Manukaji, 2018; Ahmed and Rugami, 2019). The stewardship theory was utilised by 6% and stakeholder theory by 6% of the journal articles surveyed. The resource theories constitute 5% of the studies. It was also noted that 50% of the papers did not choose to use a specific theory to anchor their studies (Table 8 and Figure 8).

Summary of emergent topics

There are many different topics covered by corporate performance. Internal corporate governance includes, among other things, board activities, board composition, gender and racial diversity, CEO duality, board meetings, board committees, board remuneration, board qualifications, board experience, board independence, and board leadership (Pucheta-Martínez and Gallego-Álvarez, 2020; Herndon, 2020) to organisational performance measurements. On the organisational performance, three measures of performance are widely used in corporate governance studies: these are: return on assets (ROA); return on equity (ROE), and Tobin’s Quotient (TQ) (Buallay, 2017; Buallay, 2021). Firm performance and corporate governance must therefore evolve to accept these fundamental changes in the structure of the economy.

Gender diversity and racial diversity

A number of investigations in the past have suggested a positive relationship between gender diversity of the board and company financial performance. (Ibrahim et al., 2019; Namanya et al., 2021; Almarayeh, 2021). The dominant culture plays a critical role in gender diversity and hence firm performance in deep cultured societies (Naghavi et al., 2021). A study conducted in Ghana revealed that the performance of the board is unaffected by the minority of women who sit on it. However, the chairperson's role is crucial in guiding the transition for selecting and assessing candidates' commitment to the board while keeping in mind diversity and governance (Kakabadse et al., 2015). (Ntim, 2015) posits that ethnic diversity is valued more highly by the stock market than gender diversity. (Gyapong et al., 2016), in a South African study showed that there is a positive and significant effect of both board gender and ethnic diversity on firm value. It also found that the increase in firm value is greater when boards have three or more women directors.

Audit committee independence

Auditors have been suggested to be independent but audit committees as they form part of the board must also seek to maintain that level of independence that allows the board to perform its tasks independently. Transparency and accuracy in reporting is important (Giannarakis et al., 2020; Fuadah and Setiyawati, 2020). The studies recommend that audit committees should be independent in order to improve firm performance (Nyarko et al., 2017). (Ibrahim et al., 2019) analysis indicates that audit committee independence significantly and positively affects the financial performance of insurance firms in Kenya. The Moroccan study posit that the audit committee and nomination and remuneration committee have a positive effect on financial performance (El Idrissi and Alami, 2021).

Board size and board committee size

There is no minimum or maximum size for boards, however boards are appointed depending on the needs of the firm and the tasks that committees need to perform. (Muchemwa et al., 2016) posit that the average board is 12.87 or 13 board members which has risen to 14 after the emergence of King III Codes with the upper ceiling being of 24 board members in South Africa. In Nigeria the average is about 9 board members (Kajola, 2008). The adoption of the board size provision as influential to firm performance is however not supported in a Ghanaian study by (Owusu and Weir, 2013). However some studies performed in Nigeria find that board size has no effect on financial performance (Odewale, 2020)

Board independence

Boards must be able to act independently in order to cut agency costs. According to the research, a sufficient number of board meetings, a sizable board, director independence, educated board members, an audit committee, board composition, and ownership all have a positive impact on business performance, which lowers agency costs (Agarwal, 2020).

CEO duality

The CEO duality is when the CEO position and the Chairperson of the board are occupied by one person (Ozbek and Boyd, 2020; Gan and Erikson, 2022). The result shows that CEO duality is negatively related to voluntary disclosure (Odewale, 2020). In a Moroccan study, the CEO duality have a negative impact on financial performance (El Idrissi and Alami, 2021), finds a negative association between CEO duality and firm performance (Nasser, 2021).

Multiple codes and code adoption

To make sure that publicly traded firms comply with the disclosure requirements, Nigerian authorities must strengthen their enforcement and compliance measures. There is no evidence that the Corporate Governance Code's adoption by the Nigerian Securities and Exchange Commission has increased voluntary disclosure by listed companies (Odewale, 2020). There is a neutral and negative but insignificant relationship respectively between CEO Duality and Multiple Codes and performance of listed financial firms in Nigeria (Mohammed, 2019).

