ABSTRACT

The history and development of Enterprise Zones, as both a deliberate government policy of integrating the economies of Sub-Saharan African into the global stream and as a trade policy instrument of re-adjustments and limited resource acquisition option, have different and varied intendments for the countries that implemented them. However, what seems evident from their current, and rather rapid proliferation, is that they soon became a preferred policy option, with significantly little evidence of improvements or changes in sub-regional market developments, employment, GDP or FDI. The objective of this paper is an attempt to answer some questions occasioned by the apparent failure of these initiatives: the reasons for the proliferate establishment; reasons or factors that explain the seeming disparate applications and outcome. This will be achieved through an evaluation of selected countries’ data and determining the success factors and failures of the Enterprise Zones’ experiment. The evaluation of data and case review indicate an inconclusive, mixed bag of outcomes that could be explained by disparate sub-regional processes’ application, national infrastructural disparities and policies’ inconsistencies. Finally, it is hoped that this exercise offers fresh insights into the dynamics of implementation, as well as identify a policy or implementation lapses, make recommendations, and possible new areas of research.

Key words: Enterprise zone development, processes evaluation, outcomes, markets development, Sub-Saharan Africa.

Much of the countries in Sub-Saharan Africa (SSA) are primary producers, in the sense that they are exporters of minerals, oil, gas and raw or semi-processed agricultural products, with little or no value-added. The urgent, if inevitable, need for processes improvements. Value addition to some of these first products before exportation called for diversification and alternative processes/ products' enhancements, and a need to create a unique economic environment that enhanced or facilitated the processes, without the strictures and bottlenecks of the traditional market environment of these countries. It was also believed that a business environment so distinctly and purposefully structured would be more attractive to foreign direct investment (FDI), especially in the context of the then freshly articulated Chinese government’s policy of “going global” (zouchuqu). For some of the countries in the sub-region, there was also the need to re-evaluate the outcomes and sustainability of the Structural Adjustments Programs (SAP) that had not produced the desired outcomes as canvassed by the Bretton Woods Institutions (BWIs), in justifying their original implementation (Madani, 1999; Nwankwo and Richards, 2001). It is in the light of these failures, and perhaps the quest for viable options, that the Economic Zones (EZs), for the majority of these countries, was considered a second-best, exploratory alternative, as opposed to the hitherto generalized country-wide reform initiatives of the BWIs’ auspices, which had had unsatisfactory outcomes (Farole and Akinci, 2011; Neveling, 2017; Watson, 2001).

It is instructive that different countries have given their initiatives different names, even though substantially, their original basis was identical and they serve the same primary market and economic development purposes or reasonably expected outcomes. And the prevalence and rapidity of establishment was rather peculiar that one cannot but wonder whether the rapid proliferation was a function of its effectiveness, fad or evolving experimentations. According to Farole (2011), “the term economic zones encompasses a wide variety of related concepts, including free trade zones, free ports, foreign trade zones, export processing zones, special economic zones, free export zones, trade and economic cooperation zones, economic processing zones, and free zones” (p. 23). The United Nations Industrial Development Organization (UNIDO) defines EZs, “as a relatively small, geographically separated area within a country, to attract export-oriented industries, by offering them especially favourable investment and trade conditions relative to the remainder of the host economy”. In particular, the EZs provide for the importation of goods to be used in the production of exports on a bonded duty-free basis (UNIDO, 1980). Perhaps borrowing from China’s distinctive initiative, Industrial Parks have become part of the collective of Special Economic Zones (SEZs) in SSA. Interestingly, the difference in terms, surrounding Industrial Parks and the other zones' description is not so much in meaning but emphasis (Bost, 2010; Côté and Cohen-Rosenthal, 1998; Dodescu and Chirilă, 2012; FIAS, 2008; UNCTC-ILO, 1988).

It has also been suggested that “Industrial Parks” has a more significant antidotal meaning or implication for SSA. It has been argued that the Apartheid State established "industrial parks" in the black enclaves known as Bantustans, to exploit cheap surplus labor, satisfy demands for jobs, and to act as buffer zones against increasing waves of black urbanization (Bezuidenhout and Moussouris, 2007), an apparent different national rationalization from the orthodoxy. Firms that invested in these “border industries” were granted government subsidy packages and other concessions. Jauch (2002) describes them as Export Processing Zones (EPZs) in disguise and claims they formed the precedent for modern-day Industrial Development Zones (IDZs).

The overarching consideration and rationale for the establishment of EZs, substantially mimicking the SAP institutional rationale, was thus to achieve several objectives: attract FDI, create viable manufacturing and exporting capacity, generate foreign research skills and technology transfer capabilities, serve as employment generator alternative, as a complementary instrument in support of a broader economic reform strategy, as well as a structural laboratory for the implementation of new and alternative policy options and approaches (Farole and Akinci, 2011; FIAS, 2008). These remain the fundamental preoccupations, rationale and impetus for current initiatives in the sub-region, all in attempts at national economic development and rejuvenation. These are also some of the kinds of linkages articulated by Stein (2012). Unfortunately, analysts believe that, with very few exceptions, the Zone Project and the original rationalization and justifications have been less than successful. Indeed, Madani (1999) believes that “EPZs did not fulfill the role of engines of industrialization and growth” (p. 7), as some proponents had projected. However, the author is also of the opinion that “under propitious circumstances and good management, export processing zones generally achieved the two basic goals of creating employment and increasing foreign exchange earnings” (p. 5). This is debatable, and the inclination here, for the authors would be to argue, strongly, to the contrary, that SSA wears a different and disappointing experience in terms of outcome, with the possible exception of Madagascar. There are myriads of reasons for this, including the fundamental competitive challenge or disadvantage that SSA has become, in every conceivable complementary infrastructure support system.

