Full Length Research Paper

ABSTRACT

This paper used quantitative and qualitative methods to analyze agency banking and customer satisfaction in Rwanda and it considered the Bank of Kigali as a case study. The research adopted a descriptive research design in nature. Data were collected from a sample size of 208 respondents who were selected from the customers that consume the Bank agency services of Bank of Kigali agents. Research data from questionnaires were assessed descriptively, and on the other hand, data from interviews were studied qualitatively. The study discovered that customers queue in the ATMs and banking halls due to; a lack of liquidity, and e-money float balances to meet customer transaction demands; lack of tangibles, leanness, and location of the agents’ outlets; and lack of in-depth knowledge and modern skills in banking among bank agents. These were supported by regression equation results that found that all the p-values were less than 0.05; this is a confirmation that all the variables were statistically significant in influencing customer satisfaction in Bank of Kigali agency services. Therefore, the study recommended that there should be constant training for Bank agents regarding Bank services and products. This will reinforce bank agents on the bank’s products and update them on some customers’ needs and will continuously build customer relationships as they will be performing as the real Bank ambassadors and satisfy them with the required information. Finally, the regulator should continuously review the regulation governing the bank agent operations since the economy is dynamic.

Keywords: Agency banking, customer satisfaction, service quality dimensions.

INTRODUCTION

Service quality has been in existence since 1985. After being introduced by Saravanan and Rao. (2007), the service quality (SERVQUAL) model has been used to pinpoint opportunities to enhance service quality and, by extension, customer happiness, for nearly three decades. Despite its usefulness, the model has been criticized for a number of shortcomings, leading to the introduction of a number of variants in research. Quality of service is the best strategy for positioning a company and assuring a sustainable competitive advantage in the red ocean market. Meeting customers’ needs induces customer retention and loyalty (Bayad et al., 2021). In Germany, the banking industry considers service quality as important and it takes an outsider's view of service quality, which holds that the customer's opinion is the most important one. This evaluation is conceived of as a discrepancy or a gap between the customer's expectations for the quality of service from a category of service providers and the service provider's actual performance and customer satisfaction which is the extent to which customers are happy and delighted with the products and services provided by a business (Munari et al., 2013). In other words, satisfaction is the state of mind felt by a person who experienced a performance of a product or service that has fulfilled his or her expectations. However, customer satisfaction is dynamic and previous researchers have focused on the current status of the customers and neglected the behavioral changes of customers. Retaining customers must match with spontaneous innovation (Chong et al., 1997). It was also highlighted that agency banking services remained relevant in the growth of the banking industry and reached customers easily (Munari et al., 2013).

This financial inclusiveness system has helped many people to access financial services which led to the entire development of the country and the world in general. Lotto (2019) revealed that agency banking helped to simplify banking services by reducing the distance for customers to reach the service point. It was also set up in the study that agency banking costs are reported to be lower compared to those of traditional banking services. It was concluded that lesser geographical content brought about by agency banking is a stronger protagonist of fiscal addition because services follow people closer to where they leave and hence reduce the traveling costs and other hassles involved like time wasted long ranges at Bank branches. Tangibility, assurance, responsiveness, and empathy are the key influencers in generating customer satisfaction for hospital and hospitality brand as customers’ choice heavily depends on these benefits (Tapan and Satyabrat, 2021). Though previous researchers showed the contribution of agency banking in solving the problems of the customers, other limited studies also were highlighted showing the causes of clients’ dissatisfaction in agency banks (Uddin and Afrin, 2019), Daily transactional limits, agent commission, limited skills and knowledge of agents, poor network, and limited infrastructure led the mistrust and complaints of customers. Bertram et al. (2019) that insufficient liquidity in the agency banking outlets affected the sustainability of operational performance and customer disutility. Since customer satisfaction is static, previous researchers have shown the contribution and challenges of banking agencies, and the quality dimensions that influenced customer satisfaction in hospitality (Tapan and Satyabrat, 2021).

The current study is interested in replicating the same study in the context of the Bank of Kigali and Rwanda in general because the Banking sector and Hospitality are different sectors of which the finding from one sector cannot be applicable/ generalizable to another sector, and all studies done on agency banking were carried outside Rwanda and their customer needs and perception might be different from Rwandans. Therefore, by integrating this study’s findings and perspectives from other empirical findings, this study addressed the question of limited literature in Rwanda.

Statement of the problem

Tangibility, assurance, responsiveness, and empathy are the key influencers in generating customer satisfaction for hospital and hospitality brand as customers’ choice heavily depends on these benefits (Tapan and Satyabrat, 2021; Tapan and Satyabrat, 2021; Uddin and Afrin, 2019; Munari et al., 2013). Even though tangibility, assurance, responsiveness, empathy, and reliability influence customers’ behavior in terms of performance but it was only focused on hospitality which cannot be generalized across all sectors. It’s in that context that the current to researcher needs replicate the study on the banking sector. Previous studies were also curried outside Rwanda and customer behavior varies based on their values. Customer satisfaction is also changing due to environmental changes and that is why the previous research findings cannot be used in current decision-making.

It is in that context that replicating this study is very relevant. Besides, the study analyzed why there are still rampant queues at Bank of Kigali branches even if the bank has got banking agents commonly termed as “BK YACU''.

Research hypotheses

Ho1: There is no significant impact of empathy against services provided by Bank Agents on the satisfaction of Bank of Kigali customers.

Ho2: There is no significant impact of the reliability of services offered by Bank Agents on the satisfaction of Bank of Kigali customers.

Ho3: There is no significant impact of the tangibility of services provided by Bank Agents on the satisfaction of Bank of Kigali customers.

REVIEW OF LITERATURE

The section presents the theoretical review which presents theories related to service quality dimensions and indicators of customer satisfaction as independent and dependent variables respectively. The second segment presents a conceptual review, followed by an empirical review, and conceptual framework and it ends with the research gap.