Board experience

Experience is arguably one of the most prominent corporate governance attributes, yet studies investigating traits of corporate governance in mitigating risk-taking behaviour have ignored board experience (Akande et al., 2020). For outsiders, a longer stay on the board is linked to greater performance levels, but insiders' number of current board seats has a favourable effect on performance. Finally, we find no evidence that any of them have been affected by their board positions to yet (Tejerina-Gaite and Fernández-Temprano, 2021). The findings show a strong link between gender diversity, board experience, and board independence and corporate fraud. According to the findings, corporate fraud is less likely to occur when there are more women directors, a mix of directors with industrial and accounting/finance experience, and independent directors (Haron et al., 2021).

Implications of the study

Future research must explore how the introduction of corporate governance has altered private sector compliance and decreased corporate governance failures in Africa. In the public sector, it should try to figure out why there aren't as many studies done there or in state-owned businesses as there are in the private sector. Additional research could look at several databases including Scopus, World of Science, and Science Direct.

CONCLUSION

Corporate governance must be viewed as more than merely ticking off compliance requirements; it must be viewed as enhancing the business. The most recent corporate scandals have severely harmed people's livelihoods and career prospects. It has shown the damage that occurs when companies break the law. When the government spends money in order to create value and ensure in order to generate revenue for its support, this is especially crucial for state-owned enterprises. In actuality, the study's time frame (2003–2022) and geographical reach are likewise limited. However, it is a useful lesson about how far research has been done in Africa. Very few researches are geared at state-owned enterprises, and corporate governance is likewise primarily focused on private companies. Unpredictability and the inability to make long-term plans are frequently linked to a nation's lack of stability. This has an impact on input and output resources, which has an impact on how well a corporation performs. The objective of this study is to critically evaluate ideas, research approaches, and issues that have been covered in corporate governance and its effects on organisational performance in Africa in the Google Scholar Database from 2003 to 2022. These themes include variables. Notably, significant advancements have been made in the study of corporate governance and organisational performance over the years, with varying degrees of success. The results show that there is a growing body of knowledge and study on corporate governance in developed countries. Therefore, it was essential to undertake a research in Africa to determine the extent of the work that has been done over the past two decades. The most popular method is agency theory, while quantitative research techniques are also often utilised. A growing number of studies link corporate governance to firm performance in a definitive, favourable, and important way (Alodat et al., 2021, Bhatt and Bhatt, 2017). It is important to conduct further study on both the effects of mandating the application of corporate governance principles and corporate governance in the public sector. Separately, more study has to be done on the impact of the fourth industrial revolution on corporate governance. The disparate continental advancements are a reflection of the various adoption, progress, and experiences in each of these fields, which has led to study. Changes in the global order, the workplace, and governmental and corporate institutions have been brought about by the emergence of covid-19. One possibility is to conduct more analysis on the impact of COVID-19 on corporate performance (Almoneef and Samontaray, 2019) as well as the impact of the fourth industrial revolution and its adoption on corporate governance and firm performance.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Adegboye A, Ojeka S, Adegboye K, Ebuzor E, Samson D (2019). Firm performance and condensed corporate governance mechanism: evidence of Nigerian financial institutions. Business: Theory Practice 20:403-416. |

|

|

Agarwal S (2020). Literature review on the relationship between board structure and firm performance. International Journal of Business Ethics in Developing Economies 9:33-43. |

|

|

Aguilera RV, Marano V, Haxhi I (2019). International corporate governance: A review and opportunities for future research. Journal of International Business Studies 50(4):457-498. |

|

|

Ahmad S, Omar R (2016). Basic corporate governance models: a systematic review. International Journal of Law and Management 58(1):73-107. |

|

|

Ahmed AF, Rugami M (2019). Corporate governance and performance of savings and credit cooperative societies in Kilifi County, Kenya. International Academic Journal of Economics and Finance 3(3):61-79. |

|

|

Akande JO, Moses O, Tewari D (2020). Board Experience, Corporate Risk-Taking and Going Concern: Evidence from South Africa. IUP Journal of Accounting Research and Audit Practices 19(1):18-52. |

|

|

Almarayeh T (2021). Board gender diversity, board compensation and firm performance. Evidence from Jordan. Journal of Financial Reporting Accounting Forum In press. |

|

|

Almoneef A, Samontaray DP (2019). Corporate governance and firm performance in the Saudi banking industry. Banks and Bank Systems 14(1):147-158. |

