ABSTRACT

COVID-19 pandemic posed a great challenge for the financial industry in Ethiopia leading to an increase of mobile banking services which becomes a new normal and necessity for users of financial services. The study seeks empirically to test the impact of m-Banking quality service on Bank of Abyssinia customer’s satisfaction during COVID-19. A quantitative study approach and a descriptive research design with survey research method were used. East Addis Ababa district office was selected as a sample using a non-probability design in the form of convenience sampling to collect data. Accordingly, 296 structured questionnaires were randomly distributed where 240 fully filled survey questioners were retrieved for analysis. The findings from the study showed that e-service quality dimensions are significant forerunner to customer satisfaction, and, among the dimensions, security, reliability and ease of use have a great influence on e-service quality and these dimensions are perceived critical by the Abyssinia Bank customers. All the six predictor variables reliability, efficiency, security, responsiveness, empathy, and ease of use were found to be positively influencing Abyssinia banks m-banking customer satisfaction, while the predictors ease of use and reliability were found to have a significant impact and the highest predictor in absolute numbers 0.2444595 and 0.2200381, respectively. Thus, the study recommends that Abyssinia bank management as a service provider should pay attention to the identified dimensions specifically, on ease of use and reliability of m-banking services while devising e-banking strategies to provide high service quality and satisfaction to its customers.

Key words: Abyssinia Bank, customer satisfaction, e-service quality, mobile banking.

Advances in innovation sway service delivery alternatives and approaches within service industries. Accordingly, one of the early adopters of technology is financial institutions which greatly change the service landscape and business models of banks (De Leon, 2019). Within the financial services sectors in different countries, banks are now effectively empowering clients towards utilizing online services (Al-Hawari et al., 2005). Furthermore, the developments also decrease workforce numbers and physical offices which may adversely affect client

perception of service quality because of decreases in human communication in service exchanges (Jabnoun and Al-Tamimi, 2003).

Mobile banking, in solid terms, alludes to "a technology where a client is connected with a bank via their mobile devices allowing them to do financial transactions” (Alalwan et al., 2017; Laukkanen, 2016; Laukkanen and Kiviniemi, 2010) supplementing the current channels, for example, automatic teller machine and Internet banking including features of mobile payment capability and mobile wallet capacities (Moser, 2015; Wessels and Drennan, 2010). Brick and mortar bases banks are now forced to reinvent themselves to become more of digital banks since now that fintech firms are joining the banking industry easily (VISA, 2017).

Thus, in the current environment for banks to ensure success in the service delivery process providing a reliable mobile banking service is crucial (Shankar et al., 2019) through development in this fragment of the financial services industry proceeds nevertheless customer reservations towards various issues related to mobile banking services provided, for example, security/ protection (Sreejesh et al., 2016),connection disappointments and the apparent danger of character/ individual data theft (Rawashdeh, 2015).

Statement of the problem

Mobile options available to consumers have expanded considerably in only a few years in Ethiopia and bank of Abyssinia was one of the private banks in Ethiopia to adopt the use of mobile phone in conducting some banking transactions in 2014 in collaboration with TEMENOS AG CO. The bank introduces the service in 2015; since then the number of users keeps on rising. There were 15,000 mobile banking users in 2015, where the number of users raised to 58,359 in year 2016, consequently 132,103 users in years 2017, and 213,215 in the year 2018, now the bank’s mobile banking users are 365,390 end of 2019 out of the total customers 1,283,300 the bank has (BA Annual Report, 2019).

The bank’s mobile banking users will be expected to rise further considering the number of households in Ethiopia witnessing a marvellous influx of portable electronic devices; for example, mobile telephone penetration rate of Ethiopia (telecom density) was 41.8% in 2016/2017; while mobile density was 43% in 2017/2018. Correspondingly in the year 2018/2019, mobile subscribers were 42.92 million which increased to 44.4 million 2019/2020 (NBE, 2018). With adoption having immediately spread to a mass of users, even the financial business could not move away from the pattern. To be sure, surmising from the ever-extending number of cell phones devices with a web access, strikingly 3G, portable banking has developed quickly (Laukkanen, 2007).

In this way, progressing from conventional branch tasks and first-generation web-based solutions to the mobile web and portable applications, banks face new difficulties in managing and building noteworthy relation with their client base. Especially, the unprecedented Covid-19 virus has disrupted our life completely and caused over two hundred thousand deaths so far worldwide (WHO, 2020). Nonetheless, the virus has also presented banks with an opportunity to reassess their relationship with customers and come up with innovative solutions by devising a flexible business strategy to ensure business continuity. For instance, e-service is self-administration advances proposed to supplant human collaboration, a significant segment of relationship marketing of human/PC intelligent interactive system dialogue (Sang and Rono, 2015). On the other hand, m-banking additionally includes impressively improved adaptability, pervasiveness, connectivity (Ha et al., 2012), and comes loaded with proactive abilities such as alerts, short message pop-ups and geolocation for tweaking the service offer and capturing the advantage of social interaction in the service. With the coming of mobile banking services, new knowledge is required in order to understand completely the mind-boggling features of customer and banks relationships (Lu et al., 2014).

In the present serious condition, customers are progressively mindful of observing gaps among banks corresponding to their e-service quality and how utilizing proficient innovations and updating/redesigning its status intermittently when required. So, banks need to create powerful mobile strategies to draw in and hold mobile clients for example, advancing features advantages and value of the mobile services (Laukkanen, 2016). Be that as it may, service quality has additionally been explored in e-environment and keeping in mind that studies have uncovered fascinating new discoveries, they have gotten less consideration in e-banking (Ayo et al., 2016).

Moreover, much of the research has tended to focus mainly on factors which impact attitudes towards banking and m-banking adoption standpoint and from a relationship marketing perspective (De Wulf et al., 2001; Shaikh and Karjaluoto, 2015). To date, few studies have probed the impact of mobile service quality on satisfaction (Sagib and Zapan, 2014; Thakur, 2014) in different countries where m-banking service is matured and to the researcher knowledge further studies are required studying the impact of m-service quality on satisfaction in late adopters environment such as in Ethiopia where basic set of services are provided and this study mainly feel that gap.

Furthermore, a great part of the research in general spotlight principally on factors which impact attitudes towards banking and mobile financial adoption outlook and from a relationship advertising point of view (De Wulf et al., 2001; Shaikh and Karjaluoto, 2015). So, few studies have tested the effect of mobile service quality on satisfaction under normal circumstance (Sagib and Zapan, 2014; Thakur, 2014) in various nations. To the researcher’s knowledge, the impact of mobile service quality on customer’s satisfaction during covid-19 lockdown in Ethiopian private banks perspective is yet to be surveyed. This study seeks to fill that gap.

Mobile banking initiatives in Ethiopia

Technology enabled finance landscape in Ethiopia is still in its early stages having great potential with the opening of regulations and subsequent innovation on the technological side. Generally, a few different models, from mobile network operators (MNO)-owned platforms, to independent third-party platforms and bank-managed platforms have prevailed to varying degrees of success in Ethiopia focusing around a bank-owned platform (CBE-birr) and a pair of third-party platforms: m-Birr and Hello-Cash. Beyond basic wallet functionality, all require partnerships with MFIs or banks as they are not able to provide financial services themselves (Busara Center, 2019).

