ABSTRACT

Many marketing executives are looking for a comprehensive plan for delivering quality services and products that will create a distinct and unforgettable long-term experience for customers when dealing with their brand. Various brand management experts believe that a company looking to enhance its brand experience in the minds of customers should have a plan to increase customer satisfaction as well as customer loyalty. The purpose of this research was to investigate the role of brand experience in customer satisfaction and customer loyalty in Ayandeh Bank branches in Tehran. The study employed quantitative methodology. For data gathering, a questionnaire was utilised to measure all the variables of the research. The statistical population of the study consisted of all the customers of Ayandeh Bank branches in Tehran, and the study data was gathered from 400 respondents. The findings indicate that brand experience has a direct and meaningful impact on customer satisfaction and customer loyalty; furthermore, customer satisfaction has a direct and significant effect on customer loyalty, in the branches of Ayandeh Bank in Tehran.

Key words: Bank, brand experience, customer satisfaction, customer loyalty.

The pace of change in the shape and diversity of the service market at the beginning of the 21st century is so great that it is not easily understood, and banking services are no exception (Shafiei et al., 2019). Every day, the world is witnessing the introduction of new forms of banking services through public media and social networks, demonstrating the increasing choice available to customers. Bank managers need to adapt to this change (Aalaie and Maleki, 2017). Creating a customer-centric culture among bank employees is one of the factors contributing to the success of these organisations (Safarai, 2010). The culture of banks should allow them to focus more heavily on customer needs and brand experience in order to secure customer satisfaction and, ultimately, loyalty (Hassania, 2019).

Nowadays, customer satisfaction is not sufficient, and organisations (including banks) should not be happy with merely customer satisfaction (Jazini and Asgar, 2013).

They need to ensure customer loyalty as it can reduce marketing costs, attract more customers and increase business effectiveness. Thus, maintaining and enhancing customer loyalty towards a company’s products or services are the most important goals of marketing activities (Alhazmi, 2019).Brand loyalty leads customers to choose one brand over its rivals, routinely buy from that brand and not give their attention to other brands. Customer loyalty refers to a situation in which a customer generally purchases or receives similar products and services from a particular company over time. Furthermore, consumer loyalty towards a particular brand leads to an increase in the brand’s special value. Customers having successful experiences of a brand promote word-of-mouth (WOM) advertising and allow the company to compete with the strategies of competitors and achieve better outcomes. Customer satisfaction is achieved when there is no gap between a customer’s expectations and their actual experience of using a product (Zhang et al., 2020). The goal of increasing customer satisfaction levels is to build long-term relationships with customers and consequently to gain long-term benefits for the company. Thus, in the modern market, bankers must try to see themselves through their customers’ eyes, understand them and work hard to ensure their satisfaction. However, over time, the situation is becoming increasingly complicated for banks (Zamani and Lahiji, 2012).

For any organisation in the manufacturing or service sector, customers are the most critical factor in the company’s survival; if an organisation succeeds in building customer satisfaction and loyalty, the ground will be prepared for its long-term growth and survival (Khorshidi and Kargard, 2010). This cannot be achieved except through study and management planning, which begins with developing a complete understanding of customers and, in particular, the requirements for obtaining their satisfaction and loyalty (Akbarpour and Zangooi, 2017). Customer loyalty is thus a significant issue in marketing research, a challenging problem for managers and a vital strategic mental attitude for all managers and employees (Talebloo and BahmanPoor, 2012). This is a result of intense market competition, especially in the service industries, and the increased focus on the relationship between customers and organisations (Khorshidi and Kargard, 2010).

Ayandeh Bank

Ayandeh Bank was established in July 2012 as a non-governmental Retail Bank in Iran. In 2017, it had about 31 branches in Tehran, which reached 100 branches in 2019. As the resources of organisations are limited, managers should use them optimally and understand the factors affecting them and their impact on customer loyalty. Ayandeh Bank is part of the phenomenon of entrepreneurship in different sectors of the economy. It is seeking to provide a high-quality service, with an emphasis on customer orientation, to become one of the leading banks in Iran in the future. The company intends to fully apply national monetary and financial rules and regulations, offer the best international experiences and provide its services according to the highest quality standards. The distinctive feature of Ayandeh Bank is its knowledge-based approach that goes beyond the traditional banking realm; alongside protecting equity and depositors, this will help the bank respond wisely to the surrounding developments and offer the best structure for its products and services (Ayandeh Bank, 2019). The numbers of customers of Ayandeh Bank in Tehran during 2017, 2018 and 2019 were 40,000, 79,000 and 113,000, respectively (Majd, 2020). The current study seeks to examine the impact of brand experience on customer satisfaction and customer loyalty in the banking services provided at branches of Ayandeh Bank in Tehran, Iran.

GOALS AND VISION OF AYANDEH BANK

Objectives

(i) To achieve a top strategic competitive position in Iran’s national private banking network.

(ii) To become known as a distinctive and value-creating bank for its customers.

(iii) To offer a comprehensive banking service according to international standards within Iran’s national private banking network to secure the interests of all stakeholders.

(iv) To obtain customer satisfaction and loyalty through continuous and close interaction, identifying and perceiving their diverse monetary and financial needs, and responding in a timely manner in providing service packages and comprehensive solutions.

(v) To empower human capital resources and change their attitudes and behaviours, along with creating an enabling organisational environment; to value and respect all employees through creating a learning organisation.