Besides, available evidence suggests that Africa has a fundamental challenge associated with competitiveness, especially concerning manufacturing, due to issues of geography, scale, and transaction costs, particularly since China and India have integrated into global markets. The success inhibitors are considerable when it comes to supporting infrastructure, regulatory oversight, policy consistency and coordination. In the management of EZs, SSA can be described as an intractable national and sub-regional enigma, defying all known orthodoxies. Much of the African countries "face a much more difficult competitive environment, resulting from factors such as the emergence and entrenchment of "factory Asia"; the expiration of the Multi-Fibre Arrangement; the consolidation of global production networks; and recently slowing demands in traditional export markets" (Farole 2011: 6). It is ironic, and perhaps instructive that some of the success factors that gave impetus to the establishment of the Zones, for the most part, may have been responsible for its relative lack of success in the region, albeit predictably. The rationale for the establishment was argued to have been to take advantage of open access in the global economy, with some rapidly evolving dynamics of processes improvements, economies of scale and scope, high technological improvements and advancements, shortened products and services life cycle (Bartlett and Beamish, 2018; Mengistu, 2014). The countries in the sub-region were either ill-equipped or lacked the requisite capacities for meaningful participation, in what became an increasingly competitive and constantly evolving global marketplace. An argument can also be based, given the weak hands of these economies and "imposed" trade liberalism of the era, on the neo-classical theory of enterprise zones being second-best policy choice, which consisted of compensating for one distortion (import duty) by introducing another (subsidy), which most analysts have argued was the policy essence of the Zones’ initiatives.

Unfortunately, in much of the sub-region, the support infrastructure, essential for successful implementation of the initiative, is obsolete, dilapidated and out of alignment with the broader national economy. This raises several questions, including whether the EZs had been contemplated as an independent, stand-alone operation, devoid of any integrative connections with the national economy. For African zones to be competitive, some of the barriers to the competitiveness of local value chains such as inadequate integration with domestic economy must be eliminated (Curran et al., 2009; Farole, 2011; Namada et al., 2017; Watson, 2001). Besides, there is also the question of the sub-regions capacity for integration into the global market, given important inhibiting variables, like unavailability of factors (of production), comparative and competitive disadvantage, and lack of market proximity. These seem to put other countries/regions in superior competitive positions, which in and of itself, would also affect FDI. Evidence in this area is too thin to reach any conclusions, and the question of whether some of these FDIs would have occurred in the economy without EZ incentives is mostly unanswered, but putative. What can be deduced from the overall assessment of the rationale or impetus for the Zones’ establishment is one of very tentative, speculative suppositions at best, and at worse, unrealized collective sub-regional objectives.

Markets proximity and comparative advantage

Following these considerations, the authors have determined two fundamental phenomena affecting EZs in SSA. One is, “Market Proximity” and the other is “Comparative Advantage”. “Market Proximity”, relates to the relative distance between the location of production completion or substantial value addition, to the location of distribution and final consumption. Besides, how large and viable the market is, measured by Purchasing Power Parity, determines the viability and relative competitiveness of the zones’ location. These lead inevitably, to “Comparative Advantage" consideration. In an extremely competitive global environment, that encapsulates "Factory Asia", Eclectic Paradigm, and Location Advantage (Dunning, 2000; Farole, 2011; Rugman and Verbeke, 2009), do these countries/regions and their designated EZ locations provide the essential comparative advantage, concerning countries outside SSA? The presence of a vast internal market and a comparative labor cost advantage are essential to the success of African SEZs. The more local investors invest in African SEZs, the higher the productivity of these zones, especially as it relates to FDI (Curran et al., 2009; Farole, 2011; Watson, 2001).

According to Porter (1990), competitive advantages of Zones may be explained in terms of the cluster approach, in that Free Zones are industrial clusters of companies that are located in a geographic region. These clusters of companies share economic infrastructure, a pool of skilled human capital. They also have shared access to governmental and other institutions that provide education, specialized training, information and technical support. These companies may also work together to create joint companies, distribution agreements and common manufacturing agreements. It has been argued that that external economy of scale and other advantages of cluster help the operating firms in reducing costs, acquiring competitive edge and attracting FDI (Dunning, 1998). This raises the question of whether these locations in SSA and their complementary attributes have inherent compositions or inadequacies that put them at substantial advantage or disadvantage? This is significant, having consideration to the underlying rationale for the Zones’ establishment in much of the sub-region, namely, the segregation of distinct geographic locations purely for the production of high quality, export-driven, high-value products/services that meet and compete in the global market place, without the regulatory and bureaucratic structures obtainable in the larger national economies in these Zones (Aggarwal, 2012).

Many countries in the sub-region have indulged some form of the Zones’ initiatives (Table 1). The benefits of SEZs are generally viewed in terms of "static" and "dynamic" effects. Static effects are direct gains such as foreign exchange earnings, export growth and employment creation. In contrast, dynamic effects are indirect gains such as technology transfer and innovation, skills upgrading, export diversification and enhancement of productivity and trade efficiency of local firms (Gibbons et al., 2008; Zeng, 2010). These benefits, as evidenced by the success of SEZs in China and other Asian countries, provide some explanation as to the popularity of SEZs as tools for economic development and rejuvenation (Economist, 2015). On the contrary, the reality is that more SEZs have performed below expectations. The question is whether these levels of proliferation are a function of the Zones’ effectiveness, copy-cat fad, evolving experimentation or replication of successful models.

The purpose of this paper is an attempt to answer some questions on the establishment and implementation of the Economic Zones initiatives, namely, the rationale for establishment; the possible underlying reasons for proliferation; reasons or factors that explain the seeming disparate applications and measurable outcomes.

In order to answer some of the questions raised, the authors identified five countries, as reference countries for this evaluation, based on attributive commonalities and similar structural assumptions amongst them, including the rapidity of proliferation. These are Ethiopia, Ghana, Kenya, Nigeria and South Africa. In countries where EZs have been established, there seems to be levels of rapid proliferation within a short period. The authors reviewed available data and reports on these countries. The data, which were primarily secondary, were obtained from national zone authorities, World Bank Indicators and past research, as well as systematic searches for published and unpublished literature. For our purposes, secondary sources provided the opportunity to learn about what is already known, and what remains to be learned. Substantial use of secondary research helped to define the thrust or focus for possible subsequent research, by suggesting which questions needed answers that had not been realized from previous research, even as inconclusive as they generally appear.

