Full Length Research Paper

ABSTRACT

This study analyses the resilience of family businesses in a developing country like Cameroon during the covid-19 crisis by applying measures of association, regression analysis, and comparison tests to data collected by administering a questionnaire on a panel of 280 companies of which 196 are family businesses and 84 non-family businesses. The results show that throughout the pandemic period, family companies are more resilient in terms of financial and social performance relative to non-family businesses. We also find that among family businesses, the most successful are those with a family member as CEO or those whose management is dominated by the family controlling the firm. The results extend former research by showing that family leadership is a form of management that can provide responses to unexpected events that affect the company.

Key words: Family leadership, social performance, financial performance, COVID-19 crisis, family businesses.

INTRODUCTION

The health crisis related to Covid-19 has affected the existence of humans and organisations in both developed and developing countries (Azimli, 2020). According to Singh (2020), this crisis is likely to affect the performance and survival of companies and the wellbeing of economies as a whole. Although certain researchers (La Porta et al., 1999; Morck and Yeung, 2003) hold that family businesses are the dominant social and economic force in the world, Van Essen et al. (2015) hold that the long-run orientation of family businesses makes them more resilient in times of crisis. This explains the growing attention researchers (Van Essen et al., 2015; Crespi?-Cladera and Martín?Oliver, 2015; Minichilli et al., 2016; Fidrmuc and Korhonene, 2018; Joe et al., 2019) place on explaining the advantages and disadvantages of family involvement on the ownership and management of companies in times of crisis, and its effects on the

performance of the company.

Empirical evidence on the effect of family CEOs on business performance during a crisis have been found by Minichilli et al. (2016) in Italy. The authors find that Italian family businesses perform better during periods of crisis when the CEO is a family member. Using a similar reasoning, this study in Cameroon seeks to address the following questions: is the financial and social performance of family businesses that are not registered in the stock exchange different from those of non-family businesses? Does the performance of family businesses depend on the mode of leadership? This study makes two main contributions to the literature on family businesses:

Firstly, it focuses on both financial and social performance in times of crisis and shows that Cameroonian family businesses perform better bothfinancially and socially in this period of COVID-19 relative to non-family businesses.

Secondly, it focuses on the differences in performance according to the mode of leadership of family businesses during this crisis period. We find that the most resilient family companies in terms of performance are those in which the CEO is a member of the controlling family and in which the management is dominated by family members.

The rest of this study is in three parts. In the first part, we present a literature review of the framework of analysis of the relationship between family CEOs and company performance during crisis. In the second part, we present the methodology used. In the third part, we present and discuss the results.

CONCEPTUAL FRAMEWORK AND LITERATURE REVIEW

The literature mainly focuses on the effects of a crisis on the financial performance of family businesses in developed countries and Asian countries (Joe et al., 2019). Globally, the meta-analysis by Hansen and Block (2020) shows that family businesses perform better than non-family businesses in all phases of the business cycle in developed countries. Other studies focus on their resilience via access to credit. Specifically, Crespi?-Cladera and Martín?Oliver (2015) find that family companies face more credit restrictions than non-family businesses in periods of crisis and this enables them to overcome the effect of lack of credit during periods of uncertainty. Few studies analyse the effects of crisis on the social performance of family businesses. Van Essen et al. (2015) find that family businesses are less likely to reduce their manpower or wages of their employees not only before but also during the crisis. The authors also find that the fall in these two indicators of social performance is less in countries where laws on the protection of investors and their application are little developed.

A look at various previous studies reveals that the question of family CEO is largely neglected. However, Miller et al. (2013, 2014) highlight a positive bond between family CEO and the performance of the company in a crisis period. Several reasons can explain the fact that family companies managed by a family member resist crisis better.

Firstly, the family as a shareholder is more willing to support the family business when the CEO is a member of the controlling family (Villalonga and Amit, 2010). Family ties also represent an important resource that enables the company to gain easier access to loans during a crisis (Miller and Breton-Miller, 2005). CEOs from the controlling family not only seek to perform their role in the company, but also seek to fight for the long- term interests of the family by protecting its wealth and reputation (Miller et al., 2013; Minichilli et al., 2016). Also, agency theory suggests that the owner-manager has a greater level of engagement in the company in the long run.