Looking at the overall digital transaction volume (ATM, PoS, M-Banking, Internet Banking) Ethiopia has seen significant growth over the past 3 years. Digital transaction value growth per annum (128%) has outpaced digital transaction volume growth (105% per annum) indicating that average digital transaction value has been increasing over time (World Bank, 2019). In 2018, the average Ethiopian adult made a digital transaction 1.5 times in a year. In contrast, in 2015, Nigerians transacted digitally more than 4 times as often, South Africans more than 40 times as often and the average EU citizen more than 167 times as often. Looking at the data it can be said Ethiopia is clearly showing strong growth in digital transaction volume but the transaction volume per adult is still below regional and international benchmarks (World Bank, 2015; The Global Economy, 2016).

The regular m-banking services that all banks offer in Ethiopia today incorporate disbursement of inward remittances, cash in and out, person to business payments, business to person payments, person to government payments, government to person payments and person to person payments (Finextra, 2018). The most significant element of these services is that customers can access it through any model and brand of mobile phones in Ethiopia.

Mobile service quality

Lin (2013) characterizes m-banking quality as a worldwide consumer decision of the quality and greatness of mobile content delivery with regards to m- banking. Studies investigating the components of mobile financial service quality (Sagip and Zapan, 2014; Jun and Palacios, 2016) and inspirations for utilizing/embracing mobile banking (Hanudin et al., 2012; Chemingui and Iallouna, 2013; Ha et al., 2012) utilize measurements fundamentally connected with utilitarian consumer value, for example, perceived usefulness, perceived risk, perceived compatibility (with lifestyle or device), responsiveness, reliability, security, and perceived cost and ease of use. Curiously, a few authors have coordinated into their model a few measurements more with regards to decadent purchaser values, dimensions especially applicable to the mobile setting, for example, perceived enjoyment (Hanudinet al., 2012; Chemingui and Iallouna, 2013), as well as a social dimension (Singh and Srivastava, 2014; Hanafizadeh et al., 2014).

Majorly, people utilize advanced mobile phones and mobile applications for most of their social online life communication (Kumari, 2016). Indulgent components, for example, perceived enjoyment and social aspects can assume a significant role in assessing the quality of expertise, data-based Web service which will in general dominate in e-banking (Bauer et al., 2005). An upgraded comprehension of the points of interest of mobile financial services quality and how the last identifies with responsibility, trust and satisfaction is expected to recognize the essential drivers of effective customer relationships in the financial segment. So as to hold the clients and continue developing in a virtual market, there is a need to gauge the consumer loyalty with service rendered from time to time (Hall, 1995; Saha and Nesa, 2011). Customer satisfaction is estimated by means of e-service quality (Loiacono et al., 2000; Yoo and Donthu, 2001; Abdullah, 2005; Parasuraman et al., 2005; Zeithaml et al., 2000; Nadiri et al., 2009) as it is viewed as a key contribution to customer satisfaction.

A few academic studies have been done on appraisal of e-service quality in various settings across various sectors. An investigation on web banking showed that clients put more accentuate on the nature of service if there should be an occurrence of picking a particular bank (Nandan and Upadhyay, 2008). Khalil (2011) thought about five measurements in his study: tangibility, assurance, empathy, reliability, and responsiveness to evaluate the satisfaction with online banking service. Additionally, Jun and Cai (2001) set forward seven measurements to survey the e-service quality and these measurements were ease of use, information, access, website design, courtesy, responsiveness, and reliability. Another study (Sohn and Tadisina, 2008) considered seven elements of e-service quality (trust, speed of delivery, reliability, ease of use, customized communication, web site content, and functionality) in their examination to gauge clients’ perception about online financial institutions. However, Li et al. (2009), in their observational investigation on online travel service, considered nine measurements: ease of use, website design, reliability, system responsiveness, availability, privacy, empathy, experience, and trust. They found that reliability, ease of use, trust, system availability and responsiveness contribute a lot to customer satisfaction.

Another study (Miran and Rasha, 2013) in Egypt explored customers’ perception about e-quality measurements and their significance. They utilized triangulation approach and found that each of the nine measurements (usability, reliability, privacy, responsiveness, incentives, assurance, empathy, efficiency, and fulfilment) of e-service has noteworthy effect on customer satisfaction.

e-Service quality (e-SERVQUAL)

SERVQUAL was developed basically with regards to face to face experiences and has experienced development over the timeframe. In the advanced online condition, distinctive service quality measurements with new items become significant. To quantify electronic service quality, Parasuraman et al. (2005) created 22-item scale called E-S-QUAL. Zeithaml et al. (2002) created a 7-dimesion scale in which, the initial four measurements establish the center e-SERVQUAL scale (efficiency, fulfilment, reliability, privacy, responsiveness, compensation, contact); however, the last 3 become an integral factor just when online clients have questions or run into problems (Zeithaml et al., 2002). Therefore, measuring the nature of e-service experience incorporates signs that happen previously, during and after the e-purchase transaction and it is plausible just through e-servqual. Therefore Zeithaml, et al. (2000) recommended that characteristics like efficiency, reliability, fulfilment, privacy, responsiveness, compensation are the appropriate measures to survey the e-service quality, or e-SERVQUAL.

Level of consumer satisfaction towards e-SERVQUAL as off late is essential for associations to decide if they have given a quality and successful services to their clients. For Sahadev and Purani (2008), more prominent infiltration of the internet and the development of new procedure to service purchasers through the electronic media, shoppers depend progressively on online venders and service providers for even the most essential errand and services. Rapp et al. (2008) expressed that numerous organizations have started the utilization of e-business to give e-services to their purchasers and business partners. Request from clients towards productive and quicker services has caused the organization to urge giving e-SERVQUAL to clients.

In a service industry like banking, there is a requirement for high client connection as a bank can win client trust just by fulfilling their necessities. Presently, decision is supplanted by online communication such as banks application or site; the organization needs to fulfil clients by giving the most significant level of service quality (Schaupp and Belanger, 2005; Dai and Lee (2018); Salehi et al. (2014). Osman et al. (2006) looked at service quality and consumer satisfaction in Malaysia and reasoned that there is a noteworthy connection between the two. As needs be, this investigation is based on customary e-SERVQUAL model and includes one more measurement from Parasuraman (2005) and Zeithaml et al. (2000)’s study.

Mobile banking service quality scale

As no service quality scale for m-banking could be found in existing literature, a multi-dimensional scale including reliability, efficiency, security/privacy, responsiveness, empathy, and ease of use were drawn from the previous literature in seeking to assess bank of Abyssinia’s mobile banking service quality.

Reliability

Reliability of the mobile financial service alludes to the likelihood that the banks will agreeably proceed as intended and reliably give a similar service through a cell phone as it did through physical branches (Sharma and Malviya, 2011). At the end of the day, at any point a client will endeavor to do banking transaction through mobile device; the service will have specialized accessibility and provides mistake free services (Ganguli and Roy, 2011). Regularly, customers' impression of unwavering quality for a service assumes an indispensable role in estimating the performance of that service (Munusamy et al., 2010). Especially, for nations like Ethiopia where the idea of m-banking is generally new, customers' impression of reliability with respect to such service should be examined. This study, therefore, proposes the following hypotheses:

H01: Reliability significantly influences satisfaction of mobile banking service customers.