(vi) To create a sustainable competitive advantage to penetrate new markets and obtain a more significant share of the market and a larger customer base by developing critical competencies in various banking services (micro, corporate, investment and proprietary) and optimising their shares in portfolios.

(vii) To reassure shareholders and markets of the stability and profitability of the bank.

(viii) To operate in the form of a parent conglomerate holding company to add value, diversify services and products, optimise revenues portfolio, manage risks of the bank and attain any appropriate position in monetary and financial markets at the national and global levels.

(ix) To carry out continuous improvements of bank productivity, with an emphasis on enhancing the quantity and quality of profits, developing key capabilities in the field of virtual banking, and scientific management of resources, consumption, and all banking affairs to improve customer satisfaction.

(x) To adapt financial and operational indicators of the bank to meet international standards of the banking industry.

(xi) Commitment to simplify, facilitate, speed up and optimise all procedures in terms of providing timely products and services; simultaneously, take advantage of innovative plans to deliver new products and services to customers at a global level.

(xii) To promote the value, credibility and social image of the bank as a leader in Iran’s financial sector.

(xiii) Commitment to social responsibilities through serving an active and leading role in enhancing community prosperity, strengthening production and creating sustainable economic development (Bank, 2019).

Vision

We believe that by considering the following, we will be able to become one of the best multi-purpose private financial institutions in the country with international credibility.

(i) Providing unique solutions to the needs of our customers and shareholders.

(ii) Becoming equipped with advanced technologies, to improve professional capabilities, and manufacture new fast, accurate, and high-quality products and services under the needs of the market.

(iii) Conducting a collective effort to provide services enthusiastically to the customers and people of Iran.

(iv) Trusting in loyal and goodwill customers.

(v) Applying the best solutions to reach the peak of capabilities and accountability

(vi) Playing a pivotal role to create a better life for our nation.

We can turn into one of the best private multi-purpose financial institutions in the country with international credibility and a symbol of innovation, value creation, and excellence (Bank, 2019).

A customer is a person who needs to purchase goods and services and tends to pay a reasonable price for those goods and services. The cost of absorbing a customer is five to eleven times higher than the cost of retaining an existing customer (Gallo, 2014), and a 2% increase in the number of customers can lead to a 10% reduction in associated costs (Gallo, 2014). The most valuable asset of any organisation is the trust of its customers; loyal customers are essential for a company to survive and continue operating efficiently (Tajzadeh and Elahyari, 2009). The growing trend of product development and rivals shows that there is no shortage of products in the market; rather, the real shortage is a lack of customers. This issue highlights the increasing importance of customers (Tajzadeh and Elahyari, 2009).

Brand: Davis (2000) defines a brand as a set of commitments and covenants that include trust, stability and a pre-defined set of requirements. This set of promises and commitments includes features and characteristics of the products or services that the buyer uses, and the result is their level of satisfaction. The attributes forming a brand may be real or fabricated, rational or emotional, tangible or intangible (Ambler, 1993).

Loyalty: Loyalty is defined as the frequency of purchases or relative volume of purchasing a specific brand, and the majority of the literature in this area is faced with an issue because the psychological sense or aspects of loyalty have not been fully considered (Hadiani and Ahmadpour, 2009). The loyalty of service customers is a different concept from other loyalty structures and, to a large extent, depends on the growth and expansion of interpersonal relationships. Generally, intangible attributes such as “reliability” or “reputation” can play a significant role in creating or retaining customer loyalty in the service sector (Hadiani and Ahmadpour, 2009). One of the most comprehensive definitions of brand loyalty to date is the one provided by Jacoby et al. (1971). They define it as a non-coincidental result of a long-term behavioural reaction, which is a psychological process of purchasing generated by decision-makers who have considered more than one brand. In previous studies, researchers have often considered repurchasing as an instrument for measuring brand loyalty (Jacoby et al., 1971); however, in more recent studies, it has been shown that the best way to assess brand loyalty is to measure attitudinal loyalty (Ranjbarian and Mohammadzadeh, 2006). Lin (2010) examined the relationship between personality traits, brand personality and brand loyalty. His results show a significant positive correlation between the personality trait and brand personality. He also shows a positive and significant relationship between brand personality and brand loyalty (Rahimnia et al., 2011). Brand loyalty is a measure that reflects how likely it is that a customer will turn to another brand, notably when that brand differs in terms of price or other aspects of the products or services offered. In addition, a consumer’s positive attitude towards a brand indicates their adherence to the brand and the intention to continue buying it in the future (Buil et al., 2008).

Customer loyalty: Customers are loyal to a provider or service provider either because they want to be or because they are forced to stay loyal (Hirschman, 1970).

In cases where the barrier to changing suppliers is high, customers will remain loyal to a service provider regardless of whether they are satisfied (Hirschman, 1970). This restriction on freedom of choice, along with lower satisfaction levels, leads to weaker repurchase intention and less customer loyalty (Hirschman, 1970).