Secondly, a CEO who is a family member is more likely to develop a tacit knowledge of the identity, culture and strategy of the company. These elements are very difficult for an external manager to reproduce and are essential in overcoming difficulties (Miller et al., 2013).

Closeness with the controlling family makes the CEO who is member of this family particularly qualified to speak in the name of the company and create a close relationship with customers, suppliers, employees, and banks (Miller et al., 2013). This close relationship reinforces the bonds of the company with local communities and other stakeholders, and allows faster decision-making, thus conferring more freedom of action to the manager than a non-family CEO would enjoy (de Vries, 1993).

It should be noted that differences in performance can also be explained within the theoretical framework of the theory of resources (Hitt et al., 2021). According to this theory, differences in company performance are not determined by external opportunities and threats but by internal resources which determine the company strategy. However, from another perspective, the survival of companies during the Covid-19 crisis is attributable to a change in the management style (Gibbons et al., 2021).

Despite the 155 studies covering 61 countries listed in the meta-analyses of Hansen and Block (2020), none focuses on Africa. The emerging countries listed are almost exclusively located in Asia because the family companies included are registered in the stock exchange. Also, the results differ according to the measure of performance used. Studies undertaken in periods of no crisis in emerging countries can be informative if the literature reaches a clear consensus, which is far from being the case. In fact, concerning the bond between family companies and financial performance, the meta-analysis conducted by Wagner et al. (2015) concludes that this relationship varies with the measuring instrument (ROA is significant but not ROE) while the bond between family companies and social performance depends on many institutional factors, the family’s share in the capital, and its involvement in the management of the business (Canavati, 2018).

This study seeks to fill this gap in the literature by comparing the financial and social performance of family companies with those of non-family companies not listed on the stock exchange, and comparing performance among family companies with different modes of leadership in Cameroon which is a developing country affected by COVID-19 like the rest of the world. In Central African countries characterized by weak systems of governance and social protection as well as a very ineffective legal system, the majority of companies are family businesses and are managed by a member of the controlling family (Mbaduet et al., 2019). Given these objectives, the authors formulate the following hypotheses:

Hypothesis 1: during the crisis related to COVID-19, family business performs better than non-family ones.

Hypothesis 2: during the crisis related to COVID-19, family businesses managed by a family member perform better than those managed by a non-family member. The authors now present the methodology used to test these hypotheses.

METHODOLOGY

Sample and data collection

In order to obtain the sample used, the authors go from 672 public companies identified by the National Institute of Statistics (INS) of Cameroon during its latest census in 2016. They then exclude financial companies, banks, and companies with less than100 employees. They administer 300 questionnaires to the CEOs of the non-excluded companies using random sampling between the months of August and September 2020. The questionnaire contains data on the characteristics of the companies, their ownership structure, the status of the CEO and performance. The questionnaires are administered only in the towns of Douala and Yaoundé since these towns according to the 2017 report of the INS of Cameroon harbour more than 69% of Cameroonian companies. From these questionnaires, 280 responses were considered useable. The sample thus includes 280 companies of which 196 are family and 84 are non-family businesses. The distinction between family and non-family companies is made by adopting the criterion of Poulain-Rehm (2006). According to this author, a family company is one in which a family holds more than 50% of the capital and the absolute majority of voting rights in the general assembly, whether this family directly exercises management duties or not. To check for the presence of selection bias between the two subsamples, three criteria are used: geographical location, industry sector, and size of the company.