Efficiency

From a customer's point of view, mobile banking service must be viewed as productive if the system is easy to utilize, organized appropriately, and requires least data to be input by the customers (Sharma and Malviya, 2011). To be exact, how rapidly customers can get to the mobile banking service, how adaptable is the user interface of the system and how rapidly or timely the system reacts to demands for banking data or transaction by the customers every one of these features characterizes the efficiency of the m-banking service (Ganguli and Roy, 2011).These characteristics by and large impact performance expectancy of a service as they control the view of system quality and at last influence the utilization expectation of clients (Nelson et al., 2005). Thus, proficiency of the m-banking service can be an intriguing determinant for this study. As needs be, the study proposes the accompanying hypothesis:

H02: Efficiency significantly influences satisfaction of mobile banking services customers

Privacy/security

Security can be characterized as how much the mobile banking service is sheltered and shields clients' banking data from any intrusion (Sharma and Malviya, 2011). Nations like Bangladesh in general experience the ill effects of innovative deficiencies – a motivation behind why clients regularly object to the transmission of their own personal bank account or transactional data over some other interchange channels outside the physical branch of the banks (Ganguli and Roy, 2011). Consequently, if privacy issues identified with the mobile banking service can be guaranteed by the banks, client will naturally be persuaded of the performance of the service and in this manner, prompting an expanded utilization of m-banking services in Ethiopia (Angst and Agarwal, 2009). In such manner, security can be a significant quality determinant of the m-banking service. Thus, the study proposes the accompanying hypothesis:

H03: Privacy/Security of mobile banking service significantly influences customer satisfaction.

Responsiveness

Responsiveness can be characterized as the readiness to support clients and to offer prompt types of assistance (Lau et al., 2013). As far as m-banking services, it very well may be additionally clarified by the banks' capacity to comprehend the customers' issues and to offer exact financial related types of assistance (Bedi, 2010). Munusamy et al. (2010) and Lau et al. (2013) found a positive connection among responsiveness and consumer satisfaction, as the more responsive the service is the more fulfilled the customer will be for that service. In light of this proof, the study utilized responsiveness as a factor that will manage clients with respect to m-banking service appropriation and the study sets the accompanying hypothesis:

H04; Responsiveness significantly influences satisfaction of mobile banking service customers.

Empathy

The dimension of empathy for the most part includes care and customized consideration that a firm can give to its clients as far as accessibility, communication and understanding of the service being given (Bedi, 2010). Especially for delicate services like banking transactions, clients consistently value an inviting and chivalrous condition. Consequently, if the banks show genuine interest, energy, and earnestness toward the clients' cutting-edge banking needs, it will naturally lead clients towards the utilization of alternate financial delivery services like mobile banking (Ganguli and Roy, 2011). In view of this point, past studies like Aghdaie and Faghani (2012) and Lau et al. (2013) contend that empathy from the service supplier can go about as a determinant of the performance of that service. Thus, empathy has been considered as an impacting factor in the model of this study. Therefore, the study hypothesizes as follows:

H05; Empathy significantly influences satisfaction of mobile banking service customers.

Ease of use

Ease of use alludes to that which is utilized and underpins intelligence to upgrade self-viability with the medium (Brangier et al., 2015). In an assessment of the m services segment in Korea, Kim and Lee (2001) indicated that perceived usefulness and ease of use essentially sway consumer satisfaction. In view of the discoveries of the study and considering the idea of the service moderately being new in Ethiopia the study hypothesizes as follows:

H06; Ease of use significantly influences satisfaction of mobile banking service customers.

Research approach

The study used quantitative approach, which is generally associated with positivism, especially since it uses predetermined and highly structured data collection techniques. A quantitative research examines relationships between variables, which are measured numerically and analyzed using a range of statistical and graphical techniques; it often ensures the validity of data, and typically involves collecting survey data (Cooper and Schindler, 2014) in a cross-sectional study (Fowler, 2009).

Research design

Causal research primarily explains why events occur by defining the cause-and-effect relationships amongst variables and suitable when the research problem is already well documented (Zikmund et al., 2003). The study is a casual research used in formalized studies that are typically structured with clearly stated investigative questions by assisting the estimates of the proportions of a population that have these characteristics and discovery of associations among different variables (Cooper and Schindler, 2014).

Population, sampling frame and sampling technique

For the present study, the target population comprises bank of Abyssinia, customers of east district branches in Addis Ababa; there were a total of 180,338 customers. However the study specifically focused on the five selected branches in east district, “Airport, Bole Medhanialem, Misrak, Moenco and Rwanda Mazoria” branches (total branch population of 10,520) in Addis Ababa, from March 5, 2020 to April 25, 2020. The selection of the 5 branches was based on proximity for data collection, and willingness of branch managers to cooperate for data collection by liaising with customers at the counter. For the purpose of this study, non-probability design in the form of convenience sampling was used (Sekaran, 2003). This enables the researcher to have the freedom to choose bank branches and random sampling probability design was used for customer from east district Addis Ababa.

Sample size

Salant and Dillman (1994) cited in Chuan (2006) point out that three of the most common factors influencing the size of the sample are the size of the population, tolerable sampling error, and variation of the variable of interest within the population. Using a confidence level of 90%, the margin error of 5% and an alpha level of 0.05 which are common in exploratory management studies, a sample of 264 was selected as per Kotrlik and Higgins (2001) table for this study (Annex 1).

Source and instruments of data collection

A survey questionnaire was adopted (self-administered) that uses a five-point Likert scale to measure the variables employed to obtain quantitative data. By reviewing the works of prominent researchers, Al-Hawari et al. (2005), Curran and Meuter (2005), Parasuraman et al. (2005) and Zeithaml et al. (2002), variables for assessment of mobile banking service quality were identified and incorporated into the structured questionnaire. In order to validate the reliability, the questionnaire was pilot tested using 30 respondents, representing 10% of the total sample size, who were not considered as the representatives of the study population (Figure 1).

Procedure of data collection

Data were collected by using self-administered questionnaire from selected east district branches, Airport, bole medhanialem, Misrak, Moenco and Rwanda Mazoria branches. The questionnaire was distributed to the respondents with the help of branch managers before customers were briefed about the purpose of the research; then it was hard covered and the participants were requested to fill up the questionnaire following the instructions provided. Then the questionnaire was immediately collected at the service desk once the customers were done filling out.

Method of data analysis

Data analysis was carried out using the STATA version 16. For statistical analysis, descriptive statistics (frequency, mean and standard deviations) were used to analyze the perception of respondents towards mobile banking service and mobile banking service quality measurement items used in the study, while, inferential statistics (Pearson correlation, multiple regression and factor analysis statistical techniques) were used to analyze the respondents’ level of agreement or disagreement in the differences between the variables employed in the study; to ensure internal consistency among the items included in each of the scales, they were estimated using a Cronbach’s coefficient alpha.

Description of sample

From March 5, 2020 to April 25, 2020, a total of 296 (including 30 pilot participants) survey instruments were distributed and 240 fully filled survey questioners were obtained. Since the researcher has been an employee in one of the east district branch offices for long and already has prior relationship with branch offices greatly helps to collect self-administered survey instruments from the participants (Table 1).

