ABSTRACT

The study was conducted in Oromia Regional State, West Shoa Zone, Ambo Town, which is far 119 km from Addis Ababa. The main objective of the study was to examine impact of service quality performance on customer satisfaction. The study helps more the managers of the bank. The design of the study was quantitative in nature. A questionnaire was used for data collection from 321 customers for data analysis. The sampling procedure used was probability random sampling. A descriptive and inferential statistics was used to see the SQ gap. The study shows that OIB in Ambo Town have not met the service expectations of the customers, as there was a significant gap between customers’ perceptions and expectations. Among the five dimensions of service quality, the highest negative gap found tangibility. Therefore, banks need to better understand their customers’ expectations and continuously measure and evaluate their service quality performance in order to improve quality based on customers need.

Key words: Service quality (SQ), Oromia International Bank (OIB), service quality dimensions.

Quality of service can be understood as a comprehensive customer evaluation of a particular service and the extent to which it meets their expectations and provides satisfaction (Al-Jazzazi and Sultan, 2017; Mualla, 2011) stated that banks amend, develop, and create effective strategies to determine the different parameters influencing service quality, in order to increase the number of their customers based on the competitive market situation by evaluating customer satisfaction with respect to the various dimensions that influence service quality. Today, business environment is rapidly changing in terms of competition and quality of services provided by the industry. This may be due to stiff competition and the increasing pressure of globalization which remind the organizations to revise the products and services they offered to the customers. The quality of products or services provided to customers implies the image of company’s brand in real terms (Kenyon and Sen, 2015). Then the role of service quality is becoming vital in every facet of the industry, such as banking sectors. Due to service intangibility, in most of the services organizations, it is very hard to define and communalize the characteristics of good service quality and hence, it becomes challenging for service organizations to deliver superior quality (Mari? et al., 2016). In view of this, service quality has become a key determinant in the service industry in which OIB is operating. According to Zeithaml et al. (2000), service quality has become a popular area of academic investigation and recognized as a key factor in keeping competitive advantage and sustainably satisfying customers and retain them. So service sectors such as banks have the responsibility to provide the best services to their customers in order to have sustainable competitive advantages (Saghier and Nathan, 2013). Recently, liberalization of the financial sector (like banks) in Ethiopia and rapid technological advancement in the world as well as in Ethiopia forced to improve service quality to survive in the marketplace (Habtamu, 2004) which indicates excellent service quality is as a vital to bank profitability and survival as Parasuraman et al. (1985) recommended. Then, the increased competition in technology and the number of banks in Ethiopia from one bank in the Derge regime (1974-1987) into greater than sixteen banks in Woyane regime (1988-2020) put the bank into lot of pressures to survive in the banking industry in which OIB Bank is now operating. As the researcher observed practical and evidenced as one of the customer who sharing its service quality performance the current situation seems as it has effects on the OIB since more customers are voicing about service quality provided by this bank. According to Parasuraman et al. (1990) banks must measure service quality continuously to survive in the dynamic competition. Subsequently, OIB still did not conducted any research relating to service quality in this branch. Therefore, OIB needs to strive to know what determines service quality performance which is based on the service quality, as this knowledge will better equip it to make up for its shortcomings through enabling better customers understanding. Therefore, this study tried to examine whether OIB is know the impact of service dimension on service quality performance which can determine customer satisfaction to build long-run loyalty for confirming sustainable profit in the competitive environment.

Problem statement

In today’s banking environment, banks’ profitability levels have been compressed due to increased competition and spread reductions. Berry et al. (1988) observed that quality of service is very important in separating competing businesses in the retail sector as well as in banking. Banks seeking to maximize profitability have to realize that good quality helps a bank obtain and keep customers and poor quality will cause customers to leave a bank. Lewis (1993) found that service quality was one of the most effective means of establishing a competitive position and improving profit performance. To establish a competitive position, it was noted by Hall (1995) that banks must measure and determine their level of service quality, if they desire to keep their customers and satisfy their needs. There have been a large number of researchers who identify service quality as a primary means of providing a competitive advantage to banks, and according to Soteriou and Stavrinides (1997), the importance of service quality has been documented in numerous studies. Trivedi (2015) discovered today’s customer to be more demanding than in the past, and thus, it became more challenging to satisfy him. Ennew et al. (2015) studied banking sector and discovered service quality and customer satisfaction to have a direct impact on customer loyalty. In a customer based approach the highest quality means the best satisfaction of consumers’ preferences (Yarimoglu, 2014). Then, organizations have realized that service quality brings a sustainable and competitive advantage (Angelova and Zekiri, 2011). According to Rauch et al. (2015) in order to conduct a comprehensive evaluation of a company, the management has to compare its performance with its customers' expectations and with the performance of other companies in the same industry. So these evidences imply that as in the world of competition, service quality is the most important parameter that needs critical attention for service quality design in the bank sectors. In Ethiopia, the recent financial liberalization has led to intense competitive pressures among banks (Gashew Tena, NP), which need them dealing consequently directing their strategies towards increasing service quality level. This fosters customer satisfaction and loyalty through improved service quality. Most service organizations such as bank lack proper understanding of customers’ expectations that are a critical component in the marketing plan of a service business. Miss of these concept lead to wrong decisions, which in turn result in poor quality perceptions or bad word of mouth by their customers. These may be created in case of poor performance on service quality dimensions. Then this study aims to identify service quality dimensions, which can be used to measure service quality and evaluate the effect of service quality dimensions (tangibles, responsiveness, empathy, assurance and reliability) on service quality performance in case of OIB Ambo Branch from customers’ point of view.

Objectives of the study

In order to address the exiting research gap, this study aims to:

(1) To examine the level of service quality performance gaps in the selected bank.

(2) To analyze the impact service quality dimensions on customer satisfaction.

Significance of the study

This research have a great deal of importance/ significance more for the mangers of OIB in coming years because it provide information about the level of quality of service the bank is providing to its customers from the point of view of the customers. It will help them to know whether the bank is delivering its promise to the customers and also it provide them insight about the gap between customer’s perception and expectation of service and ways to improve them. The research also gives some insight about service quality and customer satisfaction in the bank industry. It also serves as a spring board for other researchers to undertake further investigation in Ethiopian context.