Customer loyalty plays an essential role in the field of banking; thus, all the goals of this system are centred on creating and maintaining customer satisfaction and loyalty (Baradaran et al., 2013). The results of a study by Reichheld and Teal (1996) indicate that between 65 and 85% of consumers who claim to be satisfied or very satisfied with a product or service may still easily refuse to repurchase it and choose instead to replace it with an alternative. One of the best ways to increase customers is to maintain current customers. Every year, organizations lose a large percentage of their customers due to lack of attention to them (Qaracheh et al., 2016). A 5% increase in the number of loyal customers can increase the profitability of firms in various industries between 25 and 95% (Richards and Jones, 2008), and the reasons for this profitability lie in the different behaviours of loyal customers compared to non-loyal customers. In addition to the economic aspects of transactions, loyal customers also value their relationship with the company, while non-loyal customers focus solely on the economic dimension. Loyal customers have lower price elasticity than other customers because of substitution effect (Tajzadeh and Etemadi, 2013). Brands with loyal customers have a lower price elasticity of demand and loyal customers are less price sensitivity; therefore, demand will decrease more slowly as price goes up (Krishnamurthi and Raj, 1991). Overall, customer loyalty refers to a customer’s desire to continue buying from a particular company, person or store (Elahi et al., 2011).

Brand experience: Brand experience is viewed as an effect and a sensory, cognitive and behavioural reaction; it emerges with stimuli related to the brand and is formed through the brand identity, brand design, packaging, communication and environment. Brakus et al. (2009) identified several aspects of this experience and developed a scale of brand experience with four dimensions: sensory, emotional, rational, and behavioural. The authors showed that this scale is credible, valid and different from other brand criteria such as brand evaluation, brand engagement, brand affinity, customer interest and brand identity. In addition, brand experience affects customer satisfaction and loyalty, both directly and indirectly, through communication with brand identity (Ambler et al., 2002).

Recent studies on brand experience have focused more on its antecedents and consequences rather than its definitions and measurement methods (Iglesias et al., 2011). Thus, it is not surprising that one of the most critical challenges in this field is that brand experience is not just a secondary phenomenon; rather, it can forecast some of the most significant cognitive and analytical concepts derived from domains of branding such as brand satisfaction, brand trust, brand commitment and brand love (Motahari et al., 2014).

Customer satisfaction: Satisfaction is as an internal state that is created when a customer's expectations of a product or service are fulfilled (Kotler and Clarke, 1987). Overall, customer satisfaction is the judgement that a customer makes about their recent purchases (Bitner and Hubbert, 1994) and their emotional assessment of a brand at any given time (Anderson et al., 2004).

Satisfaction is a broader concept than quality, which is just one of the components of customer satisfaction (Bai et al., 2008). Satisfaction measurement helps to assess customers to determine whether a product or service has met their needs and expectations (Bai et al., 2008). Customer satisfaction is one of the results of meeting customers’ needs and represents their mental judgement regarding the product or service (Bai et al., 2008). The results of high satisfaction levels include loyalty creation, repurchase intentions, and recommending the same product or service to others. Obtaining a fundamental understanding of the factors affecting customer satisfaction is of great importance (Bai et al., 2008). The high quality of services is the most crucial issue in customer satisfaction in terms of having a significant impact on purchase intentions and loyalty (Bai et al., 2008). No enterprise can survive in the modern market unless it can acquire and retain a sufficient number of well-informed customers. With competition becoming increasingly fierce and ruthless, efforts towards this end have preoccupied the minds of enterprise managers. Effective customer management is a necessity for the success of service companies around the world, and customer satisfaction with the quality of services can help service companies of any size to survive in the turbulent marketplace (Archakova, 2013). Richards and Jones (2008) identified the value of retaining more customers for different industries. They showed that a 5% reduction in customer loss could lead to a 25-95% increase in annual revenue, depending on the industry (Richards and Jones, 2008).

Service loyalty: Service loyalty is a different concept from other loyalty structures. The concept of service loyalty is more complicated than brand loyalty as commonly used for goods. It does not necessarily conform with other forms of loyalty such as brand loyalty, store loyalty or loyalty to providers. Service loyalty has stricter standards than other types of loyalty, and a loyal customer must be loyal both to the brand and the store. Loyalty can target either the service or its supplier, and this enhances the intricacy of this kind of loyalty (Hamidizadeh and Ghamkhavari, 2009). Jarvis and Mayo

(1986) define service loyalty as a phenomenon observed among customers with repurchasing behaviours that creates a positive and strong attitude towards the company.

Research conceptual model

In this study, the conceptual model of the study has investigated the impact of brand experience based on the title of the study and presented literature review (Figure 1).

Research hypotheses

Main hypothesis

H1: Brand experience has an impact on customer satisfaction and customer loyalty in Ayandeh Bank branches in Tehran.

Sub-hypotheses

H2: Brand experience has an impact on customer loyalty in Ayandeh Bank branches in Tehran.

H3: Brand experience has an impact on customer satisfaction in Ayandeh Bank branches in Tehran.

H4: Customer satisfaction has an impact on customer loyalty in Ayandeh Bank branches in Tehran.

Subject scope

The study covers the subjects of customer satisfaction and customer loyalty as well as brand experience. Specifically, it examines the impact of brand experience on customer satisfaction and loyalty in relation to the banking services provided by Ayandeh Bank branches in Tehran.

Scientific study involves following a step-by-step, logical, systematic and explicit method for identifying problems, collecting data, analysing the data and making valid inferences. Thus, a scientific study is not merely based on experience or personal perceptions and direct understanding; rather, it is purposeful and precise. The basis of every scientific method, that is the value and validity of the laws of science, depends on the methodology used (Karbasian et al., 2011). By methodology, the authors mean the methods used to conduct research to examine the chosen subject and to achieve the results in practice. The aim of selecting a research method is to adopt an approach that enables the researcher to answer the research questions. The selection of the research method depends on the objectives and nature of the subject as well as on the facilities and resources available. Research methodologies can be classified in terms of two criteria: first, according to their purpose; and second, according to the type of data collection involved (Karbasian et al., 2011).