Factor analysis (Confirmatory factor analysis)

A factor analysis can be exploratory or confirmatory in nature. In this study, a confirmatory factor analysis (CFA) was used for confirmatory purpose in order to show only the relationships between a factor and specific item since the researcher has a clear expectation of the factor structure (since the proposed scale adapted in the study has been proposed by previous researchers) and the researcher wants to test for the expected structure. Furthermore, the varimax rotation, basically the default option for orthogonal rotation in Stata, is used for CFA, a procedure runs based on a few variables having a high loading; while the remaining variables’ loadings will be considerably smaller to maximize the dispersion of loadings within factors (Kaiser, 1958, 1974; Mooi et al., 2018).

Preliminary analyses and checking assumptions

In order to conduct confirmatory factor analysis, the following assumptions are checked accordingly.

The variables that should be used to identify underlying dimensions (factor analysis) are identified, that is, Reliability, Efficiency, Security, and Responsiveness Empathy Ease of use Satisfaction.

Sample size

A “satisfactory” sample size is the primary data requirement needed. This means that a sample size that enables the analysis achieves a high degree of statistical power that can lead to finding significant results is greater, if they are possible. The easiest way to do this is to correlate all the dependent and independent variables.

The first line in Table 2 represents the number of observations (obs=240) and error rate Bonferroni-adjusted significance level. Green (1991) and VanVoorhis and Morgan (2007) rule of thumb proposes that at least 104 + k observations are desirable to test whether a coefficient is significant or not, where k is the number of independent variables (best practical when using less than 15 number of independent variables). Accordingly, the study has 6 independent variables that satisfy this criterion. Alternatively, the study has a sufficient sample size applying another strict criterion of VanVoorhis and Morgan (2007) that requires at least 30 observations per variable in order to sense smaller effects (an expected R2 ≤ 0.10).

In Table 2, to check whether there are highly correlated variables or not in the study pairwise correlations are examined. Hence, the study variables are found to be sufficiently correlated (p-values below 0.05); furthermore the relationship between each independent variables and dependent variable along their collinearity is indicated accordingly.

Independent variables need to vary

Determining if the independent variables in the studydisplay some variation or not is important in order to make sure that regression model can be estimated. Thus, no variation in the dependent variable (that is, if a constant term is not included in the regression equation), R2 can be negative, and fundamentally could lead to potentially severe biases in the slope coefficient estimates (Mooi et al., 2018).

Table 3 result indicates that the number of observations is 240 and the number of cases fully observed in the study where each variable displays a large number of non-missing observations:

Dependent variable scale type

The dependent and independent variables scale is interval scaled. Specifically, seven 5-point Likert scales create the mean of twenty-four items that form the variable used in the study which meets the OLS regression data assumptions.

Collinearity

No or little collinearity present among independent variables is the last data requirement. Collinearity is a data issue that arises if two independent variables are highly correlated. Perfect collinearity occurs if two or more independent variables are entered containing exactly the same information, therefore yielding a correlation of 1 or-1 (that is, they are perfectly correlated) (Mooi et al., 2018).

In order to identify the collinearity variance inflation factor (VIF) calculation is required and the rule of thumb is that a VIF value ≥10 generally indicates the presence of multicollinearity problem (Hair et al., 2013).

As indicated in Table 4, all VIF values are below 10 indicating the absence of multicollinearity. Having met all the described requirements for factor analysis, CFA analysis with a varimax rotation is used to determine the number of factors where the minimum eigenvalues of one (1) are retained.

Internal consistency reliability test

Reliability is the ability of an instrument/system to maintain its quantity and quality under specified condition for a specified time and performs the intended function adequately for a given period of the time under the stated operating condition or environment (Mooi et al., 2018). Cronbach’s α (pronounced as alpha) is used to measure scales reliability in this study.

The alpha value is inflated by a larger number of variables and there is no set interpretation as to what an acceptable alpha value is but the alpha coefficient generally varies from 0 to 1. A rule of thumb that applies to most situations, 0.70, is an agreed lower limit for alpha but a value of 0.60 is acceptable mostly in exploratory studies; while in more advanced research a value of >=0.80 is regarded as suitable (Hair et al., 2011).

The scale result shows a high degree of internal consistency with a value of 0.7525 is greater than that compared to the rule of thumb of Cronbach’s Alpha value of 0.70 that applies for most general situations (Table 5).

Determining the number of factors

Table 6 output shows that 240 observations are used in the analysis and CFA analysis returned seven factors as expected since the eigenvalues for each factor returned generally are greater than the Kaiser criterion threshold (that is, eigenvalue >1). Accordingly, a larger portion of variance extracted by the first factor (eigenvalue of 7.20655) explained 34.79% of the total variance while factor two extracts an eigenvalue of 3.55608 explaining 17.17% of the variance (Annex IV).

Furthermore, the result in Table 6 indicates the cumulative variance extracted by the seven factors is 0.9366 or 93.66% of the variance; implying that the returned factors ability is highly satisfactory in explaining the variation. Factor loadings (pattern matrix) and unique variances show the result of rotation to achieve what is called simple structure, that is, high factor loadings on one factor and low loadings on all others (loadings vary between ±1.0). As indicated, loading value ≥0.5 indicates the strength of relationship between a particular variable and a particular factor and variable variance are reproduced well as indicated by very low uniqueness values; while 0.4302 is found to be the highest uniqueness value, signifying a communality of 1–0.4302 = 0.6 which is clearly above the 0.50 threshold.

Kaiser-Meyer-Olkin (KMO) test

KMO indicates the adequacy of the study variables for conducting factor analysis result and generally the threshold KMO value >0.50 is acceptable in order to interpret the CFA results with confidence. Accordingly, the result in Table 7 discloses a KMO value of 0.5645 (greater than the threshold 0.50) as well as the specific MSA values of most variable are all above the threshold value of 0.50 except R2, R3, EF1, EF2, RES3, and EOU1.

To interpret the factor solution, rotated factor loadings using Varimax under orthogonal rotation was conducted by applying the Kaiser normalization and the rotated factor loadings result obtained after rotation (Annex IV) is the same as the unrotated CFA output (Table 6). This indicates the analysis extracts seven factors that jointly capture 93.66% of the variance drawn from a total of 240 observations.

Regression analysis data requirements

The relationships between the dependent variables and independent variables is analysed using regression analysis, specifically a multiple regression is conducted to determine if the independent variables have a significant effect on dependent variables to make predictions. Thus, there are prerequisites that need to be checked and fulfilled before undertaking a regression analysis (Mooi et al., 2018). These include: sample size (Table 2), independent variables need to vary (Table 3), dependent variable scale type (Table 4) and multicollinearity (Table 4).

Regression model specification and estimation

Model specification

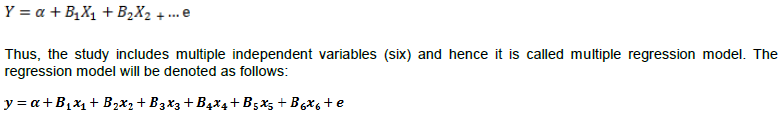

The selected variables for this model are exactly known, Satisfaction as dependent variable, and Reliability, Efficiency, Security, Responsiveness, Empathy, and Ease of use as independent variable. Alternatively, the confirmatory factor analysis indicated that 24 items loaded exactly into seven factors as excepted and thesame factors were used in the regression model as independent variables and the regression models are generally denoted as follows:

where Y is the independent variable customer satisfaction, and x1-x6 representing the independent variables Reliability, Efficiency, Security, Responsiveness, Empathy, and Ease of use, the ß1- ß6 indicates the (regression) coefficients and e indicates the error term.