|

|

Alodat AY, Salleh Z, Hashim HA, Sulong F (2021). Corporate governance and firm performance: empirical evidence from Jordan. Journal of Financial Reporting and Accounting In press. |

|

|

Amonboev M (2020). Corporate Governance and Development: The case of Uzbekistan. Available at: |

|

|

Barako DG, Hancock P, Izan HY (2006). Factors influencing voluntary corporate disclosure by Kenyan companies. Corporate Governance: An International Review 14(2):107-125. |

|

|

Barzuza M, Curtis Q, Webber DH (2019). Shareholder value (s): Index fund ESG activism and the new millennial corporate governance. |

|

|

Bathala CT, Rao RP (1995). The determinants of board composition: An agency theory perspective. Managerial and Decision Economics 16(1):59-69. |

|

|

Bhagat S, Bolton B (2008). Corporate governance and firm performance. Journal of Corporate Finance 14(3):257-273. |

|

|

Bhatia M, Gulati R (2021). Board governance and bank performance: A meta-analysis. Research in International Business and Finance 58:101425. |

|

|

Bhatt PR, Bhatt RR (2017). Corporate governance and firm performance in Malaysia. Corporate Governance: The International Journal of Business in Society 17(5):896-912. |

|

|

Booth-Bell D, Jackson P (2021). Governance theory and board diversity, where do the rationales for board diversity and governance theories converge? Global Journal of Accounting and Finance 5(2):70. |

|

|

Brenes ER, Madrigal K, Requena B (2011). Corporate governance and family business performance. Journal of Business Research 64(3):280-285. |

|

|

Buallay A (2021). Corporate governance, Sharia'ah governance and performance: A cross-country comparison in the MENA region. Al Qasimia University Journal of Islamic Economics 1(1):189-215. |

|

|

Buallay AM (2017). The relationship between intellectual capital and firm performance. Corporate Governance and Organizational Behavior Review 1(1):32-41. |

|

|

Corvino A, Doni F, Bianchi Martini S (2020). Corporate governance, integrated reporting and environmental disclosure: Evidence from the South African context. Sustainability 12(12):4820. |

|

|

Dinh TQ, Calabro A (2019). Asian family firms through corporate governance and institutions: A systematic review of the literature and agenda for future research. International Journal of Management Reviews 21(1):50-75. |

|

|

Dong JQ, Karhade PP, Rai A, Xu SX (2021). How firms make information technology investment decisions: Toward a behavioral agency theory. Journal of Management Information Systems 38(1):29-58. |

|

|

Donnelly R, Mulcahy M (2008). Board structure, ownership, and voluntary disclosure in Ireland. Corporate Governance: An International Review 16(5):416-429. |

|

|

Fama EF, Jensen MC (1983). Separation of ownership and control. The Journal of Law and Economics 26(2):301-325. |

|

|

Farag H, Mallin C (2019). Monitoring corporate boards: Evidence from China. The European Journal of Finance 25(6):524-549. |

|

|

Farah B, Elias R, Aguilera R, Abi Saad E (2021). Corporate governance in the Middle East and North Africa: A systematic review of current trends and opportunities for future research. Corporate Governance: An International Review 29(6):630-660. |

|

|

Federo R, Saz?Carranza A (2020). A typology of board design for highly effective monitoring in intergovernmental organizations under the United Nations system. Regulation and Governance 14(2):344-361. |

|

|

Ferrarini G, Siri M, Zhu S (2021). The EU sustainable governance consultation and the missing link to soft law. European Corporate Governance Institute-Law Working Paper. P 576. |

|

|

Foster R (2020). The evolution and alignment of institutional shareholder engagement through the King and CRISA reports. Journal of Global Responsibility 11(2):147-153. |

|

|

Fuadah H, Setiyawati H (2020). The Effect of the implementation of transparency and accounting information systems on the quality of financial reports. International Journal of Business Management 3(11):01-12. |

|

|

Gan D, Erikson T (2022). Venture governance: CEO duality and new venture performance. Journal of Business Venturing Insights 17:e00304. |

|

|

Giannarakis G, Andronikidis A, Sariannidis N (2020). Determinants of environmental disclosure: investigating new and conventional corporate governance characteristics. Annals of Operations Research 294(1):87-105. |