Customer satisfaction and service quality

According to Sharmin et al. (2016), satisfaction is the customer’s feeling regarding the outcome of an evaluation process, which compares what was received from the service and the commodity with expectations. Most experts agree that customer satisfaction is a short-term, transaction-specific measure, whereas service quality is an attitude formed by a long-term, overall evaluation of a performance. Without a doubt, the two concepts of customer satisfaction and service quality are intertwined. Some believe that customer satisfaction leads to perceived service quality, while others believe that service quality leads to customer satisfaction. In a customer-based approach quality means the best satisfaction of consumers’ preferences (Yarimoglu, 2014). In addition, the relationship between customer satisfaction and service quality and the way these two concepts relate to purchasing behaviour remains largely unexplained (Cronin and Taylor, 1992). In other way, service quality can be defined as how companies meet or exceed customer expectations and it can be understood as a comprehensive customer evaluation of a particular service and the extent to which it meets their expectations and provides satisfaction (Al-Jazzazi and Sultan, 2017). Accordingly, a negative discrepancy between perceptions and expectations, a ‘performance-gap’, as it is referred to, causes dissatisfaction, while a positive discrepancy leads to consumer satisfaction (Kumbhar, 2012). According to Rauch et al. (2015), in order to conduct a comprehensive evaluation of a company, the management has to compare its performance with its customers' expectations and with the performance of other companies in the same industry.

Service quality gaps

In the hopes of better understanding, how a firm can improve its overall service quality, the service quality process can be examined in terms of five gaps between expectations and perceptions on the part of management, employees, and customers. The most important gap the service gap (known as Gap 5), describes the distance between customers’ expectations of service and their perception of the service actually delivered. Ultimately, the goal of the service firm is to close the service gap, or at least narrow it as much as possible. Before the firm can close the service gap, it must close or attempt to narrow four other gaps: Gap (1) the knowledge gap, the difference between what consumers do expect of a service and what management perceives that consumers expect. Gap (2) the standards gap, the difference between what management perceives that consumers expect and the quality specifications set for service delivery. Gap (3) the delivery gap, the difference between the quality specifications set for service delivery and the actual quality of service delivered. Gap(4) is the communications gap, the difference between the actual quality of service delivered and the quality of service described in the firm’s external communications (e.g., advertising, point-of-purchase materials, and personal selling efforts). Hence, the service gap (Gap 5) is a function of the knowledge gap, the specifications gap, the delivery gap, and the communications gap. In other words, Gap5= f (Gap1+ Gap 2+ Gap3+ Gap 4). As each of these gaps increases or decreases, the service gap responds in a similar manner (Parasuraman et al., 1985).

Service quality gap closing strategies

According to Barnes et al. (2004) gap one (knowledge gap) can be closed/minimized by learning what customers expect such as understanding customer expectations through marketing research, complaint analysis, customers’ panel discussion, increase management contact with customers improve upward communication from contact personnel to management and turn information and insights into action. Gap two/inappropriate service quality standards can be solved by establishing the right service quality standards which can be obtained through ensuring top management displays ongoing promise to quality as defined by customers, set, communicate, and reinforce customer-oriented service for all work units, train mangers in the skills needed to lead employees to deliver quality service, communicate and reinforce customer oriented service standards for all works, measure performance and provide regular feedback, reward managers and employees for attaining quality goals. The third gap (performance gap) can be improved through service performance meets standards such as clarify employee roles, provide employees with technical training needed to perform assigned tasks, enhance performance by appropriate technology and equipment, measure employee performance, and recognize the delivery of quality service, teach employees about customer expectations, perceptions and problems and eliminate role conflict among employees by involving them in setting standards. The fourth gap (communication gap) can be improved via ensuring communication promises are realistic such as seek inputs from operations personnel when new advertising are being created, allow service providers to preview advertisements before customers exposed, communication specialists in the firm need to pretest all advertising, and gap five (service quality gap/customer gap) can be improved service quality to narrow the gap.

Service quality dimensions and customer satisfaction

In the literature, authors are convinced of the intimate relationship between service quality and customer satisfaction, and they point out that the higher the service quality, the higher the levels of customer satisfaction, especially in the banking sector (Siddiqi, 2011, Shahraki, 2014, Kant and Jaiswal, 2017; Peng and Moghavvemi, 2015). Parasuraman et al. (1988) argued that service quality and customer satisfaction are two diverse notions but closely related to each other in the service sector. In recent years, several authors have discussed and emphasized the relationship between these two common constructs in banking sectors and have found a positive and predictive relationship between service quality and customer satisfaction (Siddiqi, 2011; Choudhury, 2014; Krishnamurthy et al., 2010; Selvakumar, 2016). Ultimately, service quality dimensions, tangibility, reliability, assurance, responsiveness, and empathy are not used to assess the effect of the quality of the banking service on customer satisfaction in the Ethiopian banking sector.

Tangibility and customer satisfaction

In the banking sector, the tangibility dimension becomes intrinsic in service quality, according to the tangible aspects of the services cape, such as equipment, physical facilities, and visual appeal (Parasuraman et al., 1985). Subsequently, in the banking sector, it can be said that there is a significant influence of tangibility on customer satisfaction (Kant and Jaiswal, 2017; Ananth et al., 2010; Sanjuq, 2014). Similarly, many researchers have found a meaningful influence in this sense (Choudhury, 2014; Krishnamurthy et al., 2010; Selvakumar, 2016). Parasuraman et al. (1985) have defined tangibility as the appearance of physical facilities, equipment, personnel, and communication materials. It may also be defined as the clear visibility of resources necessary for providing a service to customers, the appearance of the management team and professional employees, brochures and booklets, which will have an effect on customer satisfaction (Munusamy, et al., 2010). Ananth et al. (2010) found that attractiveness, physical facility, and visual appeal could be considered positive indicators of tangibility on customer satisfaction in the banking sector. Furthermore, various researchers have found that there is a positive effect on the relationship between customer satisfaction and tangibility in the banking sector (Munusamy et al., 2010; Shanka, 2012; Lau et al., 2013). Moreover, Krishnamurthy et al. (2019) and Selvakumar (2016) emphasized that tangibility has a positive impact on customer satisfaction in banking services. Ananth et al. (2010) showed that in the banking sector sophisticated equipment and an attractive ambiance is viewed as the impact of tangibility on customer satisfaction.