Queuing theory models

Nityangini and Bhathawala (2019), queues (waiting lines) are a part of daily life; excessive costs are involved in providing too much service. The waiting line becomes long because of not providing enough service capacity. The goal is to have an economic balance between the cost of service and waiting time. The study of waiting in various guises is the subject of quenching theory. If it can be managed, forming a queue is essential to society so that both the unit that waits and the one that serves get the most benefit. In the Banking context, the effect of queuing on the time taken by customers to access bank services is becoming a major concern. If customers are kept waiting too long, it could cost them excessive costs associated with providing too much service capacity, and excessive waiting time and cost are caused by not providing enough service capacity (Nityangini and Bhathawala, 2019). Jahan (2019) stated that queuing model is a mathematical description of a queuing system that makes some specific assumptions about the probabilistic nature of the arrival and service processes, the number and type of servers, and the queue discipline and organization. It isn't useful for the banks to build the number of branch banks and servers in the banks simply. Sheikh (2018), some of the banking systems do not really get overwhelmed by the crowding experiences they have during the delivery of services to their customer because of the seeming state of complacency. However, some of the impatient and dissatisfied customers gradually begin to withdraw from such banks and look for another with better service delivery modalities, leaving the customer insensitive banks with a gradual loss of customer patronage. Bakari (2018) analyzed queuing systems obtained from queues from the observed data of some selected banks in Ogun State, Nigeria. The analysis of the data helped to make some suggestions regarding the use of queuing theory model in banking.

Bank-led theory

The Bank Led concept states that a regulated financial institution delivers financial services via a retail agent. The theory contends that a bank creates financial products and services and distributes them via retail agents who manage all or most client contacts. Agency banking is encouraged by this banking paradigm (Lyman et al., 2019). Similar to how a branch-based teller would accept deposits and handle withdrawals, retail agents interact directly with customers and perform cash-in and cash-out duties. This strategy has the bank producing financial services and goods, but distributing them via retail agents who handle all or most of the customer contacts (Lyman et al., 2019). The bank serves as both the institution where consumers maintain accounts and the provider of financial services. Any business that accepts cash and is close to customers might theoretically act as a retail agent. In some nations, retail agents also manage the entire account opening process and, in some situations, even locate and support loan borrowers (Tapan and Satyabrat, 2021). Each retail agent under this arrangement is provided with electronic communication equipment for use with the bank for which it is operating. The tools might be a mobile phone or a card-reading electronic point-of-sale terminal (Lyman et al., 2019). By employing a different distribution method, a different trading partner (Chain Store) with experience serving a market different from traditional banks, and perhaps at a lower cost than the bank-based alternatives, this model aims to considerably expand the reach of financial services. With this model, customers can complete financial transactions through a variety of retail agents rather than bank branches or through bank workers, providing a clear contrast to traditional branch-based banking (Lyman et al., 2019). The use of retail agents may also give rise to particular worries about consumer protection and adherence to laws intended to stop money laundering and the financing of terrorism (Levesque and McDougall, 1996). Multiple categories of risk are commonly recognized in banking regulation, and bank regulators and supervisors work to reduce such risks. Credit risk, operational risk, legal risk, liquidity risk, and reputation risk are five of these risk categories. Reputation risk assumes particular significance when clients utilize retail agents rather than bank branches to acquire banking services.

Disconfirmation theory

Disconfirmation theory argues that customer satisfaction is related to the size and direction of the disconfirmation experience that occurs as a result of comparing service performance against expectations. Uddin and Afrin (2019) asserted that the disconfirmation paradigm is the best predictor of customer satisfaction. It is among the most popular satisfaction theories. Satisfaction is the result of the process of comparing perceptions against a standard or expectations. However, the weakness of this theory is that research also indicates that customer satisfaction is more importantly also influenced by how the service was delivered than the result of the service process, and customer dissatisfaction with the service frequently just arises when their expectations are not met.

Services quality dimensions and customer satisfaction in agency banking

Agency banking is viewed as an important factor in service evaluation. There is ample evidence that agency banking significantly affects customers' evaluative judgments such as perceptions of quality. Moreover, agency banking significantly improves perceived service quality. That is, agency banking is a critical determinant of service quality (Bloemer, 2018). The idea behind agency banking is that the consumer is not just using agency banking services but also the image associated with that product or service. Agency banking services should be positive, unique, and instant. Agency banking has not to be created but is automatically formed. The agency banking services should appeal to be easy to use, functional, famous, and overall valuable. In the agency literature, there is a general assumption that favorable agency services have a positive impact on customer satisfaction. Andreassen (2018) found that agency banking affects customer satisfaction through a filtering effect. Similarly, Donabedian (2005) suggested that agency correlates with customer satisfaction. Agency banking has been recognized as an important antecedent of customer satisfaction. Hence, good agency services will tend to generate high customer satisfaction in the bank. If there is a necessity of defining customer satisfaction in the banking sub-sector, then one cannot ignore the quality of service. This is because the two co-exist and the deterioration of one often leads to the deterioration of the other. Although some scholars claim that quality precedes satisfaction other writers suggest that customer satisfaction is necessarily founded on the quality of service or product (Donabedian, 2005). That's why in the present study, quality in service is understood as a satisfaction antecedent. Customer satisfaction is therefore an emotional reaction strongly associated with prior expectations, related to specific transactions. This can be defined as the feelings or judgments by customers towards products or services after they have used them (Jamal and Naser, 2018). Various scholars purport that satisfaction is the result of a customer's perception of the value received in a transaction or relationship compared with price and acquisition costs. Moreover, it is relative to the value expected from transactions with competitors. According to Sheikh (2018), quality of service is defined as a construct composed of what is delivered by the company to the customer (technical aspect), and the way the service is performed (functional or relational aspect). Several empirical types of research have validated this definition and indicated a strong relationship between these two quality dimensions and customer satisfaction. In addition to technical aspects, on the other hand, studies have shown that functional quality (the way the service is performed) contributes significantly to customers' satisfaction. It’s been shown that bank clients do not overlook how the service was performed (functional quality) even when asked specifically about their satisfaction with service technical aspects. This suggests that the functional dimension also influences clients' satisfaction significantly (Lotto, 2019). Owing to the nature of the financial service activity in which customers in general, do not regard the financial product as a tangible, complete product, the service that accompanies the product is very important to determine general satisfaction towards the institution. Consequently, by modeling general satisfaction for financial service companies, it proves important to include both the attributes linked to products and the ones related to services (Lotto, 2019). Despite the fact that there are other ways to evaluate service quality, it was acknowledged that the SERVQUAL model remains the most extensive attempt to conceptualize and quantify service quality. The approach is widely used to evaluate service quality in the literature. Customers frequently are unaware of the technical aspects of a service, therefore they rely on their assessments of the service's quality on its functionality (Donabedian, 2005). These factors were: accessibility, communication, competence, courtesy, credibility, reliability, responsiveness, security, understanding, and tangibles. In further research, associated factors were combined, and the determinants were condensed into five consolidated dimensions: tangibles, reliability, responsiveness, assurance, and empathy as the metrics for service quality (Saravanan and Rao, 2007).