Model and measurement of variables

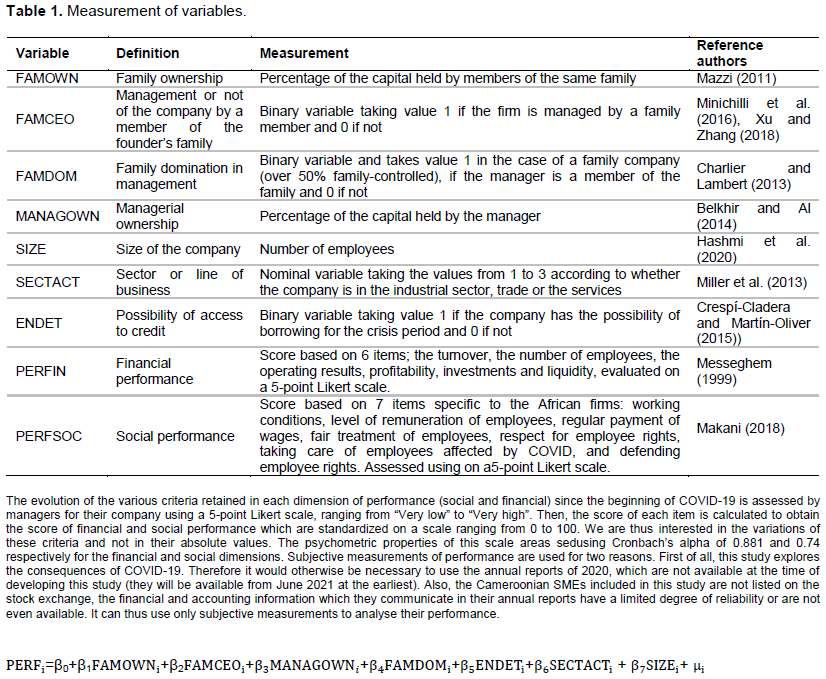

According to the literature review, the performance of a company can be affected by the structure of ownership, family leadership, and certain characteristics specific to the company in times of crisis (Minichilli et al., 2016; Miller et al., 2014; Miller et al., 2013). Based on this, the model below is developed depending on whether performance is measured using its social or financial dimension. Table 1 shows the measurement of the variables.

Where PERF is either PERFSOC (social performance) or PERFIN (financial performance), FAMOWN: is the percentage of capital held by members of the same family, FAMCEO is the management or not of the company by a member of the founder’s family, MANAGOWN: managerial ownership, FAMDOM: family dominant in management, ENDET: possibility of access to credit. SECTACT: sector of business, SIZE: size of the company.

RESULTS AND DISCUSSION

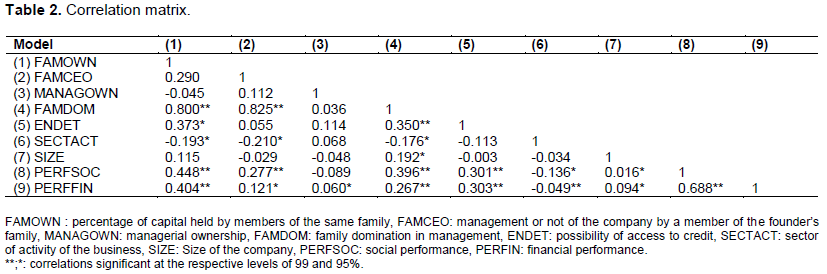

Before estimating the econometric model, it is necessary to present Table 2 which shows the correlation matrix between the variables in order to detect the existence of a possible multicollinearity problem.

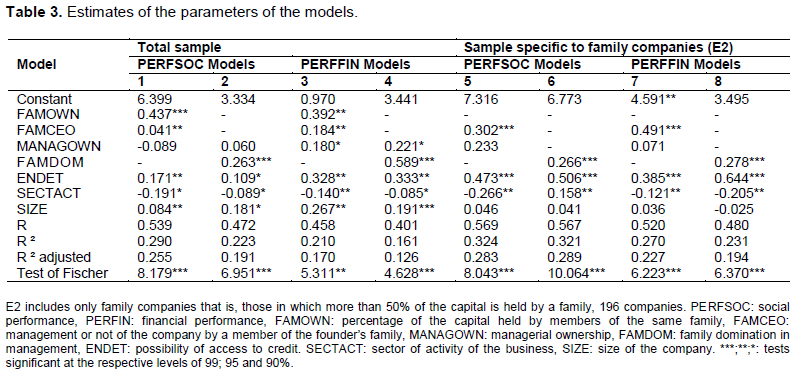

A look at Table 1 shows that the family ownership, the management of the company by a family member, loan possibilities, and the fact that the management of the company is dominated by a family positively affect the social and financial performance of the company during a crisis at the 1% significance level. However, management by owners, the sector of activity, and the size of the business do not produce significant results.

