Full Length Research Paper

ABSTRACT

The effect of financial development on economic growth coupled with exchange rate fluctuation on economic growth can be significant in a country. We investigated the impact of the economic credits on the inflation and economic growth in Togo. We endeavored to bring out the nature of the relationship between changes in credit to the economy and inflation level and analyzed the effect of credit to economic growth. To achieve this objective we used two approaches. First, the theoretical approach, which showed that the economy is simultaneously facing high inflation rate and low economic grow rate. Secondly, in the empirical approach, it appeared that the impact of credit to the economy on inflation and growth depended on many factors that are unique. We utilized panel data and a model of the production function of Cobb Douglas with technological progress to investigate the impact of change in credit level on change in inflation level and on economic growth in Togo. The time series analysis was based on some economic test that assisted us to the choice of correct model. We realized that inflation has no significant effect on the economic credit. However, any economic growth improvement influenced negatively the economic credits, hence confirming the fact that Togolese economic growth carrier sectors benefited only a bit from the economic credits.

Key words: Economic Credits, Inflation, Economic Growth, Togo.

INTRODUCTION

The debates on the effectiveness of monetary policies are strongly influenced by the assumed characteristics of the money supply. However, they have long been neglected. Three approaches can be distinguished in the field. The verticalist approach considers that the central authorities set a discretionary amount of money in circulation, so that it would be inelastic to interest rates. The horizontalist approach considers that the Central Bank accommodates any demand for reserves of private banks and that the money supply, ultimately determined by the demand for credit money of entrepreneurs, is perfectly elastic at the interest rate , this being assumed exogenous. Finally, the structuralist approach is a variation of the latter and wants to report more pragmatically the behavior of the banking system to risk. Through these last two approaches, post- Keynesians are part of the tradition of money as effect and not cause of the circulation. Inspired by analyzes of Keynes in the Treatise on Money and his articles published in the Economic Journal between 1937 and 1939 , they are founding the context of a singular and ambitious project : the radical project of Keynes, whose heart is rejection of the classical theory of interest rates in favor of a monetary theory of interest . Paradoxically, they are driven in their approach to give up one of the major contributions of the General Theory: the theory of the determination of interest rates by the confrontation between the preference for liquidity of the public and the exogenous money supply According to Keynes (1936), the interest rate is determined on the currency market by the confrontation between, on the one hand, a supply by the monetary authorities, and on the other hand, the preference for liquidity of the public. Monetary policy is to vary, on a discretionary basis, money supply to manipulate interest rates. But Keynes expressed his skepticism about the effectiveness of this policy, because of the liquidity trap. The latter would establish the inability of the Central Bank to lower interest rates beyond the threshold where the preference for liquidity became absolute. In fact, when describing the operation of the currency market, Keynes exposes two circumstances behind the change in the money supply: the first at the initiative of the monetary authorities, the second at the initiative of the banking system. In the first, the government finances its spending through money creation to avoid crowding out private investment. In the second circumstance, for various reasons (excess reserves, financial innovations), the banking system relaxes the conditions of access to credit, which boosts investment. Keynes judges the result similar to the first, since in both cases the increase in the money supply is offset higher income, and he chose to focus on the first. The relationship between the quantity of money in circulation and the general price level has long been established by the quantitative theory of money of Friedman saying that the price increase comes from an increase in the money stock. The impact of money on prices was already studied in the 16th century, even before the political economy is constituted as an autonomous subject. Thereafter, the classical authors, focusing their analysis on what they see as the real economy, reduce the effects of a change in the quantity of money in a simple change in the price level. Neoclassical supporters give a new dimension to this approach by building, with the use of mathematical formalism, a real balance without money, and showing that the introduction of money does not call into question the balance. A good economic policy would therefore consist in promoting financial deepening and certainly not constrain the development of intermediation activities. Regarding the relationship between credit supply and economic growth, credits to the economy constitute a form of currency offered by banks. This form of money creation consists in a transformation, by the banking system, of accounts receivable on non-banking agents in payment immediately usable for making settlements. However, the banking system can create money if it is certain they can get money from the Central Bank to meet bank notes withdrawals: it is about the monetary base creation. The money thus created is a multiple of the initial reservation. The impact of credit to the economy on inflation and growth can be summed up in the debate of money neutrality between classical and Keynesian supporters. Tobin (1958) shows that money is able to influence the level of activity by changing the household portfolio. Currency is regarded as a financial asset. Given a certain level of wealth, the capital intensity of the economy (capital / head) depends on the distribution of this wealth between capital and currency. If the profitability of the currency falls under the effect of inflation then the agents will prefer to hold real assets in their portfolio, which will result in increased investment and thus higher growth. On the other hand, Sidrauski (1967) takes a diametrically opposite position. He assumes that the currency is used in the composition of the household utility function because it provides a flow of services from detention. The results lead to determine the super neutrality of money. The currency in this case would play no effect either in a short-term or long-term because it is not likely to play on the level and growth of GDP. For James (1970), money is a means of action. It is not a mere " veil" or just a " medium of exchange " and " standard values " as stated by some authors, but a lever to promote the growth of the economy, changes in the income distribution and preferred source of power. " Beyond certain levels, the development of credit operations causes the rise in prices, not the development of the activity. Monetary authorities must therefore consult with each other to search for what is, among potential growth rates, the most consistent with monetary equilibrium. In this respect, it should be recalled that the pure monetary theory does little light and therefore empirical analyzes prove necessary for a better understanding of reality. It is with this concern that we are conducting this study to know the nature of the relationship between the credit to the economy, inflation and growth in the context of the Togolese economy.