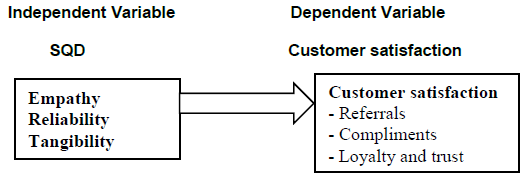

Conceptual Framework

The goal of a conceptual framework is to categorize and describe concepts relevant to the study and map relationships among them. According to Cronin and Taylor (1992), a conceptual framework is an analytical tool with several variations and contexts. It is used to make conceptual distinctions and organize ideas. Likewise, conceptual frameworks are abstract representations, connected to the research project’s goal that directs the collection and analysis of data.

METHODOLOGY

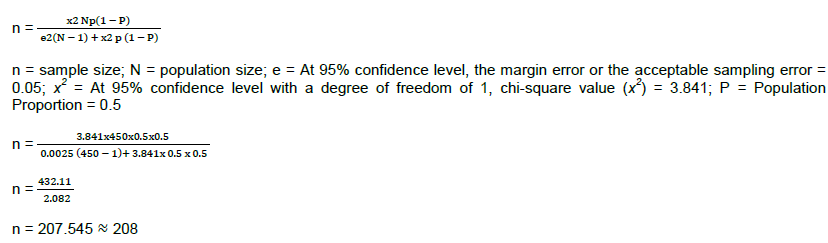

This research did embrace both descriptive and correlational study designs. Descriptive design was used to analyse banking and customer satisfaction in Rwanda and it considered Bank of Kigali as a case study, whereas correlational design was used in the study to establish the nature and magnitude of the relationship and the significance between agency banking and customer satisfaction in Rwanda and in particular Bank of Kigali. The population of interest in this research constituted agency banking clients and operators from Nyarugenge, Gasabo, and Bugesera Districts because they have more clues about the topic of the study. In line with this, the target population of this research comprised four-hundred and fifty (450) persons who serve as the heads of the department. The study focuses on the bank employees and middle-level each of the department in question as mentioned in the department population. Hakkeem and Sha (2015) define a sample as a group of subjects that are selected from the general population and are considered a representative of the real population for that specific study as a set of entities drawn from a population with the aim of estimating characteristics of the population. Mugenda and Mugenda (2018) further define a sample size as the number of cases or entities in the sample studied. April and Reddy (2015) defined sample size as a set of entities drawn from a population with an aim of estimating characteristics of the population. Thus, the sample size of this study was 208 respondents. In determining the sample size, Krejcie and Morgan sample size formula was used as expressed below for clarity.

Krejcie and Morgan’s formula and table were developed to help the researchers determine (with 95% certainty) the sample size. Thus, based on the Krejcien and Morgan sample size determination formula, this study’s population size of (450) was represented by a sample size equivalent to 208 respondents. The researcher used a simple random sampling technique to consider the right sample size from the targeted population. Sampling is a process that involves choosing from a large target population a unit of representation. Simple random sampling is the basic sampling technique where we select a group of subjects called a sample for study from a larger group called a population. Each individual is chosen entirely by chance and each member of the population has an equal chance of being included in the sample (Hajizadeh, 2019). Simple random sampling assisted the researcher with at least involving 81 respondents in Nyarugenge, 71 from Gasabo, and 56 in the Bugesera districts. In this study, a pilot study was conducted with fourteen (14) operators and customers of agency banking in the Kicukiro district in Kigali city. The researcher’s target in conducting the pilot study is to ascertain the reliability of the instruments before distributing them to the respondents. In addition, Cronbach's alpha coefficient was considered to ensure the reliability of the research. Indeed, the overall reliability Cronbach alpha (α) coefficient (α ≤ 0.7), the acceptable, good, and excellent standards are relied on to produce consistent results for describing internal consistency. Thus, this study’s reliability index was found to be 0.811 which indicated good consistency and the study models typically possess high reliability. For ensuring validity, the questionnaires were presented to the research supervisor to solicit his opinion in order to guarantee the correctness and relevance of the instrument. Data collection was followed by data processing. The researcher had to exercise good care for ensuring reliable data collection because all data collection efforts could end in vain if the collections were not well processed. Thus, the following task envisions were undergone during the data processing. The first activity under data processing was data editing. Through editing, the researcher was able to eliminate errors in the completed questionnaires and this ensured that answers are accurate and consistent. After carrying out data editing, the researcher proceeded to the data coding stage. The researcher embarked on the task of establishing coding frames by use of his own code categories based on the research questions and responses. After data coding, the researcher used the Statistical Package for Social Sciences (SPSS) version 22.0 in coming up with the statistical analysis for the study.