Reliability and customer satisfaction

Researchers have demonstrated that the reliability dimension of service quality has a positive impact on customer satisfaction (Parasuraman et al., 1988). Ennew et al. (2013) revealed that reliability could be considered the extent to which customers can rely on the service promised by the organization. Parasuraman et al. (1985) has defined reliability as the organization's capability to tool up the service, dependently and independently. As a standard of service quality, reliability has a significant impact on customer satisfaction (Parasuraman et al., 1988: 24). Ennew et al. (2013) defined reliability as the ability to do and perform the required service for customers dependably, accurately and as promised, and the capacity to treat problems faced by customers. Taking actions to solve problems, performing the required services right from the first occasion, or providing services at the proper time are critical. Maintaining an error-free record is the paradigm of reliability in terms of service quality, and has an important impact on customer satisfaction (Parasuraman et al. (1988). Peng and Moghavvemi (2015) contend that the most important factors in retaining customers in banking services are accuracy in completing orders, maintaining precise records and quotations, accuracy in billing, and fulfilling promised services. These are the basic aspects of reliability. The extant literature has also revealed that reliability has a positive relationship with customer satisfaction in the banking sector (Kant and Jaiswal, 2017; Peng and Moghavvemi, 2015; Krishnamurthy et al., 2019; Selvakumar, 2016; Shanka, 2012).

Assurance and customer satisfaction

The assurance dimension of service quality indicates employees’ competence, knowledge and courtesy, and the ability to build bridges of trust with customers (Parasuraman et al., 1985). Assurance is defined as the knowledge and good manners or courtesy of employees (Kant and Jaiswal, 2017). Further, it is defined as the ability of employees, with the help of the knowledge they possess, to inspire the trust and confidence that will strongly influence the level of customer satisfaction (Parasuraman et al., 988). There is a positive relationship between assurance and customer satisfaction (Krishnamurthy et al., 2019; Selvakumar, 2016; Munusamy et al., 2010; Shanka, 2012). In the banking sector, assurance is related to the security that a customer feels when conducting his banking transactions (Ennew et al., 2013). Providing customer assistance in a courteous manner, accuracy in completing orders, easy access to account details, convenience within the bank, maintaining precise records and quotations, employing an experienced professional team, and fulfilling promised services will have a positive impact on customer satisfaction (Sadek et al., 2010).

Responsiveness and customer satisfaction

The responsiveness dimension of service quality is related to the organization’s willingness and ability to help customers, and to provide quick service with proper timeliness (Parasuraman et al., 1985). The willingness of employees to provide the required service at any time without any inconvenience will have an impact on customer satisfaction (Parasuraman et al., 1988). Responsiveness is primarily concerned with how service firms respond to customers via their personnel. Individual attention will increase the customer’s satisfaction and so will the attention paid by employees to the problems that face customers; when this happens, a radical shift occurs in their satisfaction. Arguably, banking sector responsiveness has a direct relationship with customer satisfaction (Kant and Jaiswal, 2017; Krishnamurthy et al., 2019; Selvakumar, 2016; Lau et al., 2013). Based on the aforementioned statements, we can state that the responsiveness dimension of service quality will strongly influence customer satisfaction in banking and therefore, the research proposes the following hypothesis.

Empathy and customer satisfaction

Ennew et al. (2013) point out that the empathy dimension of service quality means being attentive in communicative situations, understanding customer needs, showing friendly behaviour, and taking care of a customer's needs individually. Navaratnaseel and Periyathampy (2014) defined empathy as the ability to take care of customers and pay attention to them individually, especially while providing services. Moreover, Parasuraman et al. (1988 24) argued those understanding customer expectations better than competitors and the provision of care and customized attention to customers strongly influences the level of customer satisfaction. Ananth et al. (2010) revealed that a positive impact on customer satisfaction is brought about by convenient working hours, individualized attention, a better understanding of customer's specific needs in the banking sector and the empathy dimension, all of which play a crucial role in customer satisfaction (Shanka, 2012; Navaratnaseel and Periyathampy, 2014).

Measuring service quality

In the first SERVQUAL model, there were Likert-type items to measure the perceived level of service provided and the expected level of service quality. As the SERVQUAL model evolved, the original 10 dimensions were reduced to five. Mauri et al. (2013) define service quality as “a multidimensional concept, assessed and perceived by consumers, according to a set of essential parts, grouped in five categories, namely: tangibility, reliability, responsiveness, assurance and empathy”. But later they reduced into five dimensions. Then Parasuraman et al. (1985) and Parasuraman et al. (1988: 24) proposed the SERVQUAL model to fill the gap between customers’ expectations and perceptions, and actual service performance. Service quality can be measured using five dimensions: tangibility, reliability, assurance, responsiveness, and empathy. Moreover, SERVPERF arose as a response to criticism of the gap in the SERVQUAL model, because the SERVQUAL model measured customer satisfaction only after the service was provided (George and Kumar, 2014). However, the SERVQUAL model is the most commonly used to measure and evaluate service quality around the world, even in the banking sector. Therefore, regardless of the increasing use of SERVQUAL, there are differing opinions on its operation and effectiveness. Then based on these facts the level of customer satisfaction increased/decreased with the level of perceived service quality as follows: If Expectations of SQ are exceeded (quality exceeds expectations) customers are delight, if expectations of SQ are met (quality is acceptable) the required level is met for customers and if expectations of SQ are not met (quality is unacceptable or not less than satisfactory) customers are dissatisfied.

To total up the scores obtained as in for each dimension j and then divide by the number of respondents as follows:

Where SQj=Overall SQ in the dimension j, Pij= performance perception in the dimension j to statement I, Eij= expected performance in the dimension j to statement I, and n = number of respondents.

Therefore, the model can use SERVQUAL to serve only as a framework. Comparing customer expectations with their perceptions is based on what marketers refer to as the expectancy disconfirmation model. Simply stated, if customer perceptions meet expectations, the expectations are said to be confirmed and the customer is satisfied. If perceptions and expectations are not equal, then the expectations said to be disconfirmed.