Selection of a research methodology depends on the goals and nature of the research subject and its executive potential. Thus, one can only decide on a research methodology when the nature of the subject as well as the objectives and scope of the research are explicit. In many cases, the appropriate research method is a combined one. Miller and Salkind (2002) state that research plan orientations can be separated into three types: fundamental, applied, and evaluation. The nature of the research subject is that the researcher seeks to investigate the consequences of measures adopted to remove problems or the consequences of actions. The purpose of the study is to provide a precise analysis of the outcome of the solution applied to a problem (Karbasian et al., 2011).

The results of the current research are intended to be useful for Ayandeh Bank executives. For the current study, the researcher was present in the branches of Ayandeh Bank in Tehran and collected information from customers, which represents a convenience sampling approach. Given the research method, the most important instrument for data collection was the multiple-choice questionnaire and the customers filled in their own questionnaire. Respondents in this study were randomly selected from those customers present in bank branches who had a bank account in Ayandeh Bank. Questionnaires from other studies were used. Brand experience questionnaire of Brakus et al. (2009), Brand loyalty questionnaire of Moghimi et al. (2011) and customer satisfaction questionnaire of Mihelis et al. 2001) have been

Samples and sampling method

When practical issues inhibit researchers from examining the whole target population, they try to utilise a representative sample by finding a sub-group that represents the whole population. In this situation, the observations are confined to this sub-group, and the results obtained for this sub-group may then be generalised to the whole population (Hafez, 2003).

Non-probability sampling is further divided into four categories: judgemental sampling, convenience sampling, quota sampling, and snowball sampling. In the convenience sampling method, samples are selected from the population based on relative convenience and availability (Khaki, 2011: 131). For the current study, the researcher was present in the branches of Ayandeh Bank in Tehran and collected information from customers, which represents a convenience sampling approach. Many researchers follow Slovin’s (1960) formula for determining sample size from a population for convenience sampling: n = N / (1+Ne2), where n is the sample size given population size N and margin of error (Sevilla, 1990: 45). Based on Slovin’s formula, a minimum of 383 respondents are needed for the current research, given the population size of 113,000, and a 5% margin of error. About 600 questionnaires were distributed among potential respondents by the researcher in 5 different branches in north, east, west and south of Tehran. The number of questionnaires completed correctly by the respondents was 400.

Brand experience questionnaire

The brand experience questionnaire developed by Brakus et al. (2009), consisting of 12 items with four subscales referring to sentiments, emotions, wisdom and behaviour (three questions each), can be used to evaluate the brand experience. The scoring of the questionnaire operates on a five-point Likert scale, where “totally disagree”, “disagree”, “no idea”, “agree” and “totally agree” receive 1, 2, 3, 4, and 5 points, respectively for most questions. Items 3, 5, 9, and 12 are scored in the reverse order.

Customer satisfaction questionnaire

The customer satisfaction questionnaire for this study was developed according to that used by Mihelis et al. (2001). This questionnaire aims to measure customer satisfaction with regard to the bank’s services. To that end, five dimensions, namely, staff, services, products, bank image and accessibility, were included. A three-point Likert scale is used to score the questionnaire, where 3 points are assigned for the first option, 2 points for the second option, and 1 point for the third option for each question.

Customer loyalty questionnaire

Moghimi and Ramazani’s questionnaire (2011) was used to measure loyalty. This questionnaire includes 15 items that measure five variables: commitment; WOM advertising; tendency to purchase from an attitudinal loyalty perspective; and repurchase and exclusive purchase from a behavioural loyalty perspective (Moghimi and Ramazani, 2011). A five-point Likert scale is used to score the questionnaire, where “totally disagree”, “disagree”, “no idea”, “agree” and “totally agree” receive 1, 2, 3, 4, and 5 points, respectively.

Reliability of the questionnaire

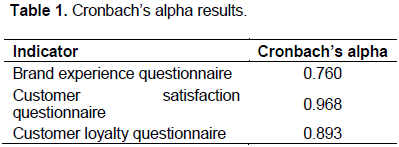

Usually, the Cronbach’s alpha coefficient ranges from 0.00 (unreliability) to 1.00 (full reliability). The closer the obtained result is to 1.00, the more reliable the questionnaire is. Usually, for a test with research objectives, a reliability of 0.7 to 0.8 would be appropriate (this is reported as an acceptable value in most sources) (Khaki, 2011: 159). Table 1 shows the results of Cronbach’s alpha testing in the current study.

Statistical methods of data analysis

CFA and SEM are used to test the research hypotheses and to analyse the structural relationships between the variables. The researcher used IBM SPSS Statistics version 24 software and LISREL (Version 8.8; J?reskog and S?rbom, 2001) for data analysis.

General specifications of the respondents/ participants

The gender frequency distribution showed that 56% of the participants in this research were male and 44% were female. An education frequency distribution indicated that the highest percentage belongs to the participants with a bachelor's degree (36%), and the lowest percentage belongs to the participants with a diploma or lower degrees (14%). An age frequency distribution showed that most of the participants have less than 30 years old (47%), and the least percentage belonged to participants with more than 50 years old (0.9%). A Frequency Distribution with respect to Marital Status indicated that 64% of the respondents are married, and 36% of them are single.