Data analysis

The research data were analyzed using both descriptive and correlational statistics; in particular, regression analysis and correlation analysis. Therefore, after acquiring adequate research data, the researcher employed qualitative data analysis which was used to analyze data from different sources as prior mentioned. With the help of SPSS, the researcher applied descriptive statistics. In addition to descriptive statistics, the research included inferential statistics which involved both correlational analysis and regression analysis. In order to produce an effective measurement of variables; it was essential to offer the correlation analysis model that the research employed by calculating; evaluating and interpreting the connection among variables via the obtained data. Additionally, regression analysis was used to establish the effect of service quality dimensions on customer satisfaction. The following is a regression model which was used in the study: X1 = Empathy; X2 = Reliability; X3 = Tangibility; ? = error. Thus, this study’s regression equation is: Customer Satisfaction = α+β1 (Empathy) + β2 (Reliability) + β3 (Tangibility) + ?

RESULTS

Data were collected from a sample of 208 respondents whereby 192 were given questionnaires and 16 respondents were interviewed. This represented a response rate of 100% and this response rate proved enough results to develop a conclusion. Findings were presented in form of both descriptive and inferential statistics. In particular, mean, standard deviation, and regression analyses considered a model summary, ANOVA, and correlation analyses.

Descriptive statistics

This section presented descriptive statistics which were also presented in line with the study’s specific objectives. The specific objectives include assessing the impact of empathy against services provided by Bank Agents on the satisfaction of Bank of Kigali customers; assessing the impact of reliability of the services offered by Bank Agents on the satisfaction of Bank of Kigali customers; and assessing the impact of the tangibility of services provided by Bank Agents on the satisfaction of Bank of Kigali customers. The findings were presented in tables in form of frequencies, percentages, mean, and standard deviation for better understanding.

Descriptive statistics on empathy

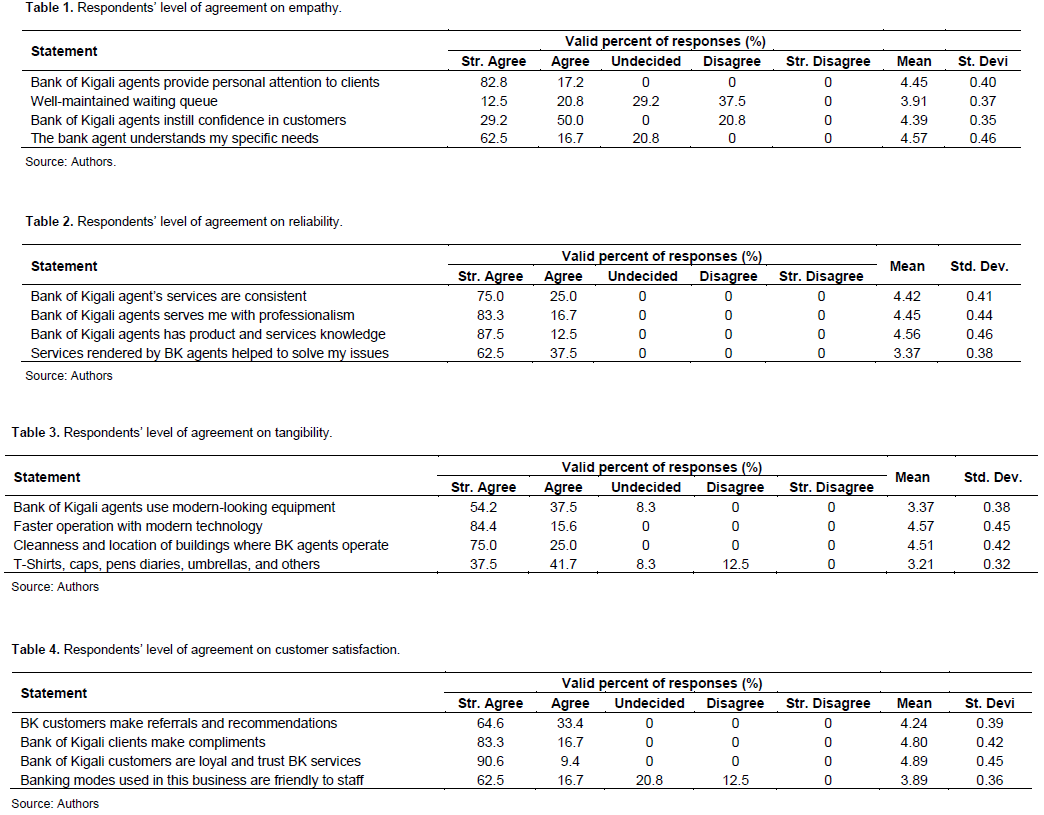

This section expressed the respondents’ level of appreciation in assessing the impact of empathy against services provided by Bank Agents on the satisfaction of Bank of Kigali customers and the results were presented in the Table 1.