The correlation matrix shows that serious problems of multi-collinearity exist between family ownership, the management of the company by one of its members, and family domination in management since the coefficients of correlation between these variables are higher than 0.8 which is greater than the threshold recommended by Wooldridge (2014). In order to circumvent this problem, the first model is estimated in the absence of the “family domination in management” (FAMDOM) variable, and in the second model, this variable is introduced to replace the two variables relating to the family: “family ownership” (FAMOWN) and “management of the firm by one of the family members” (FAMCEO). Table 3 presents the results of the estimation of econometric models.

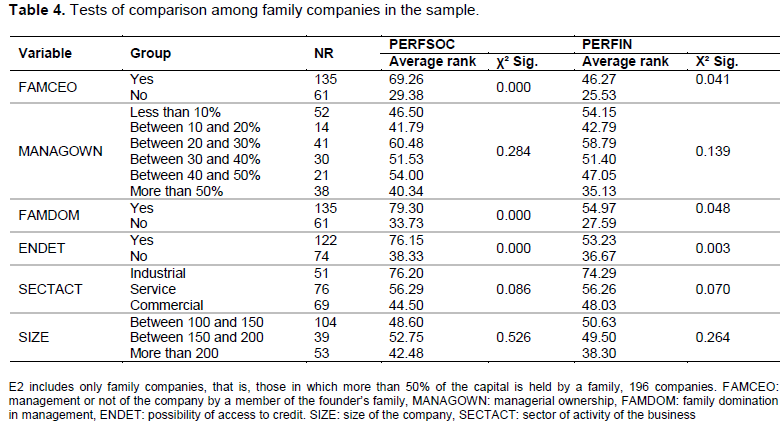

Firstly, this study reveals that family companies perform better from an economic and social point of view (the coefficient of FAMOWN is positive and highly significant in Models 1 and 3). The rank comparison test of Kruskal Wallis presented in Table 4 shows that the level of performance is significantly different depending on whether the company is family owned or not. This finding is in line with those of van Essen et al. (2015), Minichili et al. (2016), Zhou et al. (2017) and Hansen and Block (2020) who find family businesses perform better non-family ones during financial crises and Amore et al. (2021) who focus on the case of the COVID-19 crisis. Family businesses are more resilient during crises because of their long-run focus which incites them to have a social policy and do their best to avoid lay-offs (Kim et al., 2020) inspite of the weak social protection system.

Secondly, the variables relating to the mode of leadership are important determinants of the performance of family companies in periods of crisis. The effect of family domination (variable FAMDOM in all the models) on the decisions of the company is positive on financial and social performance. The variable FAMCEO also has a positive effect (Models 1 and 3) but its size is smaller. For Models 5 to 8, the two variables FAMDOM and FAMCEO are equivalent because the sample only includes firms in which more than 50% of the capital is owned by the family. These findings contradict those obtained by Miller et al. (2014) in Italy, Sánchez Pulido et al. (2019) in Spain and Saidat et al. (2020) in Jordan but are in line with Miller et al. (2013) and Amore et al. (2021) who find that the management of the company by a member of the owner family or majority shareholder is a factor that enables the performance of the company to be acceptable in difficult times. These two mechanisms which are linked by common values enable the company to react faster in times of crisis. Thus, decision scan be taken faster and shareholders are focused on the objectives and other priorities of the company.

Thirdly, the results of the explanatory analysis (correlation and regression) show a weak bond between managerial ownership and financial performance for all the companies of the sample, but this becomes insignificant for family companies (Models 5 to 8 and Table 4). This result contradicts those obtained during crisis by Mbaduet et al. (2019) in Cameroon and Saidu (2019) in Nigeria. These authors hold that the reduction of conflict between family shareholders and an external manager who is also a shareholder increases the performance of the company even in countries with poor governance.