What was evident was a lack of sufficient data and cases, as some of the countries did not keep comparable and consistent data. Amongst the countries there appeared to be a pattern of record keeping and data collection that seem inconsistent with the established objectives and outcomes. Further evaluation of these countries would also seem to suggest that there are some disparities in the implementation processes. There also appeared to be a lack of correlation between the type of Zones established and sectors’ Gross Domestic Product (GDP) contributions. Much of the findings are generalizable to other African countries that lack empirical SEZ performance data (Curran et al., 2009; Farole, 2011; Namada et al., 2017; Watson, 2001). Based on the authors' evaluation, the impact of EZs in driving economic and private-sector development seems to be quite mixed across countries of the sub-region. The lack of sufficient data and reports affected the outcome of this research, especially in measuring/determining environmental outcomes when it comes to employment, GDP and Technological transfer, including measurable FDI. Notwithstanding these shortcomings, the overall picture that emerges from this study is one of the reasonable assessments of the evolution, rationalization, evaluation and impact of enterprise zones in SSA.

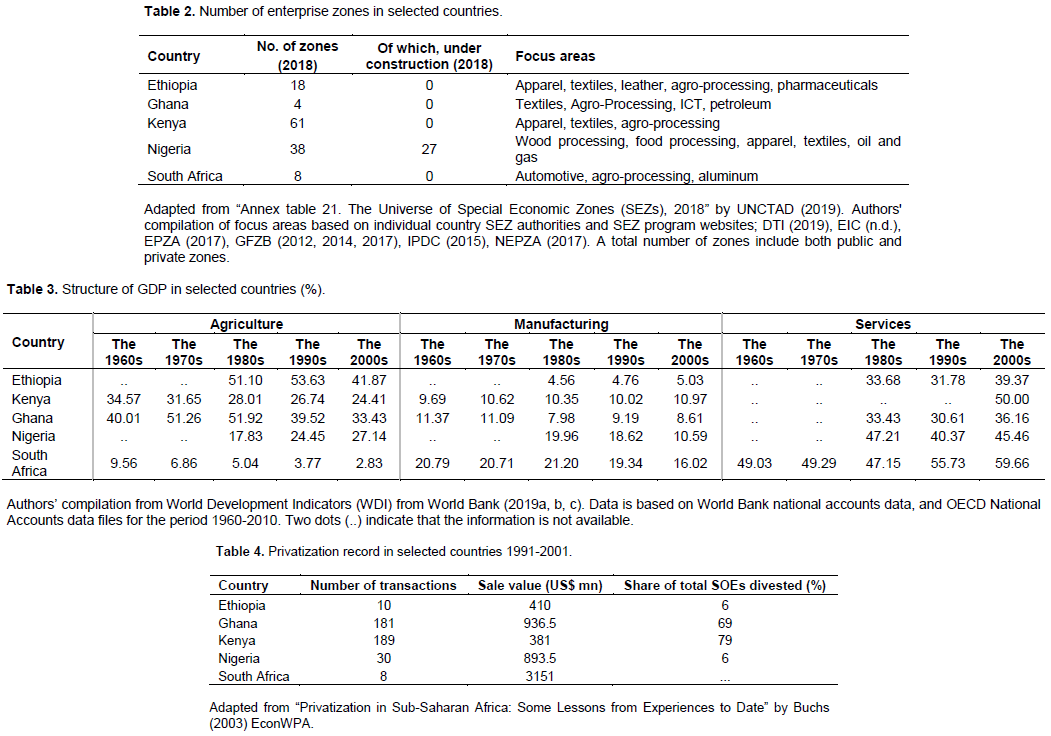

The five countries identified (Ethiopia, Ghana, Kenya, Nigeria and South Africa) have had rapid levels of proliferation of these Zones within a short space of time (Table 2). There seems to be a lack of correlation between the type of Zones established and sectors' Gross Domestic Product (GDP) contributions, such that a determination assessment could be somewhat tenuous. However, the structure of GDP in these countries, as seen in Table 3, indicates that these countries, except perhaps for South Africa, are still heavily dependent on primary production in contrast to the intended value addition expectation of the zones.

However, it would appear that for the different countries in the sub-region, the type of Zones established ranged from agriculture to manufacturing, to services, which seems more a reflection of the fundamentals of the particular stages of their economic development, which for many of them, is rather rudimentary, and not based on any discernible, measurable policy considerations. A review of the number of established ones (Table 2), in the selected countries, show seemingly inexplicable large numbers, with levels of haphazard, if incoherent duplications, in the establishment of specific Zones, that one wonders the policy and economic rationale. Indeed, there appears not to be a discernible pattern or sequence. For instance, Nigeria has a proliferation and duplication of over thirty-eight Zones, ranging from Federal to State, to Public/Private, to Private ownership; some under construction, some operational, and some just moribund declarations. This also goes for Kenya, with over sixty-one Zones, South Africa with eight, Ghana with four, and Ethiopia with eighteen. Interestingly enough, all the countries in the review in this research wear the same indistinctive, duplicative attributions. This raises the question as to whether there is the justifiable national impetus for the accelerated development of these Zones.

Common features/attributes as rationale for zones’ development

With possible substantial variations and perhaps few exceptions for South Africa, the countries in SSA functioned within the parameters of Mixed Economic Models and quasi-Command Economic Models, resulting naturally in vast State ownership of the different commanding heights economies. The percentage of State-Owned Enterprises (SOEs), almost in all cases, required huge statutory budgetary allocations to operate. These budgetary earmarks, while competing for national priorities, could not but affect resources' allocations in other critical sectors. The opportunity cost and lack of optimization have been distortive of these economies. The resultant waste and inefficiencies in their bureaucratic (mis)management were depletive, unproductive and resource-draining, thus an inhibiting drag on the overall national economies. This led, inevitably, to the intervention of the BWIs, in recommending the implementation of the widely applied SAP in the sub-region. It was believed that SAP would help manage public sector inefficiencies and waste, provide enormous scope to the private sector, attract more investment, bring in new technology and revive economic growth (Harsch, 2000; Sahn, 1996; Stiglitz and Squire, 1998). Table 4 shows transaction levels, values and share of divested SOEs, which were relatively insignificant in terms of original goal’s realization.