Model estimation

Model estimation refers to applying a technique in order to estimate a regression model. One of the most common methods of estimating linear regression models is ordinary least squares (OLS) which is a statistical technique used to estimate a linear regression models; it involves choosing the model that minimizes the residual sum of squares, with no constraints imposed. The best fit calculation between the regression line and a set of observation uses squared distances rule which is a random but effective way used for estimation (Hill et al., 2008).

Assumptions underlying classical linear regression model

A linear regression model analysis must meet the following list of assumptions stated and the violation can lead to an invalid estimation result Accordingly, the four linear regression model assumptions violation need to be checked in order for the model to provide valid prediction results (Mooi et al., 2018):

(a) the regression model can be expressed linearly (Screen plot and Ramsey’s RESET test)

(b) the average value of the errors is zero,

(c) variance of the errors is constant (homoscedasticity) (Breusch-Pagan test), and

(d) the covariance between the error terms (no autocorrelation).

Linearity assumption

The first assumption dictates that regression model must be linear and must be indicated as:

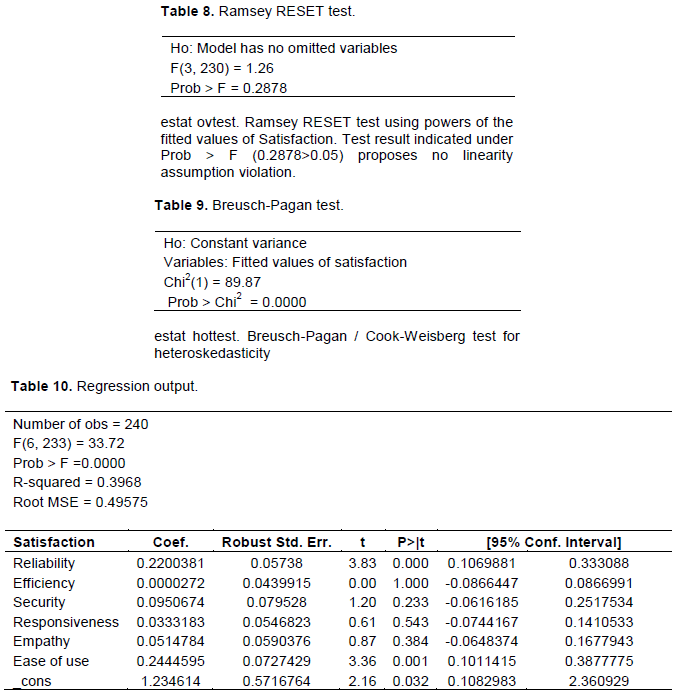

Meaning that, all non-linear relationships are unacceptable and the relationship between the independent and dependent variable must be linear and expressed mathematically as indicated earlier. So, statistically there is the presence of nonlinear relationships (linearity assumption violation) among the independent and dependent variable tested using the Ramsey’s RESET test (Ramsey, 1969; Cook and Weisberg, 1983) (Table 8).

The average value of the errors is zero

This arises since the mean value of the dependent variable will not be equal to the mean of the fitted values from the model/expected dependent variable if there is no constance in the regression. There is no statistical test for this; in fact, if the constant term is included in the regression equation, this assumption will never be violated (Mooi et al., 2018).

Variance of the errors is constant

The variance of the errors is constant. This is known as the assumption of homoscedasticity and if the errors do not have a constant variance, they are said to be heteroscedastic and tested using the White’s test and Breusch-Pagan test (1980). The test result is shown in the following.

The test result in Table 9 shows that p-value (Prob > Chi2) is 0.0000, indicating that the null hypothesis is rejected and that the error variance is constant. Thus, there is a significant degree of heteroskedasticity in the model. Accordingly, a robust regression remedy is applied in order to avoid unbiase but inefficient (that is, larger than minimum variance) estimates of the coefficients, as well as biased estimates of the standard errors (and, thus, incorrect statistical tests and confidence intervals).

No autocorrelation

When the error term in one time period is positively correlated with the error term in the previous time period, we face the problem of (positive first-order) autocorrelation. In other words, it is assumed that the errors are uncorrelated with one another. The presence of first-order autocorrelation is tested by utilizing the table of the Durbin-Watson statistic (Durbin and Watson, 1951) if there are variable components in the study that can show time component (common in time series or panel data).

Regression analysis results interpretation

After all the presumptions are tested, applying robust standard errors the regression analysis is completed since proof of heteroskedasticity has been found as shown earlier. Consequently, the regression model information and individual parameters data are presented in Table 10. The regression model result indicates that a total of 240 observations are taken and looking at the F-test, p-0.000<0.05 indicates that the regression model is Looking back the regression equation tested earlier (presented in model specification) had a constant of 1.234614, reliability coefficient of 0.2200381, and ease of use coefficient of 0.2200381 affecting the dependent variable satisfaction significantly since the p-value is smaller 0.00 is less than 0.05 (P > |t|). Similarly, looking at the output variables efficiency, security, responsiveness, and empathy have a positive insignificant effect on the dependent variable satisfaction where the variable security has a coefficient of 0.0950674, indicating having relatively higher impact on the dependent variable satisfaction. Standardized coefficients and effect sizes (the standardized β coefficients) are important indicators to identify the most important variables in the model rather than the t-values or p-values.

Table 11 provides interpretation of the standardized β coefficients and looking at the variable ease of use coefficient 0.2444595 is largest while the next highest coefficient value relates to reliability (0.2200381). The variable security coefficient 0.0950674 is found to be the third highest contributor in the model; however, the effect is statistically insignificant.

Hypothesis test

Table 12 shows the test hypothesis.

The results of the study found to align with Aghdaie and Faghani (2012) research focus on measuring the customer satisfaction in m-banking services in Iran using the SERVQUAL. The study found that the four variables, tangibility, reliability, responsiveness, and empathy correlated significantly with customer satisfaction. A similar study was conducted by Rahman et al. (2017) on Bangladesh customer satisfaction of m-banking using the SERVQUAL dimensions; the results revealed that only four variables implemented in the study, tangibility, reliability, responsiveness, and empathy have a significant positive impact on customer satisfaction. Conversely, the study result indicates that the dimensions efficiency, responsiveness, privacy/security, and empathy have insignificant impact even though they positively influence Abyssinia banks’ customers’ mobile banking satisfaction. This may probably has something to do with most banks in Ethiopia being late in adopting mobile banking and self-service technology; as a result Abyssinia banks customers are still getting used to the service and at this stage reliability and ease of use are found to be significant factors impacting Abyssinia banks’ m-banking service for customers’ satisfaction. Furthermore, especially in the financial services of industry and electronic environment, transaction privacy/security is found to be an important determinant and predictor of e-satisfaction (Liao and Cheung, 2008; Szymanski and Hise, 2000). On the other hand, the study result also shows a similar positive influence of security/privacy on e-banking service but the impact is found to be insignificant for Abyssinia m-bank service users as the service is new to them plus the covid-19 pandemic that restricts customers from getting service in bank branch face to face. Abyssinia bank customers seem to be not worried about security issue of m-banking service at least at the moment but rather the dimensions reliability and ease of use are found to be important determinants of m-banking service satisfaction during the lockdown period. This may further indicate that the dimensions that affect customers’ m-banking service satisfaction or any other e-service satisfaction under normal state of condition and state of emergency condition defiantly varies. Of course this is subject to similar further future studies in order to confirm the same.