Lastly, this study reveals that among the control variables, only the possibility of credit significantly impacts on the performance of the company, whatever the performance dimension selected. This finding is in line with those of many studies (Djoutsa Wamba and Koye, 2021; Larcker et al., 2020; Bose et al. 2021) in periods of insecurity for some and during the COVID-19 crisis for others. In addition, the greater the family share in the capital, the more likely the company is to appoint a member of the family to be manager, thus improving the company’s access to credit. Credit enables the company to overcome crisis in both the financial and social performance equations, especially by guaranteeing the payment of wages and maintaining its wage policy. Also, the results of the tests of comparison of rank (Table 4) show that family companies which have the possibility of accessing credit during a crisis perform better than companies which do not have such access. This result corroborates that of Crespi?-Cladera and Martín?Oliver (2015) who finds that family companies are less subjected to credit restrictions than non-family companies during crises. Beyond this result, differences in performance according to the size of the company also produce insignificant statistics for family companies, whereas this variable is significant for the whole sample. For family companies, size is thus not a factor of performance in periods of crisis. This result is in line with those of Saidat et al. (2020) in Jordan. For the sector of industry (SECTACT) variable, the results are in line with

those of Khanchel (2009).

The second objective of their study was to verify in the Cameroonian context if the difference in performance is significant between the groups of family companies according to their modes of leadership. To achieve this goal, we use the Kruskal Wallis rank comparison test. Table 4 gives the results of the test.

According to this result, family businesses managed by a member of the family perform better, even if this effect is less pronounced for social performance than for financial performance. This finding shows that family businesses managed by a family member perform better than those managed by non-family members. Thus, in times of crisis, the low agency conflict between shareholders and the CEO results in strong family support and higher performance. Also, it is easier for a manager who is a family member to develop tacit knowledge of the identity, culture and strategy of the company and this also enables the company to reach higher social performance. This result confirms the findings of Minichilli et al. (2016) and Miller et al. (2013) in Italian industrial companies.

CONCLUSION

The objective of this study is to examine on the one hand whether during the current COVID-19 crisis in Cameroon, family companies are more resilient in terms of performance than their non-family counterparts, and on the other hand, if the difference in performance is significant between the group of family companies according to their modes of leadership. Tests of association, regression, and comparison of means and rank applied to data on 280 companies, of which 196 are family companies show that during this crisis, family companies are more resilient than non-family businesses in terms of performance. Weak systems of governance and social protection as well as an ineffective legal system are not an obstacle to the performance of these Cameroonian companies. This is in line with former studies which approach the capacity of resilience from financial (Amann and Jaussaud, 2012) and social (Van Essen et al., 2015) perspectives in different contexts and which have measurement bias issues. Also, the authors find that in the group of family companies, the best performing are those managed by a family member or those whose management is dominated by a family, thus confirming the findings of Minichilli et al. (2016) and Miller et al. (2013).

These results which enable the authors to accept hypotheses H1 and H2 formulated from the literature review contribute both theoretically and empirically to the literature.

At the empirical level, the results of this study add to the literature comparing the performance of family and non-family businesses in times of economic recession caused by crisis, specifically COVID-19. For the case of family business, it is found that their performance is not homogeneous. The difference in performance is explained by the mode of leadership which is determined by the type of CEO who manages the company, (family member or not), with companies managed by a family member performing better than those managed by a non-family member.

Theoretically, this study has the main advantage of simultaneously analysing the effects of family management on financial and social performance. This is a step ahead in the analysis of the effects of family management on company performance during the Covid-19 crisis. To our knowledge, no study has compared these two measures of performance simultaneously. This study however has many limitations which should be noted and addressed in future studies.