LITERATURE REVIEW

In the literature, many studies have examined the relationship between money, inflation and economic growth, but few have been specifically interested on aspects of credit to the economy even though it is one of the most important components of the currency especially in developing economies. For a better pre-sentation of the literature, we firstly present the literature on theoretical approaches and then we bring out empirical elements. Much of the authors who are interested in the issue rather have reflected on the effect of money on inflation on the one hand and growth on the other hand.

Theoretical approaches

Many economies are simultaneously facing high inflation rate and low economic growth rate. Some studies have quantified the effects of inflation on welfare and economic growth.

According to Bodin (1568), the idea that the price increase would be only due to the depreciation of the unit of account is false. In order to get the same amount of goods as at the beginning of the century, one has to deliver a higher amount of metal. Not only does this author explain the price increase by the influx of metal that Spain receives first, but he shows how this increase is reflected in France. The extra metal which Spain has allowing it to import French products , especially as the rise in domestic products stimulates imports , and use a large French labor force attracted by higher wages. Payment of imports and remittances of emigrants provide a filler metal to France or price increase in turn. Hume (1752),on his part, makes a presentation of the mechanical effects of a change in the money stock on the price level that brings us closer to modern formulations of the quantitative theory of money. For this author, if in one night, the four-fifths of the money circulating in Britain disappear, prices should fall in the same proportions. On the contrary, if by some miracle this amount of money fivefold in the night, the opposite effect would occur. Hume predicted then that the increase in credit to the economy promotes high inflation.

According to the literature, the increase in credit to the economy has major implications on monetary and macroeconomic policies. The increase in credit stimulates aggregates especially on the demand side. Then, the process is maintained by an increase in bank loans for import demand and consumption of capital intensive products. Moreover, when an economy does not manage its monetary policy well, the adverse effects of this mismanagement may spill over all the macroeconomic aggregates.

The increase in import demand causes deficits on the current national account. And in this case, a small reserve accounts forces governments to resort to foreign liquidity assets and / or remove some credit lines. So, this deteriorates the conditions of banking systems and can trigger a financial even economic crisis.

Some empirical studies have shown that the increase in credit to the economy leads to a simultaneous increase in production especially during the growth phase of the economy (Favara, 2003; King and Levine, 1993; Levine, 1997). According to Fuerst (1994), the rapid increase in credit during this period is explained by the growth in demand for capital investment and capital needs for jobs hence increased economic growth. This is often the case in emerging economies. Furthermore, the rapid increase in credit can cause enormous risks in return for these emerging economies themselves. One of the common problems is the expansion of bubbles through the financial assets on the market. The rapid increase in economic growth leads financial market participants to respond inappropriately to changes.