Study area

The study was conducted in Oromia Regional State, West Shoa Zone, Ambo Town, which is far 119 km from Addis Ababa, Capital City, Ethiopia, the case of OIB Ambo Branch.

Research design

The study employed quantitative research design as numerical data collected and analyzed using descriptive and inferential statistics.

Sources of data

For the source of information primary data was collected for the specific purpose of addressing the research problem. Data was collected through structured questionnaire that filled by bank’ customers of OIB in the range of 20-28 December, 2019.

Sample size

The populations of interest were active customers of OIB getting service in Ambo Town which were about 8,387 customers. To determine sample size, the method which developed by Krejcie and Morgan (1970) was used. According to this method a sample of 367 represent 8,000 populations. Based on this, respondents from bank were selected proportionally means based on the number of the bank’ customers. The totals of 382 copies of questionnaire were distributed among customers of bank. From 382 questionnaires distributed to customers, 321 were returned, which represents 84.03% of the total respondents.

Sampling technique

As the sampling technique, probability sampling was used. In this case, respondents were selected randomly and equal chance was given for respondents by picking a number to include in the sample size. Probability sampling ensures that the sample is real representative of the population. This may help to eliminate the sampling errors and ensure the representation of the population under study.

Data collection instrument and design

Structured questionnaire was employed and distributed to the customers who have bank account. The instrument comprised 44 items composed of 22 items (22 for expectations and 22 for perceptions). Customers’ responses to their expectations and perceptions are obtained on a 5-point Likert scale (Strongly Agree =5, Agree =4, Neutral =3, Disagree=2, strongly Disagree=1).

Analysis of data

For data analysis both descriptive (mean) and inferential (paired t-test, regression and c2) statistics were used to describe the general properties of the five dimensions. Paired t-test was used to test the significance of the gaps between customers’ expectation and perception means. Based on the paired t-test result, the gaps scores for each dimension with respect to each bank were calculated by subtracting the expectation score from the expectation score. To find gap first, the score for each respondent by adding SERVQUAL scores on the features under each dimension and the total sum of these features pertaining one dimension is divided by the total respondents. Second, the score summed up for the entire respondent‘s total score and then divided by total number of respondents. The overall expectation level is showed through counting the score of each dimension and then summarizes them by diving five dimensions. In this way, respondent‘s score was counted. The score also calculated for perception of all the respondents in the same way. Statistical Package for Social Science (SPSS V.20) was used as the tool to analyze the data set.

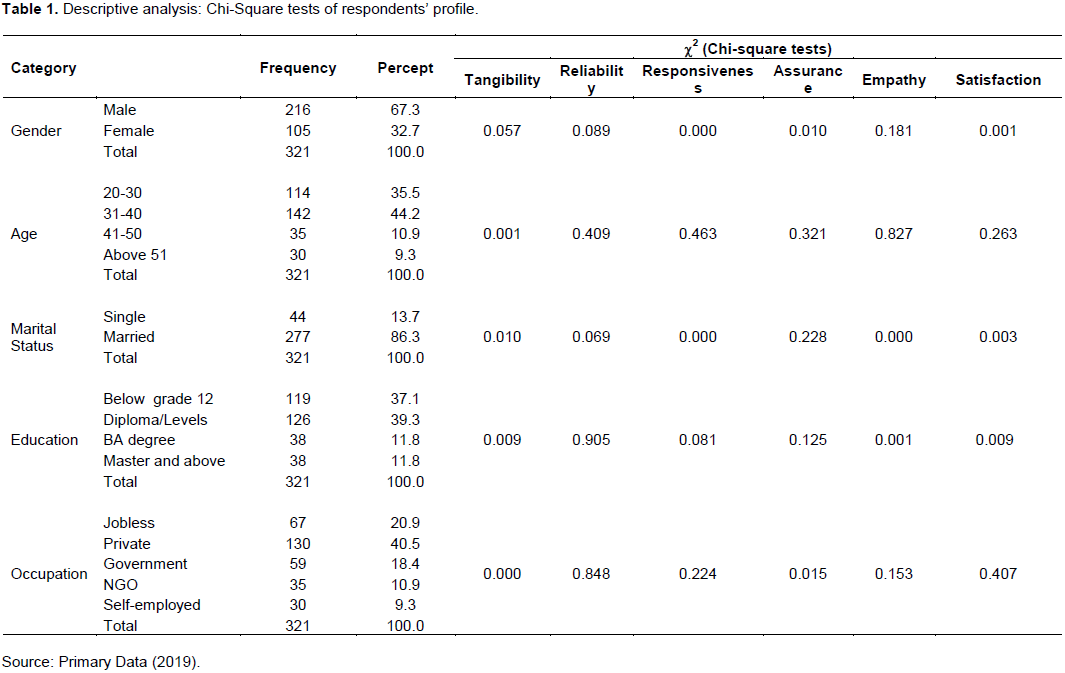

As shown in Table 1, 67.3% were males whereas 21.43% were female. Moreover, the Chi-square test revealed that there is a systematic association between gender and bank service except on the reliability and empathy by men and female respondent at 5% probability level. The findings showed that both men and women may be affected by the service provided by OIB found in Ambo Town. Likewise, Table 1 depicts distribution of respondents by age as shown in the table by indicating 20-30, 31-40, 41-50 and greater than 51 correspond with 35.5, 44.2, 10.9 and 9.3%, respectively. The Chi-square test revealed that there is no systematic association between age and service quality dimension except on the tangibility. The other demographic variable presented in Table 1 was marital status. Accordingly 13.7% were single and the left about 86.3% were married. The Chi-square test revealed that there is a systematic association between marital status and service quality dimension except on the reliability and assurance. As shown in Table 1, the distribution of respondents by education was as shown in the able by indicating below grade 12, Diploma/Levels, A degree and Master and above corresponds with 37.1, 39.3, 11.8 and 11.8%, respectively. Chi-square test revealed that there is no systematic association between education and service quality dimension on the reliability, responsiveness and assurance whereas there is relationship in case of the tangibility, empathy and satisfaction. The last respondents profile presented in Table 1 was occupation. Accordingly, jobless, private, government, NGO and self-employed shown in the table by indicating 20.9, 40.5, 18.4, 10.9 and 9.3%, respectively. The Chi-square test revealed that there is no systematic association between occupation and service quality dimension whereas there was relationship on the tangibility and assurance.