One of the limitations of this study is the non-inclusion of some governance mechanisms that are important in the fine-tuning of the findings. These mechanisms include the composition of the board and the participation of employees in the capital of the company (Mbaduet et al., 2019). Another limit of this study is the fact that generational aspects (Ventura et al., 2020), the age of the company, the gender of the manager, and the nature of support from the local and national governments which can lead to a difference of performance in times of crisis are not taken into account.

It is important to include variables relating to the age of the company, the gender of the manager, the nature of support from local and national governments and certain characteristics of company governance like the composition of the board of directors and shareholding by employees in future studies on the relative performance of family businesses during the COVID-19 crisis.

CONFLICT OF INTERESTS

The author has not declared any conflicts of interests.

REFERENCES

|

Amann B, Jaussaud J (2012). Family and non-family business resilience in an economic downturn. Asia Pacific Business Review 18(2):203-223. |

|

|

Amore MD, Quarato F, Pelucco V (2021). Family ownership during the covid-19 pandemic. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3773430 |

|

|

Azimli A (2020). The impact of COVID-19 on the degree of dependence and structure of risk-return relationship: A quantile regression approach. Finance Research Letters 36:101648. |

|

|

Belkhir M, Boubaker S, Derouiche I (2014). Control-ownership wedge, board of directors, and the value of excess cash. Economic Modelling 39:110-122. |

|

|

Bose S, Shams S, Ali MJ, Mihret D (2021). COVID?19 impact, sustainability performance and firm value: international evidence. |

|

|

Canavati SA (2018). Corporate social performance in family firms: a meta-analysis. Journal of Family Business Management 8:235-273. |

|

|

Crespi?-Cladera R, Martín?Oliver A (2015). Do family firms have better access to external finance during crises?. Corporate Governance: An International Review 23(3):249-265. |

|

|

Charlier P, Lambert G (2013). Modes de gouvernance et performances des entreprises familiales françaises en fonction des conflits d'agence. Finance Contrôle Stratégie. |

|

|

De Vries MFK (1993). The dynamics of family controlled firms: The good and the bad news. Organizational Dynamics 21(3):59-71. |

|

|

Djoutsa Wamba L, Koye R (2021). Accès aux financements externes et pérennité de la très petite entreprise: quelle évidence en temps de crise sécuritaire? Journal of Small Business and Entrepreneurship 2021:1-22. |

|

|

Fidrmuc J, Korhonen I (2018). Meta-analysis of Chinese business cycle correlation. Paci?c Economic Review 23(3):385-410. |

|

|

Gibbons JP, Forman S, Keogh P, Curtin P, Kiely R, O'Leary G, Skerritt C, O'Sullivan K, Synnott K, Cashman JP, O'Byrne JM (2021). Crisis change management during COVID-19 in the elective orthopaedic hospital: Easing the trauma burden of acute hospitals. The Surgeon 19(3):59-66. |

|

|

Hansen C, Block J (2020). Exploring the relation between family involvement and firms' financial performance: A replication and extension meta-analysis. Journal of Business Venturing Insights 13:e00158. |

|

|

Hashmi SD, Gulzar S, Ghafoor Z, Naz I (2020). Sensitivity of firm size measures to practices of corporate finance: evidence from BRICS. Future Business Journal 6(1):1-19. |

|

|

Hitt MA, Arregle JL, Holmes Jr RM (2021). Strategic management theory in a post?pandemic and non?ergodic world. Journal of Management Studies 58(1):259-264. |

|

|

Joe DY, Jung D, Oh FD (2019). Owner-managers and firm performance during the Asian and global financial crises: evidence from Korea. Applied Economics 51(6):611-623. |

|

|

Khanchel I (2009). Le rôle du pouvoir discrétionnaire du dirigeant dans l'amélioration de la performance: cas des entreprises tunisiennes. Revue des Sciences de Gestion 3(237/238):95-103. |

|

|

Kim K, Haider ZA, Wu Z, Dou J (2020). Corporate Social Performance of Family Firms: A Place-Based Perspective in the Context of Layoffs. Journal of Business Ethics 167(2):235-252. |