For Bario et al. (2001), optimism helps them to increase the value of financial assets. This can then cause an increase in capital and increased collateral values. Firms and households, in response, increase the amounts of borrowing and spending. In the case of the countries of Eastern and Central Europe, the rapid expansion of credit is also encouraged by the efforts of foreign financial institutions in the market share gain; competition pushes banks to lower their profit margins, thereby causing an increase in the level of risk (Hilbers et al., 2005).However, when performance falls below the requirements or expectations, the price of financial assets and collateral values decline, the number of indebted borrowers’ increases and the bubbles disappear. According to the IMF (2004), the decline in economic activity or crisis often follows a period of high economic growth in emerging economies.

Empirical approaches

The main econometric studies seeking to investigate the impact of financial policies on growth come from the work of McKinnon (1973). These authors sought to measure the impact in terms of growth of financial repression policies put in place after the various world wars and the Great Depression of 30s. The financial sector accelerates economic growth and improves the performance of an economy by facilitating the movement of capital to the most productive sectors. For McKinnon, the development of financial markets and deepening intermediation help economic development, in contrast to the situation where investors are forced to finance themselves fully.

Financial development has a significant positive impact on growth on the contrary; inflation negatively affects financial development and growth (Levine et al., 1999; Levine and Smith, 2001). However, the nature of the causal relationship between inflation and financial development is not clearly shown and is often measured by the credit to the economy in the literature. According to Altig (2003), low inflation is favorable to the growth of the financial market and financial market development promotes economic growth and thus low inflation improves growth through the channel of credit to the economy. Thus, monetary policy contributes to the development of the financial market, which in turn improves economic growth.

Studies by Hilbers et al. (2006) for the case of rapid credit growth in the countries of Eastern and Central Europe suggest that the estimation of credit growth would be good before any implementation of policies. A detailed analysis is necessary to give an overview of financial and macroeconomic risks before the combination of policies, including those monetary, fiscal and even administrative policies could be used.

Sun (2007) analyzed the different effects of macroeconomic and monetary policy on loans and inflation using a simple model of new Keynesian taking into account the credits. In this model, macroeconomic policy is effective when credit is stable but has a limited effect on inflation. Monetary policy and the rule of interest rates stabilize inflation, however this rule is considered as stabilizing credit. The determinants of the model require that the action of interest rates on inflation be greater than the independence of macroeconomic policy. This principle states that “Taylor principle “is applied to monetary policy. This dichotomy between macroeconomic policy and monetary policy is large due to the fact that each policy is designed to affect in different ways the decisions of household lending and borrowing. Thus, one of the great lessons in terms of macroeconomic policy is its combination with monetary policy, this posing the question of how the two policies can be used together for financial stability of the monetary policy as output stability and inflation.

A recent debate between Woodford and Curdia (2012) formalized this view. Based on their model (Curdia and Woodford, 2010) , Woodford argues that financial stability is a very important policy objective, with the consideration of the quadratic policy whose function is to analyze the gap between inflation and economic growth as well as the difference in marginal utility between borrowers and lenders which extends in a financial crisis. In the same direction, Sun (2007) shows that to a lesser extent, the New Keynesian model, the optimal combination of policies distinguishes objectives from monetary macros. His work shows that there is a gain in terms of well-being through the stabilization of inflation and credit in the model. Stabilizing inflation reduces the inefficiency of the rigidity of prices and stabilization of credit increases the supply of credit. This confirms the previous results of the author that the macro and monetary policies are characterized by their impact on lenders and borrowers in the New Keynesian model with the distinction of borrowers and savers.

For Iacoviello (2005), there are savers and borrowers households in a single population of a given economy, which are differentiated by their preferences time. Borrower’s households are much more impatient with respect to future consumption, so they may borrow in a stable condition. Many patient households are however investors in the economy.

Suh (2012), based on the New Keynesians model in which there is a welfare gain on the stabilization of credit, suggests that the optimal combination of policies is to distinguish between targets of macroeconomic and monetary policies due to the fact that the separation allows the efficient achievement of the stabilization of credit and inflation.