|

|

Gorman L, Ward AM (2020). Accountability. Encyclopedia of Sustainable Management, 1. |

|

|

Gyapong E, Monem RM, Hu F (2016). Do women and ethnic minority directors influence firm value? Evidence from post?apartheid South Africa. Journal of Business Finance and Accounting 43(3-4):370-413. |

|

|

Harnay S (2018). Explaining the production and dissemination of global corporate governance standards: a law and economics approach to corporate governance codes as a global law-making technology. In Global Phenomena and Social Sciences, Springer. pp. 63-78. |

|

|

Haron NH, Halim NAA, Alias N (2021). The Relationship between Board Diversity, Board Independence and Corporate Fraud. Advances in Business Research International Journal 7(1):33-55. |

|

|

Healy PM, Palepu KG (2001). Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31(1-3):405-440. |

|

|

Herndon F (2020). The relationship of CEO duality to financial performance and efficiency in electronics firms. Doctoral dissertation, Capella University. |

|

|

Hilton SK, Arkorful H (2021). Remediation of the challenges of reporting corporate scandals in governance. International Journal of Ethics and Systems 37(3):356-369. |

|

|

Ibrahim HB, Ouma C, Koshal JN (2019). Effect of gender diversity on the financial performance of insurance firms in Kenya. International Journal of Research in Business and Social Science 8(5):274-285. |

|

|

Iqbal S, Nawaz A, Ehsan S (2019). Financial performance and corporate governance in microfinance: Evidence from Asia. Journal of Asian Economics 60:1-13. |

|

|

El Idrissi I, Alami Y (2021). The financial impacts of board mechanisms on performance: The case of listed Moroccan banks. International Journal of Financial, Accounting, and Management 3(2):93-113. |

|

|

Kajola SO (2008). Corporate governance and firm performance: The case of Nigerian listed firms. European Journal of Economics, Finance and Administrative Sciences 14(14):16-28. |

|

|

Kakabadse NK, Figueira C, Nicolopoulou K, Hong Yang J, Kakabadse AP, Özbilgin MF (2015). Gender diversity and board performance: Women's experiences and perspectives. Human Resource Management 54(2):265-281. |

|

|

Karim S, Manab NA, Ismail RB (2020). Assessing the governance mechanisms, corporate social responsibility and performance: the moderating effect of board independence. Global Business Review 0972150920917773. |

|

|

Khan H (2011). A literature review of corporate governance. In International Conference on E-business, management and Economics 25(1):1-5. |

|

|

Liang H, Renneboog L (2018). Is corporate social responsibility an agency problem?. In Research handbook of finance and sustainability. Edward Elgar Publishing pp. 54-71. |

|

|

Madhani PM (2017). Diverse roles of corporate board: Review of various corporate governance theories. The IUP Journal of Corporate Governance 16(2):7-28. |

|

|

Manukaji IJ (2018). Corporate governance and income smoothing in the Nigerian deposit money banks. International Journal of Business and Law Research 6(1):27-38. |

|

|

Maroun W, Cerbone D (2020). Corporate Governance in South Africa. In Corporate Governance in South Africa. De Gruyter Oldenbourg. |

|

|

Mitnick BM (1975). The theory of agency. Public Choice 24(1):27-42. |

|

|

Mohammed UG (2019). Corporate Governance and Performance of Listed Financial Firms in Nigeria. Available at: |

|

|

Muchemwa MR, Padia N, Callaghan CW (2016). Board composition, board size and financial performance of Johannesburg Stock Exchange companies. South African Journal of Economic and Management Sciences 19(4):497-513. |

|

|

Naghavi N, Sharif SP, Hussain HBI (2021). The role of national culture in the impact of board gender diversity on firm performance: evidence from a multi-country study. Equality, Diversity and Inclusion: An International Journal 40:631-650. |

|

|

Namanya D, Fong WLW, Mugarura JT (2021). Corporate governance and firm performance in developing countries: evidence from East Africa. Advanced International Journal of Banking, Accounting and Finance 3(7):127-147. |

|

|

Napier CJ (1998). Intersections of law and accountancy: Unlimited auditor liability in the United Kingdom. Accounting, Organizations and Society 23(1):105-128. |

|

|

Nasser ZA (2021). The effect of internal corporate governance of the firm's performance and firm value in five GCC countries. Accounting and Finance Innovations. P 225. |