Short of granting the massive loans these countries were requesting, the BWIs and other creditor institutions rationalized that by disposing of State ownership holdings and assets in otherwise non-performing investments, funds could be realized, thus reducing the loan requirements of these countries. SAP substantially entailed Privatization and Deregulation of these economies. In this context, privatization was intended to divest and transfer public/government holdings to the private sector, thus creating a citizens-based, wealth-creating, participatory investment ownership society – an economy that is both market-driven and globally outward-looking. Implicit in the notion of privatization was the explicit correlation of deregulation, the need to liberalize and dismantle bureaucratic strictures and supposed burdensome regulations that have become consistent with State ownerships in the sub-region.

SAP was a last desperate attempt at structural re-alignment and recalibration of these economies, hoping to create a more efficient, productive and responsive economic structure, that was more in line with globalization. Not too unpredictably, it became a creative exercise in futility, with the weak and sometimes non-existent national institutional structures and framework to complement and implement the (new) SAP initiatives. Implementation was gravely riddled with corruption such that privatized assets fetched less than the pre-public ownership values, even when adjusted for inflation, in current market value. In some cases, the outcome was a mixed bag (Appiah-Kubi, 2001; Jones et al., 1998; Temu and Due, 1998; 2000; Nwankwo and Richards, 2001). The failure of this widespread sub-regional exercise has been attributed to a few reasons, prominent amongst them, the rentier state and lack of creation and reinforcement of the institutions that underpin and guide proper market renaissance. For example, as in 1999, Nigeria had over 1200 SOEs, which had been losing millions of dollars annually. The history of privatization and deregulation in Nigeria is one that was woefully replete with mismanagement and corruption (Okpanachi and Obutte, 2015). In January 2000, a similar sentiment was expressed in Kenya where several Members of Parliament and opinion-leaders interviewed, said they deplored the inefficiencies and rampant corruption in the significant SOEs, but feared that privatization would only enlarge and entrench theft and mismanagement (Nellis, 2005).

The mediocre, corrupt, and poorly structured implementation of SAP failed to realize its primary and original purpose, namely liberalizing the "state-dominated" economies and untrapping the funds mortgaged to the various non-performing SOEs. What was apparent was the insufficient resource generation through SAP, as initially envisaged. This failure led to the scramble for alternatives. Due to the fact that SAP was a mixed bag of outcomes in terms of realizing the original objectives, there was an understandable reluctance on the part of lenders (BWIs and other institutional lenders), who would compel these countries to seek funding and resources’ alternatives, hence the rather rapid proliferation of the Zones in the late 1990s and early 2000s.

What make the SSA experience in proliferation peculiar is both the underlying premises for the Zones' establishment (export-oriented/focused, lacking in any domestic integration or complementarity) and lack of supportive and reliable data from other national/regional experiments. It is therefore debatable whether this rather narrow (export-oriented focus) affected, or indeed inhibited, a more robust policy articulation and implementation that could have benefited and accommodated some domestic industries' leveraging of the Zones presence and its spillover effects. According to Farole (2011), EPZ activities were initially focused exclusively on export markets; investment was restricted to foreign capital, and activities were limited to manufacturing. EPZs have since evolved dramatically since the 1990s, and the types of activities permitted have expanded significantly.

However, due to bureaucratic and regulatory bottlenecks, this rather belated expanded inclusion has had little impact on the broader economy (World Bank, 2020).

A review and evaluation of available research and data for the selected countries (for this study) show indistinguishable differences in terms of policy articulation, focus, and processes implementation. Several conclusions could, therefore, be drawn; one that the proliferation was not due to any discernable effectiveness or replication of successful models in the sub-region. If anything, it appears to be evolving experimentation with hopeful outcomes. Two, the monolithic composition of these economies, being fundamentally primary producers, made unrealizable any structural changes in their system to accommodate a considerable shift, by the introduction of the Zones without support infrastructural enhancements or thoughtful alignment with the broader national economies. Third, the outcome may have been different had the focus of the Zones initiatives been secondary value addition to the original products, predominant in the sub-region. As it were, it seemed a monumental and unrealistic leap from zero to 100, without support infrastructure and absorptive capacity.

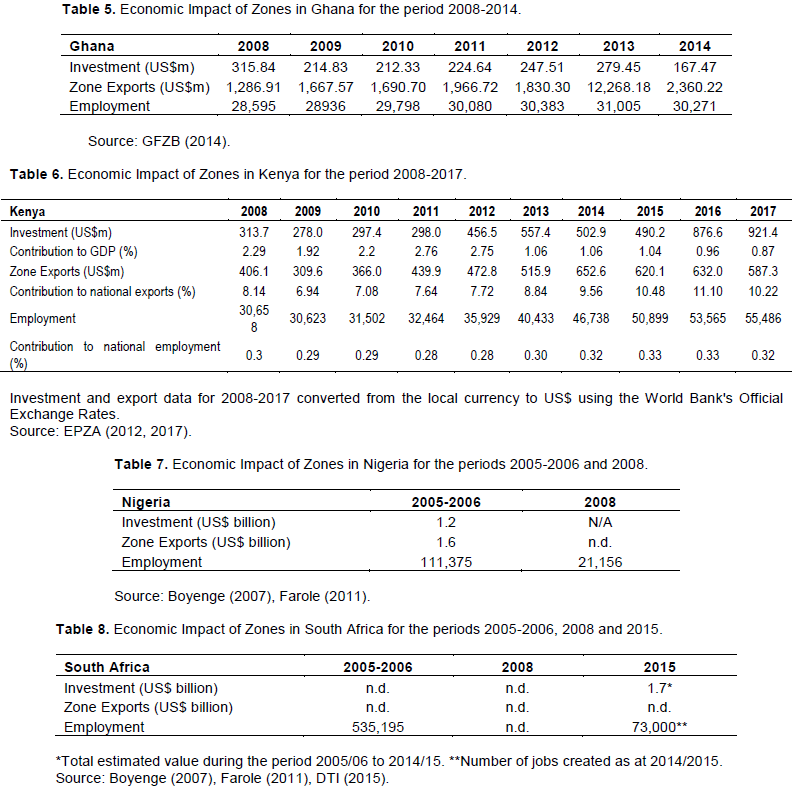

The authors have selected five countries, Ethiopia, Ghana, Kenya, Nigeria and South Africa, as reference countries for this study, based on attributive commonalities amongst them (Tables 5 to 8). They appear similarly constrained, measured against all the major development indices. It is important to note here that some of these features or attributes, including in-countries economic dynamics, may not be uniformly common or prevalent, to the same degree, in all the countries, at the time the Zones establishment policies were made. It is the opinion of the authors that some of the more critical considerations may have been: Market Proximity, Factors Limitations and Comparative Advantage, amongst others, including their vast debt ratio, which may also have been a factor. With the possible exception of South Africa, these countries were part of the Heavily Indebted Poor Countries debt relief program of the BWIs (Richards et al., 2003).