Kannan et al. (2012) analyze the effects of macroeconomic and monetary policies in a simple New Keynesians model with the distinction between borrowers and savers; the model has simplified the structure of several models of macro financial dynamics stochastic general equilibrium to study monetary and macro-economic policies. The main result of their work is the relative advantage (and disadvantage) of macroeconomic and monetary policies as instruments for stabilizing inflation and credit. This result confirms the feature that the two policies affect borrowing and savings decisions in the New Keynesians model with risk minimization. They suggest that it is important to explore the macroeconomic policies through a much broader model.

Mamadou (1998), through the theoretical framework of the Integrated Model of Simulation and Macro - Econometric Forecast for WAEMU member States," describes the transmission mechanisms of monetary policy in the WAEMU economies, including credit to the economy relationship and the prices level. The model which is based on two sectors and two goods, states that the banking system influences economic activity both through lending to the economy and through the impact of monetary policy on prices.

According to Houeton and Ahouanvoedo (2011), due to the importance of credit to the economy in monetary policy, the authorities need to reconcile their evolution with those of growth and inflation. Working in Benin, they find that the aggregate recorded between 1990 and 2003, an average annual increase of 10 %, while the growth, meanwhile, stagnated at around 5%.

This has led some well-informed observers to suggest that credits were not used to increase the national wealth, while for others; it is because its level is insufficient to stimulate the economy. It is in this perspective that the authors intended to solve this intuitive thinking through a study covering the period 1972-2003. Upon completion of their work with the error correction mechanisms, it appears that the West African States Central Bank credit and monetary policy has contributed to low inflation given its growth rate relative to domestic production. However, it remains a fact that the structure of these contributions, mainly short-term (80%) has not effectively contributed to a strong and sustained growth during the period. In the same direction Hounsa (2003), for the Beninese economy thinks that the function of credit to the economy is the result of an analysis of the behavior of banks, based on the approach of portfolio management. The author also indicates that the level of credit to the economy is insufficient to finance the economy of Benin.

Vu (2010) makes an analysis through panel data to study the interactive effects between credit growth and inflation rates in three small open economies in Scandinavian: Denmark, Norway and Sweden. Using quarterly data for the period 1998:1 - 2008:4, there is a clear relationship that the anticipation of an increase in credit to the next period has a significant impact on the evolution of the trend of inflation in the current period. The results also proved the very vital role of growth expectations of inflation and its role in the agents’ guide of central banks forecast as an important tool for the perfection of monetary policies.

Research of Gillman et al. (2004) suggests that there is a negative and significant relationship between inflation and economic growth. Conventionally, monetary growth models predict a relatively small effect of significant growth. In their work, they used a model of monetary growth with the sector of explicit credit service to explain the observed magnitudes. As noticed that the credit department is supposed to increase production, consumers put on the same footing the opportunity costs of financial holding companies with the marginal cost of credit.

Therefore, the financial sector technology influences the velocity of capital and subsequently the way inflation affects leisure, the time devoted to human capital accumulation and the output growth rate. Their calibration showed that the model generates an effect of inflation with a drop in magnitude.

Furthermore, in contrast, in previous works, they explained the effect of the growth of inflation which increased slightly as the increase in the inflation rate, as the evidence seems to show. The analysis of the cost of welfare of inflation further illuminates the effect of the growth of inflation and how the model is compared in the logic.

Thus, in view of the literature, it appears that the effect of credit to the economy on inflation and growth depends on many factors that can be unique to each economy. This is in order to verify the relationship between these three aggregates (credit to the economy, inflation and growth) that we set out the methodology for further analysis.

METHODOLOGY

Theoretical framework

Traditional growth theories (Smith, 1776; Malthus and Ricardo, 1798 1817) have emphasized the importance of the quantitative expansion of the basic factors of production such as labor, capital and land.