|

|

Larcker DF, Lynch B, Tayan B, TayLor DJ (2020). The spread of covid-19 disclosure. Rock Center for Corporate Governance at Stanford University Closer Look Series: Topics, Issues and Controversies in Corporate Governance No. CGRP-84. |

|

|

La Porta R, Lopez?de?Silanes F, Shleifer A (1999). Corporate ownership around the world. The Journal of Finance 54(2):471-517. |

|

|

Makani SR (2018). La propriété familiale, structure et performance sociale et environnementale des PME familiales camerounaises. Journal of Academic Finance 9(2):47-68. |

|

|

Mazzi C (2011). Family business and financial performance: Current state of knowledge and future research challenge. Journal of Family Business Strategy 2(3):166-181. |

|

|

Mbaduet JF, Nanfosso RAT, Djoutsa Wamba L, Sahut JM, Teulon F (2019). Pouvoir du dirigeant, gouvernance et performance financière des entreprises: le cas camerounais. Gestion 200036(2):61-82. |

|

|

Messeghem K (1999). L'assurance qualité: facteur dénaturant de la PME. Revue Internationale PME Économie et Gestion de la Petite et Moyenne Entreprise 12(3):107-126. |

|

|

Miller D, Le Breton-Miller I (2005). Managing for the long run: Lessons in competitive advantage from great family businesses. Harvard Business Press. |

|

|

Miller D, Le Breton?Miller I, Minichilli A, Corbetta G, Pittino D (2014). When do Non?Family CEOs Outperform in Family Firms? Agency and Behavioural Agency Perspectives. Journal of Management Studies 51(4):547-572. |

|

|

Miller D, Minichilli A, Corbetta G (2013). Is family leadership always beneficial? Strategic Management Journal 34(5):553-571. |

|

|

Minichilli A, Brogi M, Calabrò A (2016). Weathering the storm: Family ownership, governance, and performance through the financial and economic crisis. Corporate Governance: An International Review 24(6):552-568. |

|

|

Morck R, Yeung B (2003). Agency problems in large family business groups. Entrepreneurship Theory and Practice 27(4):367-382. |

|

|

Poulain-Rehm T (2006). Qu'est-ce qu'une entreprise familiale ? Réflexions théoriques et prescriptions empiriques. La Revue des Sciences de Gestion (219):77-88. |

|

|

Saidat Z, Bani-Khalid TO, Al-Haddad L, Marashdeh Z (2020). Does family CEO enhance corporate performance? The case of Jordan. Economics and Sociology 13(2):43-52. |

|

|

Saidu S (2019). CEO characteristics and firm performance: focus on origin, education and ownership. Journal of Global Entrepreneurship Research 9(1):1-15. |

|

|

Sánchez Pulido L, Gallizo JL, Moreno Gené J (2019). The influence of the CEO in listed family businesses. Intangible Capital 15(2):128-142. |

|

|

Singh A (2020). COVID-19 and safer investment bets. Finance research letters 36:101729. |

|

|

Van Essen M, Strike VM, Carney M, Sapp S (2015). The resilient family firm: Stakeholder outcomes and institutional effects. Corporate Governance: An International Review 23(3):167-183. |

|

|

Ventura M, Vesperi W, Melina AM, Reina R (2020). Resilience in family firms: a theoretical overview and proposed theory. International Journal of Management and Enterprise Development 19(2):164-186. |

|

|

Villalonga B, Amit R (2010). Family control of firms and industries. Financial Management 39(3):863-904. |

|

|

Wagner D, Block JH, Miller D, Schwens C, Xi G (2015). A meta-analysis of the financial performance of family firms: another attempt. Journal of Family Business Strategy 6(1):3-13. |

|

|

Wooldridge JM (2014). Introduction to econometrics. Andover MA: Cengage Learning. |

|

|

Xu J, Zhang Y (2018). Family CEO and information disclosure: Evidence from China. Finance Research Letters 26:169-176. |

|

|

Zhou H, He F, Wang Y (2017). Did family firms perform better during the financial crisis? New insights from the S&P 500 firms. Global Finance Journal 33:88-103. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0