Normality test

The normality of the data at a significance level of 95% is assessed using the Kolmogorov–Smirnov test. Regarding CFA and SEM, it is not necessary that all data should be normal; rather, only the factors (structures) must be normal (Kline, 2005). The significance value is >0.05 according to the results for all cases. Therefore, there is no reason to reject the hypothesis that is the distribution of measurement data is normal for all dimensions. This confirms that CFA and parametric tests can be used.

Confirmatory factor analysis

For the current study, a questionnaire was used to measure the research variables. To investigate the research hypothesis based on this scale, the accuracy of the scale should first be confirmed. Therefore, CFA is applied to measure the relationship between the latent variables and the measurement items (Kline, 2005). The FLs observed for all items are above 0.3, which indicates that the correlations between the latent variables (the dimensions of each one of the major structures) and the observable variables are acceptable. According to the outcome of assessment indicators for each of the indices employed at a confidence level of 95%, the t-value is >1.96, which shows that the observed correlations are considerable and significant. The next step is the goodness-of-fit test. The RMSEA index is employed in most CFA and SEM methods as an indicator of significant fit. An index of <0.05 is favourable (Figures 2 and 3).

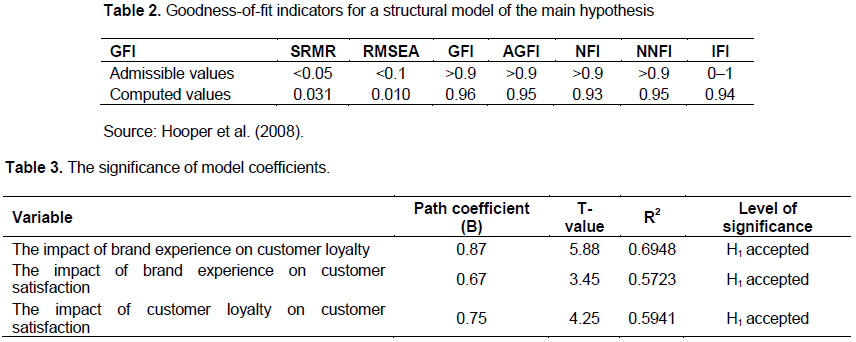

Goodness-of-fit test

The Chi-square value is estimated at 1.04. The result must be within the admitted range for the Chi-square; it should be between 1 and 5. Thus, the structural model exhibits significant and desirable fitness. The RMSEA fitness index should be >0.05. Given that the RMSEA fitness index equals 0.01, which is >0.05, so based on this result, the model shows acceptable fitness. Other goodness-of-fit indicators are also within favourable and appropriate ranges (Table 2).

The Chi-square test for the above model shows the difference between the observed and expected covariance matrices. The value of the Chi-square for this model with a degree of freedom of 207 is equal to 1.33, which is not statistically significant because its level of significance is relatively high (p = 0.9553; thus, p > 0.50). It can be concluded that the Chi-square test confirms the exact fitness of the model with the observed data, and this result indicates the relatively good fitness of the model. The model can also be examined via GFI, which is the most authentic indicator for examining the fitness of such a model. GFI refers to a relative amount of variances and covariance that will be jointly justified by the model and this indicator is the same as R-squared (R2) in multivariate regression. The CFI of GFI fluctuates between zero and one, and a higher value of the indicator represents a better fitness of the model. Given that in the above model, the value of GFI is equal to 0.96, it can be judged that the model has an acceptable fit. The value of the RMSEA is 0.01, which shows that the model has a good fit. The fitness is also evaluated from the perspective of the multiple fitness characteristics; the IFI indicators are equal to 0.94 and the NFI index is equal to 0.93, which shows that the model enjoys good fitness (Table 3).

Given that the t-statistic for the relationship between brand experience and customer loyalty is 5.88, which is >1.96, we conclude that brand experience has a significant impact on customer loyalty and R-squared is equal to 0.6948; that is, brand experience accounts for 69.48% of the changes related to brand loyalty. Given that the t-statistic for the relationship between brand experience and customer satisfaction is 3.45, which is >1.96, it was concluded that brand experience has a significant impact on customer satisfaction and R2 is equal to 0.05723; that is, brand experience accounts for 57.23% of the changes related to customer satisfaction. Given that the t-statistic for the relationship between customer loyalty and customer satisfaction is 4.25, which is >1.96, it was concluded that brand experience has a significant impact on customer satisfaction and R2 is equal to 0.0594; that is, customer satisfaction accounts for 59.41% of the changes related to customer loyalty.

Hypothesis 1: The brand experience has an impact on customer loyalty in Ayandeh Bank in Tehran. The strength of the relationship between the brand experience and customer loyalty variables was estimated at 0.78. The t-statistic was estimated at 5.88, which is greater than the t critical value at an error level of 5% (1.96), and this indicates that the observed correlation is significant. Therefore, brand experience has an impact on customer loyalty in Ayandeh Bank in Tehran.

Hypothesis 2: The brand experience has an impact on customer satisfaction in Ayandeh Bank in Tehran. The strength of the relationship between customer satisfaction and customer loyalty was estimated at 0.67. The t-statistic was estimated at 3.45, which is greater than the t critical value at an error level of 5% (1.96). This indicates that the observed correlation is significant. Therefore, brand experience has an impact on customer satisfaction in Ayandeh Bank in Tehran.