On the other hand, the neoclassical models such as Solow (1957) will instead attach great importance to technical progress and the role that elements such as improving the organization of production in economic growth can play. Based on the assumption of decreasing returns to scale of production factors, the Solow model stipulates that economies that have a lower initial level of capital stock per head tend to have more important returns to scale and growth rates, allowing them to converge in the long run to rich countries. The main criticism made to this model is that the assumption of diminishing returns of capital which means that the growth of the product could not be attributed to that of production factors. Thus, the existence of decreasing returns to scale that capital is the reason that capital accumulation cannot account for sustained growth. Hence, a long-term growth can only occur if one takes into account technological improvements related to the development of skills and related to innovation. So the appearance of a residual factor that is attributed to technical progress is considered exogenous. This observation has led some authors to know how the growth rate can be determined by an exogenous factor. This is from where models have been developed in which the key determinants of growth are endogenized. The recent theory of endogenous growth has been developed by Romer (1986), Lucas (1988), Barro (1991) and Barro and Sala-i-Martin (1995).

These news endogenous growth models have emphasized on capital accumulation and technical progress that lead to economic growth. Then the access to external technology and knowledge contribute to offset the problem of diminishing return of capital accumulation and lead to a long term economic growth.

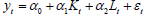

Our model was the production function of Cobb Douglas with technological progress,

Where:

Y= Total production; A= Technological Progress; K= Capital; L=Labour force

By log linear, we got the following one:

From this endogenous growth model, we may introduce the main variable and control variables.

Model specification

The impact of change in credit level on change in inflation level and on economic growth in Togo may be investigated through the following equations: Impact of credit on inflation:

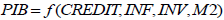

; Impact of credit on growth:

; Impact of credit on growth:  ; Impact of inflation and growth on credit:

; Impact of inflation and growth on credit:

Where: INF= inflation rate; credit= ratio of credit to private sector in GDP; exchange rate= Exchange rate between US dollar and FCFA; INV=ratio of investment to GDP; M2= Ratio of money and quasi-money to GDP.

Where: INF= inflation rate; credit= ratio of credit to private sector in GDP; exchange rate= Exchange rate between US dollar and FCFA; INV=ratio of investment to GDP; M2= Ratio of money and quasi-money to GDP.

According to this model, we might use simultaneous equations but due to the weakness of instrumental variables and the lag effect of the main variables, we have decided to use the error correction model. The time series analysis is based on some economic test that assists us to the choice of correct model. In this section, we explain the main test of time series, like stationary test and co-integration test which lead to error correction model.

Stationary test

This test is crucial as we are using time series data. A time series is stationary if it is the realization of a stationary process. This implies that the series has no trend or seasonality and generally no factors evolve over time. A variable is stationary when its Esperance and variance are constant for any time period. According to Nelson and Plosser (1982) most of macroeconomic variables are not stationary so the series level of integration is important as we are using time series data.

To study the stationary of the variables, we have used Augmented Dickeg-Fuller (ADF), Phillips-Perron (PP) and Pesaran Test. The series is stationary when two of these tests give the same answer.

Co-integration test

There are two cointegration tests: The Engel and Granger test and Johansen test. The Engel and Granger test is possible only if all the variables have some level of integration and are only two variables. When the level of integration differs from one variable to another, then the Johansen test is the only relevant. As our variables are more than two, then the appropriate test is Johansen.

Error correction model

This model presents a particularity that has been demonstrated by Granger in 1983. A set of cointegration variables that were stationary, may be used in econometric methods to estimate regression coefficients without leading to spurious regression. Results known as theorem of Granger support the error correction model (Doucouré, 2010). In our studies, we decide to use error correction model with one step of Hendry.

Data sources

The data used in this study have been collected from World Bank (world Development Indicator, 2012) and International Monetary Fund base 2012. Due to the availability of the data, the study covers the period of 1970 to 2010.

EMPIRICAL RESULT AND INTERPRETATION

According to the stationary test, all variables are stationary in first difference except the inflation rate that is level stationary.

The Johansen test rejects the hypothesis of no cointegration action against the alternative. From the Trace test, we identified a cointegrartion of the series. The presence of integration leads to the error correction model. The empirical result is summarized in Table 1.