Table 1 presented findings that are in regard to the appreciation level of respondents on the impact of empathy against services provided by Bank Agents on the satisfaction of Bank of Kigali customers. From the study’s findings, it was discovered that 82.8% of the total respondents strongly agreed that Bank of Kigali agents provide personal attention to customers. In addition, this was trailed by 62.5% of the respondents who strongly agreed that the bank agent understands my specific needs. The results also found that 50.0% of the respondents agreed that Bank of Kigali agents instill confidence in customers; though the same statement was disagreed by 20.8% of the respondents. In addition, another disagreed statement was about the well-maintained waiting queue; and disagreed 37.5% of the study’s respondents. Based on the findings revealed in Table 6, the researcher confirmed that there is a strong influence of empathy and customer satisfaction at the Bank of Kigali customers in the selected districts. This was derived due to the fact that most of the statements were agreed and strongly agreed. In addition, the findings in form of mean and standard deviation presented above showed that all the standard deviation values were above 0.33. Besides, results in terms of the mean indicated 4.45, 3.91, 4.39, and 4.57; which showed a very high mean. The findings discovered positive impact of empathy against services provided by bank agents on the satisfaction of Bank of Kigali customers. In an interview with the bank agents, indeed their responses matched with the findings from the staff. For stance, he expressed that mostly the elderly and uneducated clients never like using agency banking because they fear a lack of data confidence; this was also revealed by the staff and clients. The issue of privacy and security was also revealed by both parties and the staff. The findings were sustained by Tapan and Satyabrat (2021) who stressed that although some clients could be timid about the security and safety of the cashless payment modes practices in particular agency banking, these services offer more efficient reports infrastructure and lower transaction costs to the entrepreneur.

Descriptive statistics on reliability

This section expressed the respondents’ level of appreciation to assess the impact of the reliability of the services offered by Bank Agents on the satisfaction of Bank of Kigali customers and the results were presented in Table 2. The study findings presented in Table 2 indicated the respondents’ agreement levels as regards the impact of the reliability of services offered by Bank Agents on the satisfaction of Bank of Kigali customers. It was discovered that 87.5% of the total respondents strongly agreed that Bank of Kigali agents has product and service knowledge. More so, 83.3% of the respondents strongly agreed that Bank of Kigali agents serves me with the professionalism; also 75.0% of the respondents strongly agreed that Bank of agent services is consistent. Furthermore, 62.5% strongly agreed that the services rendered by Bank of Kigali agents helped to solve my, issue, and finally, 37.5% of the study’s respondents agreed that about the same statement. Besides, the findings were presented in form of mean and standard deviation presented in the above showed that all the standard deviation values were from 0.38 to 0.46. In addition, results in terms of the mean indicated from 4.42, 4.45, 4.56 to 3.37, and this showed a very high mean, which explains that there is positive impact of the reliability of the services offered by bank Agents on the satisfaction of BK clients. As indicated in Table 2, the research findings exposed a positive about the impact of the reliability of services offered by Bank Agents on the satisfaction of Bank of Kigali customers since all the statements about reliability were both strongly agreed and agreed in regard to the impact of service quality dimensions towards customer satisfaction. The findings revealed by the customers were in support of the interview results from the agency operators of during the interview. They, for example, point out the banking employee reduction since some clients make orders and make them from agents. The agent operator in the City center close the Nyarugenge Market ahead to express that the agency banking platforms were largely used during the period of the COVID-19 pandemic outbreak as it was always pushed by the government authorities. Hence, this confirmed that there is a strong relationship between service quality dimensions towards customer satisfaction. In the same line, according to Munari et al. (2013), agency banking brings about a concept that management at tactical levels involves before they take durable banking institution strategies regardless of the level or type of business. The main value of agency banking in strategy is to emphasize the importance of the application of financial payments as an alternative, and anticipate the reliability to the customers.

Similarly, Bayad et al. (2021) added that the agency banking system is also widely accepted by various commercial governments in cooperation with the community and sequestered sectors for the benefit of people at large. They also added that agency banking offers reliable services compared to branch banking. These were all pointed out in the study findings presented in Table 2.

Descriptive statistics on tangibility

This section conveyed the respondents’ level of appreciation on to assess the impact of the tangibility of services provided by Bank Agents on the satisfaction of Bank of Kigali customers and the results are clearly presented in Table 3 of this research report. The research outcomes presented in Table 3 present the study findings that are all about the impact of the tangibility of services provided by Bank Agents on the satisfaction of Bank of Kigali customers. The study discovered that 84.4% of the respondents strongly agreed that faster operation with modern technology. The statement on the cleanliness and location of buildings where Bank of Kigali agents operate were also strongly agreed by 75.0% of the respondents. In addition, 54.2% of this study’s respondents strongly agreed that Bank of Kigali agents use modern-looking equipment and others, while 41.7% of the respondents agreed on t-shirts, caps, pens, diaries, and umbrellas. Still, this was the only statement that was both undecided about and disagreed on by 8.3% and 12.5% of the respondents respectively. Besides, the findings were presented in form of mean and standard deviation as presented in the above showed that all the standard deviation values were from 0.32 to 0.45. In addition, results in terms of mean indicated from 3.21, 4.57, 4.51 to 3.37 and this showed very high mean, which explains that there is impact of the tangibility of services provided by Bank Agents on the satisfaction of Bank of Kigali customers. As presented in Table 3, it was found out that all the statements were agreed and strongly agreed apart from the statement of t-shirts, caps, pens, diary, umbrellas. Though, since most were agreed, this causes one to learn that there is strong impact of tangibility of services provided by Bank Agents on the satisfaction of Bank of Kigali customers. In the interview with the branch agent operators noted that the pandemic affected them hugely. They however expressed optimism about business recovery. The agency banking operators highlighted that bank cards increased convenience for clients. They continued to note that the Bank of Kigali supermarket management can easily make audits smoothly with mobile banking since all transactions made can be traced with ease. The study findings were in line with Uddin and Afrin (2019) that states agency banking especially using bank cards typically has a multi-channel approach to delivering transactional services to its customer base.