Hypothesis 3: Customer satisfaction impacts customer loyalty in Ayandeh Bank in Tehran. The strength of the relationship between customer satisfaction and customer loyalty in the provided banking services was estimated at 0.75. The t-statistic was estimated at 4.25, which is greater than the t critical value at an error level of 5% (1.96). This indicates that the observed correlation is significant. Therefore, customer satisfaction impacts customer loyalty towards the banking services provided in branches of Ayandeh Bank in Tehran.

Aghazadeh et al. (2012) investigated the impact of the Saman Insurance Company brand experience and its dimensions on perceived value and brand loyalty, as well as on repurchase intention, among 267 holders of life insurance with the company in Tehran. Their findings show that brand experience has a considerable impact on the perceived value and brand loyalty of life insurers. The findings also show that perceived value and brand loyalty affect repurchase intention, which is consistent with Hypothesis 1 of the current research.

Borhani et al. (2014) investigated the relationship between organisation image and brand, quality of services and satisfaction, and customer loyalty in the banking industry of Meybod city in Yazd province. Besides confirming the research hypotheses, the correlation results show that organisation image, brand image, satisfaction and quality of service are positively correlated with customer loyalty. The stepwise regression analysis results show that satisfaction has the highest predictive power in relation to loyalty, which is consistent with Hypothesis 3 of the current research.

Ebrahimi et al. (2014) investigated the effect of brand advantages on customer satisfaction and customers’ behavioural loyalty towards the Pars Khazar brand by examining the mediating roles of a range of variables. The findings show a significant relationship between symbolic and brand-oriented advantages and behavioural loyalty towards the brand. Analysis of the role of the mediator variables also indicates that customer satisfaction with the brand mediates the relationship between the two variables of symbolic benefits and experience-oriented benefits and behavioural loyalty towards the brand, which is consistent with Hypothesis 1 and Hypothesis 3 of the current research.

Qandahari et al. (2015) investigated the impact of brand experience on customer loyalty among the customers of Ayandeh Bank. All their research hypotheses were confirmed, and their results show that brand experience has a significant effect on customer loyalty, which is consistent with the results of the current research.

Kosari and Javidi (2016) examined the relationship between customers’ experience, brand loyalty and WOM advertising, taking into consideration the mediating role of customer satisfaction, in relation to the banking services provided by various branches of the National Bank of Khorasan Razavi. The results indicate that customer experience affects brand loyalty and WOM advertising, which is consistent with the results of the current research.

The selected sampling method was convenience sampling, which was carried out by the researcher by giving questionnaires to customers visiting a branch. Non-probability sampling was used. The content validity method was used to assess the validity of the questionnaire. For this purpose, the hypotheses and questionnaire questions were assessed by university professors and experts in the relevant field. All items were unanimously approved. The Cronbach’s alpha coefficient was used to calculate reliability.

The Cronbach’s alpha coefficients for the brand experience questionnaire, customer satisfaction questionnaire and customer loyalty questionnaire were 0.760, 0.968 and 0.893, respectively. The collected data were analysed through SEM and using LISREL software. This research sought to reject or approve three hypotheses. Hypothesis 1 held that brand experience affects customer loyalty towards banking services provided by various branches of Ayandeh Bank in Tehran. Hypothesis 2 held that brand experience affects customer satisfaction with banking services provided by various branches of Ayandeh Bank in Tehran. Hypothesis 3 held that customer satisfaction affects customers’ loyalty towards banking services provided by various branches of Ayandeh Bank in Tehran. Given the analysis results presented in Chapter 4, it was concluded that brand experience affects customer satisfaction and, consequently, their loyalty towards banking services provided by various branches of Ayandeh Bank in Tehran.

With the advancement of technology and increasing competitive market conditions in various manufacturing and service sectors, loyal customers are considered as the main source of capital for companies because customer loyalty leads to business success, increased profitability and customer value creation. Brands are the vital driving force of companies. They produce market share, increase customer loyalty, strengthen the channel’s power, provide higher profit margins and protect the company against competitors’ attacks. Based on these critical strategic factors, almost all marketing activities, from developing new products to retail promotions, are focused on building strong brands. Brand experience improves loyalty via emotional communication through providing an attractive and consistent environment to present customers with, including the physical environment and communications characteristics of the services and any other way in which the consumer comes into contact with it.

This research, as with other studies, has some strength and some drawbacks. The limitations of the study are as follows:

1. In this research, the impact of brand experience on customer satisfaction and loyalty in relation to banking services provided by various branches of Ayandeh Bank in Tehran were examined. However, according to the aforementioned definitions, other variables may also affect customer loyalty.

2. This research investigated a particular organisation, that is Ayandeh bank, and it could have disadvantages in other areas that could affect customer loyalty but were not taken into consideration.

3. The results and findings of the research are applicable only to the surveyed population, and they cannot be generalised to other groups. Convenience sampling has weak generalisability.

4. The time period of the study was limited, and certain fluctuations may have impacted this time period.

5. One common limitation in completing a questionnaire is participants’ uncertainty about the confidentiality of information or the anonymity of their identity. To some extent, this problem was addressed by reassuring the participants that their data would remain confidential and that there was no need to include their names on the questionnaires.

6. Another constraint of the research comprised unrealistic responses by the respondents. Some respondents may have represented the situation too optimistically or too pessimistically, or even in a biased way. In order to address this issue, participants were asked to provide realistic and fair responses.