According to the empirical result in the table, the variable credit does not have a significant impact on inflation in Togo, as well as in long and short run. Through, the credit is not statistically significant; it has the positive sign in the short run and negative sign in the long run. Additionally, the increase in exchange rate leads to inflation in short run. This is due to the fact that all the input is done in dollars so dollar’s appreciation against FCFA leads to inflation.

The result in Table 2 shows that variable credit to economy does not influence statistically the economic growth in Togo in the short run but one percent growth in credit leads to 3.5 percent economic growth in the long run. This result may be due to the fact that the credit to Togo economy is not enough to boost the real section. There may be a threshold point from which credit could impact positively economic growth.

Otherwise, other variables in our study do not affect the economic growth in the short run. Whenever, the variable investment and money and quasi-money influence positively the growth in the long run.

In the literature review, most researchers found the bidirectional causality between credit to economy, inflation and economic growth. This was the reason that leads us use the short run model to confirm whether inflation and economic growth in turn impact the variable credit to economy. These results are shown in Table 3

According to the result in the table, variables ( inflation and economic growth) in the short run in our main model reveals that inflation has no impact on credit to economy, however improve in growth reduce the effect on credit to economy.

The results show that the economic growth in Togo is not the result of credit to economy. Otherwise, any growth in investment and money and quasi-money increase the credit to the economy, while a dollar’s appreciation reduce the credit to economy.

In the long run like the short one, inflation has no impact on credit to economy but an increase in economic growth reduces the credit available to the economy. In addition, investment, money and quasi-money contribute to credit growth to economy in the long run while openness and exchange rate reduce the credit to economy in the long run.

CONCLUSION

The assessment of the economic credits variation impact regarding the variation of the general prices standard and the growth of the real sectors of the Togolese focused on error correction model which required, first, certain number of econometric tests that were shown to be significant. From the results, we can draw three important lessons: first, in short-term, the economic credit has effect neither on the general price standard nor on the economic growth within the Togolese framework. In the long–term, the economic credit still has no influence on the inflation but on the contrary, any increase of the Togolese economic credits reduces the economic growth. This surprising result can be explained by the fact that the sectors benefitting from the economic credit are not carrier of economic growth.

Finally, we noticed that the inflation, in its turn, has no effect on the economic credit. However, any growth improvement influences negatively the economic credit. This result confirms the fact that Togolese economic growth carrier sectors benefit only a bit from the economic credit.

CONFLICT OF INTERESTS

The author has not declared any conflict of interests.

ACKNOWLEDGMENTS

We are grateful to the comments and suggestions made by the contributors to improve this manuscript.

REFERENCES

|

Altig D (2003). "What is the right inflation rate?" Economic Commentary, Federal Reserve bank of Cleveland. |

|

|

|

|

|

Barro R (1991). Economic Growth in a Cross Section of Countries, Q. J. Econ. 56:407-443. |

|

|

|

|

|

Barro JR, Sala-i-Martin X (1995). "Economic Growth", McGraw-Hill, New York.books.google.tg/books?isbn=9264289518. |

|

|

|

|

|

Bodin J (1568). «Answer to the Paradoxes of M. Malestroict according to the enrichment of every things and the ways to find solutions », www.worldcat.org/.../ |

|

|

|

|

|

Bario C, Furfine C, Lowe CP (2001). "Procyclicality of the Financial System and Financial Stability: Issues and Policy Options", BIS Paper No. 1, Basel. Bank for International Settlement Curdia et Woodford, 2010. |

|

|

|

|

|

Favara G (2003). An Empirical Reassessment of the Relationship between Finance and Growth. IMF Working Paper, WP/03/123, European I Department. |

|

|

|

|

|

Fuerst T (1994). « Monetary Policy and Financial Intermediation », J. Money, Credit Bank. 26-3. |

|

|

|

|

|

Gillman M, Harris M,MatyasL (2004). "Inflation and growth: Explaining a negative effect", Empirical Economics, 29, nationalism.ceu.hu/biblio/author/1828. |