Descriptive statistics on customer satisfaction

This section conveyed the respondents’ level of appreciation for customer satisfaction in agency banking in Nyarugenge, Gasabo and Bugesera Districts, and the results were presented in Table 4 of this research report. The research results presented in Table 4, the researcher targeted the respondents to capture information about customer satisfaction whereby the respondents were offered a number of options to choose from. The most strongly agreed factor was that Bank of Kigali customer are loyalty and trust BK services and this was strongly agreed by 90.6% of the respondents. In addition, it was clearly witnessed that 83.3% of the respondents strongly agreed that to Bank of Kigali clients make compliments; whereas 64.6% of the respondents strongly agreed that Bank of Kigali customers make referrals and recommendations. Besides, 62.5% of the respondents strongly agreed that the banking modes that are used in this business are friendly to staff and clients. However, 20.8% of the respondents were undecided about the fact that the banking modes that are used in this business are friendly to staff and clients. The study findings presented in Table 4 revealed that at least each statement was strongly agreed or agreed apart from one of them where respondents were undecided. Thus, the researcher concluded that the respondents of selected districts believe that customer satisfaction is effective in their businesses due to the service quality dimensions. Besides, the findings were presented in form of mean and standard deviation presented in the above showed that all the standard deviation values were from 0.38 to 0.46. In addition, results in terms of the mean indicated from 4.24, 4.80, 4.89 to 3.89; and this showed a very high mean, which explains that there is level of appreciation for customer satisfaction in agency banking in Nyarugenge, Gasabo and Bugesera Districts. The findings are in line with Saravanan and Rao. (2007) who put it that from a performance perspective, customer satisfaction is fundamental and it can be expressed in many ways including referrals (recommendations), compliments and loyalty, and trust. The following types of service quality dimensions can be distinguished based on the kind of investor-involved portfolio investment, involving widely held equity securities intercompany equity securities, involving ownership links between related units, and equity securities relating to privately owned corporations.

Inferential statistics

In order to realize the effect of service quality dimensions and customer satisfaction and with the help of SPSS, this section detailed inferential statistics in form of both correlation analysis and regression analysis of the study results. In an actual sense, this section enables us to establish the relationship between the service quality dimensions and customer satisfaction.

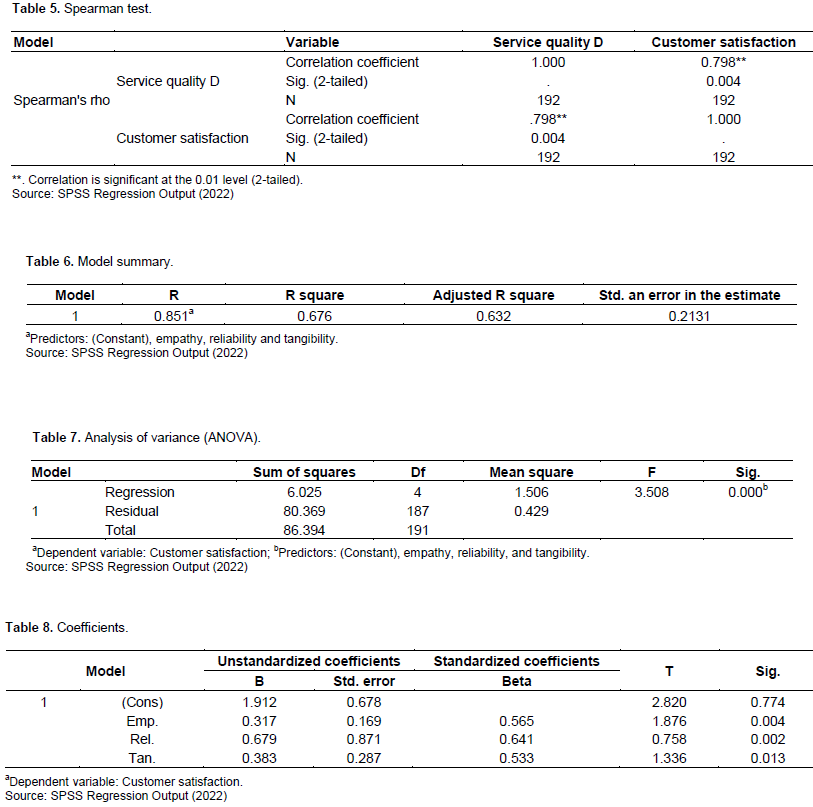

Spearman correlation analysis

Spearman Correlation analysis helped the researcher to recognize the relationship that lies between an independent variable and the dependent variable of this study. The findings were presented in Table 5. Table 5 presents the results of the Spearman test and they discovered the value of rs=0.798 and p=0.004 which explains that there was a strong, positive correlation between service quality dimensions and customer satisfaction in Bank of Kigali (= .798, n = 192, p < .004). Based on the spearman analysis, therefore, the researcher learnt that service quality dimensions in terms of empathy, reliability, and tangibility have a strong relationship with customer satisfaction in agency banking in Rwanda.

Regression analysis

The regression analysis presented results that were all about model summary, ANOVA, and coefficient findings. The results presented in Table 6 are in relation to the model summary. Findings revealed in the table show that 63.2% of changes in customer satisfaction could be accounted for by empathy, reliability, and tangibility. Thus, a strong positive impact between the study variables marked by R=.851a as asserted in the model summary table. The model instantaneous designated that an adjusted R squared is coefficient that governs the disparity in the reliant variable because of the variations in the liberated variable. As revealed in the table, the value of adjusted R squared was 0.632, an indication that there was a variation of 63.2% in customer satisfaction due to changes in empathy, reliability, and tangibility. This means that 36.8% is for the other factors that influence the variation of customer satisfaction in agency banking in Rwanda and the Bank of Kigali in particular. As revealed in Table 7, ANOVA test findings revealed that independent variables are statistically significant to the dependent variable and the p-value was found to be 0.000 which is less than alpha (5%), the significant positive impact level. In addition, the results clarify that the given perfectly well with the multiple regression models. Therefore, the significance value was less than 0.05, an indication that the model was statistically significant. This means the given data fit well with the multiple regression models. Findings obtained and presented in Table 8 were established as a regression equation as shown below:

Customer satisfaction = α + β1 (Empathy) + β2 (Reliability) + β3 (Tangibility) + ? (Error)

Customer satisfaction = 1.912 + 0.565 (Empathy) + 0.641 (Reliability) + 0.533 (Tangibility) + 0.678.