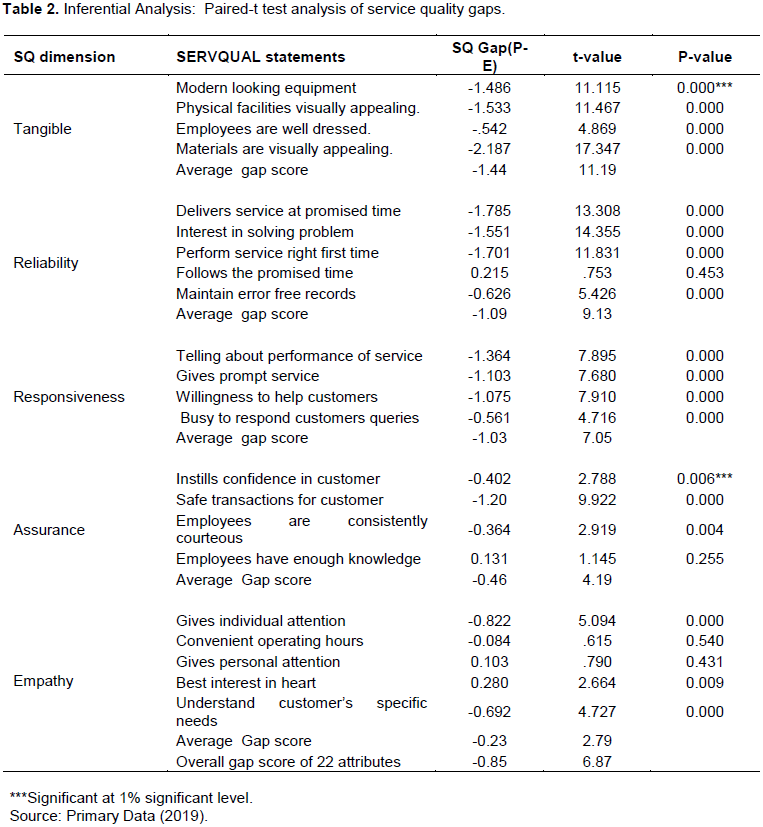

In Table 2, service quality was measured by using the five service quality dimensions, which has 22 questions relating to customers’ expectation and perception. In the result, a negative gap indicates that customers perceived level of service provided by bank did not meet their expectations. On the other hand, a positive gap indicates that customers perceived level of service quality exceeded their expectations. A comparison of bank customers’ actual perceptions of service quality with their expectations, using paired t-test, used to show a statistically significant difference on all the 22 attributes examined. The analysis was based on the "pre-post" design. That is the study consists of two measurements taken on the same customers, one before entering bank (expectation) and the other after the service is received (perception).

The gap scores of service quality of OIB for service attributes considered according to importance to the respondents based on five service quality dimensions. For each of the service dimensions the average difference (gap) between expectation and perception measures the service quality for OIB.

The estimated model is,

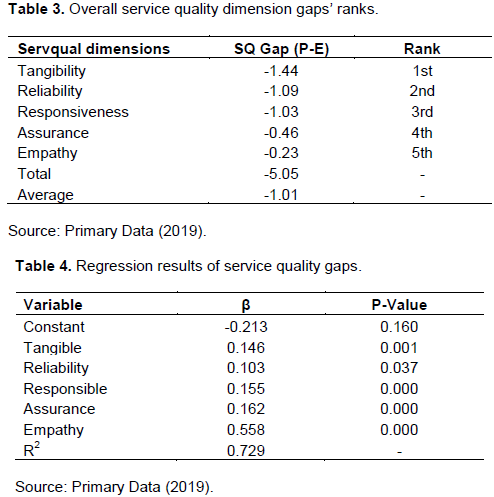

Customer satisfaction = -0.213+.146 (Tangibles) + 0.103 (Reliability) + 0.155 (Responsiveness) + 0.162 (Assurance) + 0.558 (Empathy)

Table 4 represents the regression result which shows customer satisfaction against the five dimensions of service quality. The multiple regression analysis was performed in order to test the relationships between the independent variables (tangibility, reliability, responsiveness, assurance, and empathy) and the dependent variable (customer satisfaction). With reference to the theoretical framework presented in Figure 1, the relationships of SERVQUAL and customer satisfaction were examined by regression analysis and the results are summarized in Table 4. Accordingly, all the five SERVQUAL dimensions were significantly related to customer satisfaction at the level of p < 0.05. The R-square value of customer satisfaction was 0.729 which indicate a high level of explanation of both dependent variables by the independent variables included in regression model.

Here, discusses the result by showing the consistency with the previous studies. Accordingly, Table 2 presented the inferential analysis of paired-test analysis of service quality gaps of OIB. The paired t-test showed a statistically significant difference on all service dimensions. In the first dimension, tangible, the biggest gap found was -2.187 that were in item of “materials are visually appealing”. The average gap score for this dimension was -1.44 and the paired t-test for customers’ expectations and perception was 11.19, this was statistically significant. Tangibles are used by bank to enhance its image, provide continuity, and signal quality to customers. Then, must combine tangibles with another dimension to create a service quality strategy for its customers. In the second dimension, reliability, the biggest negative gap found was -1.785 that was in the item of “tell you about performance of service”. The average gap score found in this dimension was -1.09, and the paired t-test was 9.13. This result indicated that, the reliability attributes scores of this bank was below customers’ expectations, and the gap was statistically significant. In the third dimension, responsiveness, the biggest gap found was -1.364 and this gap found in the item of “delivering service at promised time. The average gap found for reliability this was -1.03, and the paired t-test for this dimension was 7.05 and the gap was statistically significant. All this result indicated that, the attributes scores of this bank was below customers’ expectations. In the fourth dimension, assurance, the biggest gap found was -1.20 which was in item of “safe transactions for customer”. The average gap of assurance (-0.46) and the paired t-test was 4.19, which was statistically significant. This dimension is particularly important for services that the customer perceives as involving high risk and/or about which they feel uncertain about their ability to evaluate outcomes. In the fifth dimension, empathy, the biggest gap was -0.822, found in the item of “gives individual attention”. The average gap on this dimension was -0.23, and the paired t-test for customers’ expectations and perception was 2.79, which is statistically significant. This indicates that the service quality performance by this bank was below customers’ expectations. The essence of empathy functioned through personalized or customized service, that customers are unique and special. Personnel at, must know its customers by name to build relationships that reflect their personal knowledge of customer requirements and preferences. Among the five dimensions, in the tangibility dimension the largest gap was found, followed by reliability, responsiveness, assurance and empathy. Therefore, it is clear that tangibility was the dimension in which the maximum gap was found and should be monitored. From this it is possible to conclude that the overall service quality provided by this bank was below customers’ expectations from customers’ perspective. As observed from the result, almost customers’ expectation greater than perception such as the result of OIB. As Parasuraman et al. (1988), recommended frequently measuring customers’ expectations and perceptions with respect to service quality dimensions and investigating the impact of customer involvement on service quality performance of banking industry may help understand the difference between customers’ expectation and perception then, this lacks this bank (-). According to Naveen (2016), service quality is a very important element influencing customers’ satisfaction level in the banking industry but this was not recognized by this bank, which result in customer dissatisfaction and bad image on the bank’s service quality. Then the result of -on SQ gap analysis not satisfactory as expected by its customers and not much with the suggestions of past scholars on the area of service quality management area, which need the bank to revise its strategies on SQ performance.