|

|

|

|

|

Hilbers P, Otker-Robe I, ceyla P (2006). « How to Manage the boom of Credit in Oriental and Central Europe », Finance andDevelopment, Mars,static2.docstoccdn.com/search/sanctions-pour-excès-de-vitesse. |

|

|

|

|

|

Houeton B , Ahouanvoedo T (2011). « Impact of the Economic Credits on the Inflation and growth in Benin», Université Abomey- Calavi. |

|

|

|

|

|

Hounsa L (2003). "Problem of Financing Benin economy: Test Formulation of a Credit Rating Function to the Economy by Engel's and Granger Method". www.memoireonline.com/.../m_Impact-des-credits-a-leconomie-sur-linflation -et-la-croissance-au-Benin3.html |

|

|

|

|

|

Hume D (1752). 'Of Money', reprinted in A.A. Walters (ed.), Money and Banking, Harmondsworth: Penguin. Hunt, W. M. 1980. Are "mere things" Morally. |

|

|

|

|

|

Iacoviello M (2005). «House Prices, Borrowing Constraints, and Monetary Policy in the Business Cycle », Am. Econ. Rev. 95:3. |

|

|

|

|

|

James E (1970). "Nowadays Monetary Problems», Paris, Second Edition", www.memoireonline.com/.../m_Impact-des-credits-a-leconomie-sur-linflation-et-la-croissance-au-Benin20.html. |

|

|

|

|

|

Keynes JM (1936). The General Theory of Employment, Interest and Money, London: Macmillan. www.marxists.org/reference/subject/.../keynes/general-theory/. |

|

|

|

|

|

King R, Levine R (1993). "Finance and Growth: Schumpeter Might Be Right ?", Q. J. Econ. 108. |

|

|

|

|

|

Levin A, Wieland V, Williams JC (1999). « Robustness of Simple Monetary Policy Rules under Model Uncertainty ». In: Monetary Policy Rules, J. B. Taylor, Chicago, University of Chicago Press. |

|

|

|

|

|

Levine R (1997) .Financial Development and Economic Growth : Views and Agenda., J. Econ. Literature. 35. |

|

|

|

|

|

Lucas RE (1988). 'On the Mechanics of Economic Development', Journal of Monetary Economics, July. www.parisschoolofeconomics.eu/.../lucasmechanicseconomicgrowth.pdf. |

|

|

|

|

|

Mamadou OS (1998). « Integrated of Macro Econometric Projection and Simulation for WAEMU Member States : Theoretical Framework : Document Study and Research N°98/05, CBWAS, Department of Researchand Statistics, August 1998. |

|

|

|

|

|

McKinnon R (1973). "Money and Capital in Economic Development", Washington DC, Brookings Institution. www.jstor.org/stable/40201473. |

|

|

|

|

|

Nelson CR, Plosser CI (1982). 'Trends and Random Walks in MacroeconomicTime Series: Some Evidence and Implications', Journal of Monetary Economics, September. tyigit.bilkent.edu.tr/.../ Trends%20and%20Random%20Walks%20in%20Macroeconomic. |

|

|

|

|

|

Romer PM (1986). 'Increasing Returns and Long-Run Growth', J. Political Econ. 94(5):1002-1037. |

|

|

|

|

|

Sidrauski M (1967). Inflation and Economic Growth, J. Political Econ. 75:796-810. |

|

|

|

|

|

Smith A (1776). An Inquiry Into the Nature and Causes of the Wealth of Nations, R.H. Campbell and A.S. Skinner (eds) (1976), Oxford: ClarendonPress. |

|

|

|

|

|

Solow RM (1957). 'Technical Change and the Aggregate Production Function', Rev. Econ. Stat. 3:p.312. |

|

|

|

|

|

Sun H (2007). "Banking, inside money and outside moyen", QED working paper 1146, Queen's University. |

|

|

|

|

|

Tobin J (1958). 'Liquidity Preference as behaviour towards Risk', Rev. Econ. Stud. 25(2):65-86. Published. |

|

|

|

|

|

Woodford M (2012). «Inflation Targeting and Financial Stability», NBER Working Paper Series, n° 17967, books.google.tg/books?isbn=92641888. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0