Assessing the performance of the zones in selected countries

The summary of our findings in respect of the overall performance of the five countries is presented below. Our data, which were primarily secondary, were obtained from national zone authorities, World Bank Indicators and past research, as well as systematic searches for published and unpublished literature. The consensus is that the Zones initiatives have been less than successful in much of SSA, in reasonably realizing the primary objectives. The underperformance of African zones has been acknowledged by previous research, noting the possible exception of Mauritius, and partially that of Kenya. According to Baissac (2003), other than those in Mauritius, Tunisia and Egypt, African EPZs are marked by “marginal employment impact, low FDI, absent linkages with the domestic economy, and limited foreign exchange contribution”(p.6), and that given the costs of building and maintaining EPZs, “the total balance for the region, as a whole, may well have been negative” (p. 6). Although many resources have been expended on African zones, the level of export, employment, and FDI generation has been low. Estimates of direct employment and exports from the Zones in SSA in the period between 2004 and 2007 are estimated at 1 million indirect employment and about $8,605 million respectively (Cirera and Lakshman, 2017; FIAS, 2008). According to Zeng (2015), the available evidence suggests that SSA’s experience with traditional EPZs, and IZs have been relatively poor in terms of both employment generation and export performance. According to Stein (2012), most zones in Africa have remained rather small, with few linkages to the local economy and small foreign-exchange earnings. The main problem is that many zones in SSA have been driven by aid agencies and vested interest, with promises of exclusive access to foreign markets, which have proven to be quite limited, particularly after the expiration of the Multi-Fibre Arrangement in January 2005. In contrast, in many of the successful export zones in Asian countries, EPZs have been part of a broader industrial policy where zones are not an end in themselves but a component of the broader strategy to transforming institutions to improve developmental competitiveness and industrialize the country (Zeng, 2015). Besides purposeful national policy prioritization, infrastructural support has been aligned with the initiative.

Although case studies have suggested possible spillover effects associated with the establishment of some EZs (Creskoff and Walkenhorst, 2009), that does not appear the case in SSA. The socioeconomic objectives for creating these zones have not been realized. Besides, there is a dearth of current, adequate, and actionable research on the EPZ performances in African countries that can be used for decision making, which in itself is telling, in rationalizing the impetus that has informed proliferation. Consequently, there is a need for recent, high-quality data for SEZs research and analysis by stakeholders. This is true because the choice of countries analyzed by many other authors, was mainly based on the availability of data on these countries. It is important to note that these findings are generalizable to other African countries that lack empirical SEZ performance data (Curran et al., 2009; Farole, 2011; Watson, 2001).

Ethiopia

Although comprehensive data are currently unavailable for Ethiopia, the authors have provided a brief country profile, for augmentation. Ethiopia, a one-party state with a planned economy, and a GDP of about USD 80.87 as at 2017, grew at a rate of between 8 and 11% annually in the period (Central Intelligence Agency, 2019; World Bank, 2019d). Although agriculture provides more than 70% of Ethiopia’s employment, services now account for the largest proportion of the country’s GDP (Central Intelligence Agency, 2019). The country has made progress in reducing extreme poverty but continues to experience widespread poverty due to rapid population growth and a low starting base (Central Intelligence Agency, 2019). Unemployment levels stood at 18 and 17.5% for 2011 and 2012 respectively. Ethiopia’s GDP per capita grew from USD 203.56 in 1981 to USD 768.01 in 2017 (World Bank, 2019e). However, the period between 1991 and 2004 saw declining GPD per capita from $271.39 to a record low of USD 111.93 (World Bank, 2019e). The implications of these somewhat contradictory statistics, especially concerning growth rates and its translation into internal resources

generation, may help explain the added urgency for Zones' establishments in that country.

African export zones in perspective

The lack of dependable and affordable utilities is a grave impediment for investment in African SEZs. A compilation of 2009 data from World Bank Enterprise Surveys and SEZ Investor Surveys conducted in the same year reveals that, except for South Asia, Africa has the worst electricity supply uptime with over 25% of electricity generation coming from generators, and over 5% of additional cost and lost sales as a result of electricity downtime in businesses (Farole, 2011). Indeed, the situation has not changed, rather degenerated rapidly in recent times, according to the Africa Energy Outlook 2019 (IEA, 2019). The average monthly downtime as a result of power outages in Kenya's, Nigeria's, and Ghana's SEZs are 11 h (32 h for the entire country), 136 h (206 h for the entire country), and 34 h (120 h for the entire country) respectively. The average time to secure electricity connection in days in Ghana's, Kenya's, and Nigeria's SEZs are 51 days (24 days for the entire country), 22 days (41 days for the entire country), and 19 days (8 days for the entire country) respectively (Farole, 2011). Even though, electricity supply and customs clearance durations within African zones is 50 and 30% respectively better than those outside the zones, these improvements, still fall below that obtainable from other non-African SEZs, leading to a below-par or substandard investment climate.