It is obviously known that any business survival depends on customers and their satisfaction, especially in a service industry, wither customers are satisfied with the service provided by the firm or not. It is very crucial to monitor constantly the service rendered in a traditional face to face outlet as well as online bases. Accordingly, utilizing the appropriate fitting instrument e-SERVQUAL the present study focuses on assessing the satisfaction of m-banking services customers of Abyssinia bank of Ethiopia. The result displays no significant difference from other countries banks m-bank services with respect to e-SERVQUAL dimensions.

The result of the study also implicates that dimensions of e-SERVQUAL influence e-service quality customer satisfaction of Abyssinia bank customers and among the dimensions, reliability and ease of use have great influence of m-bank service quality of customers of Abyssinia bank (Abyssinia bank, 2019). This indicates that these dimensions are perceived to be critical for Abyssinia bank customers. Similarly, the dimension security is another critical dimension for Abyssinia bank customers even though it has an insignificant impact. In a nutshell Abyssinia bank customers seem to be satisfied at the moment with the current m-bank services rendered by the bank, but it does not mean that the bank’s m-banking service quality is at the desired level since the bank’s customers are still indicating the importance of six dimensions for the satisfaction of m-banking service. This indicates important provident areas in order to increase the mobile service quality.

All the six dimension variables reliability, efficiency, security, responsiveness, empathy, and ease of use were found to be positively influencing Abyssinia banks m-banking customer satisfaction; although, only the dimensions reliability and ease of use have a significant positive impact while the remaining predictor variables (efficiency, security, responsiveness, empathy) were found to have insignificant impact on Abyssinia bank m-bank service customers. Furthermore, according to the customers, the predictor variable ease of use was highest predictor (in absolute number, 0.2444595) and the variable reliability (0.2200381) was the second highest predictor; while, the third-highest predictor variable was security (0.0950674). These variables contribute the most in this order in this study.

The study findings implicate that not all e-service quality dimensions have significant impact on overall Abyssinia m-banking customer satisfaction during coid-19 lock down helping Abyssinia bank management in devising a strategy to make the service more appealing to customers. Specifically, ease of use and reliability dimensions are the strongest significant impact factors for customer satisfaction in East district of Abyssinia bank, whereas the efficiency (β = 0.00000376) has the lowest impact on e-service quality of m-banking customer satisfaction in east district of Abyssinia bank.

In addition, all the predictor variables reliability, efficiency, security, responsiveness, empathy, and ease of use have a positive impact of service quality, specifically reliability and ease of use have significant positive impact on service quality. So, customers are expecting to get highest services in reliability and ease of use during the pandemic. Even though efficiency, security, responsiveness, empathy predictor of service quality have insignificant impact on customer satisfaction but since they have a positive impact on customer satisfactions the bank is advised to work on these items as well further to increase m-bank service satisfaction of Abyssinia customers. Essentially, these outcomes will be useful for Abyssinia bank IT divisions, marketing division and customer service division to make business strategy for the related areas additionally to the execution and improvement of m-banking service quality. Besides, Abyssinia bank should pay attention to ease of use and reliability dimensions of m-banking services quality with the goal that this could assist with improving goodwill of m-banking services provided by the bank. Furthermore, bank management should device an effective risk-reducing strategy for m-banking services and create awareness and clear communication to increase customers’ confidence towards using m-banking service and to feel more secure and safe when transacting with the system. This will make Abyssinia bank and its customers to reap the great benefit that can be derived from implementing and using m-banking services. In this way, the bank board and management should give more consideration to the distinguished indicators particularly ease of use, and reliability while conceiving the m-banking service strategies to offer high quality of service in order to derive fulfilment by the bank m-bank service customers.

DIRECTIONS FOR FUTURE RESEARCH

As every study has limitation the study also has limitation related to the applied sampling technique; specifically a non-probability sampling technique was utilized and data were gathered from single district bank branch in Addis Ababa on a convenient basis; the sample size may not be adequate in order to generalize the findings to the whole Abyssinia bank m-banking service Populus. The study was also restricted to few east district Abyssinia bank branches only and did not include other banks in Ethiopia due to time and financial constraints. Additionally, few numbers of dimensions of e-SERVQUAL model were considered under the study to assess m-banking service quality provided; therefore by incorporating other dimensions of m-SERVQUAL model. Future studies may assess m-banking services quality from both the banks and customers perspective using interview and a survey questionnaire to increase generalizability of the study findings and to capture customer satisfaction of m-banking services quality provided by banks in Ethiopia under stringent environment similar to current pandemic. Lastly, the present study viewed m-banking service only from customer perspective and for future studies may be looked on other stakeholder perspectives as well.

The authors have not declared any conflict of interests.

REFERENCES

|

Abdullah MAA (2005). Security, perceptions, and practice: challenges facing adoption of online banking in Saudi Arabia. The School of Engineering and Applied Science, the George Washington University, Washington, DC.

|

|

|

|

Abyssinia Bank (2019). Abyssinia Bank makes one billion birr profit. Annual Report 2018/19. Available at:

View

|

|

|

|

|

Aghdaie SFA, Faghani F (2012). Mobile banking service quality and customer satisfaction (application of SERVQUAL model). International Journal of Management and Business Research 2(4):351-361.

|

|

|

|

|

Alalwan AA, Dwivedi YK, Rana NP (2017). Factors influencing adoption of mobile banking by Jordanian bank customers: Extending UTAUT2 with trust. International Journal of Information Management 37(3):99-110.

Crossref

|

|

|

|

|

Al-Hawari M, Hartley N, Ward T (2005). Measuring banks' automated service quality: a confirmatory factor analysis approach. Marketing Bulletin 16(1):1-19.

|

|

|

|

|

Angst MC, Agarwal R (2009). Adoption of electronic health records in the presence of privacy concerns: The Elaborate Likelihood Model and individual persuasion. Management Information Systems Quarterly 33(2):339-370.

Crossref

|

|

|

|

|

Ayo C, Oni A, Adewoye O, Ibukun E (2016). E-banking users' behaviour: E-service quality, attitude, and customer satisfaction. International Journal of Bank Marketing 34(3):347-367.

Crossref

|

|

|

|

|

Bank of Abyssinia (2019). Annual Report 2018/19. Available at:

View.

|

|

|

|

|

Bauer HH, Hammerschmidt M, Falk T (2005). Measuring the quality of e-banking portals. International Journal of Bank Marketing 23(2):153-175.