In line with the regression equation results as presented in Table 8, it was revealed that holding empathy, reliability, and tangibility to a constant zero, customer satisfaction would be 1.912. As revealed in the table, of course, this constant called y-intercept is not realistic but it is a needed parameter in the model. In addition to the findings, since earlier the study also found that all the p-values were less than 0.05; this is a confirmation that all the variables were statistically significant in influencing customer satisfaction in Bank of Kigali agency services. Indeed, this constant called y-intercept is not realistic but it is a needed parameter in the model as presented in Table 8. As per the findings, there is a positive and significant impact of empathy on customer satisfaction in the selected agencies (β = 0.565; t test = 1.876; p-value < 5%). Thus, you reject the null hypothesis. This implies that a unit increase in empathy would lead to customer satisfaction in the selected agencies by a factor of 0.565. Likewise, there is a positive and significant impact of reliability on customer satisfaction in the selected agencies (β = 0.641; t test = 0.758; p-value >5%). Thus, the null hypothesis was rejected. This implies that a unit increase in reliability would lead to increase customer satisfaction in the selected agencies by a factor of 0.641. In addition, there is a positive and significant impact of tangibility on s customer satisfaction in the selected agencies (β = 0.533; t test = 1.336; p-value >5%). Thus, the null hypothesis was rejected. This implies that a unit increase in tangibility would lead to customer satisfaction in the selected agencies by a factor of 0.533. The researcher asserted that there was a strong positive and significant impact among the study variables as shown by the regression analysis. This, therefore, led to the rejection of all the study’s null hypotheses.

DISCUSSION

This study considered both descriptive and inferential analyses. The discovered results in the model summary revealed that there was a variation of 63.2% in customer satisfaction due to changes in empathy, reliability, and tangibility. This means that 36.8% is for the other factors that influence the variation of customer satisfaction in agency banking in Rwanda and the Bank of Kigali in particular. In addition, as revealed, ANOVA test findings revealed that independent variables are statistically significant to the dependent variable and the p-value was found to be 0.000 which is less than alpha (5%), and there is a significant positive impact level. This means the given data fit well with the multiple regression models. In line with the regression equation results, it was revealed that there is a positive and significant impact of empathy on customer satisfaction in the selected agencies (β = 0.565; t test = 1.876; p-value < 5%). Thus, you reject the null hypothesis. This implies that a unit increase in empathy would lead to customer satisfaction in the selected agencies by a factor of 0.565. Likewise, there is a positive and significant impact of reliability on customer satisfaction in the selected agencies (β = 0.641; t test = 0.758; p-value >5%). Thus, the null hypothesis was rejected. This implies that a unit increase in reliability would lead to increase customer satisfaction in the selected agencies by a factor of 0.641. Referring to the prevailing gaps within the agency banking such as rampant queues at Bank of Kigali branches that had been identified at the start and based on the findings of this study, the researcher asserts that customers largely prefer branches to BK Yacu mainly due to the fact that banking agents lack knowledge about the BK services. Indeed, the findings are consistent with the expectations of the researcher. In addition, there is positive and significant impact of tangibility on s customer satisfaction in the selected agencies (β = 0.533; t test = 1.336; p-value >5%). Thus, null hypothesis was rejected. This implies that a unit increase in tangibility would lead to customer satisfaction in the selected agencies by a factor of 0.533. The researcher asserted that there was a strong positive and significant impact among the study variables as shown by the regression analysis. This, therefore, led to the rejection of all the study’s null hypotheses.

CONCLUSION

This is the last section of the study and it presents the implications of this study. This study’s overall objective was to evaluate the impact of service quality dimensions on customer satisfaction in agency banking in Rwanda. To realize this objective, the study adopted both descriptive and correlative research designs. The study’s target population included the customers and operators of agency banking in selected districts. Responses were collected from a sample of 208 respondents whereby (192) were given questionnaires whereas (13) respondents were interviewed. This represented a response rate of 100% and this response rate proved enough results to develop a conclusion. The study attempted to analyze agency Banking and Customer Satisfaction in Rwanda. Tapan and Satyabrat (2021) stated that an important concept to consider when developing a customer loyalty program is customer satisfaction. Satisfaction is a critical scale of how well a customer’s needs and demands are met while customer loyalty is a measure of how likely a customer is to repeat the purchases and involve in related activities. A banking agent is a retail or postal outlet contracted by a financial institution or a mobile network operator to process a client’s transactions. Rather than a branch teller, it is the owner or an employee of the retail outlet who conducts the transaction and lets clients deposit, withdraw, transfer funds, pay their bills, inquire about an account balance, or receive government benefits or a direct deposit from their employer. Banking agents can be pharmacies, supermarkets, convenience stores, lottery outlets, post offices, and many more (Nityangini and Bhathawala, 2019). In growing countries, Banks and other financial service providers are innovating a new way to deliver their services to the unbanked population, to increase their performance and increase customer satisfaction of their customers. Agency Banking is the latest in a series of technological innovations linking the use of mobile devices, especially mobile phones for distributing Banking products and services. Agency banking support can be an opportunity for the Bank to increase its competitive advantage in the Banking sector through customer satisfaction. With well-established agency banking, customers don’t have to travel far and then queue in ATMs and Banking halls to make payments, cash withdraws bill payments, and other transactions. In consideration of the quality service dimensions (Empathy, Reliability and Tangibility) that were considered in this research, customers pointed out that, to some extent, they were satisfied with Agency Banking services and this show that Agency Banking has got a role to play as far as customer satisfaction is concerned. However, the study also identified some challenges in the Agency Banking services that hinder the comprehensive usage of Agency Banking services as can be clarified by the data collected above and hence the rampant queues at the Bank of Kigali’s ATMs and Banking halls. It was revealed that customers queue in the ATMs and Banking halls due to; a lack of liquidity, and e-money float balances by Bank agents to meet customer transaction demands, tangibles, leanness, and location of the Agents’ outlets, lack of in-depth knowledge and modern skills in banking among Bank agents and Customers as well and limited services that are offered by the Banking agents.