It has also been determined that access to reliable transportation infrastructure, is also a critical determinant of investment in both African and non-African SEZs. Indeed, according to the Global Competitive Index, a correlation exists between the quality of the road and the quality of infrastructure in African zones. The quality of roads in Nigeria, Kenya, and Ghana are 112, 91, and 76, respectively. Similarly, the quality of port infrastructure in Nigeria, Kenya, and Ghana are 112, 84, and 69, respectively (Farole, 2011; World Economic Forum, 2009). The regulatory environment of business is most unconducive in all of the regions. The process of establishing and conducting business in much of the sub-region is corruptly bureaucratic, time-consuming, and redundant. This has the negative effect of increasing the costs and risks of successfully running any business while destroying the incentives and competitiveness of African zones (World Bank, 2019). A robust legal and regulatory environment in a country is a strong indication of the likelihood of success of its zones about conflict resolutions, environmental and labor laws compliance, etc. (Curran et al., 2009; World Bank, 2019; Watson, 2001).

It has been suggested that investors consider a few factors, in addition to this five when deciding investment locations: utility quality and cost; transportation infrastructure access; business regulatory environment; trade preferences and tariffs; and corporate tax levels. Overall, the EZs in Kenya and Lesotho outperformed those of Ghana, Nigeria, Senegal, and Tanzania respecting the five most important factors responsible for attracting investments to African EZs. Except for Mauritius, and possibly Kenya, Madagascar, and Lesotho, there is consensus among researchers and stakeholders that African zones have performed below expectation (Curran et al., 2009; Farole, 2011; Watson, 2001).

Even though the majority of the countries in our review have performed below expectations, they have continued to proliferate. The investment climate, infrastructure, and levels of national competitiveness, etc. are significant determinants of the success or failure of African zones. The zones examined in this study have experienced little or no growth and even declining growth. For countries in the study who have employed EZs as a crucial policy instrument to increase exports, employment, and foreign investment, the results are relatively indiscernible outcomes. However, these laudable aims have not been attained as a result of several factors such as inadequate high-quality infrastructure, poor policy and economic integration with the domestic market/economy, skilled human capital scarcity, poor governance, and policy restrictions or inconsistencies (Bogoviz et al., 2016; Farole, 2011). This is evident in all of the countries in this evaluation, without exception.

Based on our evaluation, the impact of EZs in driving economic and private-sector development seems to be quite mixed across the countries in the sub-regions. Except for Mauritius, little or no empirical data or current research exists that will enable policymakers to assess the performance of EZs in Africa and the factors (policies and practices) that enable or hinder economic growth and development in the areas of employment, diversification, foreign investments, exports, and other EZ goals and objectives. This is true because the few case studies that tend to address this issue are over 20 years old and are limited in the number of countries covered. Besides, most African countries tend not to keep accurate and reliable data, especially when such data contradict government’s figures and highlight poor performance (Farole, 2011; Namada et al., 2017; Watson, 2001).

Overall, it would appear from available data and research, which substantially is inconclusive, that the orthodoxy that informed the creation and proliferation of the Zones were rather superficial and ungrounded. They would appear to have been informed by markets and economic dynamics that were unsuitable or perhaps ill-prepared for the environment into which they were introduced. These do not appear to be decisions grounded on the progressional national economic developmental models in the traditions of the linearity of stages of economic development (Rostow, 1991). Instead, they appear to be the exigencies of different policy alternatives, poorly conceived and inconsistently hurriedly implemented, in the desperation of national economic redemption alternatives. The dearth of infrastructure is consistent with the overall constraint and varying levels, degrees and capacity in all the zones. In general, power, gas, roads, ports, and telecommunications are the key constraints. Given the significant investments required for the zones, a robust committed engagement from government and active public-private participation is essential.

The emergence of “factory Asia”, global production networks, and other more regional trade agreements and arrangements have negatively affected the EZ in Africa, for their lack of competitiveness and comparative labor cost advantage. It would appear that the EZs, in conception and implementation, was not and could not have been a proper “fit” for sub-Saharan Africa, in the current state of its overall support infrastructure, lacking as it were, in critical components. It would again, appear a case of adopting and implementing a one-size-fits-all initiative that is substantially unsuited for their markets and economy. The argument here is that an effective EZ structure could have been tailored to mirror the peculiarity of the sub-region’s economic development stages. This would be organized and focused on their enormous natural endowments or resources and maximizing them, rather than by the “Assemblage Factory” of imported components, they have become.

Indeed, the question is whether EZ is a feasible, viable model for the sub-region in the attainment or realization of the market and economic development impetus this model originally envisaged? The lack of institutions and support infrastructure would suggest not. Over several years, especially from the early eighties, much of the sub-region have experimented on several economic and market development models that were unviable. What seems evident is that it is a sub-region still in search of viability and (economic and market) redemptive alternatives, in a fiercely competitive global marketplace. What could that possibly be? However, to the extent that few case studies have suggested spillover effects associated with the establishment of some EZs (Creskoff and Walkenhorst, 2009), which has not been particularly evident in the region, a focus on assessing these effects may be warranted, as a new research area. Indeed, it has been suggested that positive spillover effects could come in the form of enhanced economic productivity, newly available technology, and local social welfare effects on the domestic population (FIAS, 2008; Ge, 1999; Wang, 2013). This would only happen with a more realistic, deliberately thought-out and evaluatively integrated and implemented “new” initiative; one that is not separate, but complementary and aligned with the national economy.

The introduction of new models or terminology called Industrial Parks. At the same time, nomenclatically novels substantially embody all the attributes of a typical Economic Zone, which begs the question, the relevance and significance of the new terminology. Unanswered is whether this is a new usage that encompasses new and robust attributes lacking in the original contemplation. Regardless, it seems an initiative is substantially lacking in realizability and sustainability. Evidently, because of in-country peculiarities and disparities between them, it has been ill-advised for all the countries in our evaluation to adopt seemingly common/similar objectives and parameters in the development of their EZs, when their national needs and in-country constraints and imperatives would have dictated, perhaps something different. This is especially the case due to a dearth of data and statistics, where, even though the establishment of EZ seems to have been necessitated by common denominators, growth, employment, FDI, etc.

The authors have not declared any conflict of interests.

REFERENCES

|

Aggarwal A (2012). The social and economic impact of SEZs in India. Oxford University Press.

Crossref

|

|

|

|

Appiah-Kubi K (2001). State-owned enterprises and privatization in Ghana. The Journal of Modern African Studies 39(2):197-229.