|

|

Ntim CG (2015). Board diversity and organizational valuation: Unravelling the effects of ethnicity and gender. Journal of Management and Governance 19(1):167-195. |

|

|

Nyarko FK, Yusheng K, Zhu N (2017). Corporate governance and performance of firms: An empirical evidence from the banking sector of Ghana. Journal of Economics and International Business Management 5(1):14-29. |

|

|

Odewale RW (2020). Board attributes and voluntary disclosure in an emerging economy: evidence from Nigeria. Afro-Asian Journal of Finance and Accounting 10(3):341-363. |

|

|

Oduor J, Kebba J (2019). Financial sector regulation and governance in Africa. In Extending financial inclusion in Africa, Academic Press. pp. 137-163. |

|

|

Owusu A, Weir C (2013). Do company directors underestimate the adoption of corporate governance provisions?. Journal of Modern Accounting and Auditing 9(11):1526-1534. |

|

|

Ozbek OV, Boyd B (2020). The influence of CEO duality and board size on the market value of spun-off subsidiaries: The contingency effect of firm size. Journal of Strategy and Management 13(3):333-350. |

|

|

Petticrew M, Roberts H (2008). Systematic reviews in the social sciences: A practical guide. John Wileyand Sons. |

|

|

Pucheta-Martínez MC, Gallego-Álvarez I (2020). Do board characteristics drive firm performance? An international perspective. Review of Managerial Science 14(6):1251-1297. |

|

|

Ross SA (1973). The economic theory of agency: The principal's problem. The American Economic Review 63:134-139. |

|

|

Sanda AU, Mikailu AS, Garba T (2010). Corporate governance mechanisms and firms' financial performance in Nigeria. Afro-Asian Journal of Finance and Accounting 2(1):22-39. |

|

|

Shah N, Napier CJ (2019). Governors and directors: Competing models of corporate governance. Accounting History 24(3):338-355. |

|

|

Shaikh I, Randhawa K (2022). Managing the risks and motivations of technology managers in open innovation: Bringing stakeholder-centric corporate governance into focus. Technovation 114:102437. |

|

|

Singh H, Jain G, Munjal A, Rakesh S (2019). Blockchain technology in corporate governance: disrupting chain reaction or not? Corporate Governance 20(1):67-86. |

|

|

Tan M, Liu B (2016). CEO's managerial power, board committee memberships and idiosyncratic volatility. International Review of Financial Analysis 48:21-30. |

|

|

Tang P, Yang S, Yang S (2020). How to design corporate governance structures to enhance corporate social responsibility in China's mining state-owned enterprises? Resources Policy 66:101619. |

|

|

Tejerina-Gaite FA, Fernández-Temprano MA (2021). The influence of board experience on firm performance: does the director's role matter? Journal of Management and Governance 25(3):685-705. |

|

|

Tibiletti V, Marchini PL, Furlotti K, Medioli A (2021). Does corporate governance matter in corporate social responsibility disclosure? Evidence from Italy in the "era of sustainability". Corporate Social Responsibility and Environmental Management 28(2):896-907. |

|

|

Tica A, Weißenberger BE (2021). How regulatory changes are driven by a need for control in reputational scandals: a case study in the German insurance industry. Journal of Accounting and Organizational Change 18(1):57-76. |

|

|

Wachira MM, Berndt T, Romero CM (2019). The adoption of international sustainability and integrated reporting guidelines within a mandatory reporting framework: Lessons from South Africa. Social Responsibility Journal 16(5):613-629. |

|

|

Walsh JP, Brief AP (2007). The Academy of Management Annals (Volume 1). Taylor and Francis. |

|

|

Wang H (2021). The Effect of CEO Power on Corporate Debt Financing Costs: Integrating of Agency Theory and Stewardship Theory. In The 2021 12th International Conference on E-business, Management and Economics pp. 295-304. |

|

|

Wangrow DB, Schepker DJ, Barker III VL (2015). Managerial discretion: An empirical review and focus on future research directions. Journal of Management 41(1):99-135. |

|

|

Wiley C, Monllor-Tormos M (2018). Board gender diversity in the STEM&F sectors: the critical mass required to drive firm performance. Journal of Leadership and Organizational Studies 25(3):290-308. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0