Table 3 shows the overall service quality dimension gaps’ ranks. Overall performance, as perceived by customers was below their expectations across all service quality dimensions except on Empathy customers were satisfied in OIB. It is useful to note that the gap score for OIB on the average was -1.01 which indicates OIB customers generally rated bank' performance belowtheir expectation and it shows that there is a significant gap between customer perceptions and their expectations. In general, the image of SQ performance of OIB in Ambo Town is briefly stated in the following. The first widest gap between perceived performance and expectations was found in the dimension of tangibility. The study reveals that, from the viewpoint of OIB customers, OIB-were not good at the physical elements that makes up a bank physical attributes (tangibles) as perceived by customers. Service by its nature is intangible, because it cannot be touched, sensed, tasted or smelled. However, no service is 100% intangible as it is seen from the real world situation. It somewhat includes a tangible feature in it. The all customers of bank gave the lowest point score in this dimension. The gap on this dimension was (-1.44), which shows that the bank were not fulfilling their customers’ expectation about physical appearance, modern looking building, equipment and the physical appearance and smartness of the employees. The second widest gap between perceived performance and expectations was found in the dimension of reliability (-1.09). According to Wu (2011), the consumers consider reliability to be the most important dimension in judging service. In this dimension, the customers show -1.09 which was the highest gap score among all other dimensions. That means not satisfied according to their expectations on this dimension. The Third widest gap between perceived performance and expectations is in the dimension of responsiveness (-1.03). From this result, it is possible to infer that bank employees’ willingness to help customers and provide prompt service does not seem good in this bank branch, which are included under study. Every organization in the world has its own success factor (criteria) for instance; some depend on their scarce natural resources, while others depend on their employees. Therefore, it is necessary to train and encourage employees with the convictions of the bank as its success highly depends on them. It is clear that the success fullness of a bank could be measured by the performance of its employees. The fourth gap score among the five service quality dimensions of OIB (-0.46) was found in assurance dimensions. It reveals that, from the viewpoint of bank customers, OIB are relatively good at the knowledge and courtesy, the politeness of employees and the ability to inspire trust and confidence as perceived by them. Still it is not satisfactory it need the bank to improve its service on this dimension. The fifth gap (-0.23) between perceived performance and expectations is in the dimension of empathy. Bank in Ambo Town do not seem to be good in giving and caring individualized attention to their customers by considering their individual needs. It is known that OIB, which is currently operating in the Ambo Town, are not providing services suitable working hours for customers.

From the results, it can be noted that the independent variables displayed a statistically significant positive impact on customer satisfaction as Table 4 represents regression results on service quality gaps. From the regression table, empathy, reliability, tangibles, responsiveness, and assurance have positive effects on the customer satisfaction. If other independent variables remain constants, then 1-unit change in tangibles will increase customer satisfaction on an average (β = 0.146; p = 0.001 which indicates that tangibles have positive statistically significant impact on customer satisfaction. This finding is line with the findings of Wakefield and Blodgett (1994) who noted that tangibles positively influence customer satisfaction. Samen et al. (2013) argued that tangibles are an important service quality driver of customer satisfaction. If other independent variables remain constants, then 1-unit change in reliability will increase customer satisfaction loyalty on an average β = 037; p = 0.000. Thereby, implying that reliability has a statistically significant positive impact on customer satisfaction. This finding is in line with the findings by Kant and Jaiswal (2017) who found that reliability had a positive statistically significant impact on customer satisfaction within the Jordanian customers. If other independent variables remain constants, then 1-unit change in responsiveness will increase customer satisfaction on an average β = 0.155; p = 0.000. This finding implies that responsiveness has a statistically significant positive impact on customer satisfaction. This finding is in line with the assertions by Selvakumar (2015) who purports that responsiveness is a key driver of customer satisfaction. If other independent variables remain constants, then 1-unit change in assurance will increase customer satisfaction on an average β = 0.162; p = 0.000. In this manner, it was noted that assurance has a positive statistically significant predictor of customer satisfaction. And finally if other independent variables remain constants, then 1-unit change in empathy will decrease customer satisfaction on an average 0.558, p = 0.000. In this vein, it was noted that empathy was a positive statistically significant predictor of customer satisfaction. This finding consistent with the findings by Kumar et al. (2009) who found that empathy had a positive impact on customer satisfaction.

The main objective of this study was to examine the impact of service quality performance on customer satisfaction in case of OIB Ambo branch by comparing customers’ expectations and perceptions. Based on this the effort was made to evaluate banking service quality in OIB-currently operating in Ambo Town. Keeping this in mind, an attempt has been made in this study based on the objective of the study as follows:

(1) The result of Gap 5 analyses showed that customers’ perceptions for OIBSQ performances in Ambo Town were consistently lower than their expectations. Then, there was gap between customer expectations and perceptions of services in OIB. This indicates that the customers were not satisfied with the service performance of bank’.