Crossref

|

|

|

|

|

Bedi M (2010). An integrated framework for service quality, customer satisfaction and behavioral responses in Indian banking industry: A comparison of public and private sector banks. Journal of Service Research 10(1):157-172.

|

|

|

|

|

Brangier E, Desmarais MC, Nemery A, Prom Tep, S.(2015). Évolution de l'inspection heuristique: vers une intégration des critères d'accessibilité, de praticité, d'émotion et de persuasion dans l'évaluation ergonomique. Available at:

View

|

|

|

|

|

BUSARA Center for Behavioral Economics (2019). Market Assessment of Digital Financial Services for Low Income Farmers in Ethiopia, CARE Ethiopia, august 2019.

|

|

|

|

|

Chemingui H, Iallouna H (2013). Resistance, motivations, trust and intention to use mobile financial services. International Journal of Bank Marketing 31(7):574- 592.

Crossref

|

|

|

|

|

Chuan CL, Penyelidikan J (2006). Sample size estimation using Krejcie and Morgan and Cohen statistical power analysis: A comparison. Jurnal Penyelidikan IPBL 7(1):78-86.

|

|

|

|

|

Cook RD, Weisberg S (1983). Diagnostics for heteroscedasticity in regression. Biometrika 70:1-10.

Crossref

|

|

|

|

|

Cooper DR, Schindler PS (2014). Business research methods. McGraw-Hil.

|

|

|

|

|

Curran JM, Meuter ML (2005). Self-service technology adoption: Comparing three technologies. Journal of Services Marketing 19(2):103-113.

Crossref

|

|

|

|

|

Dai W, Lee JH (2018). Effects of Website Characteristics and Delivery Service Quality on Repurchase Intention. The International Journal of Industrial Distribution and Business 9(5):17-24.

Crossref

|

|

|

|

|

De Leon MV (2019). Factors influencing behavioral intention to use mobile banking among retail banking clients. Jurnal Studi Komunikasi 3(2):118.

Crossref

|

|

|

|

|

De Wulf K, Odekerken-Schroder G, Iacobucci D (2001). Investments in consumer relationships: A cross-country and cross-industry exploration. Journal of Marketing 65(4):33-50.

Crossref

|

|

|

|

|

Durbin J, Watson GS (1951). Testing for serial correlation in least squares regression, II. Biometrika 38(1-2):159-179.

Crossref

|

|

|

|

|

Finextra (2018). Ethiopia switches on unified payment system with BPC. Available at:

View

|

|

|

|

|

Fowler FJ (2009). Survey research methods (4th ed.).Thousand Oaks, CA: Sage.

Crossref

|

|

|

|

|

Green SB (1991). How many subjects does it take to do a regression analysis? Multivariate Behavioral Research 26(3):499-510.

Crossref

|

|

|

|

|

Ganguli S, Roy SK (2011). Generic technology-based service quality dimensions in banking: Impact on customer satisfaction and loyalty. International Journal of Bank Marketing 29(2):168-189.

Crossref

|

|

|

|

|

Ha KH, Canedoli A, Baur AW, Bick M (2012). Mobile banking - insights on its increasing relevance and most common drivers of adoption. Electron Mark 22(4):217-227.

Crossref

|

|

|

|

|

Hair JF Jr, Black WC, Babin BJ, Anderson RE (2013). Multivariate data analysis. Upper Saddle River: Pearson.

Crossref

|

|

|

|

|

Hall G (1995). Surviving and prospering in the small firm sector. Routledge, London.

|

|

|

|

|

Hanafizadeh P, Behboudi M, Koshksaray AA, Tabar MJS (2014). Mobile-banking adoption by Iranian bank clients. Telematics and Informatics 31(1):62-78.

Crossref

|

|

|

|

|

Hanudin A, Rostinah S, Masmurniwati MA, Ricardo B (2012). Receptiveness of mobile banking by Malaysian local customers in Sabah: An empirical investigation. Journal of Internet Banking and Commerce 17(1):1-12.

|

|

|

|

|

Hill C, Griffiths W, Lim GC (2008). Principles of econometrics (3rd ed.). Hoboken: Wiley.

|

|

|

|

|

Jabnoun N, Al-Tamimi H (2003). Measuring perceived service quality at UAE commercial banks. International Journal of Commerce and Management, 13(2):29-53.

|

|

|

|

|

Jun M, Cai S (2001). The key determinants of Internet Banking Service Quality: a content analysis. International Journal of Bank Marketing 19:276-291.

Crossref

|

|

|

|

|

Jun M, Palacios S (2016). Examining the key dimensions of mobile banking service quality: An exploratory study. International Journal of Bank Marketing 34(3):307-326.

Crossref

|

|

|

|

|

Kaiser HF (1958). The varimax criterion for factor analytic rotation in factor analysis. Educational and Psychological Measurement 23(3):770-773.

Crossref

|

|

|

|

|

Kaiser HF (1974). An index of factorial simplicity. Psychometrika 39(1):31-36.

Crossref

|

|

|

|

|

Khalil M (2011). Online service quality and customer satisfaction: A case study of Bank Islam Malaysia Berhad. Available at:

View

|

|

|

|

|

Kim SY, Lim YJ (2001). Consumers' perceived importance of and satisfaction with internet shopping. Electronic Markets 11(3):148-154.

Crossref

|

|

|

|

|

Kotrlik JWKJW, Higgins CCHCC (2001). Organizational research: Determining appropriate sample size in survey research appropriate sample size in survey research. Information Technology, Llearning, and Performance Journal 19(1):43.

|

|

|

|

|

Kumari V (2016). 90% of time on mobile is spent in apps. Quytech blog. Available at:

View

|

|

|

|

|

Lau MM, Cheung R, Lam AYC, Chu YT (2013). Measuring service quality in the banking industry: A Hong Kong based study. Contemporary Management Research 9(3):263-282.

Crossref

|

|

|

|

|

Laukkanen,T (2007). "Internet vs mobile banking: comparing customer value perceptions", Business Process Management Journal, Vol. 13(6):788-797.

Crossref

|

|

|

|

|

Laukkanen T (2016). Consumer adoption versus rejection decisions in seemingly similar service innovations: The case of the internet and mobile banking. Journal of Business Research 69(7):2432-2439.

Crossref

|

|

|

|

|

Laukkanen T, Kiviniemi V (2010). The role of information in mobile banking resistance. International Journal of Bank Marketing 28(5):372-388.

Crossref

|

|

|

|

|

Lin H (2013). "Determining the relative importance of mobile banking quality factors". Computer Standards and Interfaces Journal. 35(2):195-204.

Crossref

|

|

|

|

|

Liao Z, Cheung MT (2008). Measuring customer satisfaction in internet banking; a core framework, Communications of the ACM, 51(4):47-51.

Crossref

|

|

|

|

|

Loiacono E, Watson RT, Goodhue D (2000). Web Qual TM: a web site quality instrument. Worcester Polytechnic Institute, Worcester, MA.

|

|

|

|

|

Lu M, Tzeng G, Cheng H, Hsu C (2014). Exploring mobile banking services for user behavior in intention adoption: using new hybrid MADM model. Service Business 9(3):541-565.

Crossref

|

|

|

|

|

Miran IH, Rasha AEA (2013). Investigating e-banking service quality in one of Egypt's banks: a stakeholder analysis. The TQM Journal 25:557-576.

Crossref

|

|

|

|

|

Mooi E, Sarstedt M, Mooi-Reci I (2018). Market research. The process, data, and methods using stata.