Recommendations

The discovered research findings led to the following recommendations that will help Bank of Kigali Plc to improve its service delivery performance so as customer expectations are exceedingly satisfied. There is a need for service and product teaching courses constantly for Bank of Kigali Plc Agents. This will reinforce bank agents on the bank’s products and update them on some customers’ needs and will continuously build customer relationships as they will be performing as the real Bank ambassadors. This will always enable the bank agents to be ready for the needs of the customers at all hours and satisfy them with the required information. It is recommended that since the dimensions of Customer satisfaction did not meet the customer’s expectations in one way, certain service dimensions require an improved effort to ensure its enhancement. For service dimensions like tangibles and assurances, actual efforts are required to ensure an improvement in these dimensions. This will help in the overall service delivery and customer satisfaction among the bank agents. To enhance on this the Bank can be in charge of approving the location and painting the Bank agent outlets. There is a need for more agents banking of Kigali Plc to consider the continuous improvement of their Banking agents’ products to operate as promised to its customers. The researcher believes this will reduce the customer’s queues in ATMs and Banking halls to transact their business, balance inquiries, bill payments, or deposits and withdraws hence enhancing customers’ satisfaction. The regulations governing the Bank agents should be continuously reviewed by the regulatory body, as the world is dynamic. This will help to increase the number of services and products that Bank agent offers to the customers. Finally, mass advertisements on Bank of Kigali agents are needed for the public to know more about its services and products and their locations.

CONFLICT OF INTERESTS

The authors have not declared any conflict of interests.

REFERENCES

|

Andreassen CS (2018). Developing an instrument to measure customer service quality in branch banking. International Journal of Bank Marketing 12(60:10-18. |

|

|

April Z, Reddy C (2015). The internationalisation of SMEs in South Africa: Export capacity, capability and commitment. Journal of Economic and Financial Sciences 8(2):567-583. |

|

|

Bayad K, Pavel AM, Pavel A, Moldovan B (2021). Hotel Service Quality: The Impact of Service Quality on Customer Satisfaction in Hospitality. Journal of Business Development 5(12):34-43. |

|

|

Bertram K, Berger, Mayland L (2019). Poor Economics. New York: Perseus Books. |

|

|

Bloemer (2018). Export diversification effects of the WTO trade facilitation agreement. World Development 76:293-310. |

|

|

Chong E, Kennedy R, Riquire C, Rungie C (1997). The difference between satisfaction and service quality. In EMAC Conference Proceedings pp. 257-269. |

|

|

Cronin Jr JJ, Taylor SA (1992). Measuring service quality: a reexamination and extension. Journal of Marketing 56(3):55-68. |

|

|

Donabedian A (2005). The definition of quality and approaches to its assessment Exploration in quality assessment and monitoring, Volume 1. Health Administration Press, Ann Arbor pp. 12-17. Available at: |

|

|

Hajizadeh K (2019). Strategic Management and Marketing in the Service Sector, Swedish School of Economics and Business Administration Helsinki 21(7):54-57. |

|

|

Hakkeem DMA, Sha YM (2015). An empirical study towards customer satisfaction in internet banking services with special reference to Tiruchirappalli District. International Journal of Scientific Research 4(5):1-4. |

|

|

Jahan I (2019). Agent banking as a relationship marketing tool by banks in Bangladesh. Available at: |

|

|

Jamal M, Naser K (2018). Research Methodology - Methods and Techniques, USA. New Age International (P) Ltd KCB Annual Report. pp. 123-130. |

|

|

Levesque T, McDougall GH (1996). Determinants of customer satisfaction in retail banking. International Journal of Bank Marketing 6(8):111-134. |

|

|

Lotto B (2019). Fundamentals of Financial Management. England: Horne Publishers 2(1):234-241. |

|

|

Lyman K, Ivatury J, Staschen H (2019). Technology management. Encyclopedia of Management. Ed. Marilyn Helms, D.B.A. 5th edition. Detroit: Boston: Library of Congress pp. 892-899. |

|

|

Mugenda O, Mugenda S (2018). Research Methods, Quantitative and Qualitative Approaches. ACT, Nairobi 6(10):54-59. |

|

|

Munari L, Ielasi F, Bajetta L (2013). Customer satisfaction management in Italian banks. Qualitative Research in Financial Markets 5(2):139-160. |

|

|

Nityangini L, Bhathawala H (2019). The role of agency banking in growth of banking sector in India: A survey of bank agents in New Delhi. International Journal of Economics, Commerce and Management 9(9):76-79. |

|

|

Saravanan R, Rao KSP (2007). Measurement of service quality from the customer's perspective-an empirical study. Total Quality Management and Business Excellence 18(4):435-449. |

|

|

Sheikh AH (2018). Research methods for business: A skill building approach (4th edition). New Delhi: John and Sons Incorporation. |

|

|

Tapan K, Satyabrat J (2021). A study on Customers perception about public private banks, International Journal of Scientific and Research Publications 6(8):111-134. |

|

|

Uddin K, Afrin M (2019). Effects of agency banking on customer satisfaction in the banking industry in Kenya. International Academic Journal of Economics and Finance 5(1):29-42. |

|

Copyright © 2024 Author(s) retain the copyright of this article.

This article is published under the terms of the Creative Commons Attribution License 4.0