(2) In the result, a negative gap indicates that customers perceived level of service provided by bank did not meet their expectations and positive gap indicates customers perceived level of service quality exceeded their expectations. Generally, customers were not satisfied with the services provided by OIB in Ambo Town.

(3) The research results revealed that the expectations of bank customers in the OIB of Ambo Town were not met. When compared the service quality performances of the banks based on the SERVQUAL gap score examined, high negative gap scores of services quality have been discovered in OIB. This indicated that customers of the bank were low in service quality performance. From this, it can conclude that OIB lacks to understand customers’ needs in detail.

(4) SQ gap is low as rated by customers. This implies that there is performing of service quality, because the SERVQUAL Gap Score obtained. From this it is possible to conclude that OIB is not happy with findings because the entire dimension have negative scores and these need to be improved otherwise the gaps will widen and cause serious problem on the performance of the bank.

The study focused to measure service quality in OIB currently operating in Ambo Town from customers’ perspectives on how it affect their satisfaction, which help bank managers to assess and improve service quality.

(1) The first widest gap between perceived performance and expectations was found in the dimension of tangibility. This reveals that, from the viewpoint of bank customers, the bank was not good at the physical element that makes up a bank physical attributes (tangibles) as perceived by customers. Then OIB should provide physical representations service that customers use to evaluate quality.

(2) The second service quality gap was found in the reliability dimension in the five SQ dimensions. As the study found that more customers of bank were dissatisfied with this dimension. To minimize this gap, the manager should provide training to employees on how to handle customers’ complaints, motivate employees to perform serve without any delay by following the promised time, perform service right first time by following the promised service and maintain error free records employees on how to reply and provide reliable information timely.

(3) The third service quality gap score examined in the responsiveness dimension. To narrow this gap, the bank should increase the understanding of their employees how to tell about performance of service to customers by providing instruction to them, gives prompt service by improving employees and managers’ abilities, show willingness to help customers’ needs, by making customer relationships, and train the frontline staff to make more responsive or make them, as they frequently respond to customers’ queries frequently by empower them.

(4) The fourth gap score among the five service quality dimensions was found in assurance dimensions. The study reveals that, from the viewpoint of bank customers, OIB are relatively good at the knowledge and courtesy, the politeness of employees and the ability to inspire trust and confidence as perceived by them. Still it is not satisfactory it need the bank to improve its service on this dimension. Then the OIB should provide trust and confidence which embodied in the person who links the customer to the OIB, such as bank. In such service contexts, the OIB seeks to build trust and loyalty between key contact people and individual customers.

(4) The fifth gap between perceived performance and expectations is in the dimension of empathy. OIB in Ambo Town do not seem to be good in giving and caring individualized attention to their customers by considering their individual needs. It is known that OIB, which is currently operating in the Ambo Town, are not providing services suitable working hours for customers. This may not equally be suitable for some customers from other organization. This means that bank do not consider their organizations employees toward customers. Then OIB should convey, through personalized or customized service, that customers are unique and special.

SUGGESTIONS FOR FUTURE RESEARCH

An attempt to extend the study coverage on a wider geographical area or city, change factors and apply advanced model could also be considered for future study in order to enhance the generalization of the findings and to further investigate the actual contribution of service quality on customer satisfaction in banking or another servicing based sector in other Oromia region and also other parts of Ethiopia.

The author has not declared any conflict of interests.

REFERENCES

|

Al-Jazzazi A, Sultan P (2017). Demographic differences in Jordanian bank service quality perceptions. International Journal of Bank Marketing 35(2):275-297.

Crossref

|

|

|

|

Ananth A, Ramesh R, Prabaharan B (2010). Service quality gap analysis in private sector bank-a customer perspective. Indian Journal of Commerce and Management Studies 2(1):245-252.

|

|

|

|

|

Angelova B, Zekiri J (2011) Measuring customer satisfaction with service quality using American Customer Satisfaction Model (ACSI Model). International Journal of Academic Research in Business and Social Sciences 1(3):232.

Crossref

|

|

|

|

|

Barnes BR, Fox MT, Morris DS (2004). Exploring the linkage between internal marketing, relationship marketing and service quality: a case study of a consulting organization. Total Quality Management and Business Excellence 15(5-6):593-601.

Crossref

|

|

|

|

|

Berry LL, Parasuraman A, Zeithaml VA (1988). SERVQUAL: A Multi-Item Scale for Measuring Consumer Perceptions of Service Quality. Journal of Retailing 64(1):12-40.

|

|

|

|

|

Choudhury K (2014). The influence of customer-perceived service quality on customers' behavioral intentions: A study of public and private sector banks, class and mass banking and consumer policy implications. International Review on Public and Nonprofit Marketing 11(1):47-73.

Crossref

|

|

|

|

|

Cronin Jr. JJ, Taylor SA (1992). Measuring service quality: a reexamination and extension. Journal of Marketing 56(3):55-69.

Crossref

|

|

|

|

|

Ennew C, Waite N, Waite R (2013). Financial Services Marketing: An International Guide to Principles and Practice; Routledge: London, UK. ISBN 978-0-415-52167-3.

Crossref

|

|

|

|

|

Ennew CT, Binks MR, Chiplin B (2015). Customer satisfaction and customer retention: An examination of small businesses and their banks in the UK. In Proceedings of the 1994 Academy of Marketing Science (AMS) Annual Conference. Springer, Cham. pp. 188-192.

Crossref

|

|

|

|

|

Gashew Tena A (NP). Credit Management in Commercial Bank: A case study of OIB. MBA Project, A. A. U (Unpublished).

|

|

|

|

|

George A, Kumar GG (2014). Impact of service quality dimensions in internet banking on customer satisfaction. Decision 41:73-85.

Crossref

|

|

|

|

|

Habtamu B (2004), Financial Performance of Ethiopian Commercial Bank. MBA Project, A.A.U (Unpublished).

|

|

|

|

|

Hall G (1995), Surviving and Prospering in the Small Firm Sector, Routledge, London.

|

|

|

|

|

Kant R, Jaiswal D (2017). The impact of perceived service quality dimensions on customer satisfaction: An empirical study on public sector banks in India. International Journal of Bank Marketing 35:411-430.

Crossref

|

|

|

|

|

Kenyon GN, Sen KC (2015). Creating a competitive advantage, In the Perception of Quality, Springer-Verlag London.