Crossref

|

|

|

|

|

Moser F (2015). Mobile banking: A fashionable concept or an institutionalized channel in future retail banking? Analyzing patterns in the practical and academic mobile banking literature, International Journal of Bank Marketing 33( 2):162-177.

Crossref

|

|

|

|

|

Munusamy J, Chelliah S, Mun HW (2010). Service quality delivery and its impact on customer satisfaction in the banking sector in Malaysia. International Journal of Innovation. Management and Technology 1(4):398-404.

|

|

|

|

|

Nadiri H, Kandampully J, Hussain K (2009). Zone of tolerance for banks: a diagnostic model of service quality. The Service Industries Journal 29:1547-1564.

Crossref

|

|

|

|

|

Nandan T, Upadhyay AK (2008). Internet banking in India: Issues and prospects. The IUP Journal of Bank Management 7(2):47-61.

|

|

|

|

|

National Bank of Ethiopia, NBE (2018). Economic performance annual report for the year 2017/18. Available at:

View

|

|

|

|

|

Nelson RR, Todd PA, Wixom BH (2005). Antecedents of information and system quality: an empirical examination within the context of data warehousing. Journal of Management Information Systems 21(4):199-235.

Crossref

|

|

|

|

|

Osman RW, Cole ST, Vessell CR (2006). Examining the role of perceived service quality in predicting user satisfaction and behavioral intentions in a campus recreation setting. Recreational Sports Journal 30(1):20-29.

Crossref

|

|

|

|

|

Parasuraman A, Zeithaml VA, Malhotra A (2005). ES-QUAL: A multiple-item scale for assessing electronic service quality. Journal of Service Research 7(3):213-233.

Crossref

|

|

|

|

|

Rahman A, Hasan M, Mia MA (2017). Mobile banking service quality and customer satisfaction in Bangladesh: An analysis. The Cost and Management 45(2):25-32.

|

|

|

|

|

Rapp A, Rapp T, Schillewaert N (2008). An Empirical Analysis of research agenda. Journal of Services Marketing 22(1):24-36.

Crossref

|

|

|

|

|

Ramsey JB (1969). "Tests for specification error in the general linear model," Journal of the Royal Statistical Society, Series B 31:350-371.

Crossref

|

|

|

|

|

Rawashdeh A (2015). Factors affecting adoption of internet banking in Jordan. International Journal of Bank Marketing 33(4):510-529.

Crossref

|

|

|

|

|

Sagip GK, Zapan B (2014). Bangladeshi mobile banking service quality and customer satisfaction and loyalty. Management and Marketing 9(3):331-346.

|

|

|

|

|

Saha S, Nesa Z (2011). Measuring service quality: a comparative assessment based on customer service of HSBC and DBBL. Journal of Banking and Financial Services 5(1):111-127.

|

|

|

|

|

Sahadev S, Keyoor Purani K (2008). Modelling the consequences of eservice quality. Marketing Intelligence and Planing 26(6).

Crossref

|

|

|

|

|

Salant P, Dillman DA (1994). How to conduct your own survey. New York: John Wiley & Sons, Inc.

|

|

|

|

|

Salehi M, Khaksar J, Torabi E (2014). Islamic banking ranking efficiency based on a decision tree in Iran. The East Asian Journal of Business Management 4(2):5-11.

Crossref

|

|

|

|

|

Sang CKK, Rono LJ (2015). Determinants of self-service banking technology in Kenya. Global Conference on Business and Finance Proceedings 10(1):99-111.

|

|

|

|

|

Schaupp L, Belanger F (2005). A Conjoint Analysis of Online Consumer Satisfaction. Journal of Electronic Commerce Research 6(2):95-111.

|

|

|

|

|

Sekaran U (2003). Research Methods for Business, A Skill-Building Approach, Fourth Edition John Wiley & Sons, Inc. ISBN 0-471-20366-1

|

|

|

|

|

Shaikh A, Karjaluoto H (2015). Mobile banking adoption: A literature review. Telematics and Informatics 32(1):129-142.

Crossref

|

|

|

|

|

Shankar A, Datta B, Jebarajakirthy C (2019). Are the generic scales enough to measure service quality of mobile banking? A comparative analysis of generic service quality measurement scales to mobile banking context. Services Marketing Quarterly 44(3):1-21.

Crossref

|

|

|

|

|

Sharma G, Malviya S (2011). Exploring the dimensions of mobile banking service quality. Review of Business and Technology Research 4(1):187-196.

|

|

|

|

|

Singh S, Srivastava RK (2014). Factors influencing the adoption of mobile banking in India, International Journal of E-Services and Mobile Applications 6(4):1-15.

Crossref

|

|

|

|

|

Sohn C, Tadisina SK (2008). Development of e-service quality measure for internet-based financial institutions. Total Quality Management and Business Excellence 19:903-918.

Crossref

|

|

|

|

|

Sreejesh S, Anusree MR, Amarnath M (2016). Effect of information content and form on customers' attitude and transaction intention in mobile banking, International Journal of Bank Marketing 34(7):1092-1113.

Crossref

|

|

|

|

|

Szymanski DM, Hise RT (2000). E-satisfaction: An initial examination. Journal of Retailing 76(3):309-322.

Crossref

|

|

|

|

|

Thakur R (2014). What keeps mobile banking customers loyal?, International Journal of Bank Marketing 32(7):628-646.

Crossref

|

|

|

|

|

The Global Economy (2016). Bank accounts per 1000 adults - Country rankings. At:

View

|

|

|

|

|

Van Voorhis CRW, Morgan BL (2007). Understanding power and rules of thumb for determining sample sizes. Tutorial in Quantitative Methods for Psychology 3(2):43-50.

Crossref

|

|

|

|

|

VISA (2017). A new world order where consumer experience will take centre-stage Fourth annual visa consumer payment attitudes survey. Available at:

View

|

|

|

|

|

Wessels L, Drennan J (2010). An investigation of consumer acceptance of M-banking. International Journal of Bank Marketing 28(7):547-568.

Crossref

|

|

|

|

|

World Health Organization (WHO) (2020), WHO Director-General's opening remarks at the media briefing on COVID-19 - 11 March 2020. Available at:

View

|

|

|

|

|

World Bank (2015). Global Payments Systems Survey 2015. Available at:

View

|

|

|

|

|

World Bank group (2019). Marco poverty outlook, sub-Saharan Africa, country by country analysis and projections for the developing world spring meeting © 2020 International Bank for Reconstruction and Development/ The World Bank 1818 H Street NW Washington DC 20433. Available at:

View

|

|

|

|

|

Yoo B, Donthu N (2001). Developing a scale to measure the perceived quality of an internet shopping site (sitequal). Quarterly Journal of Electronic Commerce 2:31-46.

|

|

|

|

|

Zeithaml V, Parasuraman A, Malhotra A (2000). e-Service quality: definition, dimensions, and conceptual model. Marketing Science Institute, Cambridge, MA.

|

|

|

|

|

Zeithaml VA, Parasuraman A, Malhotra A (2002). Service quality delivery through web sites: a critical review of extant knowledge. Journal of the Academy of Marketing Science 30(4):362-375.

Crossref

|

|

|

|

|

Zikmund WG, Babin BJ, Carr JC, Griffin M (2003). Business research methods 7th ed. Thomson/South-Western.

|

|