7. Another limitation of the researcher is lack of access to the bank's online customers.

The authors have not declared any conflict of interests.

REFERENCES

|

Aalaie A, Maleki M (2017). Effects of e-banking and brand banking services on customer satisfaction, Parsian Bank. Quarterly Journal of New Research in Management and Accounting 6:136-159. Tehran: Minrodi. Retrieved from

View

|

|

|

|

Aghazadeh H, Pour Gholli R, Divinezad E (2012). Investigating the effect of brand personality on re-purchasing intention through perceived value and brand loyalty (Case study: Saman Insurance Company Life Insurance Companies). Journal of Research on New Marketing Research 4(11):1-22.

|

|

|

|

|

Akbarpour E, Zangooi A (2017). Investigating the factors affecting brand equity using the Acker model from the perspective of customers in Hekmat Iranian Bank. 2nd National Conference on Marketing Research (pp. 55-82). Tehran: Narkish Information Institute. Retrieved from

View

|

|

|

|

|

Alhazmi BM (2019). Religiosity and customer trust in financial services marketing relationships. Journal of Financial Services Marketing 24(1-2):31-43.

Crossref

|

|

|

|

|

Ambler T (1993). Are branding and marketing synonymous? Journal of Brand Management 1(1):41-48.

Crossref

|

|

|

|

|

Ambler T, Bhattacharya CB, Edell J, Keller KL, Lemon KN, Mittal V (2002). Relating brand and customer perspectives on marketing management. Journal of Service Research 5(1):13-25.

Crossref

|

|

|

|

|

Anderson EW, Fornell C, Mazvancheryl SK (2004). Customer Satisfaction and Shareholder Value. Journal of Marketing 68(4):172-185.

Crossref

|

|

|

|

|

Archakova A (2013). Service Quality and Customer Satisfaction. Case. Retrieved from Open Repository of the Universities of Applied Sciences. Available at: View

|

|

|

|

|

Ayandeh Bank (2019). Ayandeh Bank. Available at:

View

|

|

|

|

|

Bai B, Law R, Wen I (2008). The impact of website quality on customer satisfaction and purchase intentions: Evidence from Chinese online visitors. International Journal of Hospitality Management 27(3):391-402.

Crossref

|

|

|

|

|

Baradaran M, Abbasi A, Safarnia H (2013). Investigating the Factors Affecting Customer Loyalty (Case Study of Tejarat Bank of Shiraz). Scientific-Research Journal of Shahed University 2(47):467-482.

|

|

|

|

|

Bitner MJ, Hubbert A (1994). Encounter satisfaction versus overall satisfaction versus quality. (New directions in theory and practice 34(2):72-94.

Crossref

|

|

|

|

|

Borhani L, Nouri A, Samawatian HM (2014). Investigating the relationship between organization image, brand image, quality of service and customer satisfaction with customer loyalty in banking industry. Journal of Research in Cognitive and Behavioral Sciences 4(1):115-130.

|

|

|

|

|

Brakus J, Schmitt B, Zarantonello L (2009). Brand experience what is it? How is it measured? Does it affect loyalty? Journal of marketing 73(3):52-68.

Crossref

|

|

|

|

|

Buil I, Chernatony L, Martinez E (2008). A cross-national validation of the consumer-based brand equity scale. Journal of Product & Brand Management 17(6):384-392.

Crossref

|

|

|

|

|

Davis S (2000). The Power of the Brand. Strategy and Leadership 28(4):4-9.

Crossref

|

|

|

|

|

Ebrahimi A, Alavi SM, Najafi Sinoroodi M (2014). The Effect of Brand Benefits on Customer Satisfaction and Behavioral Loyalty to Brand (Case Study: Pars Khazar Brand). Management Quarterly of Management Science 35(35):95-116.

|

|

|

|

|

Elahi S, Hamdan M, Hassanzadeh A (2011). Investigating the Relationship between Electronic Commerce and Customer Behavior. Daneshvar Behavior Scientific Research Journal 16(35):169-189.

|

|

|

|

|

Gallo A (2014). The Value of Keeping the Right Customers. Harvard Business Review. Retrieved from Harvard Business School Publishing. Available at:

View

|

|

|

|

|

Hadiani L, Ahmadpour S (2009). Investigating the effective factors in retaining and attracting customers of a commercial bank. First International Banking Marketing Conference. Tehran: Financial Services Marketing Center pp. 95-99.

View

|

|

|

|

|

Hamidizadeh MR, Ghamkhavari SM (2009). Identifying Effective Factors on Customer Loyalty Based on the Model of Accountability Organizations. Commercial Letter of Business 13(52):187-210.

|

|

|

|

|

Hassania A (2019). Iran in sanctions; Free fall of oil and zero percent growth. Available at: BBC:

View

|

|

|

|

|

Hirschman AO (1970). Exit, Voice, and Loyalty: Responses to Decline in Firms, Organizations, and States. Cambridge, MA: Harvard University Press.

|

|

|

|

|

Iglesias O, Singh J, Batista-Foguet J (2011). The role of brand experience and affective commitment in determining brand loyalty. Brand Management 18(8):570-582.

Crossref

|

|

|

|

|

Jazini A, Asgar M (2013). Assessing Customer Satisfaction Based on ACSI Model (Case Study: Ghavamin Bank). Police Journal, 701-7011.