Crossref

|

|

|

|

|

Baissac C (2003). Maximizing the Developmental Impact of EPZs: A Comparative Perspective in the African Context of Needed Accelerated Growth. A Presentation at the Johannesburg EPZ Symposium. October 15-16 2003.

|

|

|

|

|

Bartlett CA, Beamish PW (2018). Transnational management: Text and cases in cross-border management. Cambridge University Press.

Crossref

|

|

|

|

|

Bezuidenhout A, Moussouris M (2007). Towards a developmental state: The implication of the national policy framework for the Eastern Cape, SWOP Working Paper commissioned by the Eastern Cape Socio-Economic Coordinating Council.

|

|

|

|

|

Bogoviz AV, Ragulina YV, Kutukova ES (2016). Economic zones as a factor of increased economic competitiveness of the region. International Journal of Economics and Financial Issues 6(8S):1-6.

|

|

|

|

|

Bost F (2010). Atlas mondial des zones franches. Paris: La Documentation Française/CNRS

|

|

|

|

|

Boyenge JPS (2007). ILO database on export processing zones (revised). Geneva: International Labor Organization.

|

|

|

|

|

Buchs TD (2003). Privatization in Sub-Saharan Africa: Some lessons from experiences to date. EconWPA. p. 5

|

|

|

|

|

Central Intelligence Agency (2019). The World Factbook: Ethiopia. Available at: https://www.cia.gov/library/publications/the-world-factbook/geos/et.html

|

|

|

|

|

Cirera X, Lakshman RWD (2017). The impact of export processing zones on employment, wages and labour conditions in developing countries: A systematic review. Journal of Development Effectiveness 9(3):344-360.

Crossref

|

|

|

|

|

Côté RP, Cohen-Rosenthal E (1998). Designing eco-industrial parks: A synthesis of some experiences. Journal of Cleaner Production 6(3-4):181-188.

Crossref

|

|

|

|

|

Creskoff SWP, Walkenhorst P (2009). Implications of WTO disciplines for special economic zones in developing countries. Policy Research Working Papers. Washington, DC: World Bank. Available at: https://elibrary.worldbank.org/doi/abs/10.1596/1813-9450-4892

Crossref

|

|

|

|

|

Curran S, Cook J, Hampton K, Clark C, Yorgey G, Anderson CL (2009). The impacts of special economic zones. Evans School Policy Analysis and Research.

|

|

|

|

|

Dodescu A, Chirilă L (2012). Industrial Parks in Romania: From Success Stories to Emerging Challenges. International Journal of e-Education, e-Business, e-Management and e-Learning 2(4):331-335.

Crossref

|

|

|

|

|

Department of Trade and Industry (DTI) (2015). 2015/16 F/Y| SEZ Performance Analysis Bulletin12015/16SEZ PerformanceAnalysis Bulletin. Available at: https://docplayer.net/27967993-2015-16-sez-performance-analysis-bulletin.html

|

|

|

|

|

Department of Trade and Industry (DTI) (2019). 2015/16 Special Economic Zone Fact Sheet. Pretoria: DTI. Available at: http://www.thedtic.gov.za/wp-content/uploads/SEZ_Fact_Sheet.pdf

|

|

|

|

|

Dunning JH (2000). The eclectic paradigm as an envelope for economic and business theories of MNE activity. International Business Review 9(2):163-190.

Crossref

|

|

|

|

|

Dunning JH (1998). Location and the multinational enterprise: A neglected factor? Journal of International Business Studies 29(1):45-66.

Crossref

|

|

|

|

|

Economist (2015). Special economic zones not so special. The Economist. Available at: https://www.economist.com/finance-and-economics/2015/04/04/political-priority-economic-gamble

|

|

|

|

|

Ethiopian Investment Commission (EIC) (n.d.). Ethiopian Investment Commission. Available at: http://www.investethiopia.gov.et/index.php/investment-opportunities/other-sectors-of-opportunity/overview.html

|

|

|

|

|

Export Processing Zones Authority (EPZA) (2012). Export Processing Zones Program Annual Performance Report, 2012. Nairobi: EPZA. Available at: https://epzakenya.com/resources/

|

|

|

|

|

Export Processing Zones Authority (EPZA) (2017). Export Processing Zones Program Annual Performance Report, 2017. Nairobi: EPZA. Available at: https://epzakenya.com/resources/

|

|

|

|

|

Farole T, Akinci G (2011). Special economic zones: Progress, emerging challenges, and future directions (English). Directions in development; trade. Washington, DC: World Bank. Available at: http://documents.worldbank.org/curated/en/752011468203980987/Special-economic-zones-progress-emerging-challenges-and-future-directions

Crossref

|

|

|

|

|

Farole T (2011). Special economic zones in Africa: Comparing performance and learning from global experiences. Washington, DC: World Bank. P. 68. Available at: https://openknowledge.worldbank.org/handle/10986/2268

Crossref

|

|

|

|

|

Foreign Investment Advisory Service (FIAS) (2008). Special economic zones, performance, lessons learned and implications for zone development. Washington, DC: World Bank.

|

|

|

|

|

Ge W (1999). Special economic zones and the opening of the Chinese economy: Some lessons for economic liberalization. World Development 27(7):1267-1285.

Crossref

|

|

|

|

|

Ghana Free Zones Board (GFZB) (2012). Ghana Free Zones Board Annual Report & Audited Accounts 2012. Accra: GFZB. Available at:

View

|

|

|

|

|

Ghana Free Zones Board (GFZB) (2014). Ghana Free Zones Board Annual Report & Audited Accounts 2014. Accra: GFZB. Available at:

View

|

|

|

|

|

Ghana Free Zones Board (GFZB) (2017). Export Processing Zone. Available at:

View

|

|

|

|

|

Gibbon P, Jones S, Thomsen L (2008). An assessment of the impact of export processing zones and an identification of appropriate measures to support their development. For Royal Danish Ministry of Foreign Affairs. Available at:

View

|

|

|

|

|

Harsch E (2000). Privatization shifts gears in Africa. Africa Recovery 14(1):8-17.

|

|

|

|

|

IEA (2019). Africa Energy Outlook 2019. Paris: IEA. Available at:

View

|

|

|

|

|

Industrial Parks Development Corporation (IPDC) (2015). Our Parks. Available at:

View

|

|

|

|

|

Jauch H (2002). Export processing zones and the quest for sustainable development: A Southern African perspective. Environment and Urbanization 14(1):101-113.