Crossref

|

|

|

|

|

Krishnamurthy R, SivaKumar MAK, Sellamuthu P (2010). Influence of service quality on customer satisfaction: Application of SERVQUAL model. International Journal of Business and Management 5(4):117.

Crossref

|

|

|

|

|

Krishnamurthy R, SivaKumar MAK, Sellamuthu P (2019). Influence of service quality on customer satisfaction: Application of SERVQUAL model.

|

|

|

|

|

Kumbhar VM (2012). Reliability of "EBANKQUAL" scale: Retesting in internet banking service settings. Business Excellence and Management 2(2):13-24.

|

|

|

|

|

Lau MM, Cheung R, Lam AY, Chu YT (2013). Measuring service quality in the banking industry: A Hong Kong based study. Contemporary Management Research 9:263-282.

Crossref

|

|

|

|

|

Lewis BR (1993). Service Quality Measurement. Marketing Intelligence and Planning 11(4):4-12.

Crossref

|

|

|

|

|

Mari? D, Marinkovi? V, Mari? R, Dimitrovski D (2016). Analysis of tangible and intangible hotel service quality components. Industrija, 44(1):7-25.

Crossref

|

|

|

|

|

Mauri AG, Minazzi R, Muccio S (2013). A review of literature on the gaps model on service quality: A 3-decades period: 1985-2013. International Business Research 6(12):134.

Crossref

|

|

|

|

|

Mualla ND (2011). Assessing the impact of sales culture on the quality of bank services in Jordan. Jordan Journal of Business Administration 153:1-31.

|

|

|

|

|

Munusamy J, Chelliah S, Mun HW (2010). Service quality delivery and its impact on customer satisfaction in the banking sector in Malaysia. International Journal Innovation Management Technology 1:398-404.

|

|

|

|

|

Navaratnaseel J, Periyathampy E (2014). Impact of Service Quality on Customer Satisfaction: A Study on Customers of Commercial Bank of Ceylon PLC Trincomalee District. In Reshaping Management and Economic Thinking through Integrating Eco-Friendly and Ethical Practices, Proceedings of the 3rd International Conference on Management and Economics, 26-27 ; Faculty of Management and Finance, University of Ruhuna: Ruhuna, Sri Lanka pp. 359-364.

|

|

|

|

|

Naveen S (2016). "K. Restructuring the SERVQUAL Dimensions in Banking Service: A Factor Analysis Approach in Indian Context." Pacific Business Review International 1:76-91.

|

|

|

|

|

Parasuraman A, Zeithaml VA, Berry LL (1985). A conceptual model of service quality and its implications for future research. Journal of Marketing 49(4)41-50.

Crossref

|

|

|

|

|

Parasuraman A, Zeithaml VA, Berry LL (1988) Servqual: A multiple-item scale for measuring consumer perc. Journal of Retailing 64(1):12.

|

|

|

|

|

Parasuraman, A.; Zeithaml, V.A.; Berry, L.L (1990). A conceptual model of service quality and its implications for future research. Journal of Marketing 49:41-50.

Crossref

|

|

|

|

|

Peng LS, Moghavvemi S (2015). The dimension of service quality and its impact on customer satisfaction, trust, and loyalty: A case of Malaysian banks. Asian Journal Business Account 8:91-122.

|

|

|

|

|

Rauch DA, Collins MD, Nale RD, Barr PB (2015). Measuring service quality in mid-scale hotels. International Journal of Contemporary Hospitality Management 27:87-106.

Crossref

|

|

|

|

|

Sadek DM, Zainal NS, Taher MSIM, Yahya AF, Shaharudin MR, Noordin N, Zakaria Z Jusoff K (2010) Service quality perceptions between cooperative and Islamic Banks of Britain. American Journal of Economics and Business Administration 2(1):1-5.

Crossref

|

|

|

|

|

Saghier N, Nathan D (2013). Service Quality Dimensions and Customer's Satisfactions of Banks in Egypt. 20th International Business Research Conference. 4-5 April 2013, Dubai, UAE.

|

|

|

|

|

Sanjuq G (2014). The impact of service quality delivery on customer satisfaction in the banking sector in Riyadh, Saudi Arabia. International Journal of Business Administration 5(4):77.

Crossref

|

|

|

|

|

Selvakumar JJ (2016). Impact of service quality on customer satisfaction in public sector and private sector banks. PURUSHARTHA-A Journal of Management Ethics and Spirituality 8(1):1-12.

|

|

|

|

|

Shahraki A (2014). Evaluation of customer satisfaction about Bank service quality. International Journal of Industrial Mathematics 6(2):157-168.

|

|

|

|

|

Shanka MS (2012). Bank Service quality, customer satisfaction and loyalty in Ethiopian banking sector. Journal of Business Administration and Management Sciences Research 1(1):001-009.

|

|

|

|

|

Sharmin S, Tasnim I, Shimul D (2016). Measuring Customer Satisfaction through SERVQUAL Model: A Study on Beauty Parlors in Chittagong. European Journal of Business and Management 8:97-108.

|

|

|

|

|

Siddiqi KO (2011). Interrelations between service quality attributes, customer satisfaction and customer loyalty in the retail banking sector in Bangladesh. International Journal of Business and Management 6(3):12.

Crossref

|

|

|

|

|

Soteriou AC, Stavrinides Y (1997). An internal customer service quality data envelopment analysis model for bank branches. International Journal of Operations and Production Management 17(7-8):780-91.

Crossref

|

|

|

|

|

Trivedi PK (2015). Customer relationship management - The Indian perspective. International Journal on Customer Relations 3(2):16-20.

Crossref

|

|

|

|

|

Wu SI, Chan HJ (2011). Perceived service quality and self-concept influences on consumer attitude and purchase process: A comparison between physical and internet channels. Total Quality Management 22(1):43-62.

Crossref

|

|

|

|

|

Yarimoglu EK (2014). A review on dimensions of service quality models. Journal of Marketing Management 2(2):79-93.

|

|

|

|

|

Zeithaml VA, Parasuraman A, Berry LL, Berry LL (2000). Delivering quality service: Balancing customer perceptions and expectations. Simon and Schuster.

|

|