View

|

|

|

|

|

Jacoby J, Olson JC, Haddock RA (1971). Price, brand name, and product composition characteristics as determinants of perceived quality. Journal of applied psychology 55(6):570.

Crossref

|

|

|

|

|

Karbasian M, Javanmardi M, Khabushani A, Zanjirchi M (2011). A Hybrid Approach Using ISM For Leveling Agile Criteria And Fuzzy AHP To Determine The Relative Weights of Evaluation Criteria And Fuzzy TOPSIS To Rank The Alternatives. Tehran: Production and Operations Management.

View

|

|

|

|

|

Khaki G (2011). Research methodology with a dissertation approach. tehran: Baztab.

|

|

|

|

|

Khorshidi G, Kargard M (2010). Identify and rank the most important factors affecting customer loyalty, using multi-criteria decision making methods. Business Management Perspective 9(33):177-191.

|

|

|

|

|

Kline R (2005). Principles and Practice of Structural Equation Modeling (2nd ed.). New York: The Guilford.

|

|

|

|

|

Kosari Far A, Javidi Zargar M (2016). Investigating the relationship between customer experience on brand loyalty and mouth-to-mouth advertising with regard to the role of customer satisfaction mediator (Case study of National Bank of Khorasan Razavi). Journal of Management and Accounting Studies 2(3):134-145.

|

|

|

|

|

Kotler P, Clarke NC (1987). Marketing for health care organizations. Journal of Business Research 16(1):89-90.

Crossref

|

|

|

|

|

Krishnamurthi L, Raj SP (1991). An Empirical Analysis of the Relationship between Brand Loyalty and Consumer Price Elasticity. Marketing Science 10(2):172-183.

Crossref

|

|

|

|

|

Majd A (2020). Ayandeh Bank.

View

|

|

|

|

|

Mihelis G, Grigoroudis E, Siskos Y, Politis Y, Malandrakis Y (2001). Customer satisfaction measurement in the private bank sector. European Journal of Operational Research 130(2):347-360.

Crossref

|

|

|

|

|

Miller DC, Salkind N.J (2002). Defining the Characteristics of Basic, Applied, and Evaluation Research. Thousand Oaks: SAGE Publications

|

|

|

|

|

Moghimi M, Ramazani M (2011). Management Research Journal. Tehran: Rahdan.

|

|

|

|

|

Motaharinejad F, Samadi S, Tolabi Z, Pour Ashraf Y (2014). Studying the Relationship between Brand and Consumer (Case Study: Electrical Home Appliance). Jounal of Marketing Management, 9(23), 127-147.

|

|

|

|

|

Qandahari Alaviyeh Z, Karimi Alavi Je, MR, Maleki M (2015). The Impact of Brand Experience on Brand Loyalty (Case Study of Bank Shahr Branches in Tehran). Modern Orientations in Management Economics and Accounting P 33.

View

|

|

|

|

|

Qaracheh M, Akhavan Kharazian M, Ahmadi MH (2016). Explaining and Evaluating the Loyalty Model Satisfaction with the Quality of Electronic Banking Services. Strategic Management Studies 18:22-49.

View

|

|

|

|

|

Ranjbarian B, Mohammadzadeh A (2006). The effect of generalization of a brand name on new products in the food industry of Tehran. Agricultural Economics and Development 14(53):91-105.

|

|

|

|

|

Rahimnia F, Harandi A, Fatemi S (2012). The effect of customer relationship quality on perceived quality and customer loyalty: Five-star hotels in Mashhad. General Management Research (17):83-101.

View

|

|

|

|

|

Richards K, Jones E (2008). Customer Relationship Management: Finding Value Drivers. Industrial Marketing Management 37(2):120-130.

Crossref

|

|

|

|

|

Safarai A (2010). The role of customer orientation and marketing in modern banking. The Second International Conference on Financial Services Marketing. Tehran: Financial Services Marketing Center pp. 152-158.

View

|

|

|

|

|

Sevilla CG (1990). A Research Primer. Manila: Rex Bookstore.

|

|

|

|

|

Shafiei H, Zabihi MR, Sadeghian S (2019). Investigating the Factors Affecting the Non-Use of Internet Banking from the Perspective of Customers. Second Iranian Third Millennium Science and Technology Conference on Economics, Management and Accounting. Tehran: Institute for the Development of Sam Iranian-based Knowledge and Technology Conferences pp. 12-22.

|

|

|

|

|

Tajzadeh Namin A, Elahyari S (2009). considering customers loyalty (case study: tejarat bank in Tehran). Business Research 56:1-22.

View

|

|

|

|

|

Tajzadeh-Namin A (2013). Factors affecting domestic internet user's E-loyalty to travel agencies web sites. Journal of Tourism and Hospitality 2(3).

|

|

|

|

|

Talebloo R, Bahmanpour H (2012). The analysis of banking regulation on competition in Iranian banking industry. Financial Knowledge of Security Analysis (Financial Studies) 5(14):13-40.

|

|

|

|

|

Zamani MA, Lahiji K (2012). Investigating the Factors Affecting the Loyalty of Private Bank Customers Based on the Model of Rapid Response Organizations Model. Journal of Marketing Management 7(16):63-79.

View

|

|

|

|

|

Zhang S, Peng MY, Peng Y, Zhang Y, Ren G, Chen CC (2020). Expressive Brand Relationship, Brand Love, and Brand Loyalty for Tablet PCs: Building a Sustainable Brand. Frontiers in Psychology 11:231.

Crossref

|

|