Crossref

|

|

|

|

|

Jones LP, Jammal Y, Gokgur N (1998). Impact of privatization in Côte d'Ivoire. Draft final report. Lexington: Boston Institute for Developing Economies.

|

|

|

|

|

Madani D (1999). A review of the role and impact of export processing zones. World Bank Policy Research Working Paper 2238. Washington, DC: World Bank.

Crossref

|

|

|

|

|

Mengistu A (2014). Connecting Africa and Asia: Business trends that are driving opportunities on both continents. Selamta (Ethiopia), March/April 2014:26-30.

|

|

|

|

|

Namada JM, Bagire V, Aosa E, Awino ZB (2017). Strategic planning systems and firm performance in the export processing zones. American Journal of Industrial and Business Management 7:487-500.

Crossref

|

|

|

|

|

Nellis J (2005). Privatization in Africa: What has happened? What is to be done? Working Paper Number 205. Washington, DC: Center for Global Development. Available at:

View

|

|

|

|

|

Neveling P (2017). The global spread of export processing zones and the 1970s as a decade of consolidation. In Andersen K, Müller S, Richter R, eds. Changes in social regulation - State, economy, and social protagonists since the 1970s. Oxford: Berghahn, pp. 23-40.

Crossref

|

|

|

|

|

Nigeria Export Processing Zones Authority (NEPZA) (2017). Free Zones.

|

|

|

|

|

Nwankwo S, Richards DC (2001). Privatization †The myth of free-market orthodoxy in subâ€Saharan Africa. International Journal of Public Sector Management 14(2):165-180.

Crossref

|

|

|

|

|

Okpanachi E, Obutte PC (2015). Neoliberal reforms in an emerging democracy: The case of the privatization of public enterprises in Nigeria, 1999-2014. Poverty and Public Policy 7(3):253-276.

Crossref

|

|

|

|

|

Porter ME (1990). The Competitive Advantage of Nations. Harvard Business Review. Available at:

View

Crossref

|

|

|

|

|

Richards D, Nwanna G, Nwankwo S (2003). Debt burden and corruption impacts: African market dynamism. Management Decision 41(3):304-310.

Crossref

|

|

|

|

|

Rostow WW (1991). Technology and the economic theorist: past, present, and future. Favorites of Fortune: Technology, Growth, and Economic Development Since the Industrial Revolution. pp. 395-431.

|

|

|

|

|

Rugman AM, Verbeke A (2009). Location, competitiveness, and the multinational enterprise. In: Rugman AM, ed. The Oxford Handbook of International Business. Oxford, United Kingdom: Oxford University Press pp. 150-177.

Crossref

|

|

|

|

|

Sahn D (1996). Economic reform and the poor in Africa. Oxford, United Kingdom: Oxford University Press.

|

|

|

|

|

Stein H (2012). Africa, industrial policy, and export processing zones: Lessons from Asia. In: Noman A, Botchwey K, Stein H, Stiglitz JE (eds.), Good growth and governance in Africa: Rethinking development strategies. Oxford, United Kingdom: Oxford University Press.

Crossref

|

|

|

|

|

Stiglitz JE, Squire L (1998). International development: Is it possible? Foreign Policy, pp. 138-151.

Crossref

|

|

|

|

|

Temu A, Due JM (1998). The success of newly privatized companies: New evidence from Tanzania. Canadian Journal of Développement Studies/Revue (Canadienne d'études du Dévelopement) 19(2):315-341.

Crossref

|

|

|

|

|

Temu AE, Due JM (2000). The business environment in Tanzania after socialism: Challenges of reforming banks, parastatals, taxation and the civil service. The Journal of Modern African Studies 38(4): 683-712.

Crossref

|

|

|

|

|

United Nations Conference on Trade and Development (UNCTAD) (2019, June 12). World Investment Report: Annex Tables. Available at:

View

|

|

|

|

|

United Nations Centre on Transnational Corporations and The International Labor Organization (UNCTC-ILO) (1988). Economic and social effects of multinational enterprises in export processing zones. Geneva: International Labor Office.

|

|

|

|

|

United Nations Industrial Development Organization (1980). Export processing zones in developing countries. UNIDO Working papers on Structural Changes n.19. Vienna: United Nations Industrial Development Organization.

|

|

|

|

|

Wang J (2013). The economic impact of Special Economic Zones: Evidence from Chinese municipalities. Journal of Development Economics 101:133-147.

Crossref

|

|

|

|

|

Watson PL (2001). Export Processing Zones: Has Africa missed the boat? Not yet! Africa Region Working Paper Series No. 17. Washington, DC: World Bank.

|

|

|

|

|

World Bank (2019a). Manufacturing, value added (% of GDP). World Development Indicators. Available at:

View

|

|

|

|

|

World Bank (2019b). Agriculture, value added (% of GDP). World Development Indicators. Available at:

View

|

|

|

|

|

World Bank (2019c). Services, value added (% of GDP). World Development Indicators. Available at:

View

|

|

|

|

|

World Bank (2019d). GDP (current US$). World Development Indicators. Available at:

View

|

|

|

|

|

World Bank (2019e). GDP per capita (current US$). World Development Indicators Available at

View

|

|

|

|

|

World Bank (2020). Doing Business 2020: Comparing Business Regulation in 190 Economies. Washington, DC: World Bank. Available at:

View

|

|

|

|

|

World Economic Forum (2009). Global Competitive Report 2009. Geneva: World Economic Forum.

|

|

|

|

|

Zeng DZ (2010). Building engines for growth and competitiveness in China: Experience with special economic zones and industrial clusters. Washington, DC: World Bank.

Crossref

|

|

|

|

|

Zeng DZ (2015). Global experiences with special economic zones: Focus on China and Africa. Policy Research Working Paper; No. 7240. Washington, DC: World Bank.

Crossref

|

|